Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

For the third time since last February, Gong has raised a significant sum. In February, the company scored $40 million. In December, it grabbed another $65 million. And today, it was $200 million on a $2.2 billion valuation. That’s a total of $305 million in less than 18 months.

Coatue led today’s cash infusion, with help from new investors Index Ventures, Salesforce Ventures and Thrive Capital, and existing investors Battery Ventures, NextWorld Capital, Norwest Venture Partners, Sequoia Capital and Wing Venture Capital. It has now raised a total of $334 million, according to the company.

What is attracting this kind of investor attention? When we spoke to Gong about its Series B round, it had 300 customers. Today it has around 1,300, representing substantial growth in that time period. The company reports revenue has grown 2.5x this year alone.

Gong CEO Amit Bendov says his company is trying to create a category they have dubbed “revenue intelligence.” As he explains it, today sales data is stored in a CRM database consisting of descriptions of customer interactions as described by the salesperson or CSR. Gong is trying to transform that process by capturing both sides of the interaction, then, using artificial intelligence, it transcribes and analyzes those interactions.

Bendov says the pandemic and economic malaise has created a situation where there is a lot of liquidity in the market and investors have been looking for companies like his to invest some of it.

“There’s a lot of liquidity in the market. There are very few investment opportunities. I think the investment community was waiting a little bit to see how the market shakes out […] and they are betting on companies that could benefit long-term from the new normal, and I think we’re one of them,” Bendov told TechCrunch.

He says that he wasn’t looking for money, and in fact still is operating off the Series B investment, but when firms come knocking with checkbooks open and favorable terms, he wasn’t about to turn them down. “There are CEOs schools [of thought] that tell you to raise money when you can, not when you need to. It’s not very diluted at this kind of valuation and it was a very easy process. […] The whole deal closed in 14 days from term sheet to money in the bank,” he said.

Bendov said that taking the money was “pretty much a no-brainer.” In fact, he says the money gives them the freedom to operate and further legitimacy in the marketplace. “It gives us the ability to buy companies, make strategic investment, accelerate plans, and it also, especially since we cater to large enterprise customers, it gives them confidence that this company is here to stay,” he said.

With around 350 employees today, it hopes to add 100 people by the end of the year. Bendov says diversity and inclusion is a “massive priority” for the company. Among the steps they’ve taken recently is opening a recruiting hub in Atlanta to bring more diverse candidates into the company, working with a company called FlockJay to train and hire underrepresented groups in customer success roles, and in Israel where the company’s R&D center is located, helping members of the Arab community with computer science backgrounds to learn interview skills. Some of those folks will end up working for Gong, and some at other places.

While the company has grown remarkably quickly and has shown great promise, Bendov is not thinking ahead to an IPO just yet. He says he wants to grow the company to at least a couple of hundred million dollars in sales, and that’s two to three years away at this point. He certainly has plenty of cash to operate until then.

Powered by WPeMatico

Adaptive Shield, a Tel Aviv-based security startup, is coming out of stealth today and announcing its $4 million seed round led by Vertex Ventures Israel. The company’s platform helps businesses protect their SaaS applications by regularly scanning their various setting for security issues.

The company’s co-founders met in the Israeli Defense Forces, where they were trained on cybersecurity, and then worked at a number of other security companies before starting their own venture. Adaptive Shield CEO Maor Bin, who previously led cloud research at Proofpoint, told me the team decided to look at SaaS security because they believe this is an urgent problem few other companies are addressing.

Pictured is a representative sample of nine apps being monitored by the Adaptive Shield platform, including the total score of each application, affected categories and affected security frameworks and standards. (Image Credits: Adaptive Shield)

“When you look at the problems that are out there — you want to solve something that is critical, that is urgent,” he said. “And what’s more critical than business applications? All the information is out there and every day, we see people moving their on-prem infrastructure into the cloud.”

Bin argues that as companies adopt a large variety of SaaS applications, all with their own security settings and user privileges, security teams are often either overwhelmed or simply not focused on these SaaS tools because they aren’t the system owners and may not even have access to them.

“Every enterprise today is heavily using SaaS services without addressing the associated and ever-changing security risks,” says Emanuel Timor, general partner at Vertex Ventures Israel . “We are impressed by the vision Adaptive Shield has to elegantly solve this complex problem and by the level of interest and fast adoption of its solution by customers.”

