Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

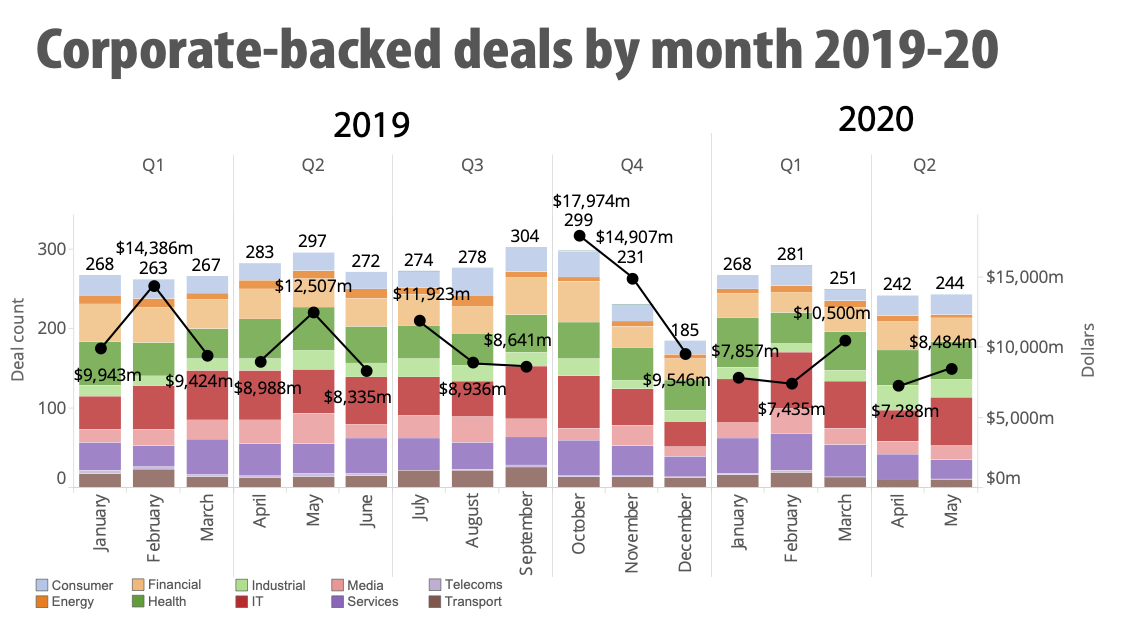

When the going gets tough, it’s common for some corporate VCs to head for the hills.

Today, it’s a narrative that’s emerging again amid the COVID-19 crisis. Global corporate venture deals fell from a total of 580 in April/May of 2019 to 486 in the same period this year, according to Global Corporate Venturing.

However, institutional VC deals are also headed for a decline, with PitchBook anticipating a drop in transaction volume over the next several quarters, as well as a downturn in valuations.

Image Credits: Global Corporate Venturing

It remains to be seen how it will play out this time, but I believe corporate venture capital (CVC) will not only stick around, but also be a vital part of the innovation ecosystem going forward.

I know that Merck Global Health Innovation Fund (MGHIF) remains fully committed to “doing” venture. Now, more than ever, health innovation is vital. Second, we understand that many of today’s most successful companies were funded in times of uncertainty. In fact, to put our money where our mouth is, we’ve recently completed two spinouts, three follow-on investments, and two new deals in 2020 — all since COVID hit. We intend to increase that pace going forward in 2020 and beyond.

It hasn’t been easy. It’s hard to do venture when you can’t venture out into the world, meet founders and do diligence the way we did in the past. But it is possible, if you do some innovating of your own and set up a smoothly functioning system to do CVC virtually.

Here’s how we’ve done it.

Powered by WPeMatico

As e-commerce companies aim to capitalize on the online spending boom connected to shelter-in-place and keep the party going as physical retailers open back up, more are turning their attention to how they can juice the functionality of their online storefronts and improve experiences for shoppers. Enter Nacelle, an LA-based startup in the burgeoning “headless” e-commerce space.

The startup bills itself as a JAMstack for e-commerce, offering a developer platform that delivers greater performance and scalability to online storefronts. Nacelle has raised about $4.8 million to date in fundings led by Index Ventures and Accomplice. Some of the company’s other angel investors include Shopify’s Jamie Sutton, Klaviyo CEO Andrew Bialecki and Attentive CEO Brian Long.

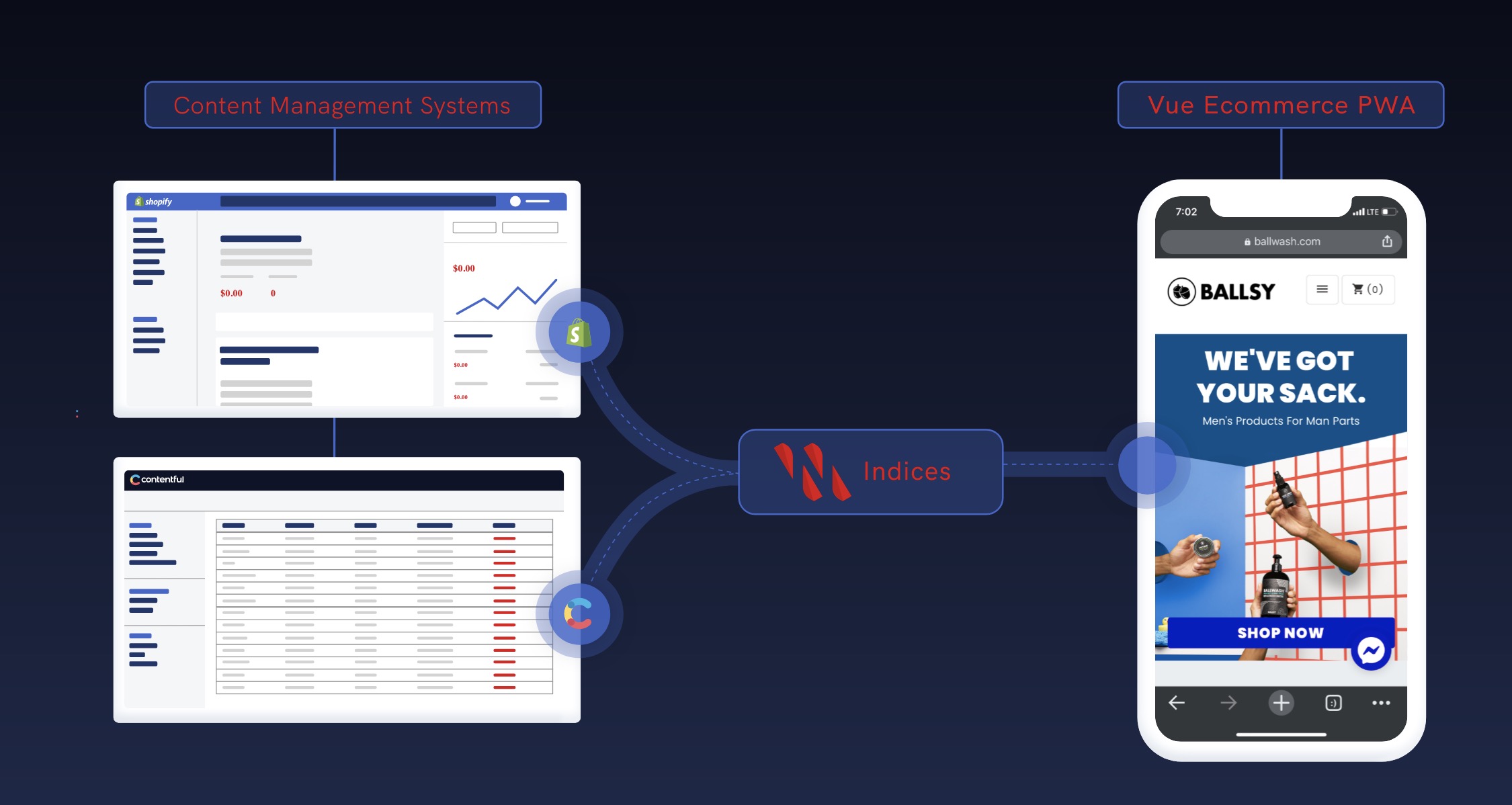

Nacelle builds an easier path for e-commerce brands to embrace a headless structure. Headless web apps essentially mean a site’s front end is decoupled from the backend infrastructure, so it’s leaning fully on dedicated frameworks for each to deliver content to users. There are some notable benefits for sites going headless, including greater performance, better scalability, fewer hosting costs and a more streamlined developer experience. For e-commerce sites, there are also some notable complexities due to how storefronts operate and how headless CMSs need to accommodate dynamic inventories and user shopping carts.

“We asked how do you pair a very dynamic requirement with the generally static system that JAMstack offers, and that’s where Nacelle comes in,” CEO Brian Anderson tells TechCrunch.

Anderson previously operated a technical agency for Shopify Plus customers building custom storefronts, a venture that has led to much of the company’s early customers. Nacelle also recently hired Kelsey Burnes as the startup’s first VP of marketing; she joins from e-commerce plug-in platform Nosto.

Though Anderson described a flurry of benefits regarding Nacelle’s platform, many are the result of reduced latency that he says converts more users and pushes them to spend more. The startup has a particular focus on mobile storefronts, with Anderson noting that most desktop storefronts dramatically outperform mobile counterparts and that the speedier load times Nacelle enables on mobile can do a lot to overcome this.

Image Credits: Nacelle

