Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Aforza, developing cloud and mobile apps for consumer goods companies, announced a $22 million Series A round led by DN Capital.

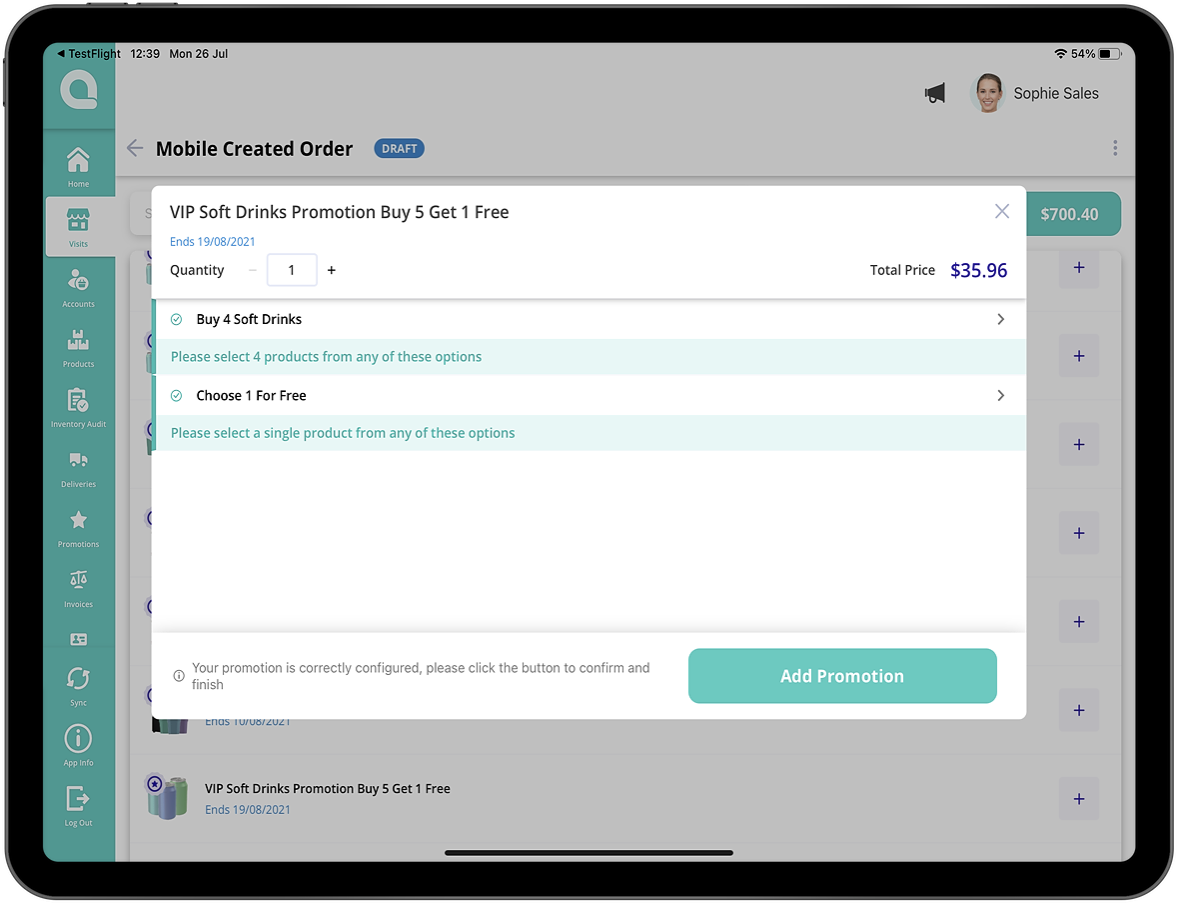

The London-based company’s technology is built on the Salesforce and Google Cloud platforms so that consumer goods companies can digitally transform product distribution and customer engagement to combat issues like unprofitable promotions and declining market share, Aforza co-founder and CEO Dominic Dinardo told TechCrunch. Using artificial intelligence, the company recommends products and can predict the order a retailer can make with promotions and pricing based on factors like locations.

The global market for consumer packaged goods apps is forecasted to reach $15 billion by 2024. However, the industry is still using outdated platforms that, in some cases, lead to a loss of 5% of sales when goods are out of stock, Dinardo said.

Aforza’s trade promotion designer mobile image. Image Credits: Aforza

Dinardo and his co-founders, Ed Butterworth and Nick Eales, started the company in 2019. All veterans of Salesforce, they saw how underserved the consumer goods industry was in terms of moving to digital.

Aforza is Dinardo’s first time leading a company. However, from his time at Salesforce he feels he got an education like going to “Marc Benioff’s School of SaaS.” The company raised an undisclosed seed round in 2019 from Bonfire Ventures, Daher Capital, DN Capital, Next47 and Salesforce Ventures.

Then the pandemic happened, which had many of the investors leaning in, which was validation of what Aforza was doing, Dinardo said.

“Even before the pandemic, the consumer goods industry was challenged with new market entrants and horrible legacy systems, but then the pandemic turned off pathways to customers,” he added. “Our mission is to improve the lives of consumers by bringing forth more sustainable products and packaging, but also helping companies be more agile and handle changes as the biggest change is happening.”

Joining DN Capital in the round were Bonfire Ventures, Daher Capital and Next47.

Brett Queener, partner at Bonfire Ventures, said he helped incubate Aforza with Dinardo and Eales, something his firm doesn’t typically do, but saw a unique opportunity to get in on the ground floor.

Also working at Salesforce, he saw the consumer goods industry as a major industry with a compelling reason to make a technology shift as customers began expecting instant availability and there were tons of emerging startups coming into the direct-to-consumer space.

Those startups don’t have a year or two to pull together the kind of technology it took to scale. With Aforza, they can build a product that works both online and off on any device, Queener said. And rather than planning promotions on a quarterly basis, companies can make changes to their promotional spend in real time.

“It is time for Aforza to tell the world about its technology, time to build out its footprint in the U.S. and in Europe, invest more in R&D and execute the Salesforce playbook,” he said. “That is what this round is about.”

Dinardo intends on using the new funding to continue R&D and to double its employee headcount over the next six months as it establishes its new U.S. headquarters in the Northeast. It is already working with customers in 20 countries.

As to growth, Dinardo said he is using his past experiences at startups like Veeva and Vlocity, which was acquired by Salesforce in 2020, as benchmarks for Aforza’s success.

“We have the money and the expertise — now we need to take a moment to breathe, hire people with the passion to do this and invest in new product tiers, digital assets and even payments,” he said.

Powered by WPeMatico

Sydney, Australia-based Fable Food is the latest plant-based food startup to announce funding. The company, which uses mushrooms in its meat alternatives, has raised $6.5 million AUD (about $4.8 million USD) in a seed round led by Blackbird Ventures, the Australian venture capital firm whose portfolio also includes Canva, Culture Amp and SafetyCulture. Other participants included agriculture and food tech venture firm AgFunder, sustainability-focused Aera VC and Better Bite Ventures, along with Singapore-based produce importer Ban Choon Marketing and former Sequoia Capital partner Warren Hogarth.

Fable is preparing to launch in the United States by the end of this year. In Australia, its products are available at retailers like Woolworths, Coles and Harris Farm Markets, along with restaurants including Grill’d, which recently started serving its Meaty Mushroom Burger Pattie at 136 locations. Fable’s products are also available at restaurants in Singapore and the United Kingdom.

The startup was founded in 2019 by fine dining chef turned chemical engineer and mycologist (mushroom scientist) Jim Fuller, organic mushroom farmer Chris McLoghlin and Michael Fox, whose previous startup was Shoes of Prey.

Fox, Fable’s chief executive officer, told TechCrunch in an email that after being a vegetarian for six years, he recently became a vegan “for a mix of health, environmental and ethical reasons.”

“Talking to my friends and family, a lot of people want to reduce their meat consumption for the same reasons but they find it challenging because they love the taste and texture of meat and giving it up is hard,” Fox said. He wanted to find a way to make it easier for people to transition to plant-based foods, and spoke to several chefs who suggested using mushrooms as a base ingredient. Then Fox met Fuller and McLoghlin, who were in the process of developing meat alternatives using mushrooms.

“When we met, we realized we shared the same values and goals and had complementary skill sets,” said Fox. “We shared a common desire to help end industrial agriculture and wanted to make our food system more ethical, healthy, sustainable and lower its greenhouse gas emissions.”

Fable’s first products include a substitute for pulled pork, braised beef and beef brisket (Fuller grew up in Texas eating slow-cooked meats and wanted to recreate the experience), along with a line of ready-made meals. The company uses shiitake mushrooms, which Fox explained are “very flavorful with their natural umami flavors, they are a slow-growing mushroom so they naturally have the fleshy fibers that give the meaty bite you typically get from animal proteins, and have the right chemical composition that when cooked allow us to taste flavors that are found in animal products.”

Fable’s ready-made meals. Image Credits: Fable

Fuller serves as Fable’s chief science officer and the startup leverages his experience as a chef/chemical engineer/mycologist to create the right combinations of flavor, aroma and texture while keeping processing and ingredients to a minimum. For example, its braised beef alternative is made with shiitake mushrooms, seven other ingredients and salt and pepper.

Fable also announced today it has appointed Dan Joyce, who was previously safety and compliance software company SafetyCulture’s general manager of Europe, the Middle East and Africa, as chief growth officer to head global sales and marketing. It will launch in the U.S. through a combination of partnerships with restaurants and meal kit companies.

Other startups that use mushrooms as basis for meat alternatives include Meati and AtLast. Fox said a main difference is that those two startups ferment mycelium, or the root structure of fungi, instead of using mushrooms, which are the fruiting body of fungi.

Fable’s new funding will be used for research and development, expanding its production and manufacturing capacity in Australia and other countries. The company is keeping its product pipeline under wraps for now, but Fox said it plans to develop mushroom-based substitutes for pork, chicken, lamb and other animal proteins.

Powered by WPeMatico

Here’s another edition of “Dear Sophie,” the advice column that answers immigration-related questions about working at technology companies.

“Your questions are vital to the spread of knowledge that allows people all over the world to rise above borders and pursue their dreams,” says Sophie Alcorn, a Silicon Valley immigration attorney. “Whether you’re in people ops, a founder or seeking a job in Silicon Valley, I would love to answer your questions in my next column.”

Extra Crunch members receive access to weekly “Dear Sophie” columns; use promo code ALCORN to purchase a one- or two-year subscription for 50% off.

Dear Sophie,

I want to extend an offer to an engineer who has been working in the U.S. on an H-1B for almost five years. Her current employer is sponsoring her for an EB-2 green card, and our startup wants to hire her as a senior engineer.

What happens to her green card process? Can we take it over?

— Recruiting in Richmond

Dear Recruiting,

Congrats on finding the right candidate for your role. Your startup’s ability to take over the EB-2 green card process for this candidate — or whether you have to start the green card process from the beginning — depends on where she is in the green card process and whether the position you are offering is similar to her current role.

Take a listen to my podcast in which my colleague, Gilberto Orozco Jr., an associate attorney at my firm, and I discuss the American Competitiveness in the 21st Century Act — or AC21 — including “green card portability.”

Enacted in 2000, AC21 gives international talent in certain situations the flexibility to change jobs during the green card process and the ability to extend an H-1B visa beyond the six-year limit to avoid having to leave the United States while waiting for a green card. I recommend discussing your situation and goals with an experienced immigration attorney to determine your options.

Image Credits: Joanna Buniak / Sophie Alcorn (opens in a new window)

As I mentioned earlier, what happens to the green card process if your candidate changes jobs depends on where she is in the EB-2 green card process. There are two types of EB-2 green cards that have slightly different processes:

The EB-2 green card requires an employer sponsor and has a three-step process:

Powered by WPeMatico

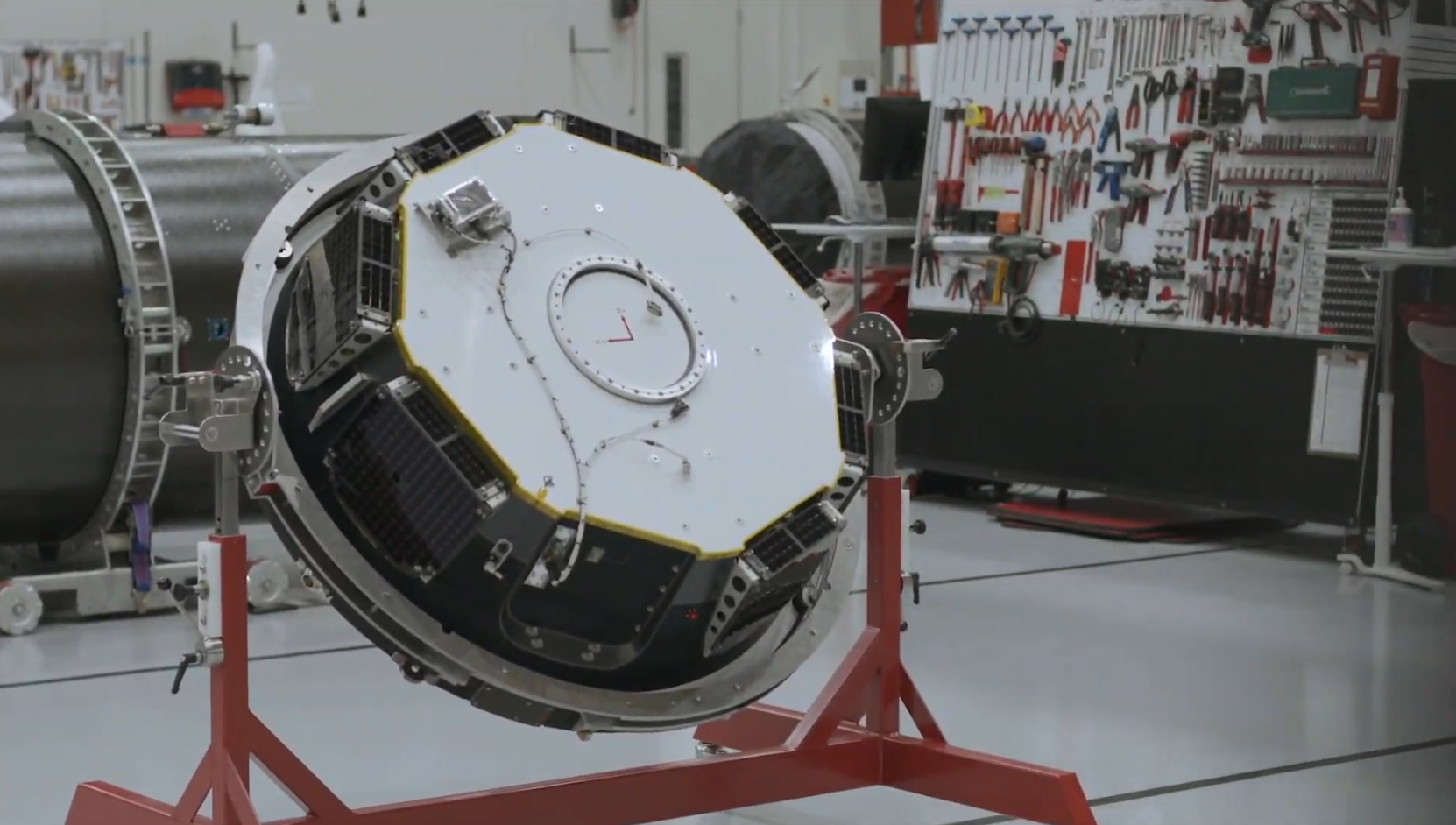

Orbital manufacturing startup Varda Space Industries is moving fast. Only a few weeks after announcing a $42 million Series A, Varda has signed a deal with launch company Rocket Lab for three Photon spacecraft to support the startup’s initial missions.

The first spacecraft will be delivered in the first quarter of 2023, with the second to follow later that year and the third in 2024. It’s an aggressive schedule for the eight-month-old Varda and would mark the company’s first three manufacturing missions to space. The contract includes an option for Varda to purchase a fourth Photon.

Partnering with a more established company makes sense — especially considering the Photon’s bona fides, which includes a NASA-funded mission to the moon at the end of the year. Rocket Lab was also awarded a subcontract by the University of California Berkeley Space Sciences Laboratory to design two Photon spacecraft for a one-year mission to Mars.

Image Credits: Rocket Lab (opens in a new window)

Varda, which was founded by SpaceX veteran Will Bruey and Founders Fund principal Delian Asparouhov, is banking big on a manufacturing condition that you can only find in space: microgravity. They think that the potential market for bioprinted organs, specialized semiconductors, fiber-optic cables or pharmaceuticals — products that you can’t make in Earthbound-conditions — is high enough to make the costs of building a spacecraft and launching to space more than worth it.

Under this most recent deal, each Photon will be outfitted with two Varda-made modules: The first will be a microgravity manufacturing module, where the space production will actually take place, and the second will be a reentry capsule designed to bring those finished products back to Earth. Asparouhov told TechCrunch that the are designing the reentry modules to bring back “on the order of 40-60 kilograms of materials” for the first couple of missions, with the aim of quickly scaling up for subsequent launches.

Varda says this approach is low-risk and incremental. “That’s why we’re seeing so much interest from the investment community, [the Department of Defense], NASA, et cetera, it’s this very pragmatic, one-step-at-a-time approach,” Asparouhov said. “We’ll prove this first space factory. And yes, as we start to scale it allows us to send a larger space factory and then eventually, yes, we might have something the size of the [International Space Station], 10 times the size of the ISS. But that’s not what we’re starting with. We’re starting with a very small, near-term pragmatic approach.”

Each mission will last roughly three months from launch to landing, Rocket Lab said in a statement.

Powered by WPeMatico

The technology industry is often thought of as being the domain of the young and the new. We see an emphasis on young founders (“40 Under 40”), innovative ideas and disruptive challenges to legacy brands, incumbent companies and “old” ways of thinking.

But one of the things I’ve learned on my journey in co-founding my latest startup is that technology should be enabling and accessible to all, and nowhere is this more critical than for empowering our older adults.

Older adults are one of the most underrepresented audiences for new technology products and platforms. There is a massive opportunity to provide products and services that will make life better for today’s seniors and future generations of older adults to come. Founders in every space, from edtech to healthcare, from financial services to robotics, can make a bigger impact if we recognize the opportunity of being of service to older adults.

One of the best strategies for tech companies that want to serve the older adult market is to focus your value proposition on empowering older adults.

Older adults often get overlooked by tech companies. In fairness, it can be hard (and insensitive and uninspiring) to market products and services as being “for old people,” because people in this group don’t tend to think of themselves as “old.”

One of the best strategies for tech companies that want to serve the older adult market is to focus your value proposition on empowering older adults. Don’t make a product “for old people” — make a product that helps older adults lead a healthier, more active, more connected life.

Whether it’s the education tech space, financial services, health tech, consumer products or other innovative digital services for seniors, tech companies have big opportunities to empower older adults.

We are seeing some great examples, including:

Older adults have so much to offer. Instead of approaching this market as a “problem” to be solved, startups should engage with older adults as an active, curious, ready-to-learn group of people who are eager to be empowered.

It often seems like so many consumer-facing apps today are created for younger people. But there’s a big disconnect between where so much of the tech industry’s attention and investment is going and the spending power and lifestyle preferences of today’s older adults.

Older adults are the most underserved demographic for the tech world. They’re also one of the fastest-growing age cohorts. The number of people worldwide who are 65 and older is expected to grow from 524 million in 2010 to 1.5 billion in 2050.

The “silver economy,” driven by the spending power of older adults, is expected to grow into the 2030s because the senior population is the wealthiest age group and their numbers are growing 3.2% per year (compared with 0.8% for the overall population).

Powered by WPeMatico

Doxel, which has developed software that uses computer vision to help track and monitor progress on construction job sites, announced today that it has raised $40 million in Series B funding.

Insight Partners led the round, which included participation from existing backers Andreessen Horowitz (a16z) and Amplo and brings the startup’s total raised to $56.5 million since its December 2015 inception. A16z has participated in each of Doxel’s rounds — from seed to Series B. In addition to its institutional investors, Robinhood CEO Vladimir Tenev also put money in Doxel’s Series A round as an angel.

Co-founder and CEO Saurabh Ladha said he could not disclose the valuation at which the capital was raised, but that it was “over a 4x multiple” from its $12 million Series A in early 2020. He described the Series B as an “opportunistic raise.”

“We raised because we could, at a phenomenal valuation. The full series A is still in the bank. We didn’t touch it even,” he told TechCrunch. “Our growth and bookings traction has actually been so high that we’ve been cash flow neutral in that period of time.

Ladha was inspired to start Doxel after his family nearly suffered from financial catastrophe after a two-year delay on a major construction project in India in which his father was involved.

“I almost thought we’d lose our house. It was the first time I was made aware of the impact construction can have on livelihoods,” Ladha told TechCrunch. “Even as a child, I realized that predictability is what keeps projects on time and on budget.”

Twenty years later, when Ladha graduated from Stanford University, he learned that 90% of projects are delayed and delivered over budget.

Ladha then teamed up with Robin Singh, Doxel’s CTO, in 2015 to found Doxel to build a “computer-vision-powered predictive analytics platform” designed to help owners and contractors “navigate problems before they happen.” Or put more simply, Doxel is building what it describes as the “Waze for Construction” platform.

The company’s biggest differentiator from competitors, according to Ladha, is that it provides forward-looking insight on the construction field.

“A lot of companies offer backward-looking analytics,” he told TechCrunch. “We’re the only player offering a forward-looking solution that’s predictive…In much the same way drivers have come to rely on satellite technology to avoid traffic accidents and slow-downs ahead of them, Doxel’s customers have come to rely on our AI-powered Project Controls platform.”

Doxel, Ladha added, does monitoring for project teams, so they can focus on solving problems rather than on finding them.

“Our predictive analytics gives building owners and general contractors a way to identify critical risk factors that threaten to derail their project before they even know the risks exist,” he said. “So they are not finding out about problems when it’s too late to actually solve them.”

The premise is that by the time potential risk factors are discovered, it’s too late and cost overruns and project delays are unavoidable. Over the years, with all the data it has gathered, Doxel has built out what it describes as a “Construction Encyclopedia” that helps it in identifying those potential risk factors.

Image Credits: Co-founders Saurabh Ladha (CEO) and Robin Singh (CTO) / Doxel

The company claims that its technology has helped its customers come in up to 11% below budget on projects and see an average 38% increase in productivity, according to Ladha.

Doxel’s platform works by tapping into multiple real-time data sources on a project, such as 360-degree images, Building Information Models (BIM) — also known as 3D designs — as well as budget and schedule in an effort to provide both predictability and control to building owners and contractors. The goal is to help prevent a domino effect of delays and heightened costs, so that building owners and contractors are better able to stay on time and on budget.

“Other companies don’t bridge all silos across field, accounting and schedule management,” Ladha said. “These are three disparate entities that operate separately and without the knowledge silos being bridged.”

Besides cost overruns, the loss of revenue associated with projects not being available for use per plan is exponentially disastrous, Ladha noted. For example, a multifamily developer expecting to make money by selling or renting condo units will lose income the longer it takes for project completion.

Over time, Doxel says it has tracked tens of billions of capital expenditures for “a diverse group” of Fortune 500 companies, including Kaiser Permanente and Royal Dutch Shell. Doxel claims to have saved companies “tens of millions” of dollars with its predictive technology.

“Our users are senior execs tasked with making multibillion-dollar decisions with little information on a week to week basis,” Ladha said. “They need to know if they are on cost and on time.”

Nikhil Sachdev, managing director at Insight Partners, said his firm was really excited about the size of the problem Doxel is going after in addition to the traction the company has “with some of the world’s largest enterprises, and their highly defensible AI-first software.”

Conversations with customers revealed that prior to using Doxel’s technology, they did not have a way to accurately predict the future state of their construction projects.

“Most construction management software tools are still dependent on manual data entry or photos tagged to blueprints, which requires weeks of manual mining to extract insights on a project’s cost & schedule performance,” Sachdev wrote via email. “Doxel is the only tool we’ve found that can ingest all of the relevant data, process it using their AI, and make the leap to what the project will look like in the future.”

Looking ahead, Redwood City, California-based Doxel plans to use its new capital to scale its platform and hire across its engineering, sales, marketing and product staff. Currently, Doxel has 75 employees across offices in the U.S. and Bangalore. It’s looking to roughly double the size of its team over the next year.

Powered by WPeMatico

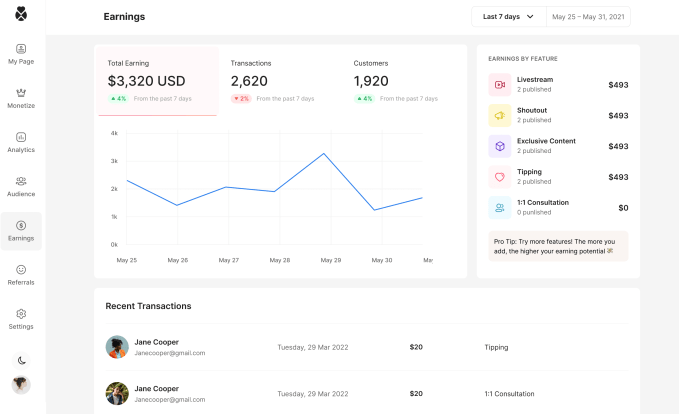

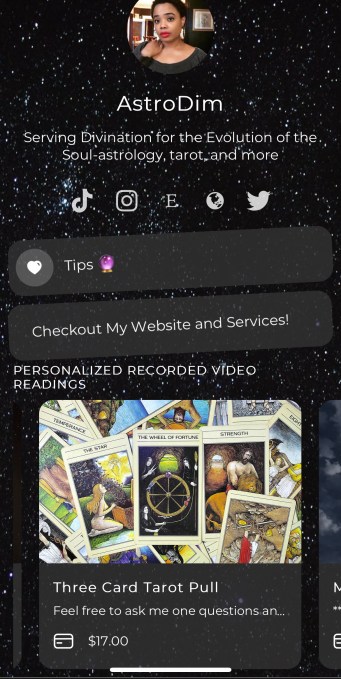

The link-in-bio business is heating up as more mobile website builders compete for a coveted slice of real estate on a creator’s TikTok, Instagram or Twitter. Linktree leads the space, securing a recent $45 million Series B raise to build out e-commerce features, but Beacons boasts competitive creator monetization tools with just a $6 million seed round in May. Now, Snipfeed enters the ring with its own $5.5 million seed round, including investments from CRV, Abstract Ventures, Crossbeam (Ali Hamed), id8, Michael Ovitz (founder of CAA), Michael Bosstick, Diaspora Ventures and others.

Linktree has been around since 2016 and has more funding than its up-and-coming competitors. But for creators seeking to monetize their following, these newer platforms may be more attractive to some creators, since they already have built-in tools to help them monetize their followings. Linktree currently supports tipping on the platform for users subscribed to its $6 Linktree Pro platform, but Snipfeed offers a wider range of monetization options; some creators are making more than $20,000 per month on the platform, according to CEO and co-founder Rédouane Ramdani.

Snipfeed started as a content discovery platform with 44,000 weekly active users — but when Snipfeed added a creator monetization tool to its platform, it became its most popular feature. So, in February 2020, with little to no funding left, the company completely pivoted to its current link-in-bio business. Since then, Snipfeed has amassed 50,000 registered users, with the user base growing 500% in the last six months (Linktree, for comparison, has more than 12 million users).

Based in Paris and Los Angeles, Snipfeed’s 15-person staff is particularly interested in the “long tail” of creators, which it says encompasses more than 46 million people.

“Content creator doesn’t necessarily mean you’re going to be the next Addison Rae or a TikTok star,” explained Ramdani. “It means that you might be a doctor or lawyer, and on top of that, you’re going to have a TikTok where you explain how to file your taxes and that kind of stuff. They have this expertise, and they’re wondering, ‘How can I turn that into a side-hustle?’ ”

Image Credits: Snipfeed

In addition to a standard tipping tool, Snipfeed allows users to sell digital goods, like on-demand video, e-books, access to livestreams and one-on-one consultations. But Snipfeed’s biggest differentiator is its Cameo-like system for selling personalized content. For example, TikToker maylikethemonthh uses Snipfeed to sell asynchronous, video-recorded tarot readings. While asking a single, personalized astrology question costs $5, a more in-depth reading can cost up to $20 or $40.

Snipfeed is free to set up, but if you make sales, the company takes 15% — this percentage is inclusive of any transaction fees. Through Snipfeed’s referral program, creators can make 5% of sales from anyone they onboard to the platform (this comes out of Snipfeed’s commission).

“We decided to go with this model because we really want to have a relationship where we help the creators really make money. We only make money if they make money,” Ramdani said.

If a creator or celebrity were to sell personalized videos on Cameo, they’d lose 25% to the platform. Meanwhile, Beacons takes 9% of sales from its free version, and 5% from its $10 per month version, which offers more customization, integrations and analytics.

Image Credits: Snipfeed

Still, depending on the type of creator, the features that each link-in-bio startup offers might matter more than the cost. Beacons allows users to share a shopping-enabled TikTok feed, which could be a huge money-maker for creators that often share product recommendations with affiliate links, which give them a commission from sales. Ramdani said that astrologers have been particularly successful on Snipfeed, since fans can book a variety of asynchronous services at a wide range of prices. But these features could benefit any creator who can profit from answering followers’ specific questions — a chef could offer recipe ideas based on what’s in a fan’s fridge, or a life coach could make a personalized video if a follower requests advice.

With its $5.5 million in seed funding, Snipfeed plans to build out its e-commerce tools so that creators can sell physical products on their link-in-bio (Beacons and Linktree are also working on this with their recent funding rounds — but Beacons’ and Snipfeed’s seed rounds are small compared to Linktree’s Series B). The company also wants to develop educational content to show its users how to best monetize their platform — if Snipfeed can help its creators make money, then it’ll make more money too.

Powered by WPeMatico

Singapore is home to fewer than six million people, making it one of the smallest ASEAN countries, in terms of population. It is a young country as well — having gained independence in 1963 — and resides in a neighborhood with far larger economies, including China, Indonesia, and Vietnam. When the country first became independent, its mandate was to simply survive rather than thrive.

So how does a country evolve from a position of relative uncertainty, with comparatively few resources, to one that leads the ASEAN region in venture capital investment and has been home to 10 unicorns?

Countries around the world examine Singapore’s ecosystem from a distance, hoping to learn from, and emulate, its story. The World Bank Group recently published a report, The Evolution and State of Singapore’s Start-up Ecosystem, documenting the country’s experience in building its startup ecosystem and the challenges facing it.

This article presents an overview of the report’s key findings and offers a few key recommendations on what other countries can learn from Singapore’s experience, as well as what Singapore itself can do to maintain progress.

As of 2019, Singapore had over $19 billion in PE and VC assets under management, more than twice that of neighboring Indonesia, Philippines, Vietnam, Malaysia, and Thailand combined. In that same year, the country was home to an estimated 3,600 tech startups and nearly 200 different intermediary and supporting organizations (accelerators, co-working spaces, coding academies, etc.) – some which have a multinational presence, such as Blk71, whose Singapore headquarters has been referred to as “the world’s most tightly packed entrepreneurial ecosystem.”

While assessing the size and strength of startup ecosystems is an evolving method, Start-up Genome priced Singapore’s ecosystem at over $25 billion, five times the global median.

Arguably, the most eye-catching hallmark of this ecosystem is its population of current and former unicorns. Collectively, Singapore has been home to ten unicorns, three of which have offered an IPO (Nanofilm, Razer and Sea) and two of which have been acquired – one by giant Alibaba (Lazada) and one by Chinese streaming powerhouse YY (Bigo Live). The remaining five are Trax, Acronis, JustCo, PatSnap, and Grab – the ASEAN region’s largest unicorn to date.

The education sector is also prominent in Singapore’s ecosystem. Universities like the National University of Singapore (NUS) and Nanyang Technological University (NTU) are deeply embedded into this ecosystem, helping with R&D commercialization linkages, incubation, talent/knowledge transfer, and other areas.

Numerous factors have contributed to building Singapore’s startup ecosystem, with government intervention and leadership being the dominant driving forces. The government has spent more than USD60 billion over the past several decades to enhance the country’s R&D infrastructure, create VC funds, and launch accelerators and other support organizations.

Powered by WPeMatico

Joby Aviation is now public, 12 years after JoeBen Bevirt founded the company at his ranch in the Santa Cruz mountains. The air taxi developer began trading on the New York Stock Exchange on Wednesday under the ticker symbol “JOBY,” after completing a merger with special purpose acquisition company Reinvent Technology Partners.

As of 10:00 AM ET, the price per share was at $11.01, up 9.8% from its prior-day closing amount.

Joby’s post-transaction valuation now stands at $4.5 billion, the largest in the industry. It also now has the highest cash balance. All told, Joby has around $1.6 billion in total capital to take its air taxi operations to commercialization in 2024. That includes $835 million of private-investment-in-public-equity, as well as more than $500 million of capital on the balance sheet.

RTP reported to the Securities and Exchange Commission that around 63% of the 69 million ordinary shares were redeemed prior to the public trading debut, giving Joby access to $255 million out of the $690 million of cash held in trust from the blank-check firm.

We have been working for over a decade to get our technology ready for market and are excited to take this moment to celebrate our achievements so far. #nyse #experiencesquare #eVTOL @NYSE pic.twitter.com/XlpxXiA1Pa

— Joby Aviation (@jobyaviation) August 11, 2021

It’s a sizable amount, but creating an entirely new form of transportation is a capital-intensive business. Joby’s executive chairman Paul Sciarra told TechCrunch he thinks $1.6 billion will be enough to prepare the company for launch.

“We think that’s enough to execute on the things that matter over the next few years, and those are […] one, ensuring that we execute on the certification program; two, showing we can demonstrate our ability to repeatedly manufacturing these aircraft in a certifiable way; and then third and finally, the opportunity to lay the groundwork for commercial launch,” Sciarra said.

Joby is developing a five-seat electric vertical take-off and landing aircraft, which it unveiled to much anticipation in February. The company, which has backing from Toyota and JetBlue, has released a slew of announcements in recent months as it geared up for the public listing.

“A lot of people talk about us as a secretive company,” Bevirt said in an interview with TechCrunch. “We’re not actually a secretive company, we just choose to do the work and then show our work, rather than talking about it and then doing it.”

Joby’s merger with blank-check firm Reinvent, headed by LinkedIn co-founder Reid Hoffman, was announced in February. The transaction includes a few provisions to ensure longer-term collaboration, including a lock-up on founder shares for up to five years, as well as vesting provision with earnout not realized until the price per share reaches $50 — a $30 billion market cap.

SPACs are not a new instrument for going public, but they have gained a widespread presence in the transportation space, particularly amongst eVTOL startups looking to secure amounts of capital. Archer Aviation was the first developer to announce it would merge with a blank-check firm, followed by Joby, Lilium and Vertical Aerospace. But there are signs that the investment bubble may be starting to deflate: late last month, Archer cut its valuation by $1 billion in a “strategic reset” of the transaction terms with Atlas Crest Investment Corp.

Such turbulence is not uncommon in markets populated by pre-revenue companies. But despite now being a public company — and having shareholders to answer to — Sciarra said Joby’s task remains unchanged. “We can’t control the markets,” he said. “[Joby] is a company that’s been executing quietly for a very long time on things that matter. I think it’s going to be incumbent upon us to do the same as we make this transition to a public company: tell folks what we’re going to do, and then go out and do them. That, quarter by quarter, is what builds credibility, what combats skepticism, and what gives investors and frankly, the broader public, confidence that this is a company that means what it says.”

One way to frame the fate of air taxis is whether they will be more like autonomous vehicles or electric vehicles. The AV space circa five years ago was filled with companies setting ambitious expectations about when true self-driving cars would be on the roads, only to have multiple companies collapse or sell under the weight of overshot expectations.

But Sciarra suggested that a better analogy to the eVTOL industry as it currently stands is the early days of electric vehicles. He pointed out that Joby’s aircraft is designed to conform to existing safety and certification standards, with a trained pilot onboard, similar to how helicopters and planes operate today. “We didn’t want to compound the technical risk of developing a new aircraft with the technical and regulatory risk of developing full autonomy from day one.”

“We think about our approach as a little bit more Tesla versus, say, Waymo,” he added.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week we were back to full strength, with Danny, Natasha and Alex joined by Chris to chat through the latest venture capital brouhaha. Namely, whether or not venture capital is about to get shaken to its core, or if we’re really parsing some long-term economic trends that will eventually revert.

Here’s a rundown:

The direction and future of the venture capital world has largely been lost amidst a sea of large numbers. New megarounds. New unicorns. That sort of thing. But inside the rising tide of capital available to private companies has been a mix-shift of sorts. The question is where that goes long-term. We tried to posit a few things that could happen next.

Equity is back on Friday!

Powered by WPeMatico