Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Nearly three in 10 employees (29%) would quit their job if they were told they were no longer allowed to work remotely, according to a recent survey. In addition, a recent Harvard Business Study found that “companies that let their workers decide where and when to do their jobs — whether in another city or in the middle of the night — increase employee productivity, reduce turnover and lower organizational costs.”

Over the past 18 months, while instituting a remote work model, our turnover rate at Insightly was the lowest in company history and an internal survey found happiness levels to be twice as high from the previous year. This in the midst of a major pandemic, social movement, forest fires and a disruptive election — all happening at the same time.

As long as your employees are available when your customers are in need and goals are consistently met, 9 to 5 no longer needs to be a thing.

On a larger, global scale, employers from companies around the world are coming to the same realization: You don’t need an office to be productive and employees are happier working from home.

The next logical step is, at the same time, a majorly disruptive one and a 180-degree shift toward how companies have operated for over 100 years — the transition from in-person headquarters to a remote, work-from-anywhere model. In line with this shift, we’ve foregone our 40,000-square-foot Soma office space and employees are able to work from anywhere in the United States while keeping the same salary.

There will no doubt be challenges, and there already have been. But with these challenges also arises immense opportunity. Here are a few battle-tested tips on how to maintain productivity while delivering flexibility with this new work model:

Let employees choose where they live. Allowing this option will better their lives and make for happy, engaged employees. Overhead costs, especially in large cities such as San Francisco, are the largest operating expense for most companies. Take this large sum of money and invest in employee happiness. You don’t need thousands of square feet in office space to be successful.

That massive overhead cost you just got rid of? Use this toward more meaningful employee experiences that will enhance their lives.

Powered by WPeMatico

Kiddom, a platform that offers a digital curriculum that fits the core standards required by states, announced today that it has raised a $35 million Series C round led by Altos Ventures, with participation from Owl Ventures, Khosla Ventures and Outcomes Collective. The financing came nearly three years after Kiddom’s Series B, a $15 million round led by Owl.

The startup didn’t just raise money, it finally learned how to make some. Founded in 2012, Kiddom was able to raise millions without revenue or a clear business model. But Ahsan Rizvi, CEO and co-founder of Kiddom, and Abbas Manjee, chief academic officer and co-founder of Kiddom, think an early focus on adoption instead of monetization was necessary.

“At our Series B, we were definitely not making money,” Manjee said. “But we have a free product that teachers and students use, and the idea was to build an enterprise product on top of it.” It’s a common strategy with bottom up sales. For example, ClassDojo prioritized adoption for years before it finally introduced a paying version of its classroom socialization product.

Kiddom poured most of its capital into research and development into its enterprise product. It has two parts. First, it offers a platform that helps schools integrate all of their different platforms into an interface that tracks student utilization and achievement. Second, it offers that platform alongside the product it’s built up for years, a digital curriculum that fits in with Common Core, a set of math and English academic standards that students are required to learn on a grade by grade level. The latter is perhaps the hardest sell for Kiddom, but also the most lucrative.

Manjee explained vendor approval processes across the States can take a long time, and the stakes are high since decision-makers will only turn to a handful of vendors when it comes to meeting core standards.

A lot of Kiddom’s success depends on if traditional curriculum providers, like the Pearsons and McGraw-Hills of the world, don’t catch up to the digitization of education. Rizvi explained that older companies are “losing market share rapidly” right now. Last year, McGraw-Hill and Cengage terminated a proposed merger that would’ve added some fresh competition to the curriculum world.

The product has resonated with some users. While Kiddom declined to give specifics, it said that new ARR growth grew 2,525% its first year. In 2020 to 2021, ARR growth is on track to be 300%. It said that at least one teacher uses its product in 70% of schools in the United States, a metric that has remained consistent since 2018.

Kiddom’s fresh funding and revenue shows that its years of product development have kept it competitive in the eyes of investors, synergistic unicorns and the stingiest enterprise customer of them all, school districts.

Powered by WPeMatico

Automation will displace 85 million jobs while simultaneously creating 97 million new jobs by 2025, according to the World Economic Forum. Although that sounds like good news, the hard reality is that millions of people will have to retrain in the jobs of the future.

A number of startups are addressing these problems of employee skills, and are looking at talent development, neuroscience-based assessments and prediction technologies for staffing. These include Pymetrics (raised $56.6 million), Eightfold (raised $396.8 million) and EmPath (raised $1 million). But this sector is by no means done yet.

Retrain.ai bills itself as a “Talent Intelligence Platform”, and it’s now closed an additional $7 million from its current investors Square Peg, Hetz Ventures, TechAviv, .406 Ventures and Schusterman Family Investments. It’s also now added Splunk Ventures as a strategic investor. The new round of funding takes its total raised to $20 million.

Retrain.ai says it uses AI and machine learning to help governments and organizations retrain and upskill talent for jobs of the future, enable diversity initiatives, and help employees and jobseekers manage their careers.

Dr. Shay David, co-founder and CEO of retrain.ai said: “We are thrilled to have Splunk Ventures join us on this exciting journey as we use the power of data to solve the widening skills gap in the global labor markets.”

The company says it helps companies tackle future workforce strategies by “analyzing millions of data sources to understand the demand and supply of skill sets.”

The new funding will be used for U.S. expansion, hiring talent and product development.

Powered by WPeMatico

The dollars keep flowing into Latin America.

Today, Argentine personal finance management app Ualá announced it has raised $350 million in a Series D round at a post-money valuation of $2.45 billion.

SoftBank Latin America Fund and affiliates of China-based Tencent co-led the round, which included participation from a slew of existing backers, including funds managed by Soros Fund Management LLC, funds managed by affiliates of Goldman Sachs Asset Management, Ribbit Capital, Greyhound Capital, Monashees and Endeavor Catalyst. New funds, such as D1 Capital Partners and 166 2nd, also put money in the round in addition to angel investors such as Jacqueline Reses and Isaac Lee.

The round is believed to be the largest private raise ever by an Argentinian company and brings Ualá’s total raised to $544 million since its 2017 inception.

Founder and CEO Pierpaolo Barbieri, a Buenos Aires native and Harvard University graduate, has said his ambition was to create a platform that would bring all financial services into one app linked to one card.

Today, Ualá says it has developed “a complete financial ecosystem,” including universal accounts, a global Mastercard card, bill payment options, investment products, personal loans, installments (BNPL) and insurance. It has also launched merchant acquiring, Ualá Bis, a solution for entrepreneurs and merchants that allows selling through a payment link or mobile point-of-sales (mPOS).

The startup has issued more than 3.5 million cards in its home country and in Mexico, where it launched operations last year. The company claims that more than 22% of 18 to 25-year-olds in Argentina have a Ualá card. At the time of its Series C raise in November 2019, it had issued 1.3 million cards.

Image Credits: Ualá

Over 1 million users invest in the mutual fund available on the Ualá app, which the company claims is the second largest mutual fund in Argentina in number of participants. The company, which has aimed to provide more financial transparency and inclusion in the region, says that 65% of its users had no credit history prior to downloading the app.

Ualá plans to use its new capital to continue expanding within Latin America, develop new business verticals and do some hiring, with the plan of having 1,500 employees by year’s end. It currently has more than 1,000 employees.

“We are most impressed by Ualá’s ambition and execution. Our investment will propel the next stage of their vision, furthering a regional ecosystem that can make financial services more accessible and transparent across LatAm,” said Marcelo Claure, CEO of SoftBank Group International and COO of SoftBank Group, in a written statement.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Our beloved Danny was back, joining Natasha and Alex and Grace and Chris to chat through yet another incredibly busy week. As a window into our process, every week we tell one another that the next week we’ll cut the show down to size. Then the week is so interesting that we end up cutting a lot of news, but also keeping a lot of news. The chaotic process is a work in progress, but it means that the end result is always what we decided we can’t not talk about.

Here’s what we got into:

Powered by WPeMatico

Luis Mario Garcia grew up in Mexico making deliveries for the grocery stores in his neighborhood. After honing his startup skills in San Francisco, he returned to Mexico with the idea of building a software company.

That’s when he met his co-founder Javier Gonzalez and the pair started Orchata in 2020, a mobile app enabling consumers to get groceries delivered in 15 minutes, with no substitutes and at supermarket prices. Products delivered include fresh fruit, beverages, bread, medicine and household essentials, Garcia told TechCrunch.

Orchata does this by operating a network of micro fulfillment centers — it is already operating in two cities — with technology for efficient picking and hyperfast delivery.

Online food delivery sales in Latin America are projected to reach $9.8 billion by 2024, with the global pandemic driving demand for faster delivery, according to Statista. Garcia sees three different waves in this market: the first one being traditional supermarkets, where you can spend hours, which led to the second wave of food delivery companies, including some big players in the region — for example Rappi in Colombia, which in July raised $500 million in Series F funding at a $5.25 billion valuation in a round led by T. Rowe Price, and Cornershop in Chile, which was acquired by Uber in 2019.

However, Garcia said many of these services still take more than an hour from order to doorstep and may require phone calls if an item is not available. He wants to be part of a third wave — software that is integrated with inventory and delivery that is super fast, and no substitutions.

“This is similar to what is going on around the world, but there is a huge opportunity to bring convenience, to be the Gopuff for Latin America, and we want to build it first in the region,” Garcia said.

The Monterrey-based company was part of Y Combinator’s summer 2020 cohort and on Friday announced a $4 million seed round from a group of investors, including Y Combinator, JAM Fund, FJ Labs, Venture Friends, Investo and Foundation Capital, and angel investors Ross Lipson, Mike Hennessey, Brian Requarth and Javier Mata.

Jonathan Lewy, co-founder of Grin Scooters and founder of Investo, is also an investor in Rappi. He said Garcia was building a product for the end user, with the key being the building of the infrastructure and inventory. Lewy believes Garcia understands how quick delivery should be done and that it is not just about offering a mobile app, but building the technology behind it.

Meanwhile, Justin Mateen, general partner at JAM Fund, and co-founder of Tinder and an early-stage investor, met Garcia over a year ago and was one of the company’s first investors. He said Garcia’s and Gonzalez’s initial idea for the model of grocery stores was still not solving the problem, but then they pivoted to doing fulfillment and inventory themselves.

“He fits the mold of what I look for in a founder, and he is the type of founder that doesn’t give up,” Mateen said. “Luis finally agreed to let me double down on my investment. The model makes sense now, he is on to something and it is now going to be about execution of capital as he scales.”

Both Mateen and Lewy agree that there will be similar apps coming because food delivery is such a large market, but that Orchata has a clear advantage of owning the customer experience from beginning to end.

Having only launched four months ago, Orchata is already processing thousands of orders and is seeing 100% monthly growth. The new funding will enable Orchata to expand into three new cities in Mexico. Garcia is also eyeing Colombia, Brazil, Peru and Chile for future expansion.

The company is also targeting multiple use cases, including someone noticing a forgotten item while cooking to consumers shopping for the week or teenagers needing food for a party.

“We are going to be super convenient to customers, and we think every use case for food delivery will be this way in the future,” Garcia said. “We will eventually introduce our own brands and foods with the goal of being that app that is there anytime you need it.”

Powered by WPeMatico

Houston-based ThirdAI, a company building tools to speed up deep learning technology without the need for specialized hardware like graphics processing units, brought in $6 million in seed funding.

Neotribe Ventures, Cervin Ventures and Firebolt Ventures co-led the investment, which will be used to hire additional employees and invest in computing resources, Anshumali Shrivastava, Third AI co-founder and CEO, told TechCrunch.

Shrivastava, who has a mathematics background, was always interested in artificial intelligence and machine learning, especially rethinking how AI could be developed in a more efficient manner. It was when he was at Rice University that he looked into how to make that work for deep learning. He started ThirdAI in April with some Rice graduate students.

ThirdAI’s technology is designed to be “a smarter approach to deep learning,” using its algorithm and software innovations to make general-purpose central processing units (CPU) faster than graphics processing units for training large neural networks, Shrivastava said. Companies abandoned CPUs years ago in favor of graphics processing units that could more quickly render high-resolution images and video concurrently. The downside is that there is not much memory in graphics processing units, and users often hit a bottleneck while trying to develop AI, he added.

“When we looked at the landscape of deep learning, we saw that much of the technology was from the 1980s, and a majority of the market, some 80%, were using graphics processing units, but were investing in expensive hardware and expensive engineers and then waiting for the magic of AI to happen,” he said.

He and his team looked at how AI was likely to be developed in the future and wanted to create a cost-saving alternative to graphics processing units. Their algorithm, “sub-linear deep learning engine,” instead uses CPUs that don’t require specialized acceleration hardware.

Swaroop “Kittu” Kolluri, founder and managing partner at Neotribe, said this type of technology is still early. Current methods are laborious, expensive and slow, and for example, if a company is running language models that require more memory, it will run into problems, he added.

“That’s where ThirdAI comes in, where you can have your cake and eat it, too,” Kolluri said. “It is also why we wanted to invest. It is not just the computing, but the memory, and ThirdAI will enable anyone to do it, which is going to be a game changer. As technology around deep learning starts to get more sophisticated, there is no limit to what is possible.”

AI is already at a stage where it has the capability to solve some of the hardest problems, like those in healthcare and seismic processing, but he notes there is also a question about climate implications of running AI models.

“Training deep learning models can be more expensive than having five cars in a lifetime,” Shrivastava said. “As we move on to scale AI, we need to think about those.”

Powered by WPeMatico

Operating in the cloud is soon going to be a reality for many businesses whether they like it or not. Points of contention with this shift often arise from unfamiliarity and discomfort with cloud operations. However, cloud migrations don’t have to be a full lift and shift.

Instead, leaders unfamiliar with the cloud should start by moving over their disaster recovery program to the cloud, which helps to gain familiarity and understanding before a full migration of production workloads.

Disaster recovery as a service (DRaaS) is cloud-based disaster recovery delivered as a service to organizations in a self-service, partially managed or fully managed service model. The agility of DR in the cloud affords businesses a geographically diverse location to failover operations and run as close to normal as possible following a disruptive event. DRaaS emphasizes speed of recovery so that this failover is as seamless as possible. Plus, technology teams can offload some of the more burdensome aspects of maintaining and testing their disaster recovery.

When it comes to disaster recovery testing, allow for extra time to let your IT staff learn the ins and outs of the cloud environment.

DRaaS is a perfect candidate for a first step into the cloud for five main reasons:

Do your research to determine if DRaaS is right for you given your long-term organizational goals. You don’t want to start down a path to one cloud environment if that cloud isn’t aligned with your company’s objectives, both for the short and long term. Having cross-functional conversations among business units and with company executives will assist in defining and iterating your strategy.

Powered by WPeMatico

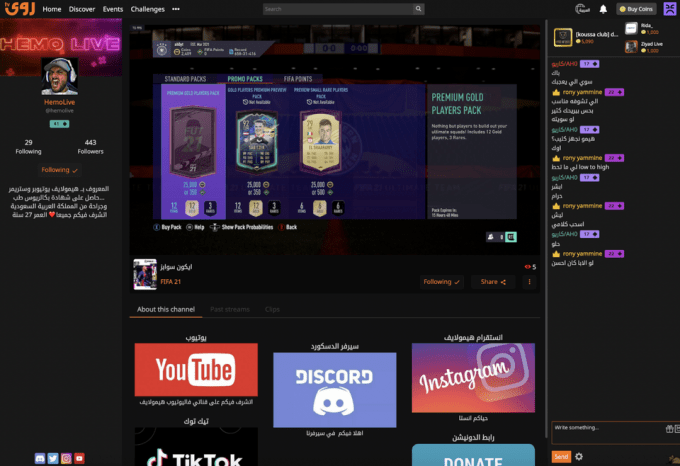

Medal.tv, a short-form video clipping service and social network for gamers, is entering the livestreaming market with the acquisition of Rawa.tv, a Twitch rival based in Dubai, which had raised around $1 million to date. The seven-figure, all-cash deal will see two of Rawa’s founders, Raya Dadah and Phil Jammal, now joining Medal, and further integrations between the two platforms going forward.

The Middle East and North African region (MENA) is one of the fastest-growing markets in gaming and still one that’s mostly un-catered to, explained Medal.tv CEO Pim de Witte, as to his company’s interest in Rawa.

“Most companies that target that market don’t really understand the nuances and try to replicate existing Western or Far-Eastern models that are doomed to fail,” he said. “Absorbing a local team will increase Medal’s chances of success here. Overall, we believe that MENA is an underserved market without a clear leader in the livestreaming space, and Rawa brings to Medal the local market expertise that we need to capitalize on this opportunity,” de Witte added.

Medal.tv’s community had been asking for the ability to do livestreaming for some time, the exec also noted, but the technology would have been too expensive for the startup to build using off-the-shelf services at its scale, de Witte said.

“People increasingly connect around live and real-time experiences, and this is something our platform has lacked to date,” he noted.

But Rawa, as the first livestreaming platform dedicated to Arab gaming, had built out its own proprietary live and network streaming technology that’s now used in all its products. That technology is now coming to Medal.tv.

Image Credits: Medal.tv

The two companies were already connected before today, as Rawa users have been able to upload their gaming clips to Medal.tv, and some Rawa partners had joined Medal’s skilled player program. Going forward, Rawa will continue to operate as a separate platform, but it will become more tightly integrated with Medal, the company says. Currently, Rawa sees around 100,000 active users on its service.

The remaining Rawa team will continue to operate the livestreaming platform under co-founder Jammal’s leadership following the deal’s close, and the Rawa HQ will remain based in Dubai. However, Rawa’s employees have been working remotely since the start of the pandemic, and it’s unclear if that will change in the future, given the uncertainty of COVID-19’s spread.

Medal.tv detailed its further plans for Rawa on its site, where the company explained it doesn’t aim to build a “general-purpose” livestreaming platform where the majority of viewers don’t pay — a call-out that clearly seems aimed at Twitch. Instead, it says it will focus on matching content with viewers who would be interested in subscribing to the creators. This addresses one of the challenges that has faced larger platforms like Twitch in the past, where it’s been difficult for smaller streamers to get off the ground.

The company also said it will remain narrowly focused on serving the gaming community as opposed to venturing into non-gaming content, as others have done. Again, this differentiates itself from Twitch which, over the years, expanded into vlogs and even streaming old TV shows. And it’s much different from YouTube or Facebook Watch, where gaming is only a subcategory of a broader video network.

The acquisition follows Medal.tv’s $9 million Series A led by Horizons Ventures in 2019, after the startup had grown to 5 million registered users and “hundreds of thousands” of daily active users. Today, the company says over 200,000 people create content every day on Medal, and 3 million users are actively viewing that content every month.

Powered by WPeMatico

Mobile field service startup Youreka Labs Inc. raised an $8.5 million Series A round of funding co-led by Boulder Ventures and Grotech Ventures, with participation from Salesforce Ventures.

The Maryland-based company also officially announced its CEO — Bill Karpovich joined to lead the company after previously general manager at IBM Cloud & Watson Platform.

Youreka Labs spun out into its own company from parent company Synaptic Advisors, a cloud consulting business focused on the customer relationship management transformations using Salesforce and other artificial intelligence and automation technologies.

The company is developing robotic smart mobile assistants that enable frontline workers to perform their jobs more safely and efficiently. This includes things like guided procedures, smart forms and photo or video capture. Youreka is also embedded in existing Salesforce mobile applications like Field Service Mobile so that end-users only have to operate from one mobile app.

Youreka has identified four use cases so far: healthcare, manufacturing, energy and utilities and the public sector. Working with companies like Shell, P&G, Humana and the Transportation Security Administration, the company’s technology makes it possible for someone to share their knowledge and processes with their colleagues in the field, Karpovich told TechCrunch.

“In the case of healthcare, we are taking complex medical assessments from a doctor and pushing them out to nurses out in the field by gathering data into a simple mobile app and making it useful,” he added. “It allows nurses to do a great job without being doctors themselves.”

Karpovich said the company went after Series A dollars because it was “time for it to be on its own.” He was receiving inbound interest from investors, and the capital would enable the company to proceed more rapidly. Today, the company is focused on the Salesforce ecosystem, but that can evolve over time, he added.

The funding will be used to expand the company’s reach and products. He expects to double the team in the next six to 12 months across engineering to be able to expand the platform. Youreka boasts 100 customers today, and Karpovich would also like to invest in marketing to grow that base.

In addition to the use cases already identified, he sees additional potential in financial services and insurance, particularly for those assessing damage. The company is also concentrated in the United States, and Karpovich has plans to expand in the U.K. and Europe.

In 2020, the company grew 300%, which Karpovich attributes to the need of this kind of tool in field service. Youreka has a licensing model with charges per end user per month, along with an administrative license, for the people creating the apps, that also charges per user and per month pricing.

“There are 2.5 million jobs open today because companies can’t find people with the right skills,” he added. “We are making these jobs accessible. Some say that AI is doing away with jobs, but we are using AI to enhance jobs. If we can take 90% of the knowledge and give a digital assistant to less experienced people, you could open up so many opportunities.”

Powered by WPeMatico