Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

It seemed so simple. A small schema issue in a database was wrecking a feature in the app, increasing latency and degrading the user experience. The resident data engineer pops in a fix to amend the schema, and everything seems fine — for now. Unbeknownst to them, that small fix completely clobbered all the dashboards used by the company’s leadership. Finance is down, ops is pissed, and the CEO — well, they don’t even know whether the company is online.

For data engineers, it’s not just a recurring nightmare — it’s a day-to-day reality. A decade plus into that whole “data is the new oil” claptrap, and we’re still managing data piecemeal and without proper systems and controls. Data lakes have become data oceans and data warehouses have become … well, whatever the massive version of a warehouse is called (a waremansion I guess). Data engineers bridge the gap between the messy world of real life and the precise nature of code, and they need much better tools to do their jobs.

As TechCrunch’s unofficial data engineer, I’ve personally struggled with many of these same problems. And so that’s what drew me into Datafold.

Datafold is a brand-new platform for managing the quality assurance of data. Much in the way that a software platform has QA and continuous integration tools to ensure that code functions as expected, Datafold integrates across data sources to ensure that changes in the schema of one table doesn’t knock out functionality somewhere else.

Founder Gleb Mezhanskiy knows these problems firsthand. He’s informed from his time at Lyft, where he was a data scientist and data engineer, and later transformed into a product manager “focused on the productivity of data professionals.” The idea was that as Lyft expanded, it needed much better pipelines and tooling around its data to remain competitive with Uber and others in its space.

His lessons from Lyft inform Datafold’s current focus. Mezhanskiy explained that the platform sits in the connections between all data sources and their outlets. There are two challenges to solve here. First, “data is changing, every day you get new data, and the shape of it can be very different either for business reasons or because your data sources can be broken.” And second, “the old code that is used by companies to transform this data is also changing very rapidly because companies are building new products, they are refactoring their features … a lot of errors can happen.”

In equation form: messy reality + chaos in data engineering = unhappy data end users.

With Datafold, changes made by data engineers in their extractions and transformations can be compared for unintentional changes. For instance, maybe a function that formerly returned an integer now returns a text string, an accidental mistake introduced by the engineer. Rather than wait until BI tools flop and a bunch of alerts come in from managers, Datafold will indicate that there is likely some sort of problem, and identify what happened.

The key efficiency here is that Datafold aggregates changes in datasets — even datasets with billions of entries — into summaries so that data engineers can understand even subtle flaws. The goal is that even if an error transpires in 0.1% of cases, Datafold will be able to identify that issue and also bring a summary of it to the data engineer for response.

Datafold is entering a market that is, quite frankly, as chaotic as the data being processed. It sits in the key middle layer of the data stack — it’s not the data lake or data warehouse for storing data, and it isn’t the end user BI tools like a Looker, Tableau or many others. Instead, it’s part of a number of tools available for data engineers to manage and monitor their data flows to ensure consistency and quality.

The startup is targeting companies with at least 20 people on their data team — that’s the sweet spot where a data team has enough scale and resources that they are going to be concerned with data quality.

Today Datafold is three people, and will be debuting officially at YC’s Demo Day later this month. Its ultimate dream is a world where data engineers never again have to get an overnight page to fix a data quality issue. If you’ve been there, you know precisely why such a product is valuable.

Powered by WPeMatico

PandaDoc, the startup that provides a fully digital sales document workflow from proposal to electronic signature to collecting payment, announced a $30 million Series B extension today, making it the second such extension the company has taken since taking its original $15 million Series B in 2017. The total for the three B investments is $50 million.

Company co-founder and CEO Mikita Mikado says that he took this approach — taking the original money in 2017, then $5 million last year along with the money announced today — because it made more sense financially for the company than taking a huge chunk of money all at once.

“Basically when we do little chunks of cash frequently, [we found that] you dilute yourself less,” Mikado told TechCrunch. He said that they’ve grown comfortable with this approach because the business became more predictable once it passed 10,000 customers. In fact today it has 20,000.

“With a high-velocity in-bound sales model, you can predict what’s going to happen next month or [say] six months out. So you kind of have this luxury of raising as much money as you need when you need it, minimizing dilution just like public companies do,” he said.

While he wouldn’t discuss specifics in terms of valuations, he did say that the B1 had 2x the valuation of the original B round and the B2 had double the valuation of the B1.

For this round, One Peak led the investment, with participation from Microsoft’s Venture Fund (M12), Savano Capital Partners, Rembrandt Venture Partners and EBRD Venture Capital Investment Programme.

Part of the company’s growth strategy is using their eSignature tool to move people to the platform. They made that tool free in March just as the pandemic was hitting hard in the U.S., and it has proven to be what Mikado called “a lead magnet” to get more people familiar with the company.

Once they do that he says, they start to look at the broader set of tools and they can become paying customers. “This launch helped us validate that businesses need a broader workflow solution. Businesses used to think of the eSignature as the Holy Grail in getting a deal done. Now they are realizing that eSignature is just a moment in time. The full value is what happens before, during and after the eSignature in order to get deals done,” Mikado said.

The company currently has 334 employees with plans to hit 380 by year’s end and is aiming for 470 by next year. With the office in San Francisco, Belarus and Manila, it has geographic diversity built in, but Mikado says it’s something they are still working at and includes anti-bias programs and training and leadership programs to give more people a chance to be hired or promoted into management.

When it came to shutting down offices and working from home, Mikado admits it was a challenge, especially as some of the geographies they operate in might not have access to a good internet connection at home or face other challenges, but overall he says it has worked out in terms of maintaining productivity across the company. And he points out being geographically diverse, they have had to deal with online communications for some time.

Powered by WPeMatico

As Kubernetes and cloud-native technologies proliferate, developers and IT have found a growing set of technical challenges they need to address, and new concepts and projects have popped up to deal with them. For instance, operators provide a way to package, deploy and manage your cloud-native application in an automated way. Kubermatic wants to take that concept a step further, and today the German startup announced KubeCarrier, a new open-source, cloud-native service management hub.

Kubermatic co-founder Sebastian Scheele says three or four years ago, the cloud-native community needed to solve a bunch of technical problems around deploying Kubernetes clusters, such as overlay networking, service meshes and authentication. He sees a similar set of problems arising today where developers need more tools to manage the growing complexity of running Kubernetes clusters at scale.

Kubermatic has developed KubeCarrier to help solve one aspect of this. “What we’re currently focusing on is how to provision and manage workloads across multiple clusters, and how IT organizations can have a service hub where they can provide those services to their organizations in a centralized way,” Scheele explained.

Scheele says that KubeCarrier provides a way to manage and implement all of this, giving organizations much greater flexibility beyond purely managing Kubernetes. While he sees organizations with lots of Kubernetes operators, he says that as he sees it, it doesn’t stop there. “We have lots of Kubernetes operators now, but how do we manage them, especially when there are multiple operators, [along with] the services they are provisioning,” he asked.

This could involve provisioning something like Database as a Service inside the organization or for external customers, while combining or provisioning multiple services, which are working on multiple levels and a need a way to communicate with each other.

“That is where KubeCarrier comes in. Now, we can help our customers to build this kind of automation around provisioning, and service capability so that different teams can provide different services inside the organization or to external customers,” he said.

As the company explains it, “KubeCarrier addresses these complexities by harnessing the Kubernetes API and Operators into a central framework allowing enterprises and service providers to deliver cloud native service management from one multi-cloud, multi-cluster hub.”

KubeCarrier is available on GitHub, and Scheele says the company is hoping to get feedback from the community about how to improve it. In parallel, the company is looking for ways to incorporate this technology into its commercial offerings, and that should be available in the next 3-6 months, he said.

Powered by WPeMatico

Harness has made a name for itself creating tools like continuous delivery (CD) for software engineers to give them the kind of power that has been traditionally reserved for companies with large engineering teams like Google, Facebook and Netflix. Today, the company announced it has acquired Drone.io, an open-source continuous integration (CI) company, marking the company’s first steps into open source, as well as its first acquisition.

The companies did not share the purchase price.

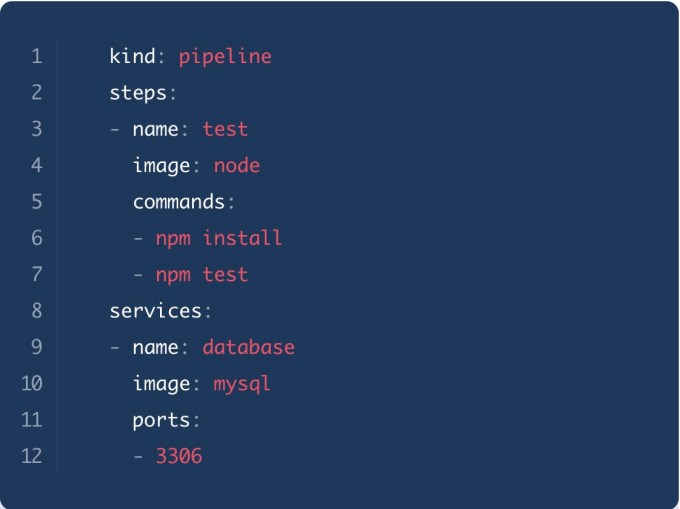

“Drone is a continuous integration software. It helps developers to continuously build, test and deploy their code. The project was started in 2012, and it was the first cloud-native, container-native continuous integration solution on the market, and we open sourced it,” company co-founder Brad Rydzewski told TechCrunch.

Drone delivers pipeline configuration information as code in a Docker container. Image: Drone.io

While Harness had previously lacked a CI tool to go with its continuous delivery tooling, founder and CEO Jyoti Bansal said this was less about filling in a hole than expanding the current platform.

“I would call it an expansion of our vision and where we were going. As you and I have talked in the past, the mission of Harness is to be a next-generation software delivery platform for everyone,” he said. He added that buying Drone had a lot of upside.”It’s all of those things — the size of the open-source community, the simplicity of the product — and it [made sense], for Harness and Drone to come together and bring this integrated CI/CD to the market.”

While this is Harness’ first foray into open source, Bansal says it’s just the starting point and they want to embrace open source as a company moving forward. “We are committed to getting more and more involved in open source and actually making even more parts of Harness, our original products, open source over time as well,” he said.

For Drone community members who might be concerned about the acquisition, Bansal said he was “100% committed” to continuing to support the open-source Drone product. In fact, Rydzewski said he wanted to team with Harness because he felt he could do so much more with them than he could have done continuing as a standalone company.

“Drone was a growing community, a growing project and a growing business. It really came down to I think the timing being right and wanting to partner with a company like Harness to build the future. Drone laid a lot of the groundwork, but it’s a matter of taking it to the next level,” he said.

Bansal says that Harness intends to also offer on the Harness platform a commercial version of Drone with some enterprise features, even while continuing to support the open source side of it.

Drone was founded in 2012. The only money it raised was $28,000 when it participated in the Alchemist Accelerator in 2013, according to Crunchbase data. The deal has closed and Rydzewski has joined the Harness team.

Powered by WPeMatico

Electric vehicles (EVs) are spreading throughout the world. While Tesla has drawn the most attention in the United States with its luxurious and cutting-edge cars, EVs are becoming a mainstay in markets far away from the environs of California.

Take India for instance. In the local mobility market, two- and three-wheel vehicles are starting to emerge as a popular option for a rapidly expanding middle class looking for more affordable options. EV versions are popular thanks to their reduced maintenance costs and higher reliability compared to gasoline alternatives.

Two-wheeled electric scooters are a fast-growing segment of India’s mobility market.

There’s just one problem, and it’s the same one faced by every country which has attempted to convert from gasoline to electric: how do you build out the charging station network to make these vehicles usable outside a small range from their garage?

It’s the classic chicken-and-egg problem. You need EVs in order to make money on charging stations, but you can’t afford to build charging stations until EVs are popular. Some startups have attempted to build out these networks themselves first. Perhaps the most famous example was Better Place, an Israeli startup that raised $800 million in venture capital before dying from negative cash flow back in 2013. Tesla has attempted to solve the problem by being both the chicken and egg by creating a network of Superchargers.

That’s what makes Statiq so interesting. The company, based in the New Delhi suburb of Gurugram, is bootstrapping an EV charging network using a multi-revenue model that it hopes will allow it to avoid the financial challenges that other charging networks have faced. It’s in the current Y Combinator batch and will be presenting at Demo Day later this month.

Akshit Bansal and Raghav Arora, the company’s co-founders, worked together previously as consultants and built a company for buying photos online, eventually reaching 50,000 monthly actives. They decided to make a pivot — a hard pivot really — into EVs and specifically charging equipment.

Statiq founders Raghav Arora and Akshit Bansal. Photos via Statiq

“We felt the need to do something about the climate because we were living in Delhi and Delhi is one of the most polluted cities in the world, and India is home to a lot of the polluted cities in the world. So we wanted to do something about it,” Bansal said. As they researched the causes of pollution, they learned that automobile exhaust represented a large part of the problem locally. They looked at alternatives, but EV charging stations remain basically non-existent across the country.

Thus, they founded Statiq in October 2019 and officially launched this past May. They have installed more than 150 charging stations in Delhi, Bangalore, and Mumbai and the surrounding environs.

Let’s get to the economics though, since that to me is the most fascinating part of their story. Statiq as I noted has a multi-revenue model. First, end users buy a subscription from Statiq to use the network, and then users pay a fee per charging session. That session fee is split between Statiq and the property owner, giving landlords who install the stations an incremental revenue boost.

A Statiq charging station. Photo via Statiq

When it comes to installation, Statiq has a couple of tricks up its sleeves. First, the company’s charging equipment — according to Bansal — costs roughly a third of the equivalent cost of U.S. equipment. That makes the base technology cheaper to acquire. From there, the company negotiates installations with landlords where the landlords will pay the fixed costs of installation in exchange for that continuing session charge fee.

On top of all that, the charging stations have advertising on them, offering another income stream particularly in high-visibility locations like shopping malls which are critical for a successful EV charging network.

In short, Statiq hasn’t had to outlay capital in order to put in place their charging equipment — and they were able to bootstrap before applying to YC earlier this year. Bansal said the company had dozens of charging stations and thousands of paid sessions on its platform before joining their YC batch, and “we are now growing 20% week-over-week.”

What’s next? It’s all about deliberate scaling. The EV market is turning on in India, and Statiq wants to be where those cars are. Bansal and his co-founder are hoping to ride the wave, continuing to build out critical infrastructure along the way. India’s government will likely continue to help: its approved billions of dollars in incentives for EVs and for charging stations, tipping the economics even further in the direction of a clean car future.

Powered by WPeMatico

You might have missed it, but amidst the current political-M&A-pandemic-election-disinformation news cycle we find ourselves in this week, SaaS and cloud companies reached new public market records.

Yesterday, the Bessemer-Nasdaq cloud index closed at 2,035.54, a new record finish for the basket of software companies. And, today, the index broached the 2,040 mark before ceding some ground.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

What matters for our purposes is that with a good chunk of the Q2 earnings cycle behind us, software companies are not only holding onto their gains from earlier in the year, they are managing to add to them, albeit modestly. Of course, valuation expansion during earnings season could still lead to gently falling multiples; as companies grow, if their shares gain value at a slower pace, their price/sales ratio can lose ground.

Regardless, for our purposes it’s notable that recent public market gains are not dissipating. Tech valuation boosts have helped major American indices regain ground lost early in the year, and Q2 earnings were a possible threat to prior progress. So far earnings-related dents are thin on the ground.

Regardless, for our purposes it’s notable that recent public market gains are not dissipating. Tech valuation boosts have helped major American indices regain ground lost early in the year, and Q2 earnings were a possible threat to prior progress. So far earnings-related dents are thin on the ground.

So, what’s going on? Why are SaaS and cloud stocks doing so well? Leaning on notes from two VCs — Jamin Ball from Redpoint and Mary D’Onofrio from Bessemer — we can unspool recent valuation highs.

Powered by WPeMatico

We’ve aggregated many of the world’s best growth marketers into one community. Twice a month, we ask them to share their most effective growth tactics, and we compile them into this Growth Report.

This is how you stay up-to-date on growth marketing tactics — with advice that’s hard to find elsewhere.

Our community consists of startup founders and heads of growth. You can participate by joining Demand Curve’s marketing training program or its Slack group.

Without further ado, on to our community’s advice.

Insights from Harry Morton of Lower Street.

Podcast growth is all about relationships. To increase your listenership, consider partnering with:

Powered by WPeMatico

Qualified, a startup co-founded by former Salesforce executives Kraig Swensrud and Sean Whiteley, has raised $12 million in Series A funding.

Swensrud (Qualified’s CEO) said the startup is meant to solve a problem that he faced when he was CMO at Salesforce. Apparently he’d complain about being “blind,” because he knew so little about who was visiting the Salesforce website.

“There could be 10 or 100 or 100,000 people on my website right now, and I don’t know who they are, I don’t know what they’re interested in, my sales team has no idea that they’re even there,” he said.

Apparently, this is a big problem in business-to-business sales, where waiting five minutes after a lead leaves your website can result in a 10x decrease in the odds of making contact. But the solution currently adopted by many websites is just a chatbot that treats every visitor similarly.

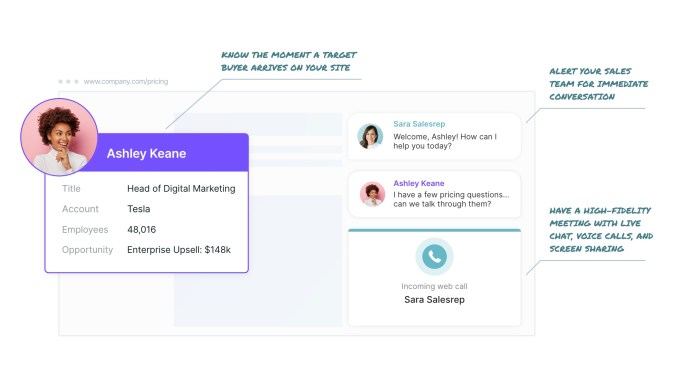

Qualified, meanwhile, connects real-time website visitor information with a company’s Salesforce customer database. That means it can identify visitors from high-value accounts and route them to the correct salesperson while they’re still on the website, turning into a full-on sales meeting that can also include a phone call and screensharing.

Image Credits: Qualified

Of course, the amount of data Qualified has access to will differ from visitor to visitor. Some visitors may be purely incognito, while in other cases, the platform might simply know your city or where you work. In still others (say if you click on a link from marketing email), it can identify you individually.

That’s something I experienced myself, when I decided to take a look at the Qualified website this morning and was quickly greeted with a message that read, “ Welcome TechCrunch! We’re excited about our funding announcement…” It was a little creepy, but also much more effective than my visits to other marketing technology websites, where someone usually sends me a generic sales message.

Welcome TechCrunch! We’re excited about our funding announcement…” It was a little creepy, but also much more effective than my visits to other marketing technology websites, where someone usually sends me a generic sales message.

Swensrud acknowledged that using Qualified represents “a change to people’s selling processes,” as it requires sales to respond in real time to website visitors (as a last resort, Qualified can also use chatbots and schedule future calls), but he argued that it’s a necessary change.

“If you email them later, some percentage of those people, they ghost you, they get bored, they moved on to the competition,” he said. “This real-time approach, it forces organizations to think differently in terms of their process.”

And it’s an approach that seems to be working. Among Qualified’s customers, the company says ThoughtSpot increased conversations with its target accounts by 10x, Bitly grew its enterprise sales pipeline by 6x and Gamma drove over $2.5 million in new business pipeline.

