Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Entrepreneurs Roundtable Accelerator -backed Nayya is on a mission to simplify choosing and managing employee benefits through machine learning and data transparency.

The company has raised $2.7 million in seed funding led by Social Leverage, with participation from Guardian Strategic Ventures, Cameron Ventures, Soma Capital, as well as other strategic angels.

The process of choosing an employer-provided healthcare plan and understanding that plan can be tedious at best and incredibly confusing at worst. And that doesn’t even include all of the supplemental plans and benefits associated with these programs.

Co-founded by Sina Chehrazi and Akash Magoon, Nayya tries to solve this problem. When enrollment starts, employers send out an email that includes a link to Nayya’s Companion, the company’s flagship product.

Companion helps employees find the plan that is right for them. The software first asks a series of questions about lifestyle, location, etc. For example, Nayya co-founder and CEO Chehrazi explained that people who bike to work, as opposed to driving in a car, walking or taking public transportation, are 20 times more likely to get into an accident and need emergency services.

Companion asks questions in this vein, as well as questions around whether you take medication regularly or if you expect your healthcare costs to go up or down over the next year, without getting into the specifics of chronic ailments or diseases or particular issues.

Taking that data into account, Nayya then looks at the various plans provided by the employer to show you which one matches the user’s particular lifestyle and budget best.

Nayya doesn’t just pull information directly from the insurance company directory listings, as nearly 40% of those listings have at least one error or are out of date. It pulls from a broad variety of data sources, including the Centers for Medicare and Medicaid Services (CMS), to get the cleanest, most precise data around which doctors are in network and the usual costs associated with visiting those doctors.

Alongside Companion, Nayya also provides a product called “Edison,” which it has dubbed the Alexa for Helathcare. Users can ask Edison questions like “What is my deductible?” or “Is Dr. So-and-So in my network and what would it cost to go see her?”

The company helps individual users find the right provider for them with the ability to compare costs, location and other factors involved. Nayya even puts a badge on listings for providers where another employee at the company has gone and had a great experience, giving another layer of validation to that choice.

As the healthtech industry looks to provide easier-to-use healthcare and insurance, the idea of “personalization” has been left behind in many respects. Nayya focuses first and foremost on the end-user and aims to ensure that their own personal healthcare journey is as simple and straightforward as possible, believing that the other pieces of the puzzle will fall into place when the customer is taken care of.

Nayya plans on using the funding to expand the team across engineering, data science, product management and marketing, as well as doubling down on the amount of data the company is purchasing, ingesting and cleaning.

Alongside charging employers on a per seat, per month basis, Nayya is also looking to start going straight to insurance companies with its product.

“The greatest challenge is educating an entire ecosystem and convincing that ecosystem to believe that where the consumer wins, everyone wins,” said Chehrazi. “How to finance and understand your healthcare has never been more important than it is right now, and there is a huge need to provide that education in a data driven way to people. That’s where I want to spend the next I don’t know how many years of my life to drive that change.”

Nayya has five full-time employees currently and 80% of the team comes from racially diverse backgrounds.

Powered by WPeMatico

Replenysh has been kicking since 2016, but up til now, the Orange County, California startup hasn’t done much press. That changes today, as the company announces that it has raised a $2 million seed round with the fairly lofty goal of transforming recycling in the U.S.

A press release outlining Replenysh’s plans offers up plenty of information about what’s wrong with recycling here in the States. Among some of the key figures are the fact that it can be up to 3x more expensive to recycle a ton of material rather than simply dropping it off in a landfill. Outside of the positive press around sustainability and the rare instance of corporate altruism, that’s a rather large fiscal penalty for doing the right thing.

For its part, the Replenysh team says it’s “building this new digital supply chain.” What that means in less buzzwordy terms is that the company is working to provide software solutions designed to benefit both those selling recycled goods and companies looking to acquire the materials. That latter bit is hotter market than you’re likely aware, as big corporations have set commitments to adopt recycled materials as part of larger pledges for sustainability.

