Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Earlier today, spend management startup Ramp said it has raised a $300 million Series C that valued it at $3.9 billion. It also said it was acquiring Buyer, a “negotiation-as-a-service” platform that it believes will help customers save money on purchases and SaaS products.

The round and deal were announced just a week after competitor Brex shared news of its own acquisition — the $50 million purchase of Israeli fintech startup Weav. That deal was made after Brex’s founders invested in Weav, which offers a “universal API for commerce platforms.”

From a high level, all of the recent deal-making in corporate cards and spend management shows that it’s not enough to just help companies track what employees are expensing these days. As the market matures and feature sets begin to converge, the players are seeking to differentiate themselves from the competition.

But the point of interest here is these deals can tell us where both companies think they can provide and extract the most value from the market.

These differences come atop another layer of divergence between the two companies: While Brex has instituted a paid software tier of its service, Ramp has not.

Let’s start with Ramp. Launched in 2019, the company is a relative newcomer in the spend management category. But by all accounts, it’s producing some impressive growth numbers. As our colleague Mary Ann Azevedo wrote:

Since the beginning of 2021, the company says it has seen its number of cardholders on its platform increase by 5x, with more than 2,000 businesses currently using Ramp as their “primary spend management solution.” The transaction volume on its corporate cards has tripled since April, when its last raise was announced. And, impressively, Ramp has seen its transaction volume increase year over year by 1,000%, according to CEO and co-founder Eric Glyman.

Ramp’s focus has always been on helping its customers save money: It touts a 1.5% cash back reward for all purchases made through its cards, and says its dashboard helps businesses identify duplicitous subscriptions and license redundancies. Ramp also alerts customers when they can save money on annual versus monthly subscriptions, which it says has led many customers to do away with established T&E platforms like Concur or Expensify.

All told, the company claims that the average customer saves 3.3% per year on expenses after switching to its platform — and all that is before it brings Buyer into the fold.

Powered by WPeMatico

Ken Babcock and his co-founders, Dan Giovacchini and Brian Shultz, were in the midst of Harvard Business School in March 2020 when they felt the call to start Tango, a Chrome extension that auto-captures workflow best practices so that teams can learn from their top performers.

“This window of opportunity was driven by the pandemic as we saw a lot of companies become distributed and go remote,” CEO Babcock told TechCrunch. “Team leaders were remotely onboarding people, for perhaps the first time, and accelerating ramp times. There was no longer the opportunity to tap on people’s shoulders in the office, so much of the training was left to people’s own devices.”

They dropped out of their program to start Los Angeles-based Tango, and today, announced a $5.7 million seed round for its workflow intelligence platform. Wing Venture Capital led the round and was joined by General Catalyst, Global Silicon Valley, Outsiders Fund and Red Sea Ventures. A group of angel investors also joined, including former Yelp executive Michael Stoppelman, former Uber head of data Jai Ranganathan, KeepTruckin CEO Shoaib Makani and Awesome People Ventures’ Julia Lipton.

Tango is designed to help employees, particularly in customer success and sales enablement, get back as much as 20% of their workweek spent searching for that one piece of information or tracking down the right colleague to assist with a task. Its technology creates tutorials by recording a users’ workflow — actions, links to pages, URLs and screenshots — and turns that into step-by-step documentation with a video.

Previously the co-founders bootstrapped the company, and decided to go after seed funding to expand the product and growth teams and invest in product development so that Tango could take a product-led growth strategy, Babcock said. The team now has 13 employees.

Since starting last year, Tango has secured 10 pilots to figure out the data and capabilities before it is set to launch publicly in September. Babcock said the company will always have a free version of the product, as well as premium and enterprise versions that will unlock additional capabilities.

“The big thing is around integrations and meeting people where the consumer content is,” Babcock added. “We are reducing that burden of creating documentation, and for companies that already have Wikis or other materials, learning how to inject ourselves into those systems.”

Zach DeWitt, partner at Wing Venture Capital, said he met the company three years ago through a mutual friend.

His firm invests in early-stage, business-to-business startups unlocking a novel data set. In Tango’s case, the company was creating a new data set for the enterprise and business, where users can analyze workflow.

With the average tech company using 150 SaaS apps, up from 20 a decade ago, there are permutations about which app to use, how to use them, what happens if the user gets stuck and what if none of the data is being captured, Dewitt said. Tango works in the background and captures workflow, which is the foundation to the business’ success.

“I was blown away by the approach,” he added. “You have to meet people where they get stuck and even anticipate where they get stuck so you can serve the Tango tutorial to get unstuck. It can also change the company’s culture when it rewards people to share knowledge. The whole idea is beneficial to multiple parties: to those who are getting stuck and to new hires. That is powerful.”

Powered by WPeMatico

Creating single-family homes for the homeless using 3D printing robotics. Developing construction systems to create infrastructure and habitats on the moon, and eventually Mars, with NASA. Delivering what is believed to be the largest 3D-printed structure in North America — a barracks for Texas Military Department.

These are just some of the things that Austin, Texas-based construction tech startup ICON has been working on.

And today, the company is adding a massive $207 million Series B raise to its list of accomplishments.

I’ve been covering ICON since its $9 million seed round in October of 2018, so seeing the company reach this milestone less than three years later is kind of cool.

Norwest Venture Partners led the startup’s Series B round, which also included participation from 8VC, Bjarke Ingels Group (BIG), BOND, Citi Crosstimbers, Ensemble, Fifth Wall, LENx, Moderne Ventures and Oakhouse Partners. The financing brings ICON’s total equity raised to $266 million. The company declined to reveal its valuation.

ICON was founded in late 2017 and launched during SXSW in March 2018 with the first permitted 3D-printed home in the U.S. That 350-square-foot house took about 48 hours (at 25% speed) to print. ICON purposely chose concrete as a material because, as co-founder and CEO Jason Ballard put it, “It’s one of the most resilient materials on Earth.”

Since then, the startup says it has delivered more than two dozen 3D-printed homes and structures across the U.S. and Mexico. More than half of those homes have been for the homeless or those in chronic poverty. For example, in 2020, ICON delivered 3D-printed homes in Mexico with nonprofit partner New Story. It also completed a series of homes serving the chronically homeless in Austin, Texas, with nonprofit Mobile Loaves & Fishes.

The startup broke into the mainstream housing market in early 2021 with what it said were the first 3D-printed homes for sale in the U.S. for developer 3Strands in Austin, Texas. Two of the four homes are under contract. The remaining two homes will hit the market on August 31.

And recently, ICON revealed its “next generation” Vulcan construction system and debuted its new Exploration Series of homes. The first home in the series, “House Zero,” was optimized and designed specifically for 3D printing.

For some context, ICON says its proprietary Vulcan technology produces “resilient, energy-efficient” homes faster than conventional construction methods and with less waste and more design freedom. The company’s new Vulcan construction system, according to Ballard, can 3D print homes and structures up to 3,000 square feet, is 1.5x larger and 2x faster than its previous Vulcan 3D printers.

From the company’s early days, Ballard has maintained ICON is motivated by the global housing crisis and lack of solutions to address it. Using 3D printers, robotics and advanced materials, he believes, is one way to tackle the lack of affordable housing, a problem that is only getting worse across the country and in Austin.

ICON’s list of future plans include the delivery of social, disaster relief and more mainstream housing, Ballard said, in addition to developing construction systems to create infrastructure and habitats on the moon, and eventually Mars, with NASA.

ICON also has two ongoing projects with NASA. Recently, Mars Dune Alpha was just announced by NASA, ICON and BIG – and ICON so far has finished printing the wall system and is onto the roof now. Also, NASA is recruiting for crewed missions to begin nextfFall to live in the first simulated Martian habitat 3D printed by ICON.

When asked, Ballard said the most significant thing that has happened since the company’s $35 million Series A last August has been the “the radical increase in demand for 3D-printed homes and structures.”

“That single metric represents a lot for us,” Ballard told TechCrunch. “People have to want these houses.”

To tackle the housing shortage, the world needs to increase supply, decrease cost, increase speed, increase resiliency, increase sustainability… all without compromising quality and beauty, he added.

“Perhaps there are a few approaches that can do some of those things, but only construction scale 3D printing holds the potential to do all of those things,” he said.

ICON has seen impressive financial growth, with 400% revenue growth nearly every year since inception, according to Ballard. It’s also tripled its team in the past, year and now has more than 100 employees. It expects to double in size within the next year.

Image Credits: Co-founders with next-gen Vulcan Construction System / ICON

The series B funds will go toward more construction of 3D-printed homes, “rapid scaling and R&D,” further space-based tech advancements and creating “a lasting societal impact on housing issues,” Ballard said.

“We have already stood up early-stage manufacturing and are in the process of upgrading and accelerating those efforts in order to meet demand for more 3D-printed houses even as we close the round,” Ballard said. “In the next five years, we believe we will be delivering thousands of homes per year and on our way to tens of thousands of homes per year.”

Norwest Venture Partners Managing Partner Jeff Crowe, who is joining ICON’s board as part of the financing, said his firm believes that ICON’s 3D printing construction technology will “massively impact the housing shortage in the U.S. and around the globe.”

It is “enormously difficult” to bring together the advanced robotics, materials science and software to develop a robust 3D printing construction technology in the first place, Crowe said.

“It is still harder to develop the technology in a way that can produce hundreds and thousands of beautiful, affordable, comfortable, energy efficient homes in varying geographies with reliability and predictability — not just one or two demonstration units in a controlled setting,” he wrote via e-mail. “ICON has done all that, and…has all the elements to be a breakout, generational success.”

Powered by WPeMatico

With the promise of an interconnected virtual world coming into focus and user-crafted gaming content exploding, Infinite Canvas is looking to apply to the metaverse lessons learned in the esports boom.

“Metaverse” is the hot buzzword right now, but it’s not an empty term. Ten different people would probably define the metaverse in 10 different ways, but it’s generally used as shorthand for the web of emerging virtual spaces full of personalized avatars, games and digital goods that are already shaping our world.

Much like the realm of esports boasts individual standout players who command their own followings, the social gaming world has its own stars who make original in-game content. But right now, creators making hit content in Fortnite, Roblox and Minecraft are mostly operating on their own, without the supportive infrastructure that quickly professionalized the esports world. And like the early waves of esports players, those content creators skew young and lack some of the resources that would make it smoother to scale the digital brands they’re building.

Founded by Tal Shachar and Sebastian Park, Infinite Canvas is looking to connect creators who craft content for the world’s most popular online games with the financial resources, tools and experience they need to grow their businesses beyond what would be possible in isolation.

Shachar, the former growth strategist at BuzzFeed Studios and chief digital officer at Immortals Gaming Club, and Park, previously VP of Esports for the Houston Rockets, where he founded League of Legends franchise team Clutch Gaming, envision a hybrid talent management company and game publisher modeled after the success they’ve seen in the esports world. The pair liken the new venture to “an esports team for the metaverse.”

To grow their vision, Infinite Canvas has raised $2.8 million in pre-seed funds led by Lightshed Venture Partners, the venture firm founded by media analyst Richard Greenfield. BITKRAFT Ventures, Day One Ventures, Crossbeam and Emerson Collective also participated in the funding round.

“We are just at the beginning of seeing what the metaverse market opportunity can be,” said Greenfield. “While the path to monetization is clear on platforms like YouTube, in virtual worlds Infinite Canvas is pioneering a network that will unite creators, players and content partners to enhance the earning power of the talent building new virtual empires.”

Out of the gate, Infinite Canvas has partnered with some big names in Roblox, including RussoPlays, DeeterPlays, Sabrina and DJ Monopoli from Terabrite Games, as well as a handful of other Roblox developers, Fortnite map makers and streamers who, combined, reach more than 4.5 million subscribers.

For the team, this nascent era of user-generated gaming content looks a lot like another now-ubiquitous creator platform once did.

“Roblox in particular, but really all of these UGC gaming platforms, really reminded me a lot of YouTube. Which is to say that they were enabling a new type of person to distribute a content format that was previously kind of locked right behind like barriers of distribution and also of skills set and capital, quite frankly,” Shachar told TechCrunch.

After getting curious, Shachar and Park dove into the creator community and found a diverse array of generally self-taught young people from all around the world crafting custom in-game content for Fortnite, Roblox and Minecraft. Much of that content, whether intentionally or not, offered players more digital spaces to connect during the pandemic-imposed social isolation, which saw interest in online social spaces take off.

“Everyone was pretty negative about the world writ large and we’re just talking to these like 17, 16, 18, 19-year-old guys, gals and non-binary pals from all over the world, just like straight up making cool stuff,” Park said.

In those conversations, Park and Shachar realized that while the world of user-generated gaming content can produce huge hits, creators were mostly isolated from support that could help them take their work to the next level.

“It felt very siloed — you have people making content over here on the right and then people developing these games on the left and then players kind of in the center there and that didn’t really make a ton of sense to us,” Shachar said. “Especially because it was super clear that there was this really strong loop of content creation leading to gameplay leading to content creation.”

With Infinite Canvas, they want to provide that missing framework, offering creators crafting content in virtual worlds everything from marketing support to capital and tech tools. As creator monetization channels within virtual worlds mature, Infinite Canvas hopes to even be able to broker ad and brand opportunities and empower creators to expand their own brands across platforms.

“What if we built a new kind of organization that blended parts of being a game publisher, parts of being an esports team, parts of being a capital and tech backend to basically enable these people to do what they do but better and bigger?” Shachar asked.

“For the metaverse — whatever word you want to use — to really exist, it’s going to take all of these independent people to actually populate it and bring it to life and make all of these experiences and there’s just an insane amount of talent out there that we think can be unlocked.”

Powered by WPeMatico

With COVID-19 disrupting the entire manufacturing supply chain including semiconductor shortages, companies across multiple industries have been struggling to seek a procurement solution that can rebalance the gap between supply and demand.

CADDi, a Tokyo-based B2B ordering and supply platform in the manufacturing and procurement industry, helps both procurement (demand side) and manufacturing facilities (supply side) by aggregating and rebalancing supply and demand via its automated calculation system for manufacturing costs and databases of fabrication facilities across Japan.

The company announced this morning a $73 million Series B round co-led by Globis Capital Partners and World Innovation Lab (WiL), with participation from existing investors DCM and Global Brain. Six new investors also have joined the round including Arena Holdings, DST Global, Minerva Growth Partners, Tybourne Capital Management, JAFCO Group and SBI Investment.

CADDi was founded by CEO Yushiro Kato and CTO Aki Kobashi in November 2017.

The post-money valuation is estimated at $450 million, according to sources close to the deal.

The new funding brings CADDi’s total raised so far to $90.5 million. In December 2018, the company closed a $9 million Series A round led by DCM and followed by Globis Capital Partners and WiL and Global Brain.

The funding proceeds will be used for accelerating digital transformation of the platform, hiring and expanding to global markets.

“We enable integrated production of complete sets of equipment consisting of custom-made parts such as sheet metal, machined parts and structural frames. Using an automatic quotation system based on a proprietary cost calculation algorithm, we select the processing company that best matches the quality, delivery date and price of the order and build an optimal supply chain,” CEO and co-founder Yushiro Kato said.

The goal of CADDi’s ordering platform is to transform the manufacturing industry from a multiple subcontractor pyramid structure to a flat, connected structure based on each manufacturers’ individual strengths, thus creating a world where those on the front lines of manufacturing can spend more time on essential and creative work, Kato said.

CADDi’s ordering platform, backed by its unique technology including automatic cost calculation system, optimal ordering and production management system, and drawing management system, offers a 10%-15% cost reduction, stable capacity and balanced order placement to its more than 600 Japanese supply partners spanning a multitude of industries.

“The demand for CADDi’s services has seen significant acceleration. Our business has been growing very fast, and our latest orders have grown more than six times compared to the previous year, leading to the company’s expanded presence into both eastern and western Japan in order to meet this increase in demand,” Kato said.

“Going forward, in addition to continuously expanding our ordering platform, we will also start to provide purchases (manufacturers) and supply partners with our technology directly to promote digital transformation of their operations, for example, the production management system and drawing management system,” Kato continued.

“As a start point, in the near future, we are thinking about selling ‘Drawing Management SaaS,’” which has been used internally for CADDi’s ordering operation, to help customers solve operational pains in handling piles of drawings. “Our ‘Drawing Management SaaS’ technology will not only help manage drawings as documents properly but also allow utilization of data of drawings in a practical way for future decision-making and action in their procurement process.”

CADDi’s next axis of growth will be other growing markets, especially in Southeast Asia, Kato pointed out. “Many of our Japanese customers have subsidiaries and branches in these countries, so it’s a natural expansion opportunity for us to strengthen our value proposition and provide more continuity and seamless service to our customers,” Kato added.

Kato also said it wants to continue investing in hiring, especially engineers, to further the development of its platform CADDi and new business. It plans to hire 1,000 employees in the next three years. CADDi had 102 employees as of March 2021.

The company aims to become a global platform with sales of USD 9.1 billion (that is 1 trillion YEN) by 2030, Kato said.

COVID-19 had a different impact on different industries in the procurement and manufacturing sector, with “the automobile and machine tool industries were negatively affected by the pandemic and experienced an up to 90% temporary drop in sales, while other industries such as the medical and semiconductor industries have experienced explosive growth in demand. The overall result of COVID-19 is that the company has captured more demand because CADDi’s system rebalances receipts across multiple industries,” according to Kato.

Masaya Kubota, partner at World Innovation Lab, told TechCrunch, “CADDi’s solution of aggregating and rebalancing supply and demand has once again proven to be indispensable to both purchasers and manufacturers, with the pandemic disrupting the entire supply chain in manufacturing. We first invested in CADDi in 2018, because we strongly believed in their mission of digitally transforming one of the most analog industries, the $1 trillion procurement market.”

Another investor principal at DCM, Kenichiro Hara, also said in an email interview with TechCrunch, “The pandemic made the manufacturing industry’s supply chain vulnerabilities quite clear early on. For example, if a country is on lockdown or a factory stalls the operations, their customers cannot procure necessary parts to produce their products. This impact amplifies, and the entire supply chain is affected. Therefore, the demand for finding new, available and accessible suppliers in a timely manner increased in importance, which is CADDi’s primary value-add.”

Powered by WPeMatico

The pandemic has highlighted some of the brightest spots — and greatest areas of need — in America’s healthcare system. On one hand, we’ve witnessed the vibrancy of America’s innovation engine, with notable contributions by U.S.-based scientists and companies for vaccines and treatments.

On the other hand, the pandemic has highlighted both the distribution challenges and cost inefficiencies of the healthcare system, which now accounts for nearly a fifth of our GDP — far more than any other country — yet lags many other developed nations in clinical outcomes.

Many of these challenges stem from a lack of alignment between payment and incentive models, as well as an overreliance on hospitals as centers for care delivery. A third of healthcare costs are incurred at hospitals, though at-home models can be more effective and affordable. Furthermore, most providers rely on fee for service instead of preventive care arrangements.

These factors combine to make care in this country reactive, transactional and inefficient. We can improve both outcomes and costs by moving care from the hospital back to the place it started — at home.

Right now in-home care accounts for only 3% of the healthcare market. We predict that it will grow to 10% or more within the next decade.

In-home care is nothing new. In the 1930s, over 40% of physician-patient encounters took place in the home, but by the 1980s, that figure dropped to under 1%, driven by changes in health economics and technologies that led to today’s hospital-dominant model of care.

That 50-year shift consolidated costs, centralized access to specialized diagnostics and treatments, and created centers of excellence. It also created a transition from proactive to reactive care, eliminating the longitudinal relationship between patient and provider. In today’s system, patients are often diagnosed by and receive treatment from individual doctors who do not consult one another. These highly siloed treatments often take place only after the patient needs emergency care. This creates higher costs — and worse outcomes.

That’s where in-home care can help. Right now in-home care accounts for only 3% of the healthcare market. We predict that it will grow to 10% or more within the next decade. This growth will improve the patient experience, achieve better clinical outcomes and reduce healthcare costs.

To make these improvements, in-home healthcare strategies will need to leverage next-generation technology and value-based care strategies. Fortunately, the window of opportunity for change is open right now.

Over the last few years, five significant innovations have created new incentives to drive dramatic changes in the way care is delivered.

Powered by WPeMatico

Y Combinator-backed Kapacity.io is on a mission to accelerate the decarbonization of buildings by using AI-generated efficiency savings to encourage electrification of commercial real estate — wooing buildings away from reliance on fossil fuels to power their heating and cooling needs.

It does this by providing incentives to building owners/occupiers to shift to clean energy usage through a machine learning-powered software automation layer.

The startup’s cloud software integrates with buildings’ HVAC systems and electricity meters — drawing on local energy consumption data to calculate and deploy real-time adjustments to heating/cooling systems which not only yield energy and (CO2) emissions savings but generate actual revenue for building owners/tenants — paying them to reduce consumption such as at times of peak energy demand on the grid.

“We are controlling electricity consumption in buildings, focusing on heating and cooling devices — using AI machine learning to optimize and find the best ways to consume electricity,” explains CEO and co-founder Jaakko Rauhala, a former consultant in energy technology. “The actual method is known as ‘demand response’. Basically that is a way for electricity consumers to get paid for adjusting their energy consumption, based on a utility company’s demand.

“For example if there is a lot of wind power production and suddenly the wind drops or the weather changes and the utility company is running power grids they need to balance that reduction — and the way to do that is either you can fire up natural gas turbines or you can reduce power consumption… Our product estimates how much can we reduce electricity consumption at any given minute. We are [targeting] heating and cooling devices because they consume a lot of electricity.”

“The way we see this is this is a way we can help our customers electrify their building stocks faster because it makes their investments more lucrative and in addition we can then help them use more renewable electricity because we can shift the use from fossil fuels to other areas. And in that we hope to help push for a more greener power grid,” he adds.

Kapcity’s approach is applicable in deregulated energy markets where third parties are able to play a role offering energy saving services and fluctuations in energy demand are managed by an auction process involving the trading of surplus energy — typically overseen by a transmission system operator — to ensure energy producers have the right power balance to meet customer needs.

Demand for energy can fluctuate regardless of the type of energy production feeding the grid but renewable energy sources tend to increase the volatility of energy markets as production can be less predictable versus legacy energy generation (like nuclear or burning fossil fuels) — wind power, for example, depends on when and how strongly the wind is blowing (which both varies and isn’t perfectly predictable). So as economies around the world dial up efforts to tackle climate change and hit critical carbon emissions reduction targets there’s growing pressure to shift away from fossil fuel-based power generation toward cleaner, renewable alternatives. And the real estate sector specifically remains a major generator of CO2, so is squarely in the frame for “greening”.

Simultaneously, decarbonization and the green shift looks likely to drive demand for smart solutions to help energy grids manage increasing complexity and volatility in the energy supply mix.

“Basically more wind power — and solar, to some extent — correlates with demand for balancing power grids and this is why there is a lot of talk usually about electricity storage when it comes to renewables,” says Rauhala. “Demand response, in the way that we do it, is an alternative for electricity storage units. Basically we’re saying that we already have a lot of electricity consuming devices — and we will have more and more with electrification. We need to adjust their consumption before we invest billions of dollars into other systems.”

“We will need a lot of electricity storage units — but we try to push the overall system efficiency to the maximum by utilising what we already have in the grid,” he adds.

There are of course limits to how much “adjustment” (read: switching off) can be done to a heating or cooling system by even the cleverest AI without building occupants becoming uncomfortable.

But Kapacity’s premise is that small adjustments — say turning off the boilers/coolers for five, 15 or 30 minutes — can go essentially unnoticed by building occupants if done right, allowing the startup to tout a range of efficiency services for its customers; such as a peak-shaving offering, which automatically reduces energy usage to avoid peaks in consumption and generate significant energy cost savings.

“Our goal — which is a very ambitious goal — is that the customers and occupants in the buildings wouldn’t notice the adjustments. And that they would fall into the normal range of temperature fluctuations in a building,” says Rauhala.

Kapacity’s algorithms are designed to understand how to make dynamic adjustments to buildings’ heating/cooling without compromising “thermal comfort”, as Rauhala puts it — noting that co-founder (and COO) Sonja Salo, has both a PhD in demand response and researched thermal comfort during a stint as a visiting researcher at UC Berkley — making the area a specialist focus for the engineer-led founding team.

At the same time, the carrots it’s dangling at the commercial real estate to sign up for a little algorithmic HVAC tweaking look substantial: Kapacity says its system has been able to achieve a 25% reduction in electricity costs and a 10% reduction in CO2-emissions in early pilots. Although early tests have been limited to its home market for now.

Its other co-founder, Rami El Geneidy, researched smart algorithms for demand response involving heat pumps for his PhD dissertation — and heat pumps are another key focus for the team’s tech, per Rauhala.

Heat pumps are a low-carbon technology that’s fairly commonly used in the Nordics for heating buildings, but whose use is starting to spread as countries around the world look for greener alternatives to heat buildings.

In the U.K., for example, the government announced a plan last year to install hundreds of thousands of heat pumps per year by 2028 as it seeks to move the country away from widespread use of gas boilers to heat homes. And Rauhala names the U.K. as one of the startup’s early target markets — along with the European Union and the U.S., where they also envisage plenty of demand for their services.

While the initial focus is the commercial real estate sector, he says they are also interested in residential buildings — noting that from a “tech core point of view we can do any type of building”.

“We have been focusing on larger buildings — multifamily buildings, larger office buildings, certain types of industrial or commercial buildings so we don’t do single-family detached homes at the moment,” he goes on, adding: “We have been looking at that and it’s an interesting avenue but our current pilots are in larger buildings.”

The Finnish startup was only founded last year — taking in a pre-seed round of funding from Nordic Makers prior to getting backing from YC — where it will be presenting at the accelerator’s demo day next week. (But Rauhala won’t comment on any additional fund raising plans at this stage.)

He says it’s spun up five pilot projects over the last seven months involving commercial landlords, utilities, real estate developers and engineering companies (all in Finland for now), although — again — full customer details are not yet being disclosed. But Rauhala tells us they expect to move to their first full commercial deals with pilot customers this year.

“The reason why our customers are interested in using our products is that this is a way to make electrification cheaper because they are being paid for adjusting their consumption and that makes their operating cost lower and it makes investments more lucrative if — for example — you need to switch from natural gas boilers to heat pumps so that you can decarbonize your building,” he also tells us. “If you connect the new heat pump running on electricity — if you connect that to our service we can reduce the operating cost and that will make it more lucrative for everybody to electrify their buildings and run their systems.

“We can also then make their electricity consumed more sustainable because we are shifting consumption away from hours with most CO2 emissions on the grid. So we try to avoid the hours when there’s a lot of fossil fuel-based production in the grid and try to divert that into times when we have more renewable electricity.

“So basically the big question we are asking is how do we increase the use of renewables and the way to achieve that is asking when should we consume? Well we should consume electricity when we have more renewable in the grid. And that is the emission reduction method that we are applying here.”

In terms of limitations, Kapacity’s software-focused approach can’t work in every type of building — requiring that real estate customers have some ability to gather energy consumption (and potentially temperature) data from their buildings remotely, such as via IoT devices.

“The typical data that we need is basic information on the heating system — is it running at 100% or 50% or what’s the situation? That gets us pretty far,” says Rauhala. “Then we would like to know indoor temperatures. But that is not mandatory in the sense that we can still do some basic adjustments without that.”

It also of course can’t offer much in the way of savings to buildings that are running 100% on natural gas (or oil) — i.e. with electricity only used for lighting (turning lights off when people are inside buildings obviously wouldn’t fly); there must be some kind of air conditioning, cooling or heat pump systems already installed (or the use of electric hot water boilers).

“An old building that runs on oil or natural gas — that’s a target for decarbonization,” he continues. “That’s a target where you could consider installing heat pumps and that is where we could help some of our customers or potential customers to say OK we need to estimate how much would it cost to install a heat pump system here and that’s where our product can come in and we can say you can reduce the operating cost with demand response. So maybe we should do something together here.”

Rauhala also confirms that Kapacity’s approach does not require invasive levels of building occupant surveillance, telling TechCrunch: “We don’t collect information that is under GDPR [General Data Protection Regulation], I’ll put it that way. We don’t take personal data for this demand response.”

So any guestimates its algorithms are making about building occupants’ tolerance for temperature changes are, therefore, not going to be based on specific individuals — but may, presumably, factor in aggregated information related to specific industry/commercial profiles.

The Helsinki-based startup is not the only one looking at applying AI to drive energy cost and emissions savings in the commercial buildings sector — another we spoke to recently is Düsseldorf-based Dabbel, for example. And plenty more are likely to take an interest in the space as governments start to pump more money into accelerating decarbonization.

Asked about competitive differentiation, Rauhala points to a focus on real-time adjustments and heat pump technologies.

“One of our key things is we’re developing a system so that we can do close to real-time control — very, very short-term control. That is a valuable service to the power grid so we can then quickly adjust,” he says. “And the other one is we are focusing on heat pump technologies to get started — heat pumps here in the Nordics are a very common and extremely good way to decarbonize and understanding how we can combine these to demand response with new heat pumps that is where we see a lot of advantages to our approach.”

“Heat pumps are a bit more technically complex than your basic natural gas boiler so there are certain things that have to be taken it account and that is where we have been focusing our efforts,” he goes on, adding: “We see heat pumps as an excellent way to decarbonize the global building stock and we want to be there and help make that happen.”

Per capita, the Nordics has the most heat pump installations, according to Rauhala — including a lot of ground source heat pump installations which can replace fossil fuel consumption entirely.

“You can run your building with a ground source heat pump system entirely — you don’t need any supporting systems for it. And that is the area where we here in Europe are more far ahead than in the U.S.,” he says on that.

“The U.K. government is pushing for a lot of heat pump installations and there are incentives in place for people to replace their existing natural gas systems or whatever they have. So that is very interesting from our point of view. The U.K. also has a lot of wind power coming online and there have been days when the U.K. has been running 100% with renewable electricity which is great. So that actually is a really good thing for us. But then in the longer term in the U.S. — Seattle, for example, has banned the use of fossil fuels in new buildings so I’m very confident that the market in the U.S. will open up more and quickly. There’s a lot of opportunities in that space as well.

“And of course from a cooling perspective air conditioning in general in the U.S. is very widespread — especially in commercial buildings so that is already an existing opportunity for us.”

“My estimate on how valuable electricity use for heating and cooling is it’s tens of billions of dollars annually in the U.S. and EU,” he adds. “There’s a lot of electricity being used already for this and we expect the market to grow significantly.”

On the business model front, the startup’s cloud software looks set to follow a SaaS model but the plan is also to take a commission of the savings and/or generated income from customers. “We also have the option to provide the service with a fixed fee, which might be easier for some customers, but we expect the majority to be under a commission,” adds Rauhala.

Looking ahead, were the sought-for global shift away from fossil fuels to be wildly successful — and all commercial buildings’ gas/oil boilers got replaced with 100% renewable power systems in short order — there would still be a role for Kapacity’s control software to play, generating energy cost savings for its customers, even though our (current) parallel pressing need to shrink carbon emissions would evaporate in this theoretical future.

“We’d be very happy,” says Rauhala. “The way we see emission reductions with demand response now is it’s based on the fact that we do still have fossil fuels power system — so if we were to have a 100% renewable power system then the electricity does nothing to reduce emissions from the electricity consumption because it’s all renewable. So, ironically, in the future we see this as a way to push for a renewable energy system and makes that transition happen even faster. But if we have a 100% renewable system then there’s nothing [in terms of CO2 emissions] we can reduce but that is a great goal to achieve.”

Powered by WPeMatico

Inflation may or may not prove transitory when it comes to consumer prices, but startup valuations are definitely rising — and noticeably so — in recent quarters.

That’s the obvious takeaway from a recent PitchBook report digging into valuation data from a host of startup funding events in the United States. While the data covers the U.S. startup market, the general trends included are likely global, given that the same venture rush that has pushed record capital into startups in the U.S. is also occurring in markets like India, Latin America, Europe and Africa.

The rapidly appreciating startup price chart is interesting, and we’ll unpack it. But the data also implies a high bar for future IPOs to not only preserve startup equity valuations at their point of exit, but exceed their private-market prices. A changing regulatory environment regarding antitrust could limit large future deals, leaving a host of startups with rich price tags and only one real path to liquidity.

Investors appear to be implicitly betting that the future IPO market will accelerate for a multiyear period at attractive prices.

That situation should be familiar: It’s the unicorn traffic jam that we’ve covered for years, in which the global startup markets create far more startups worth $1 billion and up than the public markets have historically accepted across the transom.

Let’s talk about some big numbers.

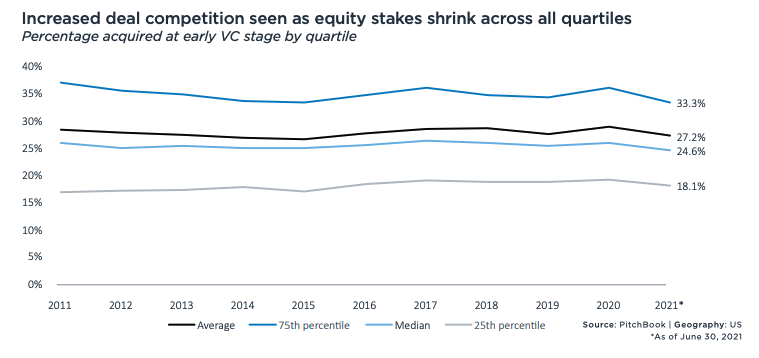

To summarize what PitchBook published: Round sizes are going up as valuations go up, and with the latter rising faster than the former, we’re not seeing investors get more ownership despite them having to spend more for deal access.

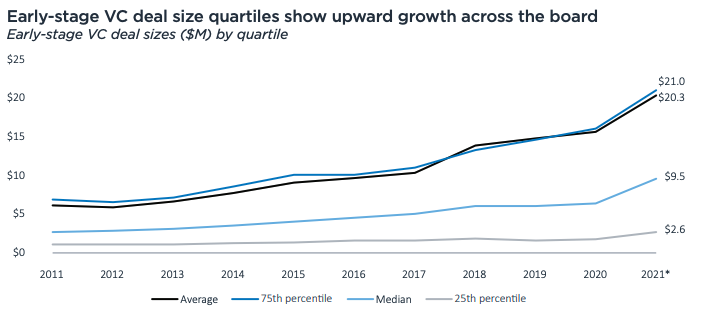

In the early-stage market, deal sizes are rising as follows:

Image Credits: PitchBook

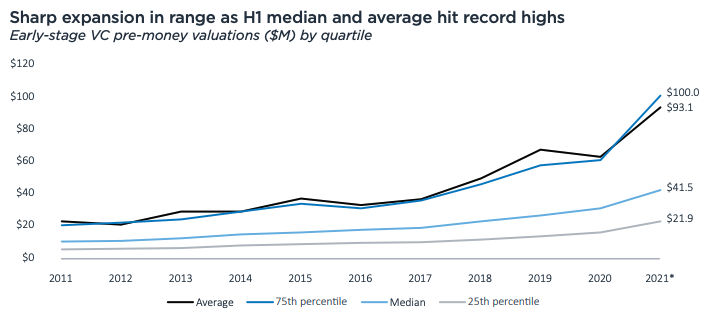

Prices are going up as well, as the following chart shows:

Image Credits: PitchBook

Which leads to the following decline in equity take rates:

Image Credits: PitchBook

Those charts belie somewhat how quickly venture capital is changing. For example, in 2020, the median early-stage value created between rounds was $16 million (or a 54% relative velocity, if you prefer). In 2021 thus far, it’s $39.4 million (120% relative velocity). And that 2020 figure was a prior record. It just got smashed.

The PitchBook dataset has other superlatives worth noting. Enterprise-focused seed pre-money valuations hit an average of $11 million in the first half of 2021, an all-time high. Early-stage valuations for enterprise-focused startups also hit fresh records — $92.7 million on average, $43 million median — this year after rising consistently since 2011.

And late-stage valuations for enterprise tech startups have gone vertical (chart on the right):

Powered by WPeMatico

Pry Financials wants to make startup finances approachable for its entire team, not just the people in charge of its accounting spreadsheets. The Y Combinator alum announced today it has raised $4.2 million from Global Founders Capital, Pioneer Fund, NOMO VC, Liquid2 and Hyphen Capital.

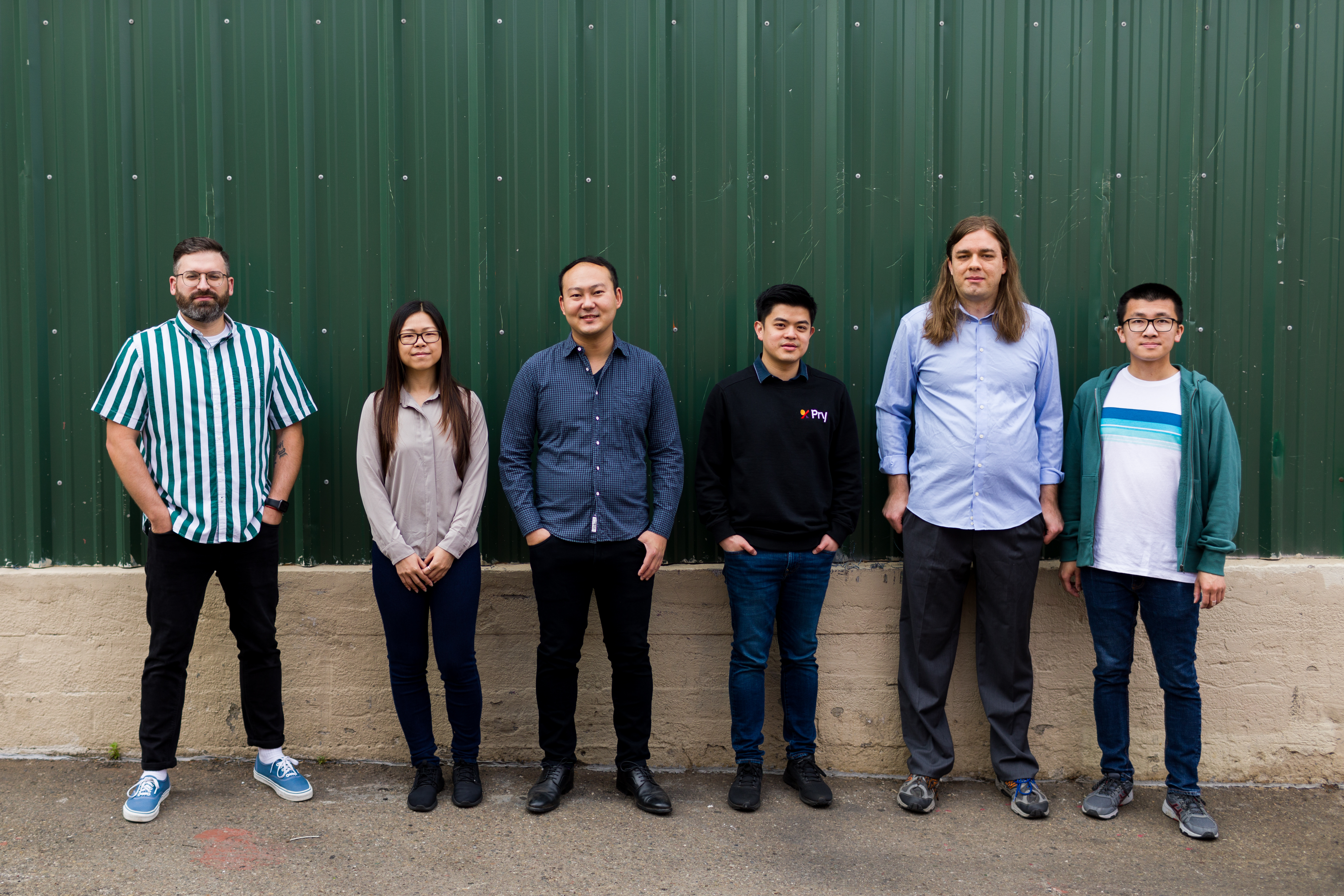

Launched in March, Pry now has more than 200 customers and claims it has grown 35% month-over-month since YC’s Demo Day. It was founded by Alex Sailer, Tiffany Wong, Hayden Jensen and Andy Su.

Before starting Pry, Su was co-founder of InDinero, another YC alum that started as a “Mint for small businesses” before pivoting to a full-service accounting company. InDinero launched while he was still a student at UC Berkeley, and Su eventually became responsible for its financial planning.

Pry Financials’ team. Image Credits: Pry Financials

He told TechCrunch that most startups can’t afford accounting software like Workday Adaptive Planning. Instead, they sometimes work with outsourced CFO services, but mostly rely on spreadsheets for everything: three-way forecasts, predicting runway, hiring and contractor budgets and investor updates.

“I was the chief technical officer and over the years, I also took on the finance function, so it was kind of a dual CTO/CFO role. This was 2010 through 2020 and as technology grew, the engineering and product teams got all sorts of new tools every six months or so, whereas the finance team was just stuck in Excel,” he said.

Started as a side project while Su was still at InDinero, Pry starts at just $50 a month and replaces those spreadsheets with easy-to-understand dashboards for accounting, financial planning and scenario modeling. The dashboards connect to QuickBooks, Xero or bank accounts, so numbers are continuously updated.

Pry’s clients typically start using it after they raise seed funding, because “for most first-time founders, that’s the most amount of money you have ever received, so you need to spend more time managing it and reviewing it every month. And you’re spending a lot of time on payroll each month,” Su said. Second-time founders, meanwhile, sign up for Pry because they are sick of Excel spreadsheets.

“Reviewing a spreadsheet is mind-numbingly hard,” said Su. “If you see a number that’s off, you get this weird formula if you didn’t do it yourself. Then you basically have to write a long email to the financial analyst who wrote it and hope that they get back to you before closing time.” For founders who need to update lenders or investors every month, this means a lot of work.

Pry makes the process more efficient by turning three-way reports — combinations of balance sheets, profit and loss statements and cashflow — into Financial Report dashboards, and then adding features like hiring plans, financial modeling and scenario planning.

The scenario planning feature serves as a sandbox, giving startup teams and their investors a way to predict how different situations will impact finances: for example, how much runway they have if they raise a certain amount of funding or adjust product pricing.

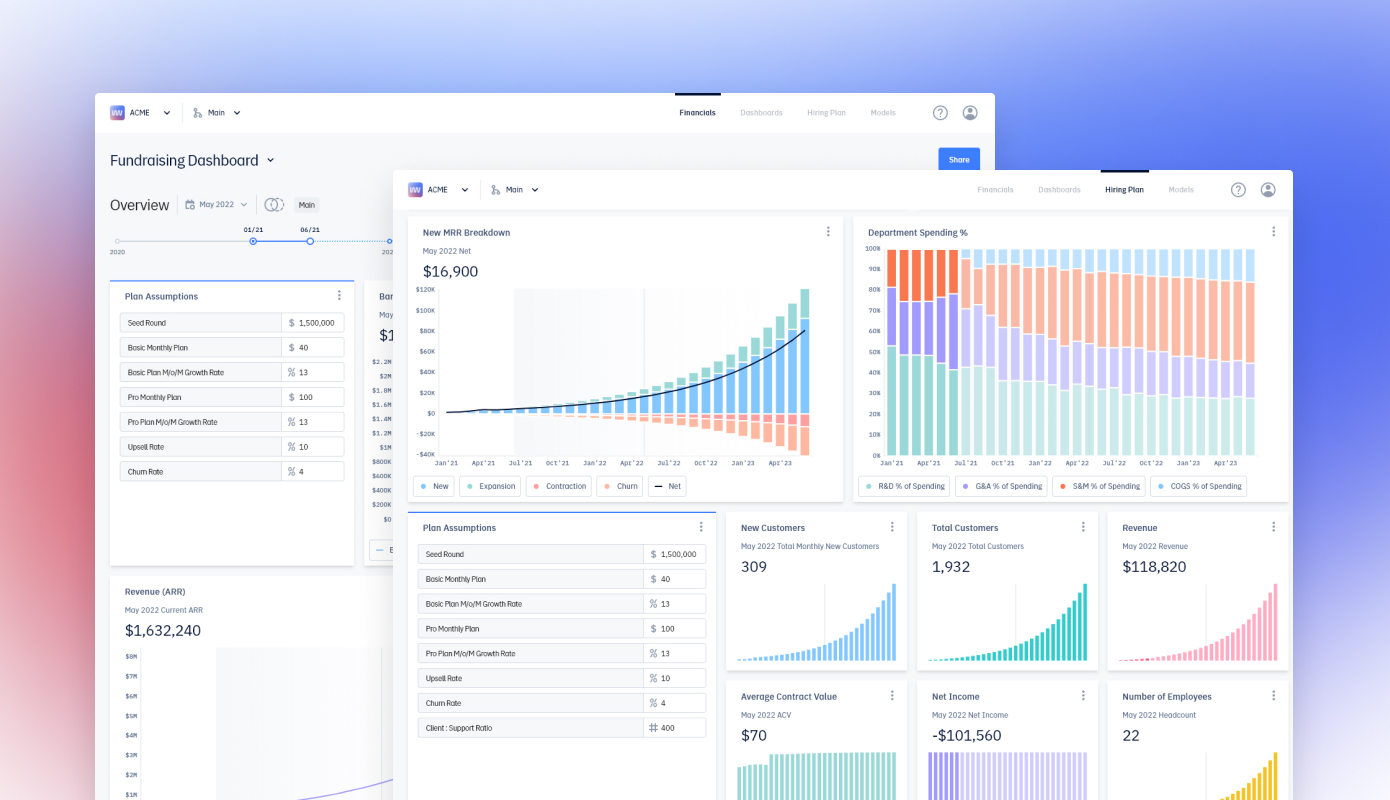

Fundraising dashboards created with Pry Financials. Image credits: Pry Financials

“We’re improving upon and trying to make decisions about the company in a collaborative way. The analogy we have is Git branching, where you have your main plan, and want to try something like a new revenue model or acquiring a business, but don’t want to mess with your current strategy,” said Su. “What you can do is create a completely new branch with, say, a new pricing strategy. You can make all the changes you want and then switch back to your old branch without worrying about overriding or conflicting with it.”

Those speculative branches are also continuously updated with the company’s most recent bank account and payroll information, so founders don’t need to recreate them from scratch if they want to revisit a potential scenario later.

Pry plans to build more complex predictive tools and also integrate industry standards, like statistic and benchmarks, into templates to help founders understand what targets they should set.

Because Pry is easier to manage than a set of Excel spreadsheets, Su said it’s helped startups spot important things. For example, one founder was able to find a way to save $15,000 by catching a tax issue. Pry also helps everyone at a startup understand its finances’ even if they haven’t worked with accounting spreadsheets before. The platform will add roles and permissions soon, so founders can give or restrict access to different people, like leaders of specific departments.

Su said Pry does not compete with the accounting services many startups rely on until they can hire a head of finance, but makes it easier for startups to collaborate with them since they can share their dashboards.

“Usually early on, you can outsource to a CFO firm. That’s the norm in the business and it works pretty well for most companies. You get a part-time CFO to work really hard for a month and get your fundraising structure done,” said Su, adding “we fit into that ecosystem well.”

Powered by WPeMatico

When Clarisse Beurrier was getting her education in chemical engineering and biotechnology, she already knew she wanted to make a difference; hence her participation in Effective Altruism Cambridge, an organization dedicated to helping smart and capable people target their philanthropic urges at the problems that will have the biggest actual impact on the world. She’s now a co-founder at Animal Alternative Technologies, a startup aiming to expedite the commercialization of cultured — aka “lab-grown” — meat.

Clarisse joined us for this week’s episode of Found, our interview podcast where we speak to a different founder every week. We talk about what Clarisse learned about the cultured meat and animal protein alternative industry from her work experience at a couple of startups, including HigherSteaks, and how that dovetailed with the work she was doing at school to help her identify a crucial gap between science and industry. We get into everything from convincing big, entrenched industry heavyweights to embrace change to the challenges of being a first-time founder right out of school.

We loved our time chatting with Clarisse, and we hope you love yours listening to the episode. And of course, we’d love if you can subscribe to Found in Apple Podcasts, on Spotify, on Google Podcasts or in your podcast app of choice. Please leave us a review and let us know what you think, or send us direct feedback either on Twitter or via email at found@techcrunch.com, or leave us a voicemail at (510) 936-1618. And please join us again next week for our next featured founder.

Powered by WPeMatico