Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Angel funding, seed investing and generally focusing on earlier stage investing is a huge business in the world of startups these days — it helps investors get in early to the most promising companies, and (because of the smaller size of the checks) allows for even the less prolific to spread their bets.

There was a time when it was immensely difficult for a founder to get a first check, not least because there were fewer people writing them. However, Jeff Clavier was an exception to that rule.

As the founder of Uncork Capital (formerly known as SoftTech VC), he has been in the business of angel and seed investing for 16 years, popularizing the opportunity and highlighting the need for more support at this stage — well before it was cool. You could say he was early to early stage.

Clavier said that at the end of 2019, it was estimated that there were more than 1,000 firms focusing on seed investing in the market, but by the end of this year, there will be about 2,000. “Don’t ask me whether it makes any sense because when I started 16 years ago, I didn’t think would be a big deal,” he said. “But certainly that creates a bit of a conundrum for founders to try and understand.”

As of now, Clavier has made nearly 230 investments and counting.

TechCrunch Early Stage, our virtual conference highlighting that stage of startup life, was the perfect venue to hear from him on all things seed investing and building startups today. Below are some highlights, a link to the video and a pitch deck he put together for the chat. Questions were edited for space and clarity.

First thing to understand is that not all VCs are created equal. There are a bunch of different firms, tons of them out there, and you as a founder need to understand what are the specifics of your pitch opportunity, how to match with the right firm, and to figure out what stage of “early” you happen to be.

Startups can be super early, or mid-stage, which is typically what we refer to as pre-seed. Then there’s the seed stage, where you have developed a product, with a demo. And there is post-seed, where you have product but are not quite ready to raise a Series A. So who are the firms that can actually be the right fit for me at those different stages? The qualification part of the targeting is really important. Especially in a COVID environment when you can’t spend the same kind of time with each other.

It’s useful for founders to try and understand investors better, maybe asking a couple of questions like, “When is the last time you made a brand new investment at seed stage?” And “How has your investment process changed as a result of COVID?”

For investors, you want to understand how you’re going to evolve your process to cope with the fact that you don’t spend time with those founders face-to-face. Some firms are still struggling with that.

At Uncork, we’re now past the point of portfolio triage that we had in the first few weeks of of the pandemic. What was surprising to me was the speed and velocity at which some deals actually.

Powered by WPeMatico

Tech stocks retain their highs as the second quarter’s earnings season begins to fade into the rearview mirror, and there are still a number of companies looking to go public while the times are good. It looks like a smart move, as public investors are hungry for growth-oriented shares — which is just what tech and venture-backed companies have in spades.

The companies currently looking to go public are diverse. China-based real-estate giant KE Holdings — a hybrid listings company and digital transaction portal for housing — is looking to raise as much as $2.3 billion in a U.S. listing. Xpeng, another China-based company that builds electric vehicles, is looking to list in the U.S as well. Xpeng has the distinction of being gross-margin negative in every key time period detailed in its S-1 filing.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

And then there’s Duck Creek Technologies, a domestic tech company looking to go public on the back of growing SaaS revenues. This morning let’s quickly spin through Duck Creek’s history, peek at its financial results, calculate its expected valuation and see how its pricing fits compared to current norms.

Duck Creek is a Boston-based software company that serves the property and casualty (P&C) insurance market. Its customers include names like AIG, Geico and Progressive, along with smaller players that aren’t as well known to the American mass market.

Duck Creek is a Boston-based software company that serves the property and casualty (P&C) insurance market. Its customers include names like AIG, Geico and Progressive, along with smaller players that aren’t as well known to the American mass market.

The KE IPO will be a big affair because the company is huge and profitable with $3.86 billion in H1 2020 revenue leading to $227.5 million in net income. The Xpeng IPO will be interesting because Tesla’s strong share price has given float to a great many EV boats. But Duck Creek is a company slowly letting go of perpetual license software sales and scaling its SaaS incomes while still generating nearly half its revenues from services. It’s a company we can understand, in other words.

So let’s get under the skin of the Boston-based company that also claims low-code functionality. This will be fun.

Powered by WPeMatico

This morning, Mux, a startup that provides API-based video streaming tooling and analytics, announced that it has closed a $37 million Series C round of capital.

