Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Getting children to school safely and reliably is a challenge as old as public education itself. But rarely have any entrepreneurs tackled the problem of updating and optimizing one of the nation’s largest legacy transit systems, now nearly a century old. It’s still common to find people at U.S. student transportation hubs speaking into walkie-talkies and wrangling clipboards as they sort passengers into gas-guzzling yellow buses.

Ritu Narayan was working as a product executive at eBay when her two children began attending school. Finding safe and reliable options for getting them to campus was sometimes so difficult that anytime those options would fall out, she would be on the verge of leaving her job.

“We had the minimum viable product, which we expanded upon, built the entire platform, and we kept on going to better places with our solutions.”

Bearing in mind that her mother in India had set aside a career to raise Narayan and her three siblings, she founded Zūm in 2016 with brothers Abhishek and Vivek Garg to optimize routes, create transparency and make school commutes greener; since then, Zūm has operated in several California districts (including San Francisco), as well as in Seattle, Chicago and Dallas. In Oakland, Zūm has optimized routes to reduce the previous bus requirement by 29 percent, with the balance being serviced by midsized vehicles.

Zūm also plans to have a fleet of 10,000 electric school buses by 2025 and is partnering with AutoGrid to transform that fleet into a virtual power plant with the potential capacity to route 1 GW of energy back to the grid.

To get a deeper look into the startup’s plans and hear what Narayan has learned from its journey so far, we discussed the pandemic’s impacts on Zūm’s development, where she thinks the company will be a year from now, and how she convinced investors to back a business model that embraces accessibility and equity.

(Editor’s note: This interview has been edited for clarity and length.)

How did COVID-19 affect your business? What percentage of your business is back now?

It’s funny, because we used to say that student transportation is a recession-proof business, and no matter what, kids are still going to go to school, but the pandemic was the first time in probably the last 100 years when kids across the globe did not go to school. It was an interesting time for us, because overnight, all the rides were closed and we had to focus on what was needed immediately to support our districts and students.

We realized that the school is such an important physical infrastructure that’s not just for education, but students get meals there as well as physical and emotional help. So we helped the school districts with reverse logistics, taking the meals or laptops from the school districts and delivering them to homes, because our software could handle that kind of thing. That was just an interim to make sure the communities settled. Starting last year, rides started coming back around 30%, and this year starting in April, it has been 100% back in the business.

Powered by WPeMatico

Silicon Valley was once one of the most productive regions in the country for the defense industry, churning out chips and technologies that helped the United States overtake the Soviet Union during the Cold War. Since then, the region has been known far less for silicon and defense than for the consumer internet products of Google, Facebook and Netflix.

A small number of startups, though, are attempting to revitalize that important government-industry nexus as the rise of China pushes more defense planners in Washington to double down on America’s technical edge. Vannevar Labs is one of this new crop, and it has hit some new milestones in its quest to displace traditional defense contractors with Silicon Valley entrepreneurial acumen.

I last chatted with the company just as it was debuting in late 2019, having raised a $4.5 million seed. The company has been quiet and heads down the past two years as it developed a product and traction within the defense establishment. Now it’s ready to reveal a bit more of what all that work has culminated in.

First, the company officially launched its Vannevar Decrypt product in January of this year. It’s focused on foreign language natural language processing, organizing overseas data and resources that are collected by the intelligence community and then immediately translating and interpreting those documents for foreign policy decisionmakers. CEO and co-founder Brett Granberg said that the product “went from one deployment to a dozen adoptions.”

Second, the company raised a $12 million Series A investment in May from Costanoa Ventures and Point72, with General Catalyst participating. Costanoa and GC co-led the startup’s seed round.

Finally, the company has been on a hiring spree. The team has grown into a crew of 20 employees, and the firm last week brought on Scott Sanders to lead business development. Sanders was one of the earliest employees at Anduril, and had spent several years at the company. Vannevar also added to its board John Doyle, a long-time Palantir employee who was head of its national security business, according to Granberg. Today, the team is equally split between national security folks and technologists, and he says that the team is set to double this year.

