Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Asset management might not be the most exciting talking topic, but it’s often an overlooked area of cyber-defenses. By knowing exactly what assets your company has makes it easier to know where the security weak spots are.

That’s the problem JupiterOne is trying to fix.

“We built JupiterOne because we saw a gap in how organizations manage the security and compliance of their cyber assets day to day,” said Erkang Zheng, the company’s founder and chief executive.

The Morrisville, North Carolina-based startup, which spun out from healthcare cloud firm LifeOmic in 2018, helps companies see all of their digital and cloud assets by integrating with dozens of services and tools, including Amazon Web Services, Cloudflare and GitLab, and centralizing the results into a single monitoring tool.

JupiterOne says it makes it easier for companies to spot security issues and maintain compliance, with an aim of helping companies prevent security lapses and data breaches by catching issues early on.

The company already has Reddit, Databricks and Auth0 as customers, and just secured $19 million in its Series A, led by Bain Capital Ventures and with participation from Rain Capital and its parent company LifeOmic.

As part of the deal, Bain partner Enrique Salem will join JupiterOne’s board. “We see a large multi-billion-dollar market opportunity for this technology across mid-market and enterprise customers,” he said. Asset management is slated to be a $8.5 billion market by 2024.

Zheng told TechCrunch the company plans to use the funds to accelerate its engineering efforts and its go-to-market strategy, with new product features to come.

Powered by WPeMatico

Here’s another edition of “Dear Sophie,” the advice column that answers immigration-related questions about working at technology companies.

“Your questions are vital to the spread of knowledge that allows people all over the world to rise above borders and pursue their dreams,” says Sophie Alcorn, a Silicon Valley immigration attorney. “Whether you’re in people ops, a founder or seeking a job in Silicon Valley, I would love to answer your questions in my next column.”

“Dear Sophie” columns are accessible for Extra Crunch subscribers; use promo code ALCORN to purchase a one- or two-year subscription for 50% off.

Dear Sophie:

I’m entering my second year in the U.S. under a five-year J-1 research visa from Italy. When we came we thought it would be temporary, but our plans have changed and now we want to try to stay in the U.S. My husband started his own company here on his J-2 visa work permit, and our daughter was born here. However, we’re supposed to return to Italy for two years. How can we get a 212(e) waiver?

—Positive in Palo Alto

Dear Positive:

Congrats on your accomplishments — the birth of your daughter, your research position and your husband’s startup. Happy to share about the J-1 visa, the two-year home residency requirement (a section of the law called “212(e)”) and obtaining a waiver so you can seek a green card or another type of visa. For more background, check out my podcast on the two-year foreign residency requirement and filing a waiver and last weeks’ Dear Sophie column with an overview of the types of J-1 visas. The earlier you begin preparing your waiver application, the better.

The J-1 Educational and Cultural Exchange Visa is intended for people from around the globe to work or study in the U.S. and then take their newly acquired knowledge and skills back to their home country. Given that, it is not a direct path if you decide after your arrival to remain longer term in the U.S. I recommend working with an experienced immigration lawyer to devise a strategy for reaching your goals beyond getting a waiver. I also recommend talking with your employer to assess whether they can later sponsor you for a green card.

Powered by WPeMatico

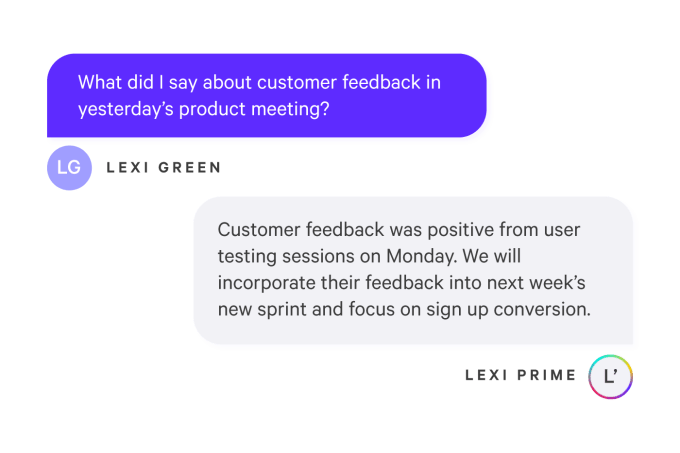

When it comes to pop culture, a company executive or history questions, most of us use Google as a memory crutch to recall information we can’t always keep in our heads, but Google can’t help you remember the name of your client’s spouse or the great idea you came up with at a meeting the other day.

Enter Luther.AI, which purports to be Google for your memory by capturing and transcribing audio recordings, while using AI to deliver the right information from your virtual memory bank in the moment of another online conversation or via search.

The company is releasing an initial browser-based version of their product this week at TechCrunch Disrupt where it’s competing for the $100,000 prize at TechCrunch Disrupt Battlefield.

Luther.AI’s founders say the company is built on the premise that human memory is fallible, and that weakness limits our individual intelligence. The idea behind Luther.AI is to provide a tool to retain, recall and even augment our own brains.

It’s a tall order, but the company’s founders believe it’s possible through the growing power of artificial intelligence and other technologies.

“It’s made possible through a convergence of neuroscience, NLP and blockchain to deliver seamless in-the-moment recall. GPT-3 is built on the memories of the public internet, while Luther is built on the memories of your private self,” company founder and CEO Suman Kanuganti told TechCrunch.

It starts by recording your interactions throughout the day. For starters, that will be online meetings in a browser, as we find ourselves in a time where that is the way we interact most often. Over time though, they envision a high-quality 5G recording device you wear throughout your day at work and capture your interactions.

If that is worrisome to you from a privacy perspective, Luther is building in a few safeguards starting with high-end encryption. Further, you can only save other parties’ parts of a conversation with their explicit permission. “Technologically, we make users the owner of what they are speaking. So for example, if you and I are having a conversation in the physical world unless you provide explicit permission, your memories are not shared from this particular conversation with me,” Kanuganti explained.

Finally, each person owns their own data in Luther and nobody else can access or use these conversations either from Luther or any other individual. They will eventually enforce this ownership using blockchain technology, although Kanuganti says that will be added in a future version of the product.

Image Credits: Luther.ai

Kanuganti says the true power of the product won’t be realized with a few individuals using the product inside a company, but in the network effect of having dozens or hundreds of people using it, even though it will have utility even for an individual to help with memory recall, he said.

While they are releasing the browser-based product this week, they will eventually have a stand-alone app, and can also envision other applications taking advantage of the technology in the future via an API where developers can build Luther functionality into other apps.

The company was founded at the beginning of this year by Kanuganti and three co-founders including CTO Sharon Zhang, design director Kristie Kaiser and scientist Marc Ettlinger . It has raised $500,000 and currently has 14 employees including the founders.

Powered by WPeMatico

Pure Storage, the public enterprise data storage company, today announced that it has acquired Portworx, a well-funded startup that provides a cloud-native storage and data-management platform based on Kubernetes, for $370 million in cash. This marks Pure Storage’s largest acquisition to date and shows how important this market for multicloud data services has become.

Current Portworx enterprise customers include the likes of Carrefour, Comcast, GE Digital, Kroger, Lufthansa, and T-Mobile. At the core of the service is its ability to help users migrate their data and create backups. It creates a storage layer that allows developers to then access that data, no matter where it resides.

Pure Storage will use Portworx’s technology to expand its hybrid and multicloud services and provide Kubernetes -based data services across clouds.

“I’m tremendously proud of what we’ve built at Portworx: An unparalleled data services platform for customers running mission-critical applications in hybrid and multicloud environments,” said Portworx CEO Murli Thirumale. “The traction and growth we see in our business daily shows that containers and Kubernetes are fundamental to the next-generation application architecture and thus competitiveness. We are excited for the accelerated growth and customer impact we will be able to achieve as a part of Pure.”

When the company raised its Series C round last year, Thirumale told me that Portworx had expanded its customer base by over 100% and its bookings increased by 376 from 2018 to 2019.

“As forward-thinking enterprises adopt cloud-native strategies to advance their business, we are thrilled to have the Portworx team and their groundbreaking technology joining us at Pure to expand our success in delivering multicloud data services for Kubernetes,” said Charles Giancarlo, chairman and CEO of Pure Storage. “This acquisition marks a significant milestone in expanding our Modern Data Experience to cover traditional and cloud native applications alike.”

Powered by WPeMatico

There are some changes at the helm of Blade, the French startup behind Shadow. Mike Fischer is going to work for the company and become chief executive officer. Jean-Baptiste Kempf is joining the company as chief technology officer.

Shadow is a cloud computing service for gamers. For a monthly subscription fee, you can access a gaming PC in a data center near you. Compared to other cloud gaming services, such as GeForce Now or Google’s Stadia, Shadow provides a full Windows 10 instance. You can install anything you want — Steam, Photoshop or Word.

The company has been growing rapidly over the past few years and raised more than $100 million in total. Last year, the company announced ambitious plans, with a wide-ranging partnership with OVHcloud and high-end configurations.

At the same time, co-founder Emmanuel Freund stepped aside as CEO, with Jérôme Arnaud taking over. There have been multiple delays with the new product offering and the company is no longer working with OVHcloud. Freund left the company in April and, as INpact Hardware reported in July, Arnaud has been on the way out for a couple of months.

All of this leads us to today’s announcement. Mike Fischer, the company’s new CEO, has been quite active in the video game industry. In the past, he has worked at Sega, Bandai Namco, Microsoft and Epic Games. He was the president and CEO of Square Enix between 2010 and 2013.

Jean-Baptiste Kempf is a well-known figure in the open-source community. For the past 14 years, he has been the president of VideoLAN, the organization behind popular media player VLC. VideoLAN has also contributed to widely used video encoding technologies. He also founded VideoLabs, a company that works on VLC-related integrations and support.

The company is still working on rolling out the new Ultra and Infinite configurations to European users who pre-ordered. It originally planned to start rolling out new tiers in the U.S. starting this summer but the company now says it expects to launch these new tiers by the end of the year.

For customers in the U.S., there are no pre-orders, there will simply be a button to upgrade in your account when it’s available. LG invested in the company earlier this year and the service will go live in South Korea later this year, as well.

Powered by WPeMatico

Zwift, a 350-person, Long Beach, California-based online fitness platform that immerses cyclists and runners in 3D-generated worlds, just raised a hefty $450 million in funding led by the investment firm KKR in exchange for a minority stake in its business.

Permira, the Amazon Alexa Fund and Specialized Bicycle’s venture capital fund, Zone 5 Ventures, also joined the round, alongside earlier backers Highland Europe, Novator, Causeway Media and True, which is a Europe-based consumer specialist firm.

Zwift has now raised $620 million altogether and is valued at north of $1 billion.

Why such a big round? Right now, the company just makes an app, albeit a popular one.

Since its 2015 founding, 2.5 million people have signed up to enter a world that, as Outside magazine once described it, is “part social-media platform, part personal trainer, part computer game.” That particular combination makes Zwift’s app appealing to both recreational riders and pros looking to train no matter the conditions outside.

The company declined to share its active subscriber numbers with us — Zwift charges $15 per month for its service — but it seemingly has a loyal base of users. For example, 117,000 of them competed in a virtual version of the Tour de France that Zwift hosted in July after it was chosen by the official race organizer of the real tour as its partner on the event.

Which leads us back to this giant round and what it will be used for. Today, in order to use the app, Zwift’s biking adherents need to buy their own smart trainers, which can cost anywhere from $300 to $700 and are made by brands like Elite and Wahoo. Meanwhile, runners use Zwift’s app with their own treadmills.

Now, Zwift is jumping headfirst into the hardware business itself. Though a spokesman for the company said it can’t discuss any particulars — “It takes time to develop hardware properly, and COVID has placed increased pressure on production” — it is hoping to bring its first product to market “as soon as possible.”

He added that the hardware will make Zwift a “more immersive and seamless experience for users.”

Either way, the direction isn’t a surprising one for the company, and we don’t say that merely because Specialized participated in this round as a strategic backer. Co-founder and CEO Eric Min has told us in the past that the company hoped to produce its own trainers some day.

Given the runaway success of the in-home fitness company Peloton, it wouldn’t be surprising to see a treadmill follow, or even a different product entirely. Said the Zwift spokesman, “In the future, it’s possible that we could bring in other disciplines or a more gamified experience.” (It will have expert advice in this area if it does, given that Zwift just brought aboard Ilkka Paananen, the co-founder and CEO of Finnish gaming company Supercell, as an investor and board member.)

In the meantime, the company tells us not to expect the kind of classes that have proven so successful for Peloton, tempting as it may be to draw parallels.

While Zwift prides itself on users’ ability to organize group rides and runs and workouts, classes, says its spokesman, are “not in the offing.”

Powered by WPeMatico

In March, famed investment firm Sequoia Capital published the Black Swan Memo, warning founders about the potential business consequences of the coronavirus, which had not yet been labeled a pandemic.

“It will take considerable time — perhaps several quarters — before we can be confident that the virus has been contained. It will take even longer for the global economy to recover its footing,” the memo read.

Six months later, Sequoia’s Roelof Botha is “surprised” at the state of venture capital and startups in the country, which are largely benefitting from — not struggling with — from COVID-19 tailwinds.

VCs are pouring money at a rapid clip into edtech, SaaS, low-code and no code, as well as telemedicine. In some cases, investors say venture funding has been hotter than ever ahead of the U.S. elections, beating not just March 2020, but 2019 records overall.

Sequoia, it seems, is happy to be wrong. This week, Sequoia Capital will have backed three of the 12 companies going public: Sumo Logic, Unity, and Snowflake. Snowflake is expected to go out at $30 billion valuation, which some say will be the largest U.S. software company to ever go public. Beyond the firm, numbers of unicorns are gearing up, or teasing, to go public in the coming weeks.

“I’m proud of the fact that we saw a few things and anticipated a few things,” he said during TechCrunch Disrupt. “But we also got many things wrong.”

Botha pointed to a few factors that saved startupland from freezing up. First, he said the U.S. government’s stimulus package helped make sure that there was not a “complete economic meltdown.”

“I didn’t quite expect that scale reaction,” Botha said. He’s referring to the $2 trillion CARES Act passed by Congress and signed by President Trump, which included PPP loans designed to provide a direct incentive for small businesses to keep their workers on the payroll. Tech recipients included Bolt Mobility, Getaround, Luminar, Stackin, TuSimple and Velodyne.

Botha addressed how tech companies have helped sustain businesses and operations amid the pandemic, which has trickled down to new customer growth and revenue.

Zoom, a Sequoia portfolio company, might be one of the best examples of how a tech company was poised to skyrocket during the pandemic. According to Botha, the firm, which still owns shares in the company, wishes it had held onto more of its position longer. Sequoia invested in Zoom when it was valued at $1 billion. Today, it is worth more than $100 billion, graduating from an enterprise videoconferencing service to a household consumer product.

To be fair, some of Sequoia’s warning signs proved true: Layoffs inundated Silicon Valley; companies shuttered citing a drop in revenue; and the market remains volatile.

“We also have to realize there’s a lot of pain and there are many mainstream businesses and local services and restaurants and coffee shops that often suffer economically,” he said. “I don’t want to be overly sanguine just because technology stocks have had a good run. As a country, we need to brace ourselves for helping everybody.”

Powered by WPeMatico

If you listed the trends that have captured the attention of 20 Warsaw-focused investors who replied to our recent surveys, automation/AI, enterprise SaaS, cleantech, health, remote work and the sharing economy would top the list. These VCs said they are seeking opportunities in the “digital twin” space, proptech and expanded blockchain tokenization inside industries.

Investors in Central and Eastern Europe are generally looking for the same things as VCs based elsewhere: startups that have a unique value proposition, capital efficiency, motivated teams, post-revenue and a well-defined market niche.

Out of the cohort we interviewed, several told us that COVID-19 had not yet substantially transformed how they do business. As Michał Papuga, a partner at Flashpoint VC put it, “the situation since March hasn’t changed a lot, but we went from extreme panic to extreme bullishness. Neither of these is good and I would recommend to stick to the long-term goals and not to be pressured.”

Said Pawel Lipkowski of RBL_VC, “Warsaw is at its pivotal point — think Berlin in the ‘90s. It’s a place to observe carefully.”

Here’s who we interviewed for part one:

For the conclusion, we spoke to the following investors:

What trends are you most excited about investing in, generally?

Gradual shift of enterprises toward increased use of automation and AI, that enables dramatic improvement of efficiency, cost reduction and transfer of enterprise resources from tedious, repeatable and mundane tasks to more exciting, value added opportunities.

What’s your latest, most exciting investment?

One of the most exciting opportunities is ICEYE. The company is a leader and first mover in synthetic-aperture radar (SAR) technology for microsatellites. It is building and operating its own commercial constellation of SAR microsatellites capable of providing satellite imagery regardless of the cloud cover, weather conditions and time of the day and night (comparable resolution to traditional SAR satellites with 100x lower cost factor), which is disrupting the multibillion dollar satellite imagery market.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

I would love to see more startups in the digital twin space; technology that enables creation of an exact digital replica/copy of something in physical space — a product, process or even the whole ecosystem. This kind of solution enables experiments and [the implementation of] changes that otherwise could be extremely costly or risky – it can provide immense value added for customers.

What are you looking for in your next investment, in general?

A company with unique value proposition to its customers, deep tech component that provides competitive edge over other players in the market and a founder with global vision and focus on execution of that vision.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

No market/sector is too saturated and has no room for innovation. Some markets seem to be more challenging than others due to immense competitive landscape (e.g., food delivery, language-learning apps) but still can be the subject of disruption due to a unique value proposition of a new entrant.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

OTB is focused on opportunities with links to Central Eastern European talent (with no bias toward any hub in the region), meaning companies that leverage local engineering/entrepreneurial talent in order to build world-class products to compete globally (usually HQ outside CEE).

Which industries in your city and region seem well-positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

CEE region is recognized for its sizable and highly skilled talent pool in the fields of engineering and software development. The region is well-positioned to build up solutions that leverage deep, unique tech regardless of vertical (especially B2B). Historically, the region was especially strong in AI/ML, voice/speech/NLP technologies, cybersecurity, data analytics, etc.

How should investors in other cities think about the overall investment climate and opportunities in your city?

CEE (including Poland and Warsaw) has always been recognized as an exceptionally strong region in terms of engineering/IT talent. Inherent risk aversion of entrepreneurs has driven, for a number of years, a more “copycat”/local market approach, while holding back more ambitious, deep tech opportunities. In recent years we are witnessing a paradigm shift with a new generation of entrepreneurs tackling problems with unique, deep tech solutions, putting emphasis on global expansion, neglecting shallow local markets. As such, the quality of deals has been steadily growing and currently reflects top quality on global scale, especially on tech level. CEE market demonstrates also a growing number of startups (in total), which is mostly driven by an abundance of early-stage capital and success stories in the region (e.g., DataRobot, Bolt, UiPath) that are successfully evangelizing entrepreneurship among corporates/engineers.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

I believe that local hubs will hold their dominant position in the ecosystem. The remote/digital workforce will grow in numbers but proximity to capital, human resources and markets still will remain the prevalent force in shaping local startup communities.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

OTB invests in general in companies with clearly defined technological advantage, making quantifiable and near-term difference to their customers (usually in the B2B sector), which is a value-add regardless of the market cycle. The economic downturn works generally in favor of technological solutions enabling enterprise clients to increase efficiency, cut costs, bring optimization and replace manual labour with automation — and the vast majority of OTB portfolio fits that description. As such, the majority of the OTB portfolio has not been heavily impacted by the COVID pandemic.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

The COVID pandemic has not impacted our investment strategy in any way. OTB still pursues unique tech opportunities that can provide its customers with immediate value added. This kind of approach provides a relatively high level of resilience against economic downturns (obviously, sales cycles are extending but in general sales pipeline/prospects/retention remains intact). Liquidity in portfolio is always the number one concern in uncertain, challenging times. Lean approach needs to be reintroduced, companies need to preserve cash and keep optimizing — that’s the only way to get through the crisis.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

A good example in our portfolio is Segron, a provider of an automated testing platform for applications, databases and enterprise network infrastructure. Software development, deployment and maintenance in enterprise IT ecosystem requires continuous and rigorous testing protocols and as such a lot of manual heavy lifting with highly skilled engineering talent being involved (which can be used in a more productive way elsewhere). The COVID pandemic has kept engineers home (with no ability for remote testing) while driving demand for digital services (and as such demand for a reliable IT ecosystem). The Segron automated framework enables full automation of enterprise testing leading to increased efficiency, cutting operating costs and giving enterprise customers peace of mind and a good night’s sleep regarding their IT infrastructure in the challenging economic environment.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

I remain impressed by the unshakeable determination of multiple founders and their teams to overcome all the challenges of the unfavorable economic ecosystem.

Powered by WPeMatico

Latent AI, a startup that was spun out of SRI International, makes it easier to run AI workloads at the edge by dynamically managing workloads as necessary.

Using its proprietary compression and compilation process, Latent AI promises to compress library files by 10x and run them with 5x lower latency than other systems, all while using less power thanks to its new adaptive AI technology, which the company is launching as part of its appearance in the TechCrunch Disrupt Battlefield competition today.

Founded by CEO Jags Kandasamy and CTO Sek Chai, the company has already raised a $6.5 million seed round led by Steve Jurvetson of Future Ventures and followed by Autotech Ventures .

Before starting Latent AI, Kandasamy sold his previous startup OtoSense to Analog Devices (in addition to managing HPE Mid-Market Security business before that). OtoSense used data from sound and vibration sensors for predictive maintenance use cases. Before its sale, the company worked with the likes of Delta Airlines and Airbus.

In some ways, Latent AI picks up some of this work and marries it with IP from SRI International .

“With OtoSense, I had already done some edge work,” Kandasamy said. “We had moved the audio recognition part out of the cloud. We did the learning in the cloud, but the recognition was done in the edge device and we had to convert quickly and get it down. Our bill in the first few months made us move that way. You couldn’t be streaming data over LTE or 3G for too long.”

At SRI, Chai worked on a project that looked at how to best manage power for flying objects where, if you have a single source of power, the system could intelligently allocate resources for either powering the flight or running the onboard compute workloads, mostly for surveillance, and then switch between them as needed. Most of the time, in a surveillance use case, nothing happens. And while that’s the case, you don’t need to compute every frame you see.

“We took that and we made it into a tool and a platform so that you can apply it to all sorts of use cases, from voice to vision to segmentation to time series stuff,” Kandasamy explained.

What’s important to note here is that the company offers the various components of what it calls the Latent AI Efficient Inference Platform (LEIP) as standalone modules or as a fully integrated system. The compressor and compiler are the first two of these and what the company is launching today is LEIP Adapt, the part of the system that manages the dynamic AI workloads Kandasamy described above.

In practical terms, the use case for LEIP Adapt is that your battery-powered smart doorbell, for example, can run in a low-powered mode for a long time, waiting for something to happen. Then, when somebody arrives at your door, the camera wakes up to run a larger model — maybe even on the doorbell’s base station that is plugged into power — to do image recognition. And if a whole group of people arrives at ones (which isn’t likely right now, but maybe next year, after the pandemic is under control), the system can offload the workload to the cloud as needed.

Kandasamy tells me that the interest in the technology has been “tremendous.” Given his previous experience and the network of SRI International, it’s maybe no surprise that Latent AI is getting a lot of interest from the automotive industry, but Kandasamy also noted that the company is working with consumer companies, including a camera and a hearing aid maker.

The company is also working with a major telco company that is looking at Latent AI as part of its AI orchestration platform and a large CDN provider to help them run AI workloads on a JavaScript backend.

Powered by WPeMatico

Varada, a Tel Aviv-based startup that focuses on making it easier for businesses to query data across services, today announced that it has raised a $12 million Series A round led by Israeli early-stage fund MizMaa Ventures, with participation by Gefen Capital.

“If you look at the storage aspect for big data, there’s always innovation, but we can put a lot of data in one place,” Varada CEO and co-founder Eran Vanounou told me. “But translating data into insight? It’s so hard. It’s costly. It’s slow. It’s complicated.”

That’s a lesson he learned during his time as CTO of LivePerson, which he described as a classic big data company. And just like at LivePerson, where the team had to reinvent the wheel to solve its data problems, again and again, every company — and not just the large enterprises — now struggles with managing their data and getting insights out of it, Vanounou argued.

The rest of the founding team, David Krakov, Roman Vainbrand and Tal Ben-Moshe, already had a lot of experience in dealing with these problems, too, with Ben-Moshe having served at the chief software architect of Dell EMC’s XtremIO flash array unit, for example. They built the system for indexing big data that’s at the core of Varada’s platform (with the open-source Presto SQL query engine being one of the other cornerstones).

Essentially, Varada embraces the idea of data lakes and enriches that with its indexing capabilities. And those indexing capabilities is where Varada’s smarts can be found. As Vanounou explained, the company is using a machine learning system to understand when users tend to run certain workloads, and then caches the data ahead of time, making the system far faster than its competitors.

“If you think about big organizations and think about the workloads and the queries, what happens during the morning time is different from evening time. What happened yesterday is not what happened today. What happened on a rainy day is not what happened on a shiny day. […] We listen to what’s going on and we optimize. We leverage the indexing technology. We index what is needed when it is needed.”

That helps speed up queries, but it also means less data has to be replicated, which also brings down the cost. As MizMaa’s Aaron Applbaum noted, since Varada is not a SaaS solution, the buyers still get all of the discounts from their cloud providers, too.

In addition, the system can allocate resources intelligently so that different users can tap into different amounts of bandwidth. You can tell it to give customers more bandwidth than your financial analysts, for example.

“Data is growing like crazy: in volume, in scale, in complexity, in who requires it and what the business intelligence uses are, what the API uses are,” Applbaum said when I asked him why he decided to invest. “And compute is getting slightly cheaper, but not really, and storage is getting cheaper. So if you can make the trade-off to store more stuff, and access things more intelligently, more quickly, more agile — that was the basis of our thesis, as long as you can do it without compromising performance.”

Varada, with its team of experienced executives, architects and engineers, ticked a lot of the company’s boxes in this regard, but he also noted that unlike some other Israeli startups, the team understood that it had to listen to customers and understand their needs, too.

“In Israel, you have a history — and it’s become less and less the case — but historically, there’s a joke that it’s ‘ready, fire, aim.’ You build a technology, you’ve got this beautiful thing and you’re like, ‘alright, we did it,’ but without listening to the needs of the customer,” he explained.

The Varada team is not afraid to compare itself to Snowflake, which at least at first glance seems to make similar promises. Vananou praised the company for opening up the data warehousing market and proving that people are willing to pay for good analytics. But he argues that Varada’s approach is fundamentally different.

“We embrace the data lake. So if you are Mr. Customer, your data is your data. We’re not going to take it, move it, copy it. This is your single source of truth,” he said. And in addition, the data can stay in the company’s virtual private cloud. He also argues that Varada isn’t so much focused on the business users but the technologists inside a company.

Powered by WPeMatico