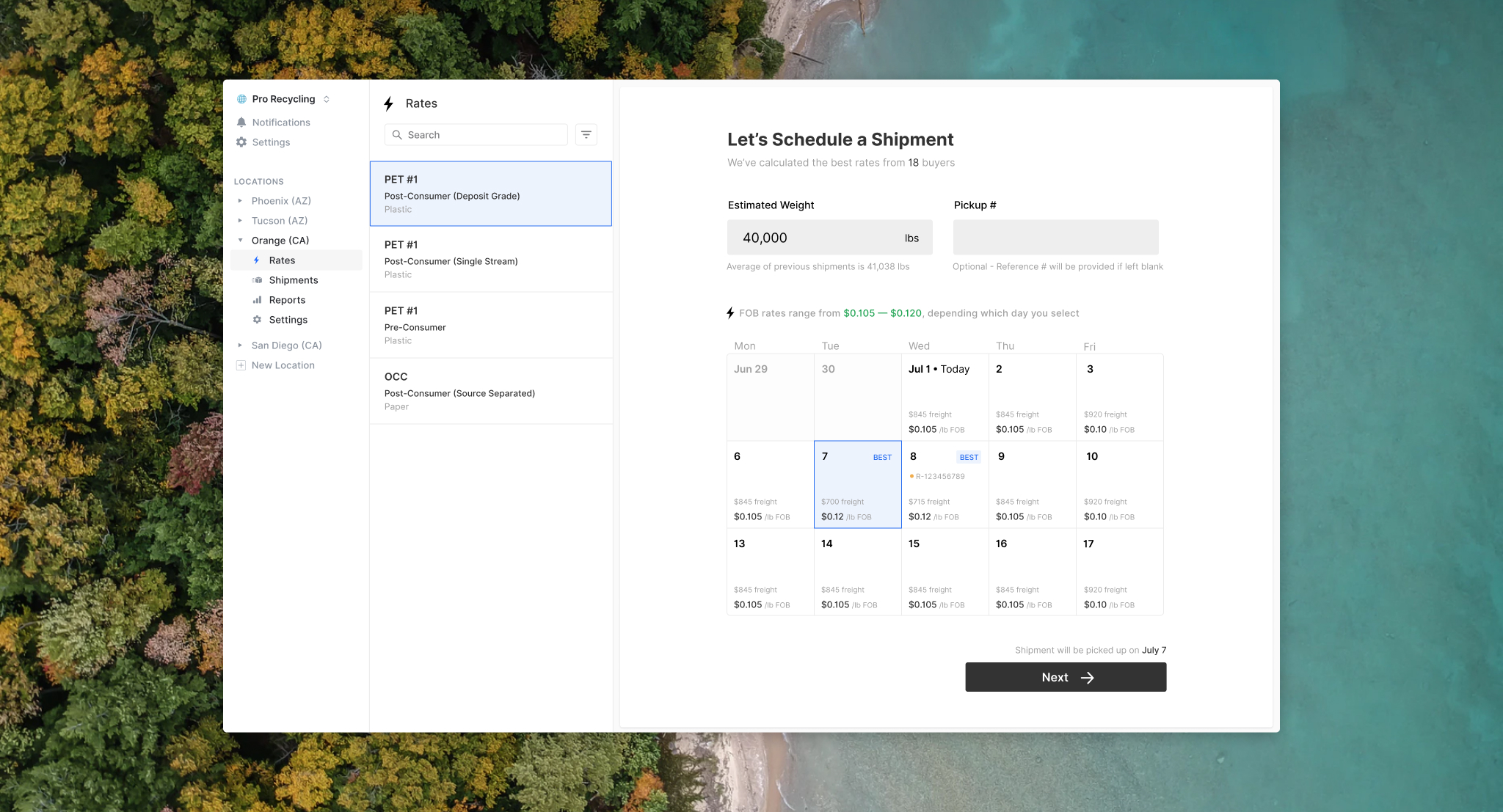

Image Credits: Replenysh

The company’s primary value comes by way of its interfacing with the owners and employees at the thousands of recycling centers based in the U.S. Replenysh has developed a software dashboard that allows the centers to find the best price for materials and schedule shipments. On the buyer side, the company also offers means by which brands can find sufficient materials and foster relationships with the aforementioned recycling centers. The company says it already has relationships with hundreds of recycling centers it has helped connect with buyers from large retailers and big brands (though it’s not yet disclosing the names of either).

“The response to our technology and services has been exciting,” founder Mark Armen told TechCrunch. “Recycling centers benefit from our rate discovery, price transparency, and workflow automation tools – and we are just getting started. We envision a world where all materials circulate through an intelligent system of continual reuse, which brands, recycling centers, and collectors can tap into and propel. The result will be a regenerative economy that restores ecosystems, relationships, and value.”

Replenysh is still a lean team, with an eight-person headcount (plus one intern). While it was founded and began working on pilots way back in 2016, the company says it really began work in earnest when it incorporated last year. The $2 million seed round is led by Kindred Ventures, Floodgate Fund and 122WEST, with plans to further build out the technologies and Replenysh’s network.

Powered by WPeMatico

Athlane, the YC-backed company from the Summer ’19 cohort, is today ready to launch with a fresh $3.3 million in capital. Investors include Y Combinator, Jonathan Kraft (New England Patriots), Michael Gordon (President of Fenway Sports Group, which owns the Red Sox and Liverpool Football Club), Global Founders Capital, Romulus Capital, Seabed VC and more.

The startup originally positioned itself as the “NCAA of esports” but, after some time in stealth, has taken a new approach. Athlane is looking to be the connective fiber between streamers and brands, facilitating sponsorship and endorsement deals with more transparent data and analytics and a streamlined communications flow.

Athlane has products for both brands and streamers.

Brands can use the Athlane Terminal to manage their sponsorships. The Insights Hub uses proprietary data to help brands understand which streamers are followed by their target demographic, and whether or not the products will resonate with that fan base. Insights also allow brands to see when a streamer’s viewership is growing.

From there, brands can send out sponsorship deals to streamers directly through the Athlane Terminal, and then track the ROI on that sponsorship deal throughout the campaign.

On the streamer side, the company has built out a platform called Athlane Pro, which lets streamers manage each task from their sponsors individually. Streamers can also use Athlane Pro to counter-offer inbound sponsorship deals or negotiate terms.

Streamers can also use Athlane’s machine learning algorithm to get clearer insights on their stream performance, such as whether their YouTube viewership overlaps with their Twitch viewership, or see which videos do better based on title or thumbnail. But more importantly, the Athlane Content Hub gives streamers the opportunity to understand if their fan base specifically aligns with this or that brand, and gives them the tools to reach out directly to that brand to solicit a sponsorship.

Athlane has also built out a Shop tool that lets streamers build out a no-code storefront for their fans, which they can link to on their Twitch, Twitter, Instagram, etc. This storefront can be a repository for all the products that streamer is endorsing, allowing fans to see products from multiple brands in a single place.

“We have a number of proprietary partnerships with data providers including companies like Twitter,” said co-founder Faisal Younus. “For example, we have a partnership with the leading manufacturer of apparel in esports, which ties back into our system so we can look at how merchandise is moving.”

That data, when paired with the data provided when a streamer signs in and integrates with the platform, becomes very precise, according to the company.

The startup charges brands using a tiered SaaS model, and streamers can do their first sponsorship for free on the platform. After the first sponsorship, streamers are charged a fee between $10 and $20 per deal. Athlane has also started working with agencies that represent brands and charges a discovery fee for talent those agencies find on the platform.

