Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

In the last few months, we’ve seen much of Silicon Valley finally start to acknowledge generations of systemic racial inequity and take actionable steps to empower and support underrepresented people in tech. Funds are looking to invest capital more equitably and have started to take concrete steps to achieve this goal.

For example, Eniac Ventures and Hustle Fund have started to meet with more Black founders via consultations and encouraging cold inbound pitches. Initiatives like venture capital fellowships run by Susa Ventures and Unshackled Ventures will allow for increased representation in investment teams. While these initiatives are exciting, it’s important to explore how we can enable sustainable change and solve the diversity problem at the root.

It’s as simple as this: Investing in diverse perspectives makes for a far more efficient economy. The data also confirms this, given that homogeneous investing teams had a success rate for M&A and IPOs that was 26.4%-32.2% lower. Data since 1990 shows that approximately only 8% of VCs identify as women, with 2% of VCs identifying as Latinx and less than 1% identifying as Black.

It’s clear that the inequitable deployment of capital that results from homogenous investment teams at VC funds has translated into missed opportunity for outsized financial returns. Since this really comes down to how venture funds operate at their core, an entity that can greatly influence this and reinvent the status quo are VC funds’ limited partners.

Limited partners are the often unheard of backers of venture capital funds. Institutional venture capital funds raise money from sources such as high-net-worth individuals (HNWs), endowments, foundations, fund of funds, banks, insurance/pension funds and sovereign wealth funds that they will in turn use to invest money into high-growth, category-defining startups (the part that you do hear about).

LPs hold a lot of power in the venture financing life cycle as institutional venture capital firms can’t write checks at the scale they do without the external financing that LPs provide. Since LPs are the source of capital, they can control who they invest in (GPs) and how they invest and manage their capital. What if LPs are the missing link who can control the flow of capital to GPs who empower, find and fund more underrepresented entrepreneurs and keep them accountable?

Powered by WPeMatico

School district technology budgets are tight. But Kami CEO and founder Hengjie Wang wanted to make his company’s digital classroom product a go-to tool anyway.

He landed on trying to disrupt the printers.

Wang found that school districts spend an average of $150,000 every year on printed materials. Kami helps teachers digitize worksheets so students can digitally annotate them. Doing the math, Wang says Kami can save districts an estimated $80,000 by getting rid of the need to print handouts every day.

“Districts are apprehensive on paying for tools unless you can also save them money at the same time,” Wang said. With this tactic, the number of school districts using Kami doubled between March and July, going from from 9,987 districts to 17,915 districts. Sales for the startup, which was founded in 2013, grew over 2,000%. Today, Kami is a cash-flow positive business that sells to schools and parents.

When it comes to wide-scale and equitable adoption for edtech startups, success can often hinge on landing contracts that extend to an entire school network. However, budget cuts and red tape have often limited a company’s ability to grow. During the pandemic, consumer edtech startups such as live tutoring or question and answer services have soared now that more kids are learning from home.

However, a second surge in edtech might be upon us. As schools seek to reopen with a hybrid learning solution, Kami and other startups are finding opportunity in one of the hardest institutions to sell to: K-12 school districts.

Powered by WPeMatico

Process automation startup Hypatos has raised a €10 million (~$11.8 million) seed round of funding from investors including Blackfin Tech, Grazia Equity, UVC Partners and Plug & Play Ventures.

The Germany and Poland-based company was spun out of AI for accounting startup Smacc at the back end of 2018 to apply deep learning tech to power a wider range of back-office automation, with a focus on industries with heavy financial document processing needs, such as the financial and insurance sectors.

Hypatos is applying language processing AI and computer vision tech to speed up financial document processing for business use cases such as invoices, travel and expense management, loan application validation and insurance claims handling via — touting a training data set of more than 10 million annotated data entities.

It says the new seed funding will go on R&D to expand its portfolio of AI models so it can automate business processing for more types of documents, as well as for fueling growth in Europe, North American and Asia. Its customer base at this point includes Fortune 500 companies, major accounting firms and more than 300 software companies.

While there are plenty of business process automation plays, Hypatos says its use of deep learning tech supports an “in-depth understanding” of document content — which in turn allows it to offer customers a “soup to nuts” automation menu that covers document classification, information capturing, content validation and data enrichment.

It dubs its approach “cognitive process automation” (CPA) versus more basic applications of business process automation with software robots (RPA), which it argues aren’t so contextually savvy — thereby claiming an edge.

As well as document processing solutions, it has developed machine learning modules for enhancing customers’ existing systems (e.g. ECM, ERP, CRM, RPA); and offers APIs for software providers to draw on its machine learning tech for their own applications.

“All offerings include machine learning pipeline software for continuous model training in the cloud or in on-premise deployments,” it notes in a press release.

“We have deep knowledge of how financial documents are processed and millions of data entities in our training data,” says chief commercial officer Cem Dilmegani, discussing where Hypatos fits in the business process automation landscape. “We get compared to RPA companies like UiPath, enterprise content management (ECM) companies like Kofax Readsoft as well as generalist ML document automation companies like Hyperscience. However, we are quite different.

“We focus on end-to-end automation, we don’t only help companies capture data, we help them process it using our deep domain understanding, enabling higher rates of automation. For example, to automate incoming invoice processing (A/P automation) we apply our document understanding AI to capture all data, classify the document, identify the specific goods and services, validate for internal/external compliance and assign financial accounts, cost centers, cost categories etc. to automate all processing tasks.

“Finally, we offer this technology as components easily accessible via APIs. This allows RPA or ECM users to leverage our technology and increase their level of automation.”

Hypatos claims it’s seeing uplift as a result of the coronavirus pandemic — noting it’s providing a service to more than a dozen Fortune 500 companies to help with in-shoring efforts, which it says are accelerating as a result of COVID-19 putting pressure on the traditional business process outsourcing model as offshore workforce productivity in lower wage regions is affected by coronavirus lockdowns.

“We believe that we are in a pivotal moment of machine learning adoption in large organizations,” adds Andreas Unseld, partner at UVC Partners, in a supporting statement. “Hypatos’ technology provides ample opportunity to transform many core business processes. We’re impressed by the Hypatos machine learning technology and see the team in a perfect position to take a leading role in the machine learning revolution to come.”

Powered by WPeMatico

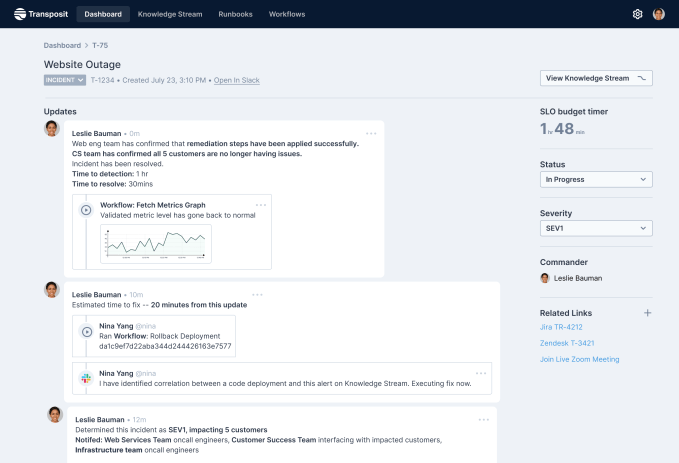

Transposit is a company built by engineers to help engineers, and one big way to help them is to get systems up and running faster when things go wrong — as they always will at some point. Transposit has come up with a way to build runbooks for faster disaster recovery, while using data to update them in an automated fashion.

Today, the company announced a $35 million Series B investment led by Altimeter Capital, with participation from existing investors Sutter Hill Ventures, SignalFire and Unusual Ventures. Today’s investment brings the total raised to $50.4 million, according to the company.

Company CEO Divanny Lamas and CTO and founder Tina Huang see technology issues as less an engineering problem and more as a human problem, because it’s humans who have to clean up the messes when things go wrong. Huang says forgetting the human side of things is where she thinks technology has gone astray.

“We know that the real superpower of the product is that we focus on the human and the user side of things. And as a result, we’re building an engineering culture that I think is somewhat differentiated,” Huang told TechCrunch.

Transposit is a platform that at its core helps manage APIs, connections to other programs, so it starts with a basic understanding of how various underlying technologies work together inside a company. This is essential for a tool that is trying to help engineers in a moment of panic figure out how to get back to a working state.

When it comes to disaster recovery, there are essentially two pieces: getting the systems working again, then figuring out what happened. For the first piece, the company is building data-driven runbooks. By being data-driven, they aren’t static documents. Instead, the underlying machine learning algorithms can look at how the engineers recovered and adjust accordingly.

Image Credits: Transposit

“We realized that no one was focusing on what we realize is the root problem here, which is how do I have access to the right set of data to make it easier to reconstruct that timeline, and understand what happened? We took those two pieces together, this notion that runbooks are a critical piece of how you spread knowledge and spread process, and this other piece, which is the data, is critical,” Huang said.

Today the company has 26 employees, including Huang and Lamas, who Huang brought on board from Splunk last year to be CEO. The company is somewhat unique having two women running the organization, and they are trying to build a diverse workforce as they build their company to 50 people in the next 12 months.

The current make-up is 47% female engineers, and the goal is to remain diverse as they build the company, something that Lamas admits is challenging to do. “I wish I had a magic answer, or that Tina had a magic answer. The reality is that we’re just very demanding on recruiters. And we are very insistent that we have a diverse pipeline of candidates, and are constantly looking at our numbers and looking at how we’re doing,” Lamas said.

She says being diverse actually makes it easier to recruit good candidates. “People want to work at diverse companies. And so it gives us a real edge from a kind of culture perspective, and we find that we get really amazing candidates that are just tired of the status quo. They’re tired of the old way of doing things and they want to work in a company that reflects the world that they want to live in,” she said.

The company, which launched in 2016, took a few years to build the first piece, the underlying API platform. This year it added the disaster recovery piece on top of that platform, and has been running its beta since the beginning of the summer. They hope to add additional beta customers before making it generally available later this year.

Powered by WPeMatico

As Slack ramps up its investment in Asia, Toss Lab, the South Korea-based creator of enterprise collaboration platform JANDI, is preparing to become a more formidable rival. The startup announced today that it has raised a $13 million Series B led by SoftBank Ventures Asia, the early-stage venture arm of SoftBank Group. Participating investors also included SV Investment, Atinum Investment, Must Asset Management, Shinhan Capital, SparkLabs and T Investment.

Founded in 2014, Toss Lab said the round means it is the first Korean company in the collaboration space to raise over $20 million to date. The company says JANDI is the top collaboration platform in Japan and Taiwan. It serves companies ranging from small to mid-sized businesses to large enterprises with thousands of employees. Its clients include LG CNS (the Korean conglomerate’s IT services subsidiary), Korean tire manufacturer Nexen Tire and Lexus. Toss Labs says its revenue has grown more than 100% over the past three years.

Matthew Kim, chief executive of Toss Lab, told TechCrunch that the Series B will be used for global expansion and to increase the company’s headcount by 20% to 25%.

JANDI has seen a 80% increase in the number of users acquired during the COVID-19 pandemic across its Asian markets. To serve remote workers, JANDI added integration with Zoom, enhanced its security and developed an advanced admin dashboard.

The platform currently supports English, Chinese, Japanese, Korean and Vietnamese, and plans to grow its operations in Japan, Taiwan, Malaysia, Vietnam and the Middle East.

Last October, Slack said it was planning to increase its investment in Asia, including new data regions in Japan and Australia.

But Kim said JANDI’s biggest rival isn’t Slack. Instead, it is competing against popular messaging apps, like Line, Kakao, WhatsApp, Zalo and Facebook Messenger, which Kim said the majority of workers in Asia still rely on for workplace communication. While Slack is used by some startups and tech companies in Asia, Chatwork and Base.vn are the top collaboration platforms in Japan and Vietnam, respectively, while JANDI is the leader in South Korea and Taiwan.

One of JANDI’s advantages is that “we are currently integrating with the legacy systems that are unique in each region and we have the local onboarding support team for enterprise,” said Kim. He added that Japan and Taiwan have the most growth potential in the near-term, followed by the United Arab Emirates, Malaysia and Indonesia.

Like other collaboration platforms, JANDI offers messaging and group chats. But it also features collaboration tools that the company says is geared toward work culture in its Asian markets. These include organization charts to help people find colleagues by department; a “board view” for company announcements and reports; video calls that can support up to 300 participants at a time; read receipts; and a secure file manager for storing confidential team documents.

As part of the funding, Toss Labs also added four new board directors: Ticket Monster founder Daniel Shin and former Kakao chief strategy officer Joon-yeol Kang, the founders of Bass Investment; SoftBank Ventures Asia CEO JP Lee; and SBI Investment Korea CEO Joon-hyo Lee. Sendbird CEO John S. Kim and Bespin Global founder HanJoo Lee are joining as advisors to Toss Labs.

Powered by WPeMatico

Wish, the San Francisco-based, 750-person e-commerce app that sells deeply discounted goods that you definitely don’t need but might buy anyway when priced so low — think pool floats, guinea pig harnesses, Apple Watch knockoffs — said yesterday that it has submitted a draft registration to the SEC for an IPO.

Because it filed confidentially, we can’t get a look at its financials just yet; we only know that its investors, who’ve provided the company with $1.6 billion across the years, think the company was worth $11.2 billion as of last summer, when it closed its most recent financing (a $300 million Series H round). Meanwhile, Wish itself says it has more than 70 million active users across more than 100 countries and 40 languages.

The big question, of course, is whether the now 10-year-old company can maintain or even accelerate its momentum.

It’s not a no-brainer. On the one hand, it’s a victim of the increasingly chilly relations between the U.S. and China, from where the bulk of Wish’s goods come. Then again, Wish has been beefing up its business elsewhere in the world partly as a result of the countries’ shifting stance toward one another.

For example, it told Recode last year that it’s increasingly looking to Latin American markets — Mexico, Argentina, Chile — for growth, and that it’s planning a bigger push into Africa, where it’s already available in South Africa, Ghana and Nigeria, among other countries.

Wish has always been a work in progress. It was co-founded by CEO Peter Szulczewski, a computer scientist who previously spent six years at Google before co-founding a company call ContextLogic, from which Wish evolved. The idea was to build a next-generation, mobile ad network to compete with Google’s AdSense network, but Szulczewski and his co-founder, Danny Zhang, realized they were “pretty bad at business development,” as he once said at an event hosted by this editor, so eventually they pivoted to Wish.

Wish originally asked people to create wish lists, then the company approached merchants, letting them know a certain number of customers wanted, say, a certain type of table. It was smart to recognize that showing the right recommendations to shoppers would become critical to its users, though it didn’t necessarily foresee the types of merchants it would ultimately work with, most of them in China, Indonesia and elsewhere in East Asia and Southeast Asia who are focused on value-conscious customers. As Wish quickly realized, these merchants didn’t have other ways to sell to or communicate with customers elsewhere in the world, so they didn’t mind paying Wish a 15% take to handle this for them.

Wish also focused around lightweight items that it could ship cheaply from China — if slowly — using something called ePacket. It’s a shipping option agreement that was established nine years ago with the cooperation of the U.S. Postal Service and Hong Kong Post (and later made available to 40 countries altogether) that enables products coming from China and Hong Kong to be sent cheaply as long as they meet certain criteria — they don’t weigh too much, they aren’t worth too much, they adhere to certain minimum and maximums regarding their size, and so forth.

The mix has proved powerful for Wish, despite growing competition from China-based outfits like AliExpress that offer many of the same goods to the same customers around the world. (Wish has also competed, always, with Walmart and Amazon.)

The company has also soldiered on despite apparent struggles to keep customers coming over time. Because it doesn’t sell essential items but rather a grab bag of different items, people tend to cycle out of the app after a few months of their first visit, as The Information once reported.

A bigger issue now is that, as of two months ago, a new USPS pricing structure went into effect that raises rates on international shipments. It also requires foreign recipient countries to ratify new rates under ePacket (whose recipient countries, by the way, have been downsized from 40 to 12). That means that companies like Wish either pay more to ship their goods — forcing its vendors to charge more — or they move to commercial networks.

Of course, a third option — and one that may position Wish well for the future — would be for Wish to invest in more local warehousing in the U.S., Europe and others of its growing markets, which it told Recode that it is doing, along with seeking more local vendors near its biggest markets.

Given shifts in the way that commercial real estate is being used — with retail-to-industrial property conversions accelerating, driven by the growth of e-commerce — it’s probably as good a time as any for Wish to be making these moves. Whether they are enough to sustain and grow the company is something that only time will tell.

Again, we’ll collectively know much more when we can get a look at that filing. It should make for interesting reading.

Wish’s private investors include General Atlantic, GGV Capital, Founders Fund, Formation 8, Temasek Holdings and DST Global, among others.

Powered by WPeMatico

I was recently part of an open forum about being Black in America, as well as in the startup space.

A white founder asked, “What can I do as the founder of a very early-stage startup?” The group gave various suggestions that included the obvious (or at least I would hope it’s obvious), “When you are growing your team, consider hiring Black team members,” or “When you are considering an investment from an investor, press them about the diversity of their current portfolio founders.”

But one suggestion really stood out, which was to make a concerted effort to find someone different from your current team’s makeup when bringing in subject matter experts. This intentional act shows your homogeneous team members that Black people, other racial minorities or genders can be experts too. It can also be applied when growing your team by making sure you interview diverse candidates whose level of expertise is often second-guessed.

This got me thinking about VC Monique Woodard’s statement that “Black founders are often overmentored and underinvested.” In June, at the height of the Black Lives Matter protests and open dialogue about anti-Blackness, we saw a slew of investors rushing to offer mentorship to Black founders. Some of the investors don’t have Black founders among their portfolio companies so to some onlookers, this rush to help Black founders was seen as insincere and a marketing ploy.

As a former founder, I can confidently say that most Black founders simply want a fair shot at presenting their startups to investors. The prevailing system of needing a warm introduction to access investors puts founders, especially Black founders, who don’t have the same networks as investors at a disadvantage. The proper mea culpa by these investors should be to make pitching more accessible for all founders. Although offers of mentorship are certainly welcome, the constant barriers Black founders tell me they struggle with are access to capital and networks, not a lack of talent or business savvy.

The quick emphasis on mentorship made me ask myself: How are the contributions of Black people (founders, investors, operators, etc.) to the startup space seen? Are we showcased as experts or as perpetual students in need of mentoring and advising? To directionally answer this question, I turned to podcasts. According to a New York Times article, “more than half the people in the United States have listened to one (podcast), and nearly one out of three people listen to at least one podcast every month.” This figure shows that podcasts are a wide-reaching medium that audiences use as a source of both entertainment and information.

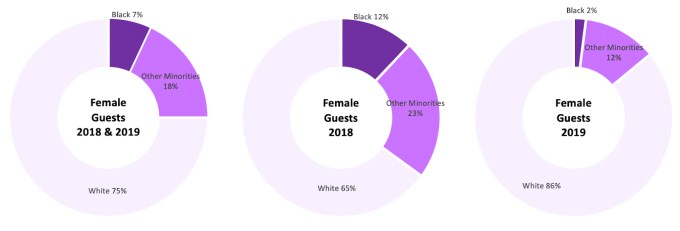

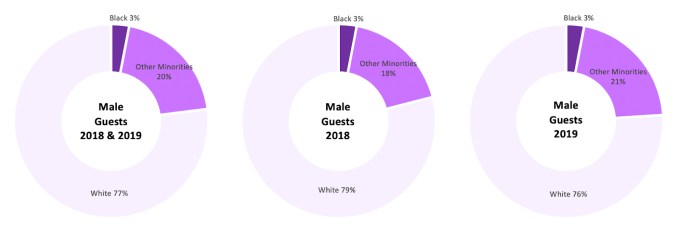

I dug into the 2018 and 2019 guest lists of three of my favorite startup-related podcasts: “This Week In Startups,” “How I Built This With Guy Raz” and “The Twenty Minute VC.” These are all top-ranked podcasts with tens of millions in downloads and over half a million subscribers.

| Podcast | Description | Typical Guest Profile |

| This Week In Startups | Entrepreneur and angel investor Jason Calacanis brings you his take on the best, worst and most interesting stories from the world of startups. Glimpse into the boardroom during deep-dive interviews with the most innovative founders and investors. Get the experts’ hottest takes on trending topics during our news roundtables. |

|

| How I Built This with Guy Raz | Guy Raz dives into the stories behind some of the world’s best-known companies. How I Built This weaves a narrative about innovators, entrepreneurs and idealists — and the movements they built. |

|

| The Twenty Minute VC | The Twenty Minute VC takes you inside the world of venture capital, startup funding and the pitch. Discover how you can attain funding for your business by listening to what the most prominent investors are directly looking for in startups, providing easily actionable tips and tricks that can be put in place to increase your chances of getting funded. |

|

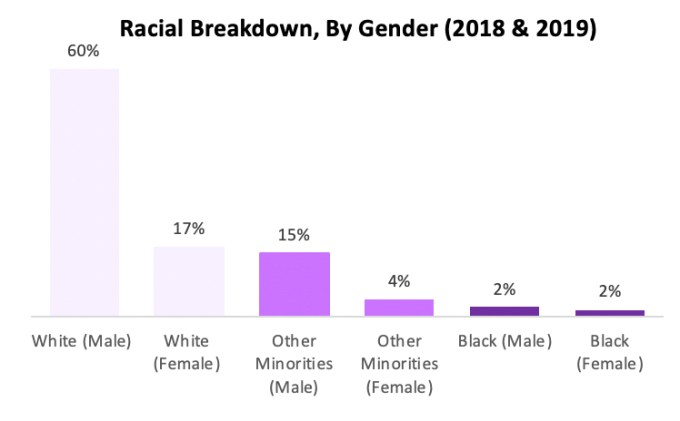

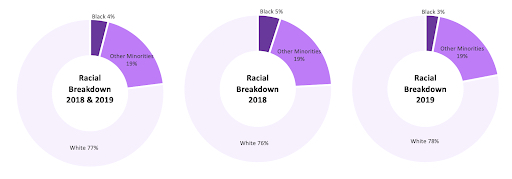

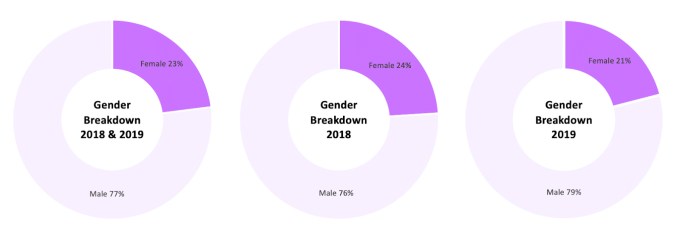

I analyzed more than 500 episodes that were aired in 2018 and 2019 across all three podcasts to get a racial and gender breakdown of guests that were featured on those episodes.

Image Credits: Kofi Ampadu (opens in a new window)

Image Credits: Kofi Ampadu (opens in a new window)

Image Credits: Kofi Ampadu (opens in a new window)

Image Credits: Kofi Ampadu (opens in a new window)

Image Credits: Kofi Ampadu

Not surprisingly, a majority of the guests featured were white men (60%). Black men and women were featured on 4% of all the episodes. A total of 15 Black (nine men and six women) unique guests were showcased as guests out of more than 400 unique guests during the two-year span. Also interesting to note that of those 15 Black guests, three were celebrities (a comedian, a TV personality and a rapper), two of whom were featured twice.

There are certainly more than 15 Black noncelebrities available who would fit the ideal guest lists of these podcasts. It is also interesting to note the percentage of Black guests decreased by 2% from 2018 to 2019 and incidentally increased by 2% for white guests during that span. The percentage of Black female guests within the female gender pool drastically decreased by 10% while white female guests increased by 21% in the two-year time period.

The results are a microcosm of what has been happening in the startup ecosystem: Black minds are undervalued and underappreciated. Oftentimes in the startup space, a founder is deemed a successful founder not based on how much money they collect from satisfied customers but by how much money they have raised from investors. Based on these misleading standards, Black founders will rarely be classified as successful because 1% of VC-backed founders are Black.

When it comes to the investor ranks, 81% of venture funds have no Black investors, so very often Black investors have to raise their own funds since the path to joining one is limited. Given these and other obstacles, I would argue Black people are the inspirational and relatable experts whose stories and advice need to be heard by wider audiences.

It is also worth noting that Black people are versed in varying topics and should not be exclusively invited on platforms to speak on Black issues. Black people are not a monolith and each person has their own passion and areas of expertise and outside of lived experiences not all Black people may be well-equipped to dissect Black issues.

In the spirit of not only pointing out systemic racism in the startup space, here is a list of emerging Black founders, investors and startup ecosystem builders, curated by Denisha Kuhlor and me. The talented people listed would make great guests for podcasts, conferences and any platforms that aim to amplify a diverse set of insights and experiences.

Methodology: Analyzed 484 guests across all three podcasts, the hosts of these podcasts were not included in the analysis as guests. As a result, podcast episodes that only included the host were excluded. Reaired podcast episodes were included in the analysis. If an episode had multiple guests, each guest was accounted for separately in the analysis.

The gender of guests was based on pronouns used to refer to guests on the podcast or publicly available information. The race of guests was objectively determined based on how the guest identifies or subjectively determined based on photographs, videos and publicly available information. The “Other Minorities” grouping includes Latinx, Southeast Asian and East Asian guests.

Disclaimer: This write-up is by no means written to cast aspersions on the three podcasts analyzed. They were simply chosen because I am an avid listener and they are all relatively popular in the startup space.

Powered by WPeMatico

What do you get when you combine six early-stage startup founders with a panel of top VCs and savvy TechCrunch editors? It’s Pitchers & Pitches, a rapid-fire pitch competition with a hefty side of advice to turn your 60-second pitch into a key that unlocks opportunity.

Grab a snack, bring your questions and tune in to our pre-Disrupt 2020 masterclass tomorrow, September 2, at 4 p.m. ET / 1 p.m. PT. You can register here. We randomly chose six startups — all exhibitors in Digital Startup Alley — to throw their best pitch. Our esteemed judges (we’ll name all the names in a moment) will critique each one and offer tips to sharpen what is arguably an entrepreneur’s most essential tool.

Get ready to take copious notes. Free advice from experts — the kind who hear pitches for a living — doesn’t come along every day, and chances are you can apply much of what you hear to your own pitch. Plus, the viewing audience decides which startup delivered the best pitch.

You can’t have a competition without a prize, and this one’s pretty nifty. The winning startup scores a consulting session with cela, a company that connects early-stage startups to accelerators and incubators that can help scale their businesses.

Hannah Webb, CEO of Findster Technologies, winner of the first Pitchers & Pitches session, dishes on the result of her P&P experience. “Disrupt and Digital Startup Alley haven’t even officially started yet, and we’ve already seen great benefits. cela introduced us to multiple accelerators in the NYC area and one is a perfect fit for our company’s situation.”

Now, without further ado, the panel of judges waiting to be impressed includes two top VCs — Konstantine Buhler, partner at Sequoia Capital, and Anne Gifford, investor at Tusk Ventures — and two pitch-savvy TechCrunch editors, Anthony Ha and Darrell Etherington.

As for the early-stage startups taking the mound, they are:

Join us for the next Pitchers & Pitches — tomorrow, September 2 at 4 p.m. ET / 1 p.m. PT. Listen, learn and turn your pitch into a key that opens doors to opportunities at Disrupt 2020 — and beyond.

Is your company interested in sponsoring or exhibiting at Disrupt 2020? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

As the first sales hire at Cloudflare, I learned firsthand from both our high growth and my own mistakes how to build a world-class sales team. Early hires are the cultural cornerstones of an organization. As Vinod Khosla described the initial hires at Sun Microsystems, “Initial hiring is way more important than you think because of its multiplicative effect. So, it’s worth taking a little longer when you hire those people.”

The first sales hire will set the best practices, cultural tone and is responsible for making sure each subsequent new sales hire succeeds. For this reason, it is important that startups look to hire missionaries, not mercenaries, when they bring on their first sales team member. If the first sales hire is a “coin-operated” mercenary whose priority is to overachieve quota and is a great solo player, they may be more competitive than collaborative. In contrast, if the first hire is a missionary who cares more about evangelizing the product and is a team player, they will naturally enable the next set of hires to succeed.

There is an overwhelming amount of declarative advice on how to make your first sales hire: They should have experience selling at an early-stage company, tenure in that company to a much larger team (five to 50 employees, or $100,000 to $10 million ARR), they’ve sold at your price point, overachieved quota consistently (beware of this one. Quota overachievement can be a false positive and may be the result of a fruitful territory, a comp plan where quotas were too low or selfish “me-first” behavior.), etc. What you should look for are missionaries, and they exhibit two key qualities: resourceful ingenuity and team-based behavior.

At early-stage startups, there is more work to do than people to do it. These are resource-constrained environments where roles go beyond job descriptions and are “jack-of-all-trades” positions. This first sales hire is not an ordinary sales gig. It requires a missionary with a deep interest in the technology who wants to evangelize the product. The resourceful missionary must have an enterprising mindset to build their own sales collateral, a clever approach for testing pricing, a passion for the product technology and an ability to navigate the organization so engineering and product teams can hear the voice of the customer.

While resourceful skills are needed to test out different sales motions, the most important quality the missionary must have is a team-first attitude to share those learnings with colleagues. As the missionary, and the subsequent missionary hires, are developing a repeatable process they are engaging in novel intellectual work; this is not routine execution. When someone develops better messaging, or discovers a new use case, the goal is to spread that expertise so overall collective intelligence and team performance increases. If that operational know-how becomes siloed and an individual optimizes for themselves, instead of the team, the organization loses.

Powered by WPeMatico

Want to save $100 on your pass to TC Sessions: Mobility 2020? Silly question, right? Of course, you do. Here’s the thing. You have just four days left to buy in at the lowest price. Knock this easy task off your to-do list and buy your pass before the early-bird savings disappear on September 4 at 11:59 p.m. (PDT). Now congratulate yourself on being both a savvy startupper and a savvy shopper.

The expanded all-virtual session runs October 6-7 and, obviously, it will look and feel very different from last year’s live event. But the content, the experts, the connections and the opportunities remain as real and plentiful as ever.

Engage with experts during interactive breakout sessions, hear top mobility founders, investors, movers and shakers in both one-on-one interviews and moderated panel discussions. Cast your eyes upon the event agenda to see just some of the speakers and the topics they’ll tackle — we’ll add more in the coming weeks.

One big advantage to this all-virtual session is global reach. Whether you’re in Europe, Africa, Australia, South America or another region in the U.S., you can learn about the latest trends, meet and connect with attendees, expand your network and discover new opportunities — without stepping foot in Silicon Valley.

“TC Sessions: Mobility exceeded my expectations in terms of useful content. Every panel discussion I attended, every interaction I had was relevant to my work or to my daily life, because we don’t stop living at 5 p.m.” — Jens Lehmann, technical lead and product manager, SAP.

“Attending TC Sessions: Mobility helps us keep an eye on what’s coming around the corner. It uncovers crucial trends so we can identify what we should be thinking about before anyone else.” — Jeff Johnson, vice president of enterprise sales and solutions at FlashParking.

Pro Tip 1: Want to bring your team to cover more ground and discover even more opportunities? Take advantage of our group discount when you book four or more passes.

Pro Tip 2: This one’s for the up-and-coming generation of mobility visionaries — grab a budget-friendly student pass here and start expanding your career network with mobility’s best and brightest. Just $50 (a $145 savings) until prices go up.

Let’s review, shall we? TC Sessions: Mobility 2020 takes place on October 6-7, but early-bird pricing ends in just four days — on September 4 at 11:59 p.m. (PDT) to be precise. Be savvy. Buy your pass today and save $100.

Is your company interested in sponsoring or exhibiting at TC Sessions: Mobility 2020? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico