Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Today Intercom announced that it has hired a chief financial officer (CFO) as it ramps toward an IPO. The unicorn also promoted its COO to the CEO role earlier this year.

The company’s recent CEO, Karen Peacock, told TechCrunch that her new CFO Dan Griggs was a strong candidate thanks to his experience helping take Rocket Fuel public, and for helping execute a “whole business transformation” at Sitecore, where he worked immediately before coming to Intercom.

Intercom is a software startup that sells customer-chat software that works with support and marketing teams. Different tiers of its service allow for automated “conversational” campaigns, and custom bots. The company has raised a hair over $240 million, according to PitchBook data.

Griggs told TechCrunch that he was not in the market for a new role, but conversations with Peacock drew him in.

Peacock took over the CEO role after around three years as the company’s COO, during which time it became known that the preceding CEO had made “unwanted advances” on employees. Intercom also underwent layoffs before Peacock took over the helm. According to reporting, the firm cut around 6% of its staff in May, a time when many tech companies were trimming personnel due to market uncertainties surrounding COVID-19 and its economic disruptions. (Update: Following publication, Intercom stressed that co-founder Eoghan McCabe earned support from its board after an investigation into the allegations in 2019. During a call, the company also emphasized that an external party had executed the investigation.)

Now Intercom has a refreshed C-suite, and is at IPO scale.

According to TechCrunch reporting at the time Peacock took over as CEO, Intercom had around $150 million in annual recurring revenue (ARR). The company clarified to TechCrunch that the ARR milestone was reached at the end of its last fiscal year, or the conclusion of January of 2020.

Dan Griggs, via the company.

Intercom, Griggs said, is near profitability and is growing in the “strong” double digits. We read that as meaning between 50% and 99% growth, implying the company could close its current fiscal year (January 2021) with $225 million to $298.5 million in ARR, with a bias — thanks to the laws of large numbers — toward the smaller figure.

With a CFO with IPO experience on hand, a new CEO, a material revenue base and good growth, when is the IPO? Not soon, sadly. The CFO said his company doesn’t need to raise new capital, and that it has enough liquidity today to invest. That’s financial-speak for “no rush.”

The CEO is on the same page, saying during the same call that Intercom is not in a hurry to go public, and wants to build out some internal infrastructure before executing the transaction. There won’t be an IPO for at least 12 months, she estimated.1 (Update: Intercom reached out after publication to clarify that the timeline discussed in our call was imprecise. The IPO is at least two years away.)

Intercom hit some market chop in 2020 and had to spend parts of the last year or so cleaning up internal issues. Now, in theory, it has sorted house, and is operating in a market that has greatly rewarded software startups in recent quarters, especially those helping other companies operate digitally.

Let’s see how fast Intercom can grow. We’ll get the full retrospective with its eventual S-1.

Powered by WPeMatico

“Marketing cloud” has become an increasingly popular concept in the world of marketing technology — used by the likes of Salesforce, Adobe, Oracle and others to describe their digital tool sets for organizations to identify and connect with customers. Now, a startup that is building its own take on the idea aimed specifically at e-commerce companies is announcing some funding after seeing a surge of business in the last few months.

Yotpo, which provides a suite of tool to help direct-to-consumer and other e-commerce players build better relationships with customers, is today announcing that it has raised $75 million in funding, money it will use to continue growing its suite of products, as well as to acquire more customers and build out more integration partnerships.

The Series E included a number of Yotpo’s existing investors, namely Bessemer Venture Partners, Access industries (the owner of Warner Music Group, among a number of other holdings) and Vertex Ventures (a subsidiary of Temasek), new investor Hanaco (which focuses on Israeli startups — Yotpo is co-headquartered in Tel Aviv and New York) and other unnamed investors.

It brings the total raised by the startup to $176 million, and while it’s not disclosing valuation, its CEO Tomer Tagrin — who co-founded the company with COO Omri Cohen — describes it as “nearly a unicorn.”

“I like to call what we’re building a flamingo, which is also a rare and beautiful animal but also a real thing, and we are a proper business,” he said in an interview, adding that Yotpo is on target for ARR next year to be $100 million.

The company had its start as an app in Shopify’s App Store, providing tools to Shopify customers to help with customer engagement by way of user-generated content, and while it has outgrown that single relationship — it now has some 500 additional strategic partners, including Salesforce, Adobe, BigCommerce and others — Yotpo’s CEO still likes to describe his company in Shopify-ish terms.

“Just as Shopify manages your business, we manage your customers end to end,” Tagrin said. He said that while it’s great to see the bigger trend of consolidation around marketing clouds, it’s not a one-size-fits-all problem. He believes Yotpo’s e-commerce-specific approach to that stands apart from the pack because it addresses issues unique to D2C and other e-commerce companies.

Yotpo’s services today include SMS and visual marketing, loyalty and referral services and reviews and ratings, which are used by a range of e-commerce companies, spanning from newer direct-to-consumer brands like Third Love and Away, to more established names like Patagonia and 1-800-Flowers. Some of these have been built in-house, and some by way of acquisition — most recently, SMSBump, in January. The plan is to use some of the funding to continue that acquisition strategy.

“Since our first investment more than three years ago, Tomer and Omri have executed flawlessly, expanding the product suite, serving a wider range of customers, and continually hiring strong talent across the organization,” says Adam Fisher, a partner at BVP, in a statement. “Yotpo is singularly focused on helping direct-to-consumer eCommerce brands solve the dual challenge of engaging consumers and increasing revenue, and with their multi-product strategy and innovative edge, they are uniquely positioned to dominate the eCommerce industry for years to come.”

Yotpo is built as a freemium platform, with some 9,000 customers paying for services, and a further 280,000 customers on its free-usage tier. Customer count grew by 250% in the last year, Tagrin said.

The COVID-19 pandemic has had a well-documented impact on internet use, and specifically e-commerce, as people turned to digital channels in record numbers to procure things while complying with shelter-in-place orders, or trying to increase social distancing to slow down the spread of the coronavirus.

E-commerce has been on the rise for years, but the acceleration of that trend has been drastic since February, with revenue and spend both regularly exceeding baseline figures over the last several months, according to research from digital marketing agency Common Thread Collective.

That, in turn, had a big impact on companies that help enable those e-commerce enterprises operate in more direct and personable ways. Yotpo was a direct beneficiary: It said it had a surge of sign-ups of new customers, many taking paid services, working out to a 170% year-on-year ARR and lower customer churn.

The bigger picture, of course, is not completely rosy, with thousands of layoffs across the whole tech service, and a huge number of brick-and-mortar business closures. Those economic indicators could ultimately also have a knock-on effect not just in more business moving online, but also a slowdown in spending overall.

That will inevitably have an impact on startups like Yotpo, too, which is definitely on a rise now but will continue to think longer term about the impact and how it can continue to diversify its products to meet a wider set of customer use cases.

For example, today, the company addresses customer care needs by way of integrations with companies like Zendesk, but longer term it might consider how it can bring in services like this to continue to build out the touchpoints between D2C brands and their customers, and specifically running those through a bigger picture of the customer as profiled on Yotpo’s platform.

This is a big part of our product in our meetings and debates,” Tagrin said about product expansions.

“I do think any celebration of growth and funding comes to me with something else: we need to be internalising more what is going on,” he said. “The world is not back to normal and we shouldn’t act like it is.”

Powered by WPeMatico

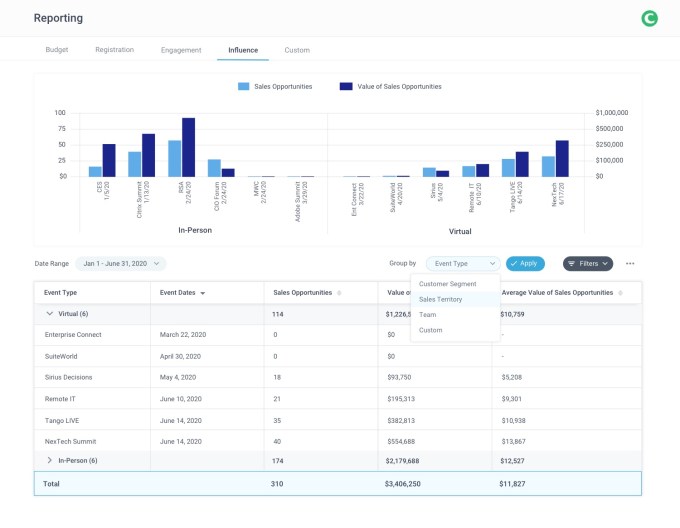

EventGeek was a Y Combinator-backed startup that offered tools to help large enterprises manage the logistics of their events. So with the COVID-19 pandemic essentially eliminating large-scale conferences, at least in-person, it’s not exactly surprising that the company had to reinvent itself.

Today, EventGeek relaunched as Circa, with a new focus on virtual events. Founder and CEO Alex Patriquin said that Circa is reusing some pieces of EventGeek’s existing technology, but he estimated that 80% of the platform is new.

While the relaunch only just became official, the startup says its software has already been used to adapt 40,000 in-person events into virtual conferences and webinars.

The immediate challenge, Patriquin said, is simply figuring out how to throw a virtual event — something for which Circa offers a playbook. But the startup’s goals go beyond virtual event logistics.

“Our new focus is really more at the senior marketing stakeholder level, helping them have a unified view of the customer,” Patriquin said.

He explained that “events have always been kind of disconnected from the marketing stack,” so the shift to virtual presents an opportunity to treat event participation as part of the larger customer journey, and to include events in the broader customer record. To that end, Circa integrates with sales and marketing systems like Salesforce and Marketo, as well as with video conferencing platforms like Zoom and On24.

