Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7am PT). Subscribe here.

You could almost hear the internet cracking apart this week as international businesses pulled away from Hong Kong and the US considered a ban on TikTok. Software can no longer eat the entire world like it had attempted last decade. Startups across tech-focused industries face a new reality, where local markets and efforts are more protected and supported by national governments. Every company now has a smaller total addressable market, whether or not it succeeds in it.

Facebook, for example, appears to be getting an influx of creators who are worried about losing TikTok audiences, as Connie Loizos investigated this week. This might mean more users, engagement and ultimately revenue for many consumer startups, and any other companies that rely on paid marketing through Facebook’s valuable channels. But it means fewer platforms to diversify to, in case you don’t want to rely on Facebook so much for your business.

As trade wars look more and more like cold wars, it also means that Facebook itself will have a more limited audience than it once hoped to offer its own advertisers. After deciding to reject requests from Hong Kong-based Chinese law enforcement, it seems to be on the path to getting blocked in Hong Kong like it is on the mainland. But as with other tech companies, it doesn’t really have a choice — the Chinese government has pushed through legal changes in the city that allow it to arrest anyone in the world if it claims they are organizing against it. Compliance with China would bring on government intervention in the US and beyond, among other reasons why doing so is a non-starter.

This also explains why TikTok itself already pulled out of Hong Kong, despite being owned by mainland China-based Bytedance. The company is still reeling from getting banned in India last week and this maneuver is trying to the subsidiary look more independent. Given that China’s own laws allow its government to access and control private companies, expect many to find that an empty gesture.

Startups should plan for things to get harder in general. See: the next item below.

(Photo by Alex Wong/Getty Images)

International students will not be allowed to stay enrolled at US universities that offer only remote classes this coming academic year, the Trump administration decided this past week. As Natasha Mascarenhas and Zack Whittaker explore, many universities are attempting a hybrid approach that tries to allow some in-person teaching without creating a community health problem.

Without this type of approach, many students could lose their visas. Here’s our resident immigration law expert, Sophie Alcorn, with more details on Extra Crunch:

International students have been allowed to take online classes during the spring and summer due to the COVID-19 crisis, but that will end this fall. The new order will force many international students at schools that are only offering remote online classes to find an “immigration plan B” or depart the U.S. before the fall term to avoid being deported.

At many top universities, international students make up more than 20% of the student body. According to NAFSA, international students contributed $41 billion to the U.S. economy and supported or created 458,000 jobs during the 2018-2019 academic year. Apparently, the current administration is continuing to “throw out the baby with the bathwater” when it comes to immigration.

Universities are scrambling as they struggle with this newfound untenable bind. Do they stay online only to keep their students safe and force their international students to leave their homes in this country? Or do they reopen to save their students from deportation, but put their communities’ health at risk?

For students, it means finding another school, scrambling to figure out a way to depart the States (when some home countries will not even allow them to return), or figuring out an “immigration plan B.”

Who knows how many startups will never exist because the right people didn’t happen to be at the right place at the right time together? What everyone does know is that remote-first is here to stay.

Image Credits: CapitalG (opens in a new window)