Andreessen Horowitz led the round, which included participation from Accel and Cobalt. Prior to this funding round, Mux most recently raised a roughly $20 million round in mid-2019. In total, the company had raised a hair under $32 million before its Series C, according to PitchBook data.

The Mux round lands amidst a number of trends that we’re tracking here at TechCrunch, namely API-based startups, which are hot as a group at the moment, and startups that are serving an accelerating digital transformation.

Let’s explore a bit of Mux’s history, and then dig into how the startup’s current pace of revenue growth explains its fresh infusion of capital.

TechCrunch spoke with Mux’s founder Jon Dahl about the round, curious about how the company came to be. Dahl was a co-founder of Zencoder back in the early 2010s, which sold to Brightcove. When Zencoder launched, TechCrunch said that it wanted “to be the Amazon Web Services of video encoding.” It wound up selling for $30 million, a figure that stood a bit taller in 2012, when the transaction was announced.

Dahl stuck around Brightcove for a few years while angel investing. Then in late 2015 he founded Mux. The new startup first built an analytics tool called Mux Data. Dahl said the analytics product was needed because more conventional tooling like Google Analytics don’t work well with online video.

Mux Data is a SaaS product. But what made Mux even more interesting is its on-demand infra play, namely Mux Video.

Mux Video is delivered via an API, supporting both live and on-demand video for other companies. The startup likes to argue that it’s doing for video what Stripe has done for payments, namely take a bundle of complexity and headache, wrestle it into shape, then offer it via a developer-friendly hook.

Delivering video, we’ve seen via the bootstrapped growth of Cloudinary and recent Daily.co round, is growing work in 2020.

That fact shows up in Mux’s numbers, which are somewhat bonkers. The company’s aggregate revenue numbers are growing at a pace that Dahl described as 4x, while Mux Video’s revenues are growing at a pace of 8x, he said. Dahl shared a few other metrics — startups: if you want folks to care about your funding round, follow this example — including that Mux Video’s LTV/CAC ratio is somewhere around 5x-6x, and that its net retention is around 160%.

The collected performance data that Mux shared explain why a16z wanted to put its capital into the company.

But to better understand that all the same, I caught up with Kristina Shen, a general partner at the venture firm. Shen stressed that Mux was heading in the right direction before the pandemic, but that COVID has accelerated the importance of video in how humans interact with one another — an accelerating secular shift for Mux to surf, in other words.

COVID has bolstered Mux, with a release regarding its new investment, noting that its “social media customers [have seen] an increase of 118% in video streaming since mid-February while fitness and health streaming surged by 162%, e-learning grew by 230% and religious streams jumped nearly 3 orders of magnitude.”

Shen said during our call that Mux is one of the fastest-growing enterprise SaaS companies that her firm has seen.

Finally, when asked about Mux’s gross margins, Shen said the company would eventually look similarly to other companies in the infra space, like Twilio and Stripe. This matches what Dahl told this publication, though the founder included a fun wrinkle. Remember Mux Data, the analytics product? Its margins more closely resembles SaaS economics, while Mux Video is more similar to other API, infra plays. So Mux has a bit of SaaS and a bit of infra in it, which should give it a super interesting blended gross margin profile.

Fun. The next time we talk to the firm we’ll be curious to see how far into the double-digit millions it can stretch its run rate.

Powered by WPeMatico

At last month’s Early Stage virtual event, channel growth experts joined TechCrunch reporters and editors for a series of conversations covering the best tools and strategies for building startups in 2020. For this post, I’ve recapped highlights of talks with:

If you’d like to hear or watch these conversations in their entirety, we’ve embedded the videos below.

Relying on internet searches to learn about growth topics like search engine optimization leads to a rabbit hole of LinkedIn thinkfluencer musings and decade-old Quora posts. Insights are few and far between, because SEO has changed dramatically as Google has squashed spammy techniques “specialists” have pushed for years.

Ethan Smith, owner of growth agency Graphite, says Google didn’t kill SEO, but the channel has evolved. “SEO has built a negative reputation over time of being spammy,” Smith says. “The typical flow of an SEO historically has been: I need to find every single keyword I possibly can find and auto-generate a mediocre page for each of those keywords, the user experience doesn’t really matter, content can be automated and spun, the key is fooling the bot.”