“COVID-19 has brought on very rapid growth on the viewership side, and because of that we’ve seen an intense interest from a number of brands while conventional entertainment is shut down,” said Younus. “A lot of media spend is going to go unspent, but there is also a higher risk appetite for spending a little bit in esports, and our challenge is making sure this industry growth is sustained.”

He added that helping brands understand the true ROI of that spend will be key.

Powered by WPeMatico

OwnBackup has made a name for itself primarily as a backup and disaster recovery system for the Salesforce ecosystem, and today the company announced a $50 million investment.

Insight Partners led the round, with participation from Salesforce Ventures and Vertex Ventures. This chunk of money comes on top of a $23 million round from a year ago, and brings the total raised to more than $100 million, according to the company.

It shouldn’t come as a surprise that Salesforce Ventures chipped in when the majority of the company’s backup and recovery business involves the Salesforce ecosystem, although the company will be looking to expand beyond that with the new money.

“We’ve seen such growth over the last two and a half years around the Salesforce ecosystem, and the other ISV partners like Veeva and nCino that we’ve remained focused within the Salesforce space. But with this funding, we will expand over the next 12 months into a few new ecosystems,” company CEO Sam Gutmann told TechCrunch.

In spite of the pandemic, the company continues to grow, adding 250 new customers last quarter, bringing it to over 2,000 customers and 250 employees, according to Gutmann.

He says that raising the round, which closed at the beginning of May, had some hairy moments as the pandemic began to take hold across the world and worsen in the U.S. For a time, he began talking to new investors in case his existing ones got cold feet. As it turned out, when the quarterly numbers came in strong, the existing ones came back and the round was oversubscribed, Gutmann said.

“Q2 frankly was a record quarter for us, adding over 250 new accounts, and we’re seeing companies start to really understand how critical this is,” he said.

The company plans to continue hiring through the pandemic, although he says it might not be quite as aggressively as they once thought. Like many companies, even though they plan to hire, they are continually assessing the market. At this point, he foresees growing the workforce by about another 50 people this year, but that’s about as far as he can look ahead right now.

Gutmann says he is working with his management team to make sure he has a diverse workforce right up to the executive level, but he says it’s challenging. “I think our lower ranks are actually quite diverse, but as you get up into the leadership team, you can see on the website unfortunately we’re not there yet,” he said.

They are instructing their recruiting teams to look for diverse candidates whether by gender or ethnicity, and employees have formed a diversity and inclusion task force with internal training, particularly for managers around interviewing techniques.

He says going remote has been difficult, and he misses seeing his employees in the office. He hopes to have at least some come back before the end of the summer and slowly add more as we get into the fall, but that will depend on how things go.

Powered by WPeMatico

Email is a critical tool in modern-day communications, so it’s natural that many entrepreneurs have tried to overhaul it over the years.

In the last decade, email client Mailbox came and went, Slack launched to try to give people an alternative to email and Superhuman emerged to help people more easily reach the promised land of Inbox Zero.

The latest startup to tackle email is project management software maker Basecamp, which launched Hey last month. Within its first 11 days of release, Hey received 125,000 signups, Basecamp founder and CEO Jason Fried tells TechCrunch. Those initial days also included some drama with the Apple App Store, but that’s not what this story is about. Instead, it’s about Hey’s approach, why Fried felt the need to try to rebuild email from the ground up and how he approaches product development.

“The last time people were really excited about email, really, in a broad scale was 16 years ago when Gmail came out in 2004,” Fried says. “I remember it feeling different in a lot of ways. It was really fast, they had archiving, which was a new concept at the time. It worked differently than what I was coming from, which was Yahoo Mail, which was sort of stuck in the past. And I think that’s where Gmail is today — stuck in the past and we’re trying to bring out something brand new with new thinking and new philosophies and a new point of view.”

At its core, Hey is about giving people control over their email and minimizing clutter so users can hear from the people who matter most, Fried says. But control comes at a price: Hey costs $99 per year, with additional fees for three- and two-character email addresses (two-character email addresses are $999 per year and three-character addresses are $349 per year).

“We got a taste of our own medicine because it was not cheap to buy hey.com,” Fried says. “So anything that short in the domain world just costs more. It’s like beachfront property almost, because it’s scarce — more desirable. So given that we have a three-letter domain, two- and three-letter email addresses are just going to cost more. There’s fewer of them and they’re more desirable.”

Hey’s current iteration is targeted toward individual users, but by the end of the year, the plan is to launch a formal enterprise version with collaborative features like shared messages and inboxes. In this unified Imbox (not a typo), people will be able to specify that they don’t want to see work email past a certain time or on weekends.

“A lot of email is collaborative in nature,” Fried says. “People end up forwarding emails around to show someone to get their take. We think that’s totally broken and really antiquated. So we have some stuff built into Hey for work, which lets people share threads with one another in a very different way and be able to have backchannel conversations about threads without having to have those conversations in another product or somewhere that is separate from the actual thread itself.”

There’s much more to this conversation, like how Hey landed on its hypothesis, why control is so important, how email shouldn’t feel like work and more. Below are Fried’s insights.

Powered by WPeMatico

Despite record-setting COVID-19 infections, American equities rose today. All major indices gained ground during regular trading, while tech stocks did even better.

The Nasdaq Composite set new 52-week and all-time highs, touching 10,462.0 points before closing at 10,433.65, up 2.21% on the day. Similarly, a basket of SaaS and cloud companies that has risen and fallen more sharply than even the tech-heavy Nasdaq closed this afternoon at 1,908.30 after touching 1,952.39 points. Both results were 52-week and all-time highs.

