Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Pattern, a Lehi, Utah-based reseller that offers large and small brands a way to optimize their sales on marketplaces like Amazon, eBay, Walmart and Google Shopping, has raised $52 million in growth funding, the company said.

The money, from Ainge Advisory and KSV Global, will be used to expand the company’s business worldwide.

Founded in 2013, the e-commerce reseller uses analytics to lock down market-specific keywords in advertising and has managed to reach a run-rate that should see it hit $500 million in annual revenue by the end of 2020, according to Pattern co-founder and chief investment officer, Melanie Alder.

Brands like Nestlé, Pandora, Panasonic, Zebra and Skechers sell their goods to Pattern in an effort to juice sales on digital marketplaces.

“Pattern represents our brands in the US, across Europe, and in select markets in Asia, selling for us on global marketplaces such as Amazon, Walmart, Tmall, and JD as well as building and managing three of our direct-to-consumer sites,” said Kyle Bliffert, CEO and president of Atrium Innovations, a Nestlé Health Science company, in a statement. “The global e-commerce growth we have experienced by leveraging Pattern’s expertise is extraordinary.”

Pattern places bets on where a product is likely to receive the most attention using specific keywords, according to the company’s chief executive, Dave Wright. The company buys products from its brand partners and then sells them widely across marketplaces in the U.S., Europe and Asia. These markets represent $2.7 trillion in total sales and Wright expects it to reach $7 trillion by 2024.

As Wright noted, a majority of searches for sales begin on Amazon . The company just opened its eighteenth location in Germany. Pattern has grown sales for brands from $3 million to $26 million and the company makes money off of the margin on the sales of products. With the new funding, the company intends to expand into other geographies like Japan and India.

Wright says his company addresses one of the fundamental problems with advertising technology — the proliferation of tools hasn’t meant better optimization for most brands, because they’re teams aren’t equipped to specialize.

While there may be hundreds of different advertising and marketing folks working at a company, each company may have hundreds of brands that it sells and the dedicated teams to specific brands may only have one or two people on staff.

“Data makes all the difference,” said co-founder and CEO Dave Wright. “I’ve spent the bulk of my career in data science and data management, and our ability to detect and act on ‘patterns’ on e-commerce platforms has allowed the brands we represent to be incredibly successful.”

Powered by WPeMatico

This year’s TC Sessions: Mobility on October 6 & 7 will be a fantastic opportunity to find out all the latest on advancements in autonomy, micromobility, transportation AI and much more. Argo AI co-founder and CEO Bryan Salesky is among the best-positioned people in the world to speak to all those topics, and how they intersect with both the startup world and legacy automaker giants like Ford and Volkswagen.

Salesky has a long history of focusing on the intersection of robotics and transportation, dating all the way back to his work at the Carnegie Mellon University National Robotics Engineering Center, and CMU’s DARPA Urban Challenge winning competition entry in 2007. He was also an early team member for Google’s self-driving car project, which would eventually become Waymo, overseeing the search company’s self-driving sensor, computer and vehicle hardware platform.

Since founding Argo AI in 2016, Salesky has also been at the center of some of the biggest and most influential developments in the autonomous vehicle industry. The startup first made waves with a $1 billion investment from automaker Ford in 2017, which gave Ford a majority stake in the venture. Then in 2019, Volkswagen announced a $2.6 billion investment in Argo, putting it at the center of the self-driving stack of now just one, but two of the world’s largest car companies.

As of July, Argo’s valuation sits at around $7.5 billion, making it a unicorn many times over. We’ll hear from Salesky how the company is helping both these industry heavyweights prepare for an autonomous future. We’ll also talk about the path to commercialization of these services, and how soon we can think about seeing them in active use as consumers.

Get your tickets for TC Sessions: Mobility to hear from Bryan Salesky, along with several other fantastic speakers from Porsche, Waymo, Lyft and more. Tickets are just $145 for a limited time, with discounts for groups, students and exhibiting startups. We hope to see you there!

Powered by WPeMatico

Till, a platform that serves as an intermediary between landlords and renters, has raised an $8 million seed round led by Route 66 Ventures, with participation from MetaProp and NextGen Venture Partners.

Till was founded on the premise that people are not always able to pay their rent on the 1st of the month, but might be better suited to paying their rent in smaller payments throughout the month. Through its flexible rent platform, Till creates a customized payment schedule for renters that aligns with their monthly cash flow. Till estimates it can help cut evictions by as much as 50%.

“We work to understand that timing and we can look at their expense loads to help them balance if they should be paying more now or more later in the month,” Till CEO David Sullivan told TechCrunch.

With the funding, Till plans to work on getting more landlords on board across additional states and further develop the flexible rent product. In order for renters to use the platform, their landlords must already be working with Till. To date, Till is live at 170 properties that consist of 30,000 units in total across 14 states.

“Since we first learned about Till, we have been extremely impressed by its ability to bridge the gap between the increasingly volatile income and expense patterns of renters and the more rigid financial realities of landlords,” MetaProp General Partner Zak Schwarzman said in a statement. “As the uncertainty wrought by the COVID-19 pandemic and related economic fallout continues with no clear end in sight, it’s more important than ever that landlords find new, mutually beneficial, ways to work with renters to reduce late fees, minimize evictions and foster renters’ long-term financial health.”

Late fees vary by state and by landlord. Sometimes they come in the form of a flat fee or a percentage of your rent. Either way, they’re punitive.

“It’s a very punitive fee against a renter having a cash flow issue,” Sullivan said. “Even if a renter has the ability to stay in the unit, renters then get overburdened with fees, which makes their ability to pay even more challenging.”

While this product may have more relevance these days, during a time when people are facing severe economic insecurity as a result of COVID-19, Sullivan said this problem is not specific to the pandemic. Though, COVID-19 has exacerbated the issue.

“Pre-Covid, you have about $50 billion of delinquent rent a year and renters being charged about $5 billion in late fees,” Sullivan said. “That creates a burden on renters. It leads to three million families being evicted in a normal year. And evictions disproportionately impact minority communities.”

The business model, however, relies on financial insecurity, as Till’s target customer is someone who already struggles to make their monthly rental payments. For its flexible rent product, Till charges renters $3 per month if they make all of their payments on time, and $9 per month if they don’t. Till also offers a rental loan product for renters with varying rates.

“We want to create win-win outcomes,” Sullivan said. “We fundamentally believe that when you get renters to succeed, landlords succeed to.”

Powered by WPeMatico

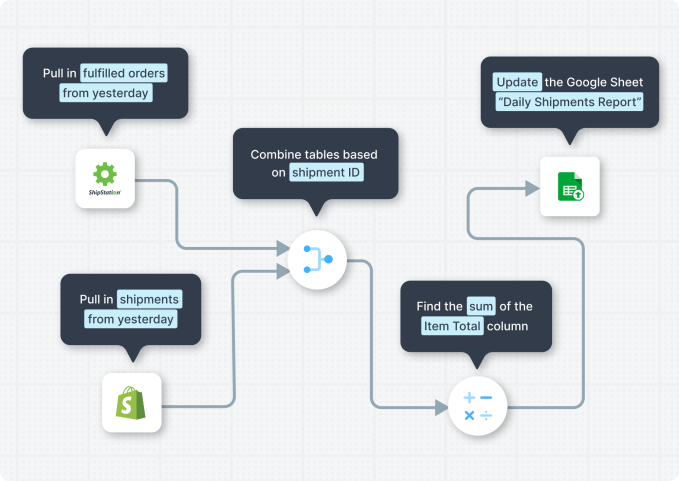

Many workers today are still stuck doing a bushel of manual tasks, copying and pasting data into spreadsheets, sending out the same emails every morning and generally lacking any kind of automation because they lack coding skills. Parabola wants to change that with a simple drag and drop workflow setup, and today the startup announced an $8 million Series A investment.

Matrix Partners led the round with participation from Thrive Capital and various individual investors. Ilya Sukhar from Matrix will be joining the Parabola board under the terms of the agreement. The company has now raised $10.2 million, including a $2.2 million seed round in 2018.

At the same time, the company also announced a new Shopify connector. As COVID has forced a dramatic increase in online shopping, Parabola has seen a corresponding increase in demand for its workflow automation services from e-commerce vendors, and they have added functionality to support that.