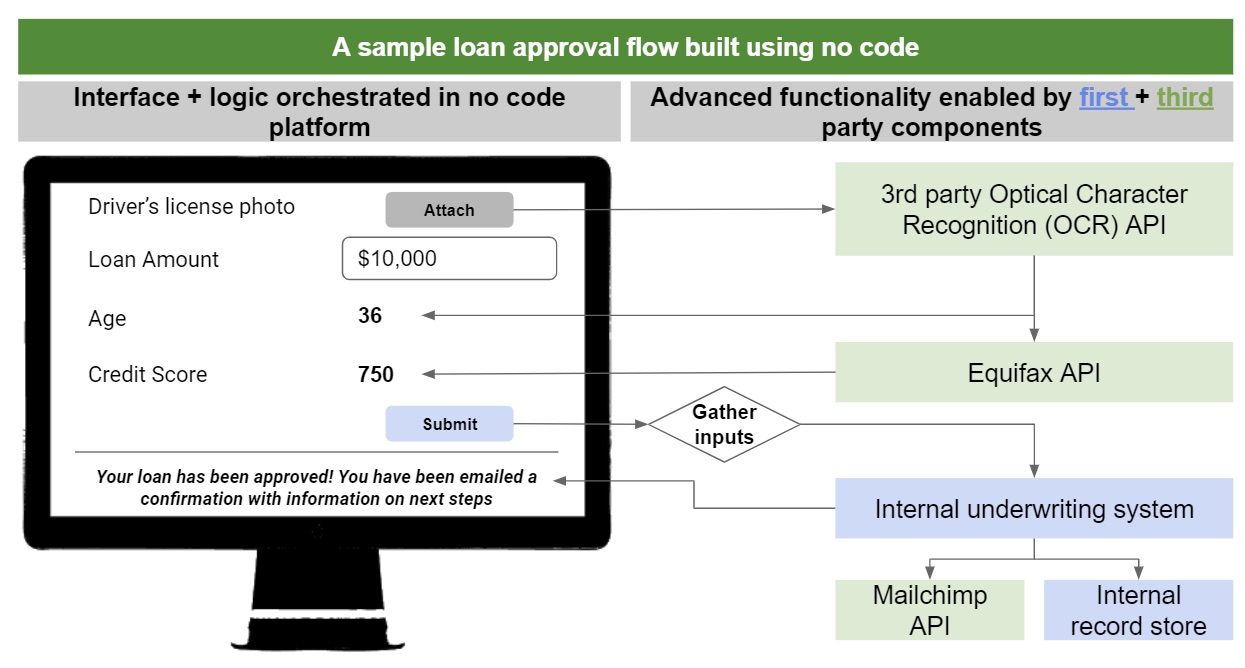

A few tech trends seem unstoppable despite any geopolitics, and one seems to be the universal human goal of making enterprise software suck less. (Okay, nearly universal.) Alex Nichols and Jesse Wedler of CapitalG explain why now is the time for no code software and what the impact will bel, in a very popular article for Extra Crunch this week. Here’s their setup:

First, siloed cloud apps are sprawling out of control. As workflows span an increasing number of tools, they are arguably getting more manual. Business users have been forced to map workflows to the constraints of their software, but it should be the other way around. They need a way to combat this fragmentation with the power to build integrations, automations and applications that naturally align with their optimal workflows.

Second, architecturally, the ubiquity of cloud and APIs enable “modular” software that can be created, connected and deployed quickly at little cost composed of building blocks for specific functions (such as Stripe for payments or Plaid for data connectivity). Both third-party API services and legacy systems leveraging API gateways are dramatically simplifying connectivity. As a result, it’s easier than ever to build complex applications using pre-assembled building blocks. For example, a simple loan approval process could be built in minutes using third-party optical character recognition (a technology to convert images into structured data), connecting to credit bureaus and integrating with internal services all via APIs. This modularity of best-of-breed tools is a game changer for software productivity and a key enabler for no code.

Finally, business leaders are pushing CIOs to evolve their approach to software development to facilitate digital transformation. In prior generations, many CIOs believed that their businesses needed to develop and own the source code for all critical applications. Today, with IT teams severely understaffed and unable to keep up with business needs, CIOs are forced to find alternatives. Driven by the urgent business need and assuaged by the security and reliability of modern cloud architecture, more CIOs have begun considering no code alternatives, which allow source code to be built and hosted in proprietary platforms.

Photo: Jason Alden/Bloomberg

It’s 16 years old, worth $26 billion and widely used by private and public entities of all types around the world, but this employer of thousands is counted as a startup tech unicorn, because, well, it was one of the pioneers of growing big, raising bigger, and staying private longer. Aileen Lee even mentioned Palantir as one of the 39 examples that helped inspire the “unicorn” term back in 2013. Now the secretive and sometimes controversial data technology provider is finally going to have its big liquidity event — and is filing confidentially to IPO, which means the finances are still staying pretty secret.

Alex Wilhelm went ahead and pieced together its funding history for Extra Crunch ahead of the action, and concluded that “Palantir seems like the Platonic ideal of a unicorn. It’s older than you’d think, has a history of being hyped, its valuation has stretched far beyond the point where companies used to go public, and it appears to be only recently growing into its valuation.”

It also appears to be one of the unicorns that has seen a lot of upside lately. It has been in the headlines recently for cutting big-data deals with governments for pandemic work, on top of a long-standing relationship with the US military and other arms of the government. As with Lemonade, Accolade and a range of other IPOing tech companies that we have covered in recent weeks, it is presumably in a positive business cycle and primed to take advantage of an already receptive market.

(Photo by Kimberly White/Getty Images for TechCrunch)

In an investor survey for Extra Crunch this week, Megan Rose Dickey checked in with eight Black investors about what they are investing in, in the middle of what feels like a new focus on making the tech industry more representative of the country and the world. Here’s how Arlan Hamilton of Backstage Capital responded when Megan asked what meaningful change might come from the recent heightened attention on the Black Lives Matter movement.

I happen to be on the more optimistic side of things. I’m not at a hundred percent optimistic, but I’m close to that. I think that there’s an undeniable unflinching resolve right now. I think that if we were to go back to status quo, I would be incredibly surprised. I guess I would not be shocked, unfortunately, but I would be surprised. It would give me pause about the effectiveness of any of the work that we do if this moment fizzles out and doesn’t create change. I do think that there is going to be a shift. I can already feel it. I know that more people who are representative of this country are going to be writing checks, whether through being hired, or taken through the ranks, or starting their own funds, and our own funds. I think there’s more and more capital that’s going to flow to underrepresented founders. That alone, I think, will be a huge shift.

Extra Crunch support expands into Argentina, Brazil and Mexico

Five reasons to attend TC Early Stage online

Hear from James Alonso and Adam Zagaris how to draw up your first contracts at Early Stage

Hear how to manage your enterprise infrastructure from Sam Pullara at TechCrunch Early Stage

Kerry Washington is coming to Disrupt 2020

Amazon’s Alexa heads Toni Reid and Rohit Prasad are coming to Disrupt

Minted’s Mariam Naficy will join us at TechCrunch Early Stage

TechCrunch

14 VCs discuss COVID-19 and London’s future as a tech hub

Societal upheaval during the COVID-19 pandemic underscores need for new AI data regulations

PC shipments rebound slightly following COVID-19-fueled decline

Here’s a list of tech companies that the SBA says took PPP money

Equity Monday: Uber-Postmates is announced, three funding rounds and narrative construction

Regulatory roadblocks are holding back Colombia’s tech and transportation industries

Extra Crunch

In pandemic era, entrepreneurs turn to SPACs, crowdfunding and direct listings

Four views: Is edtech changing how we learn?

VCs are cutting checks remotely, but deal volume could be slowing

Logistics are key as NYC startup prepares to reopen office

From Alex:

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

We wound up having more to talk about than we had time for but we packed as much as we could into 34 minutes. So, climb aboard with Danny, Natasha and myself for another episode of Equity.

Before we get into topics, a reminder that if you are signing up for Extra Crunch and want to save some money, the code “equity” is your friend. Alright, let’s get into it:

Whew! Past all that we had some fun, and, hopefully, were of some use. Hugs and chat Monday!

Equity drops every Monday at 7:00 a.m. PT and Friday at 6:00 a.m. PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Welcome to The Exchange, an upcoming weekly newsletter featuring TechCrunch and Extra Crunch reporting on startups, money, and markets. You can sign up for it here to receive it regularly when it launches on July 25th. You can email me about it here, or talk to me about it on Twitter. Let’s go!

Ahead of parsing Q2 venture capital data, we got a look this week into the VC world’s take on making deals over Zoom. A few months ago it was an open question whether VCs would simply stop making new investments if they couldn’t chop it up in person with founders. That, it turns out, was mostly wrong.

This week we learned that most VCs are open to making remote deals happen, even if 40% of VCs have actually done so. This raises a worrying question: If only 40% of VCs have actually made a fully remote deal, how many deals happened in Q2?

Judging from my inbox over the past few months, it’s been an active period. But we can’t lean on anecdata for this topic; The Exchange will parse Q2 VC data next week, hopefully, provided that we can scrape together the data points we need to feel confident in our take. More soon.

As TechCrunch reported Friday, some startups are delaying raising capital for a few quarters. They can do this by limiting expenses. The question for startups that are doing this is what shape they’ll be in when they do surface to hunt for fresh funds; can they still grow at an attractive pace while trying to extend their runway through burn conservation?

But there’s another option besides waiting to raise a new round, and not raising at all. Startups can raise an extension to their preceding deal! Perhaps I am noticing something that isn’t a trend, or not a trend yet, but there have been a number of startups recently raised extensions lately that caught my eye. For example, this week MariaDB raised a $25 million Series C extension, for example. Also this week Sayari put together $2.5 million in a Series B extension. And CALA put together $3 million in a Seed extension. Finally, across the pond Machine Labs put together one million pounds in another Seed extension this week.

I don’t know yet how to numerically drill into the available venture data to tell if we’re really seeing an extension wave, but do let me know if you have any notes to share. And, to be completely clear, the above rounds could easily be merely random and un-thematic, so please don’t read into them more deeply than that they were announced in the last few days and match something that we’re watching.

On the public markets front, the news is all good. Tech stocks are up in general, and software stocks set some new record highs this week. It’s nearly impossible to recall how scary the world was back in March and April in today’s halcyon stock market run, but it was only a few months back that stocks were falling sharply.

The return-to-form has helped a number of companies go public this year like Vroom, Accolade, Agora, and others. This week was another busy period for startups, former startups, and other companies looking to go out.

In quick fashion to save time, this week we got to see GoHealth’s first IPO range, nCino’s second (more on the two companies’ finances here), learned that Palantir is going public (it’s financial history as best we can tell is here), and even got an IPO filing (S-1) from Rackspace, as it looks towards the public markets yet again.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, and now you can receive it in your inbox. Sign up for The Exchange newsletter, which drops every Friday starting July 25.

The IPO waters are so warm that Lemonade is still up more than 100% from its IPO price. So long as growth companies that are miles from making money can command rich valuations, expect companies to keep running through the public market’s door.

There’s fun stuff on the horizon. Coinbase might file later this year, or in early 2021. And the Airbnb IPO is probably coming within four or five quarters. Gear up to read some SEC filings.

The coolest funding round of the week was obviously the one that I wrote about, namely the $2.2 million that MonkeyLearn put together from a pair of lead investors. But other companies raised money, and among them the following investments stood out:

That’s The Exchange for the week. Keep your eye on SaaS valuations, the latest S-1 filings, and the latest fundings. Chat Monday.

Powered by WPeMatico

If you’re an angel who invested in a startup that was meant to go public in 2014, you might be getting a little bit impatient. High-risk, high-reward investing has lost its shine in this environment: the stock market is a mess these days, and you want your cash back.

Enter recapitalization events, where startups restructure their entire cap table to squeeze out old investors, bring on new ones and shift the way equity and debt is managed. For investors, it’s a killer way to enter a company on friendlier terms than normal (read: desperation), and a nice way to get liquidity on a startup you’re betting on.

For founders, it’s rarely good news, as departing investors is not a metric they’re going to add to the pitch deck. As one investor said on background, the spur of coronavirus-related recapitalization events shows “hella dilution for desperate times.”

That’s what makes Workhuman’s transparency with its recent recapitalization event all the more enticing.

Last year, the human-resources platform brought in $580 million in revenue from customers like LinkedIn, Cisco, J&J and other clients. In April, business grew 40%. Co-founder and CEO Eric Mosley says business has grown five times in size since the company pulled back from its 2014 plans to IPO. Workhuman hasn’t raised a single venture round since 2004 (and doesn’t plan to any time soon).

Being conservative has paid off; although Workhuman has operated for nearly two decades, Mosley says he thinks the company is still at the “tip of the iceberg.” The company recently had a recapitalization event to sell the stakes of its earliest investors, who cut a $200,000 check more than 20 years ago.

Powered by WPeMatico

After going private in 2016 after accepting a $32 per share, or $4.3 billion, price from Apollo Global Management, Rackspace is looking once again to the public markets. First going public in 2008, Rackspace is taking second aim at a public offering around 12 years after its initial debut.

The company describes its business as a “multicloud technology services” vendor, helping its customers “design, build and operate” cloud environments. That Rackspace is highlighting a services focus is useful context to understand its financial profile, as we’ll see in a moment.

But first, some basics. The company’s S-1 filing denotes a $100 million placeholder figure for how much the company may raise in its public offering. That figure will change, but does tell us that firm is likely to target a share sale that will net it closer to $100 million than $500 million, another popular placeholder figure.

Rackspace will list on the Nasdaq with the ticker symbol “RXT.” Goldman, Citi, J.P. Morgan, RBC Capital Markets and other banks are helping underwrite its (second) debut.

Similar to other companies that went private, only later to debut once again as a public company, Rackspace has oceans of debt.

The company’s balance sheet reported cash and equivalents of $125.2 million as of March 31, 2020. On the other side of the ledger, Rackspace has debts of $3.99 billion, made up of a $2.82 billion term loan facility, and $1.12 billion in senior notes that cost the firm an 8.625% coupon, among other debts. The term loan costs a lower 4% rate, and stems from the initial transaction to take Rackspace private ($2 billion), and another $800 million that was later taken on “in connection with the Datapipe Acquisition.”

The senior notes, originally worth a total of $1,200 million or $1.20 billion, also came from the acquisition of the company during its 2016 transaction; private equity’s ability to buy companies with borrowed money, later taking them public again and using those proceeds to limit the resulting debt profile while maintaining financial control is lucrative, if a bit cheeky.

Rackspace intends to use IPO proceeds to lower its debt-load, including both its term loan and senior notes. Precisely how much Rackspace can put against its debts will depend on its IPO pricing.

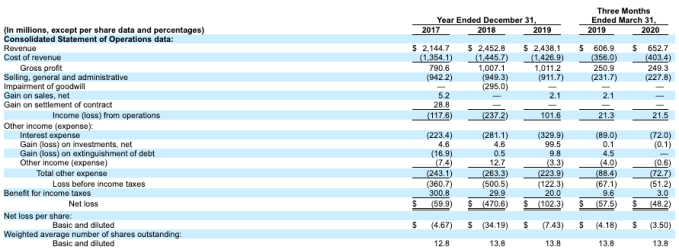

Those debts take a company that is comfortably profitable on an operating basis and make it deeply unprofitable on a net basis. Observe:

Image Credits: SEC

Looking at the far-right column, we can see a company with material revenues, though slim gross margins for a putatively tech company. It generated $21.5 million in Q1 2020 operating profit from its $652.7 million in revenue from the quarter. However, interest expenses of $72 million in the quarter helped lead Rackspace to a deep $48.2 million net loss.

Not all is lost, however, as Rackspace does have positive operating cash flow in the same three-month period. Still, the company’s multi-billion-dollar debt load is still steep, and burdensome.

Returning to our discussion of Rackspace’s business, recall that it said that it sells “multicloud technology services,” which tells us that its gross margins will be service-focused, which is to say that they won’t be software-level. And they are not. In Q1 2020 Rackspace had gross margins of 38.2%, down from 41.3% in the year-ago Q1. That trend is worrisome.

The company’s growth profile is also slightly uneven. From 2017 to 2018, Rackspace saw its revenue expand from $2.14 billion to $2.45 billion, growth of 14.4%. The company shrank slightly in 2019, falling from $2.45 billion in revenue in 2018 to $2.44 billion the next year. Given the economy that year, and the importance of cloud in 2019, the results are a little surprising.

Rackspace did grow in Q1 2020, however. The firm’s $652.7 million in first-quarter top-line easily bested in its Q1 2019 result of $606.9 million. The company grew 7.6% in Q1 2020. That’s not much, especially during a period in which its gross margins eroded, but the return-to-growth is likely welcome all the same.

TechCrunch did not see Q2 2020 results in its S-1 today while reading the document, so we presume that the firm will re-file shortly to include more recent financial results; it would be hard for the company to debut at an attractive price in the COVID-19 era without sharing Q2 figures, we reckon.

How to value Rackspace is a puzzle. The company is tech-ish, which means it will find some interest. But its slow growth rate, heavy debts and lackluster margins make it hard to pin a fair multiple onto. More when we have it.

Powered by WPeMatico

The biggest story to come out of the post-March stock market boom has been explosive growth in the value of technology shares. Software companies in particular have seen their fortunes recover; since March lows, public software companies’ valuations have more than doubled, according to one basket of SaaS and cloud stocks compiled by a Silicon Valley venture capital firm.

Such gains are good news for startups of all sizes. For later-stage upstarts, software share appreciation helps provide a welcoming public market for exits. And, strong public valuations can help guide private dollars into related startups, keeping the capital flowing.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, and now you can receive it in your inbox. Sign up for The Exchange newsletter, which drops every Friday starting July 24.

For software-focused startup companies, especially those pursuing recurring revenue models like SaaS, it’s a surprisingly good time to be alive.

Indeed, after COVID-19 hit the United States, layoffs and rising software sales churn were key, worrying indicators coming out of startup-land. Since then, the data has turned around.

Indeed, after COVID-19 hit the United States, layoffs and rising software sales churn were key, worrying indicators coming out of startup-land. Since then, the data has turned around.

As TechCrunch reported in June, startup layoffs have declined and software churn has recovered to the point that business and enterprise-focused SaaS companies are on the bounce.

But instead of merely recovering to near pre-COVID levels, software stocks have continued to rise. Indeed, the Bessemer Cloud Index (EMCLOUD), which tracks SaaS firms, has set an array of all-time highs in recent weeks.

There’s some logic to the rally. After speaking to venture capitalists over the past few weeks, notes from EQT Ventures‘ Alastair Mitchell, Sapphire’s Jai Das, and Shomik Ghosh from Boldstart Ventures paint the picture of a possibly accelerating digital transformation for some software companies, nudged forward by COVID-19 and its related impacts.

The result of the trend may be that the total addressable market (TAM) for software itself is larger than previously anticipated. Larger TAM could mean bigger future sales for and more substantial future cash flows for some software companies. This argument helps explain part of the market’s present-day enthusiasm for public tech equities, and especially the shares of software companies.

We won’t be able explain every point that Nasdaq has gained. But the TAM argument is worth understanding if we want to grok a good portion of the optimism that is helping drive tech valuations, both private and public.

Powered by WPeMatico

Earlier this month, Spanish early-stage venture capital firm K Fund officially launched its second fund, which sits at €70 million, up from €50 million the first time around.

Targeting Spanish startups with an international outlook, the seed-stage firm plans to invest from €200,000 to €2 million, writing first checks in 25-30 companies. Meanwhile, a portion of the fund will also be set aside for follow-on funding for the most promising of its portfolio.

Described as business model- and sector-agnostic, K Fund currently has a mix of B2B and B2C companies in its portfolio across a wide variety of sectors, such as travel, fintech, insurtech and others. They include online travel agency Exoticca, HR software Factorial, insurtech startup Bdeo and Hubtype, a conversational messaging tech provider.

I caught up with K Fund’s Jaime Novoa to delve deeper into the firm’s investment remit, how the Spanish startup and tech ecosystem has developed over the last few years and to learn more about “K Founders,” the VC’s new pre-seed funding program.

TechCrunch: K Fund’s first fund was announced in late 2016 to back startups in Spain with an international outlook at seed and Series A. At €70 million, this second fund is €20 million larger but I gather the remit remains broadly the same. Can you be more specific with regards to cheque size, geography, sector and the types of startups you look for?

Jaime Novoa: We’re both agnostic in terms of business models and industries. Since our focus is, for the most part, Spain, we do not believe that the Spanish market is big enough to build a vertically focused fund, either in terms of business model or sector.

With our first fund we invested in 28 companies, with a slightly larger number of B2B SaaS companies than B2C ones, and across a wide variety of sectors. We do have a bit of exposure to travel and fintech/insurtech, but that’s because we’ve found several interesting companies in those spaces, not because we proactively said, “let’s invest in fintech/travel.”

In terms of check sizes, the core of the fund will be to make the same type of investments as in our first fund: first cheques from €200k to €2m and then sufficient capital for follow-on rounds. We’ll probably do a similar number of deals compared to the previous fund, but we want to have additional capital for follow-on purposes.

Powered by WPeMatico

Amie, a new productivity app from ex-N26 product manager Dennis Müller, has picked up $1.3 million in pre-seed funding to “kickstart” development and hiring.

Backing 23-year-old Müller is Creandum — the European VC best known for being an early investor in Spotify — along with Tiny.VC and a plethora of angels. They include Laura Grimmelmann (Ex-Accel), Nicolas Kopp (CEO, N26 U.S.), Roland Grenke (Dubsmash co-founder) and Zachary Smith (SVP of product at U.S. challenger bank Chime).

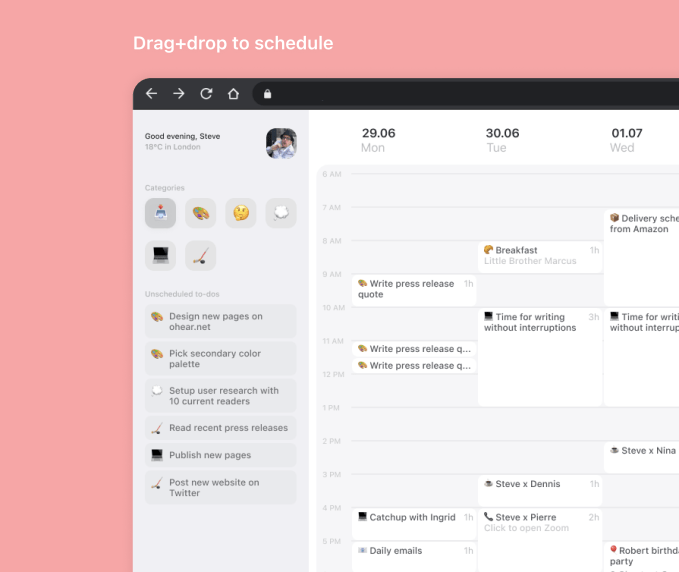

Founded early this year and with a planned launch in early 2021, Berlin-based Amie is developing a productivity app that combines a person’s calendar and to-dos in one place. Previously called coco, it promises to work across all devices, with an interface that “works just like you think.”

“Back in the day, you had a calendar on your office wall, and a to-do list on a notepad,” Müller tells me. “You could take your list with you elsewhere, but not your calendar. Those were digitized instead of rethinking the flow. Most productivity apps solve very specific problems, creating a new one, [and] users need too many tools.”

Amie pre-release app screenshot.

Müller says Amie is built on the principle that “to-dos, habits and events all take time, and all belong in the same place.” Many people already schedule to-dos and the startup wants to offer the fastest way to create to-dos, schedule events, check your calendar “and even jump into Zoom calls.”

As a glimpse of what’s to come, Amie promises to let you drag ‘n’ drop to-dos into your day, or turn links and screenshots into to-dos. “With Amie’s Alfred-like app, you can create an event and invite people in a different timezone, all while other apps are still loading,” says the young company.

More broadly, Amie wants to act as a central workspace, letting you also do things like join video calls, take notes and do email, without the need to open extra browser tabs and therefore avoid “context switching.”

“Amie will target professionals who are currently using Google Calendar, due to our integration,” adds Müller. “The waitlist already counts thousands of users, who are mostly professionals working in the tech industry (e.g., designers, developers, bizdevs, etc.”

Powered by WPeMatico

It’s hard to believe that Alexa was only announced in November 2014. In fewer than six years, the smart assistant has gone from consumer electronics curiosity to a nearly ubiquitous tech phenomenon. Launched alongside the first Echo device, Alexa has helped define a new paradigm of voice computing, alongside Apple’s Siri and Google’s Assistant.

According to recent numbers, 29% of U.S. internet users also use a smart speaker. With that demographic Amazon has been utterly dominant, with roughly 70% of all U.S. smart speaker owners using an Echo. Alexa’s reach spread far beyond that, of course, to all manner of smart home devices, laptops, cars, phones, wearables and TVs. We’re excited to announce today that the heads of Amazon’s Alexa team will be joining us at Disrupt this September to discuss the smart assistant’s growth and the future of voice computing.

Toni Reid is the vice president of Alexa Experience & Echo Devices at Amazon, a company she’s been with for over a decade. She’s being a driving force in Alexa’s dominance of the category. Rohit Prasad is the vice president and head scientist, Alexa Artificial Intelligence. He’s an expert in natural language understanding, machine learning, dialog science and machine reasoning.

Together the pair have been the driving force in Alexa’s growth and domination of the smart assistant category. Hear how it all got started from Reid and Prasad at Disrupt 2020 on September 14-18. Get a front-row seat with your Digital Pro Pass for just $245 or with a Digital Startup Alley Exhibitor Package.

Powered by WPeMatico

Today, the U.S. exceeded three million COVID-19 cases and 132,000 deaths. In several states, new hotspots have rolled back plans to reopen businesses. The novel coronavirus has — and will continue — to profoundly impact the way we live and work.

For the moment, that includes a shift in the employment status of many Americans. More than 50 million people have filed for unemployment since mid-March. And while many states have made efforts to reopen businesses and return some sense of normality, these moves have led to a spike in cases and may prolong the pandemic and its ongoing economic impact.

Technology has been a lifeline for many, from food delivery to the 3D printing I highlighted last week, which has worked to address a nation suffering from personal protective equipment shortages. Automation and robotics have also been a constant in conversations around tech’s battle against COVID-19.

Robots don’t get sick, tired or emotionally burnt out, and unlike us, they aren’t walking, talking disease vectors. Automation advocates like to point to the “three Ds” of dull, dirty and dangerous jobs that will eventually be replaced by a robotic workforce, but in the age of COVID-19, nearly any essential job qualifies.

The robotic invasion has already begun in earnest. The service, delivery, health care and sanitation industries in particular have all opened a massive gap over the past several months that automation has been more than happy to roll right through. A recent report from The Brookings Institute notes that automation arrives in the workforce in fits and starts — most notably, during times of economic downturn.

“Robots’ infiltration of the workforce doesn’t occur at a steady, gradual pace. Instead, automation happens in bursts, concentrated especially in bad times such as in the wake of economic shocks, when humans become relatively more expensive as firms’ revenues rapidly decline,” the study found. “At these moments, employers shed less-skilled workers and replace them with technology and higher-skilled workers, which increases labor productivity as a recession tapers off.”

Powered by WPeMatico

LogDNA, a startup that helps DevOps teams dig through their log data to find issues, announced a $25 million Series C investment today along with the promotion of industry vet Tucker Callaway to CEO.

Let’s start with the funding. Emergence Capital led the round with participation from previous investors Initialized Capital and Providence Equity. New investors TI Platform Management, Radianx Capital, Top Tier Capital and Trend Forward Capital also joined the round. Today’s investment brings the total raised to $60 million, according to the company.

Current CEO and co-founder Chris Nguyen says the company provides a centralized way to manage log data for DevOps teams with an eye toward troubleshooting issues and getting applications out faster.

New CEO Callaway, whose background includes executive stints at Chef and Sauce Labs, came on board in January as president and CRO with an eye toward moving him into the top spot when the time was right. Nguyen, who will move to the role of chief strategy officer, says everyone was on board with the move, and he was ready to step back into a more technical role.

“When we closed the latest round of funding and looked at what the journey forward looks like, there was just a lot of trust and confidence from my co-founder, the board of directors, all of the investors on the team that Tucker is the right leader,” Nguyen said.

As Callaway takes over in the midst of the pandemic, the company is in reasonably good shape, with 3,000 customers using the product and a strategic partnership with IBM to provide logging services for IBM Cloud. Having $25 million in additional capital certainly helps, but he sees a company that’s still growing and intends to keep hiring.

As he brings more people on board to lead the company of approximately 100 employees, he says that diversity and inclusion is something he is passionate about and takes very seriously. For starters, he plans to put the entire company through unconscious bias training. They have also hired someone to review their hiring practices to date and they are bringing in a consultant to help them design more diverse and inclusive hiring practices and hold them accountable to that.

The company was a member of the same Y Combinator winter 2015 cohort as GitLab. It actually started out building a marketing technology product, only to realize they had built a powerful logging tool on the back end. That logging tool became the basis for LogDNA .

Powered by WPeMatico