As more brands embrace headless structures, Nacelle is aiming to manage the experience. Nacelle is optimized for Shopify users to get up and running the most quickly. Users can also easily integrate the system with popular CMSs like Contentful and Sanity. All in all, Nacelle sports integrations for more than 30 services, including payments platforms, SMS marketing platforms, analytics platforms and more. The goal is to minimize the need for users to migrate data or learn new workflows.

The company is unsurprisingly going after direct-to-consumer brands pretty heavily. Some of Nacelle’s early customers include D2C bedding startup Boll & Branch, cozy things marketplace Barefoot Dreams and fashion brand Something Navy. Most of Nacelle’s rollouts launch later this summer. Last month, Nacelle went live with men’s toiletries startup Ballsy and says that the storefront has already seen conversions increase 28%.

Nacelle is far from the only young entrant in this space. Just last month, Commerce Layer announced that it had raised $6 million in funding from Benchmark.

Powered by WPeMatico

Here’s a Fourth of July event that doesn’t require a mask or social distancing. This week only you can save an extra $50 when you buy Disrupt Digital Pro passes or a Disrupt Digital Startup Alley Package for Disrupt 2020.

Buy the pass or package you want and save $50 at checkout when you use this promo code: 50JULY4. The discount remains in play until Sunday, July 5 at 11:59 p.m. (PDT).

Our first virtual Disrupt spans five programming-packed days from Sept 14-18. Both types of Digital Pro pass holders enjoy live and on-demand access to the full breadth of content across all Disrupt stages. For starters, don’t miss TechCrunch editors interviewing some of the biggest names in tech and watch the always-epic Startup Battlefield pitch competition on the Disrupt Stage.

The Extra Crunch Stage features interactive, moderated discussions with top experts — growth marketers, lawyers, investors, technologists, recruiters — on topics critical to founders’ success. Submit questions and get answers in real time.

Check out early-stage startups in Digital Startup Alley. Browse hundreds of exhibiting startups, organized by category, and watch their product demos on demand. See something you like? Arrange a 1:1 video conference right then and there with the founders.