Image Credits: Circa

“We don’t actually deliver [the conference] experience,” Patriquin said. “We put it into that context of the customer journey.”

Liz Kokoska, senior director of demand generation for North America at Circa customer Okta, made a similar point.

“Prior to Circa, we had to manage our physical and virtual events in separate systems, even though we thought of them as parts of the same marketing channel,” Kokoska said in a statement. “With Circa, we now have a single view of all our events in one place — this is helpful in planning and company-wide visibility on marketing activity. Being able to seamlessly adapt to the new world of virtual and hybrid events has given our team a significant advantage.”

And as Patriquin looks ahead to a world where large conferences are possible again, he predicted that there’s still “a really big opportunity for the events industry and for Circa.”

“As in-person events start to come back, there’s going to be a phase where health and safety are going to be paramount,” he continued. “After that health and safety phase, it’s going to be the age of hybrid events — where everything is virtual right now, hybrid will provide the opportunity to bring key [virtual] learnings back into the in-person world, to have a lot more data and intelligence and really be able to personalize an attendee’s experience.”

Powered by WPeMatico

The TechCrunch Exchange newsletter just launched. Soon only a partial version will hit the site, so sign up to get the full download.

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter for your weekend enjoyment. It’s broadly based on the daily column that appears on Extra Crunch, but free. And it’s made just for you.

You can sign up for the newsletter here. With that out of the way, let’s talk money, upstart companies and the latest spicy IPO rumors.

If you are tired of reading about special purpose acquisition companies, or SPACs, we hear you. We’re sick of them as well. But they keep cropping up, this time in the form of a possible IPO alternative for Affirm, a fintech unicorn that has raised more than $1 billion to provide consumers with point-of-sale installment loans. (Rates from 0% to 30%, terms of up to 36 months.)

Affirm is effectively a lending company that plugs into e-commerce firms. Researching this entry I had an idea in the back of my head that Affirm had a super-neat credit system to rate users. But reading through its own FAQ and what NerdWallet has to say on the company, its methods seem somewhat pedestrian.

Regardless, distribution is key for the company, and Affirm recently linked up with Shopify. That should provide it another dose of growth. The very sort of thing that IPO investors want. The WSJ reported that Affirm could go public this year, perhaps via a SPAC, at a valuation of $5 to $10 billion.

I did my best to map out what those valuations implied, generally finding that Affirm needs to have hella loan volume to make the sort of money that a $10 billion figure implies. Of course, I was trying to make numerical sense. The stock market in 2020 is a bit more relaxed than that.

All this SPAC talk is still mostly bullshit, mind. We are seeing public debuts this year. And every single one of them that has been of note has been a traditional IPO, at least as far as I can recall. The running history of direct listings and SPAC debuts that matter is pretty slim.

Of course, Coinbase and Asana and DoorDash and Airbnb, among others, are in need of liquidity and could yet pull the trigger on a more exotic debut. Hell, Qualtrics could do something wild in its impending IPO but we doubt it will.

The biggest market news this week had little to do with startups. Instead, it came from the anti-startups, namely the largest American tech companies, which smashed their earnings reports. Alphabet actually shrank year-over-year, but it still beat expectations. Facebook and Amazon and Apple were juggernauts in the quarter.

The startups that aren’t are DOA. As Freestyle Capital’s Jenny Lefcourt told TechCrunch the other week, every investor wants into the next round of startups that have caught a COVID tailwind. And precisely zero investors want into the proximate funding event for startups that haven’t.

Moving along, don’t re-invest your retirement funds just yet, but bitcoin is back over $10,000 and is currently trading for $11,300 as I write to you. Given that the price of bitcoin is a workable barometer for consumer interest, trading volume and, perhaps, development work in the crypto space, the recent market movement is good news for crypto-fans.

Turning our heads to breaking news this Friday, news was brewing that the Trump administration was looking to force ByteDance, a Chine-based mega-startup, to sell the U.S. operations of TikTok, the super-popular social app.

There were 25 equity-only rounds of $50 million or more in the last week, 22 if you strip out private equity-led rounds and post-IPO investments. That’s a little over $2.6 billion in late-stage capital collected by Crunchbase in a single week. No matter what you might hear from startups stuck on the wrong side of the COVID-19 divide, money is still flowing and quickly.

Stack Overflow’s $85 million round was the tenth largest deal of the week. Damn.

Other rounds you may have missed: $33 million for San Mateo-based Helix, Argo AI is now worth $7.5 billion after its most recent fundraising, $11 million for Brazil-focused wealth manager Magnetis, $16 million for construction-tech company Buildots and $20 million for Instrumental, my favorite round of the week,

Investment into AI-focused startups suffered in Q2, but descended from all-time highs so the numbers were still pretty ok.

