Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Three University of Michigan students are building Channels Inc., a communication software tailored for physical workers, and already racking up some big customers in the event management industry.

Siddharth Kaul, 18, Elan Rosen, 20, and Ibrahim Mohammed, 20, started the company after finding some common ground in retail and events. The company’s customer list boasts names like Marriott Hotels, and it announced a $520,000 seed round, led by Sahra Growth Capital, to give it nearly $570,000 in total funding.

Kaul grew up going to a lot of events in Kuwait and Dubai, but started noticing there was a delay in things that should happen and many processes were being done on pen and paper.

“The technology that was available was inharmonious and made it hard for physical workers to fulfill tasks,” Kaul told TechCrunch. “We saw it happening in the event management space, forcing workers to coordinate across technologies.”

Legacy communication platforms like Slack are aggregating communications, but are better for remote workers; for physical workers, they rely more on text communication, he said. However, the disadvantage with texting is that you have to keep scrolling to get to the new message, and old communication is lost amid all of the replies.

They began developing a platform for small hotels to help them transition to digital and provide communication in a non-chronological order that is easier to access, enables discussion and can be searched. Users of the SaaS platform can build live personnel maps to see where employees are and what the event floor looks like, prioritize alerts and automate tasks while monitoring progress.

Marriott became a customer after one of its employees saw the Channels platform was being tested at an event. He saw employees pulling out their phones and asked the manager why they were doing that, and was told they were testing out the product and referred him to Kaul.

“What they thought was helpful was that it was communication, and though the employees were checking their phones, it was quick and they remained attentive,” Kaul said.

Channels provides a solid platform in terms of analytics and graphical representation, which is a major selling point for customers, leading to initial traction and revenue for the company that Rosen said he expects can occur at the convention level the company is striving for.

The new funding will be used to grow in development and bring additional engineering talent to the team. In addition, it will allow Kaul and Rosen to continue with their studies, while Mohammed will be doing more full-time work. They want to increase their recurring revenue in the Middle East while building up operations in the United States.

Jamal Al-Barrak, managing partner of Sahra Growth Capital, said Channels was on his firm’s radar ever since they won the 2020 Dubai X-Series competition it sponsors. As a result of winning the competition, he was able to see the founders on multiple occasions and hear their growth.

Sahra doesn’t typically invest in companies like Channels, but the firm started a “seed sourcing effort” to make investments of between $200,000 and $800,000 into early-stage companies, Al-Barrak said. Channels is one of the first investments with that effort.

“Channels is one of our first investments in this initiative and they look very promising so far even compared to our investments before we started this initiative,” Al-Barrak said. He liked the founders’ work ethic and their focus on the event industry, which he called, “historically outdated and bereft of technological innovation.”

“Sid, Elan and Ibrahim are some of the youngest yet brightest entrepreneurs I have come across to this day and I have invested in over 25 technology startups,” he said. “Additionally, I enjoyed that they had proof of concept with a prior customer base and revenue. I was most impressed by their vision past their current industry and bounds as they want to encapsulate communication for all physical workers, whether it is events, retail or more.”

Powered by WPeMatico

Choosing an insurance policy is one of the most complicated financial decisions a person can make. Jakarta-based Lifepal wants to simplify the process for Indonesians with a marketplace that lets users compare policies from more than 50 providers, get help from licensed agents and file claims. The startup, which says it is the country’s largest direct-to-consumer insurance marketplace, announced today it has raised a $9 million Series A. The round was led by ProBatus Capital, a venture firm backed by Prudential Financial, with participation from Cathay Innovation and returning investors Insignia Venture Partners, ATM Capital and Hustle Fund.

Lifepal was founded in 2019 by former Lazada executives Giacomo Ficari and Nicolo Robba, along with Benny Fajarai and Reza Muhammed. The new funding brings its total raised to $12 million.

The marketplace’s partners currently offer about 300 policies for life, health, automotive, property and travel coverage. Ficari, who also co-founded neobank Aspire, told TechCrunch that Lifepal was created to make comparing, buying and claiming insurance as simple as shopping online.

“The same kind of experience a customer has today on a marketplace like Lazada—the convenience, all digital, fast delivery—we saw was lacking in insurance, which is still operating with offline, face-to-face agents like 20 to 30 years ago,” he said.

Indonesia’s insurance penetration rate is only about 3%, but the market is growing along with the country’s gross domestic product thanks to a larger middle-class. “We are really at a tipping point for GDP per capita and a lot of insurance carriers are focusing more on Indonesia,” said Ficari.

Other venture-backed insurtech startups tapping into this demand include Fuse, PasarPolis and Qoala. Both Qoala and PasarPolis focus on “micro-policies,” or inexpensive coverage for things like damaged devices. PasarPolis also partners with Gojek to offer health and accident insurance to drivers. Fuse, meanwhile, insurance specialists an online platform to run their businesses.

Lifepal takes a different approach because it doesn’t sell micro-policies, and its marketplace is for customers to purchase directly from providers, not through agents.

Based on Lifepal’s data, about 60% of its health and life insurance customers are buying coverage for the first time. On the other hand, many automotive insurance shoppers had policies before, but their coverage expired and they decided to shop online instead of going to an agent to get a new one.

Ficari said Lifepal’s target customers overlap with the investment apps that are gaining traction among Indonesia’s growing middle class (like Ajaib, Pluang and Pintu). Many of these apps provide educational content, since their customers are usually millennials investing for the first time, and Lifepal takes a similar approach. Its content side, called Lifepal Media, focuses on articles for people who are researching insurance policies and related topics like personal financial planning. The company says its site, including its blog, now has about 4 million monthly visitors, creating a funnel for its marketplace.

While one of Lifepal’s benefits is enabling people to compare policies on their own, many also rely on its customer support line, which is staffed by licensed insurance agents. In fact, Ficari said about 90% of its customers use it.

“What we realize is that insurance is complicated and it’s expensive,” said Ficari. “People want to take their time to think and they have a lot of questions, so we introduced good customer support.” He added Lifepal’s combination of enabling self-research while providing support is similar to the approach taken by PolicyBazaar in India, one of the country’s largest insurance aggregators.

To keep its business model scalable, Lifepal uses a recommendation engine that matches potential customers with policies and customer support representatives. It considers data points like budget (based on Lifepal’s research, its customers usually spend about 3% to 5% of their yearly income on insurance), age, gender, family composition and if they have purchased insurance before.

Lifepal’s investment from ProBatus will allow it to work with Assurance IQ, the insurance sales automation platform acquired by Prudential Financial two years ago.

In a statement, ProBatus Capital founder and managing partner Ramneek Gupta said Lifepal’s “three-pronged approach” (its educational content, online marketplace and live agents for customer support) has the “potential to change the way the Indonesian consumer buys insurance.”

Part of Lifepal’s funding will be used to build products to make it easier to claim policies. Upcoming products include Insurance Wallet, which will include an application process with support on how to claim a policy—for example, what car repair shop or hospital a customer should go to—and escalation if a claim is rejected. Another product, called Easy Claim, will automate the claim process.

“The goal is to stay end-to-end with the customer, from reading content, comparing policies, buying and then renewing and using them, so you really see people sticking around,” said Ficari.

Lifepal is Cathay Innovation’s third insurtech investment in the past 12 months. Investment director Rajive Keshup told TechCrunch in an email that it backed Lifepal because “the company grew phenomenally last year (12X) and is poised to beat its aggressive 2021 plan despite the proliferation of the COVID delta variant, accentuating the fact that Lifepal is very much on track to replicate the success of similar global models such as Assurance IQ (US) and PolicyBazaar (India).”

Powered by WPeMatico

As one of four general partners at Andreessen Horowitz who are investing the venture firm’s new $2.2 billion crypto fund, Arianna Simpson is very focused on how to return that capital and much more to the firm’s limited partners.

Toward that end, she has been more focused of late on startups that combine crypto with gaming. Last month, for example, her team co-led an investment in Virtually Human Studio, the startup behind a digital horse racing service Zed Run, wherein users buy, sell and breed virtual horses whose value rises depending on their performance against other virtual horses. (Each is essentially a non-fungible token, or NFT, meaning it is unique.)

Simpson is relatedly intrigued with NFT-based “play-to-earn” models, wherein gamers can earn cryptocurrency that they can then cash out for their local currency if they so choose. Indeed, a16z is announcing today that it just led a $4.6 million investment in the tokens of Yield Guild Games (YGG), a decentralized gaming outfit based in the Philippines that invites players to share in the company’s revenue by playing games like “Axie Infinity,” a blockchain-based game where players breed, battle and trade digital creatures named Axies in order to earn tokens called “Small Love Potion” that they can eventually cash out. YGG lends players the money to buy the Axies and other digital assets to start the game, so they can start earning money. (The obvious hope is that they earn more than they have to pay YGG for the use of its assets.)

We talked yesterday with Simpson — who joined a16z after first backing some of the same startups, including the blockchain infrastructure company Dapper Labs and the global payment platform Celo — to learn more about what’s happening at the intersection of crypto and gaming. She also shared which platforms a16z tracks most closely to identify up-and-coming crypto startups. Our chat, edited for length, follows.

TC: Zed Run is really interesting. How did you first come across this digital horse racing business?

AS: I think it was crypto Twitter, which honestly is where we’re finding a lot of our gaming investments. The community on there is really incredible and often one of the first places where really exciting new projects are surfaced.

Zed really marks the advent of kind of a new type of more involved gameplay in crypto. If you look at [the collectibles game] CryptoKitties, it was one of the first NFT-based games that really caught the attention of people outside of the crypto sphere. Zed is definitely a derivative extension in the sense that you have a digital animal that you’re playing with, but the gameplay is much more complex, and the thing that’s been incredible to watch is just how excited the community is. People are putting together all kinds of very sophisticated guides around how to play the game, to read [race] courses, how to do all kinds of different things in the game, and tens of thousands of people all over the world [are playing].

TC: Maybe these already exist, but are there endless opportunities across verticals here, like, say, a digital car racing equivalent or a UFC-style equivalent, where people are buying and betting on digital fighters and hoping they’ll rise in value?

AS: There’s an incredibly broad range of possibilities in terms of what’s happening and what will happen in the universe of crypto games. I think at the core of this movement is really the idea of giving more of the value and ownership in these game assets back to the players. That’s something that has historically been a problem. You might spend years and years building up your arsenal of skins or in-game assets, and then a game will change the rules, take [some of your winnings] away from you or do any number of things that can leave players feeling very disappointed and kind of ripped off. The idea [with blockchain-based games] is to make them more open and allow players to have actual ownership in the space themselves.

