Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

As an early-stage investor, Floodgate’s Ann Miura-Ko looks for two breakthroughs in order to invest in a startup: The first happens in the value-seeking stage of a startup’s journey and the second occurs in its growth-seeking phase.

“There are really two stages to building a company,” Miura-Ko said at the TechCrunch Early Stage virtual event earlier this week. “One is what we call value-seeking mode, and this is where you’re really trying to figure out what the company actually looks like, including what’s the product? Who are you selling to? How do you price it? All of these things are still being discovered in the value-seeking mode.”

After founders have answered those questions, they can move into growth-seeking mode, she said. That’s the point when startups are trying to attract as many customers as possible.

Throughout these two distinct stages, Miura-Ko says she looks for the two breakthroughs: the inflection insight and product-market fit.

The idea of an inflection insight, Miura-Ko said, is a relatively new framework Floodgate is exploring. Often times, she said founders need to ride some massive, exponential curves that allow their businesses to grow sustainably and scale.

These inflections have two parts to it: cause and impact. The causes are generally either technological (cloud, 5G), regulatory (GDPR, AV regulation) or societal (belief or behavior shifts). On the impact side, products and distribution may become cheaper or faster, while also presenting new use cases or customers, she said.

“Or even more interesting, you have something that was impossible that now is possible,” she said. “And that is an exponential impact that you could ride on.”

But simply finding that inflection insight doesn’t mean you should create a business. What founders must do next is determine if the insight is right and nonconsensus.

Powered by WPeMatico

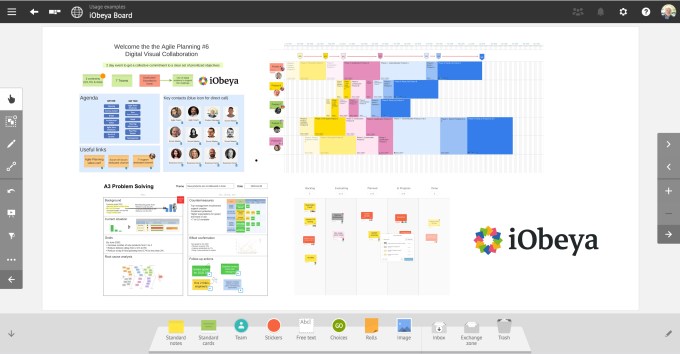

As we move deeper into the pandemic, companies are looking for ways to digitize processes that previously required in-person meetings with manual approaches. Investors appear to be rewarding companies that can achieve this. IObeya, a French company that helps digitize management planning processes like lean and agile, announced a $17 million Series A today.

Red River West led the round with help from Atlantic Bridge Capital and Fortino Capital Partners. It has now raised a total of $20 million, according to the company.

Tim McCracken, who heads up the company’s U.S. operations, says the name comes from the Japanese word for the large room where companies did all their planning. Many companies gather a group of people in a conference room and line the walls with sticky notes and white boards with their plans for the coming weeks and months.

Even before the pandemic struck, it wasn’t the most effective way to record this valuable business content, and iObeya has developed a service to put it in the digital realm. “And so one of the things that they did with those obeya rooms was they had lots of different visual management boards with Post-it notes and with different types of indicators that they would use to manage their business. And so what iObeya does is digitize that type of visual management, so that you can access it from multiple locations and share it amongst teams and basically eliminate the need for doing it on paper and on walls,” McCracken explained.

This involves digitizing four main areas that include lean management, factory floor management, agile programming and, finally, what they call the digital workplace, which includes design thinking, virtual whiteboarding and brainstorming. All of these approaches have lots of planning associated with them and could benefit from being moved online.

Image Credits: iObeya

They are approaching 100 employees, with the majority in France right now, with a small office in the U.S. (in Seattle), but they will be using this money to expand with plans to add 50 more people. He says the company has always looked at diversity when it comes to its hiring practices.

“We want to try to attract, not only experienced salespeople, as well as the support organization around them, but also really do as much outreach in the local community to see how we can ensure that our workforce reflects the community,” he said.

As the company had to shut down offices due to COVID-19, McCracken says their own software helped them make that transition more smoothly. “We actually use our own software to manage business so we had very little disruption to our actual work. At the same time, the volume of work increased probably four to five fold, simply because of increased demand for the software. So we had to manage not only moving from working in an office to work at home, but also the increased workload,” he said.

The company was founded near Paris in 2011. They plan to use the money to expand operations in the U.S. and build awareness of the company through greater sales and marketing spend.

Powered by WPeMatico

The wider field of cybersecurity — not just defending networks, but identifying fraudulent activity — has seen a big boost in activity in the last few months, and that’s no surprise. The global health pandemic has led to more interactions and transactions moving online, and the contractions we’re feeling across the economy and society have led some to take more desperate and illegal actions, using digital challenges to do it.

Today, a U.K. company called Quantexa — which has built a machine learning platform branded “Contextual Decision Intelligence” (CDI) that analyses disparate data points to get better insight into nefarious activity, as well as to (more productively) build better profiles of a company’s entire customer base — is raising a growth round of funding to address that opportunity.

The London-based startup has picked up $64.7 million, a Series C it will be using to continue building out both its tools and the use cases for applying them, as well as expanding geographically, specifically in North America, Asia-Pacific and more European territories.

The mission, said Vishal Marria, Quantexa’s founder and CEO, is to “connect the dots to make better business decisions.”

The startup built its business on the back of doing work for major banks and others in the financial services sector, and Marria added that the plan will be to continue enhancing tools for that vertical while also expanding into two growing opportunities: working with insurance and government/public sector organizations.

The backers in this round speak to how Quantexa positions itself in the market, and the traction it’s seen to date for its business. It’s being led by Evolution Equity Partners — a VC that specialises in innovative cybersecurity startups — with participation also from previous backers Dawn Capital, AlbionVC, HSBC and Accenture, as well as new backers ABN AMRO Ventures. HSBC, Accenture and ABN AMRO are all strategic investors working directly with the startup in their businesses.

Altogether, Quantexa has “thousands of users” across 70+ countries, it said, with additional large enterprises, including Standard Chartered, OFX and Dunn & Bradstreet.

The company has now raised some $90 million to date, and reliable sources close to the company tell us that the valuation is “well north” of $250 million — which to me sounds like it’s between $250 million and $300 million.

Marria said in an interview that he initially got the idea for Quantexa — which I believe may be a creative portmanteau of “quantum” and “context” — when he was working as an executive director at Ernst & Young and saw “many challenges with investigations” in the financial services industry.

“Is this a money launderer?” is the basic question that investigators aim to answer, but they were going about it, “using just a sliver of information,” he said. “I thought to myself, this is bonkers. There must be a better way.”

That better way, as built by Quantexa, is to solve it in the classic approach of tapping big data and building AI algorithms that help, in Marria’s words, connect the dots.

As an example, typically, an investigation needs to do significantly more than just track the activity of one individual or one shell company, and you need to seek out the most unlikely connections between a number of actions in order to build up an accurate picture. When you think about it, trying to identify, track, shut down and catch a large money launderer (a typical use case for Quantexa’s software) is a classic big data problem.

While there is a lot of attention these days on data protection and security breaches that leak sensitive customer information, Quantexa’s approach, Marria said, is to sell software, not ingest proprietary data into its engine to provide insights. He said that these days deployments typically either are done on premises or within private clouds, rather than using public cloud infrastructure, and that when Quantexa provides data to complement its customers’ data, it comes from publicly available sources (for example, Companies House filings in the U.K.).

There are a number of companies offering services in the same general area as Quantexa. They include those that present themselves more as business intelligence platforms that help detect fraud (such as Looker) through to those that are secretive and present themselves as AI businesses working behind the scenes for enterprises and governments to solve tough challenges, such as Palantir, through to others focusing specifically on some of the use cases for the technology, such as ComplyAdvantage and its focus on financial fraud detection.

Marria says that it has a few key differentiators from these. First is how its software works at scale: “It comes back to entity resolution that [calculations] can be done in real time and at batch,” he said. “And this is a platform, software that is easily deployed and configured at a much lower total cost of ownership. It is tech and that’s quite important in the current climate.”

And that is what has resonated with investors.

“Quantexa’s proprietary platform heralds a new generation of decision intelligence technology that uses a single contextual view of customers to profoundly improve operational decision making and overcome big data challenges,” said Richard Seewald, founding and managing partner of Evolution, in a statement. “Its impressive rapid growth, renowned client base and potential to build further value across so many sectors make Quantexa a fantastic partner whose team I look forward to working with.” Seewald is joining the board with this round.

Powered by WPeMatico

When you need a loan, the cost and speed of getting it can be as critical to get right as the financing itself, a principle that might be even more relevant today in our shaky pandemic-hit economy than ever before. Today, a company that proposes to cut both the time and price for securing financing, with a platform, initially aimed at SMBs, that lets business owners put up their home property as collateral to get the loan, is announcing a funding round to expand its business.

Selina Finance, which provides loans to small and medium businesses in the form of flexible credit facilities — you pay back only what you borrow, and you do that over time, rather than in one lump sum — that are backed by the value of your personal home, is today announcing that it has raised £42 million ($53 million) — £12 million in equity and £30 million in debt to distribute as loans. The company says it plans to raise significantly more debt in the coming months as its business expands.

The funding is coming from several investors, including Picus Capital and Global Founders Capital — two firms that are tied in part to the Samwer brothers, which built the Rocket Internet e-commerce incubator in Berlin. The company’s valuation is not being disclosed.

London-based Selina plans to use the funding in a couple of areas: first, to continue growing its business in the UK, which was founded by Andrea Olivari, Hubert Fenwick and Leonard Benning and launched in June 2019; and second, to start the process of opening up to other markets in Europe.

Selina today focuses on SMEs whose applications qualify as “prime” (as opposed to sub-prime). They can borrow up to £1 million in funds — the average amount is significantly less, £150,000, says Olivari — with interest rates starting at 4.95% APR. That undercuts the rates on typical unsecured loans. Selina is also in the process of getting a license to expand its offering to consumer borrowers, too.

We’ve moved on from the days when property investing was so stable that “safe as houses” was a common expression to mean absolute reliability. But for most people, their properties continue to represent the single-biggest asset that they own and thus become a key part of how a person might construct their wider financial profile when it comes to borrowing money.

Selina’s tech essentially operates a kind of two-sided marketplace: on one hand, its algorithms process details about your property to determine its market value and how that will appreciate (or depreciate), and on the other, it’s evaluating the health of the SME business, and the purpose of the loan, to determine whether the borrower will be good for it. It’s only a year old and so it’s hard to say whether this is a strong record, but Benning notes that so far, no customers have defaulted on loans.

“We have the security of the home, yes,” he said, “but we only take credit-worthy customers to make sure the default scenario doesn’t happen. It’s something that we avoid at any cost. Technically there is a long process that leads to that outcome, but it almost never happens.” He noted that Selina has people on its team who have worked for sub-prime lenders, which gives them experience in helping to determine prime opportunities.

More generally, the idea of leveraging your property to raise capital — say, through a remortgage or loan against its value — are not new concepts: banks have been offering and distributing this kind of financing for years. The issue that Selina is addressing is that typically these deals come with high interest rates and commissions, and might take six to eight weeks from application to approval and finally loan. Selina’s pitch is that it can bring that down to five days, or possibly less.

“It’s critical that we can make a loan in five days to be be nimble and accurate, because this is one area where banks break down,” said Fenwick. “It can take two weeks to arrange for someone to walk around on behalf of a bank to make a valuation. It’s just a backwards and archaic process. We can use big data and tap different areas and dynamics all that into a model to assess the valuation of a property with a low margin of error.”

Selina is not the only tech company tackling this opportunity — specifically, Figure, the startup founded by Mike Cagney formerly of SoFi, is also providing loans to individuals against the value of their property, among other services. And for those who have followed other commerce startups financed by the Samwers, you could even say that there is a hint of cloning going on here, with even the sites of the two bearing some similarities. But for now at least Selina seems to be the only one of its kind in the UK, and for now that spells opportunity.

“Selina Finance is bringing much-needed innovation to the UK lending space by allowing customers to access the equity locked up in their residential property, seamlessly and on flexible terms,” said Robin Godenrath, MD at Picus Capital, in a statement. “The team impressed us with their strong focus on building a fully digital customer experience and have already achieved great product-market fit with their business loan use case. We’re excited and confident that Selina’s consumer proposition will also become an attractive alternative in the consumer lending space.”

Powered by WPeMatico

How’s your 60-second pitch working for ya? Could it stand a refresh? Get ready to learn new and better ways to make your pitch more effective at opening doors to opportunity. Step one: register here — it won’t cost you a dime.

Step two: tune in and join us tomorrow, July 23 at 4:30 p.m. ET / 1:30 p.m. PT, for the next Pitchers & Pitches competition. We randomly chose five Digital Startup Alley exhibitors to bring the heat — in the form of their best 60-second pitch — in front of a panel of expert judges. We’ll name all the names in just a minute.

Note: Anyone can attend Pitchers & Pitches, but only companies exhibiting in Digital Startup Alley during Disrupt 2020 are eligible to pitch.