The Series A brings Qualified’s total funding to $17 million. It was led by Norwest Venture Partners, with participation from existing investors including Redpoint Ventures and Salesforce Ventures. Norwest’s Scott Beechuk is joining Qualified’s board of directors.

“The conversational model is simply a better way to connect with new customers,” Beechuk said in a statement. “Buyers love the real-time engagement, sellers love the instant connections, and marketers have the confidence that every dollar spent on demand generation is maximized. The multi-billion-dollar market for Salesforce automation software is going to adopt this new model, and Qualified is perfectly positioned to capture that demand.”

Powered by WPeMatico

Radish is announcing that it has raised $63.2 million in new funding.

Breaking up book-length stories into smaller chapters that are released over days or weeks is an idea that was popularized in the 19th century, and startups have been trying to revive it for at least the past decade. Still, this round represents a major step up in funding, not just for Radish (which only raised around $5 million previously), but also compared to other startups in a relatively nascent market. (Digital fiction startup Wattpad is the notable exception.)

When I first wrote about Radish at the beginning of 2017, the startup was focused on user-generated content. Last year, however, the company launched the Radish Originals program, where Radish is able to produce more content using teams of writers lead by a “showrunner,” and where the startup owns the resulting intellectual property.

“Instead of becoming YouTube or Wattpad for serial fiction, we want to be more like Netflix and create our own originals,” founder and CEO Seungyoon Lee told me. “I got a lot of inspiration from platforms in Korea, China and Japan, where serial fiction is huge and established on mobile.”

One of the ideas Radish took from the Asian markets is rapidly updating its stories. For example, its most popular title, “Torn Between Alphas” (a romance story with werewolves) has released 10 seasons in less than a year, with each season consisting of more than 50 chapters — later seasons have more than 100 chapters — that are released multiple times a day.

“On Netflix, you can binge-watch three seasons of a show at once,” Lee said. “On Radish, you can binge-read a thousand episodes.”

While Radish borrowed the writing room model from TV — and hired Emmy-winning TV writers, particularly those with a background in soap operas — Lee said it’s also taken inspiration from gaming. For one thing, it relies on micro-payments to make money, with users buying coins that allow them to unlock later chapters of a story (chapters usually cost 20 or 30 cents, and more chapters get moved out from behind the paywall over time). In addition, the company can allow reader taste to determine the direction of stories by A/B testing different versions of the same chapter.

Lee pointed to the fall of 2019 as Radish’s “inflection point,” where the model really started to work. Now, the company says its most popular story has made more than $4 million and has received more than 50 million “reads.” Radish stories are mostly in the genres of romance, paranormal/sci-fi, LGBTQ, young adult, horror, mystery and thriller, and Lee said the audience is largely female and based in the United States.

By raising a big round led by SoftBank Ventures Asia (the early-stage investment arm of troubled SoftBank Group) and Kakao Pages (which publishes webtoons, web novels and more, and is part of Korean internet giant Kakao), Lee said he can take advantage of their expertise in the Asian market to grow Radish’s audience in the U.S. That will mean accelerating content production in the hopes of creating more hit titles, and also spending more on performance marketing.

“With its own fast-paced original content production, Radish is best positioned to become a leading player in the global online fiction market,” said SoftBank Ventures Asia CEO JP Lee in a statement. “Radish has proven that its serialized novel platform can change the way people consume online content, and we are excited to support the company’s continued disruption in the mobile fiction space. Leveraging our global SoftBank ecosystem, we hope to support and accelerate Radish’s expansion across different regions worldwide.”

Powered by WPeMatico

Big news today the world of IT startups targeting businesses. Rippling, the startup founded by Parker Conrad to take on the ambitious challenge of building a platform to manage all aspects of employee data, from payroll and benefits through to device management, has closed $145 million in funding — a monster Series B that catapults the company to a valuation of $1.35 billion.

Parker Conrad, the CEO who co-founded the company with Prasanna Sankar (the CTO), said in an interview that the plan will be to use the money to continue its own in-house product development (that is, bringing more tools into the Rippling mix organically, not by way of acquisition) but also to have it just in case, given everything else going on at the moment.

“We will double down on R&D but to be honest we’re trying not to change the formula too much,” Conrad said. “We want to have that discipline. This fundraising was opportunistic amid the larger macroeconomic risk at the moment. I was working at startups in 2008-2009 and the funding markets are strong right now, all things considered, and so we wanted to make sure we had the stockpile we needed in case things went bad.”

This latest round included Greenoaks Capital, Coatue Management and Bedrock Capital, as well as existing investors including Kleiner Perkins, Initialized Capital and Y Combinator. Founders Fund partner Napoleon Ta will join Rippling’s board of directors. Founders Fund had also backed Zenefits when Parker was at the helm, and from what we understand, this round was oversubscribed — also a big feat in the current market, working against a lot of factors, including a wobbling economy.

It is a big leap for the company: it was just a little over a year ago that it raised a Series A of $45 million at a valuation of $270 million.

This latest round is notable for a few reasons.

First is the business itself. HR and employee management software are two major areas of IT that have faced a lot of fragmentation over the years, with many businesses opting for a cocktail of services covering disparate areas like employee onboarding, payroll, benefits, device management, app provisioning and permissions and more. That’s been even more the case among smaller organizations in the 2-1,000 employee range that Rippling targets.

Rippling is approaching that bigger challenge as one that can be tackled by a single platform — the theory being that managing HR employee data is essentially part and parcel of good management of IT data permissions and device provision. This funding is a signal of how both investors and customers are buying into Rippling and its approach, even if right now the majority of customers don’t onboard with the full suite of services. (Some 75% are usually signing up with HR products, Conrad noted.)

“We like to think of ourselves as a Salesforce for employee data,” Conrad said, “and by that, we think that employee data is more than just HR. We want to manage access to all of your third-party business apps, your computer and other devices. It’s when you combine all that that you can manage employees well.”

The company is gradually adding more tools. Most recently, it’s been launching new tools to help with job costing, helping companies track where employees are spending time when working on different projects, a tool critical for IT, accounting and other companies where employees work across a number of clients. Other new tools include SMS communications for “desk-less” workers and more accounting integrations.

Second is the founder. You might recall that Conrad was ousted from his previous company, Zenefits (taking on a related, but smaller, challenge in payroll and benefits), over a controversy linked to compliance issues and also misleading investors. But if Zenefits was finished with Conrad, Conrad was not finished with Zenefits — or at least the problem it was tackling. This funding is a testament to how investors are putting a big bet on Conrad himself, who says that a lot of what he has been building at Rippling was what he would have done at Zenefits if he’d stayed there.

“Once you’re lucky, twice you’re good,” said Mamoon Hamid, a partner at Kleiner Perkins, in a separate statement. “Parker is a true product visionary, and he and his team are solving an enormous pain point for businesses everywhere. We’re thrilled to continue partnering with Rippling as demand for their platform dramatically increases in this era of remote work.”

“Rippling is not just a superior payroll company, but something much broader: they’ve built the system of record for all employee data, creating an entirely new software category. Rippling’s massive market opportunity is to streamline the employee life cycle, from software to payroll to benefits, and fundamentally improve the way businesses hire and manage their employees,” said Ta in a statement.

Third is the context in which this round is coming. We’re in the midst of an economic downturn caused in part by a global health pandemic, and that’s leading to a lot of companies curtailing budgets, reducing headcount and potentially shutting down altogether. Ironically, that force is also propelling companies like Rippling full steam ahead.

Its SaaS model — priced at a flat $8 per person per month — not only fits with how many businesses are being run at the moment (primarily remotely), but Rippling’s purpose is specifically geared to helping businesses both onboard and offboard employees more efficiently, the kind of software that companies need to have in place to fit how they are working right now.

Updated with commentary from an interview with Conrad.

Powered by WPeMatico