Onboarding is pretty easy, as Bin showed me, and typically involves setting up a user in the SaaS app and then logging into a given service through Adaptive Shield. Currently, the company supports most of the standard SaaS enterprise applications you would expect, including GitHub, Office 365, Salesforce, Slack, SuccessFactors and Zoom.

“I think that one of the most important differentiators for us is the amount of applications that we support,” Bin noted.

The company already has paying customers, including some Fortune 500 companies across a number of verticals, and it has already invested some of the new funding round, which closed before the global COVID-19 pandemic hit, into building out more integrations for these customers. Bin tells me that Adaptive Shield immediately started hiring once the round closed and is now also in the process of hiring its first employee in the U.S. to help with sales.

Powered by WPeMatico

Tomorrow’s a big day for early-stage startup founders preparing to exhibit in Digital Startup Alley at Disrupt 2020. We’re kicking off the first of three exclusive, interactive webinars to help exhibitors make the most of their Startup Alley experience.

Tune in tomorrow, August 12 at 1 p.m. PT/ 4 p.m. ET for The Dos and Don’ts of Working with the Press. Presenting your company to the media is both a skill and an art form. It takes thought and practice — and media training can help you craft a compelling story. Hundreds of journalists from around the world will be on the lookout for compelling stories at Disrupt 2020, and this workshop can help you catch their eye.

Positive media exposure is essential for early-stage startups. It can drop a spotlight on your business, help attract potential customers and jumpstart your funding. Or, as Luke Heron, CEO of TestCard and veteran Startup Alley exhibitor puts it:

“Coverage is the life blood of a startup. Cash at the beginning of the start-up journey is difficult to come by, and an article from a credible organization can help push things in the right direction.”

During tomorrow’s media training, TechCrunch writers and editors Greg Kumparak, Anthony Ha and Ingrid Lunden — experts at interviewing startup founders — will discuss best practices when it comes to talking with the press. You’ll learn what journalists look for and how to avoid pitfalls that could tank an interview.

If you’re still on the fence about exhibiting in Startup Alley, consider this: Disrupt 2020 spans five days and it’s the biggest, longest Disrupt ever. You’ll be able to network with thousands of attendees from around the world. And if you purchase your Disrupt Digital Startup Alley Package today, you can attend tomorrow’s media training.

You’ll also be able to attend two more webinars exclusively for Startup Alley exhibitors later this month. Check ’em out and mark your calendar now!

Got your Digital Startup Alley Package? Then tune in tomorrow for The Dos and Don’ts of Working with the Press and get ready to make your best possible impression with the press at Disrupt 2020.

Is your company interested in sponsoring or exhibiting at Disrupt 2020? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

The automotive industry is knee deep in the vast transition to electric, but one place where gas is still going strong is out on the water. Seattle startup Zin Boats wants to start what you might call a sea change by showing, as Tesla did with cars, that an electric boat can be not just better for the planet, but better in almost every other way as well.

With a minimalist design like a silver bullet, built almost entirely from carbon fiber, the 20-foot Z2R is less than half the weight of comparable craft, letting it take off like a shot and handle easily, while also traveling a hundred miles on a charge — and you can fill the “tank” for about five bucks in an hour or so.

Waiting for the other shoe to drop? Well, it ain’t cheap. But then, few boats are.

Piotr Zin, the company’s namesake, has been designing racing sailboats for 20 years, while working in industrial design at BMW, GM and other major companies. Soon after settling down on a houseboat on Seattle’s Lake Union, he realized that the waterways he had enjoyed his whole life might not exist for the next generation.

(Disclosure: Zin actually moved in next door to my mother, and I happened to find out he was working on this while visiting her.)

“The reason I started working on electric boats specifically is because I had a kid, and I had a come to Jesus moment,” he told me. “I realized: If we’re not going to do something personally about the quality of the water we live in, it’s not going to be here when my kid is my age.”

Traditional gas-powered boats are very much a product of the distant past, like running a ’70s-era car half underwater. Surprisingly, electric boats are equally old. Like electric cars, they enjoyed a brief vogue in the early 20th century. And likewise they were never considered viable for “real” boating until quite recently.

Like most things, it comes down to physics: “The power required to move a boat, versus the power to move a car, is absolutely enormous,” Zin explained. “It’s like driving a car in first gear at full throttle all the time.”

That level of draw limited electric boats to being the aquatic equivalent of golf carts — in fact, carts and some of the more popular old-school electric boats share many components. If you’ve ridden in one, it was probably a Duffy, which has made models for puttering around lakes at 3-4 knots since the ’60s. Perfectly pleasant, but not exactly thrilling.

“We tested this boat to 55, but decided not to sell that to people. It’s just insane.”

What changed everything was the increasing density and falling cost of lithium-ion batteries. The Z2R uses BMW batteries mated to a custom Torqeedo engine, and at cruising speeds (say 15 knots) can go a hundred miles or more. It recharges using anything from an ordinary wall plug to the high-amperage charging cables found at most marinas, in which case it will put another 50 miles in the tank while you eat a sandwich.

Considering traditional boats’ fuel efficiency and the rising price of marine gas, going electric might save a boat owner thousands every year. (Maintenance is also practically non-existent; Zin advised hosing it down once in a while.)

But it’s also more than capable of going extremely fast.

“The top speed is way over 30 knots,” Zin noted. “We tested this boat to 55, but decided not to sell that to people. It’s just insane.”

Having ridden in it myself, I can confirm that the Z2R really jumps off the line in a level-bottomed way that, compounded by its near silence, seems impossible. Just as Tesla’s consumer sedans compete with Lamborghinis in 0-60 times, the instantaneous response is almost frightening.

“The boat was designed around the battery. The unique part of using an electric system is we can put the motor anywhere we want,” Zin said. By sitting it flat on the bottom, the center of gravity is lowered and weight distribution evened out compared to most speedboats. “You look at a lot of traditional boats’ builds, they kind of cram everything in the back. Then when you put the hammer down, you can’t see anything for five seconds. In this boat, there’s no bow rise — it sits flat.”

Being so level means there’s almost no risk of overturning it, or many of the other failure modes resulting from lopsided designs that misbehave at speed. Simplicity of operation and surprising performance seem to be a family characteristic of electric vehicles.

“Most builders aren’t about innovation, they’re about ‘this is how we do it.’ “

Zin is proud to have designed the boat himself from scratch, using both high-performance fluid dynamics software and scale models to work out the shape of the hull.

“Boat building is a very traditional business. Most builders aren’t about innovation, they’re about ‘this is how we do it.’ ” Zin said. “But there’s a huge advantage in being able to use these tools. The computing power that we have in video cards just in the last few years, mainly because of the gaming industry, has pushed what’s possible further and further.”

Previously, large computational fluid dynamics suites would have users submit their parameters and pick a few milestone speeds at X thousand dollars per data point — 10 knots, 20 knots, etc. The way the water would react to the boat and vice versa would be calculated at those speeds and extrapolated for speeds in between. But with increases in computing power, that’s no longer necessary, as Zin ended up proving to a commercial CFD software provider when he used a separate compute stack to calculate the water’s behavior continuously at all speeds and in high definition.

“Right now you can run the boat [in the simulation] at any speed you want and see the way the water will spray, including little droplets. And then you can tweak the shape of your hull to make sure those droplets don’t hit the passengers,” he said. “It’s not exactly the way most boat designers would do it. So utilizing high-end software that was not really being given its full potential was amazing.”

Building practically everything out of carbon fiber (an ordeal of its own) puts the whole boat at around 1,750 pounds — normally a 20-foot boat would be twice that or more. That’s crucial for making sure the boat can go long distances; range anxiety is if anything a bigger problem on the water than on the road. And of course it means it’s quick and easy to control.

Yet the boat hardly screams speed. The large open cockpit is flat and spacious, with only a steering wheel, throttle and screens with friendly readouts for range, media controls GPS and so on. There’s no vibration or engine roar. No aesthetic choices like stripes or lines suggest its explosive performance. The wood veneer (to save weight — and it’s tuned to the speakers to provide better sound) floor and cream leather upholstery make it feel more like a floating Mercedes.

That’s not an accident. Zin’s first customers are the type of people who can afford a boat that costs $250,000 or so. He compared it to Tesla’s Roadster: A showy vehicle aimed at the high end that will fund and prove out the demand for a more practical one — an open-bow tender model Zin is already designing that will cost more like $175,000.

The target consumer is one who has money and an eco-conscious outlook — either of their own or by necessity.

“There are a lot of inquiries from Europe, where the environmental restrictions are stricter than in North America. But we also have a number of pristine lakes that are electric-only for the purpose of keeping them clean,” Zin explained. “So if you live on a lake in Montana that’s electric-only, you have the option to go at five knots, and you can’t even cross the lake because the boat is so slow… or you can have a fully functional powerboat that you can water ski behind, the same speeds you get in a gas power boat, but it’s absolutely emissions free. I mean, this boat is as clean as it gets — there’s zero oil, zero gasoline, zero anything that will get into the water.”

It really made me wonder why the whole industry didn’t go electric years ago. And in fact there are a few competitors, but they tend to be even more niche or piecemeal jobs, mating an electric engine to an existing hull and saying it’s an electric boat that goes 50 knots. And it does — for five or 10 minutes. Or there are custom boat builders who will create something quite nice for a Zin-type customer — head on over to Monte Carlo and buy one at auction for a couple million bucks.

Zin sees his boat as the first one to check every box and a few that weren’t there before. As fast as a powerboat but nearly silent; same range but a fraction of the price to get there; handles like a dream but requires practically no maintenance. It’s as smart as the smartest car, limiting its speed based on the waterway, automatically adjusting itself to stay within range of a safe harbor or charger, over-the-air updates to the software anywhere in the world. I didn’t even get a chance to ask about its self-driving capabilities.

As a first-time founder, a technical one at that, of a hardware company, Zin has his work cut out for him. He’s raised seed money to get the prototype and production model ready, but needs capital to start filling his existing orders faster. Like many other startups, he was just gearing up to go all out when the pandemic struck, shutting down production completely. But they’re just about ready to start manufacturing again.

“I realized that there isn’t such a thing as a boat company any more,” said Zin. “Part of what we do is to build that shell that holds everything, and it happens to be moving through the water, which makes it a boat, but that’s really where the boating part of it ends. It’s really a technology hub, and my company is not just a boat company, it has to be a technology company.”

He said that his investors understand that this isn’t a one-off toy but the beginnings of an incredibly valuable IP that — well, with Tesla’s success, the pitch writes itself.

“We don’t only have a plan like, just make one really fast boat,” Zin concluded. “We know what we want to do with this technology right now, we know what we’re going to do with this technology in 24 months, and 48 months; I wish I could show you some of this stuff. It’s tough, and we need to survive this year, but this is just the start.”

Powered by WPeMatico

On a Wednesday at 4 p.m. in June 2017, I was in a small, packed office in midtown Manhattan.

The overcrowded conference room, with at least five more people than any fire marshal would recommend, was stacked comically high with paperwork and an eclectic collection of cheap pens. As I neared the end of the third hour and the ink of my seventh pen, I realized the mortgage closing process may be somewhat antiquated.

After closing on my first home, it was inconceivable to me that every other expense in my life has gone digital, but the most significant purchase I’ve ever made required hundreds of signatures and several handwritten checks delivered in person. By comparison, I have been able to repay my student loans, comparable in magnitude to a down payment, exclusively through online portals.

The COVID-19 pandemic has changed nearly every facet of our lives. One potential silver lining for the real estate world may be a forced reckoning with the mortgage closing process. Technological advances like e-closings are accelerating this arduous process into the digital age. The U.S. Census Bureau released figures in July citing the rise in homeownership across the country as the pandemic fuels the demand for single-family properties outside of urban areas. This is confirmed by the significant spike in mortgage applications seen in the second quarter of 2020.

The first signs of digitization of the mortgage origination process were seen in mid-2010 when lenders began adopting digital disclosures. Despite the availability of technology, the market has been slower to fully embrace digital closings that enable the full loan package to be electronically reviewed, recorded, signed and notarized. A true e-closing includes a digital promissory note (“eNote”), a virtual closing appointment and the electronic transfer and recording of documents by the county, all of which can be remotely coordinated and executed by the parties involved. The market started to pick up pace in recent years, and we’ve seen the number of e-mortgages increase by more than 450% from 2018 to 2019.

