Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Playdots — developer of the mobile games Dots, Two Dots and Dots & Co. — has reached an agreement to be acquired by publisher Take-Two Interactive.

Take-Two will pay $192 million for the deal, $90 million in cash and the remaining $102 million in stock.

Playdots was founded in 2014 by Paul Murphy and Patrick Moberg, spinning out of startup studio betaworks with $10 million in funding led by Tencent and Greycroft. It’s currently led by CEO Nir Efrat, a former King.com executive who joined Playdots in 2018.

In the acquisition announcement, Take-Two (best known for publishing major franchises like BioShock and NBA 2K, plus — through its Rockstar Games subsidiary — Grand Theft Auto and Red Dead Redemption) says that Erfat will continue to lead Playdots’ 70-person team.

Apparently the various Dots games have been downloaded more than 100 million times, with more than 80 million of those downloads coming from the most popular title, Two Dots.

In a statement, Michael Worosz, Take-Two’s executive vice president and head of strategy and independent publishing, said:

Our acquisition of Playdots will diversify and strengthen further Take-Two’s mobile game offerings, particularly within the casual, free-to-play segment. Two Dots continues to grow its audience and under the leadership of Nir, the addition of scavenger hunts, social leader boards and live-ops technology are enhancing the game and driving meaningful, long-term consumer engagement. We are very pleased to welcome Nir and the entire team at Playdots to the Take-Two family and are excited by the potential of their development pipeline and positive, long-term contributions to our business.

Powered by WPeMatico

Buildkite, a Melbourne-based company that provides a hybrid continuous integration and continuous delivery (CI/CD) platform for software developers, announced today that it has raised AUD $28 million (about USD $20.2 million) in Series A funding, bringing its valuation to more than AUD $200 million (about USD $145 million).

The funding was led by OpenView, an investment firm that focuses on growth-stage enterprise software companies, with participation from General Catalyst.

This round is the company’s first since Buildkite raised about AUD $200,000 in seed funding when it was founded in 2013.

Co-founder and chief executive officer Lachlan Donald told TechCrunch that Buildkite didn’t seek more funding earlier because it was growing profitably. In fact, the company turned away interested investors “because we wanted to focus on sustainable growth and maintain control of our destiny.”

But Donald said they were open to investment from OpenView and General Catalyst because they see the two investors as “true partners as we enter and define this next generation of CI/CD.”

Buildkite’s team is small, with just 26 employees. “We’re a lean, focused team, so their expert advice and guidance will help more software teams around the world discover Buildkite,” Donald said. He added that part of the funding round will be used to give 42X returns to early investors and shareholders, and the rest will be used on product development.

In a statement about the funding, OpenView partner Mackey Craven said, “The global pandemic and the resulting economic uncertainty underlines the importance for companies to maximize efficiencies and build for growth. As the world continues to build digital-first applications, we believe Buildkite’s unique approach will be the new enterprise standard of CI/CD and we’re excited to be supporting them in realizing this ambition.”

Continuous integration gives software teams an automated way to develop and test applications, making collaboration more efficient, while continuous delivery refers to the process of pushing code to environments for further testing by other teams, or deploying it to customers. CI/CD platforms make it easier for fast-growing tech companies to test and deliver software. Buildkite says it now has more than 1,000 customers, including Shopify, Pinterest and Wayfair.

As part of the round, Jean-Michel Lemieux, Shopify’s chief technology officer, and Ashley Smith, chief revenue officer at Gatsby and OpenView venture partner, will join Buildkite’s board.

The increased use of online applications caused by the COVID-19 pandemic means there is more demand for CI/CD platform, since engineering teams need to work more quickly.

“A good example is Shopify, one of our longstanding partners. They came to us after they outgrew their previous hosted CI provider,” Donald said. “Their challenge is one we see across all of customers — they needed to reduce build time and scale their team across multiple time zones. Once they wrapped Buildkite into their development flow, they saw a 75% reduction in build wait times. They grew their team by 300% and have still been able to keep build time under 10 minutes.”

Other CI platforms available include Jenkins, CircleCI, Travis, Codeship and GitLab. Co-founder and chief technology officer Keith Pitt said one of the ways that BuildKite differentiates from its rivals is its focus on security, which prompted his interest in building the platform in the first place.

“Back in 2013, my then-employer asked that I stop using a cloud-based CI/CD platform due to security concerns, but I found the self-hosted alternatives to be incredibly outdated,” Pitt said. “I realized a hybrid approach was the solution for testing and deploying software at scale without compromising security or performance, but was surprised to find a hybrid CI/CD tool didn’t exist yet. I decided to create it myself, and Buildkite was born.”

Powered by WPeMatico

Movable Ink, a company that helps businesses deliver more personalized and relevant email marketing, is announcing that it has raised $30 million in Series C funding.

The company will be 10 years old in October, and founder and CEO Vivek Sharma told me that it’s always been “capital efficient” — even with the new round, Movable Ink has only raised a total of $39 million.

However, Sharma noted that with COVID-19, it felt like “a good idea to have some dry powder on our balance sheet … if things turned south.”

At the same time, he suggested that the pandemic’s impact has been more limited than he anticipated, and has been “really focused” on a few sectors like travel, hospitality and “old line retailers.”

“Those who are adopting to e-commerce really quickly have done well, financial services has done well, media has done well,” he said.

The company’s senior vice president of strategy Alison Lindland added that clients using Movable Ink were able to move much more quickly, with campaigns that would normally take months launching in just a few days.

“We really saw those huge, wholesale digital transformations in a time of duress,” Lindland said. “Obviously, large Fortune 500 companies were making difficult decisions, were putting vendors on hold, but email marketers are always the last people furloughed themselves, because of how critical email marketing is to their businesses. We were just as critical to their operations.”

Image Credits: Movable Ink

The company said it now works with more than 700 brands, and in the run up to the 2020 election, its customers include the Democratic National Committee.

The new funding comes from Contour Venture Partners, Intel Capital and Silver Lake Waterman. Sharma said the money will be spent on three broad categories: “Platforms, partners and people.”

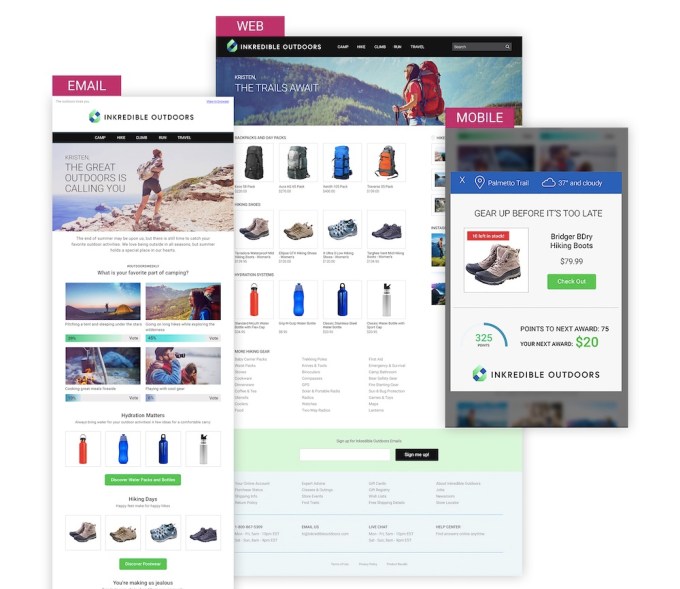

On the platform side, that means continuing to develop Movable Ink’s technology and expanding into new channels. He estimated that around 95% of Movable Ink’s revenue comes from email marketing, but he sees a big opportunity to grow the web and mobile side of the business.

“We take any data the brand has available to it and activate and translate it into really engaging creative,” he said, arguing that this approach is applicable in “every other channel where there’s pixels in front of the consumer’s eyes.”

The company also plans to make major investments into AI. Sharma said it’s too early to share details about those plans, but he pointed to the recent hire of Ashutosh Malaviya as the company’s vice president of artificial intelligence.

As for partners, the company has launched the Movable Ink Exchange, a marketplace for integrations with data partners like Oracle Commerce Cloud, MessageGears Engage, Trustpilot and Yopto.

And Movable Ink plans to expand its team, both through hiring and potential acquisitions. To that end, it has hired Katy Huber as its senior vice president of people.

Sharma also said that in light of the recent conversations about racial justice and diversity, the company has been looking at its own hiring practices and putting more formal measures in place to track its progress.

“We use OKRs to track other areas of the business, so if we don’t incorporate [diversity] into our business objectives, we’re only paying lip service,” he said. “For us, it was really important to not just have a big spike of interest, and instead save some of that energy so that it’s sustained into the future.”

Powered by WPeMatico

What early-stage startup founder wouldn’t love to have a crystal ball? Especially now with a pandemic wreaking economic uncertainty across industries in every corner of the world.

We don’t have mystical powers, but we do have the next best thing, and it’s available exclusively to early-stage founders exhibiting in Digital Startup Alley at Disrupt 2020. Sign up today for our interactive webinar, COVID-19’s Impact on the Startup World, scheduled for August 19th at 1pm PT/ 4pm ET.

What does the future of work look like? In what ways will startups need to adapt, and how can they course-correct both during and after COVID-19? These are some of the challenging topics our expert panel will address, and they’ll take questions from the viewing audience, too.

Which brilliant minds will offer their perspective, tips and advice? None other than Nicola Corzine, executive director of the Nasdaq Entrepreneurship Center and Cameron Stanfill, a VC analyst at PitchBook. Jon Shieber, a TechCrunch writer who covers venture capital and private equity investments will moderate the conversation. It’s an interactive webinar, folks, so don’t be shy — bring your questions, comments and ideas to the table.

If you haven’t purchased a Disrupt Digital Startup Alley Package, go grab yours now. You’ll be able to attend this webinar and the next one, too (more on that in a minute). But here’s the most important part — you’ll showcase your tech, talent and products to thousands of Disrupt attendees from around the world. Boost your brand recognition, and connect with potential customers, partners, investors, media and other influencers across the startup ecosystem. You never know who you’ll meet exhibiting in the Alley or where a chance connection might lead.

“Exhibiting in Startup Alley gave our company and technology invaluable exposure to potential customers and partners that we would not have met otherwise. A company that does 15 billion in annual sales thinks our tech is a fit for their ecosystem, and we’re excited to continue building that relationship.” — Joel Neidig, founder of SIMBA Chain.

Now that you’re all set with your Digital Startup Alley exhibitor pass, circle August 26 on your calendar for the final webinar we scheduled for exhibitors’ edification.

August 26 — Fundraising and Hiring Best Practices

Moderated by TC’s Natasha Mascarenhas, panelists Sarah Kunst (Cleo Capital) and Brett Berson (First Round Capital) discuss two essential topics for startup success. Securing funding may feel like the hardest part of growing a startup, but hiring the right people ain’t no walk in the park either. You need to get a handle on both areas, and these folks can help you do just that.

Exhibitors, sign up for the August 19 webinar, COVID-19’s Impact on the Startup World. And to the rest of the early-stage startup founders out there — don’t miss your chance to be an exhibitor at Disrupt 2020 — buy a Disrupt Digital Startup Alley Package today.

Is your company interested in sponsoring or exhibiting at Disrupt 2020? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Lana, a new startup based in Madrid, is looking to be the next big thing in Latin American fintech.

Founded by serial entrepreneur Pablo Muniz, whose last business was backed by one of Spain’s largest financial services institutions, BBVA, Lana is looking to be the all-in-one financial services provider for Latin America’s gig economy workers.

Muniz’s last company, Denizen, was designed to provide expats in foreign and domestic markets with the financial services they would need as they began their new lives in a different country. While the target customer for Lana may not be the same middle to upper-middle-class international traveler that he had previously hoped to serve, the challenges gig economy workers face in Latin America are much the same.

Muniz actually had two revelations from his work at Denizen. The first — he would never try to launch a fintech company in conjunction with a big bank. And the second was that fintechs or neobanks that focus on a very niche segment will be successful — so long as they can find the right niche.

The biggest niche that Muniz saw that was underserved was actually in the gig economy space in Latin America. “I knew several people who worked at gig economy companies and I knew that their businesses were booming and the industry was growing,” he said. “[But] I was concerned about the inequalities.”

Workers in gig economy marketplaces in Latin America often don’t have bank accounts and are paid through the apps on which they list their services in siloed wallets that are exclusive to that particular app. What Lana is hoping to do is become the wallet of wallets for all of the different companies on which laborers list their services. Frequently, drivers will work for Uber or Cabify and deliver food for Rappi. Those workers have wallets for each service.

(Photo by Cris Faga/Pacific Press/LightRocket via Getty Images)

Lana wants to unify all of those disparate wallets into a single account that would operate like a payment account. These accounts can be opened at local merchant shops and, once opened, workers will have access to a debit card that they can use at other locations.

The Lana service also has a bill pay feature that it’s rolling out to users, in the first evolution of the product into a marketplace for financial services that would appeal to gig workers, Muniz said.

“We want to become that account in which they receive funds,” he said. “We are still iterating the value proposition to gig economy companies.”

Working with companies like Cabify, and other, undisclosed companies, Lana has plans to roll out in Mexico, Chile, Peru and, eventually, Colombia and Argentina.

Eventually, Lana hopes to move beyond basic banking services like deposits and payments and into credit services. Already hundreds of customers are using the company’s service through the distribution partnership with Cabify, which ran the initial pilot to determine the viability of the company’s offering.

“The idea of creating Lana was initially tested as an internal project at Cabify,” Muniz wrote in an email. “Soon Cabify and some potential investors saw that Lana could have a greater impact as an independent company, being able to serve gig economy workers from any industry and decided to start over a new entrepreneurial project.”

Through those connections with Cabify, Lana was able to bring in other investors like the Silicon Valley-based investment firm Base 10.

“One of the things we’ve been interested in is in inclusion generally and in fintech specifically,” said Adeyemi Ajao, the firm’s co-founder. “We had gotten very close to investing in a couple of fintech companies in Latin America and that is because the opportunity is huge. There are several million people going from unbanked to banked in the region.”

Along with a few other investors, Base 10 put in $12.5 million to finance Lana as it looks to expand. It’s a market that has few real competitors. Nubank, Latin America’s biggest fintech company, is offering credit services across the continent, but most of their end users already have an established financial history.

“Most of their end users are not unbanked,” said Ajao. “With Lana it is truly gig workers… They can start by being a wallet of wallets and then give customers products that help them finance their cars or their scooters.”

The ultimate idea is to get workers paid faster and provide a window into their financial history that can give them more opportunities at other gig economy companies, said Ajao. “The vision would be that someone can plug in their financial information for services. If they’re working for Rappi and have never been an Uber driver and they want to be an Uber driver, Lana can use their financial history with Rappi to offer a loan on a car,” he said.

That financial history is completely inaccessible to a traditional bank, and those established financial services don’t care about the history built in wallets that they can’t control or track. “Today if you’ve been a gig worker and you go to a bank, that’s worth nothing,” said Ajao.

Powered by WPeMatico

Microsoft’s new Flight Simulator is a technological marvel that sets a new standard for the genre. But to recreate a world that feels real and alive and contains billions of buildings all in the right spots, Microsoft and Asobo Studios relied on the work of multiple partners.

One of those is the small Austrian startup Blackshark.ai from Graz that, with a team of only about 50 people, recreated every city and town around the world with the help of AI and massive computing resources in the cloud.

Ahead of the launch of the new Flight Simulator, we sat down with Blackshark co-founder and CEO Michael Putz to talk about working with Microsoft and the company’s broader vision.

Blackshark is actually a spin-off of game studio Bongfish, the maker of World of Tanks: Frontline, Motocross Madness and the Stoked snowboarding game series. As Putz told me, it was actually Stoked that set the company on the way to what would become Blackshark.

“One of the first games we did in 2007 was a snowboarding game called Stoked and S Stoked Bigger Edition, which was one of the first games having a full 360-degree mountain where you could use a helicopter to fly around and drop out, land everywhere and go down,” he explained. “The mountain itself was procedurally constructed and described — and also the placement of obstacles of vegetation, of other snowboarders and small animals had been done procedurally. Then we went more into the racing, shooting, driving genre, but we still had this idea of positional placement and descriptions in the back of our minds.”

Bongfish returned to this idea when it worked on World of Tanks, simply because of how time-consuming it is to build such a huge map where every rock is placed by hand.

Based on this experience, Bongfish started building an in-house AI team. That team used a number of machine-learning techniques to build a system that could learn from how designers build maps and then, at some point, build its own AI-created maps. The team actually ended up using this for some of its projects before Microsoft came into the picture.

“By random chance, I met someone from Microsoft who was looking for a studio to help them out on the new Flight Simulator. The core idea of the new Flight Simulator simulator was to use Bing Maps as a playing field, as a map, as a background,” Putz explained.

But Bing Maps’ photogrammetry data only yielded exact 1:1 replicas of 400 cities — for the vast majority of the planet, though, that data doesn’t exist. Microsoft and Asobo Studios needed a system for building the rest.

This is where Blackshark comes in. For Flight Simulator, the studio reconstructed 1.5 billion buildings from 2D satellite images.

Now, while Putz says he met the Microsoft team by chance, there’s a bit more to this. Back in the day, there was a Bing Maps team in Graz, which developed the first cameras and 3D versions of Bing Maps. And while Google Maps won the market, Bing Maps actually beat Google with its 3D maps. Microsoft then launched a research center in Graz and when that closed, Amazon and others came in to snap up the local talent.

“So it was easy for us to fill positions like a PhD in rooftop reconstruction,” Putz said. “I didn’t even know this existed, but this was exactly what we needed — and we found two of them.

“It’s easy to see why reconstructing a 3D building from a 2D map would be hard. Even figuring out a building’s exact outline isn’t easy.

“What we do basically in Flight Simulator is we look at areas, 2D areas and then finding out footprints of buildings, which is actually a computer vision task,” said Putz. “But if a building is obstructed by a shadow of a tree, we actually need machine learning because then it’s not clear anymore what is part of the building and what is not because of the overlap of the shadow — but then machine learning completes the remaining part of the building. That’s a super simple example.”

While Blackshark was able to rely on some other data, too, including photos, sensor data and existing map data, it has to make a determination about the height of the building and some of its characteristics based on very little information.

The obvious next problem is figuring out the height of a building. If there is existing GIS data, then that problem is easy to solve, but for most areas of the world, that data simply doesn’t exist or isn’t readily available. For those areas, the team takes the 2D image and looks for hints in the image, like shadows. To determine the height of a building based on a shadow, you need the time of day, though, and the Bing Maps images aren’t actually timestamped. For other use cases the company is working on, Blackshark has that and that makes things a lot easier. And that’s where machine learning comes in again.

“Machine learning takes a slightly different road,” noted Putz. “It also looks at the shadow, we think — because it’s a black box, we don’t really know what it’s doing. But also, if you look at a flat rooftop, like a skyscraper versus a shopping mall. Both have mostly flat rooftops, but the rooftop furniture is different on a skyscraper than on a shopping mall. This helps the AI to learn when you label it the right way.”

And then, if the system knows that the average height of a shopping mall in a given area is usually three floors, it can work with that.

One thing Blackshark is very open about is that its system will make mistakes — and if you buy Flight Simulator, you will see that there are obvious mistakes in how some of the buildings are placed. Indeed, Putz told me that he believes one of the hardest challenges in the project was to convince the company’s development partners and Microsoft to let them use this approach.

“You’re talking 1.5 billion buildings. At these numbers, you cannot do traditional Q&A anymore. And the traditional finger-pointing in like a level of Halo or something where you say ‘this pixel is not good, fix it,’ does not really work if you develop on a statistical basis like you do with AI. So it might be that 20% of the buildings are off — and it actually is the case I guess in the Flight Simulator — but there’s no other way to tackle this challenge because outsourcing to hand-model 1.5 billion buildings is, just from a logistical level and also budget level, not doable.”

Over time, that system will also improve, and because Microsoft streams a lot of the data to the game from Azure, users will surely see changes over time.

Labeling, though, is still something the team has to do simply to train the model, and that’s actually an area where Blackshark has made a lot of progress, though Putz wouldn’t say too much about it because it’s part of the company’s secret sauce and one of the main reasons why it can do all of this with just about 50 people.

“Data labels had not been a priority for our partners,” he said. “And so we used our own live labeling to basically label the entire planet by two or three guys […] It puts a very powerful tool and user interface in the hands of the data analysts. And basically, if the data analyst wants to detect a ship, he tells the learning algorithm what the ship is and then he gets immediate output of detected ships in a sample image.”

From there, the analyst can then train the algorithm to get even better at detecting a specific object like a ship, in this example, or a mall in Flight Simulator. Other geospatial analysis companies tend to focus on specific niches, Putz also noted, while the company’s tools are agnostic to the type of content being analyzed.

And that’s where Blackshark’s bigger vision comes in. Because while the company is now getting acclaim for its work with Microsoft, Blackshark also works with other companies around reconstructing city scenes for autonomous driving simulations, for example.

“Our bigger vision is a near-real-time digital twin of our planet, particularly the planet’s surface, which opens up a trillion use cases where traditional photogrammetry like a Google Earth or what Apple Maps is doing is not helping because those are just simplified for photos clued on simple geometrical structures. For this we have our cycle where we have been extracting intelligence from aerial data, which might be 2D images, but it also could be 3Dpoint counts, which are already doing another project. And then we are visualizing the semantics.”

Those semantics, which describe the building in very precise detail, have one major advantage over photogrammetry: Shadow and light information is essentially baked into the images, making it hard to relight a scene realistically. Since Blackshark knows everything about that building it is constructing, it can then also place windows and lights in those buildings, which creates the surprisingly realistic night scenes in Flight Simulator.

Point clouds, which aren’t being used in Flight Simulator, are another area Blackshark is focusing on right now. Point clouds are very hard to read for humans, especially once you get very close. Blackshark uses its AI systems to analyze point clouds to find out how many stories a building has.

“The whole company was founded on the idea that we need to have a huge advantage in technology in order to get there, and especially coming from video games, where huge productions like in Assassin’s Creed or GTA are now hitting capacity limits by having thousands of people working on it, which is very hard to scale, very hard to manage over continents and into a timely delivered product. For us, it was clear that there need to be more automated or semi-automated steps in order to do that.”

And though Blackshark found its start in the gaming field — and while it is working on this with Microsoft and Asobo Studios — it’s actually not focused on gaming but instead on things like autonomous driving and geographical analysis. Putz noted that another good example for this is Unreal Engine, which started as a game engine and is now everywhere.

“For me, having been in the games industry for a long time, it’s so encouraging to see, because when you develop games, you know how groundbreaking the technology is compared to other industries,” said Putz. “And when you look at simulators, from military simulators or industrial simulators, they always kind of look like shit compared to what we have in driving games. And the time has come that the game technologies are spreading out of the game stack and helping all those other industries. I think Blackshark is one of those examples for making this possible.”

Powered by WPeMatico

Robinhood announced this morning that it has raised $200 million more at a new, higher $11.2 billion valuation. The new capital came as a surprise.

Astute observers of all things fintech will recall that Robinhood, a popular stock trading service, has raised capital multiple times this year, including an initial $280 million round at an $8.3 billion valuation, and a later $320 million addition that brought its valuation to $8.6 billion.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Those rounds, coming in May and July, now feel very passé in the sense that they are frightfully cheap compared to the price at which Robinhood just added new funds. D1 Partners — a private capital pool founded in 2018 — led the funding.

The unicorn’s new nine-figure tranche, a Series G, values the firm at $11.2 billion. A $2.6 billion bump in about a month is an impressive result, one that points to an inescapable conclusion: Robinhood is still growing, and fast.

How fast is the question. There are three things to bring up in this regard: Trading growth at Robinhood, the company’s soaring incomes from selling order flow to other financial institutions, and, oddly enough, crypto. Let’s peek at each and come up with a good why as to the new Robinhood valuation.

After all, we’re going to see an IPO from this company before the markets get less interesting, if it’s smart.

Robinhood is currently walking a line between enthusiasm that its trading volume is growing and conservatism, arguing that its userbase is not majority-comprised of day traders. The company is stuck between the need for huge revenue growth and keeping pedestrian users from tanking their net worth with unwise options bets.

It’s worth noting that Robinhood spent a lot of its funding round announcement email to TechCrunch talking about its users safety and education work. It makes sense given that we know that the company is seeing record trades, and record incomes from options themselves. After a Robinhood user killed themself after misunderstanding an options trade on the platform, Robinhood pledged to do better. We’re keeping tabs on how well it manages to meet the mark of its promise.

But back to the revenue game, let’s talk volume. On the trading front Robinhood has lots of darts. And by darts we mean daily average revenue trades. Robinhood had 4.31 million DARTs in June, with the company adding that “DARTs in Q2 more than doubled compared to Q1” in an email.

The huge gain in trading volume does not mean that most Robinhood users are day trading, but it does imply that some are given the huge implied trading volume results that the DARTs figure points to. Robinhood saw around 129,300,000 trades in June, which is 30 days. That’s a lot!

Powered by WPeMatico

Over the past two years, the global supply chain has been hit with two major upheavals: the United States-China trade war and, more cataclysmically, COVID-19.

When Reefknot Investments launched its $50 million fund for logistics and supply chain startups last September, the industry was already dealing with the effects of the tariff war, says managing director Marc Dragon. Then a few months later, the COVID-19 crisis began in China before spreading to the rest of the world, disrupting the supply chain on an unprecedented scale.

Almost all industries have been impacted, from food, consumer goods and medical supplies to hardware.

Reefknot, a joint venture between Temasek, Singapore’s sovereign fund, and global logistics company Kuehne + Nagel, focuses on early-stage tech companies that use AI to solve some of the supply chain’s most pressing issues, including risk forecasting, financing and tracking goods around the world.

In March, around the time the World Health Organization declared the COVID-19 crisis a pandemic, Reefknot surveyed nine shippers about the challenges they face. While there are other macroeconomic factors at play, including Brexit and the oil price war, the survey’s main focus was on the combined effect of COVID-19 and the U.S.-China trade war on the supply chain and logistics industry.

According to the study, the main things shippers want is the ability to dynamically manage supply chain risks and operations and optimize cash flow between corporate buyers and their suppliers, who often struggle with working capital.

Many of the current solutions used in the supply chain involve a lot of manual tasks, including spreadsheets to predict demand, phone calls to confirm capacity on planes and ships and checking goods to make sure orders were fulfilled properly.

Powered by WPeMatico

It’s been less than a year since Group Nine Media acquired PopSugar — but it’s been a uniquely challenging time in digital media.

Brian Sugar founded the eponymous women’s lifestyle site with his wife Lisa Sugar . Post-acquisition, he’s become president for the entirety of Group Nine (which also owns Thrillist, NowThis, The Dodo and Seeker) and also joined the company’s board.

That job probably looks very different from what he expected last fall. The company had to lay off 7% of its staff back in April, which Sugar described as “one of the worst days of my career.” At the same time, he remains confident about the online advertising business. In his view, it’s TV advertising that’s taken a “huge punch” in the face and will never recover.

“We like to think of ourselves as one of the fastest, most innovative publishers out there,” Sugar told me. “And now’s the time for us to kind of show that off.”

You can read an edited, updated and condensed transcript of our conversation below, in which I talked to Sugar about how his role has evolved, how he motivates the team during difficult times and what gets lost in the shift to remote work.

TechCrunch: Obviously, it’s been a crazy couple of months since we last talked. What does your job look like now?

Brian Sugar: Well, I feel like a data miner, searching for answers. I feel like a hackathon engineer. And I feel like a therapist. You know, we like to think of ourselves as one of the fastest, most innovative publishers out there. And now’s the time for us to kind of show that off.

[We’ve just been] looking at data on how people are consuming our content across platforms. And on our site, we’ve come up with some really interesting ideas that we’ve implemented. We’ve been having these really cool hackathon Fridays to build stuff quickly, because a lot of people feel like they have a little bit more time on their hands — because you don’t have to travel to meetings, you can get more work done. Some people feel they’re more efficient.

We’re extremely optimistic. All our brands are extremely optimistic, and so is [the whole] company.

You mentioned launching some new products to respond to how audience behavior is changing. Are there any examples?

The first one [is] the PopSugar Fitness thing. We were planning on launching a paid workout subscription service in May, but everybody was working from home [in March], and we decided to pull the launch all the way up to as fast as we can launch it. We launched it that following weekend. Since the launch in late March, over the past few months, we’ve had 200,000 people sign up, and we have 50,000 monthly active users on it.

Powered by WPeMatico

It’s possible to raise VC funding even if you haven’t built a real product, according to Charles Hudson, founder and managing partner at seed-stage firm Precursor Ventures. It’s just very, very difficult.

I interviewed Hudson during TechCrunch Early Stage, our virtual event for startup founders. He gave a short talk titled “How to sell an idea when you don’t have a product,” then answered questions from me and from attendees watching at home.

Hudson said Precursor invests in about 25 startups every year and that a majority are pre-launch and pre-traction. So when he’s considering startups where there “isn’t any evidence or traction,” he and other investors are basically considering two things: How well the founder knows the industry, and how well the investors know the founder.

Of course, if you’ve already had success and you know everyone on Sand Hill Road, it might not be that hard to get that first check. But what about everyone else?

Below, I’ve quoted some highlights from Hudson’s thoughts about how to raise money pre-product. You can also watch the full presentation/conversation at the end of this post.

You need to have a unique and durable insight that will still be true in 12 to 18 months … The unique part is important because you still haven’t launched your product yet. And so whatever it is that you’re doing, if it’s not unique, if it’s a really obvious insight, you’ll probably have 10 or 12 competitors that are launched in the market by the time you get your product out.

Powered by WPeMatico