Artificial intelligence has disrupted this flow as algorithms have abandoned hard-coded rules for more flexible designs that are less vulnerable to being gamed. What SEO looks like today, Smith says, is all about trying to “figure out what the algorithm is trying to accomplish and try to accomplish the same thing.” Google’s algorithms aren’t looking for buckets of keywords, they’re looking to distill a user’s intent.

The key to building a strategy around SEO as a company breaks down into six steps surrounding intent, says Smith:

Powered by WPeMatico

Entrepreneurial creators have to do a lot with limited time. They need to, well, create, but then they also need to build their marketing funnels, convert users to their paid products and manage business operations. Yet, perhaps the most important task they face is keeping their existing fans engaged, because ultimately, that engagement ties directly to the health of their brand long-term.

Social tools are abysmal on platforms like YouTube and Instagram, particularly when it comes to creators owning their own communities and building deeper relationships with them. Other products like Discord have been used to some success, although Discord was built with a different focus in mind and is being hammered in to fix the problem.

Circle believes there is a better way. The New York City-based startup officially launched today for creators (following eight months of product beta testing). The platform is designed from the bottom-up to offer better community building and engagement tools for creators, while also integrating with other software typical in the creator toolkit.

Circle co-founders Sid Yadav, Rudy Santino and Andrew Guttormsen. Photo via Circle.

The key DNA for the company is another NYC-based startup called Teachable. Two of Circle’s three founders, Sid Yadav and Andrew Guttormsen, hail from the edtech platform, which helps entrepreneurial teachers setup online storefronts for their classes. Teachable was sold to Hotmart earlier this year for what was reported to be a quarter of a billion dollars. Yadav was VP of Product there, and Guttormsen was VP of Growth and Marketing. Their third co-founder, Rudy Santino, knew Yadav from previous work.

Yadav spun out of Teachable and actually got his start as a contractor for Sahil Lavingia, the founder of Gumroad we were just talking about last week because he launched a new seed fund. He worked part-time as a product and design consultant, allowing him the flexibility to begin spending time thinking about new product ideas.

“I always knew that my next startup was going to be in [the creator] space,” Yadav said. “I just loved what they’re all about, which is about making an income from what they love doing.”

Teachable’s rapid growth in a small slice of the creator space taught Yadav some of the key challenges that creators face, and what a new product needed to solve in order to help them. With his co-founders, he enlisted a group of creators — including Pat Flynn at Smart Passive Income and Anne-Laure Le Cunff, who operates a newsletter called Ness Labs — to actively build communities on Circle to prove out their various design and product decisions.

The growth of the platform and the engagement of potential customers attracted the attention of Notation Capital, a NYC-based pre-seed fund that just announced its third fund late last month. Notation led a $1.5 million seed round into Circle, which also included Lavingia, Ankur Nagpal (the founder and CEO of Teachable), Dave Ambrose and Matthew Ziskie, among others.

There is a growing movement of software designed to help creators start their businesses. Substack of course has gotten the most attention in Silicon Valley, with a platform designed mostly around email newsletter subscriptions. Pico, meanwhile, has focused on building out more of the infrastructure of the creator business through a CRM that integrates with most other platforms. Patreon handles more of the payments and revenue engagement of fans.

Circle may end up touching on those areas, but today, wants to be the destination where you send all your creators in between newsletters or blog posts or Instragrams. It’s a smart part of the creator stack to play in, and with strong early customer enthusiasm and a chunk of funding, seems ready to make a mark in this burgeoning market.

Powered by WPeMatico

Skillshare CEO Matt Cooper said 2020 has been a year of rapid growth — even before the pandemic forced large swaths of the population to stay home and turn to online learning for entertainment and enrichment.

Cooper (who became CEO in 2017) told me that the company decided last year to “focus on our strength,” leading to a “brand relaunch” in January 2020 to emphasize the richness of its creativity-themed content. At the same time, Cooper said the company defines creativity very broadly, with classes divided into categories like animation, design, illustration, photography, filmmaking and writing.

“It’s not Bob Ross,” he said. “And I love Bob Ross, but that’s a very narrow definition of creativity. Creativity can come in lots of different forms — art, design, journaling, creative writing, it can be culinary, it can be crafts.”

Cooper added that daily usage was already up significantly by mid-March, when the pandemic led to widespread social distancing orders across the United States. That created some challenges, particularly for the more polished Skillshare Originals that the company offers alongside its user-taught classes. (For example, Originals include a color masterclass taught by Victo Ngai, a class on “discovering your creative voice” taught by Shantell Martin and a creative nonfiction class by Susan Orlean.)

But of course the pandemic also meant that, as Cooper put it, “A lot more people had a lot more free time at home and were looking for a constructive way to spend it.” In fact, the company said that since its rebranding, new membership sign-ups have tripled, with existing members watching three times the number of lessons.

And Skillshare has continued producing Originals by sending instructors “a huge box of gear” and then supervising the shoot remotely. In fact, Cooper suggested that this has “opened up a whole new world” for the Originals team, allowing them to “look at parts of the world where we probably weren’t going to fly a camera crew to go shoot.”

The company now has 12 million registered members, 8,000 teachers and 30,000 classes — all accessible for $99 a year or $19 a month. And it’s announcing that it has raised $66 million in new funding led by OMERS Growth Equity, with managing director Saar Pikar joining the board of directors. Previous investors Union Square Ventures, Amasia, Burda Principal Investments and Spero Ventures also participated.

“Skillshare serves the needs of professional creatives and everyday creative hobbyists alike, which presents a highly-innovative value proposition for the online learning market,” Pikar said in a statement. “We look forward to deepening our partnership with Skillshare, and our fellow investors, in order to help Matt Cooper and his team scale up the company’s international reach – and help Skillshare achieve the full potential of its unique approach to online learning.”

Cooper added that the company (which had previously raised $42 million) was cash-flow positive for the first half of 2020, so it raised the new round to invest in growth — particularly in the Skillshare for Teams enterprise product, which allows customers like GM Financial, Vice, AWS, Lululemon, American Crafts and Benefit to offer Skillshare as a perk for their employees.

Cooper is also hoping to expand internationally. Apparently two-thirds of new member sign-ups are coming from outside the United States, with India as Skillshare’s fastest growing market, and that’s with “no local language content, no local language teachers.” While Cooper plans to remain focused on English content for the near future, he noted there are other steps Skillshare can take to encourage global viewership, like accepting payments in different currencies and supporting subtitles in different languages.

“Just by making it a little easier for those international users to get value from the platform, we expect to see dramatic growth in these international markets,” he said.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest big news, chats about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here, and myself here, and don’t forget to check out last Friday’s episode.

This morning was a bit of a grab-bag of news, but of course we had to start off with the biggest story from the past few weeks:

All that and earnings season is largely behind us, leaving tech companies generally unscathed. So, the good times will persist for a while yet. Have a great week!

Equity drops every Monday at 7:00 a.m. PT and Friday at 6:00 a.m. PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

CakeResume is a startup creating an alternative for the tech industry to job search platforms like LinkedIn. The Taipei-based company, founded in 2016, announced today that it has raised $900,000 in seed funding from Mynavi, one of the largest staffing and public relations companies in Japan. The round will be used to expand CakeResume’s operations in other countries, including Japan and India.

Founder and chief executive officer Trantor Liu, who was a full-stack web developer at Codementor before launching CakeResume, said the startup’s goal is to have the biggest pool of tech talent in Asia. The platform currently has about 500,000 resumes in its database, 75% of which were created by job seekers in Taiwan. More than 3,000 employers, ranging from startups like Appier to large companies like Amazon Web Services, TSMC, Nvidia and Tesla, use it for recruitment.

The other 25% of resumes come from countries including India, Indonesia and the United States. CakeResume plans to expand in Japan with the help of Mynavi, a strategic investor, and is also seeking partnerships in Southeast and South Asia with recruiters. Liu said CakeResume has a particularly high conversion rate in India, and its goal is to build a pool of at least 100,000 resumes there.

In a statement about its decision to invest in CakeResume, a Mynavi representative said, “The global shortage of IT engineers is becoming more apparent and we are focusing on services related to IT talent in Asia. Among them, CakeResume’s service is excellent in product design, and the service is already used by many talent in the country,” adding that it expects the platform to become “the largest IT talent pool in Asia in the near future.”

In Taiwan, CakeResume’s main rivals are LinkedIn and job search site 104.com.tw. It also competes against other job sites like AngelList, Indeed and Glassdoor.

CakeResume differentiates by giving tech professionals more ways to show off their skills, since many tech companies want more in-depth resumes than the traditional one-pagers used in other fields. The startup was named because its resume builder enables job seekers to add more layers of information, like assembling a cake. For example, CakeResume’s template allows engineers to embed projects from GitHub, while designers can add data visualizations, instead of just including links to them.