And that brings us to the Disrupt Digital Startup Alley Package. You get all the access benefits of a Digital Pro pass for up to three people in your company and will be able to exhibit and promote your product from wherever you are in the world. It includes a custom landing page to collect leads, post a marketing video or promote your pitch deck among several other benefits and tools to help you get in front of the right audience.

Whether you buy an individual pass or a package, CrunchMatch will keep your networking organized and on track. The AI-powered platform features a new-and-improved algorithm for faster and more precise matching, and it makes connecting with people who can help grow your business easier than ever. Schedule 1:1 video meetings with prospective investors, customers, collaborators — or recruit talent. CrunchMatch launches weeks before Disrupt begins so you can disrupt longer.

There’s so much more to do at Disrupt 2020, and all of it’s designed to help you keep your business moving forward. Take advantage of the July Fourth discount. Buy a Disrupt Digital Pro pass or a Disrupt Digital Startup Alley Package and plug in promo code 50JULY4 — before July 6 at 11:59 p.m. (PDT), save an extra $50 and disrupt for less. No mask or social distancing required.

Is your company interested in sponsoring or exhibiting at Disrupt 2020? Contact the sponsorship sales team by filling out this form.

Powered by WPeMatico

In the two years since Jeff Semenchuk took the reins in the newly created position of chief innovation officer for Blue Shield of California, the nonprofit health insurer with $20 billion in revenues has stepped up its investments in startup companies.

As one of California’s largest insurance providers with more than four million members, Blue Shield plays an outsized role in technology adoption among physicians, hospital networks and patients. With that in mind, and with the acceleration of entrepreneurial activity around the multitrillion health care market, Semenchuk was brought on board after serving as chief executive of Yaro (now Virgin Plus) and CIO of Hyatt Hotels and co-founder of Citi Ventures.

Semenchuk said he sees Blue Shield as working to create a new health care system: “It’s not to perpetuate the health care system we have today.” Increasingly, startups have a role to play in that revisioning of health care services in America, according to Semenchuk.

“What I would say has happened over the last two years is that we have really focused on transformational innovation,” he added.

Investing in those transformational technologies involves taking cash directly from Blue Shield’s balance sheet for investments. The company doesn’t operate a corporate venture capital fund in the traditional sense, instead making strategic investments under the auspices of Semenchuk or Chief Financial Officer Sandra Clarke.*

Powered by WPeMatico

If you have bought a house in the last decade, you likely started the process online. Perhaps you browsed for your future dream home on a website like Zillow or Realtor, and you may have been surprised by how quickly things moved from seeing a property to making an offer.

When you reached the closing stage, however, things slowed to a crawl. Some of those roadblocks were anticipated, such as the process of getting a mortgage, but one likely wasn’t: the tedious and time-consuming process of obtaining title insurance — that is, insurance that protects your claim to home ownership should any claims arise against it after sale.

For a product that is all but required to purchase a home, title insurance isn’t something many people know about until they have to pay for it and then wait up to two months to get.

Now, finally, a handful of startups are taking on the title insurance industry, hoping to make the process of buying a policy easier, cheaper and more transparent. These startups, including Spruce, States Title, JetClosing, Qualia, Modus and Endpoint, enable part or all of the title insurance buying process. Whether these startups can finally topple the title insurance monopoly remains to be seen, but they are already causing cracks in the system.

To that end, we’ve outlined what’s broken about today’s title industry; recent developments in technology and government that are priming the industry for change; and a synthesis of some key trends we’ve observed in the space, as entrepreneurs begin to capitalize on a tipping point in a century-old, $14 billion business.

To understand how startups are beginning to challenge title insurance incumbents, we need to first understand what title insurance is and what title companies do.

Title insurance is unique from other types of insurance, which require ongoing payments and protect a buyer against future incidents. Instead, title insurance is a one-time payment that protects a buyer from what has already happened — namely errors in the public record, liens against the property, claims of inheritance and fraud. When you buy a home, title insurance companies research your property’s history, contained in public archives, to make sure no such claims are attached to it, then correct any issues before granting a title insurance policy.

Powered by WPeMatico

Today Personal Capital, a fintech company that had attracted more than $265 million in private funding, announced that it is selling itself to Empower Retirement, a company that provides retirement services to other companies. The deal is worth $825 million upon closing, with another $175 million in what are described as “planned growth” incentives, according to a release.

The deal is a likely win for Personal Capital . According to Forbes, the firm was worth $660 million around the time of its Series F round of funds, which it raised in February of 2019. The company was valued at around $500 million in December of 2016, meaning that investors who put capital in at that point, or before, likely did well on their investment.

Venture groups who put capital in later, unless they had ratchets in place, likely didn’t make as much from the deal as they originally hoped. Regardless, a $1 billion all-inclusive exit is nothing to scoff at; Facebook once bought Instagram for that much money, and the sheer cheek of the transaction at the time nearly broke the internet.

During its life as a private company, Crosslink Capital, IGM Financial, Venrock, IVP and Corsair each led rounds into the company according to Crunchbase data.

Personal Capital is a consumer service that helps folks plan for retirement, and invest their capital. The company offers free financial tools, and a higher-cost wealth management option for accounts of at least $100,000. The company doesn’t like being called a robo-advisor, instead claiming to exist in the space between old-fashioned in-person wealth management relationships and fully automated options.

Regardless, the company’s sale price should help market rivals price themselves. Here are Personal Capital’s core stats (data via Personal Capital, accurate as a May 31, 2020):

So, Wealthfront and M1 Finance and others, there are some metrics for you to weigh yourselves against. Of course, other, competing companies have different monetization methods, so the comparison won’t be 100% direct.

The Personal Capital exit fits into the theme that TechCrunch has tracked lately, in which savings and investing applications have seen demand surge for their wares. This is a trend not merely in the United States where Personal Capital is based, but also abroad.

Aside from Personal Capital’s exit today, we’ve also seen huge deals in 2020 from Plaid, which sold to Visa for over $5 billion, Galileo’s exit for over $1 billion and Credit Karma’s sale for north of $7 billion. In response to this particular news item, TechCrunch’s Danny Crichton noted that fintech is “probably the hottest exit market right now.” He’s right.

Powered by WPeMatico

Agora isn’t the only company headquartered outside the United States aiming to go public domestically this quarter. After catching up on Agora’s F-1 filing, the China-and-U.S.-based, API-powered tech company that went public last week, today we’re parsing DoubleDown Interactive’s IPO document.

The Exchange is a daily look at startups and the private markets for Extra Crunch subscribers; use code EXCHANGE to get full access and take 25% off your subscription.

The mobile gaming company is targeting the NASDAQ and wants to trade under the ticker symbol “DDI.”

As with Agora, DoubleDown filed an F-1, instead of an S-1. That’s because it’s based in South Korea, but it’s slightly more complicated than that. DoubleDown was founded in Seattle, according to Crunchbase, before selling itself to DoubleU Games, which is based in South Korea. So, yes, the company is filing an F-1 and will remain majority-held by its South Korean parent company post-IPO, but this offering is more a local affair than it might at first seem.

As with Agora, DoubleDown filed an F-1, instead of an S-1. That’s because it’s based in South Korea, but it’s slightly more complicated than that. DoubleDown was founded in Seattle, according to Crunchbase, before selling itself to DoubleU Games, which is based in South Korea. So, yes, the company is filing an F-1 and will remain majority-held by its South Korean parent company post-IPO, but this offering is more a local affair than it might at first seem.

Even more, with a $17 to $19 per-share IPO price range, the company could be worth up to nearly $1 billion when it debuts. Does that pricing make sense? We want to find out.

So let’s quickly explore the company this morning. We’ll see what this mobile, social gaming company looks like under the hood in an effort to understand why it is being sent to the public markets right now. Let’s go!

Any gaming company has to have its fun-damentals in place so that it can have solid financial results, right? Right?

Anyway, DoubleDown is a nicely profitable company. In 2019 its revenue only grew a hair to $273.6 million from $266.9 million the year before (a mere 2.5% gain), but the company’s net income rose from $25.1 million to $36.3 million, and its adjusted EBITDA rose from $85.1 million to $101.7 million over the same period.

Powered by WPeMatico

The Trump administration’s decision to extend its ban on issuing work visas to the end of this year “would be a blow to very early-stage tech companies trying to get off the ground,” Silicon Valley immigration lawyer Sophie Alcorn told TechCrunch this week.

In 2019, the federal government issued more than 188,000 H-1B visas — thousands of workers who live in the San Francisco Bay Area and other startup hubs hold H-1B and H-2B visas or J and L visas, which are explicitly prohibited under the president’s ban. Normally, the government would process tens of thousands of visa applications and renewals in October at the start of its fiscal year, but the executive order all but guarantees new visas won’t be granted until 2021.

Four TechCrunch staffers analyzed the president’s move in an attempt to see what it portends for the tech industry, the U.S. economy and our national image:

America’s economic supremacy is increasingly precarious.

Outsourcing and offshoring led to a generational loss of manufacturing skills, management incompetence killed off many of the country’s leading businesses and the nation now competes directly with China and other countries in critical emerging industries like 5G, artificial intelligence and the other alphabet soup of technological acronyms.

We have one thing going for us that no other country can rival: our ability to attract top talent. No other country hosts more immigrants, nor does any other country capture the imagination of a greater portion of the world’s top minds. America — whether Silicon Valley, Wall Street, Hollywood, Harvard Square or anywhere in between — is where smart people congregate.

Or at least, it was.

The coronavirus was the first major blow, partially self-inflicted. Remote work pushed employers toward keeping workers where they are (both domestically and overseas) rather than centralizing them in a handful of corporate HQs. Meanwhile, students — the first step for many talented workers to enter the United States — are taking a pause, fearing renewed outbreaks of COVID-19 in America while much of the rest of the developed world reopens with few cases.

The second blow was entirely self-inflicted. Earlier this week, President Donald Trump announced that his administration would halt processing critical worker visas like the H-1B due to the current state of the American economy.

Powered by WPeMatico

Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7am PT). Subscribe here.

While the US tech industry relentlessly tries to do business with the rest of the world, this week it became further embroiled in national politics. High-skill immigration visas have been suspended until the end of the year by the Trump administration, precluding thousands of present and future startup employees and founders from coming to the US and building companies here.

Instead, the suspension is another accelerant to the global remote work trend that had already been a thing for many of us this decade, that has just been pushed to the mainstream because of the pandemic. For anyone trying to find great people to hire, the next funding check, or new markets, virtual solutions are often the only solutions available today.

Our resident immigration law expert, Sophie Alcorn, has been covering the issue in-depth this week, including an explainer about the crucial role of immigration in the economy for TechCrunch, and for Extra Crunch, an overview of what you can do if you’re affected. For subscribers, she also wrote about the impact of the Supreme Court overturning Trump’s termination of DACA.

On a personal note, our global editorial staff is looking forward to resuming our global events schedule as soon as possible regardless of these national political issues. We’re here for the startup world. In the meantime, here’s Alex Ames on how we’re connecting virtual Disrupt attendees this year.

Image Credits: Nigel Sussman (opens in a new window)

The big industries and big-city amenities that have made New York City what it is are going to help power it forward even as more people and jobs appear to be heading away from city centers. At least that’s my takeaway from reading the 11 investors who Anthony Ha talked to this week in an Extra Crunch survey about the future of the startup hub. First, even if you can work from anywhere, millions of people will prefer that place to be New York — with the big-city housing supply, networking opportunities and amenities to attract people like before. Second, many key industries like finance, real estate, enterprise software, health care, media and other consumer products are not dying but being reinvented, and appear to be maintaining their centers in the city. Here’s Alexa von Tobel of Inspired Capital:

I’ve seen NYC grow into the powerful startup hub it’s become over the last decade, and I think that momentum will continue. Now that we’ve learned high productivity is indeed possible remotely, we expect to see companies maintain some element of a remote workforce within their broad hiring plans. But for startups in their earliest stages, I think there’s still a power to sitting side by side as you build a business. When founders are making their first hires and inking their first deals, NYC remains an incredible place to do that.

Some of those industry reinventions are more exciting than others. In a separate survey, Anthony talked to 5 investors who have tended to focus on advertising and marketing tech… the good news is that advertising and marketing costs are dropping and tech-driven efficiency is improving for the world. For founders in the space, though, the challenges have only grown as the pandemic has forced more ad budget cuts on top of shifts to the largest platforms. As John Elton of Greycroft put it:

Only the next technology breakthrough will provide fertile ground for the next wave of innovation, just as mobile and internet breakthroughs gave rise to today’s giants. Perhaps machine learning is that type of breakthrough, so we are looking at companies that use machine learning to dramatically improve what is possible in the space. The issue there is the scaled players are also very good at machine learning, so it may not be a technology that provides the same opportunity as prior disruptions.

TIm O’Reilly

Tim O’Reilly has been going a different route from much of Silicon Valley in recent years. While his publishing company, series of conferences, essays and investments have helped to shape the modern internet for decades, he says that venture capital has gone wrong. Here’s more from an interview on with Connie Loizos on TechCrunch this week:

[I]’ve been really disillusioned with Silicon Valley investing for a long time. It reminds me of Wall Street going up to 2008. The idea was, ‘As long as someone wants to buy this [collateralized debt obligation], we’re good.’ Nobody is thinking about: Is this a good product? So many things that what VCs have created are really financial instruments like those CDOs. They aren’t really thinking about whether this is a company that could survive on revenue from its customers. Deals are designed entirely around an exit. As long as you can get some sucker to take them, [you’re good]. So many acquisitions fail, for example, but the VCs are happy because — guess what? — they got their exit.

His firm, O’Reilly AlphaTech Ventures, has instead been focused in recent years on funding founders who are creating a product that is valued by customers and generates sustainable cash flow, on terms that incentivize organic growth.

Last week we launched a new effort to highlight investors who were the first to back your big and (increasingly) successful idea. It’s gotten a great response so far. From Danny Crichton:

Well, the TechCrunch community came through, since in just a few days, we’ve already received more than 500 proposals from founders recommending VCs who wrote their first checks and who have been particularly helpful in fundraising and getting a round closed.

If you haven’t submitted a recommendation, please help us using the form linked here.

The short survey takes five minutes, and could save founders dozens of hours armed with the right intel. Our editorial team is carefully processing these submissions to ensure their veracity and accuracy, and the more data points we have, the better the List can be for founders.

Check out Danny Crichton’s full post on TechCrunch for answers to questions that we’ve gotten frequently so far.

TechCrunch:

A look at tech salaries and how they could change as more employees go remote

Apple will soon let developers challenge App Store rules

China’s GPS competitor is now fully launched

GDPR’s two-year review flags lack of ‘vigorous’ enforcement

The Exchange: IPO season, self-driving misfires and a fintech letdown

Extra Crunch:

Four perspectives: Will Apple trim App Store fees?

4 enterprise developer trends that will shape 2021

Ideas for a post-COVID-19 workplace

Plaid’s Zach Perret: ‘Every company is a fintech company’

Volcker Rule reforms expand options for raising VC funds

Register for next week’s Pitches & Pitchers session

Join GGV’s Hans Tung and Jeff Richards for a live Q&A: June 30 at 3:30 pm EDT/12:30 pm PDT

Airtable’s Howie Liu to join us at Disrupt 2020

Zoom founder and CEO Eric Yuan will speak at Disrupt 2020

How to supercharge your virtual networking at Disrupt 2020

From Alex Wilhelm:

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week was a bit feisty, but that’s only because Danny Crichton and Natasha Mascarenhas and I were all in pretty good spirits. It would have been hard to not be, given how much good stuff there was to chew over.

We kicked off with two funding rounds from companies that had received a headwind from COVID-19:

Those two rounds, however, represented just one side of the COVID coin. There were also companies busy riding a COVID-tailwind to the tune of new funds:

But we had room for one more story. So, we talked a bit about Robinhood, its business model and the recent suicide of one of its users. It’s an awful moment for the family of the human we lost, but also a good moment for Robinhood to batten the hatches a bit on how its service works.

How far the company will go, however, in limiting access to certain financial tooling, will be interesting to see. The company generates lots of revenue from its order-flow business, and options are a key part of those incomes. Robinhood is therefore balancing the need to protect its users and make money from their actions. How they thread this needle will be quite interesting.

All that and we had a lot of fun. Thanks for tuning in, and follow the show on Twitter!

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

TuSimple, the self-driving truck startup backed by Sina, Nvidia, UPS and Tier 1 supplier Mando Corporation, is headed back into the marketplace in search of new capital from investors. The company has hired investment bank Morgan Stanley to help it raise $250 million, according to multiple sources familiar with the effort.

Morgan Stanley recently sent potential investors an informational packet, viewed by TechCrunch, that provides a snapshot of the company and an overview of its business model, as well as a pitch on why the company is poised to succeed — all standard fare for companies seeking investors.

TuSimple declined to comment.

The search for new capital comes as TuSimple pushes to ramp up amid an increasingly crowded pool of potential rivals.

TuSimple is a unique animal in the niche category of self-driving trucks. It was founded in 2015 at a time when most of the attention and capital in the autonomous vehicle industry was focused on passenger cars, and more specifically robotaxis.

Autonomous trucking existed in relative obscurity until high-profile engineers from Google launched Otto, a self-driving truck startup that was quickly acquired by Uber in August 2016. Startups Embark and the now defunct Starsky Robotics also launched in 2016. Meanwhile, TuSimple quietly scaled. In late 2017, TuSimple raised $55 million with plans to use those funds to scale up testing to two full truck fleets in China and the U.S. By 2018, TuSimple started testing on public roads, beginning with a 120-mile highway stretch between Tucson and Phoenix in Arizona and another segment in Shanghai.

Others have emerged in the past two years, including Ike and Kodiak Robotics. Even Waymo is pursuing self-driving trucks. Waymo has talked about trucks since at least 2017, but its self-driving trucks division began noticeably ramping up operations after April 2019, when it hired more than a dozen engineers and the former CEO of failed consumer robotics startup Anki Robotics. More recently, Amazon-backed Aurora has stepped into trucks.

TuSimple stands out for a number of reasons. It has managed to raise $298 million with a valuation of more than $1 billion, putting it into unicorn status. It has a large workforce and well-known partners like UPS. It also has R&D centers and testing operations in China and the United States. TuSimple’s research and development occurs in Beijing and San Diego. It has test centers in Shanghai and Tucson, Arizona.

Its ties to, and operations in China can be viewed as a benefit or a potential risk due to the current tensions with the U.S. Some of TuSimple’s earliest investors are from China, as well as its founding team. Sina, operator of China’s biggest microblogging site Weibo, is one of TuSimple’s earliest investors. Composite Capital, a Hong Kong-based investment firm and previous investor, is also an investor.

In recent years, the company has worked to diversify its investor base, bringing in established North American players. UPS, which is a customer, took a minority stake in TuSimple in 2019. The company announced it added about $120 million to a Series D funding round led by Sina. The round included new participants, such as CDH Investments, Lavender Capital and Tier 1 supplier Mando Corporation.

TuSimple has continued to scale its operations. As of March 2020, the company was making about 20 autonomous trips between Arizona and Texas each week with a fleet of more than 40 autonomous trucks. All of the trucks have a human safety operator behind the wheel.

Powered by WPeMatico