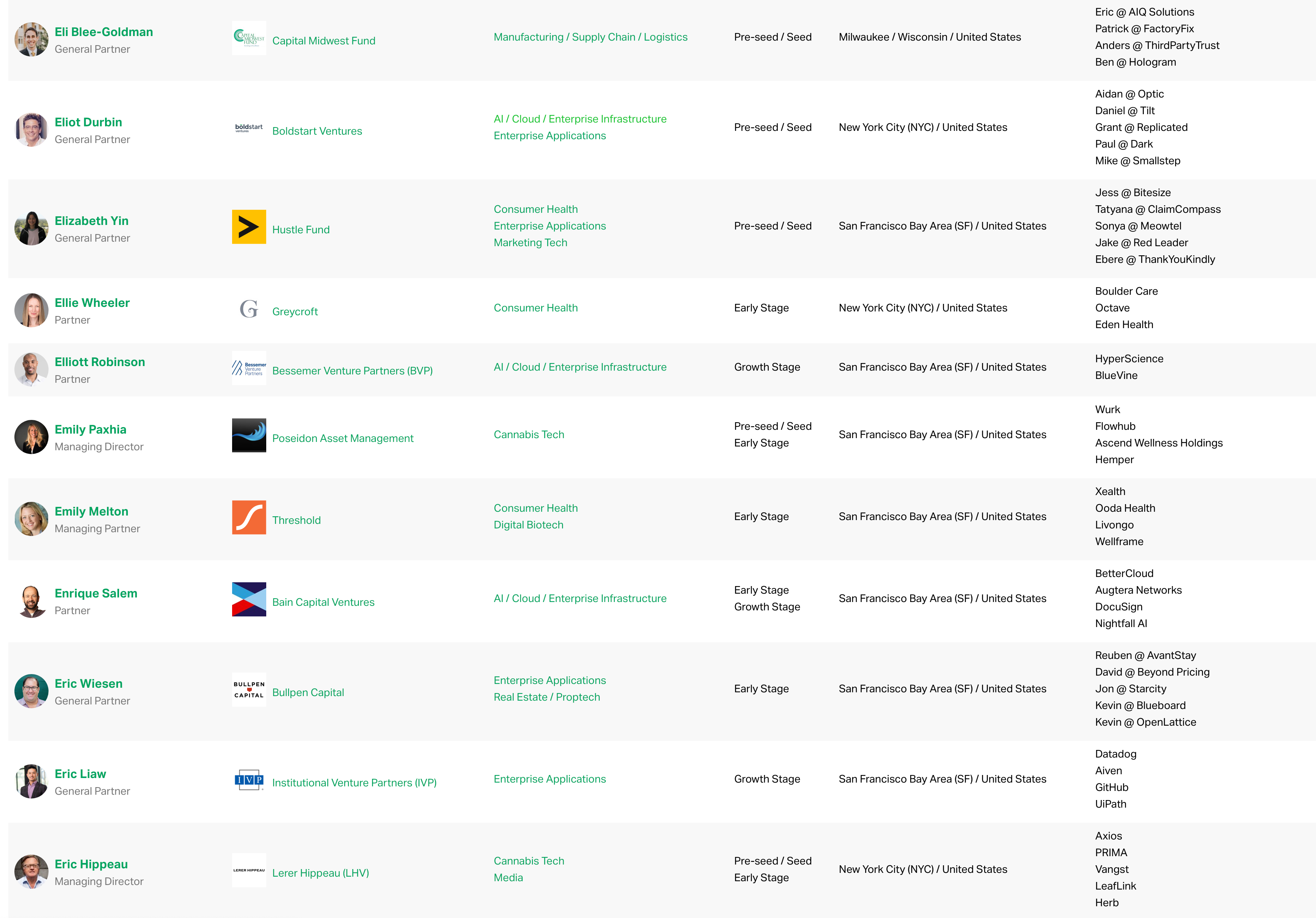

On the VC topic, TechCrunch’s own Danny Crichton (he’s on the podcast with me every week) has updated the TechCrunch list with another 116 VCs that are willing to write first checks. The project has been oceans of work, so please do check it out if you have the time, or are looking to fundraise.

And, to wrap up, as always, here’s a collection of data, news and other miscellania that is worth your time from this super insane week:

Moving toward the close, Redpoint VP Jamin Ball is writing a series on cloud/SaaS that I’m reading here and there. Take a peek.

And, speaking of VCs out there doing my job, Floodgate partner Iris Choi (an Equity regular) does frequent live streams that she calls Market Musings that I try to snag when I can. It’s always interesting to hear how people with more money than I do think about the market as they are ever-so-slightly more invested in its outcomes.

Excuse the pun, give yourself a hug for making it through the week, make sure to hit up the latest Equity episode and let’s all go for a run. — Alex

Powered by WPeMatico

Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7am PT). Subscribe here.

German software giant SAP bought experience management platform Qualtrics for $8 billion days before the unicorn’s IPO, back in November of 2018. But last weekend it decided to spin out the experience management provider to finally go public on its own. The analysts Ron Miller talked to speculated about strategic issues on the SAP side, and concluded this was more of an internal reset combined with the financial gain from a promising offering.

Qualtrics, meanwhile, already put the Utah startup scene on the map for people around the world. Having grown strongly post-acquisition, it is now set up to be the largest IPO in state history. Here’s Alex Wilhelm with more analysis in Extra Crunch:

According to metrics from the Bessemer Cloud Index, cloud companies with growth rates of 35.5% and gross margins of 71.3% are worth around 17.3x in enterprise value compared to their annualized revenue.

Given how close Qualtrics is to that averaged set of metrics (slightly slower growth, slightly better gross margins), the 17.3x number is probably not far from what the company can achieve when it does go public. Doing the sums, $800 million times 17.3 is $13.8 billion, far more than what SAP paid for Qualtrics. (For you wonks out there, it’s doubtful that Qualtrics has much debt, though it will have lots of cash post-IPO; expect the company’s enterprise value to be a little under its future market cap.)

So, the markets are valuing cloud companies so highly today that even after SAP had to pay a huge premium to buy Qualtrics ahead of its public offering, the company is still sharply more valuable today after just two years of growth.

The tech industry is getting broken down and reformed by national governments in ways that many of its leaders do not seem to have planned for as part of scaling to the world, whether you consider TikTok’s ever-shrinking global footprint or leading tech CEOs getting called out by Congress. When you skim through the numerous headlines on these topics this week, you’ll see a very clear message in the subtext: Every startup has to think more carefully about its place in the world these days, as a matter of survival.

Big tech crushes Q2 earnings expectations

Lawmakers argue that big tech stands to benefit from the pandemic and must be regulated

Secret documents from US antitrust probe reveal big tech’s plot to control or crush the competition

Apple’s App Store commission structure called into question in antitrust hearing

Zuckerberg unconvincingly feigns ignorance of data-sucking VPN scandal

In antitrust hearing, Zuckerberg admits Facebook has copied its competition

Before buying Instagram, Zuckerberg warned employees of ‘battle’ to ‘dislodge’ competitor

Google’s Sundar Pichai grilled over ‘destroying anonymity on the internet’

Bezos ‘can’t guarantee’ no anti-competitive activity as Congress catches him flat-footed

Amazon’s hardware business doesn’t escape Congressional scrutiny

Time for TikTok:

India bans 47 apps cloning restricted Chinese services

After India and US, Japan looks to ban TikTok and other Chinese apps

Report: Microsoft in talks to buy TikTok’s US business from China’s ByteDance

The leading arguments for a Microsoft-TikTok tie-up 😉

And last but not least ominously, for large platforms…

Australia now has a template for forcing Facebook and Google to pay for news

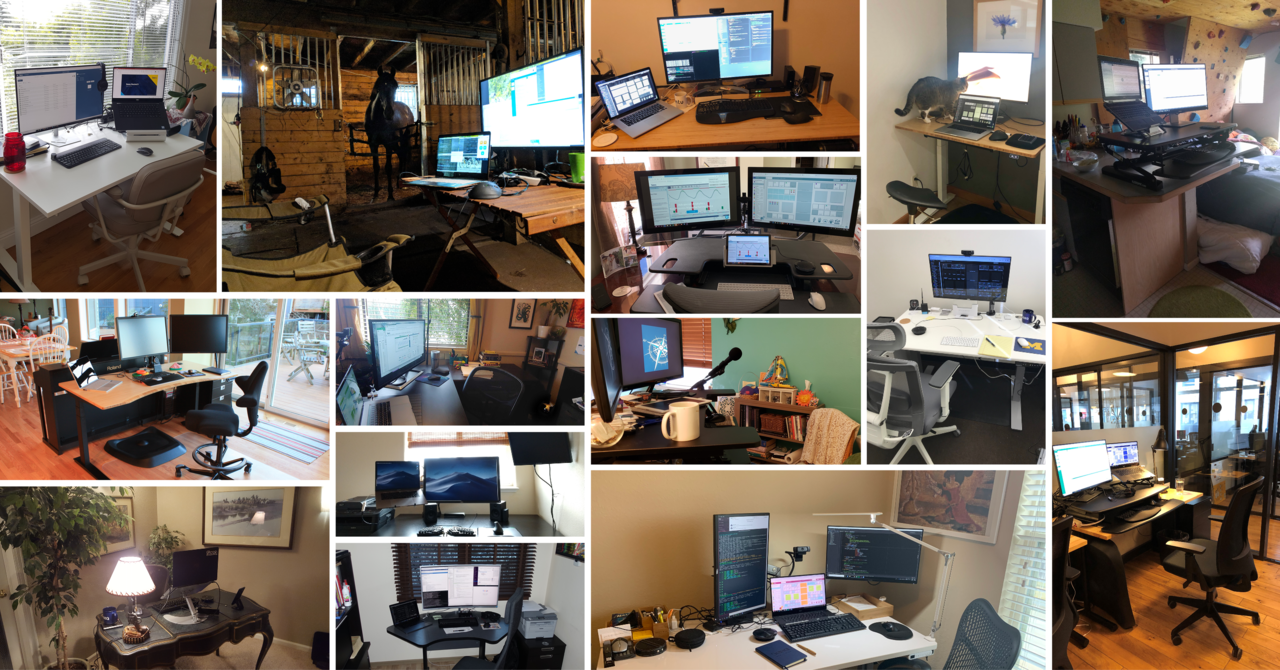

The team at remote-first enterprise startup Seeq put together this montage of some of its remote offices.

This loosely defined subsector of SaaS went from being a somewhat mainstream idea within the startup world last year to being fully mainstream with the wider world due to the pandemic this year. But publicly traded companies have been some of the biggest beneficiaries (see previous item), and the action around earlier-stage startups has been less clear. Lucas Matney and Alex caught up with six investors who have been focused on various parts of the space to get the latest for Extra Crunch. Here’s a pithy description of fundraising trends that companies are experiencing, from Elliott Robinson, a growth-stage investor at Bessemer:

How competitive are remote-work tooling venture rounds now?

Incredibly competitive. I think one dynamic I’ve seen play out is that the basket of remote-work companies that are really high-performing right now are setting lofty price expectations well ahead of the raise. Many of these companies didn’t plan on raising in Q2/Q3, but with COVID tailwinds, they are choosing to raise at some often sight-unseen-level valuation multiples.

Are prices out of control?

I think it depends on your definition of out of control. The reality is that many of these companies are raising money off cycle from their natural fundraising date for two reasons: One, they are seeing once in a lifetime digital transformation and adoption of remote-work tooling solutions. And, two, so many investors have raised sizable funds during the last nine months that they are leaning into investing in these companies — one of the few segments that will likely continue to see tailwinds as COVID cases continue to rise again in the U.S. Other traditional software value props may face significant headwinds in a uncertain COVID world. Thus, growth equity investors are paying high multiples to get a shot at the category-defining RW app companies.

Haptics are a great sort of gee-whiz technology, but the practical future of touch-based communication is all over the place — VR devices are suddenly more interesting, touchpads less so. Devon Powers and David Parisi are academics and authors who focus on the space, and they wrote a big guest post for TechCrunch this week that sketched out some of the ups and downs of the decades-old concept. Here’s a key excerpt:

Getting haptics right remains challenging despite more than 30 years’ worth of dedicated research in the field. There is no evidence that COVID is accelerating the development of projects already in the pipeline. The fantasy of virtual touch remains seductive, but striking the golden mean between fidelity, ergonomics and cost will continue to be a challenge that can only be met through a protracted process of marketplace trial-and-error. And while haptics retains immense potential, it isn’t a magic bullet for mending the psychological effects of physical distancing.

Curiously, one promising exception is in the replacement of touchscreens using a combination of hand-tracking and midair haptic holograms, which function as button replacements. This product from Bristol-based company Ultraleap uses an array of speakers to project tangible soundwaves into the air, which provide resistance when pressed on, effectively replicating the feeling of clicking a button.

Ultraleap recently announced that it would partner with the cinema advertising company CEN to equip lobby advertising displays found in movie theaters around the U.S. with touchless haptics aimed at allowing interaction with the screen without the risks of touching one. These displays, according to Ultraleap, “will limit the spread of germs and provide safe and natural interaction with content.”

A recent study carried out by the company found that more than 80% of respondents expressed concerns over touchscreen hygiene, prompting Ultraleap to speculate that we are reaching “the end of the [public] touchscreen era.” Rather than initiate a technological change, the pandemic has provided an opportunity to push ahead on the deployment of existing technology. Touchscreens are no longer sites of naturalistic, creative interaction, but are now spaces of contagion to be avoided. Ultraleap’s version of the future would have us touching air instead of contaminated glass.

Speaking of investors, TechCrunch has been busy with a few other projects to you find the right ones faster.

First, Danny Crichton has pushed a third update to The TechCrunch List, due to the ongoing flood of recommendations. In his words: “Now using more than 2,600 founder recommendations — more than double our original dataset — we have underscored a number of the existing investors on our list as well as added 116 new investors who have been endorsed by founders as investors willing to cut against the grain and write those critical first checks and lead venture rounds.”

Check it out and filter by location, category and stage to narrow down your pitch list. If you are a founder and haven’t submitted your recommendation yet, please fill out our very brief survey. If you have questions, we put together a Frequently Asked Questions page that describes the qualifications and logistics, some of the logic behind the List and how to get in touch with us.

Second, our editor-at-large Mike Butcher is embarking on a virtual investor survey of European countries, to help Extra Crunch provide a clearer view about what’s happening in the Continent’s startup hubs in the middle of the world going crazy:

TechCrunch is embarking on a major new project to survey the venture capital investors of Europe. Over the next few weeks, we will be “zeroing-in” on Europe’s major cities, from A-Z, Amsterdam to Zurich — and many points in-between. It’s part of a broader series of surveys we’re doing to help founders find the right investors. For example, here is the recent survey of London.

Our survey will capture how each European startup hub is faring, and what changes are being wrought amongst investors by the coronavirus pandemic. We’d like to know how your city’s startup scene is evolving, how the tech sector is being impacted by COVID-19 and, generally, how your thinking will evolve from here. Our survey will only be about investors, and only the contributions of VC investors will be included. The shortlist of questions will require only brief responses, but the more you want to add, the better.

The deadline for entries is the end of next week, August 7th and you can fill it out here.

He also wanted me to let you know that he’ll resume his in-person trips as soon as allowed. (I actually made that up, but he has said as much.)

Submit your pitch deck to Disrupt 2020’s Pitch Deck Teardown

Announcing the Disrupt 2020 agenda

Talking virtual events and Disrupt with Hopin founder Johnny Boufarhat

The TechCrunch Exchange: What’s an IPO to a SPAC?— In case you haven’t checked out Alex’s new weekly email newsletter yet.

TechCrunch

Connected audio was a bad choice

Stanford students are short-circuiting VC firms by investing in their peers

Bitcoin bulls are running, as prices spike above $11K

Recruiting for diversity in VC

Build products that improve the lives of inmates

Extra Crunch

Six things venture capitalists are looking for in your pitch

VCs and startups consider HaaS model for consumer devices

Cannabis VC Karan Wadhera on why the industry, which took a hit last year, is now quietly blazing

Jesus, SaaS and digital tithing

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

We had the full team this week: Myself, Danny and Natasha on the mics, with Chris running skipper as always.

Sadly this week we had to kick off with a correction as I am 1) dumb, and, 2) see point one. But after we got past SPAC nuances (shout-out to David Ethridge), we had a full show of good stuff, including:

And that’s Equity for this week. We are back Monday morning early, so make sure you are keeping tabs on our socials. Hugs, talk soon!

Equity drops every Monday at 7:00 a.m. PT and Friday at 6:00 a.m. PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Even the hard-charging world of early-stage startups has its share of procrastinators, lollygaggers, slow-pokes, wafflers and last-minute decision makers. If that’s your demographic, today is your lucky day.

You now have an extra week (courtesy of Saint Expeditus, the patron saint of procrastinators), to score early-bird savings to Disrupt 2020, which takes place September 14-18. Buy your pass before the new and final deadline — August 7 at 11:59 p.m. (PT) — and save up to $300. Who says prayers (or secular entreaties) go unanswered?

Your pass opens the door to five days of Disrupt — the biggest, longest TechCrunch conference ever. Drawing thousands of attendees and hundreds of innovative early-stage startups from around the world, you won’t find a better time, place or opportunity to accelerate the speed of your business.

Here are four world-class reasons to attend Disrupt 2020.

World-class speakers. Hear and engage with leading voices in tech, business and investment across the Disrupt stages. Folks like Sequoia Capital’s Roelof Botha, Ureeka’s Melissa Bradley and Slack’s Tamar Yehoshua — to name just a few. Here’s what you can see onstage so far.

World-class startups. Explore hundreds of innovative startups exhibiting in Digital Startup Alley — including the TC Top Picks. This elite cadre made it through our stringent screening process to earn the coveted designation, and you’ll be hard-pressed to find a more varied and interesting set of startups.

World-class networking. CrunchMatch, our AI-powered networking platform, simplifies connecting with founders, potential customers, R&D teams, engineers or investors. Schedule 1:1 video meetings and hold recruitment or extended pitch sessions. CrunchMatch launches weeks before Disrupt to give you more time to scout, vet and schedule.

World-class pitching. Don’t miss Startup Battlefield, the always-epic pitch competition that’s launched more than 900 startups, including big-time names like TripIt, Mint, Dropbox and many others. This year’s crop of startups promises to throw down hard for bragging rights and the $100,000 cash prize.

Need another reason to go? Take a page out of SIMBA Chain founder Joel Neidig’s playbook:

Our primary goal was to make people aware of the SIMBA Chain platform capabilities. Attending Disrupt is great way to get your name out there and build your customer base.

It’s time for all you last-minute lollygaggers to get moving and take advantage of this second, final chance to save up to $300. Buy your pass before August 7 at 11:59 p.m. (PT).

Is your company interested in sponsoring or exhibiting at Disrupt 2020? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Owning one brick-and-mortar business seems complicated enough. But running multiple locations? For many owners, that’s a constant juggling act of phone calls, check lists and driving back and forth from store to store. In the middle of a pandemic, it gets all the more complex.

Delightree, a company out of the previous Alchemist Accelerator class, has raised $3 million to build a tool hyper-focused on helping owners of franchise businesses (think hotels, gyms, restaurant chains, etc.) take their operations and workflows digital.

A big part of the idea with Delightree is to move much of what currently happens through pen-and-paper checklists over to smartphones, allowing franchise owners to know what’s going at their locations from afar. They digitize workflows like the daily store opening/closing procedures or maintenance routines, with employees checking boxes on their devices rather than a paper to-do list. If something gets missed along the way, Delightree can automatically ping the owner to let them know before it becomes an issue.

They’ll also help to automate and track things like onboarding new employees and staying prepared for inspections, while giving owners a centralized place to make team-wide announcements or contact employees.

Delightree evolved out of a previous company built by its co-founders, Madhulika Mukherjee and Tushar Mishra. They’d been working on Survaider, a tool that monitored customer feedback across social media, review sites, etc., and turned that feedback into actionable to-do lists.

“When we were piloting it, our customers started saying: ‘can we create our own tasks? Or can I tell something to my employees through this?’ ” Mishra told me. “It was just such an obvious problem, so we started building Delightree.”

Delightree co-founders Tushar Mishra and Madhulika Mukherjee

The team has also been working on a feature they call Delightcomply, which helps stores stay up to date on the latest CDC guidelines for businesses operating through the pandemic, and to automatically share compliance details with potential customers. A business could use Delightcomply to publicly outline the steps it’s taking to keep employees/customers safe, for example, with the listing automatically updated to show the status of each task.

Delightree is currently working directly with each new customer to help them through the initial setup — specifically, to help franchisees take the standard operating procedures they receive directly from the brand owners and turn them into Delightree workflows. They’re still working out their exact pricing model, but say that they charge on a per-location-per-month basis, with pricing varying depending on the size/complexity of the business. They’ve set up a waitlist for anyone interested.

This $3 million seed round was funded by Accel Partners, Emergent Ventures, Brainstorm Ventures, Axilor Ventures and Alchemist. As part of the deal, Emergent partner Anupam Rastogi has joined Delightree’s board of directors.

Powered by WPeMatico

This week, the CEOs of Facebook, Apple, Alphabet and Amazon were called before the House’s Antitrust Subcommittee to defend the vast empires they’ve built. Jeff Bezos, Tim Cook, Sundar Pichai and Mark Zuckerberg faced questions about how their business practices propelled them into the market-dominant giants they are today. They lead four of the top six most valuable public companies in existence and are widely regarded as reshaping the consumer world, both within the tech industry and beyond. Watch TechCrunch reporters Taylor Hatmaker, Devin Coldewey and Alex Wilhelm discuss what happened during the hearing and what this might mean for the future of big tech.

Powered by WPeMatico

As the Internet of Things proliferates, security cameras are getting smarter. Today, these devices have machine learning capability that helps the camera automatically identify what it’s looking at — for instance, an animal or a human intruder? Today, Cisco announced that it has acquired Swedish startup Modcam and is making it part of its Meraki smart camera portfolio with the goal of incorporating Modcam computer vision technology into its portfolio.

The companies did not reveal the purchase price, but Cisco tells us that the acquisition has closed.

In a blog post announcing the deal, Cisco Meraki’s Chris Stori says Modcam is going to up Meraki’s machine learning game, while giving it some key engineering talent, as well.

“In acquiring Modcam, Cisco is investing in a team of highly talented engineers who bring a wealth of expertise in machine learning, computer vision and cloud-managed cameras. Modcam has developed a solution that enables cameras to become even smarter,” he wrote.

What he means is that today, while Meraki has smart cameras that include motion detection and machine learning capabilities, this is limited to single camera operation. What Modcam brings is the added ability to gather information and apply machine learning across multiple cameras, greatly enhancing the camera’s capabilities.

“With Modcam’s technology, this micro-level information can be stitched together, enabling multiple cameras to provide a macro-level view of the real world,” Stori wrote. In practice, as an example, that could provide a more complete view of space availability for facilities management teams, an especially important scenario as businesses try to find safer ways to open during the pandemic. The other scenario Modcam was selling was giving a more complete picture of what was happening on the factory floor.

All of Modcams employees, which Cisco described only as “a small team,” have joined Cisco, and the Modcam technology will be folded into the Meraki product line, and will no longer be offered as a standalone product, a Cisco spokesperson told TechCrunch.

Modcam was founded in 2013 and has raised $7.6 million, according to Crunchbase data. Cisco acquired Meraki back in 2012 for $1.2 billion.

Powered by WPeMatico