“We aren’t just providing a form to fill in that you can then download as a formatted PDF resume. We want to allow you to be more creative,” said Liu. “You can easily embed project images and add descriptions, which makes it easier for HR to understand what you can contribute.”

Another difference between CakeResume and its competitors is that most people who create a profile are actively seeking new positions, instead of professional networking opportunities. Because it is also tailored for the tech industry, recruiters have a higher chance of getting responses from interested candidates, Liu said.

“We recently got a review from one of our clients, and they said when they used our platform to contact talent, they got about a 50% reply rate, but on LinkedIn it might be less than 10%,” he added.

Before the COVID-19 pandemic, many job seekers were willing to relocate, but chief operating officer Wei-Cheng Hsieh said CakeResume is now focusing more on helping people find remote jobs. More tech companies, including Facebook and Google, are extending their work from home policies until at least summer 2021.

Though many job postings still specify a location, Liu said CakeResume’s team anticipates this will change as companies continue adapting to the pandemic. While CakeResume will remain focused on matching applicants to jobs instead of networking, it also is also testing some social features to help workers around the world connect with companies and each other.

Powered by WPeMatico

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter for your weekend enjoyment. It’s broadly based on the weekday column that appears on Extra Crunch, but free. And it’s made just for you. You can sign up for the newsletter here.

With that out of the way, let’s talk money, upstart companies and the latest spicy IPO rumors.

(In time the top bit of the newsletter won’t get posted to the website, so do make sure to sign up if you want the whole thing!)

One of the most interesting disconnects in the market today is how VC Twitter discusses successful IPOs and how the CEOs of those companies view their own public market debuts.

If you read Twitter on an IPO day, you’ll often see VCs stomping around, shouting that IPOs are a racket and that they must be taken down now. But if you dial up the CEO or CFO of the company that actually went public to strong market reception, they’ll spend five minutes telling you why all that chatter is flat wrong.

Case in point from this week: BigCommerce. Well-known VC Bill Gurley was incensed that shares of BigCommerce opened sharply higher after they started trading, compared to their IPO price. He has a point, with the Texas-based e-commerce company pricing at $24 per share (above a raised range, it should be said), but opened at $68 and is worth around $88 on Friday as I write to you.

So, when I got BigCommerce CEO Brent Bellm on Zoom after its debut, I had some questions.

First, some background. BigCommerce filed confidentially back in 2019, planned on going public in April, and wound up delaying its offering due to the pandemic, according to Bellm. Then in the wake of COVID-19, sales from existing customers went up, and new customers arrived. So, the IPO was back on.

BigCommerce, as a reminder, is seeing growth acceleration in recent quarters, making its somewhat modest growth rate more enticing than you’d otherwise imagine.

Anyhoo, the company was worth more than 10x its annual run-rate at its IPO price if I recall the math, so it wasn’t cheap even at $24 per share. And in response to my question about pricing Bellm said that he was content with his company’s final IPO price.

He had a few reasons, including that the IPO price sets the base point for future return calculations, that he measures success based on how well investors do in his stock over a ten-year horizon, and that the more long-term investors you successfully lock in during your roadshow, the smaller your first-day float becomes; the more investors that hold their shares after the debut, the more the supply/demand curve can skew, meaning that your stock opens higher than it otherwise might due to only scarce equity being up for purchase.

All that seems incredibly reasonable. Still, VCs are livid.

The Exchange spent a lot of time on the phone this week, leading to a host of notes for your consumption. And there was a deluge of interesting data. So, here’s a digest of what we heard and saw that you should know:

Whatever the case, during our chat Fastly CEO Joshua Bixby taught me something new: Usage-based software companies are like SaaS firms, but more so.

In the old days, you’d buy a piece of software, and then own it forever. Now, it’s common to buy one-year SaaS licenses. With usage-based pricing, you make the buying choice day-to-day, which is the next step in the evolution of buying, it feels. I asked if the model isn’t, you know, harder than SaaS? He said maybe, but that you wind up super aligned with your customers.

To wrap up, as always, here’s a final whack of data, news and other miscellania that are worth your time from the week:

We’ve blown past our 1,000 word target, so, briefly: Stay tuned to TechCrunch for a super-cool funding round on Monday (it has the fastest growth I can recall hearing about), make sure to listen to the latest Equity ep, and parse through the latest TechCrunch List updates.

Hugs, fistbumps, and good vibes,

Powered by WPeMatico

Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7am PT). Subscribe here.

They say business needs certainty to succeed, but new tech startups are still getting funded aggressively despite the pandemic, recession, trade wars and various large disasters created by nature or humans. But before we get to the positive data, let’s spend some time reviewing the hard news — there is a lot of it to process.

TikTok is on track to get banned if it doesn’t get sold first, and leading internet company Tencent’s WeChat is on the list as well, plus Trump administration has a bigger “Clean Network” plan in the works. The TikTok headlines are the least significant part, even if they are dominating the media cycle. The video-sharing social network is just now emerging as an intriguing marketing channel, for example. And if it goes, few see any real opening in the short-form video space that market leaders aren’t already deep into. Indeed, TikTok wasn’t a startup story since the Musical.ly acquisition. It was actually part of an emerging global market battle between giant internet companies, that is being prematurely ended by political forces. We’ll never know if TikTok could have continued leveraging ByteDance’s vast resources and protected market in China to take on Facebook directly on its home turf.

Instead of quasi-monopolies trying to finish taking over the world, those with a monopoly on violence have scrambled the map. WeChat is mainly used by the Chinese diaspora in the US, including many US startups with friends, family and colleagues in China. And the Clean Network plan would potentially split the Chinese mobile ecosystem from iOS and Android globally.

Let’s not forget that Europe has also been busy regulating foreign tech companies, including from both the US and China. Now every founder has to wonder how big their TAM is going to be in a world cleaved back the leading nation-states and their various allies.

“It’s not about the chilling effect [in Hong Kong],” an American executive in China told Rita Liao this week about the view in China’s startup world. “The problem is there won’t be opportunities in the U.S., Canada, Australia or India any more. The chance of succeeding in Europe is also becoming smaller, and the risks are increasing a lot. From now on, Chinese companies going global can only look to Southeast Asia, Africa and South America.”

The silver lining, I hope, is that tech companies from everywhere are still going to be competing in regions of the world that will appreciate the interest.

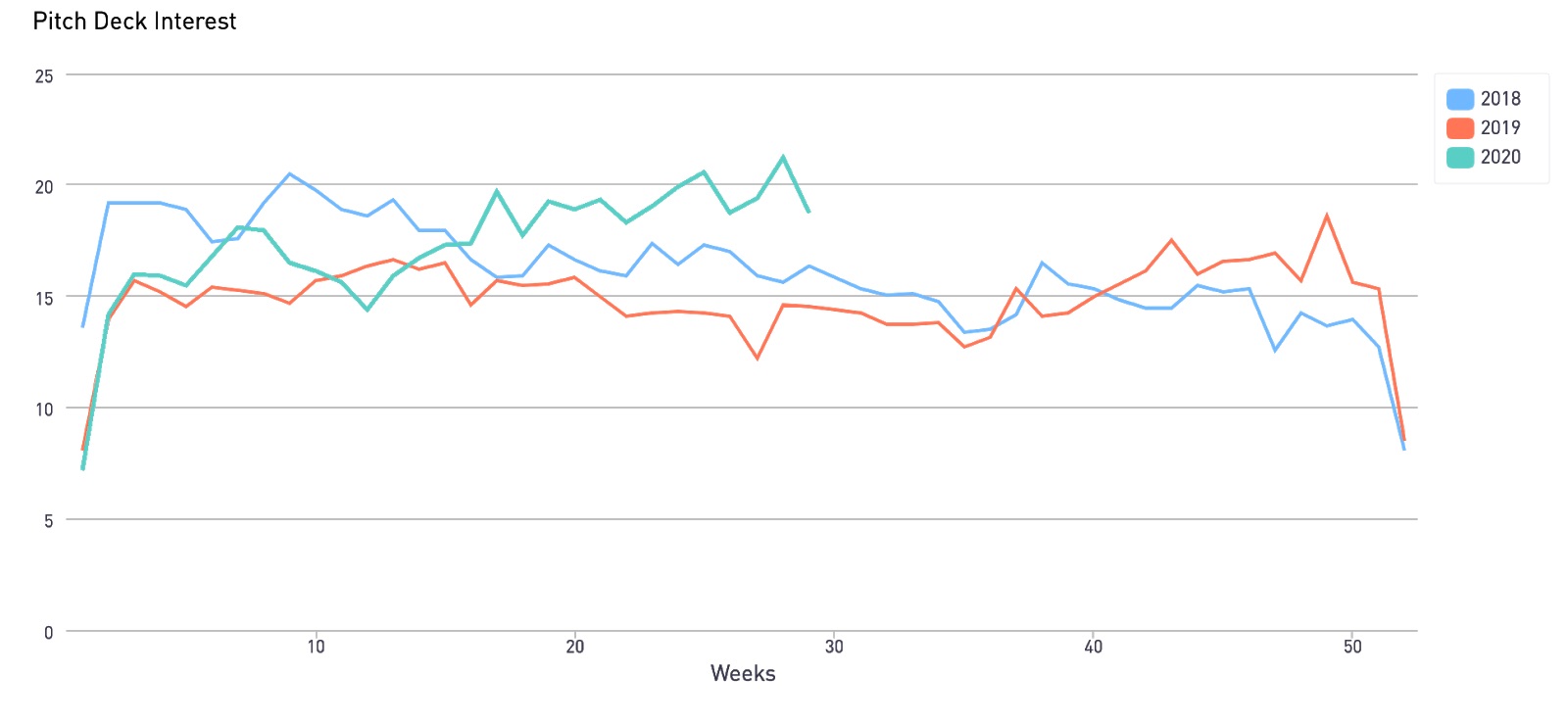

Image Credits: DocSend (opens in a new window)

A fresh analysis from our friends over at Docsend reveals that startup investment activity has actually sped up this year, at least by the measure of pitchdeck activity on its document management platform used by thousands of companies in Silicon Valley and globally (which makes it a key indicator of this hard-to-see action).

Founders are sending out more links than before and VCs are racing through more decks faster, despite the gyrations of the pandemic and other shocks. Meanwhile, many startups shared that they had cut back hard in March and now have more room to wait or raise on good terms. Docsend CEO Russ Heddleston concludes that the rest of the year could actually see activity increase further as companies finish adjusting to the latest challenges and are ready to go back out to market.

All this should shape how you approach your pitchdeck, he writes separately for Extra Crunch. Additional data shows that decks should be on the short side, must include a “why now” slide that addresses the COVID-19 era, and show big growth opportunities in the financials.

Image Credits: Cadalpe (opens in a new window) / Getty Images

“In one decade, we went from buying licenses for software to paying monthly for services and in the process, revolutionized the hundreds of billions spent on enterprise IT,” Danny Crichton observes. “There is no reason why in another decade, SaaS founders with the metrics to prove it shouldn’t have access to less dilutive capital through significantly more sophisticated debt underwriting. That’s going to be a boon for their own returns, but a huge challenge for VC firms that have been doubling down on SaaS.”

Sure, the market is sort of providing this with various existing venture debt vehicles, and by other routes like private equity (which has acquired a taste for SaaS metrics this past decade). Danny sees a more sophisticated world evolving, as he details on Extra Crunch this week. First, he sees underwriters tying loans to recurring revenues, even to the point that your customers could be your assets that the bank takes if you go bust. The trend could then build from there:

Part two is to take all those individual loans and package them together into a security… Imagine being an investor who believes that the world is going to digitize payroll. Maybe you don’t know which of the 30 SaaS providers on the market are going to win. Rather than trying your luck at the VC lottery, you could instead buy “2018 SaaS payroll debt” securities, which would give you exposure to this market that’s safer, if without the sort of exponential upside typical of VC investments. You could imagine grouping debt by market sector, or by customer type, or by geography, or by some other characteristic.

Image Credits: Hussein Malla / AP

Beirut is home to a vibrant startup scene but like the rest of Lebanon it is reeling from a massive explosion at its main port this week. Mike Butcher, who has helped connect TechCrunch with the city over the years, has put together a guide to local people and organizations that you can help out, along with stories from local founders about what they are overcoming. Here’s Cherif Massoud, a dental surgeon turned founder of invisible-braces startup Basma:

We are a team of 25 people and were all in our office in Beirut when it happened. Thankfully we all survived. No words can describe my anger. Five of us were badly injured with glass shattered on their bodies. The fear we lived was traumatizing. The next morning day, we went back to the office to clean all the mess, took measurements of all the broken windows and started rebuilding it. It’s a miracle we are alive. Our markets are mainly KSA and UAE, so customers were still buying our treatments online, but the team needed to recover so we decided to take a break, stop the operations for a few days and rest until next Monday.

