Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

At Disrupt this year TechCrunch is digging into the $100 million annual recurring revenue (ARR) threshold. To help us explore the software revenue milestone, we’re bringing in a number of CEOs that have already reached it: Egnyte’s Vineet Jain, GitLab’s Sid Sijbrandij and Kaltura’s Michal Tsur.

Join us on the Extra Crunch stage to hear this session, along with several other sessions around how founders can navigate the choppy startup waters. You can snag a ticket here.

The modern software world, often called software as a service, or SaaS, operates against a well-defined set of inflection points. These include $1 million ARR, a key moment for startups looking to raise their first Series-defined round of capital; the $10 million ARR mark, at which point the same companies become hard to kill; and $100 million ARR, at which point startups can start to prep for a public offering, or regular, large capital raises from private investors.

It’s that last milestone we want to explore. With three executives from companies that we’ve included in our series on $100 million ARR companies, we’ll dig into what they had to learn the hard way as they grew to material business scale, what went well and what they might be able to share with startups that aspire to a similar level of success.

That we’ll be hosting the conversation during a mini-IPO wave will make it all the more exciting; these three business leaders will certainly have at least one eye on the public markets. And as we’ll have the chat in the shadow of COVID-19, we’ll learn about how the highly valued private companies have had to adapt to a changed economic environment and working setup.

We’ll lean into lessons, learnings and other operational questions with the CEO of Egnyte, an enterprise content and management service provider; the CEO of GitLab, a DevOps company that has long had a distributed-employee model that is incredibly pertinent to the current moment; and the president of Kaltura, a software company that powers online video for other companies.

Since TechCrunch started compiling a list of companies that had either reached $100 million ARR, or were on their way, we’ve collected dozens of firms to the list. The three we’re talking to are among the most interesting. At a minimum, the conversation should be an interesting look into the next set of leaders in the software and startup space. See you there.

You can read our entries from the $100 million ARR series on each firm below:

Disrupt is happening for five action-packed days — September 14-18 — and if you want to partake in this session (or any other session on the Extra Crunch stage), you’ll need to get your Digital Pro Pass for just $345 for a limited time. Or if you are a founder, showcase your startup in Digital Startup Alley for just $445 for you PLUS another member of your team. Get your pass today!

Powered by WPeMatico

Coronavirus stay-home orders have sparked an unprecedented demand for grocery delivery around the world. Now investors are clamoring to bet on promising players in the field.

That includes DST Global, the investment firm helmed by Israeli-Russian billionaire Yuri Milner. Most recently, it poured $35 million into Weee!, a California-based startup that from its own warehouses delivers to major cities across the U.S. Asian groceries like fresh kimchi and Japanese desserts. The funding boosted the five-year-old startup’s total raise since launch to more than $100 million.

Weee! declined to share its post-money valuation, but the figure likely surpasses $500 million, given it’s widely known that DST Global does not generally back companies whose valuation is less than $500 million.

Online grocery is a capital-intensive business with thin profit margins, so it’s unsurprising to see many contenders — in both China and the U.S. — operating in the red. Against the odds, Weee! turned profitable earlier this year and went cash-flow positive.

That means the startup was in no rush to fundraise, probably giving it more bargaining power in negotiating terms with a storied investor like DST Global, whose portfolio spans Spotify, Twitter, Airbnb, Slack, Didi and Gojek, just to name a few.

Weee! certainly matches DST Global’s investment target as a high-growth startup. In June, the company recorded 700% year-over-year growth in revenue and was on course to generate revenue in the lower hundreds of millions of dollars in 2020, it told TechCrunch at the time.

Since the U.S. began winding down lockdowns and people returned to supermarkets, some grocery delivery services have seen their revenue growth slow. Weee!, however, is currently growing 15-20% more than its March peak. CEO Larry Liu explained the sustained boom stems from the service’s product differentiation: Asian specialties that one can’t even find in Chinatowns.

“People don’t want to pay extra if [an online grocery] only provides convenient delivery but no product differentiation,” said Han Shen, founding partner of iFly.vc, a California-based fund that backed Weee! in its Series A round.

In addition, Weee! tries to streamline every step of its operations, from product procurement, warehouse management, staff allocation, through to door-to-door delivery. The result is zero food waste thanks to fast inventory turnover.

“There is no secret tactic that we can’t talk about, nothing more than achieving efficiency throughout the entire process,” Shen observed.

In the meantime, Weee! works to keep prices down by cultivating direct relationships with suppliers like local farms and opting for next-day delivery rather than the more costly 30-minute standard expected in China, where he grew up. Earlier this year, former chief operations officer of Netflix Tom Dillon joined the board to help beef up Weee!’s operational efficiency.

With the new proceeds, the Asian e-grocer hopes to hire new talents and expand its delivery service from eight key regions to 13-14 cities across the U.S. by the end of this year.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest big news, chats about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here, and myself here, and don’t forget to check out last Friday’s episode.

This morning we had a bit of a detour, wandering into the world of Big Tech to wonder what is going on with those megacorps. Too big for their own good, or too big to be good, here’s what’s up with the incumbents:

All told it seems that the biggest tech companies are busy defending their market position instead of re-earning it with great products. A good time for startups? I think so. When incumbents are busy fighting with governments, themselves and each other, it’s a great time to show up, steal a march and build neat products that take away their momentum.

On the funding front, we peeked at the neat Help Lightning round, the Agiloft investment and the Vertafore exit.

And then there was this report concerning Asana, which is growing nicely for a company of its size and could actually be cheap at its current price. Anyway, we want the company to get on with getting public so that we can read its S-1 filing. Give it to us!

All that and we had some fun, chat soon!

Equity drops every Monday at 7:00 a.m. PT and Friday at 6:00 a.m. PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Hammock, a U.K. fintech/proptech helping landlords and property manages gain better oversight on the financial health of their rental properties, has raised £1 million in seed funding as it readies the launch of a current account.

Backing comes from Fuel Ventures and Ascension Ventures, joining existing investors that include Founders Factory and various unnamed angels. Hammock was incubated within Founders Factory Studio, and in the last 12 months has on-boarded onto its platform more than 1,700 managed properties, tracking over £7 million in rent.

“At a practical level, we want to save landlords time and money,” explains Hammock founder and CEO Manoj Varsani. “As a landlord, I know too well how time-consuming and inefficient it is to manage your properties with spreadsheets, paper notes and to collate data from multiple bank accounts. As a fintech expert, I realised that landlords and letting agents often rely on archaic technology and haven’t experienced the benefits of new-generation tech solutions.”

Varsani says that most of the data needed by landlords to manage their property finances is already available on various banking and budgeting apps, but argues it isn’t accessible in “an easy and understandable” format. “We aim to solve these problems by streamlining property finances management,” he adds.

As it exists currently, Hammock plugs into a landlord’s bank accounts, via open banking, and automatically monitors rent collection, tracks payments and expenses and provides live analytical reporting on the well-being of each rental house or flat. However, next on the roadmap, to be launched in the coming weeks, is an FCA-regulated current account designed specifically for landlords and property managers — thus setting up the company to launch future financial services for rental property owners.

“Landlords who use Hammock get real-time notifications about all income and expenses, so rent collection and cash flow management are easier to keep an eye on,” says Varsani. “They also get the tools they need to reconcile transactions as they happen, so they always know where they stand in terms of profit and loss. This means that compiling their tax statement goes from taking hours to taking minutes. Landlords can already get our functionalities if they connect their bank accounts via open banking. In September we’ll launch our own current account, so all functionalities will be natively integrated and the whole experience will be even more seamless.”

Direct Hammock customers span professional landlords with large portfolios (e.g. more than 50 properties) as well as part-time landlords who manage only 1 or 2 properties. The startup also serves B2B customers, such as letting agents, property managers and build to rent companies, and works with accountants who act as a customer acquisition funnel by recommending the service to their landlord clients.

Meanwhile, the business model is simple enough. Customers pay a monthly subscription to use the platform based on the number of properties managed, with the vast majority paying £9.99 per month.

Powered by WPeMatico

Autonomous vehicle startup AutoX announced the public launch of of its self-driving taxi service in Shanghai today. Called simply RoboTaxi, AutoX’s offering already faces competition from Didi, China’s largest ride-hailing platform, which launched its own robo-taxi pilot program in Shanghai at the end of June.

AutoX’s RoboTaxis will first be available in Jiading District, starting with a fleet of 100 vehicles. Rides can be booked through AutoNavi, the mapping and transportation-booking app owned by Alibaba, one of the startup’s investors. AutoX, which is headquartered in Shenzhen, raised a $100 million Series A last year from backers including Dongfeng Motor, one of China’s largest vehicle manufacturers, Alibaba, and Plug and Play’s China fund.

AutoX’s service will compete against Didi’s self-driving taxi pilot, which also operates in Jiading District, a large suburban district that is fairly close to Shanghai’s center, but less congested. Didi’s service launched a few weeks after the company announced it had raised $500 million from investors including SoftBank for its new autonomous driving subsidiary. Didi’s ambitious goal is to deploy more than one million autonomous vehicles by 2030.

AutoX and Didi are both competing against a list of autonomous taxi services from Chinese rivals like Pony.ai, Baidu and WeRide. All have already deployed robotaxi programs in different cities. Other companies, like Momenta, are focused on building and selling software for self-driving taxis to partners, which may enable even more robotaxi fleets to launch. Momenta’s progress is due in part to state support, because the Chinese government has created several large funds for industries including autonomous driving, 5G and artificial intelligence, as it tries to offset the economic impact of COVID-19.

When asked about the competitive landscape, Jewel Li, the chief operating officer of AutoX, told TechCrunch that one of its advantages is investor list, which includes original equipment manufacturers and Alibaba. This means AutoX’s backers not only provide funds, but also “the use cases in both mobility and logistics for autonomous driving. This investor portfolio is one of a kind, not only in the China market, but also globally.”

The company also has a robotaxi fleet in Shenzhen’s Nanshan District, she added, giving the company experience with autonomous rides in a densely-populated urban area.

AutoX is currently the third, and only China-focused company, to hold a permit for driverless robotaxis in California, which Li calls the “highest standard permit in the autonomous driving industry.” (The other two holders are Waymo and Nuro).

AutoX’s RoboTaxis will also be available for bookings through Shanghai-based taxi fleet Letzgo’s app. The two companies announced a strategic partnership today that will have Letzgo staff running RoboTaxis at AutoX’s Shanghai operations center, which opened in April.

AutoX also has plans to build out its robotaxi service in Europe.

Powered by WPeMatico

Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7am PT). Subscribe here.

There are few things that US political leaders can agree on these days, but one of them thankfully appears to be 5G. Manufacturing, transportation, agriculture, health care and many other industries are beginning to incorporate the fast, device-to-device connectivity provided by the fifth-generation wireless standard. But the key 3.5 GHz band of spectrum had been reserved for military and government use. Following years of congressional and most recently executive-branch action, it will now be auctioned off in early 2021. The marketing fluff will finally make way for the technology’s promise(s). More analysis from Danny Crichton:

There has been growing pressure on U.S. government leaders in recent years over the plodding 5G transition, which has fallen behind peer countries like China and South Korea. Korea in particular has been a world leader, with more than two million 5G subscribers already in the country thanks to an aggressive industrial policy by Seoul to invest in the country’s telecommunications infrastructure and take a lead in this new wireless transition.

The U.S. has been faster at moving ahead in millimeter (high frequency) spectrum for 5G that will have the greatest bandwidth, but it has lagged in midband spectrum allocation. While the announcements today is notable, there will also be concerns whether 100 Mhz of spectrum is sufficient to support the widest variety of 5G devices, and thus, this allocation may well be just the first in a series.

Nonetheless, additional midband spectrum for 5G will help move the transition forward, and will also help device and chip manufacturers begin to focus their efforts on the specific bands they need to support in their products. While it may be a couple of more years until 5G devices are widely available (and useful) in the United States, spectrum has been a key gating factor to reaching the next-generation of wireless, and a gate that is finally opening up.

Image Credits: Nigel Sussman (opens in a new window)

“Today, it’s nearly hard to recall the fear that took over startup-land,” Alex Wilhelm writes in a review of recent unicorn news for Extra Crunch. “Sure, there are warning signs about cloud growth rates, but for many unicorns, we still live in boom times.” Indeed, two of the biggest names in pre-public startups appear once again track for IPOs. Airbnb could file to go public this month, despite pandemic losses to its business. Payments provider Stripe seems to be headed that way, too. The Valley’s oldest unicorn, Palantir, may finally do that direct filing. In the meantime, Accenture spinout Duck Creek Technologies had its big liquidity event for its private equity owners yesterday, with a 50% pop — Alex did a closer look at the insurtech company’s financials on Monday for Extra Crunch, and predicted events basically:

[T]o understand its revenue base, we’ll need to annualize the nine-month period that ended May 31, 2020 (ew), and use that to extrapolate a (kinda) revenue multiple using a set of metrics that we don’t tend to use for such things (yuck).