Such is the mood on Wall Street regarding the health of technology companies. It’s not hard to find bullish sentiment, jockeying to push tech shares higher. Some examples of today’s enthusiasm paint the picture:

You can’t swing your arms without running into a reason why it makes sense for SaaS stocks to be trading at record valuation multiples, or why one company or another is actually reasonably valued over a long-enough time horizon.

It’s worth noting that this putatively rational public investor thinking doesn’t fit at all with what the tech set used to pound into my head about the public markets, namely that they are infamously impatient and thus utter bilge for most long-term value creation. Going public was garbage, I was told; you have to report every three months and no one looks out a few years.

Now, I’m being told by roughly the same people that the market is doing the very thing that they said it didn’t do, namely price firms for future results instead of trailing outcomes. Fine by me either way, frankly, but I’d like to know which story is true.

Happily, we’re about to see if all this high-fiving and enthusiasm is real.

Earnings season beckons, and it should bring with it a dose or two of clarity. If the digital transformation has managed to accelerate sufficiently that most tech companies have managed to greatly boost their near-term value, hats off to the cohort and bully for the startups that must also be enjoying similar revenue upswells.

But that doesn’t have to happen. There are possible earnings result sets that can cause investors to dump tech shares, as Slack learned a month ago.

The background to all of this is that there are good reasons to have some doubts about the current health of the national economy. And, sure, most people are willing to allow that the stock market and the aggregate domestic economy are not perfectly linked — this is no less than partially true — but each day the stock market steps higher and COVID-19 surges again leading to re-closings around the nation makes you to wonder if this is all for real.

Earnings season is here soon. Let’s find out.

Powered by WPeMatico

Hundreds of tech-oriented startups worth a billion or more dollars had envisioned successful public offerings before the pandemic hit. But new tech listings slowed to nearly nothing this spring as companies have tried to adjust to the profound changes sweeping the world.

Today, more and more companies are back to their previous plans, with Lemonade and Accolade finding an enthusiastic public this week, following Agora’s pop last Friday, as Alex Wilhelm has been covering.

The first big tech IPO this week was in online insurance, the second in health, and despite both being in promising markets, the valuations are quite a bit higher than their business realities to date. Here’s more, from his analysis on Extra Crunch:

Lemonade is being valued at more than 15x the value of its annualized Q1 revenue despite not sporting the gross margins you might expect investors to demand for it to merit that SaaS valuation. And Accolade only expects to grow by about 20% in Q2 2020 compared to its year-ago results while probably losing more money.

But who cares? The IPO market is standing there with open arms today (there’s always another IPO cliché lurking).

The read of this is impossibly simple: However open we thought that the IPO market was before, it is even more welcoming. For companies on the sidelines, like Palantir, Airbnb, DoorDash and Asana, you have to wonder what they are waiting for. Sure, you can raise more private capital like Palantir and DoorDash have, but so what; if you want to defend your valuation, isn’t this the market that was hoped for?

He also takes a look at a few more companies getting ready to file, including banking software company nCino and GoHealth, an insurance portal that was bought by a private equity firm last year, as well as gaming company DoubleDown Interactive. The general trend seems to be that initial stock pricing has stayed more conservative than how public markets are feeling.

“Early-stage startups are confident of re-opening their offices in the wake of the COVID-19 within the next six months,” writes Mike Butcher for TechCrunch this week. “But there will be changes.” Here’s more from our UK-based editor-at-large:

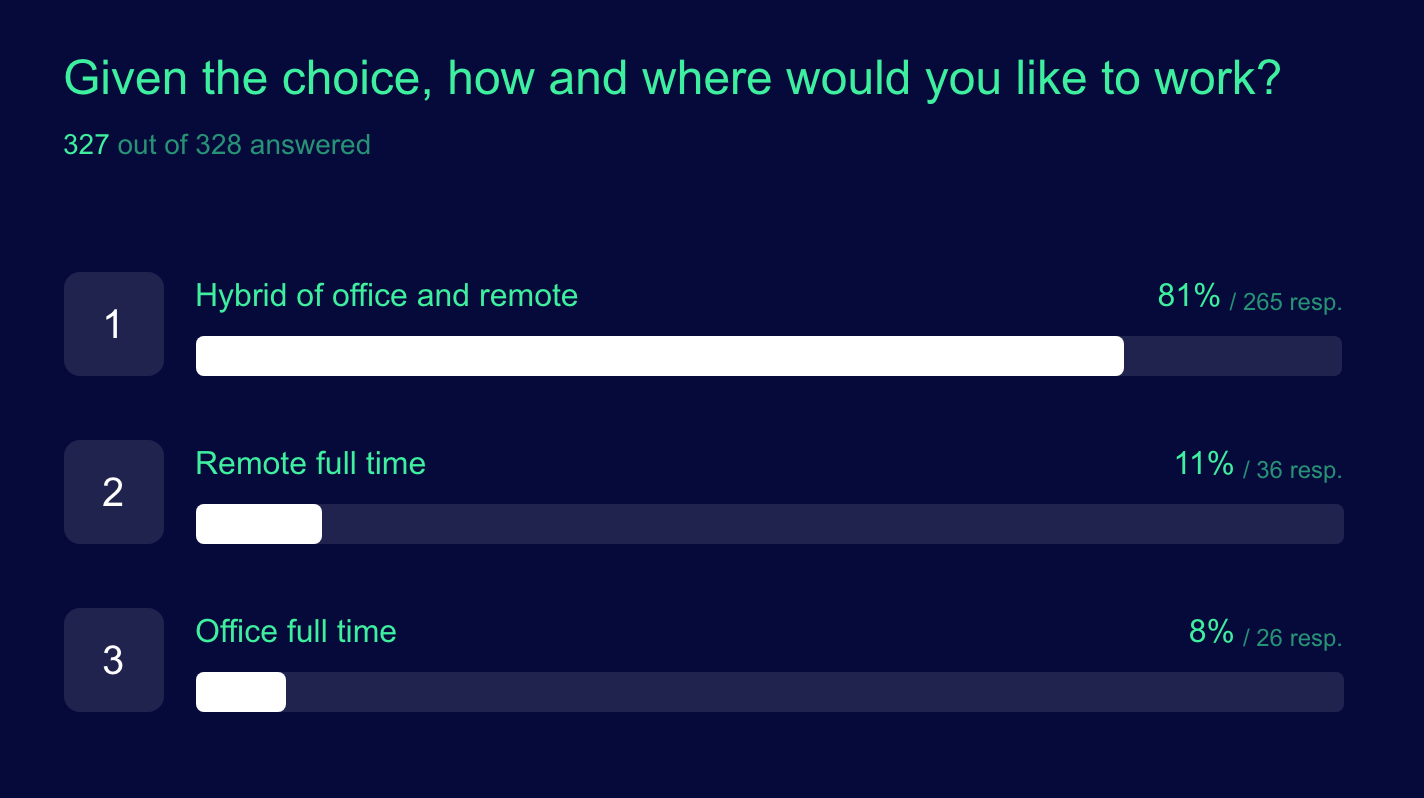

An exclusive survey compiled by Founders Forum, with TechCrunch, found 63% of those surveyed said they would only re-open in either 1-3 months or 3-6 months — even if the government advises [sic] that it is safe to do so before then. A minority have re-opened their offices, while 10% have closed their office permanently. The full survey results can be found here.

However, there will clearly be long-term impact on the model of office working, with a majority of those surveyed saying they would now move to either a flexible remote working model (some with permanent offices, some without), but only a small number plan a “normal” return to work. A very small number plan to go fully “remote.” Many cited the continuing benefits of face-to-face interaction when trying to build the team culture so crucial with early-stage companies.

A lot of people are thinking harder about homeownership as they wait out quarantines — but real estate is still an old-fashioned industry, layered with complexities and surprising costs that can keep a dream purchase out of reach. Title insurance is a great example. A one-time cost to protect buyers and sellers during the closing process, it can extend the purchase process by a month or two, in addition to potentially adding thousands of dollars in costs. But various new regulations and rulings have combined with the larger trends in SaaS to open up the market. Here’s more, in a detailed guest post for Extra Crunch from Ashley Paston of Bain Capital Ventures:

In a very short period of time, we’ve seen startups take advantage of this new, more competitive landscape by offering solutions to streamline the task of getting title insurance. Qualia, for example, offers an end-to-end platform that connects all parties involved in a real estate transaction, so title agents can manage and coordinate all aspects of the process in real time. San Francisco-based States Title, for example, uses a predictive underwriting engine that produces nearly instantaneous title assessment, dramatically reducing the cost and time required to issue a policy. Qualia and States Title are among several companies hoping to revolutionize title insurance and they reflect the two emerging meta-trends.

The first trend, enablement, consists of companies developing technology designed to integrate with incumbent real estate businesses… The second trend, disruption, consists of companies displacing incumbent real estate business altogether.

Image Credits: Black Innovation Alliance

The tech industry has talked about making its opportunities available to all for many years, and struggled to deliver. But more than a month after George Floyd was killed, this time is still feeling different. One example is

.fm, a viral sort of insidery prank from last weekend that a diverse small group of friends in tech created and turned into a successful grassroots fundraiser for racial justice organizations (it was not a VC fundraising stunt). “In one fell swoop,” veteran product leader Ravi Mehta wrote for TechCrunch, “the team chastised Silicon Valley’s use of exclusivity as a marketing tactic, trolled thirsty VCs for their desire to always be first on the next big thing, deftly leveraged the virality of Twitter to build awareness and channeled that awareness into dollars that will have a real impact on groups too often overlooked.”

.fm, a viral sort of insidery prank from last weekend that a diverse small group of friends in tech created and turned into a successful grassroots fundraiser for racial justice organizations (it was not a VC fundraising stunt). “In one fell swoop,” veteran product leader Ravi Mehta wrote for TechCrunch, “the team chastised Silicon Valley’s use of exclusivity as a marketing tactic, trolled thirsty VCs for their desire to always be first on the next big thing, deftly leveraged the virality of Twitter to build awareness and channeled that awareness into dollars that will have a real impact on groups too often overlooked.”

Meanwhile, a group of Black startup founders and the Transparent Collective created a public spreadsheet to provide a comprehensive list of every VC who has backed a Black founder in the US, and the umbrella Black Innovation Alliance launched to help hundreds of related Black-focused tech and entrepreneurship organizations connect and support each other. Efforts like these, combined with a real generational willingness to address the structural problems, are what can make the difference finally.

Augmented reality concepts may become a core part of how people live in the future, but the first wave of companies in the space have not fared well. Here’s why, from Lucas Matney on Extra Crunch:

The technology was almost there in a lot of cases, but the real issue was that the stakes to beat the major players to market were so high that many entrants pushed out boring, general consumer products. In a race to be everything for everybody, the industry relied on nascent developer platforms to do the dirty work of building their early use cases, which contributed heavily to nonexistent user adoption.

Instead, he says success will come from nailing the use-cases first, and not messing around with complex developer platforms and expensive hardware.

Hear Charles Hudson explain how to sell an idea (without a product) at Early Stage

Get your pitchdeck critiqued by Accel’s Amy Saper and Bessemer’s Talia Goldberg at Early Stage

Pioneering CRISPR researcher Jennifer Doudna is coming to Disrupt

One week only: Score 4th of July discounts on Disrupt 2020 passes

Sale: Save 25% on annual Extra Crunch membership

Extra Crunch is now available in Greece, Ireland and Portugal

Extra Crunch expands into Romania

TechCrunch

Global app revenue jumps to $50B in the first half of 2020, in part due to COVID-19 impacts

Let’s stop COVID-19 from undoing diversity gains

Strap in — a virtual Tour de France is coming this weekend

US suspends export of sensitive tech to Hong Kong as China passes new national security law

India bans TikTok, dozens of other Chinese apps

Extra Crunch

Top LA investors discuss the city’s post-COVID-19 prospects

13 Boston-focused venture capitalists talk green shoots and startup recovery

How $20 billion health care behemoth Blue Shield of California sees startups

From napkin notes to term sheets: A chat with Inspired Capital’s Alexa von Tobel

Are virtual concerts here to stay?

From Alex:

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Before we dive in, don’t forget that the show is on Twitter now, so follow us there if you want to see discarded headline ideas, outtakes from the show that got cut, and more. It’s fun!

Back to task, listen, we’re tired too. But we didn’t let that stop us from packing this week’s Equity to the very gills with news and notes and jokes and fun. Hopefully you can chuckle along with myself and Natasha and Danny and Chris on the dials as we riffed through all of this:

Right, that’s our ep. Hugs from the team and have a lovely weekend. You are all tremendous and we appreciate you spending part of your day with the four of us.

Equity drops every Monday at 7:00 AM PT and Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Earlier this week, GGV Capital’s Jeff Richards and Hans Tung joined TechCrunch for an Extra Crunch Live session. During our hour-long chat, we touched on startup profitability, the global venture capital scene, why GGV doesn’t have an office in Europe, how the venture industry is responding to its stark lack of diversity and other issues.

When it comes to useful bits of information, this was perhaps the most useful Extra Crunch Live discussion in which I’ve participated. One moment that stood out came early in the chat when we were talking about COVID-19-driven headwinds and tailwinds and how many startups might be in trouble. Richards said the following (emphasis via TechCrunch):

“You know, the one thing that’s been remarkable for me — I was in Silicon Valley as an entrepreneur in the ’99, 2000 dot-com bubble, and 9/11. I was here in ’08, ’09 — I think there is a level of resiliency in Silicon Valley that we did not have 10 years ago and 20 years ago. I don’t have data to point to that. But we have been saying now for a few months that we’ve been blown away at the level of maturity, calmness, perseverance [and] resiliency that our companies and the founders and management teams have. On an emotional level, it’s been very heartwarming, because you hope to back the kind of people that are building real companies that can withstand challenges.

I think the corollary to that is you’ve seen companies that raised a ton of money and were burning a ton of cash and weren’t building very good businesses, a lot of those frankly went under in Q1 or are going under now. They haven’t been able to raise more cash and they’re just kind of dead.”

Both Richards and Tung were positive about their own portfolio companies’ recent performance and financial health (cash position, really). But it appears that not only are their portfolios doing well, but other startups are a bit more solid than in previous downturns.

On the flip side, however, there is a separate cohort of startups that were running inefficiently before and are now perhaps unfundable. Reading both points in unison, it appears that the startup market is bifurcating between the companies that will come out of the COVID-19 era unwounded, and those that are suffering. And the companies that weren’t the most cash hungry probably have the highest chance of being in the first bucket.

There’s a lot more to get to. So hit the jump for the full video and audio, and a few more of the best bits from the transcript. (You can snag a cheap Extra Crunch trial here if you need one.)

Oh, and don’t forget to stay up to date on coming chats. There’s still a lot to do.

Here’s the full video rewind. Our favorite bits of the transcript follow:

Powered by WPeMatico

Welcome back to our $100 million annual recurring revenue (ARR) series, in which we take irregular looks at companies that have reached material scale while still private. The goal of our project is simple: uncovering companies of real worth beyond how they are valued by private investors.

The Exchange is a daily look at startups and the private markets for Extra Crunch subscribers; use code EXCHANGE to get full access and take 25% off your subscription.

It’s all well and good to get a $1 billion valuation, call yourself a unicorn and march around like you invented the internet. But reaching material revenue scale means that, unlike some highly valued companies, you’re actually hard to kill. (And more valuable, and more likely to go public, we reckon.)

Before we dive into today’s new companies, keep in mind that we’ve expanded the type of company that can make it into the $100M ARR club to include companies that reach a $100 million annual run rate pace. Why? Because we don’t only want to collect SaaS companies, and if we could go back in time we’d probably draw a different box around the companies we are tracking.

Before we dive into today’s new companies, keep in mind that we’ve expanded the type of company that can make it into the $100M ARR club to include companies that reach a $100 million annual run rate pace. Why? Because we don’t only want to collect SaaS companies, and if we could go back in time we’d probably draw a different box around the companies we are tracking.

If you need to catch up, you can find the two most recent entries in the series here and here. For everyone who’s current, today we are adding Snow Software, A Cloud Guru, Zeta Global and Upgrade to the club. Let’s go!

Just this week, Snow Software announced that it has crossed the $100 million ARR mark, according to a release shared with TechCrunch. The Swedish software asset management company has raised a few private rounds, including a $120 million private equity round in 2017. But, unlike many American companies that make this list, we don’t have a historical record of needing extensive private capital to scale.

Powered by WPeMatico

When Troy Hunt launched Have I Been Pwned in late 2013, he wanted it to answer a simple question: Have you fallen victim to a data breach?

Seven years later, the data-breach notification service processes thousands of requests each day from users who check to see if their data was compromised — or pwned with a hard ‘p’ — by the hundreds of data breaches in its database, including some of the largest breaches in history. As it’s grown, now sitting just below the 10 billion breached-records mark, the answer to Hunt’s original question is more clear.