Image Credits: Madrona (opens in a new window)

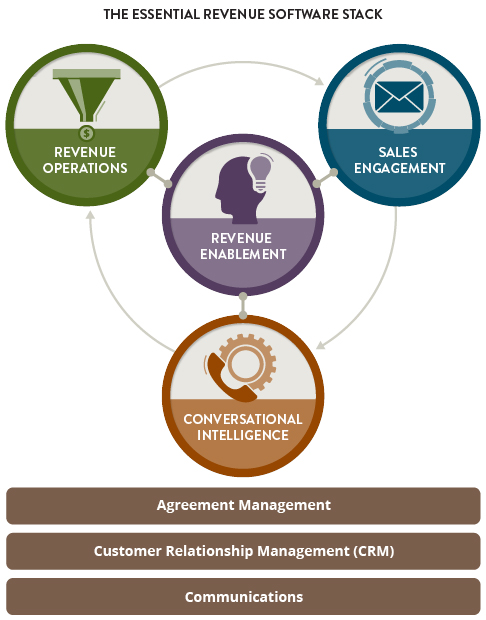

Every business has been scrambling to figure out online sales and marketing during the pandemic. Fortunately the Cambrian explosion of SaaS products began years ago and now there are many powerful options for revenue teams of all shapes and sizes. The problem is how to put everything together right for your company’s needs. Tim Porter and Erica La Cava of Madrona Venture Group have created a framework for how to build what they call the “revenue stack.” While most companies are already using some form of CRM, communications and agreement management software generally, each one needs to figure out four new “capabilities.” What they define as revenue enablement, sales engagement, conversational intelligence and revenue operations.

Here’s a sample from Extra Crunch, about sales engagement:

Some think of sales engagement as an intelligent e-mail cannon and analysis engine on steroids. While in reality, it is much more. Consider these examples: How can I communicate with prospects in a way that is both personalized and efficient? How do I make my outbound sales reps more productive and enable them to respond more quickly to leads? What tools can help me with account-based marketing? What happened to that email you sent out to one of your sales prospects?

Now, take these questions and multiply them by a hundred, or even a thousand: How do you personalize a multitouch nurture campaign at scale while managing and automating outreach to many different business personas across various industry segments? Uh-oh. Suddenly, it gets very complicated. What sales engagement comes down to is the critical understanding of sending the right information to the right customer, and then (and only then) being able to track which elements of that information worked (e.g., led to clicks, conversations and conversions) … and, finally, helping your reps do more of that. We see Outreach as the clear leader here, based in Seattle, with SalesLoft as the number two. Outreach in particular is investing considerably in adding additional intelligence and ML to their offering to increase automation and improve outcomes.

Hear how working from home is changing startups and investing at Disrupt 2020

Register for Disrupt to take part in our content series for Digital Startup Alley exhibitors

Boston Dynamics CEO Rob Playter is coming to Disrupt 2020 to talk robotics and automation

TechCrunch

The tale of 2 challenger bank models

Majority of tech workers expect company solidarity with Black Lives Matter

‘Made in America’ is on (government) life support, and the prognosis isn’t good

What Microsoft should demand in exchange for its ‘payment’ to the US government for TikTok

Equity Monday: Could Satya and TikTok make ByteDance investors happy enough to dance?

Extra Crunch

5 VCs on the future of Michigan’s startup ecosystem

Eight trends accelerating the age of commercial-ready quantum computing

A look inside Gmail’s product development process

The story behind Rent the Runway’s first check

After Shopify’s huge quarter, BigCommerce raises its IPO price range

From Alex Wilhelm:

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

As ever, I was joined by TechCrunch managing editor Danny Crichton and our early-stage venture capital reporter Natasha Mascarenhas. We had Chris on the dials and a pile of news to get through, so we were pretty hyped heading into the show.

But before we could truly get started we had to discuss Cincinnati, and TikTok. Pleasantries and extortion out of the way, we got busy:

It was another fun week! As always we appreciate you sticking with and supporting the show!

Equity drops every Monday at 7:00 a.m. PT and Friday at 6:00 a.m. PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico