Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

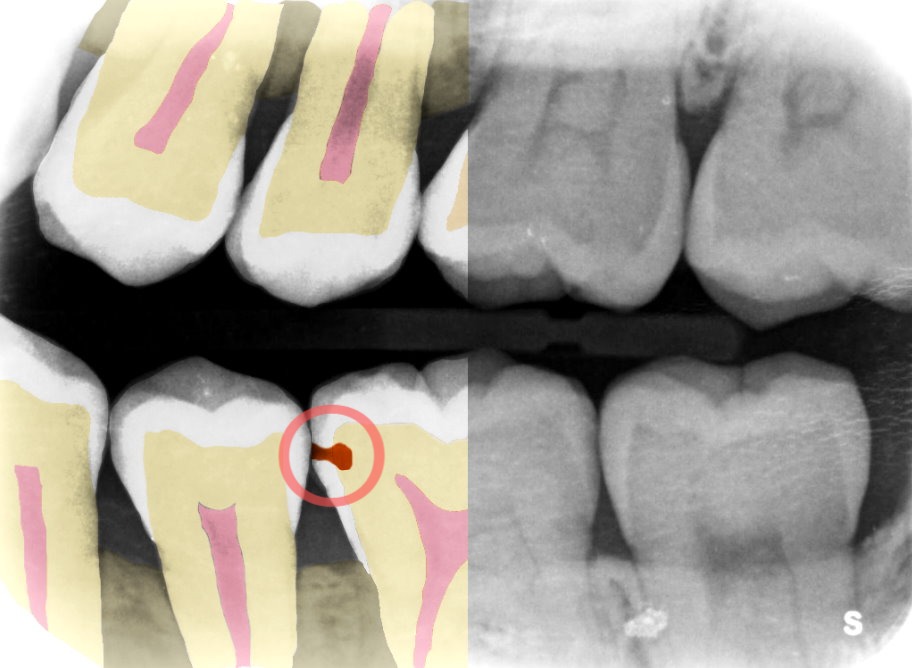

Like other areas of healthcare, the dental industry is steadily embracing technology. But while much of it is in the orthodontic realm, other startups, like Adra, are bringing artificial intelligence into a dentist’s day-to-day workflow, particularly in finding cavities, of what will be a $435.08 billion global dental services market this year.

The Singapore-based company was founded in 2021, but was an idea that started last year. Co-founder Hamed Fesharaki has been a dentist for over a decade and owns two clinics in Singapore.

He said dentists learn to read X-rays in dental school, but it can take a few years to get good at it. Dentists also often have just minutes to read them as they hop between patients.

As a result, dentists end up misdiagnosing cavities up to 40% of the time, co-founder Yasaman Nematbakhsh said. Her background is in imaging, where she developed an artificial intelligence machine identifying hard-to-see cancers, something Fesharaki thought could also be applied to dental medicine.

Providing the perspective of a more experienced dentist, Adra’s intent is to make every dentist “a super dentist,” Fesharaki told TechCrunch. Its software detects cavities and other dental problems on dental X-rays faster and 25% more accurately, so that clinics can use that time to better serve patients and increase revenue.

Example of Adra’s software. Image Credits: Adra

“We are coming from the eye of an experienced dentist to help illustrate the problems by turning the X-rays into images to better understand what to look for,” he added. “Ultimately, the dentist has the final say, but we bring the experience element to help them compare and give them suggestions.”

By quickly pointing out the problem and the extent of it, dentists can decide in what way they want to treat it — for example, do a filling, a fluoride treatment or wait.

Along with third co-founder Shifeng Chen, the company is finishing up its time in Y Combinator’s summer cohort and has raised $250,000 so far. Fesharaki intends to do more formalized seed fundraising and wants to bring on more engineers to tackle user experience and add more features.

The company has a few clinics doing pilots and wants to attract more as it moves toward a U.S. Food and Drug Administration clearance. Fesharaki expects it to take six to nine months to receive the clearance, and then Adra will be able to hit the market in late 2022 or early 2023.

Powered by WPeMatico

Servicing one’s car personally is a time-consuming, expensive and painstaking process. It’s a cycle that can lead to more expensive repairs and safety issues down the line, and no car owner likes that.

Egypt and Dubai-based auto tech startup Odiggo is a platform addressing this problem. It allows car owners to get the help they need by finding car services and parts suppliers from providers around them. Then for the suppliers, it increases their sales and reaches more customers without necessarily spending on marketing.

Odiggo is part of the current YC Summer batch and has secured a $2.2 million seed round before Demo Day. The rosters of existing investors participating in the round are Y Combinator, 500 Startups, and Plug and Play Ventures. Regional VCs like Seedra Ventures, LoftyInc Capital, and Essa Al-Saleh (CEO of Volta-Tucks) also took part.

Ahmed Omar and Ahmed Nasser launched Odiggo in December 2019. The company operates a marketplace that connects car owners with service providers who can solve their problems, from servicing and repair to washing and maintenance. A commission-based model is used and Odiggo charges the car suppliers 20% commission on every transaction.

Over 50,000 car owners across three markets — Egypt, the UAE and Saudi Arabia — use Odiggo. The company also works directly with over 300 merchants. It claims merchant numbers have grown 40% month-on-month while its user base has increased 200% since the start of the pandemic.

“We believe we are at a watershed moment. It is incredible that since COVID hit, Odiggo has experienced over 10 times growth in the last year,” said co-founder Omar.

CEO Omar said with this new round, Odiggo’s priority will be to attain consistent growth while expanding its team across the UEA, Saudi Arabia and Egypt.

L-R: Ahmed Nassir (co-founder) & Ahmed Omar (co-founder and CEO)

He adds that since Odiggo taps into a mix of data sources — including car metrics and internal software, it will use that same information to provide more product offerings.

Odiggo will use part of the funding to continue developing its tech and dashboard software, he said.

“For example, the platform would be hooked up to the car owner’s vehicle and link the vehicle to the marketplace and provide frequent updates of your vehicle condition so you’ll be informed if the tires are low, the oil needs changing, or if a service is required.”

The pandemic has upended the mobility and logistics sectors, especially in MENA, making players like Odiggo gain much visibility from investors. In an industry today worth over $61 billion in the Middle East and Africa alone, Odiggo is looking to become a market leader. It has even more lofty plans to go public in the next three years.

“We are also aiming to be fully focused on spending more on our product and technology, as building an ecosystem to monetize requires more capital. Our target is to go for IPO by 2024 and achieve one billion services booked, and this requires a lot of network effects, infrastructure and technology,” the CEO said.

“We aim to be the first $100 billion company coming out of the region,” added Nasser.

Some of its investors, Idris Ayodeji Bello, managing partner at LoftyInc, and Essa Al-Saleh, are onboard with the startup’s plan despite early days.

“We are excited to back Odiggo through our Afropreneurs Funds in its quest to transform the automotive parts market and provide superior service to clients, starting from MENA. The leadership team of Omar and Nasser, supported by the rest of the employees, have been a joy to work with and we are on a countdown to the IPO,” said Bello in a statement.

Powered by WPeMatico

Disrupt is right around the corner, and this year the show is packed to the brim with incredible panels and conversations, an absolutely stacked Startup Battlefield cohort of companies launching on our stage, investor insights and a virtual expo hall full of exciting new products and services in the Startup Alley.

We can’t wait! Literally. So we’re giving you guys a sneak peek at some of the startups you might see at Disrupt in upcoming episodes of Extra Crunch Live.

Usually, the Extra Crunch Live crew sits down with founders and the investors who finance them to learn how they decided to partner with one another and, ultimately, how startups can get to “yes” when fundraising. In the latter half of the episode, those same guests give live feedback to folks in the audience who come on our virtual stage and pitch their products.

Truth be told, everyone loves a good pitch-off. So in these upcoming Startup Alley Edition episodes of Extra Crunch Live, we’re turning the entire episode into a pitch-off. SUA companies will come on stage, one at a time, and have exactly 60 seconds to get us excited about their startup. But it wouldn’t be a true pitch-off without some expert feedback.

I’m excited to announce the investors joining us on these episodes to share their insights and wisdom with both the startups and the audience.

Image Credits: Elena Zhukova / Scale Venture Partners

Sequeira was managing director at General Catalyst before venturing out to start Defy. Before GC, he was at TimeWarner Investments and was a founding member of AOLTW Ventures. Defy has a portfolio that includes Dropcam, Nest, Bustle and more. Sequeira has served on more than 40 company boards, so it should go without saying that he’ll have plenty of insightful feedback for our founders.

Bishop brings more than 20 years of investment experience to our little pitch-off. She currently serves on the boards of Abstract, Airspace, Demandbase, Extole, Lever and more. Bishop has also served on several boards where the company has seen a successful exit, including HubSpot, Bizible and Vitrue. Bishop specializes in business applications and will have lots to share with our pitch-off startups. Register here for Extra Crunch Live with defy.vc and Scale Venture Partners.

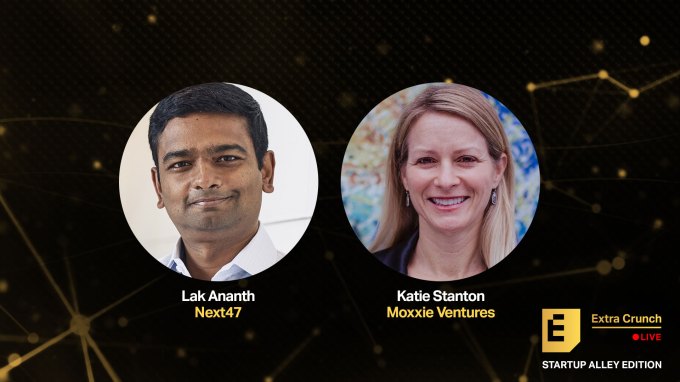

Image Credits: Next47 / Amanda Aude

Ananth serves as founding CEO at Next47, which is backed by Siemens AG. He’s sat on several boards where he has helped the companies grow beyond $1 billion valuations. Ananth specializes in emerging areas of deep tech, including AI/ML, vertical SaaS, robotics, mobility, etc. Some of Ananth’s current investments include Verkada, rideOS and Markforged.

Katie Stanton has been an executive and an operator for much of her career, holding roles at Twitter, Google, Yahoo and Color across a wide variety of departments, including marketing, comms, recruiting, product and media. Stanton also served in the Obama White House and State Department after getting her career started as a banker at JP Morgan. She currently sits on the board of Vivendi and has invested in dozens of early-stage companies, including Airtable, Cameo, Carta, Coinbase, Literati, Modern Fertility, Shape Security and Threads. Register here for Extra Crunch Live with Next47 and Moxxie Ventures.

You don’t want to miss these episodes of Extra Crunch Live. Register (for free) to come hang out with us!

Powered by WPeMatico

If you’re a founder who finds yourself in a meeting with a VC, try to remember two things:

Even so, many entrepreneurs squander this opportunity, often because they direct questions or fail to understand their BATNA (best alternative to a negotiated agreement).

“As the venture landscape becomes more a meritocratic environment where resumes and institutional affiliations matter less, these strategies can make the difference between a successful fundraise and a fruitless meeting,” says Agya Ventures co-founder Kunal Lunawat.

Whether you’re already in the fundraising process or plan to be in the future, be sure to read “A crash course on corporate development” that Venrock VP Todd Graham shared with us this week.

“If you’re going to get acquired, chances are you’re going to spend a lot of time with corporate development teams,” says Graham. “With a hot stock market, mountains of cash and cheap debt floating around, the environment for acquisitions is extremely rich.”

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

On Wednesday, August 24 at 3 p.m. PDT/6 p.m. EDT/11 p.m GMT, Managing Editor Danny Crichton will host a conversation on Twitter Spaces with Eric Dean Wilson, author of “After Cooling: On Freon, Global Warming, and the Terrible Cost of Comfort.”

Wilson’s book explores the history of freon, a common refrigerant that was later banned due to its devastating impact on the ozone layer. After their discussion, they’ll take questions from the audience.

Thanks very much for reading Extra Crunch this week! I hope you have an excellent weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Carol Yepes (opens in a new window) / Getty Images

Apple iPhone, Apple Mail and Apple iPad account for nearly half of all email opens, but the privacy features included with iOS 15 will allow consumers to block marketers from seeing their physical location, IP address and tracking data like invisible pixels.

Email marketers rely heavily on these and other metrics, which means they should prepare now for the changes to come, advises Litmus CMO Melissa Sargeant.

In a detailed post, she shares several action items that will help marketing teams leverage their email analytics so they can “continue delivering personalized experiences consumers crave.”

Image Credits: Cimmerian (opens in a new window) / Getty Images

Venrock Vice President Todd Graham has some frank advice for founders at venture-backed startups: “It would be wise to generate a return at some point.”

With that in mind, he authored a primer on corporate development that lays out the three most common categories of acquisitions, tips for dealing with bankers, and explains why striking a partnership with a big company isn’t always the best way forward.

Regardless of the path you choose, “you need to take the meeting,” advises Graham.

“In the worst-case scenario, you’ll get a few new LinkedIn connections and you’re now a known quantity. The best-case scenario will be a second meeting.”

Image Credits: Nigel Sussman (opens in a new window)

The pandemic failed to slow the momentum of venture capitalists pouring money into startups, but Chicago stands out as an “outlying benefactor of accelerating venture capital activity and the rise of remote investing,” Alex Wilhelm and Anna Heim write for The Exchange.

When the world shut down and it didn’t matter if you were in NYC or SF (because everyone was on Zoom), the Windy City was ready to present itself as the venture champion of the Midwest.

Image Credits: Priscila Zambotto (opens in a new window) / Getty Images

The Brazilian Central Bank made a major reform to the way payments are processed that may throw the doors open for e-commerce in South America’s largest market.

Historically, merchants who accepted credit card payments had two options: Receive the full payment distributed over two to 12 installments, or offer a deep discount to receive a smaller sum up front.

But in June 2021, the BCB created new “registration entities” that permit “any interested receivables buyer/acquirer to make an offer for those receivables, forcing buyers to become more competitive in their discount offers,” says Leonardo Lanna, head of payment products at Monkey Exchange.

The new framework benefits consumers and sellers, but for the region’s startups, “it opens the door to a plethora of opportunities and new business models, from payments to credit.”

Image Credits: Nigel Sussman (opens in a new window)

An inflow of VC dollars, notable acquisitions and rising unicorn counts are all features of the Brazilian tech startup market, Anna Heim and Alex Wilhelm note in The Exchange.

“The IPO market in Brazil is changing,” they write. “TechCrunch noted last year that in the decade leading up to 2020, just two of the 56 IPOs in Brazil were technology companies. More recently, the number of technology companies listed in the country has swelled to at least 16, up from just four in 2019.”

Image Credits: Andriy Onufriyenko / Getty Images

“For good reason, security certifications like the SOC 3 really put you through the wringer,” Waydev CEO Alex Cercei writes in a guest column.

Waydev, a Git analytics tool that helps engineering leaders measure team performance automatically, just attained the SOC 3 certification.

“We learned so much from the process, we felt it was right to share our experience with others that might be daunted by the prospect,” Cercei writes.

“So here’s our advice on how teams can smoothly reach an SOC 3 while simultaneously balancing workloads and minimizing disruption to users.”

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

I’m on an H-1B living and working in the U.S. I want to apply for a green card on my own. I’m concerned about only relying on my current employer and I want to be able to easily change jobs or create a startup. I’ve been looking at the EB-1A and EB-2 NIW.

I’m not sure if I would qualify for an EB-1A, but since I was born in India, I face a much longer wait for an EB-2 NIW.

Any tips on how to proceed?

— Inventive from India

Image Credits: Cordelia Molloy Science Photo Library (opens in a new window) / Getty Images

Most startups could use an advisory board, but in health tech, it’s a core requirement.

Founders seeking to innovate in this area have a unique need for mentors who have experience navigating regulations, raising capital and managing R&D, to name just a few areas.

Based on his own experience, Patrick Frank, co-founder and COO of PatientPartner, shared some very specific ideas about who to recruit, where to find them and how to fit them into your cap table.

“You want to leverage these individuals so you are able to focus on the full view of the company to ensure it is something that both the market and investors want at scale,” says Frank.

Image Credits: Nigel Sussman (opens in a new window)

There’s no shortage of tech news to analyze, Alex Wilhelm notes, but this week, he took a fresh look at crypto.

How come?

“Because there are some rather bullish trends that indicate the world of blockchain is maturing and creating a raft of winning players,” he writes.

Image Credits: kentoh (opens in a new window) / Getty Images (Image has been modified)

In one recent survey, 58% of workers said they plan to quit if they’re not allowed to work remotely.

Startups that don’t offer employees work-from-home flexibility are at a competitive disadvantage, but figuring out how to pay hybrid workers raises a complex set of questions:

Powered by WPeMatico

Less than three months after announcing a $300 million Series E, Brazilian proptech QuintoAndar has raised an additional $120 million.

New investors Greenoaks Capital and China’s Tencent co-led the round, which included participation from some existing backers as well. São Paulo-based QuintoAndar is now valued at $5.1 billion, up from $4 billion at the time of its last raise in late May. With the extension, the startup has now raised more than $700 million since its 2013 inception. Ribbit Capital led the first tranche of its Series E.

QuintoAndar describes itself as an “end-to-end solution for long-term rentals” that, among other things, connects potential tenants to landlords and vice versa. Last year, it also expanded into connecting home buyers to sellers. Its long-term plan is to evolve into a one-stop real estate shop that also offers mortgage, title insurance and escrow services.

To that end, earlier this month, the startup acquired Atta Franchising, a 7-year-old São Paulo-based independent real estate mortgage broker. Specifically, acquiring Atta is designed to speed up its ability to offer mortgage services to its users. QuintoAndar also plans to explore the possibility of offering a product to perform standalone transactions outside of its marketplace in partnership with other brokers, according to CEO and co-founder Gabriel Braga.

This year, QuintoAndar expanded operations into 14 new cities in Brazil. Eventually, QuintoAndar plans to enter the Mexican market as its first expansion outside of its home country, but it has not yet set a date for that step. Today, the company has more than 120,000 rentals under management and about 10,000 new rentals per month. Its rental platform is live in 40 cities across Brazil, while its home-buying marketplace is live in four (São Paulo, Rio de Janeiro, Belo Horizonte and Porto Alegre) and seeing more than 10,000 sales in annualized terms.

QuintoAndar, he said, is open to acquiring more companies that it believes can either help it accelerate in a particular way or add something it had not yet thought about.

“We’re receptive to the idea but our core strategy is to focus on organic growth and our own innovation and accelerate that,” Braga said.

The Series E was oversubscribed with investors who got in and “some who could not join,” according to Braga.

Greenoaks and Tencent, he said, couldn’t participate because of “timing issues.”

“We kept talking and they came back to us after the round, and wanted to be involved so we found a way to have them on board,” Braga said. “We did not need the money. But we have been constantly overachieving on the forecast that we shared with our investors. And that’s part of the reason why we had this extension.”

Greenoaks’ long-term time horizon was appealing because the firm’s investment was designed to be “perpetual capital with no predefined time frame,” Braga said.

“We’re doing our best to build an enduring company that will be around for many, many years, so it’s good to have investors who share that vision and are technically aligned,” he added.

Greenoaks partner Neil Shah said his firm believes that what QuintoAndar is building will “fundamentally reshape real estate transactions, enhancing transparency, expanding options for Brazilians seeking housing, dramatically simplifying the experience for landlords and driving increased investment into real estate across the country.” He also believes there is big potential for the company to take its offering to other parts of Latin America.

“We look forward to being partners for decades to come,” he added.

Tencent’s experience in China is something QuintoAndar also finds valuable.

“We believe we can learn a lot from them and other Chinese companies doing interesting stuff there,” Braga said.

QuintoAndar isn’t the only Brazilian proptech firm raising big money: In March, São Paulo digital real estate platform Loft announced it had closed on $425 million in Series D funding led by New York-based D1 Capital Partners. Then, about one month later, it revealed a $100 million extension that valued the company at $2.9 billion.

Powered by WPeMatico

Newly reported financial data from Bird, an American scooter sharing service, shows a company with an improving economic model and a multiyear path to profitability. However, that path is fraught unless a number of scenarios all work out in concert and without a glitch.

Bird, well known for its early battles with domestic rival Lime, is pursuing a SPAC-led deal that will see it go public and raise fresh capital. The former startup is merging with Switchback II Corporation in a deal that values it at around $2.3 billion, including a $160 million PIPE (private investment in public equity) component. (Note: The group purchasing TechCrunch’s parent company from its own parent company is part of the Bird PIPE.)

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

COVID-19 hasn’t been kind to Bird and similar companies around the world. As many around the world stayed home, usage of shared-asset services and ride-hail applications fell sharply. Bird saw rides decline. Airbnb took a temporary hit. Uber and Lyft saw ride demand fall.

Responses to the crisis were varied. Airbnb cut costs and raised external capital. Lyft cut expenses and focused on its core model while Uber grew its food delivery business, which saw transaction volume soar as demand fell for its traditional business.

Responses to the crisis were varied. Airbnb cut costs and raised external capital. Lyft cut expenses and focused on its core model while Uber grew its food delivery business, which saw transaction volume soar as demand fell for its traditional business.

Meanwhile, Bird flipped its entire business model. That decision has helped the scooter outfit improve its economics markedly, giving it a shot at generating profit in the future — provided its forecasts prove achievable.

This morning, let’s talk about how Bird has changed its business, their impacts on its operating results and how long the company thinks its climb to profitability is.

In their initial forms, Bird and Lime bought and deployed large fleets of electric scooters. Not only was this capital intensive, the companies also wound up with costs that were more than sticky — charging wasn’t simple or cheap, moving scooters around to balance demand took both human capital and vehicles, and the list went on.

Throw in vehicle depreciation — the pace at which scooters in the wild degraded from use or abuse — and the businesses proved excellent vehicles for raising capital and throwing that money at more scooters, costs, and, as it turned out, losses.

Results improved somewhat over time, though. As scooter-share companies increasingly built their own hardware, their economics improved. Sturdier scooters meant lower depreciation, and better battery tech could allow for more rides per charge. That sort of thing.

But the model wasn’t incredibly lucrative even before COVID-19 hit. Costs were high, and the model did not break-even, even on a gross margin basis, let alone when considering all corporate expenses. You can see the financial mess from that period of operations in historical Bird results.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Danny was back, joining Natasha and Alex and Grace and Chris to chat through the week’s coming and goings. But, before we get to the official news, here’s some personal news: Danny is stepping back from his role as co-host of the Friday show! Yes, Mr. Crichton will still take part in our mid-week, deep-dive episodes, but this is the conclusion of his run as part of the news roundup. We will miss him, glad that his transitions and wit will continue to be part of the Equity universe.

Who will take the third chair? Well, stay tuned. We have some neat things planned.

Now, the rundown:

Powered by WPeMatico

Poland-based health tech AI startup Cardiomatics has announced a $3.2 million seed raise to expand use of its electrocardiogram (ECG) reading automation technology.

The round is led by Central and Eastern European VC Kaya, with Nina Capital, Nova Capital and Innovation Nest also participating.

The seed raise also includes a $1 million non-equity grant from the Polish National Centre of Research and Development.

The 2017-founded startup sells a cloud tool to speed up diagnosis and drive efficiency for cardiologists, clinicians and other healthcare professionals to interpret ECGs — automating the detection and analysis of some 20 heart abnormalities and disorders with the software generating reports on scans in minutes, faster than a trained human specialist would be able to work.

Cardiomatics touts its tech as helping to democratize access to healthcare — saying the tool enables cardiologists to optimise their workflow so they can see and treat more patients. It also says it allows GPs and smaller practices to offer ECG analysis to patients without needing to refer them to specialist hospitals.

The AI tool has analyzed more than 3 million hours of ECG signals commercially to date, per the startup, which says its software is being used by more than 700 customers in 10+ countries, including Switzerland, Denmark, Germany and Poland.

The software is able to integrate with more than 25 ECG monitoring devices at this stage, and it touts offering a modern cloud software interface as a differentiator versus legacy medical software.

Asked how the accuracy of its AI’s ECG readings has been validated, the startup told us: “The data set that we use to develop algorithms contains more than 10 billion heartbeats from approximately 100,000 patients and is systematically growing. The majority of the data-sets we have built ourselves, the rest are publicly available databases.

“Ninety percent of the data is used as a training set, and 10% for algorithm validation and testing. According to the data-centric AI we attach great importance to the test sets to be sure that they contain the best possible representation of signals from our clients. We check the accuracy of the algorithms in experimental work during the continuous development of both algorithms and data with a frequency of once a month. Our clients check it everyday in clinical practice.”

Cardiomatics said it will use the seed funding to invest in product development, expand its business activities in existing markets and gear up to launch into new markets.

“Proceeds from the round will be used to support fast-paced expansion plans across Europe, including scaling up our market-leading AI technology and ensuring physicians have the best experience. We prepare the product to launch into new markets too. Our future plans include obtaining FDA certification and entering the US market,” it added.

The AI tool received European medical device certification in 2018 — although it’s worth noting that the European Union’s regulatory regime for medical devices and AI is continuing to evolve, with an update to the bloc’s Medical Devices Directive (now known as the EU Medical Device Regulation) coming into application earlier this year (May).

A new risk-based framework for applications of AI — aka the Artificial Intelligence Act — is also incoming and will likely expand compliance demands on AI health tech tools like Cardiomatics, introducing requirements such as demonstrating safety, reliability and a lack of bias in automated results.

Asked about the regulatory landscape it said: “When we launched in 2018 we were one of the first AI-based solutions approved as medical device in Europe. To stay in front of the pace we carefully observe the situation in Europe and the process of legislating a risk-based framework for regulating applications of AI. We also monitor draft regulations and requirements that may be introduced soon. In case of introducing new standards and requirements for artificial intelligence, we will immediately undertake their implementation in the company’s and product operations, as well as extending the documentation and algorithms validation with the necessary evidence for the reliability and safety of our product.”

However it also conceded that objectively measuring efficacy of ECG reading algorithms is a challenge.

“An objective assessment of the effectiveness of algorithms can be very challenging,” it told TechCrunch. “Most often it is performed on a narrow set of data from a specific group of patients, registered with only one device. We receive signals from various groups of patients, coming from different recorders. We are working on this method of assessing effectiveness. Our algorithms, which would allow them to reliably evaluate their performance regardless of various factors accompanying the study, including the recording device or the social group on which it would be tested.”

“When analysis is performed by a physician, ECG interpretation is a function of experience, rules and art. When a human interprets an ECG, they see a curve. It works on a visual layer. An algorithm sees a stream of numbers instead of a picture, so the task becomes a mathematical problem. But, ultimately, you cannot build effective algorithms without knowledge of the domain,” it added. “This knowledge and the experience of our medical team are a piece of art in Cardiomatics. We shouldn’t forget that algorithms are also trained on the data generated by cardiologists. There is a strong correlation between the experience of medical professionals and machine learning.”

Powered by WPeMatico

Breef raised $3.5 million in funding to continue developing what it boasts as “the world’s first online marketplace” for transactions between brands and agencies.

Greycroft led the round and was joined by Rackhouse Ventures, The House Fund, John and Helen McBain, Lance Armstrong and 640 Oxford Ventures. Including the new round, the New York and Colorado-based company has brought in total funding of $4.5 million since its inception in 2019 by husband-and-wife co-founders George Raptis and Emily Bibb.

Bibb’s background is in digital marketing and brand building at companies like PopSugar, VSCO and S’well, while Raptis was on the founding team at fintech company Credible.com.

Both said they experienced challenges in finding agencies, which traditionally involved asking for referrals and then making a bunch of calls. There were also times when their companies would be in high demand for talent, but didn’t necessarily need a full-time employee to achieve the goal or project milestone.

While the concept of outsourcing is not new, Breef’s differentiator is its ability to manage complex projects: a traditional individual freelance project is less than $1,000 and takes a week or less. Instead, the company is working with team-based projects that average $25,000 with a length of engagement of about six months, Raptis said.

Breef’s platform is democratizing how brands and boutique agencies connect with each other in the process of planning, scoping, pitching and paying for projects, Raptis told TechCrunch.

“At the core, we are taking the agency online,” Bibb added. “We are building a platform to streamline a complicated process for outsourcing high-value work and allow users to find, pay for and work with agencies in days rather than months.”

Brands can draft their own brief to articulate what they need, and Breef will connect them to a short list of agencies that match those requirements. Rather than a one- or two-month search, the company is able to bring that down to five days.

Bibb and Raptis decided to seek venture capital after experiencing demand — millions of dollars in projects are being created on the platform each month — and some tailwinds from the shift to remote work. They saw many brands that may have originally utilized in-house teams or agencies of record turn to distributed or smaller teams.

Due to the nature of agency work being expensive, Breef is processing large amounts of money over the internet, and the founders want to continue developing the technology and hiring talent so that it is a secure and trustworthy system.

It also launched its buy now, pay later project funding service, Breef(pay), to streamline payments to agencies and reduce cash flow challenges. Users can construct their own payment terms, mix up the way they are paid and utilize a credit line or defer payments to control external spend.

To date, Breef has more than 5,000 vetted boutique agencies in 20 countries on its platform and is able to save its users an average of 32% in product costs compared with a traditional agency model. It boasts a customer list that includes Spotify, Brex, Shutterstock, Bluestone Lane and Kinrgy.

Kevin Novak, founder of Rackhouse Ventures, said he met Raptis through the Australian tech community. He recently launched his first fund targeting startups in novel applications of data.

“When they were talking to me about what they wanted to do, I got intrigued,” Novak said. “I like finding marketplaces where the idea is well understood by the people involved. Looking at the matching problem, Emily and George have found a unique way to find ad agencies that hasn’t existed before.”

Powered by WPeMatico

Rutter, a remote-first company, is developing a unified e-commerce API that enables companies to connect with data across any platform.

On Friday the company announced it was emerging from stealth with $1.5 million in funding from a group of investors including Haystack, Liquid 2 and Basis Set Ventures.

Founders Eric Yu and Peter Zhou met in school and started working on Rutter, which Zhou called “Plaid for commerce,” in 2017 before going through the summer 2019 Y Combinator cohort.

They stumbled upon the e-commerce API idea while working in education technology last year. The pair were creating subscription kits and learning materials for parents concerned about how their children would be learning during the global pandemic. Then their vendor customers had problems listing their storefronts on Amazon, so they wrote scripts to help them, but found that they had to write separate scripts for each platform.

With Rutter, customers only need one script to connect anywhere. Its APIs connect to e-commerce platforms like Shopify, Walmart and Amazon so that tech customers can build functions like customer support and chatbots, Yu told TechCrunch.

Lan Xuezhao, founding and managing partner of Basis Set Ventures, said via email that she was “super excited” about Rutter first because of the founders’ passion, grit and speed of iteration to a product. She added it reminded her of another team that successfully built a business from zero to over $7 billion.

“After watching them (Rutter) for a few years, it’s clear what they built is powerful: it’s the central nervous system of online commerce,” Xuezhao added.

As the founders see it, there are two big explosions going on in e-commerce: the platform side with the adoption of headless commerce — the separating of front end and back end functions of an e-commerce site, and new companies coming in to support merchants.

The new funding will enable Yu and Zhou to build up their team, including hiring more engineers.

Due to the company officially launching at the beginning of the year, Yu did not disclose revenue metrics, but did say that Rutter’s API volume was doubling and tripling in the last few months. It is also supporting merchants that connect with over 5,000 stores.

Some of Rutter’s customers are building one aspect of commerce, like returns, warranties and checkouts, but Yu said that since Shopify represents just 10% of e-commerce, the company’s goal is to take merchants beyond the marketplace by being “that unified app store for merchants to find products.”

“We think that in the future, the e-commerce stack of a merchant will look like the SaaS stack of a software company,” Zhou added. “We want to be the glue that holds that stack together for merchants.”

Powered by WPeMatico