Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

“What happens after a company gets called out?” he asked over the phone. “Do you know what happens to the people in-house that come forward?”

I didn’t.

A Black male engineer at a fashion tech company who wished to remain anonymous was telling me how he’d been passed over for promotions white counterparts later received after they’d pursued risky and unsuccessful projects. At one point, he said management tasked him with doing recon on a superior who made disparaging comments about women because his subordinates were uncomfortable reporting it directly to HR.

When human resources eventually took up the matter, the engineer said his participation was used against him.

More recently, his company brought furloughed employees back and managers promoted a younger, white subordinate over him. When he asked about the move, his direct supervisor said he was too aggressive and needed to be more of a role model to be considered in the future.

In the absence of industry leadership, there’s no blueprint to remedy institutional problems like these. The lack of substantial progress toward true representation, diversity and inclusion across several industries illustrates what hasn’t worked.

Audrey Gelman, former CEO of women-focused co-working/community space The Wing, stepped down in June following a virtual employee walkout. Three months earlier, a New York Times exposé interviewed 26 former and current employees there who described systemic discrimination and mistreatment. At the time, about 40% of its executive staff consisted of women of color, the article reported.

Within days, Refinery29’s EIC Christene Barberich also resigned after allegations of racism, bullying and leadership abuses surfaced with hashtag #BlackatR29.

In December 2019, The Verge reported allegations of a toxic work environment at Away under CEO Steph Korey. After a series of updates and corrections in reporting, it seemed she would be stepping away from her role or accelerating an existing plan for a new CEO to take over. But the following month, she returned to the company as co-CEO, sharing the statement: “Frankly, we let some inaccurate reporting influence the timeline of a transition plan that we had.”

Last month, after Korey posted a series of Instagram stories that negatively characterized her media coverage, the company again announced she would step down.

Bon Appétit former editor-in-chief Adam Rapaport resigned his position the same month after news broke that the cooking brand didn’t prioritize representation in its content or hiring, failed to pay women of color equally and freelance writer Tammie Teclemariam shared a 2013 photo of Rappaport in brown face.

In a public apology, staffs of Bon Appétit and Epicurious acknowledged that they had “been complicit with a culture we don’t agree with and are committed to change.”

Removing one problematic employee doesn’t upend company culture or help someone who’s been denied an opportunity. But with so much at stake when it comes to employing Instagram-ready branding, the lane is wide open for companies to meet the moment when it comes to doing the right thing.

A 2017 report by the Ascend Foundation found few Asian, Black and Latinx people were represented in leadership pipelines, and at that point, the numbers were actually getting worse. Seemingly, in an effort for transparency and accountability to do better, 17 tech companies shared diversity statistics and their plans to improve with Business Insider in June 2020. The numbers were staggering, especially for an initiative supposedly prioritized industry-wide in 2014:

Underrepresented minorities like Black and Latinx people still only make up single-digit percentages of the workforce at many major tech companies. When you look at the leadership statistics, the numbers are even bleaker.

While tech’s shortcomings show up clearly in a longstanding lack of diversity, companies in other industries polished their brands sufficiently to skate by — until COVID-19 and the call for racial justice after George Floyd’s murder called for lasting change.

In June, Adidas employees protested outside the company’s U.S. headquarters in Portland, Oregon and shared stories about internal racism. Just a year ago, The New York Times interviewed current and former employees about “the company’s predominantly white leadership struggling with issues of race and discrimination.”

In 2000, an Adidas employee filed a federal discrimination suit alleging that his supervisor called him a “monkey” and described his output as “monkey work.” When spokesperson Kanye West said in 2018 that he believed slavery was a choice, CEO Kasper Rorsted discussed his positive financial impact on the brand and avoided commenting on West’s statement.

In response to the internal turmoil at Adidas, the brand originally pledged to invest $20 million into Black communities in the U.S. over the next four years, increasing it to $120 million and releasing an outline of what they plan to do internally, Footwear News reported.

On June 30, Karen Parkin stepped down from her role as Adidas’ global head of HR in mutual agreement with the brand. In an all-employee meeting in August 2019, she reportedly described concerns about racism as “noise” that only Americans deal with. She’d been with the brand for 23 years.

Routinely protecting employees perceived as racist, misogynistic or abusive is bad for business. According to a 2017 “tech leavers” study conducted by the Kapor Center, employee turnover and its associated costs set the tech industry back $16 billion.

POC experience-centered social and wellness club Ethel’s Club invested into its community’s well-being and has not only managed to stay open (virtually) through the COVID-19 pandemic, it has managed to grow. Meanwhile, The Wing lost 95% of its business.

So, what really happens after the companies are called out? Often, the bare minimum. While the perpetrators of the injustice may endure backlash, abusers in corporate structures are often shifted into other roles.

Tiffany Wines, a former social media and editorial staffer at media/entertainment company Complex, posted an open letter to Twitter on June 19 alleging that Black women at the outlet were mistreated, sharing a story in which she claimed to have ingested marijuana brownies left in an office that was billed as a drug-free environment. Wines said she blacked out and accused superiors of covering up the incident after she reported it.

Her decision to speak up prompted other former employees to share stories alleging misogyny, racism, sexual assault and protection of abusers. One anonymous editor said she was asked if she would be comfortable with a workplace that had a “locker room culture” during a 2010 interview. (She did not end up working there.)

Complex Media Group put out a statement four days later on its corporate Twitter account, which had approximately 100 followers — as opposed to its main account, which has 2.3 million followers.

“We believe Complex Networks is a great place to work, but it is by no means perfect,” read the statement. “It’s our passion for our brands, communities, colleagues, and the belief that a safe and inclusive workplace should be the expectation for everyone.” It went on to state that they’ve taken immediate action, but it’s unclear if anyone has been terminated. [Complex is co-owned by Verizon Media, TechCrunch’s parent company.]

Members of the fashion community have formed multiple groups to combat systemic racism, establish accountability and advance Black people in the industry.

Set to launch in July 2020, The Black In Fashion Council, founded by Teen Vogue editor-in-chief Lindsay Peoples Wagner and fashion publicist Sandrine Charles, works to advance Black individuals in fashion and beauty.

The Kelly Initiative is comprised of 250 Black fashion professionals hoping to blaze equitable inroads, and they’ve publicly addressed the Council of Fashion Designers of America in a letter accusing them of “exploitative cultures of prejudice, tokenism and employment discrimination to thrive.”

Co-founders of True To Size, Jazerai Allen-Lord and Mazin Melegy, an extension of the New York-based branding agency Crush & Lovely, started offering their Check The Fit solutions to the brands they were working with in 2019. The initiative is an audit process created to align in-house teams and ensure sufficient representation is in place for brands’ storytelling.

Check The Fit determines who the consumer is, what the internal team’s history is with that demographic and the message they’re trying to communicate to them, and how the team engage’s with that subject matter in everyday life and in the office. Melegy says, “that look inward is a step that is overlooked almost everywhere.”

“At most companies, we’ve seen a lack of coherence within the organization, because each department’s director is approaching the problem from a siloed perspective. We were able to bring 15 leaders across departments together, distill through a list of concerns, find points of leverage and agree on a common goal. It was noted that it was the first time they were able to feel unified in their mission and felt prepared to move forward,” Lord says of their work with Reebok last year.

Brooklyn-based retailer Aurora James established the 15 Percent Pledge campaign, which urges retailers to have merchandise that reflects today’s demographics: 15% of the population should represent 15% of the shelves.

During the melee that transpired largely on Twitter and Instagram only to attempt to be reconciled in boardrooms, one Condé Nast employee and ally has been suspended. On June 12, Bon Appétit video editor Matt Hunziker tweeted, “Why would we hire someone who’s not racist when we could simply [checks industry handbook] uhh hire a racist and provide them with anti-racism training…” As his colleagues shared an outpouring of support online, a Condé Nast representative said in a statement, “There have been many concerns raised about Matt that the company is obligated to investigate and he has been suspended until we reach a resolution.”

Simply reading through accusers’ first-person accounts, it often seems like these stories end up on public forums because little to nothing is done in favor of the people who step forward. The protection has consistently been of the company.

The Black engineer I spoke to escalated his concerns to his company’s CEO and said the executive was unaware of the allegations and seemed deeply concerned.

Seeing someone who seemed genuinely invested in doing the right thing “obviously, means a lot,” he said.

“But at the same time, I’m still really concerned knowing the broader environment of the company, and it’s never just one person.”

Powered by WPeMatico

Atlassian today announced that it has acquired Mindville, a Jira-centric enterprise asset management firm based in Sweden. Mindville’s more than 1,700 customers include the likes of NASA, Spotify and Samsung.

With this acquisition, Atlassian is getting into a new market, too, by adding asset management tools to its lineup of services. The company’s flagship product is Mindville Insights, which helps IT, HR, sales, legal and facilities to track assets across a company. It’s completely agnostic as to which assets you are tracking, though, given Atlassian’s user base, most companies will likely use it to track IT assets like servers and laptops. But in addition to physical assets, you also can use the service to automatically import cloud-based servers from AWS, Azure and GCP, for example, and the team has built connectors to services like Service Now and Snow Software, too.

“Mindville Insight provides enterprises with full visibility into their assets and services, critical to delivering great customer and employee service experiences. These capabilities are a cornerstone of IT Service Management (ITSM), a market where Atlassian continues to see strong momentum and growth,” Atlassian’s head of tech teams Noah Wasmer writes in today’s announcement.

Co-founded by Tommy Nordahl and Mathias Edblom, Mindville never raised any institutional funding, according to Crunchbase. The two companies also didn’t disclose the acquisition price.

Like some of Atlassian’s other recent acquisitions, including Code Barrel, the company was already an Atlassian partner and successfully selling its service in the Atlassian Marketplace.

“This acquisition builds on Atlassian’s investment in [IT Service Management], including recent acquisitions like Opsgenie for incident management, Automation for Jira for code-free automation, and Halp for conversational ticketing,” Atlassian’s Wasmer writes.

The Mindville team says it will continue to support existing customers and that Atlassian will continue to build on Insight’s tools while it works to integrate them with Jira Service Desk. That integration, Atlassian argues, will give its users more visibility into their assets and allow them to deliver better customer and employee service experiences.

“We’ve watched the Insight product line be used heavily in many industries and for various disciplines, including some we never expected! One of the most popular areas is IT Service Management where Insight plays an important role connecting all relevant asset data to incidents, changes, problems, and requests,” write Mindville’s founders in today’s announcement. “Combining our solutions with the products from Atlassian enables tighter integration for more sophisticated service management, empowered by the underlying asset data.”

Powered by WPeMatico

Point, a new challenger bank in the U.S., is launching publicly today with an invite system. While Point is technically providing a bank account, the company focuses on rewards associated with a debit card.

“I started Point as a solution about everything that is frustrating and complicated about credit cards. The incentives between credit card companies and cardholders are misaligned,” Point co-founder and CEO Patrick Mrozowski told me.

When Mrozowski first got a credit card, he was spending a ton of money to reach a certain level of spending and unlock the sign-up bonus. At the end of the month, he ended up with credit card debt for no valid reason.

“What would American Express look like today?” he says to sum up Point’s vision. It comes down to two important principles — being in charge of your budget so that you don’t end up with debt and unlocking rewards from brands that you actually interact with.

Many challenger banks want to provide a simple banking experience for the underbanked. Point doesn’t have the same positioning. Creating a Point account is more like joining a membership program.

When you sign up, you get a debit card with some level of insurance as it’s a Mastercard World Debit card. You can expect some trip cancellation insurance, rental car insurance, purchase insurance, etc.

As the name of the startup suggests, you earn points with each purchase. You get 5x points on subscriptions, such as Spotify and Netflix, 3x points on food, grocery deliveries and ride sharing, and 1x points on everything else. Points can be redeemed for dollars — each point is worth $0.01. In addition to that, Point is going to create a feed of offers with discounts, content, events and more.

Due to its premium positioning, Point isn’t free. You have to pay $6.99 per month or $60 per year to join Point. Point doesn’t charge any foreign transaction fees.

You can connect your Point account with another bank account using Plaid. It lets you top up your account using ACH transfers. Behind the scenes, Point works with Radius Bank for the banking infrastructure, an FDIC-insured bank.

The company announced earlier this month that it has raised a $10.5 million Series A led by Valar Ventures with Y Combinator, Kindred Ventures, Finventure Studio and business angels also participating.

Image Credits: Point

Powered by WPeMatico

Buildots, a Tel Aviv and London-based startup that is using computer vision to modernize the construction management industry, today announced that it has raised $16 million in total funding. This includes a $3 million seed round that was previously unreported and a $13 million Series A round, both led by TLV Partners. Other investors include Innogy Ventures, Tidhar Construction Group, Ziv Aviram (co-founder of Mobileye & OrCam), Magma Ventures head Zvika Limon, serial entrepreneurs Benny Schnaider and Avigdor Willenz, as well as Tidhar chairman Gil Geva.

The idea behind Buildots is pretty straightforward. The team is using hardhat-mounted 360-degree cameras to allow project managers at construction sites to get an overview of the state of a project and whether it remains on schedule. The company’s software creates a digital twin of the construction site, using the architectural plans and schedule as its basis, and then uses computer vision to compare what the plans say to the reality that its tools are seeing. With this, Buildots can immediately detect when there’s a power outlet missing in a room or whether there’s a sink that still needs to be installed in a kitchen, for example.

“Buildots have been able to solve a challenge that for many seemed unconquerable, delivering huge potential for changing the way we complete our projects,” said Tidhar’s Geva in a statement. “The combination of an ambitious vision, great team and strong execution abilities quickly led us from being a customer to joining as an investor to take part in their journey.”

The company was co-founded in 2018 by Roy Danon, Aviv Leibovici and Yakir Sundry. Like so many Israeli startups, the founders met during their time in the Israeli Defense Forces, where they graduated from the Talpiot unit.

“At some point, like many of our friends, we had the urge to do something together — to build a company, to start something from scratch,” said Danon, the company’s CEO. “For us, we like getting our hands dirty. We saw most of our friends going into the most standard industries like cloud and cyber and storage and things that obviously people like us feel more comfortable in, but for some reason we had like a bug that said, ‘we want to do something that is a bit harder, that has a bigger impact on the world.’ ”

So the team started looking into how it could bring technology to traditional industries like agriculture, finance and medicine, but then settled upon construction thanks to a chance meeting with a construction company. For the first six months, the team mostly did research in both Israel and London to understand where it could provide value.

Danon argues that the construction industry is essentially a manufacturing industry, but with very outdated control and process management systems that still often relies on Excel to track progress.

Construction sites obviously pose their own problems. There’s often no Wi-Fi, for example, so contractors generally still have to upload their videos manually to Buildots’ servers. They are also three dimensional, so the team had to develop systems to understand on what floor a video was taken, for example, and for large indoor spaces, GPS won’t work either.

The teams tells me that before the COVID-19 lockdowns, it was mostly focused on Israel and the U.K., but the pandemic actually accelerated its push into other geographies. It just started work on a large project in Poland and is scheduled to work on another one in Japan next month.

Because the construction industry is very project-driven, sales often start with getting one project manager on board. That project manager also usually owns the budget for the project, so they can often also sign the check, Danon noted. And once that works out, then the general contractor often wants to talk to the company about a larger enterprise deal.

As for the funding, the company’s Series A round came together just before the lockdowns started. The company managed to bring together an interesting mix of investors from both the construction and technology industries.

Now, the plan is to scale the company, which currently has 35 employees, and figure out even more ways to use the data the service collects and make it useful for its users. “We have a long journey to turn all the data we have into supporting all the workflows on a construction site,” said Danon. “There are so many more things to do and so many more roles to support.”

Powered by WPeMatico

After raising $15 million in financing from one of technology’s most successful global investment firms, the Los Angeles-based consumer goods rental company Joymode is selling itself to an early-stage retail investment firm out of New York, XRC Labs.

Joymode’s founder Joe Fernandez will continue on as an advisor to Joymode as the company moves to pivot its business to focus on retail partnerships.

The relationship with XRC Labs’ Pano Anthos began after a small pilot integration between Joymode and Walmart launched in late 2019. “[It] became obvious that we should go all in on retail partnerships,” according to Fernandez. And as the company cast about for partners to pursue the strategy, Anthos and his firm, XRC, kept being mentioned, Fernandez said.

The precise terms of the deal with XRC Labs were undisclosed, but Joymode will become a wholly owned business of XRC and could potentially return to market to raise additional funds from additional investors, according to Fernandez.

“We could never crack growth at the scale we needed,” said Fernandez of the company’s initial business. “From day one, my belief was Joymode was going to be huge or dead. We grew, but given the cost structure of our business it put a lot of pressure on the business to grow exponentially fast. Everyone loved the idea but the actual growth was slower than we needed it to be.”

Though Joymode wasn’t a success, Fernandez said he can’t fault his investors or his team. “We got to iterate through every possible idea we had. Literally every idea we had was exhausted… We failed and that’s a bummer, but we got a fair shot,” he said.

What remains of the company is an inventory management system on the back end and a service that will allow any retailer to get involved in the rental business going forward.

“Part of the thesis was that by making things available for rental, people would want to do more stuff,” said Fernandez, but what happened was that consumers needed additional reasons to use the company’s service, and there weren’t enough events to drive demand.

“I believe that the inventory management system we made was incredible and it will be a standard for retailers doing rentals going forward,” he said.

As the company turned to retailers, the rental option became a way to generate revenue through additional products. “All the accessories that made the event even better,” said Fernandez. “Add-ons, try before you buy, experiential things that are just much more complete in a retail environment.”

At Joymode, the problem was that the company was owning the inventory, which created a high fixed cost. “We never felt confident with the growth in LA to justify the expense of opening in another city,” Fernandez said. “If we had cracked user acquisition in LA we would have rolled it out in a bunch of places.”

Ultimately, Joymode members saved $50 million by using Joymode to rent products rather than buying them. In all, the company acquired 2,000 unique products — from beach and camping equipment to video games, virtual reality headsets to cooking appliances. On a given weekend, roughly 30,000 products would ship from the company’s warehouse to locations across Southern California.

At XRC Labs, a firm launched in 2015 to support the consumer goods and brand space, Joymode will complement an accelerator that raises between $6 million and $9 million every two years and manages a growth fund that could reach $50 million in assets under management.

For Anthos, the best corollary to Joymode’s business could be the rental business at Home Depot. “Home Depot’s rental business is over $1 billion per year,” Anthos said. “There’s going to be this enormous component of our society and for them renting will be not just a more sustainable but reasonable option. They’re going to want to rent because they don’t want to own it.”

Joymode was backed by TenOneTen, Wonder, Struck Ventures, Homebrew and Naspers (now Prosus).

Powered by WPeMatico

From Airbnb to Zapier, and Coinbase to Instacart, many of the tech world’s most valuable companies spent their earliest days in Y Combinator’s accelerator program.

Steering the ship at Y Combinator today is its president, Geoff Ralston . We’re excited to share that Ralston will be joining us on Extra Crunch Live tomorrow at noon pacific.

Extra Crunch Live is our virtual speaker series, with each session packed with insight and guidance from the top investors, leaders and founders. This live Q&A is exclusive to Extra Crunch members, so be sure to sign up for a membership here.

Ralston took on the YC President role a little over a year ago shortly after Sam Altman stepped away to focus on OpenAI.

In the months since, Y Combinator has had to reimagine much about the way it operates; as the pandemic spread around the world, YC (like many organizations) has had to figure out how to work together while far apart. In the earliest weeks of the pandemic, this meant quickly shifting their otherwise in-person demo day online; later, it meant adapting the entire accelerator program to be completely remote.

While still relatively new to the president seat, Ralston is by no means new to YC. He joined the accelerator as a partner in 2012, and his edtech-focused accelerator Imagine K12 was fully merged into YC’s operations in 2016.

Powered by WPeMatico

As offices worldwide shift to remote work, our interactions with customers and colleagues have evolved in tandem. Professionals who once relied on face-to-face communication and firm handshakes must now close deals in a world where both are rare. Coworkers we once sat beside every day are now only available over Slack and Zoom, changing the nature of internal communication as well.

While this new reality presents a challenge, the advancement of key technologies allows us to not just adapt, but thrive. We are now on the precipice of the biggest revolution in workplace communication since the invention of the telephone.

It’s not enough to simply accept the new status quo, particularly as the overall economic climate remains tenuous. Artificial intelligence has much to offer in improving the way we speak to one another in the social distance era, and has already seen wide adoption in certain areas. Much of this algorithmic work has gone on behind the scenes of our most-used apps, such as Google Meet’s noise-canceling technology, which uses an AI to mute certain extraneous sounds on video calls. Other advances work in real-time right before our eyes — like Zoom’s myriad virtual backgrounds, or the automatic transcription and translation technology built into most video conferencing apps.

This kind of technology has helped employees realize that, despite the unprecedented shift to remote work, digital conversations do not just strive to recreate the in-person experience — rather, they can improve upon the way we communicate entirely.

It’s estimated that 65% of the workforce will be working remotely within the next five years. With a more hands-on approach to AI — that is, using the technology to actually augment everyday communications — workers can gain insight into concepts, workflows and ideas that would otherwise go unnoticed.

Roughly 55% of the data companies collect falls into the category of “dark data”: information that goes completely unused, kept on an internal server until it’s eventually wiped. Any company with a customer service department is invariably growing their stock of dark data with every chat log, email exchange and recorded call.

When a customer phones in with a query or complaint, they’re told early on that their call “may be recorded for quality assurance purposes.” Given how cheap data storage has become, there’s no “maybe” about it. The question is what to do with this data.

Powered by WPeMatico

The fortunes of startups that leverage artificial intelligence have soared dramatically in recent years.

These AI-powered startups have seen quarterly investment totals rise from a few hundred rounds and a few billion dollars each quarter to 1,245 rounds and $17.3 billion in the second and third quarters of 2019, according to data from CB Insights. The rise in dollars chasing AI startups has been huge, demonstrating strong venture capital interest in the cohort.

But in recent quarters, the trend has slowed as VC deals for AI-powered startups fell off.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

A new report from the business-data company looking at the second quarter of venture capital results for global AI startups shows historically strong but declining investing rates for the upstart firms. During a pandemic and widespread recession, this is not a complete surprise; other areas of VC investment have also fallen in recent quarters. This is The Exchange’s second look at quarterly data in the startup category, something partially spurred by our interest in the economics of the startups that make up the group.

The scale of decline is notable, however, as is the national breakdown of VC investment into AI. (The United States is doing better than you probably guessed, if you have only listened to politicians lately.)

The scale of decline is notable, however, as is the national breakdown of VC investment into AI. (The United States is doing better than you probably guessed, if you have only listened to politicians lately.)

Let’s unpack the latest results, determine how investing patterns have changed by stage and examine how different countries compare when it comes to deal and dollar volume for AI-powered startups.

In the second quarter of 2020, global investment into AI startups fell to 458 deals worth $7.2 billion. According to the CB Insights dataset, the deal volume is the lowest for 12 quarters, or since Q2 2017 when 387 investments into AI startups were worth $4.7 billion.

Powered by WPeMatico

2020 has been all but normal. For businesses and brands. For innovation. For people.

The trajectory of business growth strategies, travel plans and lives have been drastically altered due to the COVID-19 pandemic, a global economic downturn with supply chain and market issues, and a fight for equality in the Black Lives Matter movement — amongst all that complicated lives and businesses already.

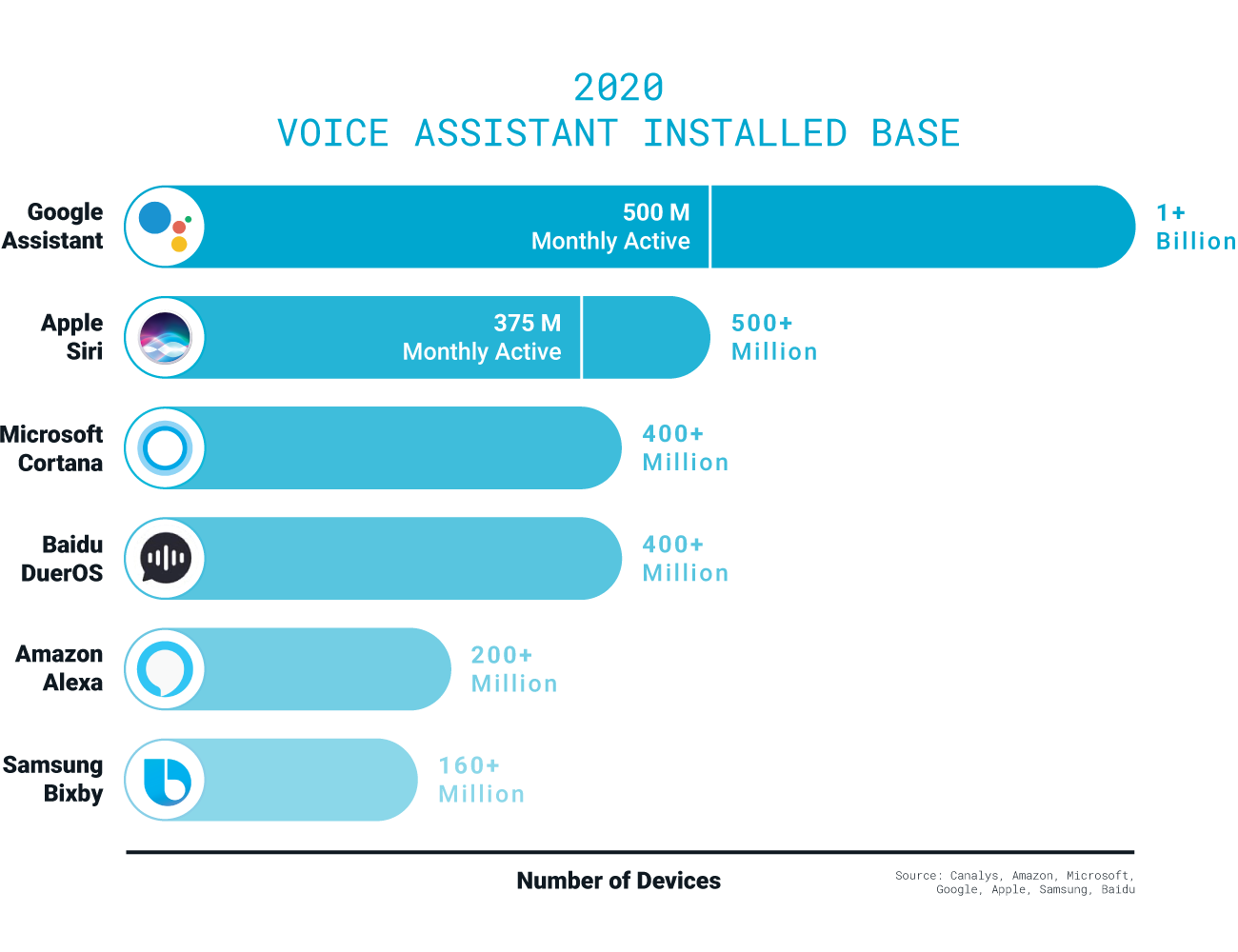

One of the biggest stories in emerging technology is the growth of different types of voice assistants:

With so many assistants proliferating globally, voice will become a commodity like a website or an app. And that’s not a bad thing — at least in the name of progress. It will soon (read: over the next couple years) become table stakes for a business to have voice as an interaction channel for a lovable experience that users expect. Consider that feeling you get when you realize a business doesn’t have a website: It makes you question its validity and reputation for quality. Voice isn’t quite there yet, but it’s moving in that direction.

Adoption of any new technology is key. A key inhibitor of technology is often distribution, but this has not been the case with voice. Apple, Google, and Baidu have reported hundreds of millions of devices using voice, and Amazon has 200 million users. Amazon has a slightly more difficult job since they’re not in the smartphone market, which allows for greater voice assistant distribution for Apple and Google.

Image Credits: Mark Persaud

But are people using devices? Google said recently there are 500 million monthly active users of Google Assistant. Not far behind are active Apple users with 375 million. Large numbers of people are using voice assistants, not just owning them. That’s a sign of technology gaining momentum — the technology is at a price point and within digital and personal ecosystems that make it right for user adoption. The pandemic has only exacerbated the use as Edison reported between March and April — a peak time for sheltering in place across the U.S.

Powered by WPeMatico

Financial services companies like banks and insurance tend to be heavily regulated. As such, they require a special level of security and auditability. Hearsay, which makes compliant communications tools for these types of companies, announced a new partnership with Salesforce today, enabling smooth integration with Salesforce CRM and marketing automation tools.

The company also announced that Salesforce would be taking a minority stake in Hearsay, although company co-founder and CEO Clara Shih, did not provide any details on that part of the announcement.

Shih says the company created the social selling category when it launched 10 years ago. Today, it provides a set of tools like email, messaging and websites along with a governance layer to help financial services companies interact with customers in a compliant way. Their customers are primarily in banking, insurance, wealth management and mortgages.

She said that they realized if they could find a way to share the data they were collecting with the Hearsay tool set with CRM and marketing automation software in an automated way, it would make greater use of this information than it could on its own. To that end, they have created a set of APIs to enable that with some built-in connectors. The first one will be to connect Hearsay to Salesforce, with plans to add other vendors in the future.

“It’s about being able to connect [data from Hearsay] with the CRM system of record, and then analyzing it across thousands, if not tens of thousands of advisors or bankers in a single company, to uncover best practices. You could then use that information like GPS driving directions that help every advisor behave in the moment and reach out in the moment like the very best advisor would,” Shih explained.

In practice, this means sharing the information with the customer data platform (CDP), the CRM and marketing automation tooling to deliver more intelligent targeting based on a richer body of information. So the advisor can use information gleaned from everything he or she knows about the client across the set of tools to deliver a more meaningful personal message instead of a targeted ad or an email blast. As Shih points out, the ad might even make sense, but could be tone deaf depending on the circumstances.

“What we focus on is this human-client experience, and that can only be delivered in the last mile because it’s only with the advisor that many clients will confide in these very important life events and life decisions, and then conversely, it’s only in the last mile that the trusted advisor can deliver relationship advice,” she said.

She says what they are trying to do by combining streams of data about the customer is build loyalty in a way that pure technology solutions just aren’t capable of doing. As she says, nobody says they are switching banks because it has the best chat bot.

Hearsay was founded in 2009 and has raised $51 million, as well as whatever other money Salesforce will be adding to the mix with today’s investment. Other investors include Sequoia and NEA Associates. Its last raise was way back in 2013, a $30 million Series C.

Powered by WPeMatico