Powered by WPeMatico

SlideShare has a new owner, with LinkedIn selling the presentation-sharing service to Scribd for an undisclosed price.

According to LinkedIn, Scribd will take over operation of the SlideShare business on September 24.

Scribd CEO Trip Adler argued that the two companies have very similar roots, both launching in 2006/2007 with stories on TechCrunch, and both of them focused on content- and document-sharing.

“The two products always had kind of similar missions,” Adler said. “The difference was, [SlideShare] focused on more on PowerPoint presentations and business users, while we focused more on PDFs and Word docs and long-form written content, more on the general consumer.”

Over time, the companies diverged even further, with SlideShare acquired by LinkedIn in 2012, and LinkedIn itself acquired by Microsoft in 2016.

Scribd, meanwhile, launched a Netflix-style subscription service for e-books and audiobooks, but Adler said that both the “user-generated side” and the “premium side” remain important to the business.

“We get people who come in looking for documents, then sign up for our premium content,” he said. “But they do continue to read documents, too.”

So when Microsoft and LinkedIn approached Scribd about acquiring SlideShare, Adler saw an opportunity to expand the document side of the product dramatically, incorporating SlideShare’s content library of 40 million presentations and its audience of 100 million unique monthly visitors.

The deal, Adler said, is fundamentally about tapping into SlideShare’s “content and audience,” though he said there may be aspects of the service’s technology that Scribd could incorporate as well. Scribd isn’t taking on any new employees as part of the deal; instead, its existing team is taking responsibility for SlideShare’s operation.

He added that SlideShare will continue to operate as a standalone service, separate from Scribd, and that he’s hopeful it will continue to be well-integrated with LinkedIn.

“Nothing will change in the initial months,” Adler said. “We have a lot of experience with a product like this, both the technology stack and with users uploading content. We’re in a good position make SlideShare really successful.”

Meanwhile, a statement from LinkedIn Vice President of Engineering Chris Pruett highlighted the work that the company has done on SlideShare since the acquisition:

LinkedIn acquired SlideShare in May 2012 at a time when it was becoming clear that professionals were using LinkedIn for more than making professional connections. Over the last eight years, the SlideShare team, product, and community has helped shape the content experience on LinkedIn. We’ve incorporated the ability to upload, share, and discuss documents on LinkedIn.

Powered by WPeMatico

In May 2020, Intel announced its purchase of Moovit, a mobility as a service (MaaS) solutions company known for an app that stitched together GPS, traffic, weather, crime and other factors to help mass transit riders reduce their travel times, along with time and worry.

According to a release, Intel believes combining Moovit’s data repository with the autonomous vehicle solution stack for its Mobileye subsidiary will strengthen advanced driver-assistance systems (ADAS) and help create a combined $230 billion total addressable market for data, MaaS and ADAS .

Before he was a member of Niantic’s executive team, private investor Omar Téllez was president of Moovit for the six years leading up to its acquisition. In this guest post for Extra Crunch, he offers a look inside Moovit’s early growth strategy, its efforts to achieve product-market fit and explains how rapid growth in Latin America sparked the company’s rapid ascent.

In late 2011, Uri Levine, a good friend from Silicon Valley and founder of Waze, asked me to visit Israel to meet Nir Erez and Roy Bick, two entrepreneurs who had launched an application they had called “the Waze of public transportation.”

By then, Waze was already in conversations to be sold (Google would finally buy it for $1.1 billion) and Uri was thinking about his next step. He was on the board of directors of Moovit (then called Tranzmate) and thought they could use a lot of help to grow and expand internationally, following Waze’s path.

At the time, I was part of Synchronoss Technologies’ management team. After Goldman Sachs and Deutsche Bank took us public in 2006, AT&T and Apple presented us with an idea that would change the world. It was so innovative and secret that we had to sign NDAs and personal noncompete agreements to work with them. Apple was preparing to launch the first iPhone and needed a system where users could activate devices from the comfort of their homes. As such, Synchronoss’ stock became very attractive to the capital markets and ours became the best public offering of 2006.

After six years with Synchronoss while also making some forays into the field of entrepreneurship, I was ready for another challenge. With that spirit in mind, I got on the plane for Israel.

I will always remember the landing at Ben Gurion airport. After 12 hours traveling from JFK, I was called to the front of the immigration line:

“Hey! The guy in the Moovit T-shirt, please come forward!”

For a second, I thought I was in trouble, but then the immigration officer said, “Welcome to Israel! We are proud of our startups and we want the world to know that we are a high-tech powerhouse,” before he returned my passport and said goodbye.

I was completely amazed by his attitude and wondered if I really knew what I was getting into.

At first glance, the numbers seemed very attractive. In 2012, there were roughly seven billion people in the world and only a billion vehicles. Thus, many more people used mass public transport than private and users had to face not only the uncertainty of when a transport would arrive, but also what might happen to them while waiting (e.g., personal safety issues, weather, etc.). Adding more uncertainty: Many people did not know the fastest way to get from point A to point B. As designed, mass public transport was a real nightmare for users.

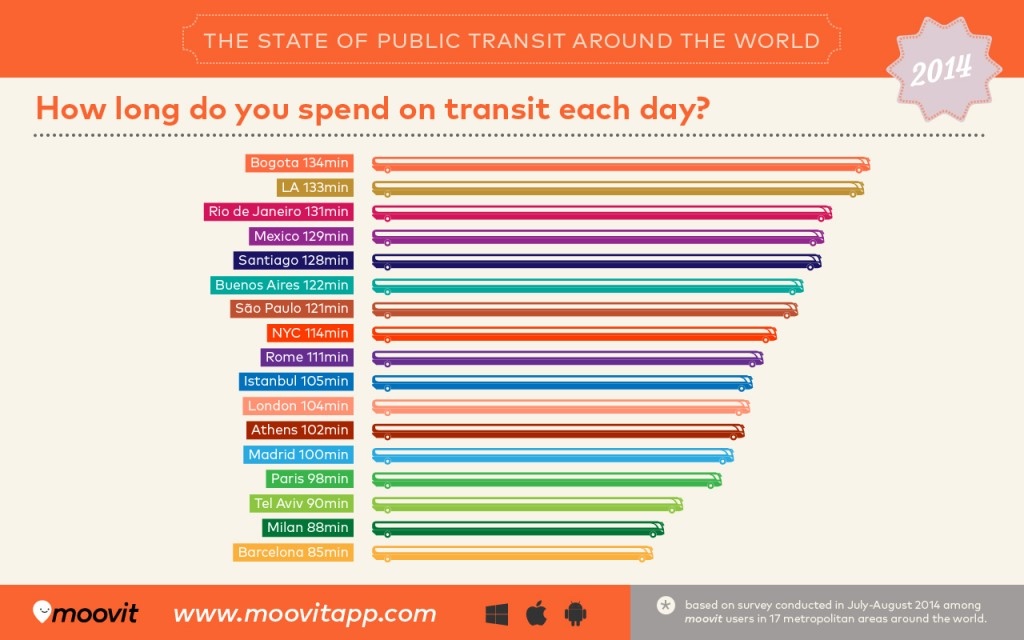

Uri advised us to “fall in love with the problem and not with the solution,” which is what we tried to do at Moovit. Although Waze had spawned a new transportation paradigm and helped reduce traffic in big cities, mass transit was a much bigger monster that consumed an average of two hours of each day for some people, which adds up to 37 days of each year*!

What would you do if someone told you that in addition to your vacation days, an app could help you find 18 extra days off work next year by cutting your transportation time in half?

* Assumes 261 working days a year, 14 productive hours per day.

Image Credits: Moovit (opens in a new window)

Powered by WPeMatico

According to The Wall Street Journal, Airbnb could file confidentially to go public as early as this month. The same report states that Airbnb could follow that filing with an IPO before year’s end. Morgan Stanley and Goldman are helping the former startup with its IPO process, the Journal writes.

The news that Airbnb’s IPO could be back on caps a tumultuous year for the home-sharing unicorn, which promised in 2019 to go public in 2020. The company was widely tipped to be considering a direct listing before COVID-19 arrived, crashing the global travel market, and with it, Airbnb’s financial health.

Airbnb declined to comment on its IPO plans.

As travelers stayed home, the company was forced to sharply cut staff and take on billions in capital at prices that, compared to its late 2019-momentum, looked rather expensive.

But since those blows, Airbnb has begun to make noise about positive progress regarding its platform usage, and, implicitly, its financial performance.

In June, Airbnb said that between “May 17 to June 6, 2020, there were more nights booked for travel to Airbnb listings in the US than during the same time period in 2019,” and that “globally, over the most recent weekend (June 5-7), we saw year-over-year growth in gross booking value” for “the first time since February.”

And in July, the company said that its users had “booked more than 1 million nights’ worth of future stays at Airbnb listings” globally in a single day, the first time since March 3rd that that had happened.

Precisely how far Airbnb has financially clawed its way back is not clear. But the company’s cost basis in the wake of its layoffs could lower the revenue base it needs to recover to reach something akin to profitability, a traditional IPO benchmark, though one that has lost luster in recent years.

And with local travel taking off — slowly-improving airline occupancy rates are, therefore, not indicative of Airbnb’s performance or health — the company could have retooled its business in the wake of COVID to something that can still put up attractive revenues at strong margins.

Needless to say, I am hyped to read the Airbnb S-1, so the sooner it drops the happier I’ll be. Getting an in-depth look at what happened to the unicorn during COVID-19 is going to be fascinating.

Airbnb joins DoorDash, Coinbase, Palantir and others on our IPO shortlist. More as we have it.

Powered by WPeMatico

Valence, the Los Angeles-based online community dedicated to increasing economic opportunity for the Black community, has raised $5.25 million in financing as it looks to continue to expand its network for Black professionals in all fields.

The timing for the investment is critical as the country reckons with the implications and effects of systemic racism. In no field is the under-representation of Black professionals more deeply felt than the tech industry, where lack of diversity can have profound implications on products and services that are becoming increasingly central to large swaths of the economy.

Problems with under-representation and underlying issues of systemic racism manifest in facial recognition technologies, social networking applications and decision-making software for lending and credit that are aspects of how American society functions.

It’s with an eye toward technology and entrepreneurship that Valence raised its most recent round, according to a letter sent to the company’s users by new chief executive officer Guy Primus.

“Now that we have the capital that we were seeking, we will be doing three things. First we will improve the current product. We are very proud of what we have built thus far, but we know there are a few issues. We will continue to address those issues and will accelerate work to enhance technical performance on the platform,” Primus wrote. “Second, we will be expanding the team. We expect the team to more than triple in the coming months so that we can better serve you. Finally, we’ll be adding features and expanding our services. We will be delivering additional tools that facilitate even more meaningful connections and will expand Valence’s scope to include the professional growth and development of our members.”

A lot of that product development will go toward building tools that can help with professional development and career growth.

“We’re being very targeted in how we can drive economic opportunity and wealth creation in the black community,” said Valence co-founder and Upfront Ventures general partner Kobie Fuller.

Already, Valence has brought on some of the top names in Silicon Valley as participants in a program to promote entrepreneurship and career development.

Valence currently has 10,000 people signed up for the platform and is growing at about 20% per month, according to Primus. The goal is to serve educational advice and tools to Valence users while at the same time making that group of career-minded Black professionals available to companies that would want to hire them.

Primus said that Valence will be selling its database and access to companies that would want to find prospective hires on the platform in a per-seat licensing model that would be accessible to headhunters and human resources departments.

The new investment round was led by GGV Capital, the international investment firm whose investments include Slack, Peloton, Wish and StockX. Hans Tung, the managing director who invested in those marquee deals, will be joining the company’s board of directors.

Other investors in the round include Upfront Ventures, along with Maveron, the SoftBank Opportunity Fund and Silicon Valley Bank.

Powered by WPeMatico

We’ve aggregated many of the world’s best growth marketers into one community. Twice a month, we ask them to share their most effective growth tactics, and we compile them into this Growth Report.

This is how you stay up-to-date on growth marketing tactics — with advice that’s hard to find elsewhere.

Our community consists of startup founders and heads of growth. You can participate by joining Demand Curve’s marketing training program or its Slack group.

Without further ado, on to our community’s advice.

Excerpt from Demand Curve’s Growth Training.

A surprising benefit of referrals is how they often lead to social partnership opportunities.

Consider this process:

Going through groups can be a high-leverage way to land and expand into ideal audiences.

Powered by WPeMatico