- Duck Creek nine-months’ revenue for period ending May 31, 2020: $153.35 million.

- That figure, annualized: $204.5 million.

- Implies revenue multiple at its two IPO valuations: 11.9x, and 13.2x.

Those seem somewhat reasonable? Maybe a little expensive given the company’s slow aggregate revenue growth and lower-than-average SaaS gross margins?

By that logic, the company will raise its IPO range, price above the boosted interval, and quintuple on its first day’s trading…

Want more zingers like this? He’s busy covering the 2020 unicorn-to-IPO path through all its twists and turns over on The Exchange, which subscribers can get as a daily post and as a weekly newsletter coming out every Saturday.

Image Credits: Bryce Durbin / TechCrunch / Getty Images

Our security editor Zack Whittaker had a first-person situation this week with poor security practices at a startup. And not just any kind of startup:

I got a tip about a new security startup, with fresh funding and an idea that caught my interest. I didn’t have much to go on, so I did what any curious reporter would do and started digging around. The startup’s website was splashy but largely word salad. I couldn’t find basic answers to my simple questions. But the company’s idea still seemed smart. I just wanted to know how the company actually worked.

So I poked the website a little harder.

Reporters use a ton of tools to collect information, monitor changes in websites, check if someone opened their email for comment, and navigate vast pools of public data. These tools aren’t special, reserved only for card-carrying members of the press, but rather are open to anyone who wants to find and report information. One tool I use frequently on the security beat lists all the subdomains on a company’s website. These subdomains are public but deliberately hidden from view, yet you can often find things that you wouldn’t from the website itself.

Bingo! I immediately found the company’s pitch deck. Another subdomain had a ton of documentation on how its product works. A bunch of subdomains didn’t load, and a couple were blocked off for employees only. (It’s also a line in the legal sand. If it’s not public and you’re not allowed in, you’re not allowed to knock down the door.) I clicked on another subdomain. A page flashed open, an icon in my Mac dock briefly bounced, and the camera light flashed on. Before I could register what was happening, I had joined what appeared to be the company’s morning meeting….

Founders, lock up those docs!

Image Credits: TechCrunch (opens in a new window)

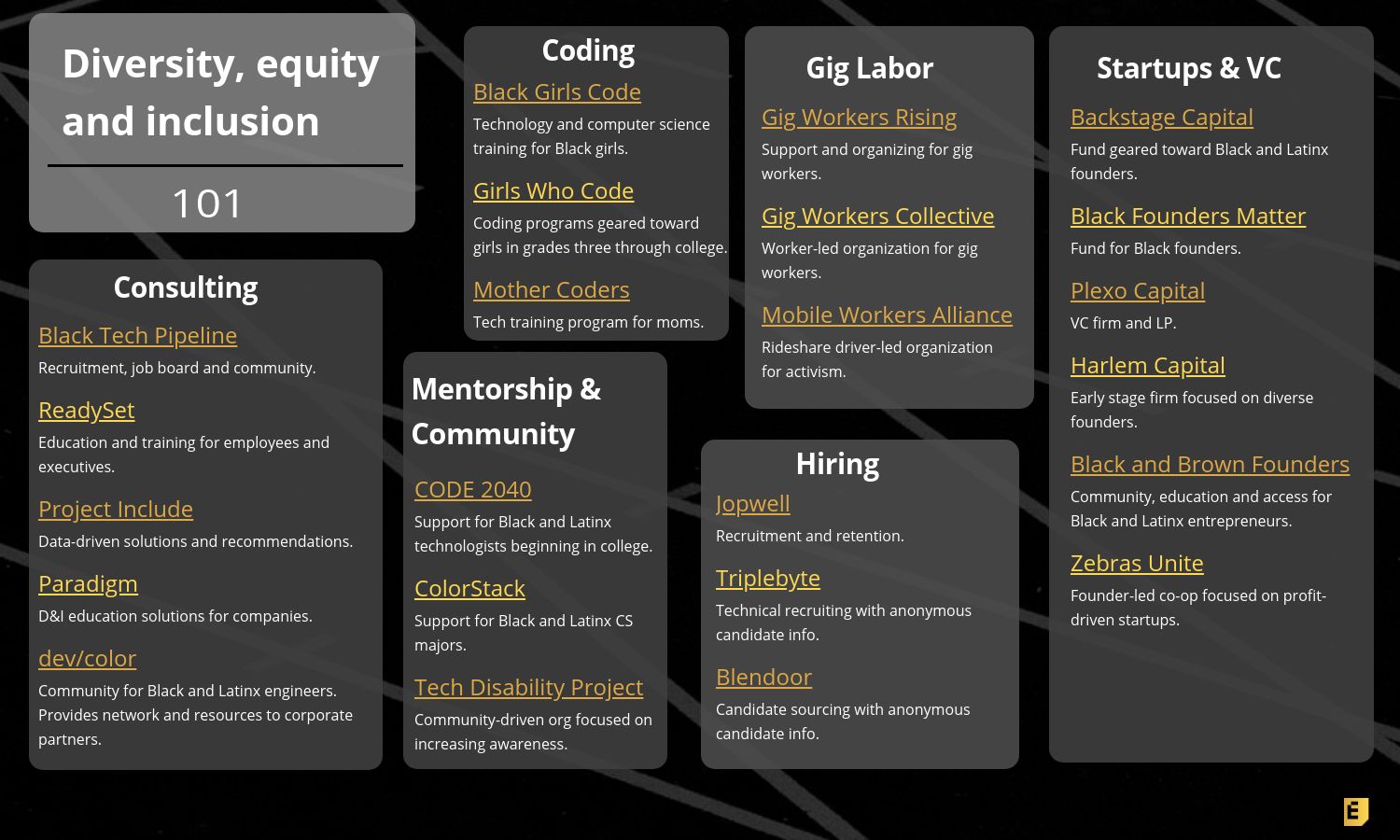

Megan Rose Dickey, who has started writing weekly column about tech labor called Human Capital, put together a quick set of resources for companies including a glossary of terms and key organizations, as well as key issues and data points for context. Here’s more:

After Minneapolis police killed George Floyd and the subsequent racial justice uprising, many people in tech shouted from the rooftops that “Black Lives Matter,” despite having subpar representation of Black and Latinx folks at their companies. In some cases, these companies’ proclamations of ‘Black Lives Matter’ felt especially performative in contrast to their respective stances on Trump and selling their technology to law enforcement agencies.

Still, this has led to an increased focus on diversity, inclusion and equity in the tech industry. If you’re wondering things like, “Where do I find Black and brown talent?” or saying, “I’d invest in Black and Latinx people if I could find them!,” then this is for you.

Below, you’ll learn about some of the issues at play, some of the key organizations doing work in this space and access a glossary of frequently used terms in the realm of diversity, equity and inclusion in tech.

Lucas Matney took a look through three growth marketing talks at early stage to glean key tactics for those who didn’t attend. Along discussions around SEO and landing pages, here’s a big presentation from Sound Venture’s Susan Su about growing a business through email marketing in 2020. Here’s an excerpt:

“The first role email plays in growth is as a tool to help you accelerate your reinforcing feedback loops. For example, email growth can help you expand LTV if you’re building a consumer e-comm or it can help you shorten your sales cycle if you’re a B2B, or enterprise SaaS business. It’s also really powerful for reducing attrition or churn, which is key, obviously, and sometimes it’s an overlooked way of actually increasing growth.”

The second role that [email] plays in growth is as a two-way channel connecting your product and your user, and that channel can carry information either about your product value from your brand out to your user, or it can carry information about your users needs and preferences from them to you.”

Check out her full talk, which was moderated by your faithful correspondent, for advanced topics like how to improve the credibility of your domain with spam filters.

Save with group discounts to TC Sessions: Mobility 2020

Ready, set, network: CrunchMatch is open for Disrupt 2020

We’re exploring the future of SaaS at Disrupt this year

Waymo COO Tekedra Mawakana is coming to TC Sessions: Mobility 2020

Rep. Zoe Lofgren to talk privacy and policy at Disrupt 2020

TechCrunch

Facebook launches support for paid online events

The robots occupying our sidewalks

Kamala Harris brings a view from tech’s epicenter to the presidential race

Extra Crunch

Building a fintech giant is very expensive

Minted.com CEO Mariam Naficy shares ‘the biggest surprise about entrepreneurship’

IoT and data science will boost foodtech in the post-pandemic era

What’s different about hiring data scientists in 2020?

No pen required: The digital future of real estate closings

From Alex:

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

This week we had the full crew around once again — Natasha Mascarenhas, Danny Crichton, Chris Gates and myself. And as always, it was key to have the full crew as there was an ocean of news to get through. Before we get into the show, make sure you’ve checked out Danny’s latest work on the TechCrunch List… now, let’s get to it:

And that was our show! We are back Monday morning. Stay cool!

Equity drops every Monday at 7:00 a.m. PT and Friday at 6:00 a.m. PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Rent the Runway and Glossier became unicorns within the same week in June 2019. That same year, only 2.7% of venture capital dollars went toward female-founded companies.

Silicon Valley’s disconnect between the monetary success of female-founded companies and funding them in the first place is disheartening. The conversation is there, but the dollar sign momentum remains missing.

Anu Duggal founded the Female Founders Fund before both were even a tangible reality. In 2014, the entrepreneur launched her first fund to invest in female-led startups. It took her 700 meetings over two years to make that first close, she said. Years later, venture capital has slightly taken note. But the Female Founders Fund, or “F Cubed,” has tracked female-led wins and bet big on the underestimated asset class.

Her early focus on female founders hasn’t evolved, but the landscape has. And in an unprecedented world of remote deals and democratization of venture capital, we’re even more excited to have Duggal join us on Extra Crunch Live this upcoming Thursday at 11 a.m. PT/2 p.m. EST/6 p.m. GMT

Those tuning in and taking notes are encouraged to ask questions, but you have to be an Extra Crunch member to access the chat. If you still haven’t signed up, now’s your chance! With the subscription, you’ll also be able to check out all of our stellar previous guests on-demand (watch those episodes here).

Female Founders Fund has provided seed institutional capital to entrepreneurs with over $3 billion in enterprise value. The firm has cut checks into women-led companies such as Rent the Runway, Billie, Tala, Peanut, Thrive Global and Zola. The fund has also attracted limited partners like Melinda Gates and Girls Who Code founder Reshma Saujani.

Duggal herself has a fascinating trajectory into technology investing. At 25, she started a wine bar in Bombay called The Tasting Room. She went on to get an MBA from London Business School, and co-founded Exclusively.in, an e-commerce company that got acquired by Indian fashion e-commerce company Myntra in 2011.

Hear from Duggal on August 20 about how the investment landscape has changed for female founders, what she thinks of as a success story and if 2020 feels different than 2014. And Extra Crunch fam, make sure to bring your thoughtful questions for me to ask her live on air.

You can find the full details of the conversation below the jump.

Powered by WPeMatico

At TechCrunch Early Stage, I spoke with Coatue Management GP Caryn Marooney about startup branding and how founders can get people to pay attention to what they’re building.

Marooney recently made the jump into venture capital; previously she was co-founder and CEO of The Outcast Agency, one of Silicon Valley’s best-regarded public relations firms, which she left to become VP of Global Communications at Facebook, where she led comms for eight years.

While founders often may think of PR as a way to get messaging across to reporters, Marooney says that making someone care about what you’re working on — whether that’s customers, investors or journalists — requires many of the same skills.

One of the biggest insights she shared: at a base level, no one really cares about what you have to say.

Describing something as newsworthy or a great value isn’t the same as demonstrating it, and while big companies like Amazon can get people to pay attention to anything they say, smaller startups have to be even more strategic with their messaging, Marooney says. “People just fundamentally aren’t walking around caring about this new startup — actually, nobody does.”

Getting someone to care first depends on proving your relevance. When founders are forming their messaging to address this, they should ask themselves three questions about their strategy, she recommends:

Powered by WPeMatico

No matter what you think of Sequoia Capital, the firm doesn’t rest on its laurels. Though it’s now managing ungodly amounts of money and has for decades been considered among the top venture firms in the world, it routinely finds new ways to stay relevant and to ensure that it gets a first look at the most promising founders.

It was the first firm to employ scouts, for example. Recently, to create more room between itself and its ever-growing number of competitors, the firm has also begun fine-tuning a curriculum for the founders of both the pre-seed and seed-stage startups it has funded, as well as its Series A and B-stage founders.

According to Roelof Botha — the U.S. head of the venture firm since 2017 — and Jess Lee, a partner at Sequoia for nearly four years, the idea is to arm the individuals it backs with Sequoia’s vast “tribal knowledge” so they can not only compete with their rivals but, hopefully, outperform them. “We were already delivering this on an on-demand basis,” says Botha, “so we figured why not [institutionalize it]?”

How do they work? Much as you might imagine. The pre-seed and seed-stage program is shorter but more intensive than the later-stage program. Think three weeks of between three to six hours of programming a day, versus up to 10 weeks of more occasional programming for founders whose companies are more mature and who maybe can’t drop in for quite as much hands-on education.

The content differs meaningfully, too. The seed-stage modules are about creating a foundation that won’t crumble under pressure, whereas the later-stage sessions center more around metrics, building out a sales organization, and other aspects of more mature company building.

Both programs are entirely opt-in, and so far, over the last three years, 80 founders have participated, with another 20 engaged in a seed-stage program that kicked off virtually this week. Both are highly interactive and involve enough workshopping that founders are “walking out with deliverables,” says Lee. “Everyone does show-and-tell demos. You see sausage-making that you wouldn’t typically get to see.”

Lee happens to lead programming around storytelling with Sequoia’s in-house design partner, James Buckhouse. (They presented one small part of that module at our recent Extra Crunch event, which you can watch below.) But many of the firm’s partners are involved in the program.

Longtime partner Alfred Lin, who was formerly the COO and chairman of Zappos, teaches a module on culture, for example. Partner Bryan Schreier, long ago a senior director at Google, talks with founders about category creation and how to sell their products. Carl Eschenbach, the former president and COO of VMware (who, notably, persuaded Sequoia to invest nearly $100 million in Zoom in early 2017), separately coaches founders on their go-to-market strategies.

As a result, founders are exposed to many of the firm’s partners beyond the one who may have a seat on their board. They’re also exposed to founders like Julia Hartz and Tony Xu who’ve been backed by Sequoia over time and who drop in to help mentor their peers. Combined, the two prongs go a long way toward fostering community, says Lee.

In fact, “Community is really the core element” of the programs, she says, adding that each “cohort really bonds with each other.”

Of course, the programming — first launched in 2018 — was happening in-person until earlier this year. Now and for the foreseeable future, it will be happening online, suggests Botha, who says he “emcees the entire Series A-stage program,” while Lee plays master of ceremonies to its earlier-stage founders.

They insist that transition to a virtual setting isn’t slowing anyone down and that on the contrary, it has enabled the growing number of Sequoia-backed founders elsewhere in the world to participate. (According to Lee, some actually used to fly in to join these sessions.)

In fact, a bigger change that Botha can foresee right now is layering in more education around “how to deal with a culture with a remote workforce.”

As he says, in a future where people may be working in smaller hubs, taking turns at the office, or working remotely entirely, “it will be interesting to see what it means for young founders who are first-time managers and who have to manage a distributed team.”

It will most certainly be “more taxing on [their] people skills,” he notes.

Powered by WPeMatico

Andy Rachleff founded Wealthfront a decade ago to give investors a better and smarter way to manage their wealth, building on core academic research showing that a carefully balanced portfolio of low-fee ETFs outperformed more aggressive strategies. Since then, the company has taken in billions of dollars of invested capital under management and expanded into new banking services, including high-interest checking accounts.

Rachleff and I talked on Extra Crunch Live about where Wealthfront is heading as it speeds toward its second decade, how he sees the competition from other, more active trading platforms like Robinhood and his advice for startup founders looking to build enduring products and companies away from the daily status quo.

Rachleff began our conversation talking about the future of Wealthfront, which is increasingly moving beyond its wealth management app to new services.

“Our vision is to automate all of your finances — we call this self-driving money,” he said. That platform is expected to role out in September, and include features like easy direct deposit and automated bill pay, with any savings left over automatically moving to the right investment assets that meet a user’s chosen risk tolerance.

Powered by WPeMatico