The invaluable critique, feedback and advice pitchers receive will help them take their elevator pitch to new heights — a great way to prepare for showcasing their tech at Disrupt 2020. Not pitching? No problem — you can apply what you learn to your own business and take your elevator pitch up a few more floors.

Here are five more excellent reasons to tune in:

The founders of the winning startup get a consulting session with cela, a company that connects early-stage startups to accelerators and incubators that can help scale their businesses.

Okay, let’s get to the judges for this session. We’ve tapped the experienced minds of two TechCrunch editors — Jordan Crook and Alex Wilhelm. Rounding out the panel we have two top featured VCs — Monique Idlett, of Reign Ventures and Jess Morris Jr., general partner and founder of Chapter One VC. They’ll drop a whole lot of knowledge to help you impress potential investors and customers alike.

Here are the five pitchers currently warming up in the bullpen and ready to take the mound in tomorrow’s competition:

The next Pitchers & Pitches takes place tomorrow, July 23 at 4:30 p.m. ET / 1:30 p.m. PT. Register here for free. Don’t miss your chance to improve your pitch, bring the heat and unlock more opportunity.

Is your company interested in sponsoring or exhibiting at Disrupt 2020? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

I have struggled for years about whether or not to write a piece like this.

Speaking out about racism goes against every lesson I have learned since I was the only Black kid in my first-grade class in the Boston suburbs:

Save candid conversations about race for Black people. You’re being a victim. People will think you’re whining or making excuses. They’re not interested. Don’t make white people feel uncomfortable.

In a professional environment, speaking up could be career suicide. But now is not the time to be silent.

The startup I founded, Indenseo, is a data and analytics software insurtech company that provides automated underwriting services, software and analytics services to the insurance industry.

Despite strong customer relationships and support from angel investors, we didn’t complete building solutions and moving the company forward until we stopped taking unproductive pitch meetings with VCs. Some of my [white] colleagues who attended those meetings characterized these encounters as disrespectful and dismissive, but for me, they were par for the course.

I was raised by a single mother in West Medford, Massachusetts, and worked my way through Harvard, located about five miles away. Before starting Indenseo, I worked for @Road, a fleet management telematics company that was acquired by Trimble, a company that says it transforms “the way the world works by delivering products and services that connect the physical and digital worlds.” There, I led a team that pioneered the sale of telematics data, which started with using data for traffic predictions and expanded to other markets, including insurance.

At Trimble, I saw the difficulty legacy insurance carriers faced when they tried to incorporate new types of data into their underwriting and business processes; I started Indenseo to solve this problem by combining deep insurance industry experience with the nimbleness of a startup.

I knew fundraising would be a challenge: Commercial auto insurance has been unprofitable for years, and industry executives would be naturally skeptical that my solution would make it better. As my insurance industry friends said, “you sure picked a hard problem to solve.”

Even as a first-time founder, I did not anticipate how difficult it would be to raise venture funding, but the experience offered some insights into why so few Black entrepreneurs are funded by VCs.

Insurance is not the most mainstream venture category, though in recent years many insurtech companies have received funding. And VCs are not accustomed to seeing Black founders in this space. The overall scarcity of Black founders suggests that they’re not used to seeing many of us, period.

The odds of winning a venture round are low for everyone, but Black founders have a better chance playing pro sports than they do landing venture investments.

The odds of winning a venture round are low for everyone, but Black founders have a better chance playing pro sports than they do landing venture investments.

According to a Harvard study, between 1990 and 2016, just 0.4% of the entrepreneurs who received funding were Black. That’s 188 Black entrepreneurs, versus 34,000 white entrepreneurs in total, or about seven per year. In 2016, nine Black NFL quarterbacks started at least one game during the season. Should anyone wonder why ambitious young Black men pursue sports careers?

I got the meetings and pitched Indenseo to investors in Silicon Valley, New York City, Chicago and Boston. I expected that my experience, my best-in-class team, the compelling Indeseo proposition, market fit, and the financial and advisory backing of notable insurance executives would land the dollars, despite the odds. I was wrong.

One recurring phenomenon we frequently encountered were dismissive and disrespectful investors (in the words of a white colleague). When I had one disappointing meeting after another, people in my multiracial network — many with extensive fundraising experience — told me it didn’t make sense. I’d resisted getting distracted by race as a factor, but white colleagues were saying that something wasn’t adding up.

As Toni Morrison said, “The very serious function of racism is distraction. It keeps you from doing your work.” My own lived experience is that it’s an added factor that Black entrepreneurs have to manage.

I followed advice given to many Black founders: take a white colleague to your pitch meeting. I brought colleagues who had done a lot of fundraising themselves; some of these meetings were with their contacts. I tried this strategy dozens of times, and my colleagues were repeatedly shocked at the treatment we received.

I assumed most investors were jerks in pitch meetings, but they told me the level of disrespect and dismissiveness I received was not typical.

But if I lose my temper, I’d likely be labeled as just another angry Black man.

I did let my frustration show once when I directed a VC’s attention to the milestones we’d met and industry support we had gathered.

“What does it take for us to get a check from you?” I asked. His response: There is nothing you can say or do to get me to invest, but if you get another VC to lead the round, call me.

In another conversation with a VC, I pointed out the lack of diversity in both the ranks of investors and the entrepreneurs they choose to fund. He replied that Silicon Valley has produced the greatest accumulation of wealth in human history in the last 25 years. Why do we need to change anything?

GW Chew is a friend and a Black founder who was also having difficulty getting VC funding for his vegan meat company, Something Better Foods. He approached investors to raise funds to meet the fast expanding demand for his products. Talk about traction.

A white investor told Chew that if the founder/CEO were white, the company would have raised millions already. My friend told me he’s no longer talking to VCs and is raising funds from alternative sources.

Then there are the grifters. I don’t think Black founders are the only ones whose ideas get stolen after pitch meetings, but it happened to me.

We pitched a VC firm that had a consultant with an insurance background on their team to help evaluate the Indenseo opportunity. VCs don’t sign NDAs, but we did sign one with the consultant, who said Black founders can’t get companies funded but white founders can. (Yes, he said it.)

He later tried to ingratiate himself by saying he was considering investing too. Instead, he founded a company that copied our ideas. (So much for our NDA.)

Eventually, he told me, “I like your team. Call me when the wheels fall off.” When he announced his new company, we saw that he was backed by the VC who brought him into our meeting. He has since gone on to raise more than $40 million.

So why didn’t I sue him for violating the NDA? I consulted with some of our angel investors and they said we would be better off fighting them in the marketplace, given our limited time and resources. It wasn’t the first time our ideas were stolen.

When another company we pitched appropriated some of our ideas, my contact there informed his executives that they’d signed an NDA with Indenseo. Their reply: Indenseo doesn’t have the money to sue us. But they weren’t domain experts and we had left out much about our plans: They announced their launch in The Wall Street Journal, but as I expected, they failed.

Am I calling VCs racists? I don’t know what’s in their hearts, but I do know what’s in their numbers. Dealing with unconscious bias is difficult because as a Black entrepreneur trying to build a company, you know it exists and you have to figure out a way to manage around it. But it’s a subtle problem.

I don’t think VCs wake up in the morning and consciously decide not to invest in Black entrepreneurs or businesses intentionally choose not to buy from companies founded by Black entrepreneurs. But, the results of who receives investment and who doesn’t are quantifiable: few VC funds have Black employees or invest in companies started by Black founders.

I have never pitched at a VC firm that had a Black person in the room. And the pipeline excuse doesn’t work. There are Black people with technical degrees who aren’t hired at VC firms and white VC investment partners who earned liberal arts degrees.

Sure, there are funds started by Black VCs, but they encounter unconscious bias too when raising money. While more Black VCs with more capital is a crucial element of addressing underrepresentation, does that mean VC firms that aren’t founded by Black investors don’t have to change anything?

Deciding to stop the time-consuming VC pitch process and go in another direction to fund and develop the company was quite liberating. Moving forward, we’re free to manage our startup without wondering how VCs will view our decisions in the future when we seek funding.

We raised money from angel investors (including the former CEO of one of the world’s leading analytics software companies and his wife). In addition to money, it expanded our knowledge and it improved our products. Another lesson learned: Angel investors may be more helpful to your company than VCs.

The ultimate judgment on Indenseo’s products and team will be rendered by customers, partners and domain experts. The insurance industry has unique metrics that determine a company’s profitability. If you’re selling analytics software and services, either your solution is helping improve those metrics or it isn’t. The insurance industry is validating our market fit and survival skills.

I was able to build Indenseo without VCs because the insurance industry operates differently from VCs. One of the keys to success in the insurance industry is developing trust. Insurance isn’t a tangible product. It offers the promise that when a customer pays its premiums the insurance company will be able to support them when they file a claim. Without trust, a company can’t succeed in the industry.