“Empirically, it’s very likely,” Hunt told me from his home on Australia’s Gold Coast. “For those of us that have been on the internet for a while it’s almost a certainty.”

What started out as Hunt’s pet project to learn the basics of Microsoft’s cloud, Have I Been Pwned quickly exploded in popularity, driven in part by its simplicity to use, but largely by individuals’ curiosity.

As the service grew, Have I Been Pwned took on a more proactive security role by allowing browsers and password managers to bake in a backchannel to Have I Been Pwned to warn against using previously breached passwords in its database. It was a move that also served as a critical revenue stream to keep down the site’s running costs.

But Have I Been Pwned’s success should be attributed almost entirely to Hunt, both as its founder and its only employee, a one-man band running an unconventional startup, which, despite its size and limited resources, turns a profit.

As the workload needed to support Have I Been Pwned ballooned, Hunt said the strain of running the service without outside help began to take its toll. There was an escape plan: Hunt put the site up for sale. But, after a tumultuous year, he is back where he started.

Ahead of its next big 10-billion milestone mark, Have I Been Pwned shows no signs of slowing down.

Even long before Have I Been Pwned, Hunt was no stranger to data breaches.

By 2011, he had cultivated a reputation for collecting and dissecting small — for the time — data breaches and blogging about his findings. His detailed and methodical analyses showed time and again that internet users were using the same passwords from one site to another. So when one site was breached, hackers already had the same password to a user’s other online accounts.

Then came the Adobe breach, the “mother of all breaches” as Hunt described it at the time: Over 150 million user accounts had been stolen and were floating around the web.

Hunt obtained a copy of the data and, with a handful of other breaches he had already collected, loaded them into a database searchable by a person’s email address, which Hunt saw as the most common denominator across all the sets of breached data.

And Have I Been Pwned was born.

It didn’t take long for its database to swell. Breached data from Sony, Snapchat and Yahoo soon followed, racking up millions more records in its database. Have I Been Pwned soon became the go-to site to check if you had been breached. Morning news shows would blast out its web address, resulting in a huge spike in users — enough at times to briefly knock the site offline. Hunt has since added some of the biggest breaches in the internet’s history: MySpace, Zynga, Adult Friend Finder, and several huge spam lists.

As Have I Been Pwned grew in size and recognition, Hunt remained its sole proprietor, responsible for everything from organizing and loading the data into the database to deciding how the site should operate, including its ethics.

Hunt takes a “what do I think makes sense” approach to handling other people’s breached personal data. With nothing to compare Have I Been Pwned to, Hunt had to write the rules for how he handles and processes so much breach data, much of it highly sensitive. He does not claim to have all of the answers, but relies on transparency to explain his rationale, detailing his decisions in lengthy blog posts.

His decision to only let users search for their email address makes logical sense, driven by the site’s only mission, at the time, to tell a user if they had been breached. But it was also a decision centered around user privacy that helped to future-proof the service against some of the most sensitive and damaging data he would go on to receive.

In 2015, Hunt obtained the Ashley Madison breach. Millions of people had accounts on the site, which encourages users to have an affair. The breach made headlines, first for the breach, and again when several users died by suicide in its wake.

The hack of Ashley Madison was one of the most sensitive entered into Have I Been Pwned, and ultimately changed how Hunt approached data breaches that involved people’s sexual preferences and other personal data. (AP Photo/Lee Jin-man, File)

Hunt diverged from his usual approach, acutely aware of its sensitivities. The breach was undeniably different. He recounted a story of one person who told him how their local church posted a list of the names of everyone in the town who was in the data breach.

“It’s clearly casting a moral judgment,” he said, referring to the breach. “I don’t want Have I Been Pwned to enable that.”

Unlike earlier, less sensitive breaches, Hunt decided that he would not allow anyone to search for the data. Instead, he purpose-built a new feature allowing users who had verified their email addresses to see if they were in more sensitive breaches.

“The purposes for people being in that data breach were so much more nuanced than what anyone ever thought,” Hunt said. One user told him he was in there after a painful break-up and had since remarried but was labeled later as an adulterer. Another said she created an account to catch her husband, suspected of cheating, in the act.

“There is a point at which being publicly searchable poses an unreasonable risk to people, and I make a judgment call on that,” he explained.

The Ashely Madison breach reinforced his view on keeping as little data as possible. Hunt frequently fields emails from data breach victims asking for their data, but he declines every time.

“It really would not have served my purpose to load all of the personal data into Have I Been Pwned and let people look up their phone numbers, their sexualities, or whatever was exposed in various data breaches,” said Hunt.

“If Have I Been Pwned gets pwned, it’s just email addresses,” he said. “I don’t want that to happen, but it’s a very different situation if, say, there were passwords.”

But those remaining passwords haven’t gone to waste. Hunt also lets users search more than half a billion standalone passwords, allowing users to search to see if any of their passwords have also landed in Have I Been Pwned.

Anyone — even tech companies — can access that trove of Pwned Passwords, he calls it. Browser makers and password managers, like Mozilla and 1Password, have baked-in access to Pwned Passwords to help prevent users from using a previously breached and vulnerable password. Western governments, including the U.K. and Australia, also rely on Have I Been Pwned to monitor for breached government credentials, which Hunt also offers for free.

“It’s enormously validating,” he said. “Governments, for the most part, are trying to do things to keep countries and individuals safe — working under extreme duress and they don’t get paid much,” he said.

“There have been similar services that have popped up. They’ve been for-profit — and they’ve been indicted.”

Troy Hunt

Hunt recognizes that Have I Been Pwned, as much as openness and transparency is core to its operation, lives in an online purgatory under which any other circumstances — especially in a commercial enterprise — he would be drowning in regulatory hurdles and red tape. And while the companies whose data Hunt loads into his database would probably prefer otherwise, Hunt told me he has never received a legal threat for running the service.

“I’d like to think that Have I Been Pwned is at the far-legitimate side of things,” he said.

Others who have tried to replicate the success of Have I Been Pwned haven’t been as lucky.

“There have been similar services that have popped up,” said Hunt. “They’ve been for-profit — and they’ve been indicted,” he said.

LeakedSource was, for a time, one of the largest sellers of breach data on the web. I know, because my reporting broke some of their biggest gets: music streaming service Last.fm, adult dating site AdultFriendFinder, and Russian internet giant Rambler.ru to name a few. But what caught the attention of federal authorities was that LeakedSource, whose operator later pleaded guilty to charges related to trafficking identity theft information, indiscriminately sold access to anyone else’s breach data.

“There is a very legitimate case to be made for a service to give people access to their data at a price.”

Hunt said he would “sleep perfectly fine” charging users a fee to access their data. “I just wouldn’t want to be accountable for it if it goes wrong,” he said.

Five years into Have I Been Pwned, Hunt could feel the burnout coming.

“I could see a point where I would be if I didn’t change something,” he told me. “It really felt like for the sustainability of the project, something had to change.”

He said he went from spending a fraction of his time on the project to well over half. Aside from juggling the day-to-day — collecting, organizing, deduplicating and uploading vast troves of breached data — Hunt was responsible for the entirety of the site’s back office upkeep — its billing and taxes — on top of his own.

The plan to sell Have I Been Pwned was codenamed Project Svalbard, named after the Norweigian seed vault that Hunt likened Have I Been Pwned to, a massive stockpile of “something valuable for the betterment of humanity,” he wrote announcing the sale in June 2019. It would be no easy task.

Hunt said the sale was to secure the future of the service. It was also a decision that would have to secure his own. “They’re not buying Have I Been Pwned, they’re buying me,” said Hunt. “Without me, there’s just no deal.” In his blog post, Hunt spoke of his wish to build out the service and reach a larger audience. But, he told me, it was not about the money

As its sole custodian, Hunt said that as long as someone kept paying the bills, Have I Been Pwned would live on. “But there was no survivorship model to it,” he admitted. “I’m just one person doing this.”

By selling Have I Been Pwned, the goal was a more sustainable model that took the pressure off him, and, he joked, the site wouldn’t collapse if he got eaten by a shark, an occupational hazard for living in Australia.

But chief above all, the buyer had to be the perfect fit.

Hunt met with dozens of potential buyers, and many in Silicon Valley. He knew what the buyer would look like, but he didn’t yet have a name. Hunt wanted to ensure that whomever bought Have I Been Pwned upheld its reputation.

“Imagine a company that had no respect for personal data and was just going to abuse the crap out of it,” he said. “What does that do for me?” Some potential buyers were driven by profits. Hunt said any profits were “ancillary.” Buyers were only interested in a deal that would tie Hunt to their brand for years, buying the exclusivity to his own recognition and future work — that’s where the value in Have I Been Pwned is.

Hunt was looking for a buyer with whom he knew Have I Been Pwned would be safe if he were no longer involved. “It was always about a multiyear plan to try and transfer the confidence and trust people have in me to some other organizations,” he said.

Hunt testifies to the House Energy Subcommittee on Capitol Hill in Washington, Thursday, Nov. 30, 2017. (AP Photo/Carolyn Kaster)

The vetting process and due diligence was “insane,” said Hunt. “Things just drew out and drew out,” he said. The process went on for months. Hunt spoke candidly about the stress of the year. “I separated from my wife early last year around about the same time as the [sale process],” he said. They later divorced. “You can imagine going through this at the same time as the separation,” he said. “It was enormously stressful.”

Then, almost a year later, Hunt announced the sale was off. Barred from discussing specifics thanks to non-disclosure agreements, Hunt wrote in a blog post that the buyer, whom he was set on signing with, made an unexpected change to their business model that “made the deal infeasible.”

“It came as a surprise to everyone when it didn’t go through,” he told me. It was the end of the road.

Looking back, Hunt maintains it was “the right thing” to walk away. But the process left him back at square one without a buyer and personally down hundreds of thousands in legal fees.

After a bruising year for his future and his personal life, Hunt took time to recoup, clambering for a normal schedule after an exhausting year. Then the coronavirus hit. Australia fared lightly in the pandemic by international standards, lifting its lockdown after a brief quarantine.

Hunt said he will keep running Have I Been Pwned. It wasn’t the outcome he wanted or expected, but Hunt said he has no immediate plans for another sale. For now it’s “business as usual,” he said.

In June alone, Hunt loaded over 102 million records into Have I Been Pwned’s database. Relatively speaking, it was a quiet month.

“We’ve lost control of our data as individuals,” he said. But not even Hunt is immune. At close to 10 billion records, Hunt has been ‘pwned’ more than 20 times, he said.

Earlier this year Hunt loaded a massive trove of email addresses from a marketing database — dubbed ‘Lead Hunter’ — some 68 million records fed into Have I Been Pwned. Hunt said someone had scraped a ton of publicly available web domain record data and repurposed it as a massive spam database. But someone left that spam database on a public server, without a password, for anyone to find. Someone did, and passed the data to Hunt. Like any other breach, he took the data, loaded it in Have I Been Pwned, and sent out email notifications to the millions who have subscribed.

“Job done,” he said. “And then I got an email from Have I Been Pwned saying I’d been pwned.”

He laughed. “It still surprises me the places that I turn up.”

Related stories:

Powered by WPeMatico