Co-founders Nini Moorhead and Brett Granberg of Vannevar Labs. Photo via Vannevar Labs.

With a few years of hindsight, Granberg says that he has refined what he considers the best model for defense tech startups to break into the hardscrabble market at the Pentagon and across Northern Virginia.

First, there needs to be incredible focus on getting access to actual end users and learning their work. The functions that defense and intelligence personnel perform are completely different from operations in the commercial economy, and trying to translate what works at a large corporation into defense is a fool’s errand. “You need to have both the DNA of understanding new technology and the DNA of deeply understanding a lot of different use cases within DoD,” Granberg said, referencing the Department of Defense.

That has directly informed how Decrypt has developed over time. “We started focusing on the counter-terrorism space, and as the government moved away from counter-terrorism, we started moving to the foreign actors that were important,” he said. “Once we have our first couple of deployments, we are able to iterate very, very quickly.”

He also strongly eschews a popular view in defense procurement circles that there are “dual-use” technologies that can be used equally well in commercial and defense applications. “Some of the most important mission problems where the government spends the most money and has the most interest,” he explained, are also contexts where commercial off-the-shelf products (dubbed COTS in the industry parlance) are least useful. He says startups targeting defense simply cannot split their bandwidth by also trying to learn commercial use cases.

In fact, he went so far to predict that “you are going to see a lot of companies that have raised a lot of money that will fizzle out in the coming years” because they just can’t nail the dual-use model well.

Second, he argues that defense tech startups need to move beyond the model that each company should work on one platform, and instead move to an organizational model where a company offers multiple products to reach scale. Each product has the potential to reach “a couple of hundred million in revenue,” according to Granberg, but it is hard to expand a company’s size if it doesn’t parallelize product development.

To that end, Granberg said that he pushes Vannevar Labs to always be exploring new product lines for growth. “Decrypt is our first product [but]10% of our energy is in new product efforts,” he said. “I can imagine when we are three to four years down the line… it might be nine-10 products.” He said that the one platform approach might have worked for Palantir, which ironically, is the major winner in the defense tech space the last few years. But newer companies like Anduril and Shield AI have been designed around product line expansion.

Finally, noting those other companies, Granberg believes there is something of a collective benefit as each startup makes headway in the defense sector. “There is this theory in our space that we don’t view ourselves as competitors — if one of us does well, we all do well,” he said. Given the varied mission requirements of different agencies and the absolute massive scale of budgets in this field, startups actually have a lot of independent terrain to explore, even if they come up against the big legacy defense contractors on a regular basis.

As for Vannevar Labs, its next goal is to turn its Decrypt product into a program of record, which would guarantee it a certain level of sales and revenue for potentially years into the future. That’s a huge bar to leap, but would be a turning point in the company’s long-term trajectory.

Powered by WPeMatico

On October 27, we’re taking on the ferociously competitive field of software as a service (SaaS), and we’re thrilled to announce our packed agenda, overflowing with some of the biggest names and most exciting startups in the industry. And you’re in luck, because $75 early-bird tickets are still on sale — make sure you book yours so you can enjoy all the agenda has to offer and save $100 bucks before prices go up!

Throughout the day, you can expect to hear from industry experts, and take part in discussions about the potential of new advances in data, open source, how to deal with the onslaught of security threats, investing in early-stage startups and plenty more.

We’ll be joined by some of the biggest names and the smartest and most prescient people in the industry, including Javier Soltero at Google, Kathy Baxter at Salesforce, Jared Spataro at Microsoft, Jay Kreps at Confluent, Sarah Guo at Greylock and Daniel Dines at UiPath.

You’ll be able to find and engage with people from all around the world through world-class networking on our virtual platform — all for $75 and under for a limited time, with even deeper discounts for nonprofits and government agencies, students and up-and-coming founders!

Our agenda showcases some of the powerhouses in the space, but also plenty of smaller teams that are building and debunking fundamental technologies in the industry. We still have a few tricks up our sleeves and will be adding some new names to the agenda over the next month, so keep your eyes open.

In the meantime, check out these agenda highlights:

We’ll have more sessions and names shortly, so stay tuned. But get excited in the meantime, we certainly are.

Pro tip: Keep your finger on the pulse of TC Sessions: SaaS. Get updates when we announce new speakers, add events and offer ticket discounts.

Why should you carve a day out of your hectic schedule to attend TC Sessions: SaaS? This may be the first year we’ve focused on SaaS, but this ain’t our first rodeo. Here’s what other attendees have to say about their TC Sessions experience.

“TC Sessions: Mobility offers several big benefits. First, networking opportunities that result in concrete partnerships. Second, the chance to learn the latest trends and how mobility will evolve. Third, the opportunity for unknown startups to connect with other mobility companies and build brand awareness.” — Karin Maake, senior director of communications at FlashParking.

“People want to be around what’s interesting and learn what trends and issues they need to pay attention to. Even large companies like GM and Ford were there, because they’re starting to see the trend move toward mobility. They want to learn from the experts, and TC Sessions: Mobility has all the experts.” — Melika Jahangiri, vice president at Wunder Mobility.

TC Sessions: SaaS 2021 takes place on October 27. Grab your team, join your community and create opportunity. Don’t wait — jump on the early bird ticket sale right now.

Powered by WPeMatico

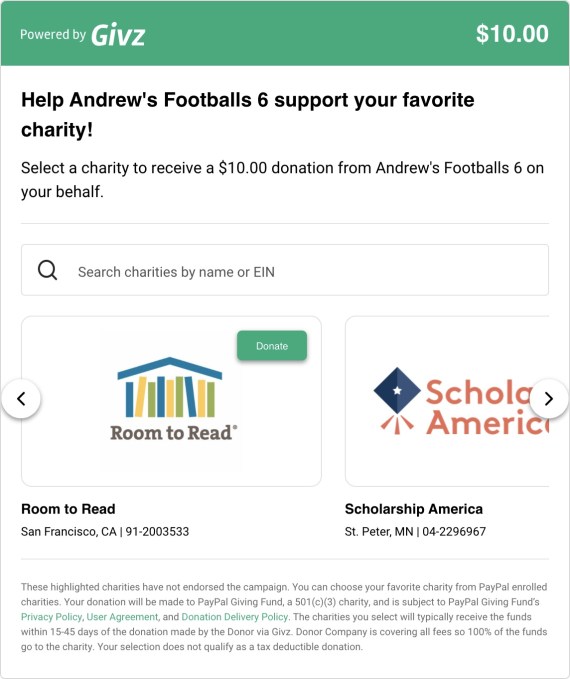

Givz, which has developed an API-powered platform that gives brands a way to convert discounts into donations, has raised $3 million in seed funding.

Eniac and Accomplice co-led the financing for the New York-based startup. Additional investors include Supernode Ventures, Claude Wasserstein of Fine Day, Phoenix Club and Dylan Whitman.

Givz was founded in 2017 to make charitable giving more accessible and convenient for the masses. In March 2020, right before the COVID-19 pandemic hit, the company pivoted from B2C to B2B and used the technology rails it had built to create the e-commerce marketing platform that Givz is today.

The company aims to drive “full-price purchasing behavior” by giving consumers the ability to convert the money they would be saving if getting a discount, and donating it to their favorite charities.

Prior to the funding, Givz had been working with more than 80 enterprise, mid-market and SMB retail and e-commerce clients such as H&M, Tom Brady’s TB12, Seedlip and Terez, and accumulated more than 40,000 individual users. Since the shift last year, the company has helped drive more than $1 million to 1,100 charities, according to CEO and founder Andrew Forman.

It just launched on Shopify, which Forman says will give the startup access to the 1.7 million retailers that use Shopify as their e-commerce platform.

Givz operates under the premise that “donation-driven marketing” consistently outperforms discounts and costs less, “making it an attractive addition” to corporate marketing.

“We are creating a new marketing category and generating the largest sustainable charitable giving platform in the process,” he told TechCrunch.

An example of a company using Givz can be found in Tervis, which offered customers “For every $50 you spend, you’ll receive $15 to give to the charity of your choice.”

“They used Givz technology to allow consumers to choose the charity of their choice and make a turnkey disbursement to hundreds of charities,” Forman explained. “They saw a 20% lift in website conversion and a 17% increase in average order value as a result of this offer.”

Image Credits: Givz

Currently, Givz has eight employees with plans to more than double that number over the next year.

The company plans to use the new capital toward that hiring, and to do some marketing of its own.

“We also want to explore the full potential around the consumer behavior data we collect,” Forman said.

In the short term, Givz is focused on “Shopify growth” with direct to consumer brands.

“But we have successful use cases and huge potential with enterprise retailers and financial institutions,” Forman told TechCrunch. “In the future, we have our sights set on restaurants, the gaming industry and global expansion. I believe that using personalized donations to incentivize consumer behavior has endless application across industries, verticals and continents.”

Eniac partner Vic Singh said that there’s been a trend of brands experimenting with different ways to target the socially conscious consumer.

“We believe Givz’s donation-driven marketing platform offers brands the best way to attract the socially conscious consumer while elevating their brand, moving more inventory and driving increased order value rather than simplistic traditional discounting,” he added.

Accomplice’s TJ Mahony said that both he and Singh believed SMS would emerge as a new marketing category, which led to early investments in Attentive and Postscript, respectively.

“We both saw a similar opportunity with Givz,” he wrote via e-mail. “Discounting is a well worn marketing muscle, but it’s detrimental to the brand, margins and customer expectations. We believe continuous impact marketing becomes the alternative to discounting and marketers will begin to build teams and budget around thoughtful and persistent giving strategies.”

Powered by WPeMatico

Deena Shakir is a partner at Lux Capital, where she looks to invest in technologies that are streamlining analog industries while also improving lives and livelihoods. Among the companies she has backed, for example, are Shiru, which is leveraging computational design to create enhanced proteins to help feed the world; and AllStripes, which aggregates and analyzes medical records, then sells the de-identified data to pharma companies to help them develop medicines.

It’s not a surprise that Shakir is focused on empowering people. Shakir’s father is a psychiatrist and as she once told us, “for a hot minute, I thought I was going to be a doctor myself.” Instead, after attending Harvard, then Georgetown’s School of Foreign Service, she wound up working for the State Department during the Obama administration, then headed to Google. She would stay for the next seven years, spending the last of them with GV, Google’s venture unit. There, her work revolved in part around some of the alternative protein companies in GV’s portfolio. Then, in 2019, she was poached by Lux.

Indeed, while Shakir might have once imagined working with people on an individual basis, she has become an increasingly sought-after investor in startup teams, which is why we couldn’t be more excited that she’s able to join us this year for TechCrunch Disrupt. Specifically, we’re thrilled that Shakir will be judging our Startup Battlefield competition, the centerpiece of Disrupt every year and oftentimes a life-changing event for the winning team — and often runners-up, too. Consider that past winners include Vurb, Dropbox, Mint and Yammer, while runner-up Cloudflare currently boasts a market cap of $38 billion.

It’s because we take the competition — and our record to date — so seriously that we’re exceedingly thankful to savvy investors like Shakir, who ask the right questions, and make the tough decisions when it comes time to decide which teams to move along.

Want to watch and judge from home? With our entirely virtual event this year, you’re more than welcome to join us from the comfort of your home or office (and let us know what you think of the startups within the many networking forums you’ll find).

To watch this year’s 20+ startups compete for $100,000 — and to interact with more than 100 hours of content and thousands of enthusiastic startup fans — make sure to book your pass to TC Disrupt, happening September 21-23 — all for less than $100.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here. I also tweet.

Today’s show was good fun to put together. Here’s what we got to:

Woo! And that’s the start to the week. Hugs from here, and we’ll chat you on Wednesday!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

Covering public companies can be a bit of a drag. They grow some modest amount each year, and their constituent analysts pester them with questions about gross margin expansion and sales rep efficiency. It can be a little dull. Then there are startups, which grow much more quickly — and are more fun to talk about.

That’s the case with Shelf.io. The company announced an impressive set of metrics this morning, including that from July 2020 to July 2021, it grew its annual recurring revenue (ARR) 4x. Shelf also disclosed that it secured a $52.5 million Series B led by Tiger Global and Insight Partners.

That’s quick growth for a post-Series A startup. Crunchbase reckons that the company raised $8.2 million before its Series B, while PitchBook pegs the number at $6.5 million. Regardless, the company was efficiently expanding from a limited capital base before its latest fundraising event.

What does the company’s software do? Shelf plugs into a company’s information systems, learns from the data and then helps employees respond to queries without forcing them to execute searches or otherwise hunt for information.

The company is starting with customer service as its target vertical. According to Shelf CEO Sedarius Perrotta, Shelf can absorb information from, say, Salesforce, SharePoint, legacy knowledge management platforms and Zendesk. Then, after training models and staff, the company’s software can begin to provide support staff with answers to customer questions as they talk to customers in real time.

The company’s tech can also power responses to customer queries not aimed at a human agent and provide a searchable database of company knowledge to help workers more quickly solve customer issues.

Per Perrotta, Shelf is targeting the sales market next, with others to follow. How might Shelf fit into sales? According to the company, its software may be able to offer staff already written proposals for similar-seeming deals and other related content. The gist is that at companies that have lots of workers doing similar tasks — clicking around in Salesforce, or answering support queries, say — Shelf can learn from the activity and get smarter in helping employees with their tasks. I presume that the software’s learning ability will improve over time, as well.

Shelf, around 100 people today, hopes to double in size by the end of the year, and then double again next year.

That’s where the new capital comes in. Hiring folks in the worlds of machine learning and data science is very expensive. And because the company wants to scale those hires quickly, it will need a large bank balance to lean on.

Quick ARR growth was not the only reason Shelf was able to secure such an outsized Series B, at least when compared to how much capital it had raised before. Per Perrotta, Shelf has 130% net dollar retention and no churn to report, meaning its customers are both sticky and expand organically.

While Shelf is interesting today and has certainly found niches it can sell into in its current form, I am more curious about how far the company can take its machine learning system, called MerlinAI. If its tech can get sufficiently smart, its ability to prompt and help employees could reduce onboarding time and the overall cost of employee training. That would be a huge market.

This is the sort of deal that we expect to see Tiger in — an outsized investment (compared to prior rounds) into a high-growth company that has lots of market room. Whatever price Tiger just paid for the company’s stock, a few years of continued growth should de-risk the investment. By our read, Tiger is really just the market-leading bull on software market growth in the long term. Shelf fits into that thesis neatly.

Powered by WPeMatico

As more companies provide more API-first services, Moesif has developed a way for those companies to learn how their customers are utilizing them.

The San Francisco-based startup is adding to its capital raise Monday with the announcement of a $12 million Series A round led by David Sacks and Arra Malekzadeh of Craft Ventures. Existing investor Merus Capital, which led Moesif’s $3.5 million seed round in 2019, also participated in the round, bringing the company’s total raise to $15.5 million, Moesif co-founder and CEO Derric Gilling told TechCrunch.

Gilling and Xing Wang founded Moesif in 2017 and went through the Alchemist Accelerator in 2018.

Companies seeking data around API usage and workflow traditionally had to build that capability in-house on top of a tech like Snowflake, Gilling said. One of the problems with that was if someone wanted a report, the process was ad hoc, meaning they would file a ticket and wait until a team had time to run the report. In addition, companies find it difficult to accurately bill customers on usage or manage when someone exceeds the rate limits.

“We started to see people build on top of our platform and pull data on APIs, and they started asking us how to directly serve customers, like making them aware if they are hitting a rate limit,” Gilling added. “We started to build new functionality and a way to customize the look and feel of the platform.”

Moesif provides self-service analytics that can be accessed daily and features to scale analytics in a more cost-effective manner. Customers use it to monitor features to better understand when there are issues with the API, and there are additional capabilities to understand who is using the API, how often and who may be likely to stop using a product based on how they are using it.

The company is also now seeing its revenue grow over 20% month over month this year and adoption by more diverse use cases and larger companies. At the time of the seed round, the company was just getting started with analytics and user trials, Gilling said. Today, it boasts a customer list that includes UPS, Tomorrow.io, Symbl.ai and Deloitte.

The company has also gone from a team of two to nine employees, and Gilling expects to use the new funding to bolster that roster across engineering, sales, developer relations and customer success.

He is also focusing on being a thought leader in the space and is pushing go-to-market and building out a new set of features to monetize APIs and improve its dashboard to better differentiate Moesif from competitors, which he said focus more on server health versus customer usage.

As part of the investment, Craft Ventures’ Malekzadeh is joining Moesif’s board. She was introduced to Gilling by another portfolio company and felt Moesif fit into Crafts’ thesis on SaaS companies.

Malekzadeh’s particular interest is in developer tools, and while in her previous position working at a startup developing APIs, she felt firsthand the pain point of not being able to know how those APIs were being used, how much customers should be billed and “was always bugging the product and engineering teams for reports.”

Moesif didn’t exist at the time she worked at the startup, and instead, her company had to build it own tools that turned out to be clunky, while at the same time recruiting top engineers that didn’t want to take up their time with building something that wasn’t the company’s core product.

“The two founders are highly technical, but they provided great content on their website that helped me learn about them,” Malekzadeh added. “One of the interesting things about them is that even though they are technical, they speak the same language as a business user, which makes them special as a developer-first company. Just the growth in their revenue was super impressive, and their customer references were glowing.”

Powered by WPeMatico

Chinese-backed and Africa-focused fintech company OPay raised $400 million in new financing led by SoftBank Vision Fund 2, Bloomberg reported Monday, valuing the company at $2 billion.

The round, which marks the fund’s first investment in an African startup, drew participation from existing investors like Sequoia Capital China, Redpoint China, Source Code Capital and Softbank Ventures Asia. Other investors, including DragonBall Capital and 3W Capital, also took part in the new financing round.

This news comes three months after The Information reported that the company was in talks to raise “up to $400 million at a $1.5 billion valuation” from a group of Chinese investors. The new financing also comes two years after OPay announced two funding rounds in 2019 — $50 million in June and a $120 million Series B in November.

In an emailed statement, OPay CEO Yahui Zhou said OPay “wants to be the power that helps emerging markets reach a faster economic development.” The company, founded in 2018, had an exclusive presence in Nigeria before last year.

While the company started with providing customers with digital services in their everyday life, from mobility and logistics to e-commerce and fintech at cheap rates, those super app plans have been largely underwhelming.

Right now, it’s the company’s mobile money and payment arm that thrives the most. By simply allowing unbanked and underbanked users in Nigeria to send and receive money and pay bills through a network of thousands of agents, OPay has grown at an exponential rate.

The company plays in an extremely competitive fintech market. Nigeria is Africa’s most populous nation, and with a large share of its people underbanked and unbanked, fintech is the most promising digital sector in the country. The same can be said for the continent as a whole. Mobile money services have long catered to the needs of the underbanked. Per GSMA, Africa had more than 160 million active mobile money users generating over $495 billion in transaction value last year.

Parent company Opera reported that OPay’s monthly transactions grew 4.5x to over $2 billion in December last year. OPay also claims to process about 80% of bank transfers among mobile money operators in Nigeria and 20% of the country’s nonmerchant point of sales transactions. Last year, the company also said it acquired an international money transfer license with a WorldRemit partnership also in the works.

Per Bloomberg, the company’s monthly transaction volumes exceed $3 billion at the moment.

Last year, OPay expanded to Egypt, and according to the company, that’s an entry point to the Middle East market.

In a statement, Kentaro Matsui, a managing director at SoftBank Group Corp, said, “We believe our investment will help the company extend its offering to adjacent markets and replicate its successful business model in Egypt and other countries in the region.”

SoftBank joins a growing list of high-flying investors (Dragoneer, Sequoia and SVB Capital, among others) that have cut their first checks in African ventures this year. As the continent continues to show promise, fintech remains its poster child. This year up to half of the total investments raised have emerged from the sector; it contributed to more than 25% last year.

In addition, fintech has produced the most mega-rounds so far. TymeBank raised $109 million in February, Flutterwave bagged a $170 million round in March and Chipper Cash secured $100 million in May.

OPay’s fundraise is the largest of the lot in terms of size and value, making it the second African fintech unicorn after Flutterwave and the third African unicorn after e-commerce giant Jumia. The three make up the five billion-dollar tech companies on the continent, which include Interswitch and Fawry.

Powered by WPeMatico

Figuring out size and cut of clothes through a website can suck the fun out of shopping online, but Revery.ai is developing a tool that leverages computer vision and artificial intelligence to create a better online dressing room experience.

Under the tutelage of University of Illinois Center for Computer Science advisrr David Forsyth, a team consisting of Ph.D. students Kedan Li, Jeffrey Zhang and Min Jin Chong, is creating what they consider to be the first tool using existing catalog images to process at a scale of over a million garments weekly, something previous versions of virtual dressing rooms had difficulty doing, Li told TechCrunch.

Revery.ai co-founders Jeffrey Zhang, Min Jin Chong and Kedan Li. Image Credits: Revery.ai

California-based Revery is part of Y Combinator’s summer 2021 cohort gearing up to complete the program later this month. YC has backed the company with $125,000. Li said the company already has a two-year runway, but wants to raise a $1.5 million seed round to help it grow faster and appear more mature to large retailers.

Before Revery, Li was working on another startup in the personalized email space, but was challenged in making it work due to free versions of already large legacy players. While looking around for areas where there would be less monopoly and more ability to monetize technology, he became interested in fashion. He worked with a different adviser to get a wardrobe collection going, but that idea fizzled out.

The team found its stride working with Forsyth and making several iterations on the technology in order to target business-to-business customers, who already had the images on their websites and the users, but wanted the computer vision aspect.

Unlike its competitors that use 3D modeling or take an image and manually clean it up to superimpose on a model, Revery is using deep learning and computer vision so that the clothing drapes better and users can also customize their clothing model to look more like them using skin tone, hair styles and poses. It is also fully automated, can work with millions of SKUs and be up and running with a customer in a matter of weeks.

Its virtual dressing room product is now live on many fashion e-commerce platforms, including Zalora-Global Fashion Group, one of the largest fashion companies in Southeast Asia, Li said.

Revery.ai landing page. Image Credits: Revery.ai

“It’s amazing how good of results we are getting,” he added. “Customers are reporting strong conversion rates, something like three to five times, which they had never seen before. We released an A/B test for Zalora and saw a 380% increase. We are super excited to move forward and deploy our technology on all of their platforms.”

This technology comes at a time when online shopping jumped last year as a result of the pandemic. Just in the U.S., the e-commerce fashion industry made up 29.5% of fashion retail sales in 2020, and the market’s value is expected to reach $100 billion this year.

Revery is already in talks with over 40 retailers that are “putting this on their roadmap to win in the online race,” Li said.

Over the next year, the company is focusing on getting more adoption and going live with more clients. To differentiate itself from competitors continuing to come online, Li wants to invest body type capabilities, something retailers are asking for. This type of technology is challenging, he said, due to there not being much in the way of diversified body shape models available.

He expects the company will have to collect proprietary data itself so that Revery can offer the ability for users to create their own avatar so that they can see how the clothes look.

“We might actually be seeing the beginning of the tide and have the right product to serve the need,” he added.

Powered by WPeMatico