There is a process to get insurance industry trust, and many senior executives in the industry are reluctant to invest the time in startups that’s necessary for them to get that trust. That’s because they aren’t convinced the startup will persevere to get through the process of getting that trust. We are able to get time with those executives because they trust our team and they don’t doubt that it’s worth their time to talk to Indenseo. They know we won’t fold when times are difficult.

A change I’ve seen since I started Indenseo that works in our favor is insurers don’t rely on VCs to act as a de facto screen for which insurtechs have the best teams and solutions. That’s because they don’t have confidence in investors’ judgments about insurtech companies.

Another lesson I’ve learned from my experiences: Don’t let VCs be the gatekeepers of your success. There are other funding sources, such as angel investors, corporate strategic investors, crowdfunding and more. There is funding outside the United States. Don’t overlook international investors: There is wealth in African countries. I found a way of funding the company that works for Indenseo.

We’ve developed Indenseo with angel investors and sweat equity. The key to our success is the amazing team, our advisory board and using capital efficiently. They remind me that you’re not the only one with an emotional investment in this company. When I started this company the only people in the insurance industry I knew were the people I had interacted with when I worked at Trimble.

Most of the people on our advisory board and team with insurance industry backgrounds are people I’ve met since I started Indenseo. It takes time to build those relationships. Because of them there is no corner of the commercial property casualty insurance industry we can’t access. The head of insurtech at a global reinsurance company told me that ours is the best balanced team of any insurtech company they’ve seen.

We are in the early stages of showing our flagship product, and it isn’t available for general release yet. Our VP of Engineering is telling me about a new concern: that we don’t take on too many customers too quickly.

Powered by WPeMatico

Glimpse is giving Airbnb hosts a way to make extra money while also supplying their accommodations with new products.

The startup was founded by CEO Akash Raju, COO Anuj Mehta and CPO Kushal Negi, who all attended Purdue University together. It’s part of the current batch of startups at accelerator Y Combinator — where, coincidentally or not, Airbnb is the most famous alum.

Raju said that he and his co-founders came up with the idea while they were still in school and working with brands to create pop-up shops on campus. They realized that many new, direct-to-consumer brands are looking to increase awareness, and they decided that Airbnbs were the perfect place to convince someone to try (for example) a new mattress or a new kind of coffee. After all, hotels are already in the product placement business.

If you’re an Airbnb host, you can sign up and then browse offers for free product samples. (If you really want to stock up, you can buy larger quantities at a discounted price.)

Glimpse works with you to showcase the products on your properties, and to email a digital “lookbook” highlighting the various products to guests at the beginning and end of their stay. You then earn a commission fee (Raju said $100 to $500 on average, though it can be even higher for big-ticket items) when these samples lead consumers to make a purchase.

Glimpse founders

Brands that have marketed themselves through the platform include the GhostBed mattress and Liquid Death water.

The startup first launched in March of this year — not exactly the best time for the travel business. Raju recalled, “We actually launched right before COVID started. After that, what we really spent a lot of time on was empathizing with hosts.”

In fact, some of Glimpse’s early partners stopped listing their properties for a while. But travel is on the rise again, including (or even especially) via Airbnb, and Raju said many of Glimpse’s 750 current properties are now fully booked through September. And given the lost income of the past few months, hosts might be even more interested than usual.

He added that the team will continue building out the platform with new features for product discovery and attribution, but he said, “The key thing that makes us unique is our emphasis on that in-home experience.”

Powered by WPeMatico

Back in 2016, Mobalytics wowed the judges at Disrupt SF with its data-based coach for the exploding competitive gaming world, winning the Startup Battlefield. The company is building on the success of the past few years with a new funding round and a compelling new collaboration with Tobii that uses eye-tracking to provide powerful insights into gamers’ skills.

Mobalytics began with the idea that, by leveraging the in-game data of a competitive esport like League of Legends (LoL), they could provide objective feedback to players along the lines of how fast or effective they are in different situations. Quantifying things like survivability or teamplay provides an analogue to similar measures in physical sports.

“On an athlete you have all these measurements, like pulse oximeters, ECGs, the 40-yard dash,” said Amine Issa, co-founder and “Warchief of Science.” Not so much with PC games. Their challenge at that time was to take the LoL API provided by Riot and transform it into actionable feedback, which the company’s success in the years since suggests they managed to do.

But Issa had always wanted to use another, more direct and objective measurement of a gamer’s mental processes: eye tracking. And last year they began an internal project to evaluate doing just that, in partnership with eye-tracking hardware maker Tobii.

“If you know where someone is looking, it’s the closest thing to knowing what they’re thinking,” Issa said. “When you combine that with the larger picture you can put together something to help them along. So we spent six months conducting research, taking players of different levels and roles and studying their eye tracking data to find some metrics we could organize the platform around.”

Not surprisingly, there are characteristics of the highly skilled (and practiced) that set them apart, and the team was able to collect them into a set of characteristics that any player can relate to.

Well, the gif compression isn’t so hot, but you get the idea — the purple square indicates attention. Image Credits: Mobalytics

“We had to think about how to build a product that people want to use. One thing we learned after TechCrunch is that even a simple score from 0-100 doesn’t work for everyone. You need to provide the context for that. So with something like eye tracking, you’re getting 30 data points per second — how do you break that down in a way that players understand it?”

Talking to professional gamers and coaches during the study helped them form the main categories that Mobalytics now tracks with the aid of a Tobii device, like information processing, map awareness and tunnel vision.

“It’s important to be able to tell a narrative to people. Say you get ganked a lot,” said Issa, referring to the unfortunate occurrence of being picked off by enemy players while alone. “Why are you getting ganked? If your vision score is high but map awareness is low, that’s one thing. Did you know all the information and go in arrogantly, or were you not aware? League is a very complicated game, so players want to know, in this specific fight, what did I do wrong, and what should I have done instead?”

That second question is a tougher one (though perhaps AI MOBA players may have something to say about it), but the metrics are powerful in and of themselves. “Pros are fascinated by this technology,” Issa said. “There’s a lot of ‘I had no idea’ moments. Coaches have said, these are my fastest players but it’s cool to see that as a quantifiable variable.”

Tobii’s head of gaming, Martin Lindgren, echoed this feeling: “Pro teams aren’t interested in being told what to do. They want the data so they can draw their own conclusions.”

Tobii now has a gaming-focused eye-tracker and integrates with a number of AAA games, like Rise of the Tomb Raider, where it can be used in place of fiddly aiming using the analog sticks. As someone who’s bad at specifically that part of games, this is attractive to me, and Lindgren said opportunities like that are only increasing as gaming companies embrace both accessibility and try to stand out in a crowded market.

The companies have worked together to improve the eye-tracking coaching, for instance lowering the number of games a user must play before the system can accurately track their in-game actions; Lindgren said the collaboration with Mobalytics is ongoing — “definitely a long-term partnership” — in fact Tobii’s relationship with the founders predates their startup.

The ultimate goal of Mobalytics is to have a gaming assistant that adapts itself to your playing and preferences, making intelligent suggestions to improve your skills. That’s a ways off, but the company is getting the hang of it. Its first product, the LoL assistant, took a year to build, Issa said. A more recent one, for Legends of Runeterra, took three months. Teamfight Tactics took three weeks.

Admittedly it was more difficult to design one for Valorant, which, being a first-person shooter, is wildly different from the other games — but now that it’s done, a lot of that work could be applied to an assistant for Counter-Strike or Overwatch.

Expansion to other games and genres is the reason for raising an $11 million Series A, led by Almaz Capital and Cabra VC, with HP Tech Ventures, General Catalyst, GGV Capital, RRE Ventures, Axiomatic and T1 Esports participating.

“It was a very different experience from the post-TechCrunch one, where you’re in the spotlight and everyone’s throwing money your way,” said Issa. “But we’ve built a successful product on LoL, expanded to four games, today we have more than seven million monthly active users… Our plan is to double down on what’s worked for us and create the ultimate gaming companion.”

Powered by WPeMatico

SaaS is hot in 2020. Tooling that helps facilitate remote work is hot in 2020. And we all know that anything related to video chatting in particular is on fire this year. In the midst of all three trends is Kudo, which just raised $6 million in a round led by Felicis.

But Kudo’s video chatting and conferencing tool with built-in support for translators and multiple audio streams wasn’t initially constructed for the COVID-19 era. It got started back in 2016, so let’s talk about how it got to where it is today before we talk about how much the pandemic and ensuing remote-work boom accelerated its growth by what the company described in a release as 3,500%.

TechCrunch spoke to Fardad Zabetian, Kudo’s founder and CEO, earlier this week to learn about how his company got started. According to the executive, he started working on Kudo back in 2016 after feeling the need to add language support to what he calls decentralized meetings.

After getting a proof of concept (could interactive audio and video be compiled for remote participants with less than 500 milliseconds of latency?) in place, the company itself launched in 2017, and after more work its product was put into the market in September, 2018.

During that time, Kudo put together angel and friends-and-family money that Zabetian described as less than $1 million, meaning that the startup got a lot done without spending a lot. (In my experience, talking to founders over the last decade or so, that’s a good sign.)

All that work paid off this year when COVID-19 shook up the world, forcing companies to cancel business travel and instead lean on video conferencing solutions. Given the international nature of modern business — globalization is a fact, regardless of what nationalists want — the change in the world’s meeting landscape scooted demand toward Kudo.

Here’s how it works: Kudo provides a self-serve SaaS video conferencing solution, allowing any company to spin up meetings as they need. It also has a translator pool, and can supply humans to fill out a meeting’s needs if a customer wants. Or, customers can bring their own translators.

So, Kudo is SaaS with an optional services component, though given the lower margins inherent to services over software, I’d hazard that we should think of its services revenue as a helper to its SaaS incomes. There’s no need to fret about their impact on Kudo’s blended gross margins, in other words.

According to Zabetian, about three-quarters of its customers bring their own translators, while about a fourth hire them through Kudo’s cadre.

As noted, Kudo got into the market back in 2018, which means it was already selling its software in the pre-pandemic days. Lead investor Niki Pezeshki told TechCrunch that Kudo has “stepped up in a big way for its customers during the pandemic,” but that while COVID “has certainly accelerated Kudo’s growth, we think they are enabling a longer-term shift in the market by showing customers that it is possible to effectively run multilingual conferences and meetings without the hassle of international travel and all the planning that goes into it.”

Kudo was already right about where the world was going, then, even if the pandemic provided a boost.

That tailwind is evident in its round size, notably. Kudo’s CEO said that he set out to raise $2 million, not $6 million; the $4 million delta is indicative of a company that has become a competitive asset for the venture class to fight over.

And Kudo’s growth has brought with it notable financial benefits, including several months of cash flow positivity — something nearly unheard of amongst startups of its age and size. But the company will spend from its $6 million and push that line-item negative, it said. Kudo has 30 open positions today that it expects to fill in the next few quarters, including building out its sales and marketing functions, which to date it has not invested in (another good sign among startups is how long they can grow attractively without needing to spend heavily on sales and marketing). That won’t come cheap, in the short-term.

So that’s Kudo and its round. What we want to know next is its H1 2020 year-over-year revenue growth. Do write in if you know that number.

Powered by WPeMatico

Ready to do everything in your power to keep your startup on track for success — and keep more of your hard-earned currency in your wallet? Listen up. Early-bird pricing on passes to Disrupt 2020 ends in less than two weeks. Buy your pass before the bird expires on July 31 at 11:59 p.m. PDT, and you’ll save up to $300.

Disrupt 2020 will occur on September 14-18 — five full days of exploration, exhibition, education and connection. No matter your role in the startup universe, you’ll see innovative technologies, learn new skills, discover new resources, share ideas and network with people who can help your business move to the next level and beyond. And it all happens on a global scale.

A Digital PRO Pass is your ticket to everything Disrupt offers, including CrunchMatch, our AI-powered networking platform. Based on a profile you create, CrunchMatch makes short work of finding and connecting you with people who share your business goals. The newly upgraded algorithm makes faster, more precise matches, and it gets smarter the more you use it.

It’s the perfect tool to help you meet Disrupt attendees from around the world. Use it as you explore hundreds of cutting-edge early-stage startups exhibiting in Digital Startup Alley. Meet founders, view product demos and uncover the latest innovations.

Want more? Okay — schedule 1:1 video meetings with potential investors and customers, showcase your innovative products, host private roundtable events or interview prospective employees.

I used CrunchMatch to schedule meetings, and the digital aspect made connecting easier. It helped me stay organized, meet people and still have time to take in a piece of everything at Disrupt. — JC Bodson, founder and CEO of Arbitrage Technologies.

If you like specifics, your Digital PRO Pass lets you view content from multiple stages as it happens, and it provides replays on demand. Our growing speaker roster includes top investors, founders and experts from across the startup ecosystem.

This is not a passive experience, folks. You get to engage with what’s happening while it’s happening. Ask questions and participate in polling during live-streamed sessions.

Don’t miss Startup Battlefield as this year’s cohort of extraordinary startups competes virtually for glory, massive media attention, investor affection and, of course, $100,000 in equity-free cash. Nothing virtual about those benefits, no ma’am.

Disrupt 2020 takes place from September 14-18, but you have less than two weeks to reap the lowest price. Choose the early bird’s smaller bill. Buy your pass before July 31 at 11:59 p.m. PDT, and use the $300 savings to feather your nest.

Powered by WPeMatico