Company founder and CEO Alex Yaseen sees the tool as a way to bring programming-like automation to anyone who deals with data tasks on a regular basis, particularly in a spreadsheet. “We’re a drag and drop productivity tool, and we like to say we bring the power of programming to everybody,” Yaseen told TechCrunch.

They do this by providing a library of pre-built steps that you can drag and drop onto a workflow canvas. Each of those steps helps you automate what was previously a manual, repetitive data task in Excel or Google Sheets.

Image Credits: Parabola

Lead investor Sukhar says that while low code is becoming more popular right now, he and Yaseen have always seen it as a way to bring programming-level productivity enhancing skills to a much broader set of users, and to bring that focus to e-commerce in particular.

“The real trick is finding the right set of users, the right abstraction, the right niche to start with and that’s where I think this goes back to the e-commerce focus. I think that’s what’s super exciting about the approach Parabola has taken, and what got me excited,” he said.

As e-commerce in general surges during the pandemic, Yaseen says he has seen a corresponding increase in usage on the platform over the last couple of months as retail companies move online or increase their online presence and need to find ways to automate more of their internal processes to keep up.

While the company is still in its early stages of development with around 20 employees, it is actively hiring and looking to build a diverse workforce as it does. Yaseen sees this tied to the company’s overall mission of bringing programming level skills to a larger group of people who don’t know how to code, and they need a diverse set of workers that reflects society at large to build that effectively.

“We talk about this as a core authentic value, and I think we’ve done a pretty good job so far. I think we have a lot of room for improvement, as does the tech industry as a whole, but we are pushing very hard,” he said.

The company wants to use the money from this round to keep refining the design of the platform to make it even easier for non-technical users. “This round is very much for product and design work to make it increasingly comfortable for these users who are today really familiar with doing their tasks in spreadsheets […] and increasingly working towards a less and less technical user, as we make products easier and more approachable,” he said.

Powered by WPeMatico

Venture capitalists and other investors have poured capital into fintech startups around the world in recent years, including a record number of rounds worth $100 million or more in the second quarter of 2020. In Q2 2020 venture-backed fintech startups raised 28 nine-figure rounds, underscoring the scale of the bet investors are making on fintech’s long-term success.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Inside that fintech wave are various hubs of activity, including payments tech, investing and banking. That last category has helped give rise to so-called neobanks, startup banking entities that offer mobile-first, consumer-friendly banking tools and services. Given the old-fashioned nature of banking in many countries (and how far out of reach banking remains for many) neobanks have seen strong uptake by users in recent years.

And the startup cohort has raised oceans of capital to help fuel its growth. In America, Chime was most recently valued at $5.8 billion after raising hundreds of millions in late 2019. More recently, neobank Revolut added $80 million to its Q1 2020 round worth $500 million. Revolut is also worth north of $5 billion. Monzo is well-funded (albeit at a recent valuation reduction), Latin America-focused NuBank is worth $10 billion, according to Crunchbase, Starling recently raised another £40 million, while Germany’s N26 is worth over $3 billion after its most recent nine-figure round.

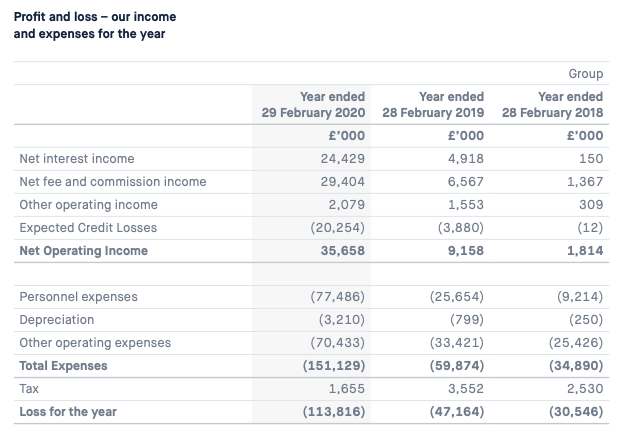

From the fundraising perspective, then, neobanks are killing the game. And thanks to recent tailwinds from the COVID-19 pandemic that have bolstered interest in savings-related products, many of the same entities could be enjoying a strong year thus far. But recent self-reporting of some neobank’s 2019-era results details ample red ink — perhaps more than we might have anticipated.

From the fundraising perspective, then, neobanks are killing the game. And thanks to recent tailwinds from the COVID-19 pandemic that have bolstered interest in savings-related products, many of the same entities could be enjoying a strong year thus far. But recent self-reporting of some neobank’s 2019-era results details ample red ink — perhaps more than we might have anticipated.

Of course, startups don’t raise money for fun; they raise it to invest it in their operations and drive scale. So, we knew that these megafundraisers were losing money on purpose. All the same, let’s peek at the economics of several neobanks, as their now dated and thus not at all current results can provide useful context on two points: Why investors are excited to put their capital to work in neobanks, and why neobanks always seem to have another check to announce.

To prevent my receiving unhappy emails from irked fans of these companies, please bear in mind that we’re looking several quarters back when observing the following results.

It would be lovely to have more recent data, but with European neobanks reporting their — roughly — 2019 results in recent weeks, this is what we have. We are going to parse the numbers, but we will not conflate past performance with current results. We do not know much about 2020 neobank financial performance.

Anyhoo, to the numbers. You can read the full documents from Monzo here, Starling here (or here, if that link is struggling) and Revolut here.

Let’s start with Monzo, which has a clear set of figures for us to peek at:

Image Credits: Monzo

Powered by WPeMatico

As the COVID-19 epidemic spread across the U.S. earlier this year, Nurx, like most other digital providers of healthcare and prescription services, saw a huge spike in demand.

Now, with $22.5 million in new financing and a surging annual run rate that could see the company hit $150 million in revenue, the company is emerging as the largest digital practice for women’s health.

“We saw this tremendous surge in need for our contraception and sensitive health services,” says Nurx chief executive Varsha Rao .

The growth hasn’t come without controversy. Only last year, a New York Times article pointed to corner cutting at the startup, which boasts Chelsea Clinton as an investor and advisor.

Undeterred, Rao said the company has now seen tremendous acceleration in all areas of its business. It’s now providing care to more than 300,000 patients on a monthly basis, boasts that $150 million run rate and has new investors like Comcast Ventures, Trustbridge and Wittington Ventures — the investment arm of one of the largest pharmacy chains in Canada, Shoppers Drug Mart.

The new $22.5 million is an extension on the company’s previous $32 million round and will take the company to profitability by 2021, according to Rao.

And while birth control and contraception are still the largest areas of the company’s business, Nurx is growing its range of services, seeing adoption of its testing for sexually transmitted infections including HPV and herpes and a new treatment area for migraines.

That focus on sexual health and what the company calls sensitive health is different from trying to be a primary care provider, says Rao. “Our real focus right now is on our core demographic who are women between the ages of 20 and 40 and really focusing on their needs,” she says. “That’s why migraines make a lot of sense. It’s not exclusively hormone-related, but it often is… One-in-four women experience migraines and they’re largely from hormonal changes… This is a condition we’re well-positioned to address.”

Another way that Nurx differentiates itself from competitors like Hims and Ro, which provide women’s health and contraceptive prescriptions as well, is through its ability to take insurance. “It’s actually pretty challenging to build the system to actually offer insurance,” says Rao. “And yet, we don’t think you can be a true healthcare company if you don’t accept insurance.”

Powered by WPeMatico

Sonny Vu, the former founder and chief executive of the wearable technology company Misfit, has had a busy summer since he was named the new chief executive of 3D printing technology company Arevo.

Vu’s new startup brought on a new executive management team, launched a crowdfunding campaign for its 3D-printed Superstrata bicycle and is now announcing the close of a $25 million financing round to support the growth of its business.

It’d be a lot for anyone to take on even if it didn’t happen in the middle of a global pandemic. But Vu, a serial entrepreneur whose last business went head-to-head with Apple before it was acquired by Fossil for $260 million, doesn’t shy away from challenges.

Vu was first introduced to Arevo in 2019 and was initially going to come on as an advisor to the company. Since the acquisition of Misfit he had been investing from Alabaster, his personal investment vehicle. First introduced by Vinod Khosla, an investor in the business, Vu quickly moved from being an advisor to an executive at the helm of the business and an investor providing bridge financing until the company could close its latest round.

Vu had initially intended to start his own business, but was drawn to Arevo’s potential. “3D printing is about making things slowly and in small quantities. With Arevo’s technology you can make big things quite fast,” Vu said in an interview.

Several companies are attempting to take 3D printing into heavy industry and large-scale manufacturing. Relativity raised $140 million in its most recent financing to make rockets using 3D printers, Velo3D is a supplier of 3D printers to SpaceX and now Arevo has $34 million for its efforts to scale 3D printers. Of course, all of these investments pale in comparison to the whopping $438 million that Desktop Metal has raised for its 3D printing tech.

“Arevo is a compelling opportunity for us as it combines our three main investment foci: consumer internet, enterprise, and smart tech. We see fantastic potential in this market, and have backed Sonny before at Misfit,” said Hans Tung, in a statement. “Arevo is led by an experienced team with solid technological foundation and 3D printing manufacturing know-how at scale – to offer breakthrough products at competitive prices.”

Arevo already has a successful proof of concept with its Superstrata bicycle and manufacturing facilities in Vietnam that are intended to prove that the company’s technology will work as expected.

“We’re making this bike to make a point that we can make complex shapes at a pretty large scale,” Vu said. Unlike other companies that sell their printers to manufacturers, Arevo intends to sell parts. That’s because the printers are a pretty hefty ticket for anyone to buy. At $1 million to $1.4 million, it’s a big ask for a company to acquire if it wants to start using 3D printing.

On top of that cost, Vu said candidly that the company’s Achilles’ heel was the post-manufacturing treatment process required to finish the pieces. And while Arevo already counts automotive and aerospace companies as customers (including Airbus, which previously invested in the business), Vu wants to bring this to consumers. “We’ve had tennis racquet companies, golf clubs, surfboards,” approach Arevo about using the company’s technology, Vu says.

“We can do about two frames per day per machine,” Vu says of the latest production rates. “And coming up with our next-gen system we can do about six frames per day.”

The ascension of Vu to the chief executive position and the new capital infusion marks the latest chapter for Arevo, which is on its third chief executive since it was founded. Two years ago, Jim Miller, a former Amazon and Google executive, was brought on board to take the reins at the company. Miller’s appointment coincided with a $12.5 million investment round led by Asahi Glass, with Sumitomo Corp., Leslie Ventures and Khosla Ventures participating. Miller was involved with collaborating with Studio West on the design of its Superstrata bike.

Now, Defy Partners and GGV Capital are joining to lead the company’s Series B round with participation from Khosla Ventures, Alabaster and others. Brian Shin, a scout with Defy Ventures is joining the board, which now counts Bruce Armstrong, from Khosla Ventures, and Hemant Bheda, Arevo’s co-founder, as directors (along with Vu).

“Arevo’s new platform enables fabrication of high-strength, low-weight carbon fiber parts, currently not possible with today’s standard techniques,” said Trae Vassallo, founding partner at Defy. “We are thrilled to be working with the team to help scale up this incredibly impactful technology.”

Powered by WPeMatico

It seems the pandemic has forced the business world to digitize faster, and the industrial sector is no different. Parsable, a San Francisco startup that is helping digitize industrial front-line workers, announced a $60 million Series D today.

Activate Capital and Glade Brook Capital Partners co-led the round. They got help from new investors Alumni Ventures Group, Cisco Investments, Downing Ventures, Evolv Ventures and Princeville Capital, along with existing investors Lightspeed Venture Partners, Future Fund, B37 Ventures, Honeywell and Saudi Aramco. Today’s money brings the total raised to more than $133 million, according to the company.

As I wrote at the time of the company’s $40 million Series C in 2018, “Parsable has developed a Connected Worker platform to help bring high tech solutions to deskless industrial workers who have been working mostly with paper-based processes.”

CEO Lawrence Whittle says that while the pandemic has shut some factories, and reduced overall worker headcount, it has still led to increased usage on the platform of companies whose products are considered essential services. What’s more, Parsable’s ability to deal with information on an individual mobile device or laptop means that in many cases, workers can stay separated and not share computers on the factory floor, making the process safer.

“Fortunately, the majority of our focus is in what’s often deemed as essential industries — so consumer packaged goods (CPG), food, beverage, agriculture and related industries such as paper and packaging. Those markets, interestingly enough, predominantly because of consumer demand continue to operate pretty successfully from a demand perspective during this COVID period,” Whittle told TechCrunch.

While the company would not give specific growth numbers, they shared that registered users grew 11x and the number of deployed sites tripled year over year. What’s more, they have users in more than 100 countries encompassing 14 languages.

With the money, the company wants to expand internationally into Asia, EMEA and Latin America. The startup has 120 employees, but plans to hire for essential needs over the next several months, preferring to be conservative and seeing where the pandemic takes the economy in the coming months.

Whittle points out that the diversity of its user base, and the desire to expand into other regions demands that they have a more diverse employee base, even while it’s a clear ethical consideration, as well.

“When you’re serving customers in over 100 countries, and you provide a product in in 14 languages, [having] diversity and inclusion is to some extent a given. What we’re doing as a company […] is taking every opportunity to further lean into that and that’s one of the leading lights of our of our business,” Whittle said.

Parsable launched in 2013. It took a few years to build the product. Today, customers include Georgia-Pacific, Henkel and Shell.

Powered by WPeMatico

Running a startup accelerator comes with a number of occupational hazards, but “skepticism is the easiest thing to fall into when you’ve seen too many companies,” said Y Combinator President Geoff Ralston, “and it’s the thing you have to avoid the most.”

Ralston joined me last week for an hour-long Extra Crunch Live interview where we talked about several topics, including how YC has adapted its program during the pandemic, why he has “never stopped coding” and what he sees changing in tech.

“We try to not be too smart, because great founders often see things beyond what you’re seeing,” he said. “If you try to be too smart, you’ll miss the Airbnbs of the world. You’ll say ‘Airbeds in peoples houses? That’s stupid! I’m not going to invest in that,’ and you could’ve bought 10% of Airbnb for like nothing back then… 10% of that company… you can do your own math.”

Extra Crunch Live is our new virtual event series where we sit down with some of the top founders, investors and builders in tech to glean every bit of insight they care to share. We’ve recently been joined by folks like Hunter Walk, Kirsten Green and Mark Cuban.

To watch the entire interview with Geoff Ralston, sign up for ExtraCrunch — but once you’ve got that covered, you can find it (and a bunch of key excerpts from the chat!) below.

I prefer it when an Extra Crunch Live conversation starts out with actionable advice, so we kicked things off with any suggestions Ralston had for folks looking to apply to YC. And he had plenty! Such as:

Later in the video (around the 40:55 mark), a question from the audience leads Ralston back to the topic, and he has a few more pieces of advice:

Powered by WPeMatico

The team at DoubleVerify, a company that helps advertisers eliminate fraud and ensure brand safety, said that it’s recently identified a new tactic used by ad fraudsters seeking to make money on internet-connected TVs.

Senior Vice President of Product Management Roy Rosenfeld said that it’s harder for those fraudsters to create a legitimate-looking TV app — at least compared to the web and mobile, where “you can just put up a site [or app] to generate content.” For a connected TV app, you need lots of video, which can be costly and time-consuming to produce.

“What these guys have started to do is take old content that’s in the public domain and package that in fancy-looking CTV apps that they submit to the platform,” Rosenfeld said. “But at the end of the day, no one is really watching the old westerns or anything like that. This is just a vehicle to get into the app stores.”

As noted in a new report from the company (which will soon be available online), DoubleVerify said it has identified more than 1,300 fraudulent CTV apps in the past 18 months, with more than half of that coming in 2020.

The report outlined a process by which fraudsters create an app from this content (often old TV and movies from the ’50s and ’60s that has fallen into the public domain); submit the app for approval from Roku, Amazon Fire or Apple TV; then, with the additional legitimacy of an app store ID, generate fake traffic and impressions.

Rosenfeld compared this to a previous boom in flashlight apps for smartphones: “Are there legit flashlight apps? Absolutely. But most of them were not.” In the same way, he argued, “This is not a testament about public domain content overall, it’s not to say that there aren’t legit channels and apps out there that people are consuming and enjoying” — it’s just that many of the public domain apps being submitted are used for ad fraud.

To avoid paying for fake impressions, DoubleVerify recommends that advertisers advocate for transparency standards, buy from platforms that support third-party verification and, of course, buy through ad platforms certified by DoubleVerify.

Powered by WPeMatico