Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Lidar startup Ouster has spent the past several years expanding and improving its line of sensors as it jostles for a piece of the crowded and competitive market place. Now, Ouster says it has raised $42 million, fresh capital that will be used to fund product development and ramp up sales.

In short: Ouster is keeping the fight alive and there are signs that the San Francisco-based startup is making progress despite some headwinds. The $42 million Series B round didn’t feature any new investors — existing backers Cox Automotive, Fontinalis Partners and Tao Capital Partners all participated — and it was less than its previous raise of $60 million. Ouster, like many others, also reduced its workforce by 10% due to COVID-19, the company confirmed.

However, it’s worth noting that Ouster managed to close the round in the midst of COVID-19 and has continued to increase sales, even as its San Francisco-based manufacturing facility was shuttered temporarily due to a COVID-related government shutdown. The business grew enough to avoid further layoffs and to fully pay all employees and temp workers, according to the company. Ouster has raised $140 million to date.

Ouster wouldn’t share specific revenue numbers, but the company said its 12-month revenue has grown 62%, with third-quarter bookings up 209% year-over-year — a stat that makes sense, considering its business model and the expansion of its product line.

Lidar measures distance using laser light to generate highly accurate 3D maps of the world around the car. Lidar is considered by most in the automated vehicle technology industry a key sensor required to safely deploy robotaxis and other autonomous vehicles (with perhaps the exception of Elon Musk and a few others).

Ouster is taking a different technological and business approach than many of its competitors.

The company’s lasers and photodetectors are printed onto two chips using a standard process to produce integrated circuits (known as CMOS to those in the know). Ouster says this allows it to ditch the more common practice of stacking discrete components on top of each other to reach the desired resolution. Ouster argues that its approach results in a less complex sensor that is more reliable and cheaper.

“Ouster’s digital lidar architecture gives us fundamental advantages that are winning over customers in every market we serve. Digital CMOS technology is the future of lidar and Ouster was the first to invent, build, patent, and commercialize digital lidar. Once our customers experience the resolution and reliability of these sensors at an affordable price, there’s no turning back to legacy analog lidar,” Ouster CEO Angus Pacala said in a statement.

In January, Ouster launched its second-generation lidar product line, which includes three different 128-beam sensors to be used for different purposes, including one designed for navigating urban environments and warehouses. The other two sensors include a mid-range model with a 120-meter range and a 45-degree field of view, and a long-range lidar sensor with a more than 200-meter range for high-speed vehicle automation. All three products are currently shipping to customers and are available in 50 different configurations, according to Ouster.

The company’s business model is also slightly different than many others. Instead of targeting automakers or companies trying to commercialize robotaxis, Ouster has cast a wider net to diversify its business. The company is selling its lidar sensors to robotics, drones, mapping, defense, building security, mining and agriculture companies. The company launched in January its second-generation lidar sensors, which included three new 128-beam models that have different applications. The second-generation line is an improvement from its previous 64-beam models, with better resolution.

The strategy has appeared to pay off. Ouster has doubled its customer base since March 2019, according to the company. Today, Ouster says it has 800 customers across 15 markets, including Konecranes, Postmates, Ike, May Mobility, Kodiak Robotics, Coast Autonomous, the U.S. Army, NASA, Stanford University and MIT. Some of that growth has come from sales to Chinese automation companies such as idriverplus, WhaleAI, Hongjing Drive and qCraft.

Despite the growth, Ouster needs the capital to scale, as designing, manufacturing and selling lidar sensors is an expensive undertaking. Ouster has opened offices in Paris, Hamburg, Frankfurt, Hong Kong and Suzhou to expand global sales and customer service capabilities. It also has two manufacturing facilities. Its San Francisco facility, which opened in March 2019, is primarily used to introduce new products. Production volumes are lower at this facility. Once the product is validated, they’re transferred to Ouster’s contract manufacturer Benchmark in Southeast Asia.

Benchmark is now producing hundreds to thousands of second-generation sensors per month, according to Ouster.

Powered by WPeMatico

On the heels of new filings from both Sumo Logic and JFrog, Snowflake, a venture-backed unicorn looking to go public on the strength of its data-focused cloud service, set an initial price range for its IPO.

The $75 to $85 per-share IPO price target values the firm at between $20.9 billion and $23.7 billion, huge sums for the private company. Its IPO could raise more than $2.7 billion for the startup.

Snowflake was last valued at around $12.5 billion when it raised a Series G worth $479 million earlier this year.

Built into those valuation projections are two private placements of stock in Snowflake, $250 million apiece from both Salesforce, the well-known CRM player, and Berkshire Hathaway, better known for its investment returns in the 80s and 90s, Cherry Coke and Charlie Munger’s humor.

Jokes aside, the inclusion of Salesforce in the IPO is notable, but not a shock, but Berkshire taking part in the public market debut of Snowflake, a company with historic losses that are nigh-tyrannical, is.

Here’s the S-1/A text on the setup:

Immediately subsequent to the closing of this offering, and subject to certain conditions of closing as described in the section titled “Concurrent Private Placements,” each of Salesforce Ventures LLC and Berkshire Hathaway Inc. will purchase $250 million of our Class A common stock from us in a private placement at a price per share equal to the initial public offering price. Based on an assumed initial public offering price of $80.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, each of Salesforce Ventures LLC and Berkshire Hathaway Inc. would purchase 3,125,000 shares of our Class A common stock. […]

In addition, Berkshire Hathaway Inc. has agreed to purchase 4,042,043 shares of our Class A common stock from one of our stockholders in a secondary transaction at a price per share equal to the initial public offering price that will close immediately subsequent to the closing of this offering.

That second paragraph makes it clear that Berkshire is actually looking to snooker even more shares into its corner, for a total purchase price that might scale to more than $500 million.

What is so attractive about Snowflake? TechCrunch wrote a bit about that when the company filed, but the short gist is that it has epic growth, improving gross margins and dramatically curtailed losses. The package adds up to one valuable IPO, and something durable enough to tempt Buffett.

Regardless, what could be the most highly valued IPO of the year — Airbnb depending — here in America just got a lot more exciting.

Powered by WPeMatico

I cover a lot of data breaches. From inadvertent exposures to data-exfiltrating hacks, I’ve seen it all. But not every data breach is the same. How a company responds to a data breach — whether it was their fault — can make or break its reputation.

I’ve seen some of the worst responses: legal threats, denials and pretending there isn’t a problem at all. In fact, some companies claim they take security “seriously” when they clearly don’t, while other companies see it merely as an exercise in crisis communications.

But once in a while, a company’s response almost makes up for the daily deluge of hypocrisy, obfuscation and downright lies.

Last week, Assist Wireless, a U.S. cell carrier that provides free government-subsidized cell phones and plans to low-income households, had a security lapse that exposed tens of thousands of customer IDs — driver’s licenses, passports and Social Security cards — used to verify a person’s income and eligibility.

A misconfigured plugin for resizing images on the carrier’s website was blamed for the inadvertent data leak of customer IDs to the open web. Security researcher John Wethington found the exposed data through a simple Google search. He reported the bug to TechCrunch so we could alert the company.

Make no mistake, the bug was bad and the exposure of customer data was far from ideal. But the company’s response to the incident was one of the best I’ve seen in years.

Take notes, because this is how to handle a data breach.

Their response was quick. Assist immediately responded to acknowledge the receipt of my initial email. That’s already a positive sign, knowing that the company was looking into the issue.

Powered by WPeMatico

Despite the public markets posting a few days of losses, the IPO wave continues to crest as a number of well-known technology companies line up to float their equity on American exchanges. Most recently we saw e-commerce giant Wish file (albeit privately) and news that dating service Bumble could look to go public next year.

Those bits of news came on the heels of Airbnb filing, again privately, and the public release of IPO filings from Unity, Asana, Snowflake and, key for our work today, Sumo Logic and JFrog.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

There are too many venture capital firms associated with the above companies to name here, but the mid-to-late-2020 IPO cohort is a fulcrum upon which a number of venture funds rest, their return profile waiting to see which way the scales tip.

Which made new IPO filings from Sumo Logic and JFrog this morning all the more exciting. The documents provide a bit of homework for us to handle, namely calculating the company’s valuation ranges. But when we do have those figures in place, we’ll be able to see what sort of revenue multiples each company may be able to earn during their public offerings and what sort of delta the former startups can build against their final, private valuations.

Which made new IPO filings from Sumo Logic and JFrog this morning all the more exciting. The documents provide a bit of homework for us to handle, namely calculating the company’s valuation ranges. But when we do have those figures in place, we’ll be able to see what sort of revenue multiples each company may be able to earn during their public offerings and what sort of delta the former startups can build against their final, private valuations.

If you are just catching up to these IPOs, we have notes on Sumo Logic and JFrog’s earlier SEC filings ready for you. Let’s go!

We’ll proceed in alphabetical order, kicking off with JFrog .

You can read JFrog’s new IPO filing here, which has all the notes you could want on its new price and past performance. Today, however, in honor of saving time, I’ll walk you through the key numbers quickly:

Powered by WPeMatico

The 2020 class of Techstars Starburst Space Accelerator is graduating with an official demo day on Wednesday at 10 a.m. PDT (1 p.m. EDT), and you can watch all the teams present their startups live via the stream above. This year’s class includes 10 companies building innovative new solutions to challenges either directly or indirectly related to commercial space.

Techstars Starburst is a program with a lot of heavyweight backing from both private industry and public agencies, including from NASA’s JPL, the U.S. Air Force, Lockheed Martin, Maxar Technologies, SAIC, Israel Aerospace Industries North America and The Aerospace Corporation. The program, led by managing director Matt Kozlov, is usually based locally in LA, where much of the space industry has significant presence, but this year the demo day is going online due to the ongoing COVID-19 situation.

Few, if any, programs out there can claim such a broad representation of big-name partners from across commercial, military and general civil space in terms of stakeholders, which is the main reason it manages to attract a range of interesting startups. This is the second class of graduating startups from the Starburst Space Accelerator; last year’s batch included some exceptional standouts like in-orbit refueling company Orbit Fab (also a TechCrunch Battlefield participant), imaging microsatellite company Pixxel and satellite propulsion company Morpheus.

As for this year’s class, you can check out a full list of all 10 participating companies below. The demo day presentations begin tomorrow, September 9 at 10 a.m. PDT/1 p.m. PDT, so you can check back in here then to watch live as they provide more details about what it is they do.

A synthetic data API that allows AI teams to generate their own custom datasets up to 99% faster — no tedious collection, curation or labelling required.

founders@bifrost.ai

A virtual reality content management system that makes it super easy for curriculum designers to create and deploy immersive learning experiences.

founders@holos.io

Infinite Composites Technologies

The most efficient gas storage systems in the universe.

founders@infinitecomposites.com

Lux is developing next generation System-on-Foil electronics.

founders@luxsemiconductors.com

Natural Intelligence Systems, Inc.

Developer of next-generation pattern-based AI/ML systems.

leadership@naturalintelligence.ai

Engineering collaboration software for teams building challenging deep tech projects.

founders@prewittridge.com

Providing satellite radar-based intelligence for decision makers.

founders@satim.pl

Developing stratospheric microballoons to capture the freshest, high-res earth observation data.

founders@urbansky.space

Real-time remote robotic controls.

founders@vrotors.com

Proactive air insights.

founders@weavair.com

Powered by WPeMatico

Hasura, a service that provides developers with an open-source engine that provides them a GraphQL API to access their databases, today announced that it has raised a $25 million Series B round led by Lightspeed Venture Partners. Previous investors Vertex Ventures US, Nexus Venture Partners, Strive VC and SAP.iO Fund also participated in this round.

The new round, which the team raised after the COVID-19 pandemic had already started, comes only six months after the company announced its $9.9 million Series A round. In total, Hasura has now raised $36.5 million.

In addition to the new funding, Hasura also today announced that it has added support for MySQL databases. Until now, the company’s service only worked with PostgreSQL databases.

Rajoshi Ghosh, co-founder and COO (left) and Tanmai Gopal, co-founder and CEO (right). Image Credits: Hasura

As the company’s CEO and co-founder Tanmai Gopal told me, MySQL support has long been at the top of the most requested features by the service’s users. Many of these users — who are often in the healthcare and financial services industry — are also working with legacy systems they are trying to connect to modern applications and MySQL plays an important role there, given how long it has been around.

In addition to adding MySQL support, Hasura is also adding support for SQL Server to its lineup, but for now, that’s in early access.

“For MySQL and SQL Server, we’ve seen a lot of demand from our healthcare and financial services / fin-tech users,” Gopal said. “They have a lot of existing online data, especially in these two databases, that they want to activate to build new capabilities and use while modernizing their applications.

Today’s announcement also comes only a few months after the company launched a fully managed cloud service for its service, which complements its existing paid Pro service for enterprises.

“We’re very impressed by how developers have taken to Hasura and embraced the GraphQL approach to building applications,” said Gaurav Gupta, partner at Lightspeed Venture Partners and Hasura board member. “Particularly for front-end developers using technologies like React, Hasura makes it easy to connect applications to existing databases where all the data is without compromising on security and performance. Hasura provides a lovely bridge for re-platforming applications to cloud-native approaches, so we see this approach being embraced by enterprise developers as well as front-end developers more and more.”

The company plans to use the new funding to add support for more databases and to tackle some of the harder technical challenges around cross-database joins and the company’s application-level data caching system. “We’re also investing deeply in company building so that we can grow our GTM and engineering in tandem and making some senior hires across these functions,” said Gopal.

Powered by WPeMatico

Progress, a Boston-area developer tool company, boosted its offerings in a big way today when it announced it was acquiring software automation platform Chef for $220 million.

Chef, which went 100% open source last year, had annual recurring revenue (ARR) of $70 million from the commercial side of the house. Needless to say, Progress CEO Yogesh Gupta was happy to bring the company into the fold and gain not only that revenue, but a set of highly skilled employees, a strong developer community and an impressive customer list.

Gupta said that Chef fits with his company’s acquisition philosophy. “This acquisition perfectly aligns with our growth strategy and meets the requirements that we’ve previously laid out: a strong recurring revenue model, technology that complements our business, a loyal customer base and the ability to leverage our operating model and infrastructure to run the business more efficiently,” he said in a statement.

Chef CEO Barry Crist offered a typical argument for an acquired company; that Progress offered a better path to future growth, while sending a message to the open-source community and customers that Progress would be a good steward of the startup’s vision.

“For Chef, this acquisition is our next chapter, and Progress will help enhance our growth potential, support our Open Source vision, and provide broader opportunities for our customers, partners, employees and community,” Crist said in a statement.

Chef’s customer list is certainly impressive, and includes tech industry stalwarts like Facebook, IBM and SAP, as well as non-tech companies like Nordstrom, Alaska Airlines and Capital One.

The company was founded in 2008 and had raised $105 million, according to Crunchbase data. It hadn’t raised any funds since 2015, when it raised a $40 million Series E led by DFJ Growth. Other investors along the way included Battery Ventures, Ignition Partners and Scale Venture Partners.

The transaction is expected to close next month, pending normal regulatory approvals.

Powered by WPeMatico

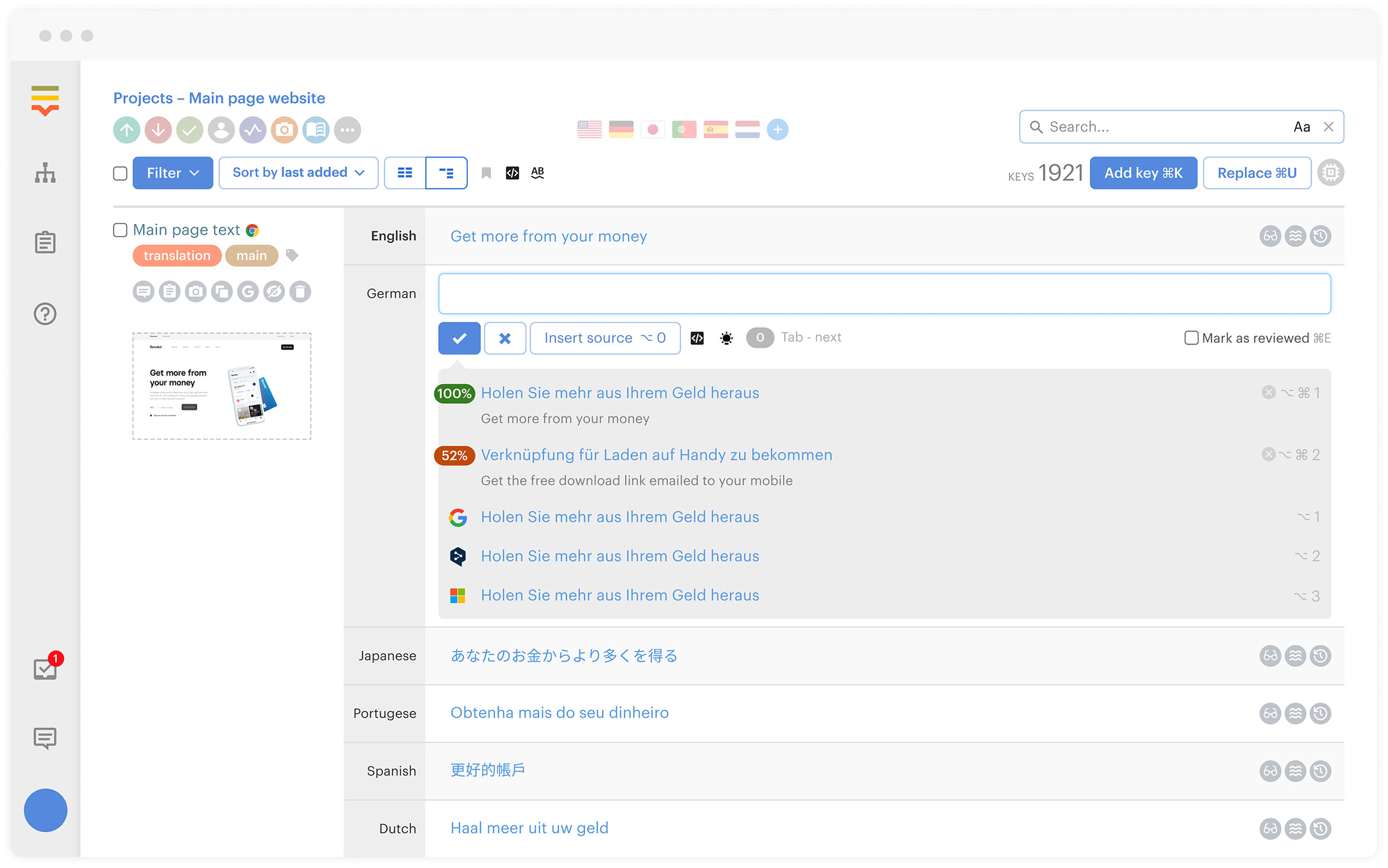

Meet Lokalise, a Latvian startup that focuses on translation and localization of apps, websites, games and more. The company provides a software-as-a-service product that helps you improve your workflow and processes when you need to update text in different languages in your product.

The company just raised a $6 million funding round led by Mike Chalfen, with capital300, Andrey Khusid, Nicolas Dessaigne, Des Traynor, Matt Robinson and others also participating.

When it’s time to ship an update, many companies waste time at the last minute as they still need to translate new buttons and new text in other languages. It’s often a manual process that involves sending and incorporating files with long lists of text strings in different languages.

“As a matter of fact, the most popular tools used in localisation processes are still Excel and Google Sheets. Next come internally-built scripts and tools,” co-founder and CEO Nick Ustinov told me.

Lokalise is all about speeding up that process. You can either manually upload your language files or integrate directly with GitHub or GitLab so that it automatically fetches changes.

You can then browse each sentence in different languages from the service. Your team of translators can edit text in the Lokalise interface. As a web-based service, everybody remains on the same page.

Image Credits: Lokalise

Some productivity features let you collaborate with other team members. You can comment and mention other people. You can assign tasks and trigger events based on completed tasks. For instance, Lokalise can notify a reviewer when a translation is done.

When everything is completed, you can use Lokalise to dynamically deliver language files to your mobile apps using SDKs and an API, or you can simply upload to an object storage bucket so that your app can fetch the latest language file from a server.

If you’re a small company and don’t have a team of translators, Lokalise lets you use Google Translate or a marketplace of professional translators. It works with Gengo or Lokalise’s own marketplace. There are some built-in spelling and grammar features to help you spot the most obvious errors.

“Most customers work with internal or external individual translators or language service providers (LSPs) directly,” Ustinov said. “The SaaS product generates 90% of our revenue — the revenue breakdown between the SaaS product and the marketplace of translation services is 90%/10%.”

The startup now has 1,500 customers, such as Revolut, Yelp, Virgin Mobile and Notion. It currently generates $4 million in annual recurring revenue.

Overall, Lokalise solves a very specific need. It is probably overkill for many companies. But if you ship often and you have customers all around the world, it could speed up the process a little bit.

Image Credits: Lokalise

Powered by WPeMatico

Fintech startup Revolut is expanding to Japan. After testing the service with 10,000 users, anybody can now sign up and open an account. The company originally obtained its authorization to operate from Japan’s Finance Service Agency in 2018.

When you open an account, you get an electronic wallet and a Visa debit card. You can top up your account and spend money with your card, a virtual card, Apple Pay, Google Pay, etc. Revolut sends you instant notifications and lets you freeze and unfreeze your card from the app.

You can also send money to other Revolut users or a bank account. Like in other countries, Revolut lets you exchange money in the app and send money in other currencies. Many users have taken advantage of the service to travel and pay less in foreign exchange fees.

Users in Japan will also be able to create vaults and put some money aside by rounding up transactions and creating recurring transactions. And that’s about it for now.

The company has already launched premium plans in Japan, but it doesn’t give you a lot of benefits other than lower fees on foreign exchange, different card designs, better support and the ability to buy airport lounge access with LoungeKey Pass.

Unlike in the U.K. and Europe, you won’t be able to buy cryptocurrencies, trade stocks, buy insurance products, create Revolut Junior accounts for your children, etc. Revolut is really trying to build a super app in its home country and has massively expanded its feature set over the years.

The company promises that some features, such as cryptocurrency and stock trading, will be available globally. But there’s no release date just yet. So let’s see how the product evolves in the coming months.

Revolut is currently available in the U.K., Europe, the U.S., Singapore and Australia. It currently has 13 million customers.

Image Credits: Revolut

Powered by WPeMatico

Get ready to spend two days rubbing virtual elbows with the global mobility community’s best and brightest minds and makers. TC Sessions: Mobility 2020 takes place October 6-7, and we’ve packed the agenda with experts, interviews, demos, panel discussions, breakout sessions and a metric ton of opportunity.

Speaking of opportunity, savvy startuppers know to take advantage of every one that comes along, especially when faced with unprecedented challenges and a tanked economy. Jump on board and buy your passes here. Pro tip: we offer both group and student discounts.

If you’re still on the fence (sheesh, tough room), here are five excellent reasons you should attend TC Sessions: Mobility 2020.

Leading voices

Experts. You want ‘em, and we’ve got ‘em. You into autonomous cars? We’ve got Waymo’s Tekedra Mawakana and Argo AI’s Bryan Salesky. Trucks? We’ve got Ike’s Nancy Sun and TuSimple’s Xiaodi Hou. Micromobility? We’ve got Lyft’s Dor Levi and Elemental Excelerator’s Danielle Harris. That’s just for starters and the list goes on and on. Check the agenda here.

Trendspotting

Mobility is a fast-moving target, and success depends in large part on your ability to spot possibilities before they turn into full-blown trends. TC Sessions: Mobility experts and attendees span the mobility and transportation tech spectrum. It’s where you need to be to figure out what’s coming next.

“Attending TC Sessions: Mobility helps us keep an eye on what’s coming around the corner. It uncovers crucial trends so we can identify what we should be thinking about before anyone else.” — Jeff Johnson, vice president of enterprise sales and solutions at FlashParking.

Global networking with CrunchMatch

CrunchMatch, our free, AI-powered networking platform (think speed dating for techies) makes connecting with like-minded attendees quick and painless — no matter where they’re located. A virtual conference means global participation, and you might just find your next customer, partner, investor or engineer living on a different continent. It takes only one connection to move your business forward.

“TC Sessions: Mobility isn’t just an educational opportunity, it’s a real networking opportunity. Everyone was passionate and open to creating pilot programs or other partnerships. That was the most exciting part. And now — thanks to a conference connection — we’re talking with Goodyear’s Innovation Lab.” — Karin Maake, senior director of communications at FlashParking.

The early-stage expo

More than 40 early-stage startups will showcase their mobility tech in our virtual expo. Peruse the exhibitors, peek at their pitch decks, schedule a demo, start a conversation and see where it leads.

Pitch Night

For the first time, TechCrunch will select 10 early-stage mobility startups to compete on October 5, and the top five founders will get to pitch the next day on the Main stage. Get more details here, and if you want in, apply here before September 15.

TC Sessions: Mobility 2020 takes place October 6-7, and we just laid out five reasons why your should join us. Grab all the opportunity and drive (autonomously or otherwise) your business forward.

Is your company interested in sponsoring or exhibiting at TC Sessions: Mobility 2020? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico