Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Electric vehicle startup Fisker Inc. said Wednesday it has raised $50 million, much needed capital that will go toward funding the next phase of engineering work on the company’s all-electric luxury SUV.

The startup is aiming to launch the Fisker Ocean SUV in 2022.

The Series C funding round was led by Moore Strategic Ventures LLC, the private investment vehicle of Louis M. Bacon, the billionaire hedge fund manager.

“Since we first showed the car at CES earlier this year, reaction from customers and investors has been extremely positive,” Fisker Inc. Chairman and CEO Henrik Fisker said in a statement. “We are radically challenging the conventional industry thinking around developing and selling cars and this capital will allow us to execute our planned timeline to start producing vehicles in 2022.”

The company is also beefing up its executive lineup to help push the project along. Fisker said it has hired Burkhard Huhnke as its CTO. Huhnke was the former vice president of e-mobility for Volkswagen America and vice president of automotive at chipmaker Synopses.

As CTO, Huhnke will spread his time between the company’s R&D work in Los Angeles and its new Fisker Innovation Lab in Silicon Valley.

Building a car company isn’t easy. Just ask Fisker. The well-known automotive designer, who was behind the Aston Martin V8 Vantage, Aston Martin DB9 and BMW Z8 among others, launched a startup called Fisker Automotive that aimed to produce a luxury plug-in hybrid electric vehicles. The flagship vehicle, the Fisker Karma, debuted at the 2008 North American International Auto Show, and first deliveries were in 2011. But the company ran into numerous challenges and production was suspended in November 2012 and ended in bankruptcy a year later.

China’s Wanxiang Group purchased what was left of Fisker in 2014 and launched a new company called Karma Automotive . On a side note: Karma, which has had its own financial struggles, also announced Wednesday it had raised $100 million.

This time around, Fisker is focused on an SUV. The Fisker Ocean, which was officially revealed in January at CES 2020, starts at $37,499 before applying any federal income tax credit or state incentives.

Powered by WPeMatico

The Colombian trucking and logistics services startup Liftit has raised $22.5 million in a new round of funding to capitalize on its newfound traction in markets across Latin America as responses to the COVID-19 epidemic bring changes to the industry across the region.

“We’re focusing on the five countries that we’re already in,” says Liftit chief executive Brian York.

The company recently hired a head of operations for Mexico and a head of operations for Brazil as it looks to double down on its success in both regions.

Funding for the round was led by Cambridge Capital and included investments from the new Latin American-focused firm H20 Capital along with AC Ventures, the venture arm of the second-largest Coca-Cola bottler in LatAm; 10x Capital, Banyan Tree Ventures, Alpha4 Ventures, the lingerie brand Leonisa; and Mexico’s largest long-haul trucking company, Grupo Transportes Monterrey. Individual investor Jason Radisson, the former chief operating officer of the on-demand ride hailing startup 99, also invested.

The new capital comes on top of Liftit’s $14.3 million Series A from some of the region’s top local investors. Firms like Monashees, Jaguar Ventures and NXTP Ventures all joined the International Finance Corp. in financing the company previously and all returned to back the company again with its new funding.

Investors likely responded to the company’s strong performance in its core markets. Already profitable in Chile and Colombia, Liftit expects to reach profitability across all of its operations before the end of the year. That’s despite the global pandemic.

Of the 220 contracts the company had with shippers, half of them went to zero and the other half spiked significantly, York said. While Liftit’s major Colombian customer stumbled, new business, like Walmart, saw huge spikes in deliveries and usage.

“Managing truck drivers is incredibly difficult, and trucking, in our opinion, is not on-demand,” said York. “At the end of the day the trucking market in all of Latin America is a majority of independent owners. They’re not looking for on-demand work… they’re looking for full-time work.”

Less than 1% of the company’s deliveries come from on-demand orders; instead, it’s a service comprised of scheduled shipments with optimized routes and efficiencies that are bringing customers to Liftit’s virtual door.

“We do scheduled trucking delivery so we integrate with existing systems that shippers have and start planning how many trucks they’re going to need and the routes they’re going to take and … tee it up exactly what is going to happen regardless what the traffic conditions are so we have been able to reduce the delivery times for the trucks,” said York.

Powered by WPeMatico

At first glance, Colvin — which recently announced that it has raised a $15 million Series B — might look like just another flower and plant delivery company, but co-founder and CEO Andres Cester said the startup has a much grander vision.

“We were born with the ambition to be the company that would redesign global flower trade,” he said.

Apparently, when Cester and his co-founder/COO Sergi Bastardas started researching the flower supply chain, they found an industry that was both “fragmented” in terms of growers and sellers, but also surprisingly centralized, with the Aalsmeer Flower Auction in the Netherlands accounting for 77% of all flower bulbs sold globally.

With all the middlemen, Cester said flowers end up being more expensive (with the growers getting a smaller share of the overall payment), and it takes longer for the flowers to reach the consumer.

So the startup created a marketplace where consumers are buying flowers straight from the growers, with Colvin as the only intermediary. That results in average savings of 50% to 100% compared to online competitors, Cester said. (For example, the bouquets featured on the Colvin homepage all cost about €33 or €34).

And while the flower business is hurting overall due to the COVID-19 pandemic, Bastardas said consumers are turning to online options, with Colvin seeing a fourfold sales increase year-over-year, and delivery volumes worth $1 million in a single day. The challenge, he said, has been making sure to deliver those flowers within the promised time window.

Image Credits: Colvin

Cester said Colvin started by selling directly to consumers because it was a good way to build the supply from growers, and that consumer sales should become a profitable, “cash-generating business.” However, the company’s big focus moving forward is building out its sales to flower wholesalers, who in turn sell to the retailers.

“We’re envisioning the B2B part of the business is going to drive most of the returns and valuation,” Bastardas added.

Colvin was founded in Spain and currently operates in Spain, Italy, Germany and Portugal. There are no plans to come to the U.S. anytime soon, but Cester said, “We believe that if we really want to … redesign how the flower industry works, we’re going to have to land in U.S. sooner or later.”

The startup has now raised a total of $27 million. The new round was led by Italian investment fund Milano Investment Partners, with participation from P101 sgr and Samaipata.

And if you’re wondering about the name, Bastardas said the company was named for civil rights pioneer Claudette Colvin, who was arrested several months before Rosa Parks in Montgomery, Alabama for refusing to give up her bus seat to a white person.

It’s an incongruous choice for a flower startup, but Bastardas said the founders took inspiration from Colvin’s story and the idea that “from several small actions, we can really change an industry.”

Powered by WPeMatico

If necessity is the mother of invention, then new business owners are getting very inventive in the ways in which they access cash. Relying on some long-tested and some new avenues to raise money, entrepreneurs are finding more ways to get public market cash faster than they would have in the past.

Whether it’s from Reg A crowdfunding dollars, Special Purpose Acquisition Companies (SPACs) or direct listings, these somewhat arcane and specialized financing vehicles are making a comeback alongside a rise in new funding mechanisms to get to market quickly and avoid the dilution that comes from private market rounds (especially since those rounds are likely to come at a reduced valuation given market conditions).

Some of these tools have existed for a while and are newly popular in an era where retail investors are driving much of the daily fluctuations of the public markets. Wall Street institutions are largely maintaining their conservative postures with regard to new offerings, so secondary market retail volume growth is outpacing institutional. Retail investors want into these new issues and are pouring into the markets, contributing to huge pops to new public offerings for companies like Lemonade this Thursday and creating an environment where SPACs and crowdfunding campaigns can flourish.

The rise of zero-commission brokerages and the popularization of fractional trading led by the startup Robinhood and adopted by every one of the major online brokers including Charles Schwab, TD Ameritrade, E-Trade and Interactive Brokers has created a stock market boom that defies the underlying market conditions in the U.S. and globally. For instance, daily trades on Robinhood are up 300% year-over-year as of March 2020.

According to data from the BATS exchange, the total trade count in the U.S. was up 71% and May trading was up more than 43% over 2019. Meanwhile, E-Trade daily average revenue trades posted a 244% increase in May over last year’s numbers.

The appetite for new issues is growing and if many of the largest venture-backed companies are holding off on going public, smaller names are using SPACs to access public capital and reach these new investors.

Powered by WPeMatico

A deep tech startup building cryptographic solutions to secure hardware, software, and communications systems for a future when quantum computers may render many current cybersecurity approaches useless is today emerging out of stealth mode with $7 million in funding and a mission to make cryptographic security something that cannot be hackable, even with the most sophisticated systems, by building systems today that will continue to be usable in a post-quantum future.

PQShield (PQ being short for “post-quantum”), a spin out from Oxford University, is being backed in a seed round led by Kindred Capital, with participation also Crane Venture Partners, Oxford Sciences Innovation and various angel investors, including Andre Crawford-Brunt, Deutsche Bank’s former global head of equities.

PQShield was founded in 2018, and its time in stealth has not been in vain.

The startup claims to have the UK’s highest concentration of cryptography PhDs outside academia and classified agencies, and it is one of the biggest contributors to the NIST cybersecurity framework (alongside academic institutions and huge tech companies), which is working on creating new cryptographic standards, which take into account the fact that quantum computing will likely make quick work of breaking down the standards that are currently in place.

“The scale is massive,” Dr Ali El Kaafarani, a research fellow at Oxford’s Mathematical Institute and former engineer at Hewlett-Packard Labs, who is the founder and CEO of PQShield said of that project. “For the first time we are changing the whole of public key infrastructure.”

And according to El Kaafarani, the startup has customers — companies that build hardware and software services, or run communications systems that deal with sensitive information and run the biggest risks from being hacked.

They include entities in the financial and government sectors that it’s not naming, as well as its first OEM customer, Bosch. El Kaafarani said in an interview that it is also in talks with at least one major communications and messaging provider exploring more security for end-to-end encryption on messaging networks. Other target applications could include keyless cars, connected IoT devices, and cloud services.

The gap in the market the PQShield is aiming to address is the fact that while there are already a number of companies exploring the cutting edge of cryptographic security in the market — they include large tech companies like Amazon and Microsoft, Hub Security, Duality, another startup out of the UK focused on post-quantum cryptography called Post Quantum and a number of others — the concern is that quantum computing will be utilised to crack even the most sophisticated cryptography such as the RSA and Elliptic Curve cryptographic standards.

This has not been much of a threat so far since quantum computers are still not widely available and used, but there have been a number of signs of a breakthrough on the horizon.

El Kaafarani says that PQShield is the first startup to approach that predicament with a multi-pronged solution aimed at a variety of use cases, including solutions that encompass current cryptographic standards and provide a migration path the next generation of how they will look — meaning, they can be commercially deployed today, even without quantum computers being a commercial reality, but in preparation for that.

“Whatever we encrypt now can be harvested, and once we have a fully functioning quantum computer people can use that to get back to the data and the sensitive information,” he said.

For hardware applications, it’s designed a System on Chip (SoC) solution that will be licensed to hardware manufacturers (Bosch being the first OEM). For software applications, there is an SDK that secures messaging and is protected by “post-quantum algorithms” based on a secure, Signal-derived protocol.

Thinking about and building for the full spectrum of applications is central to PQShield’s approach, he added. “In security it’s important to understand the whole ecosystem since everything is about connected components.”

Some sectors in the tech world have been especially negatively impacted by the coronavirus and its consequences, a predicament that has been exacerbated by uncertainties over the future of the global economy.

I asked El Kaafarani if that translated to a particularly tricky time to raise money as a deep tech startup, given that deep tech companies so often work on long-term problems that may not have immediate commercial outcomes.

Interestingly, he said that wasn’t the case.

“We talked to VCs that were interested in deep tech to begin with, which made the discussion a lot easier,” he said. “And the fact is that we’re a security company, and that is one of the areas that is doing well. Everything has become digitised, and we have all become more heavily reliant on our digital connections. We ultimately help make the digital world more secure. There are people who understand that, and so it wasn’t too difficult to talk to them and understand the importance of this company.”

Indeed, Chrysanthos Chrysanthou, partner at Kindred Capital, echoed that sentiment:

“With some of the brightest minds in cryptography, mathematics and engineering, and boasting world-class software and hardware solutions, PQShield is uniquely positioned to lead the charge in protecting businesses from one of the most profound threats to their future,” he said. “We couldn’t be happier to support the team as it works to set a new standard for information security and defuse risks resulting from the rise of quantum.”

Powered by WPeMatico

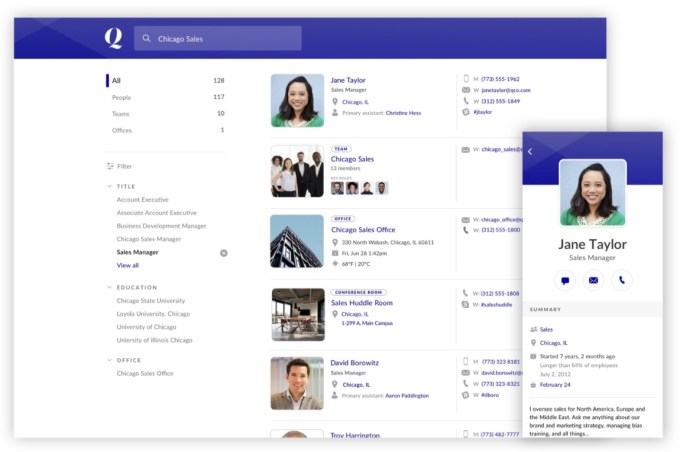

For the second time in less than 24 hours, an enterprise company bought an early-stage startup. Yesterday afternoon DocuSign acquired Liveoak, and this morning Slack announced it was buying corporate directory startup Rimeto, which should help employees find people inside the organization who match a specific set of criteria from inside Slack.

The companies did not share the purchase price.

Rimeto helps companies build directories to find employees beyond using tools like Microsoft Active Directory, homegrown tools or your corporate email program. When we covered the company’s $10 million Series A last year, we described what it brings to directories this way:

Rimeto has developed a richer directory by sitting between various corporate systems like HR, CRM and other tools that contain additional details about the employee. It of course includes a name, title, email and phone like the basic corporate system, but it goes beyond that to find areas of expertise, projects the person is working on and other details that can help you find the right person when you’re searching the directory.

In the build versus buy equation that companies balance all the time, it looks like Slack weighed the pros and cons and decided to buy. You could see how a tool like this would be useful to Slack as people try to build teams of employees, especially in a world where so many are working from home.

While the current Slack people search tool lets you search by name, role or team, Rimeto should give users a much more robust way of searching for employees across the company. You can search for the right person to help you with a particular problem and get much more granular with your search requirements than the current tool allows.

Image Credit: Rimeto

At the time of its funding announcement, the company, which was founded in 2016 by three former Facebook employees, told TechCrunch it had bootstrapped for the first three years before taking the $10 million investment last year. It also reported it was cash-flow positive at the time, which is pretty unusual for an early-stage enterprise SaaS company.

In a company blog post announcing the deal, as is typical in these deals, the founders saw being part of a larger organization as a way to grow more quickly than they could have alone. “Joining Slack is a special opportunity to accelerate Rimeto’s mission and impact with greater reach, expanded resources, and the support of Slack’s impressive global team,” the founders wrote in the post.

The acquisition is part of a continuing trend around enterprise companies buying early-stage startups to fill in holes in their product road maps.

Powered by WPeMatico

Most sales teams earn a commission after a sale closes, but nothing prior to that. Yet there are a variety of signals along the way that indicate the sales process is progressing, and SetSail, a startup from some former Google engineers, is using machine learning to figure out what those signals are, and how to compensate salespeople as they move along the path to a sale, not just after they close the deal.

Today, the startup announced a $7 million investment led by Wing Venture Capital with help from Operator Collective and Team8. Under the terms of the deal, Leyla Seka from Operator will be joining the board. Today’s investment brings the total raised to $11 million, according to the company.

CEO and co-founder Haggai Levi says his company is based on the idea that commission alone is not a good way to measure sales success, and that it is in fact a lagging indicator. “We came up with a different approach. We use machine learning to create progress-based incentives,” Levi explained.

To do that they rely on machine learning to discover the signals that are coming from the customer that indicate that the deal is moving forward, and using a points system, companies can begin compensating reps on hitting these milestones, even before the sale closes.

The seeds for the idea behind SetSail were planted years ago when the three founders were working at Google tinkering with ways to motivate sales reps beyond pure commission. From a behavioral perspective, Levi and his co-founders found that reps were taking fewer risks with a pure commission approach and they wanted to find a way to change that. The incremental compensation system achieves that.

“If I’m closing the deal, I’m getting my commission. If I’m not closing the deal, I’m getting nothing. That means from a behavioral point of view, I would take the shortest path to win a deal, and I would take the minimum risk possible. So if there’s a competitive situation I will try to avoid that,” he said.

They look at things like appointments, emails and call transcripts. The signals will vary by customer. One may find an appointment with CIO is a good signal a deal is on the right trajectory, but to avoid having reps gaming the system by filling the CRM with the kinds of positive signals the company is looking for, they only rely on objective data, rather than any kind of self-reporting information from reps themselves.

The team eventually built a system like this inside Google, and in 2018, left to build a solution for the rest of the world that does something similar.

As the company grows, Levi says he is building a diverse team, not only because it’s the right thing to do, but because it simply makes good business sense. “The reality is that we’re building a product for a diverse audience, and if we don’t have a diverse team we would never be able to build the right product,” he explained.

The company’s unique approach to sales compensation is resonating with customers like Dropbox, Lyft and Pendo, who are looking for new ways to motivate sales teams, especially during a pandemic when there may be a longer sales cycle. This kind of system provides a way to compensate sales teams more incrementally and reward positive approaches that have proven to result in sales.

Powered by WPeMatico

Karma Automotive has raised a $100 million lifeline from outside investors, as reported by Bloomberg, with the struggling electric vehicle maker’s fortunes likely buoyed by the current market optimism on other EV companies, including Tesla. Karma is the reincarnated version of Fisker Automotive, which previously faced bankruptcy before being acquired by Wanxiang Group in 2014.

Karma Automotive has made more progress than Fisker ever did, including actually delivering around 500 of its inaugural Revero electric sport sedan in 2019. The company will be continuing to sell the Revero, which retails starting at around $140,000, and will also be looking to add a high-horsepower GTE version, as well as a supercar for an even higher-tier customer.

The automaker also says that it’s in discussions with a partner for a commercial delivery truck, which it intends to develop in prototype form by year’s end. There are a number of different companies pursuing delivery vans for use by courier companies, including UPS and FedEx, and the increase in e-commerce spending presents an opportunity for multiple players to succeed in this category, even as there is a rush on in terms of entrants.

Karma will also seek to leverage and extend the benefits of its fresh investment by shopping around its EV platform to other automakers and OEMs, the company says, and also will eventually expand beyond pure EVs to hybrid fuel vehicles. In short, it sounds like Karma is willing to try just about everything and anything to chart a path toward profitability, but time will tell if that’s intelligent opportunism, or scattershot desperation.

Powered by WPeMatico

We’re excited to announce that Extra Crunch is now available to readers in Argentina, Brazil and Mexico. That adds to our existing support in the U.S., Canada, the U.K., and select European countries.

You can sign for Extra Crunch here.

Latin America has always caught the eye of big tech. For companies like Facebook, Amazon and Uber, Latin America has represented a massive growth opportunity. But it’s not just big tech that’s investing in Latin America. The startup scene is booming. According to Crunchbase, VCs invested billions into Latin America in 2018 and 2019.

In 2018, the TechCrunch team took a trip to São Paulo, Brazil to host Startup Battlefield Latin America. We knew about the hot startup scene and massive investments, and wanted to meet the founders fueling the fire in person.

The excitement, wit, creativity and energy of the entrepreneurs in Latin America was impressive. We were dazzled by the pitches from budding startup teams, and we were enlightened by the investors sharing their wealth of knowledge about the ecosystem. What we saw in person helped us tie the funding to the faces of the teams building the future. The entrepreneurial mentality of Silicon Valley doesn’t have borders; it’s alive and well across Latin America.

We wanted to bring Extra Crunch to Latin America to help support the startups and investors in this market because community has always been our top priority. We hope that Extra Crunch’s deep analysis and company-building resources will help the Latin America tech community grow even stronger than it is today.

We’ve been polling our audience about expanded country support for over a year now, and Argentina, Brazil and Mexico have always been near the top of the list. Now, we’re delivering on the promise to bring Extra Crunch to everyone who asked for it.

We’re optimistic that Extra Crunch will be a big hit in Latin America, and we hope entrepreneurs and investors in the region who have not yet heard of TechCrunch will give it a try.

You can sign for Extra Crunch here.

Extra Crunch is a membership program from TechCrunch that features research and reporting, reader utilities and savings on software services and events. We deliver more than 100 exclusive articles per month, with a focus on startup teams and investors.

Our weekly Extra Crunch investor surveys will help members find out where startup investors plan to write their next checks. Extra Crunch subscribers will be able to build a company better with how-tos and interviews from experts on fundraising, growth, monetization and other key work topics. Readers can also learn about the best startups through our IPO analysis, late-stage deep dives and other exclusive reporting delivered daily.

Here’s a taste of the articles you can expect to see in Extra Crunch:

Beyond articles, Extra Crunch also features a series of reader utilities and discounts to help save time and money. This includes an exclusive newsletter, no banner ads on TechCrunch.com, Rapid Read mode, List Builder tool and more. Committing to an annual or two-year Extra Crunch membership will unlock discounts on TechCrunch events and access to Partner Perks. Our Partner Perks can help you save on services like AWS, Brex, Canva, DocSend, Zendesk and more.

Thanks to all of our readers who voted on where to expand support for Extra Crunch, and thanks to all who participated in the Extra Crunch beta in Latin America. If you haven’t voted and you want to see Extra Crunch in your local country, let us know here. We’re actively working on expanding support to more countries, and input from readers is greatly appreciated.

You can sign up or learn more about Extra Crunch here.

Powered by WPeMatico

Even in the best of times, finding a notary can be a challenge. In the middle of a pandemic, it’s even more difficult. DocuSign announced it has acquired Liveoak Technologies today for approximately $38 million, giving the company an online notarization option.

At the same time, DocuSign announced a new product called DocuSign Notary, which should ease the notary requirement by allowing it to happen online along with the eSignature. As we get deeper into the pandemic, companies like DocuSign that allow workflows to happen completely digitally are in more demand than ever. This new product will be available for early access later in the summer.

The deal made sense given that the two companies had a partnership already. Liveoak brings together live video, collaboration tooling and identity verification that enables parties to get notarized approval as though you were sitting at the desk in front of the notary.

Typically, you might get a document that requires your signature. Without electronic signature, you would need to print it, sign the document, scan it and return it. If it requires a notary, you would need to sign it in the notary’s presence, which requires an in-person visit. All of this can be streamlined with an online workflow, which DocuSign is providing with this acquisition.

It’s like the perfect pandemic acquisition, making a manual process digital and saving people from having to make face-to-face transactions at a time when it can be dangerous.

Liveoak Technologies was founded in 2014 and is part of the Austin, Texas startup scene. The company raised just under $28 million during its life as a private company. The firm most recently raised $8 million at a post-money valuation of $30.4 million, according to PitchBook data. Given the amount that DocuSign paid for the startup, it appears to have gotten a bargain.

This acquisition is part of a growing pandemic acquisition trend of sorts, where larger public enterprise companies are plucking early-stage startups, in some cases for relatively bargain prices. Among the recent acquisitions are Apple buying Fleetsmith and ServiceNow acquiring Sweagle last month.

Powered by WPeMatico