TC: Which leads us to your newest investment, Yield Guild Games, or YGG. Why did this company capture the firm’s attention?

AS: During the pandemic, a lot of people were put out of work and not able to provide for themselves and for their families. This time kind of coincided with the rise of a game called “Axie Infinity,” one of the first games to pioneer a play-to-earn model, which is becoming a very important theme in crypto games.

In order to play “Axie Infinity,” you need to have three Axies, and generally speaking, that means you need

to buy them upfront. Obviously if you’re out of work, you have no money [so buying these digital pets] can become a very challenging proposition. So [YGG founder] Gabby Dizon in the Philippines, who played “Axie Infinity” started lending out his Axies so other people could play the game and earn tokens that could then be converted to local currency. And so basically YGG emerged as sort of the productization of what they were doing here, so YGG either purchases or breeds in-game assets that are yield-earning, then loans them to out “scholars,” who are the recipients of these in-game assets, and YGG then takes a small cut of the in-game revenue that the players generate over time.

TC: Does a “scholar” have to be a sophisticated player?

AS: There are managers who basically manage teams of scholars; they’re the ones who effectively decide who to bring into the guild.

TC: So these Axies can be cashed out for currency, but where, and who is buying them?

AS: They can be bought or sold on exchanges and other players are buying them if they need to breed in “Axie” and needs some [Axies]; others are buying them for investment purposes. Also, they aren’t necessarily selling the NFTs but they may be selling the tokens that they earn as part of the gameplay.

TC: There are now 5,000 of these scholars playing the game. Are they mostly in Southeast Asia?

AS: A majority of the players and scholars are in Southeast Asia, but we’re seeing really strong international growth as well, both for “Axie Infinity” and YGG, in particular. At this point, scaling internationally is definitely a core focus for the YGG team.

TC: You mentioned crypto Twitter. What about Discord and Reddit? Where else are you looking around for new crypto projects that are bubbling up and capturing people’s imagination?

AS: All of the above. Discord in particular is very actively used by the crypto community, and the thing that’s interesting there is it really allows you to get a pulse for how active a community is, how engaged people are, how frequently they’re talking, and what they’re talking about. It gives you a look into the community at large and that’s a very important thing to consider when looking to make an investment or assess the health of a project.

TC: One of the cofounders of YGG is known only as the Owl of Moistness. Why do we see these pseudonyms so often in this world?

AS: One of the things I love the most about crypto is that it’s a little bit weird. The industry doesn’t take itself too seriously. I actually think that’s really important in terms of allowing people enough creativity to build new things rather than copies of existing things.

Powered by WPeMatico

Facebook is a monopoly. Right?

Mark Zuckerberg appeared on national TV today to make a “special announcement.” The timing could not be more curious: Today is the day Lina Khan’s FTC refiled its case to dismantle Facebook’s monopoly.

To the average person, Facebook’s monopoly seems obvious. “After all,” as James E. Boasberg of the U.S. District Court for the District of Columbia put it in his recent decision, “No one who hears the title of the 2010 film ‘The Social Network’ wonders which company it is about.” But obviousness is not an antitrust standard. Monopoly has a clear legal meaning, and thus far Lina Khan’s FTC has failed to meet it. Today’s refiling is much more substantive than the FTC’s first foray. But it’s still lacking some critical arguments. Here are some ideas from the front lines.

To the average person, Facebook’s monopoly seems obvious. But obviousness is not an antitrust standard.

First, the FTC must define the market correctly: personal social networking, which includes messaging. Second, the FTC must establish that Facebook controls over 60% of the market — the correct metric to establish this is revenue.

Though consumer harm is a well-known test of monopoly determination, our courts do not require the FTC to prove that Facebook harms consumers to win the case. As an alternative pleading, though, the government can present a compelling case that Facebook harms consumers by suppressing wages in the creator economy. If the creator economy is real, then the value of ads on Facebook’s services is generated through the fruits of creators’ labor; no one would watch the ads before videos or in between posts if the user-generated content was not there. Facebook has harmed consumers by suppressing creator wages.

A note: This is the first of a series on the Facebook monopoly. I am inspired by Cloudflare’s recent post explaining the impact of Amazon’s monopoly in their industry. Perhaps it was a competitive tactic, but I genuinely believe it more a patriotic duty: guideposts for legislators and regulators on a complex issue. My generation has watched with a combination of sadness and trepidation as legislators who barely use email question the leading technologists of our time about products that have long pervaded our lives in ways we don’t yet understand. I, personally, and my company both stand to gain little from this — but as a participant in the latest generation of social media upstarts, and as an American concerned for the future of our democracy, I feel a duty to try.

According to the court, the FTC must meet a two-part test: First, the FTC must define the market in which Facebook has monopoly power, established by the D.C. Circuit in Neumann v. Reinforced Earth Co. (1986). This is the market for personal social networking services, which includes messaging.

Second, the FTC must establish that Facebook controls a dominant share of that market, which courts have defined as 60% or above, established by the 3rd U.S. Circuit Court of Appeals in FTC v. AbbVie (2020). The right metric for this market share analysis is unequivocally revenue — daily active users (DAU) x average revenue per user (ARPU). And Facebook controls over 90%.

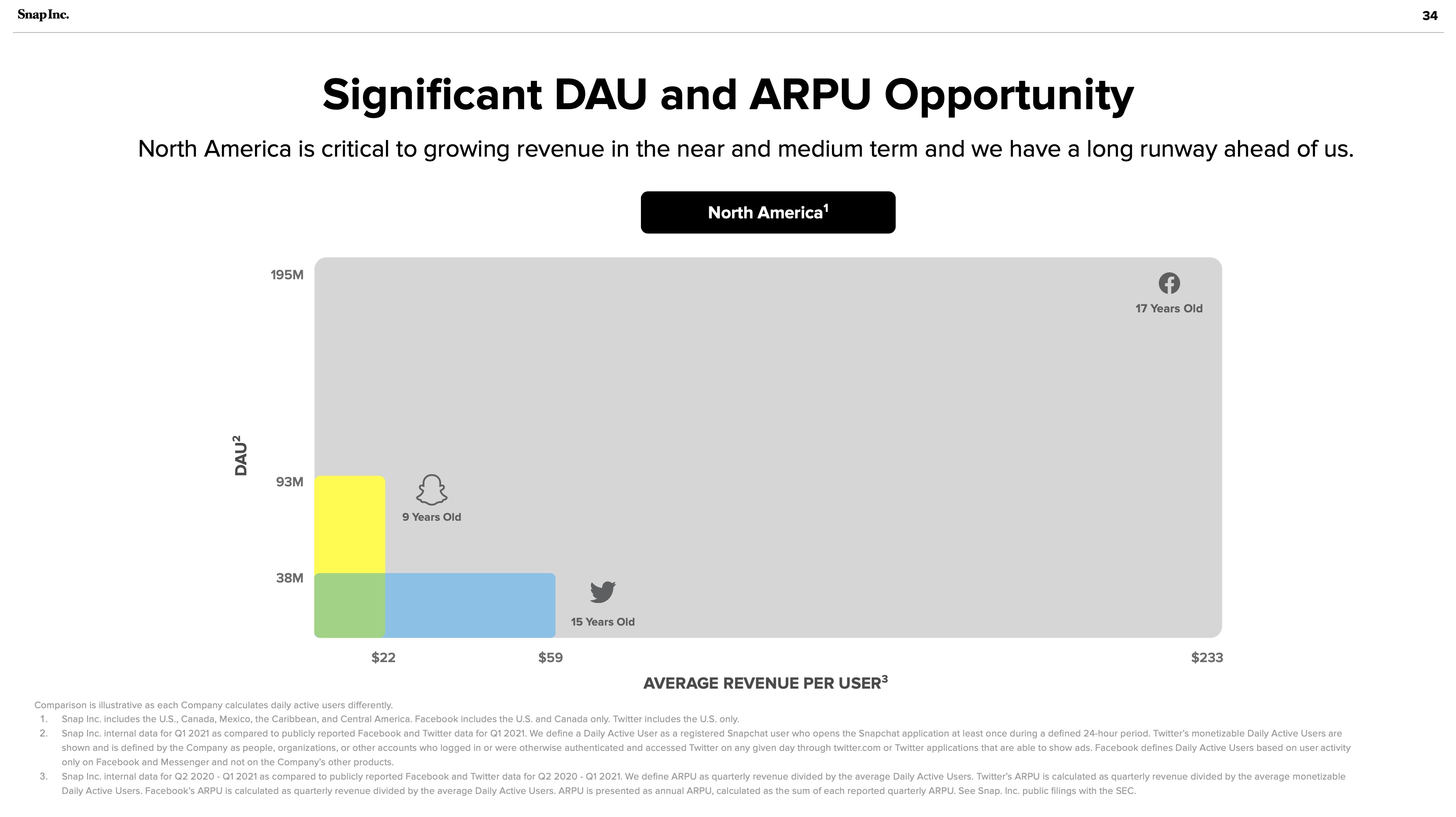

The answer to the FTC’s problem is hiding in plain sight: Snapchat’s investor presentations:

Snapchat July 2021 investor presentation: Significant DAU and ARPU Opportunity. Image Credits: Snapchat

This is a chart of Facebook’s monopoly — 91% of the personal social networking market. The gray blob looks awfully like a vast oil deposit, successfully drilled by Facebook’s Standard Oil operations. Snapchat and Twitter are the small wildcatters, nearly irrelevant compared to Facebook’s scale. It should not be lost on any market observers that Facebook once tried to acquire both companies.

The FTC initially claimed that Facebook has a monopoly of the “personal social networking services” market. The complaint excluded “mobile messaging” from Facebook’s market “because [messaging apps] (i) lack a ‘shared social space’ for interaction and (ii) do not employ a social graph to facilitate users’ finding and ‘friending’ other users they may know.”

This is incorrect because messaging is inextricable from Facebook’s power. Facebook demonstrated this with its WhatsApp acquisition, promotion of Messenger and prior attempts to buy Snapchat and Twitter. Any personal social networking service can expand its features — and Facebook’s moat is contingent on its control of messaging.

The more time in an ecosystem the more valuable it becomes. Value in social networks is calculated, depending on whom you ask, algorithmically (Metcalfe’s law) or logarithmically (Zipf’s law). Either way, in social networks, 1+1 is much more than 2.

Social networks become valuable based on the ever-increasing number of nodes, upon which companies can build more features. Zuckerberg coined the “social graph” to describe this relationship. The monopolies of Line, Kakao and WeChat in Japan, Korea and China prove this clearly. They began with messaging and expanded outward to become dominant personal social networking behemoths.

In today’s refiling, the FTC explains that Facebook, Instagram and Snapchat are all personal social networking services built on three key features:

Unfortunately, this is only partially right. In social media’s treacherous waters, as the FTC has struggled to articulate, feature sets are routinely copied and cross-promoted. How can we forget Instagram’s copying of Snapchat’s stories? Facebook has ruthlessly copied features from the most successful apps on the market from inception. Its launch of a Clubhouse competitor called Live Audio Rooms is only the most recent example. Twitter and Snapchat are absolutely competitors to Facebook.

Messaging must be included to demonstrate Facebook’s breadth and voracious appetite to copy and destroy. WhatsApp and Messenger have over 2 billion and 1.3 billion users respectively. Given the ease of feature copying, a messaging service of WhatsApp’s scale could become a full-scale social network in a matter of months. This is precisely why Facebook acquired the company. Facebook’s breadth in social media services is remarkable. But the FTC needs to understand that messaging is a part of the market. And this acknowledgement would not hurt their case.

Boasberg believes revenue is not an apt metric to calculate personal networking: “The overall revenues earned by PSN services cannot be the right metric for measuring market share here, as those revenues are all earned in a separate market — viz., the market for advertising.” He is confusing business model with market. Not all advertising is cut from the same cloth. In today’s refiling, the FTC correctly identifies “social advertising” as distinct from the “display advertising.”

But it goes off the deep end trying to avoid naming revenue as the distinguishing market share metric. Instead the FTC cites “time spent, daily active users (DAU), and monthly active users (MAU).” In a world where Facebook Blue and Instagram compete only with Snapchat, these metrics might bring Facebook Blue and Instagram combined over the 60% monopoly hurdle. But the FTC does not make a sufficiently convincing market definition argument to justify the choice of these metrics. Facebook should be compared to other personal social networking services such as Discord and Twitter — and their correct inclusion in the market would undermine the FTC’s choice of time spent or DAU/MAU.

Ultimately, cash is king. Revenue is what counts and what the FTC should emphasize. As Snapchat shows above, revenue in the personal social media industry is calculated by ARPU x DAU. The personal social media market is a different market from the entertainment social media market (where Facebook competes with YouTube, TikTok and Pinterest, among others). And this too is a separate market from the display search advertising market (Google). Not all advertising-based consumer technology is built the same. Again, advertising is a business model, not a market.

In the media world, for example, Netflix’s subscription revenue clearly competes in the same market as CBS’ advertising model. News Corp.’s acquisition of Facebook’s early competitor MySpace spoke volumes on the internet’s potential to disrupt and destroy traditional media advertising markets. Snapchat has chosen to pursue advertising, but incipient competitors like Discord are successfully growing using subscriptions. But their market share remains a pittance compared to Facebook.

The FTC has correctly argued for the smallest possible market for their monopoly definition. Personal social networking, of which Facebook controls at least 80%, should not (in their strongest argument) include entertainment. This is the narrowest argument to make with the highest chance of success.

But they could choose to make a broader argument in the alternative, one that takes a bigger swing. As Lina Khan famously noted about Amazon in her 2017 note that began the New Brandeis movement, the traditional economic consumer harm test does not adequately address the harms posed by Big Tech. The harms are too abstract. As White House advisor Tim Wu argues in “The Curse of Bigness,” and Judge Boasberg acknowledges in his opinion, antitrust law does not hinge solely upon price effects. Facebook can be broken up without proving the negative impact of price effects.

However, Facebook has hurt consumers. Consumers are the workers whose labor constitutes Facebook’s value, and they’ve been underpaid. If you define personal networking to include entertainment, then YouTube is an instructive example. On both YouTube and Facebook properties, influencers can capture value by charging brands directly. That’s not what we’re talking about here; what matters is the percent of advertising revenue that is paid out to creators.

YouTube’s traditional percentage is 55%. YouTube announced it has paid $30 billion to creators and rights holders over the last three years. Let’s conservatively say that half of the money goes to rights holders; that means creators on average have earned $15 billion, which would mean $5 billion annually, a meaningful slice of YouTube’s $46 billion in revenue over that time. So in other words, YouTube paid creators a third of its revenue (this admittedly ignores YouTube’s non-advertising revenue).

Facebook, by comparison, announced just weeks ago a paltry $1 billion program over a year and change. Sure, creators may make some money from interstitial ads, but Facebook does not announce the percentage of revenue they hand to creators because it would be insulting. Over the equivalent three-year period of YouTube’s declaration, Facebook has generated $210 billion in revenue. one-third of this revenue paid to creators would represent $70 billion, or $23 billion a year.

Why hasn’t Facebook paid creators before? Because it hasn’t needed to do so. Facebook’s social graph is so large that creators must post there anyway — the scale afforded by success on Facebook Blue and Instagram allows creators to monetize through directly selling to brands. Facebooks ads have value because of creators’ labor; if the users did not generate content, the social graph would not exist. Creators deserve more than the scraps they generate on their own. Facebook suppresses creators’ wages because it can. This is what monopolies do.

Facebook has long been the Standard Oil of social media, using its core monopoly to begin its march upstream and down. Zuckerberg announced in July and renewed his focus today on the metaverse, a market Roblox has pioneered. After achieving a monopoly in personal social media and competing ably in entertainment social media and virtual reality, Facebook’s drilling continues. Yes, Facebook may be free, but its monopoly harms Americans by stifling creator wages. The antitrust laws dictate that consumer harm is not a necessary condition for proving a monopoly under the Sherman Act; monopolies in and of themselves are illegal. By refiling the correct market definition and marketshare, the FTC stands more than a chance. It should win.

A prior version of this article originally appeared on Substack.

Powered by WPeMatico

The Pareto principle, also known as the 80-20 rule, asserts that 80% of consequences come from 20% of causes, rendering the remainder way less impactful.

Those working with data may have heard a different rendition of the 80-20 rule: A data scientist spends 80% of their time at work cleaning up messy data as opposed to doing actual analysis or generating insights. Imagine a 30-minute drive expanded to two-and-a-half hours by traffic jams, and you’ll get the picture.

As tempting as it may be to think of a future where there is a machine learning model for every business process, we do not need to tread that far right now.

While most data scientists spend more than 20% of their time at work on actual analysis, they still have to waste countless hours turning a trove of messy data into a tidy dataset ready for analysis. This process can include removing duplicate data, making sure all entries are formatted correctly and doing other preparatory work.

On average, this workflow stage takes up about 45% of the total time, a recent Anaconda survey found. An earlier poll by CrowdFlower put the estimate at 60%, and many other surveys cite figures in this range.

None of this is to say data preparation is not important. “Garbage in, garbage out” is a well-known rule in computer science circles, and it applies to data science, too. In the best-case scenario, the script will just return an error, warning that it cannot calculate the average spending per client, because the entry for customer #1527 is formatted as text, not as a numeral. In the worst case, the company will act on insights that have little to do with reality.

The real question to ask here is whether re-formatting the data for customer #1527 is really the best way to use the time of a well-paid expert. The average data scientist is paid between $95,000 and $120,000 per year, according to various estimates. Having the employee on such pay focus on mind-numbing, non-expert tasks is a waste both of their time and the company’s money. Besides, real-world data has a lifespan, and if a dataset for a time-sensitive project takes too long to collect and process, it can be outdated before any analysis is done.

What’s more, companies’ quests for data often include wasting the time of non-data-focused personnel, with employees asked to help fetch or produce data instead of working on their regular responsibilities. More than half of the data being collected by companies is often not used at all, suggesting that the time of everyone involved in the collection has been wasted to produce nothing but operational delay and the associated losses.

The data that has been collected, on the other hand, is often only used by a designated data science team that is too overworked to go through everything that is available.

The issues outlined here all play into the fact that save for the data pioneers like Google and Facebook, companies are still wrapping their heads around how to re-imagine themselves for the data-driven era. Data is pulled into huge databases and data scientists are left with a lot of cleaning to do, while others, whose time was wasted on helping fetch the data, do not benefit from it too often.

The truth is, we are still early when it comes to data transformation. The success of tech giants that put data at the core of their business models set off a spark that is only starting to take off. And even though the results are mixed for now, this is a sign that companies have yet to master thinking with data.

Data holds much value, and businesses are very much aware of it, as showcased by the appetite for AI experts in non-tech companies. Companies just have to do it right, and one of the key tasks in this respect is to start focusing on people as much as we do on AIs.

Data can enhance the operations of virtually any component within the organizational structure of any business. As tempting as it may be to think of a future where there is a machine learning model for every business process, we do not need to tread that far right now. The goal for any company looking to tap data today comes down to getting it from point A to point B. Point A is the part in the workflow where data is being collected, and point B is the person who needs this data for decision-making.

Importantly, point B does not have to be a data scientist. It could be a manager trying to figure out the optimal workflow design, an engineer looking for flaws in a manufacturing process or a UI designer doing A/B testing on a specific feature. All of these people must have the data they need at hand all the time, ready to be processed for insights.

People can thrive with data just as well as models, especially if the company invests in them and makes sure to equip them with basic analysis skills. In this approach, accessibility must be the name of the game.

Skeptics may claim that big data is nothing but an overused corporate buzzword, but advanced analytics capacities can enhance the bottom line for any company as long as it comes with a clear plan and appropriate expectations. The first step is to focus on making data accessible and easy to use and not on hauling in as much data as possible.

In other words, an all-around data culture is just as important for an enterprise as the data infrastructure.

Powered by WPeMatico

Consumer shift to buying online during the global pandemic — and keeping that habit — continues to boost revenue for makers of developer tools that help e-commerce sites provide better shopping experiences.

LA-based Nacelle is one of the e-commerce infrastructure companies continuing to attract investor attention, and at a speedy clip, too. It closed on a $50 million Series B round from Tiger Global. This is just six months after its $18 million Series A round, led by Inovia, and follows a $4.8 million seed round in 2020.

The company is working in “headless” commerce, which means it is disconnecting the front end of a website, a.k.a. the storefront, from the back end, where all of the data lives, to create a better shopping experience, CEO Brian Anderson told TechCrunch. By doing this, the back end of the store, essentially where all the magic happens, can be updated and maintained without changing the front end.

“Online shopping is not new, but how the customer relates to it keeps changing,” he said. “The technology for online shopping is not up to snuff — when you click on something, everything has to reload compared to an app like Instagram.”

More people shopping on their mobile devices creates friction due to downloading an app for each brand. That is “sucking the fun out of shopping online,” because no one wants that many apps on their phone, Anderson added.

Steven Kramer, board member and former EVP of Hybris, said via email that over the past two decades, the e-commerce industry went through several waves of innovation. Now, maturing consumer behaviors and expectations are accelerating the current phase.

“Retailers and brands are struggling with adopting the latest technologies to meet today’s requirements of agility, speed and user experience,” Kramer added. “Nacelle gives organizations a future-proof way to accelerate their innovation, leverage existing investments and do so with material ROI.”

Data already shows that COVID-era trends accelerated e-commerce by roughly five years, and Gartner predicts that 50% of new commerce capabilities will be incorporated as API-centric SaaS services by 2023.

Those kinds of trends are bringing in competitors that are also attracting investor attention — for example, Shopistry, Swell, Fabric, Commerce Layer and Vue Storefront are just a few of the companies that raised funding this year alone.

Anderson notes that the market continues to be hot and one that can’t be ignored, especially as the share of online retail sales grows. He explained that some of his competitors force customers to migrate off of their current tech stack and onto their respective platforms so that their users can get a good customer experience. In contrast, Nacelle enables customers to keep their tech stack and put components together as they see fit.

“That is painful in any vertical, but especially for e-commerce,” he said. “That is your direct line to revenue.”

Meanwhile, Nacelle itself grew 690% in the past year in terms of revenue, and customers are signing multiyear contracts, Anderson said.

Anderson, who is an engineer by trade, wants to sink his teeth into new products as adoption of headless commerce grows. These include providing a dynamic layer of functionality on top of the tech stack for storefronts that are traditionally static, and even introducing some livestream capabilities later this year.

As such, Nacelle will invest the new round into its go-to-market strategy and expand its customer success, partner relations and product development. He said Nacelle is already “the de facto standard” for Shopify Plus merchants going headless.

“We want to put everything in a tailor-made API for e-commerce that lets front-end developers do their thing with ease,” Anderson added. “We also offer starter kits for merchants as a starting point to get up-and-running.”

Powered by WPeMatico

Open-source business intelligence company Metabase announced Thursday a $30 million Series B round led by Insight Partners.

Existing investors Expa and NEA joined in on the round, which gives the San Francisco-based company a total of $42.5 million in funding since it was founded in 2015. Metabase previously raised $8 million in Series A funding back in 2019, led by NEA.

Metabase was developed within venture studio Expa and spun out as an easy way for people to interact with data sets, co-founder and CEO Sameer Al-Sakran told TechCrunch.

“When someone wants access to data, they may not know what to measure or how to use it, all they know is they have the data,” Al-Sakran said. “We provide a self-service access layer where they can ask a question, Metabase scans the data and they can use the results to build models, create a dashboard and even slice the data in ways they choose without having an analyst build out the database.”

He notes that not much has changed in the business intelligence realm since Tableau came out more than 15 years ago, and that computers can do more for the end user, particularly to understand what the user is going to do. Increasingly, open source is the way software and information wants to be consumed, especially for the person that just wants to pull the data themselves, he added.

George Mathew, managing director of Insight Partners, believes we are seeing the third generation of business intelligence tools emerging following centralized enterprise architectures like SAP, then self-service tools like Tableau and Looker and now companies like Metabase that can get users to discovery and insights quickly.

“The third generation is here and they are leading the charge to insights and value,” Mathew added. “In addition, the world has moved to the cloud, and BI tools need to move there, too. This generation of open source is a better and greater example of all three of those.”

To date, Metabase has been downloaded 98 million times and used by more than 30,000 companies across 200 countries. The company pursued another round of funding after building out a commercial offering, Metabase Enterprise, that is doing well, Al-Sakran said.

The new funding round enables the company to build out a sales team and continue with product development on both Metabase Enterprise and Metabase Cloud. Due to Metabase often being someone’s first business intelligence tool, he is also doubling down on resources to help educate customers on how to ask questions and learn from their data.

“Open source has changed from floppy disks to projects on the cloud, and we think end users have the right to see what they are running,” Al-Sakran said. “We are continuing to create new features and improve performance and overall experience in efforts to create the BI system of the future.

Powered by WPeMatico

Coming off a $1.5 million seed round in June, bttn. announced Thursday that it secured another $5 million extension, led by FUSE, to the round to give it a $26.5 million post-money valuation.

The Seattle-based company was founded in March 2021 by JT Garwood and Jack Miller after seeing the challenges medical organizations had during the global pandemic to not only find supplies, but also get fair prices for them.

“We went into this building on the pain points customers had dealing with a system that is so archaic and outdated — most were still faxing in order forms and keeping closets full of supplies, but not knowing what was there,” Garwood, CEO, told TechCrunch.

Bttn. is going after the U.S. wholesale medical supply market, which is predicted to be valued at $243.3 billion by the end of 2021, according to IBISWorld. The company created a business-to-business e-commerce platform with a variety of high-quality medical supplies, saving customers an average of between 20% and 40%, while providing a better ordering and shipping experience, Garwood said.

It now boasts more than 300 customers, including individual practices and surgical centers, and multiple government contracts. It is also currently the preferred supplier for over 17 healthcare associations across the country, Garwood said. In addition to expanding into dental supplies, bttn. is also attracting customers like senior living facilities and home and hospice care.

Garwood intends to use the funds to expand bttn.’s technology, sales and operations teams, and increase its partnerships. The company is also adding new features like a portal to track shipments more easily, better order automation and improve the ability to control when supplies will get to them.

Bttn. is also analyzing more of the data coming in from its marketplace to recognize where the trends are coming from, including hospitalization rates, to share with customers. For example, if hospitals are overcrowded, supply shortages will follow, Garwood said.

“The medical supply industry was built on inequity, and we have a sense of duty to build a product that enables a better future for our customers,” he added. “We can proactively let customers know that spikes are expected, provide them with correct information and give that power back to the consumers and healthcare providers in ways they never had before.”

Whereas bttn.’s first seed round was “about pouring gas on the fire,” partnering with FUSE this time around was an easy decision for Garwood, who said the firm is bringing new assets to the table.

Brendan Wales, general partner at FUSE, said via email that his firm backs promising entrepreneurs building businesses in the Pacific Northwest and discovered bttn. before they announced any funding.

He said there is massive consumerization of healthcare, most evident on the patient side for years, but now becoming so on the provider side. Medical office employees are looking for the same type of customer experience they get from online businesses they frequently shop at, and bttn. “has a relentless drive to provide the same type of experiences and interactions to health providers.”

“We fell in love with the idea of providing a transparent and delightful customer experience to health providers, something that has been sorely lacking,” Wales added. “That, tied in with a young and ambitious team, made it so that our entire partnership worked tirelessly to partner with them.”

Powered by WPeMatico

When you enter the health tech industry as a new startup, an advisory board is a crucial foundational step. A board can guide you through industry-specific nuances, help you make important decisions and prove your legitimacy to investors looking for a strong industry background.

An advisory board will be able to give you strategic insights about both your company and the wider healthcare and technology industries.

In my experience of raising capital, the unpredictable financial situation at the beginning of the pandemic meant we nearly lost our $2 million round, but came through with a committed $250,000, which we used to bring in about $500,000 in revenue.

Something that helped this process was building our advisory board and starting small — we didn’t go for all of healthcare but instead focused on two healthcare verticals. This allowed us to prove our concept, build case studies and win contracts with specific teams in our customers’ companies.

It pays off to stay focused and prove your worth so that your advisory board members can champion you in niche markets, with the potential to expand in the future. For this reason, it’s important to identify the main intention behind your board, and exactly who should be on it.

Three to five people is an ideal starting point for an advisory board, depending on the size and stage of your company. In health tech, you need more than just the healthcare perspective — you also need the insight of those who have already grown technology companies, perhaps outside of the industry. Our company’s board is an even split of two healthcare and two technology advisers, and, ideally, you want to find a fifth who is well versed in both industries.

It pays off to stay focused and prove your worth so that your advisory board members can champion you in niche markets, with the potential to expand in the future.

An M.D., a Ph.D. from a respected institution or a thought leader in your relevant field of healthcare is the most important asset to an advisory board. These are the highly decorated physicians who have strong connections and act as a reference for their peers.

They provide instant credibility for your company, help you get into the minds of both patients and healthcare providers, and can outline how various health systems work.

Powered by WPeMatico

Here’s another edition of “Dear Sophie,” the advice column that answers immigration-related questions about working at technology companies.

“Your questions are vital to the spread of knowledge that allows people all over the world to rise above borders and pursue their dreams,” says Sophie Alcorn, a Silicon Valley immigration attorney. “Whether you’re in people ops, a founder or seeking a job in Silicon Valley, I would love to answer your questions in my next column.”

Extra Crunch members receive access to weekly “Dear Sophie” columns; use promo code ALCORN to purchase a one- or two-year subscription for 50% off.

Dear Sophie,

I’m on an H-1B living and working in the U.S. I want to apply for a green card on my own. I’m concerned about only relying on my current employer and I want to be able to easily change jobs or create a startup. I’ve been looking at the EB-1A and EB-2 NIW.

I’m not sure if I would qualify for an EB-1A, but since I was born in India, I face a much longer wait for an EB-2 NIW. Any tips on how to proceed?

— Inventive from India

Dear Inventive,

Thanks for your question. Take a listen to my podcast episode in which I discuss the latest tech immigration news and delve into the benefits and requirements of the EB-1A green card for individuals of extraordinary ability and the EB-2 NIW (National Interest Waiver) green card, which as you know are the main employment-based green cards for which individuals can self-sponsor.

I recommend you consult an experienced immigration attorney who can evaluate your abilities and accomplishments and assess your prospects for each green card. After an initial consultation with new clients, we’re able to provide a lot more detail to folks on their specific options since these are such individualized pathways.

There are some groups of people who might need every advantage. Those can include folks born in India or China, who might face long green card backlogs. Another such group includes people whose skills and accomplishments might be borderline for an EB-1A green card for extraordinary ability. In some cases — if eligible and to have every opportunity for green card security and to mitigate wait times as much as possible — our clients choose to file both the EB-1A and EB-2 NIW in parallel.

Image Credits: Joanna Buniak / Sophie Alcorn (opens in a new window)

The EB-1A is the highest priority green card and the standard for qualifying is much higher than for the EB-2 NIW. And that means an EB-1A is typically quicker to get, which is particularly the case now: According to the August 2021 Visa Bulletin, there is no wait for an EB-1A green card regardless of country of birth, while only individuals who were born in India and have a priority date of June 1, 2011 or earlier can proceed with their EB-2 NIW petition.

Please remember that the Visa Bulletin fluctuates and changes every month. Also, the EB-1A is currently eligible for premium processing on the I-140. Although there is talk to add this option to the EB-2 NIW one day, premium processing is not available for EB-2 NIW I-140s yet.

Powered by WPeMatico