Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Y Combinator kicked off its fourth-ever virtual Demo Day today, revealing the first half of its nearly 400-company batch. The presentation, YC’s biggest yet, offers a snapshot into where innovation is heading, from not-so-simple seaweed to a Clearco for creators.

The TechCrunch team stuck to its tradition of covering every single company live (but, you know, from home) so you’ll find all of the Day One companies here. For those who want a sampling of standouts, however, we’re also bringing you a host of our favorites from today’s one-minute pitch-off extravaganza.

As reporters, we’re constantly inundated with hundreds of pitches on a daily basis. The startups below caught our picky attention for a whole host of reasons, but that doesn’t mean other startups weren’t compelling or potential unicorns as well. Instead, consider the below to be a data point on which startups made us do a double take, be it due to the size of the market opportunity, the ambition exhibited by the founding team or an idea that was just too clever to pass up.

Genei is, dare I say, a refreshing mashup between robots and writers. The startup has a simple goal: Automatically summarize background reading so content creators can grab the top facts, attribute and move onto the next graf. Writing is innately an art, so I find Genei’s positioning as a tool for writers instead of a replacement out to take their jobs as smart. Better yet, it’s launching by targeting some of the hardest workers in our industry: freelance writers. These folks often have to balance consistent pitches, diverse assignments and tight deadlines for their livelihood, so I’d presume a sidekick can’t hurt. Down the road, I could totally see this startup playing the same role as a Grammarly: a helpful extension of workflows that optimizes the way people who write for a living, write. — Natasha

Powered by WPeMatico

On the heels of Heroes announcing a $200 million raise earlier today, to double down on buying and scaling third-party Amazon Marketplace sellers, another startup out of London aiming to do the same is announcing some significant funding of its own. Olsam, a roll-up play that is buying up both consumer and B2B merchants selling on Amazon by way of Amazon’s FBA fulfillment program, has closed $165 million — a combination of equity and debt that it will be using to fuel its M&A strategy, as well as continue building out its tech platform and to hire more talent.

Apeiron Investment Group — an investment firm started by German entrepreneur Christian Angermayer — led the Series A equity round, with Elevat3 Capital (another Angermayer firm that has a strategic partnership with Founders Fund and Peter Thiel) also participating. North Wall Capital was behind the debt portion of the deal. We have asked and Olsam is only disclosing the full amount raised, not the amount that was raised in equity versus debt. Valuation is also not being disclosed.

Being an Amazon roll-up startup from London that happens to be announcing a fundraise today is not the only thing that Olsam has in common with Heroes. Like Heroes, Olsam is also founded by brothers.

Sam Horbye previously spent years working at Amazon, including building and managing the company’s business marketplace (the B2B version of the consumer marketplace); while co-founder Ollie Horbye had years of experience in strategic consulting and financial services.

Between them, they also built and sold previous marketplace businesses, and they believe that this collective experience gives Olsam — a portmanteau of their names, “Ollie” and “Sam” — a leg up when it comes to building relationships with merchants; identifying quality products (versus the vast seas of search results that often feel like they are selling the same inexpensive junk as each other); and understanding merchants’ challenges and opportunities, and building relationships with Amazon and understanding how the merchant ecosystem fits into the e-commerce giant’s wider strategy.

Olsam is also taking a slightly different approach when it comes to target companies, by focusing not just on the usual consumer play, but also on merchants selling to businesses. B2B selling is currently one of the fastest-growing segments in Amazon’s Marketplace, and it is also one of the more overlooked by consumers. “It’s flying under the radar,” Ollie said.

“The B2B opportunity is very exciting,” Sam added. “A growing number of merchants are selling office supplies or more random products to the B2B customer.”

Estimates vary when it comes to how many merchants there are selling on Amazon’s Marketplace globally, ranging anywhere from 6 million to nearly 10 million. Altogether those merchants generated $300 million in sales (gross merchandise value), and it’s growing by 50% each year at the moment.

And consolidating sellers — in order to achieve better economies of scale around supply chains, marketing tools and analytics, and more — is also big business. Olsam estimates that some $7 billion has been spent cumulatively on acquiring these businesses, and there are more out there: Olsam estimates there are some 3,000 businesses in the U.K. alone making more than $1 million each in sales on Amazon’s platform.

(And to be clear, there are a number of other roll-up startups beyond Heroes also eyeing up that opportunity. Raising hundreds of millions of dollars in aggregate, others that have made moves this year include Suma Brands [$150 million], Elevate Brands [$250 million], Perch [$775 million], factory14 [$200 million], Thrasio [currently probably the biggest of them all in terms of reach and money raised and ambitions], Heyday, The Razor Group, Branded, SellerX, Berlin Brands Group [X2], Benitago, Latin America’s Valoreo and Rainforest and Una Brands out of Asia.)

“The senior team behind Olsam is what makes this business truly unique,” said Angermayer in a statement. “Having all been successful in building and selling their own brands within the market and having worked for Amazon in their marketplace team – their understanding of this space is exceptional.”

Powered by WPeMatico

Even as hundreds of millions of people in India have a bank account, only a tiny fraction of this population invests in any financial instrument.

Fewer than 30 million people invest in mutual funds or stocks, for instance. In recent years, a handful of startups have made it easier for users — especially the millennials — to invest, but the figure has largely remained stagnant.

Now, an Indian startup believes that it has found the solution to tackle this challenge — and is already seeing good early traction.

Nishchay AG, former director of mobility startup Bounce, and Misbah Ashraf, co-founder of Marsplay (sold to Foxy), founded Jar earlier this year.

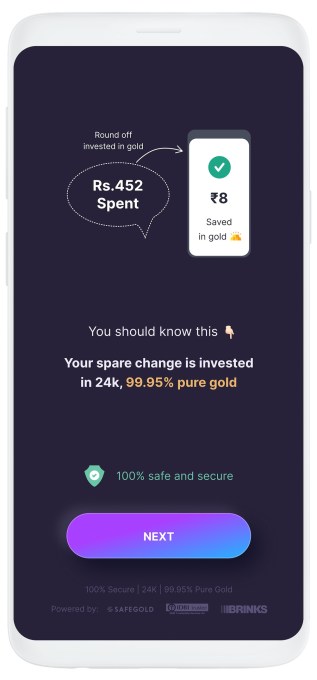

The startup’s eponymous six-month-old Android app enables users to start their savings journey for as little as 1 Indian rupee.

Users on Jar can invest in multiple ways and get started within seconds. The app works with Paytm (PhonePe support is in the works) to set up a recurring payment. (The startup is the first to use UPI 2.0’s recurring payment support.) They can set up any amount between 1 Indian rupee to 500 for daily investments.

The Jar app can also glean users’ text messages and save a tiny amount based on each monetary transaction they do. So, for instance, if a user has spent 31 rupees in a transaction, the Jar app rounds that up to the nearest tenth figure (40, in this case) and saves nine rupees. Users can also manually open the app and spend any amount they wish to invest.

Once users have saved some money in Jar, the app then invests that into digital gold.

The startup is using gold investment because people in the South Asian market already have an immense trust in this asset class.

India has a unique fascination for gold. From rural farmers to urban working class, nearly everyone stashes the yellow metal and flaunts jewelry at weddings.

Indian households are estimated to have a stash of over 25,000 tons of the precious metal whose value today is about half of the country’s nominal GDP. Such is the demand for gold in India that the South Asian nation is also one of the world’s largest importers of this precious metal.

Jar’s Android app (Image Credits: Jar)

“When you’re thinking about bringing the next 500 million people to institutional savings and investments, the onus is on us to educate them on the efficacies of the other instruments that are in the market,” said Nishchay.

“We want to give them the instrument they trust the most, which is gold,” he said. The startup plans to eventually offer several more investment opportunities, he said.

The founders met several years ago when they were exploring if MarsPlay and Bounce could have any synergies. They stayed in touch and, last year during one of their many conversations, realized that neither of them knew much about investments.

“That’s when the dots started to connect,” said Misbah, drawing stories from his childhood. “I come from a small town in Bihar called Bihar Sharif. During my childhood days, I saw my family deeply troubled with debt because of poor financial decisions and no savings,” he said.

“We both understand what a typical middle class family goes through. Someone who comes from this background never had any means in the past but their aspirations are never-ending. So when you start earning, you immediately start to spend it all,” said Nishchay.

“The market needs products that will help them get started,” he said.

That idea, which is similar to Acorn and Stash’s play in the U.S. market, is beginning to make inroads. The app has already amassed about half a million downloads, the founders said. Investors have taken notice, too.

On Wednesday, Jar announced it has raised $4.5 million from a clutch of high-profile investors, including Arkam Ventures, Tribe Capital, WEH Ventures, and angels including Kunal Shah (founder of CRED), Shaan Puri (formerly with Twitch), Ali Moiz (founder of Stonks), Howard Lindzon (founder of Social Leverage), Vivekananda Hallekere (co-founder of Bounce), Alvin Tse (of Xiaomi) and Kunal Khattar (managing partner at AdvantEdge).

“Over 400 million Indians are about to embrace digital financial services for the first time in their lives. Jar has built an app that is poised to help them — with several intuitive ways including gamification — start their investment journey. We love the speed at which the team has been executing and how fast they are growing each week,” said Arjun Sethi, co-founder of Tribe Capital, in a statement.

Transactions and AUM on the Jar app are surging 350% each month, said Nishchay. The startup plans to broaden its product offerings in the coming days, he said.

Powered by WPeMatico

Can reading glasses actually be cool? A new eyewear company called Cheeterz Club thinks so. The startup is working to change the perception of reading glasses from being just cheap, disposable items you pick up from a rotating display rack at your local drug store to being something you’d actually be proud to wear. To do so, the company is designing its glasses with quality lenses and frames in a range of styles, while still keeping the pricing affordable.

The startup — whose name is a reference to the slang term for glasses, “cheaters” — was founded by Jennifer Farrelly, whose background includes work in advertising and sales at companies like Uber and Virool.

She said the idea to make a better set of readers came to her because she found herself frustrated by the current options on the market.

“It all started a few years ago. My friends were posting on social media these really depressing comments and posts like: ‘I’m old and turning into my parents, this is awful.’ And I [thought to myself] why does it have to be like that? I feel just as young today as I did 10 years ago,” Farrelly explains. “Why are my friends and I feeling forced to feel old because of something that happens overnight?,” she says, of what felt like the sudden onset of middle age and the hardships it brings.

What’s worse, Farrelly says, is that when you finally make your way to the drugstore to pick out some reading glasses, all you’ll find are bad, plastic pairs that both look and feel cheap.

“That’s even more demoralizing,” she adds.

Image Credits: Cheeterz Club

So Farrelly teamed up with a former Warby Parker and Pair Eyewear head of Product, Lee Zaro, to design a new line of more fashion-forward eyewear.

Zaro, who is based in the LA area, immediately saw the opportunity.

“Drugstore reading glasses are typically poor in quality, and can feel like they are designed with our parents in mind, leaving a huge unmet need for sophisticated eyewear options,” he said. “When Jennifer approached me to help design her first line of eyewear, I knew it was a brilliant idea.”

To differentiate itself from lower-end readers, Cheeterz Club glasses are made with 100% acetate and feature spring hinges and stainless steel. The lenses, meanwhile, offer more clarity than is often found in reading glasses.

Image Credits: Cheeterz Club

Typically, ophthalmic plastic lens materials have an Abbe value — a measure of the degree at which light is dispersed or separated — between 30 and 58. The higher number offers better optical performance. Crown glass can have an Abbe value as high as 59, but polycarbonate readers (like those from Warby Parker, Farrelly notes) would have an Abbe value of 30. Cheeterz Club lenses, which are CR-39 lenses, are at at 58. This is a difference you can tell when trying the glasses on alongside your drugstore readers.

Cheeterz’ lenses also offer 100% UVA/UVB protection, and are oil and water repellent. They can optionally be bought in one of eight fashion tints, from pink to blue, or in two sun shades. Consumers can also opt to add Blue Light coating to help with screen-induced eye fatigue or they can choose Progressive lenses, which combine distance vision with a reading lens.

Tints are an extra $10, Blue Light protection is $25 and Progressive lenses are $40.99 — lower than market rates.

At launch, Cheeterz Club offers 42 different styles ranging from traditional to the more modern, starting at $28.99.

Farrelly says finding the right price was key, because unlike regular glasses, consumers often buy multiple pairs of readers to leave around the house or car, pack in purses and bags, and so on.

“If I break something that costs me a couple hundred dollars, I’d be really upset about it,” she says. “But at a drugstore price of under $30, I can have them in all sorts of colors and different tints.”

For Farrelly, making the startup a success goes beyond bringing higher-quality reading glasses to market. It’s also about serving a demographic that often gets overlooked.

“Founders in their forties do not get representation, and it’s unfortunate. And there are also people in their forties and fifties that have disposable income and are looking for cute things. They’re spending so much money on facial creams and Botox,” she says, “but then you’re forced to put this really ugly pair of glasses on your face that make you feel bad about yourself.”

While Cheeterz Club today is selling direct to the consumer, the company is talking to eye doctors, boutiques and others who may eventually resell for them, as more of a B2B model. It’s also testing selling on Amazon with one pair of Blue Light glasses.

Cheeterz Club plans to start discussing fundraising with seed investors later this fall.

Update, 8/31/21, 5:30 PM ET: Cheeterz Club incorrectly shared the number of frames available at launch. An earlier version of this article said it was 14, it’s actually 42, they said. We’ve updated with the new information.

Powered by WPeMatico

Heroes, one of the new wave of startups aiming to build big e-commerce businesses by buying up smaller third-party merchants on Amazon’s Marketplace, has raised another big round of funding to double down on that strategy. The London startup has picked up $200 million, money that it will mainly be using to snap up more merchants. Existing brands in its portfolio cover categories like babies, pets, sports, personal health and home and garden categories — some of them, like PremiumCare dog chews, the Onco baby car mirror, gardening tool brand Davaon and wooden foot massager roller Theraflow, category best-sellers — and the plan is to continue building up all of these verticals.

Crayhill Capital Management, a fund based out of New York, is providing the funding, and Riccardo Bruni — who co-founded the company with twin brother Alessio and third brother Giancarlo — said that the bulk of it will be going toward making acquisitions, and is therefore coming in the form of debt.

Raising debt rather than equity at this point is pretty standard for companies like Heroes. Heroes itself is pretty young: it launched less than a year ago, in November 2020, with $65 million in funding, a round comprised of both equity and debt. Other investors in the startup include 360 Capital, Fuel Ventures and Upper 90.

Heroes is playing in what is rapidly becoming a very crowded field. Not only are there tens of thousands of businesses leveraging Amazon’s extensive fulfillment network to sell goods on the e-commerce giant’s marketplace, but some days it seems we are also rapidly approaching a state of nearly as many startups launching to consolidate these third-party sellers.

Many a roll-up play follows a similar playbook, which goes like this: Amazon provides the marketplace to sell goods to consumers, and the infrastructure to fulfill those orders, by way of Fulfillment By Amazon and its Prime service. Meanwhile, the roll-up business — in this case Heroes — buys up a number of the stronger companies leveraging FBA and the marketplace. Then, by consolidating them into a single tech platform that they have built, Heroes creates better economies of scale around better and more efficient supply chains, sharper machine learning and marketing and data analytics technology, and new growth strategies.

What is notable about Heroes, though — apart from the fact that it’s the first roll-up player to come out of the U.K., and continues to be one of the bigger players in Europe — is that it doesn’t believe that the technology plays as important a role as having a solid relationship with the companies it’s targeting, key given that now the top marketplace sellers are likely being feted by a number of companies as acquisition targets.

“The tech is very important,” said Alessio in an interview. “It helps us build robust processes that tie all the systems together across multiple brands and marketplaces. But what we have is very different from a SaaS business. We are not building an app, and tech is not the core of what we do. From the acquisitions side, we believe that human interactions ultimately win. We don’t think tech can replace a strong acquisition process.”

Image Credits: Heroes

Heroes’ three founder-brothers (two of them, Riccardo and Alessio, pictured above) have worked across a number of investment, finance and operational roles (the CVs include Merrill Lynch, EQT Ventures, Perella Weinberg Partners, Lazada, Nomura and Liberty Global) and they say there have been strong signs so far of its strategy working: of the brands that it has acquired since launching in November, they claim business (sales) has grown five-fold.

Collectively, the roll-up startups are raising hundreds of millions of dollars to fuel these efforts. Other recent hopefuls that have announced funding this year include Suma Brands ($150 million); Elevate Brands ($250 million); Perch ($775 million); factory14 ($200 million); Thrasio (currently probably the biggest of them all in terms of reach and money raised and ambitions), Heyday, The Razor Group, Branded, SellerX, Berlin Brands Group (X2), Benitago, Latin America’s Valoreo and Rainforest and Una Brands out of Asia.

The picture that is emerging across many of these operations is that many of these companies, Heroes included, do not try to make their particular approaches particularly more distinctive than those of their competitors, simply because — with nearly 10 million third-party sellers today on Amazon globally — the opportunity is likely big enough for all of them, and more, not least because of current market dynamics.

“It’s no secret that we were inspired by Thrasio and others,” Riccardo said. “Combined with COVID-19, there has been a massive acceleration of e-commerce across the continent.” It was that, plus the realization that the three brothers had the right e-commerce, fundraising and investment skills between them, that made them see what was a ‘perfect storm’ to tackle the opportunity, he continued. “So that is why we jumped into it.”

In the case of Heroes, while the majority of the funding will be used for acquisitions, it’s also planning to double headcount from its current 70 employees before the end of this year with a focus on operational experts to help run their acquired businesses.

Powered by WPeMatico

Founded in 2012, Whoop is far from a household name in the world of fitness trackers. But over the years, the company has attracted its share of converts. It hasn’t had any issue attracting venture capital over the years, either. Last time we checked in on the Boston-based company was in late-2019, when it raised $55 million. Now it’s back with a massive $200 million raise.

The Series F round brings Whoop’s total funding to nearly $405 million — a pretty massive investment for a company of its size. The round, led by SoftBank’s Vision Fund 2, puts the valuation at a jaw-dropping $3.6 billion valuation.

Additional investors include IVP, Cavu Venture Partners, Thursday Ventures, GP Bullhound, Accomplice, NextView Ventures and Animal Capital. They join a long list of former backers, including the National Football League Players Association, Jack Dorsey and a number of professional athletes.

The company’s targeting of athletes marks a strong contrast with leading consumer wearables like the Apple Watch and Fitbit. In fact, the company has a specific offering for sports teams, as well as solutions for businesses, healthcare and government/defense.

Whoop’s name made the rounds recently when Fitbit announced a “Daily Readiness Score” for the Charge 5, which many likened to the company’s more advanced analytics.

The company cites “rapid growth” in its membership offering over the past year as a motivation behind seeking additional funding. That was likely driven, in part, by the decision in 2019 to make the $500 wearable free, while focusing on a subscription service that starts at $18 a month for an 18-month membership (the shorter the membership, the more the monthly fee).

Whoop is eying international expansion beyond the U.S. and using the massive influx of cash on R&D for its hardware, software and analytics solutions. Money will also go toward expanding headcount, which is currently in excess of 500 (with nearly half of those employees having joined in the past year).

“We are thrilled to deepen our partnership with SoftBank as we grow internationally,” founder and CEO Will Ahmed said in a release. “While we have experienced amazing growth in the past year, the potential of our technology and the vast market for health monitoring remains largely untapped.”

Powered by WPeMatico

Amsterdam-based challenger bank Bunq is updating its service with a handful of new features. In addition to Dutch, German and French bank account numbers, existing and new users in Spain can now get a Spanish IBAN.

European IBANs are supposed to work across Europe. Your employer or internet provider can’t force you to get a local IBAN. And yet, that’s rarely the case. When you move to another European country, chances are the first thing you do is that you open a local bank account.

While European fintech companies have teamed up to create a lobbying effort called “Accept my IBAN”, some challenger banks, such as Bunq, are adding the ability to get local bank account numbers as an intermediary fix. Bunq users can also choose to associate IBANs from multiple European countries with their account. You have to pay a one-time fee of €9.99 every time you add a new local IBAN.

Bunq is also drawing inspiration from Revolut, Wise, Vivid Money and others as you’ll soon be able to receive, convert and hold other currencies. For instance, if you’re going to a non-Euro country for an internship, you will be able to receive your salary on your Bunq account. Bunq is starting with USD accounts with plans to add more currencies down the road.

Other new features include the ability to receive reminders the day before a direct debit occurs, a subscription view that lets you view current subscriptions and when they’re set to expire, an improved search feature and the ability to automatically accept direct debits and payment requests from your friends — make sure you set up a limit before enabling that feature.

Bunq recently announced plans to raise $228 million (€193 million) at a $1.9 billion valuation (€1.6 billion). The investment round hasn’t been approved by the Netherlands’ banking regulator just yet. Bunq is currently operating in 29 European markets.

Powered by WPeMatico

Apna, a 21-month-old startup that is helping millions of blue- and gray-collar workers in India upskill themselves, find communities and land jobs, is inching closer to becoming the fastest tech firm in the world’s second-largest internet market to become a unicorn.

Tiger Global is in advanced stages of talks to lead a $100 million round in Apna, according to four sources familiar with the matter. The proposed terms value the startup at over $1 billion, the sources said.

The round hasn’t closed yet, so terms of the deal may change, some of the sources cautioned.

If the round materializes, Apna will become the youngest Indian startup to attain the much-coveted unicorn status. The startup, which launched its app in December 2019, was valued at $570 million in its Series B financing round in June this year. It will also be the third financing round Apna would have secured in a span of less than seven months.

Tiger Global, an existing investor in Apna, didn’t respond to a request for comment earlier this month. Apna founder and chief executive Nirmit Parikh, an Apple alum, declined to comment on Tuesday.

Indian cities are home to hundreds of millions of low-skilled workers who hail from villages in search of work. Many of them have lost their jobs amid the coronavirus pandemic that has slowed several economic activities in the world’s second-largest internet market.

Apna, whose name is inspired from a 2019 Bollywood song, is building a scalable networking infrastructure so that these workers can connect to the right employers and secure jobs. On its eponymous Android app, users also upskill themselves, review their interview skills and become eligible for more jobs.

As of June this year, Apna had amassed over 10 million users and was facilitating more than 15 million job interviews each month. All jobs listed on the Apna platform are verified by the startup and free of cost for the candidates.

The startup has also partnered with some of India’s leading public and private organizations and is providing support to the Ministry of Minority Affairs of India, National Skill Development Corporation and UNICEF YuWaah to provide better skilling and job opportunities to candidates.

The investment talks further illustrate Tiger Global’s growing interest in India. The New York-headquartered firm has made several high-profile investments in India this year, including in BharatPe, Gupshup, DealShare, Classplus, Urban Company, CoinSwitch Kuber and Groww.

More than two dozen Indian startups have become a unicorn this year, up from 11 last year, as several high-profile investors, including Tiger Global, SoftBank and Falcon Edge, have increased the pace of their investments in the world’s second most populous nation.

Apna also counts Insight Partners, Lightspeed and Sequoia Capital among its existing investors.

Powered by WPeMatico

Startups are hard work, but the complexities of global supply chains can make running hardware companies especially difficult. Instead of existing within a codebase behind a screen, the key components of your hardware product can be scattered around the world, subject to the volatility of the global economy.

I’ve spent most of my career establishing global supply chains, setting up manufacturing lines for 3D printers, electric bicycles and home fitness equipment on the ground in Mexico, Hungary, Taiwan and China. I’ve learned the hard way that Murphy’s law is a constant companion in the hardware business.

But after more than a decade of work on three different continents, there are a few lessons I’ve learned that will help you avoid unnecessary mistakes.

Shipping physical products is quite different from “shipping” code — you have to pay a considerable amount of money to transport products around the world. Of course, shipping costs become a line item like any other as they get baked into the overall business plan. The issue is that those costs can change monthly — sometimes drastically.

At this time last year, a shipping container from China cost $3,300. Today, it’s almost $18,000 — a more than fivefold increase in 12 months. It’s safe to assume that most 2020 business plans did not account for such a cost increase for a key line item.

Shipping a buggy hardware product can be exponentially costlier than shipping buggy software. Recalls, angry customers, return shipping and other issues can become existential problems.

Similar issues also arise with currency exchange rates. Contract manufacturers often allow you to maintain cost agreements for any fluctuations below 5%, but the dollar has dropped much more than 5% against the yuan compared to a year ago, and hardware companies have been forced to renegotiate their manufacturing contracts.

As exchange rates become less favorable and shipping costs increase, you have two options: Operate with lower margins, or pass along the cost to the end customer. Neither choice is ideal, but both are better than going bankrupt.

The takeaway is that when you set up your business, you need to prepare for these possibilities. That means operating with enough margin to handle increased costs, or with the confidence that your end customer will be able to handle a higher price.

Over the past year, many businesses have lost billions of dollars in market value because they didn’t order enough semiconductors. As the owner of a hardware company, you will encounter similar risks.

The supply for certain components, like computer chips, can be limited, and shortages can arise quickly if demand increases or supply chains get disrupted. It’s your job to analyze potential choke points in your supply chain and create redundancies around them.

Powered by WPeMatico

The digital transformation currently sweeping society has likely reached your favorite local restaurant.

Since 2013, Boston-based Toast has offered bars and eateries a software platform that lets them manage orders, payments and deliveries.

Over the last year, its customers have processed more than $38 billion in gross payment volume, so Alex Wilhelm analyzed the company’s S-1 for The Exchange with great interest.

“Toast was last valued at just under $5 billion when it last raised, per Crunchbase data,” he writes. “And folks are saying that it could be worth $20 billion in its debut. Does that square with the numbers?”

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

Airbnb, DoorDash and Coinbase each debuted at past Y Combinator Demo Days; as of this writing, they employ a combined 10,000 people.

Today and tomorrow, TechCrunch reporters will cover the proceedings at YC’s Summer 20201 Demo Day. In addition to writing up founder pitches, they’ll also rank their favorites.

Even remotely, I can feel a palpable sense of excitement radiating from our team — anything can happen at YC Demo Day, so sign up for Extra Crunch to follow the action.

Thanks very much for reading; I hope you have an excellent week.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Ron Miller/TechCrunch

In August 2006, AWS activated its EC2 cloud-based virtual computer, a milestone in the cloud infrastructure giant’s development.

“You really can’t overstate what Amazon was able to accomplish,” writes enterprise reporter Ron Miller.

In the 15 years since, EC2 has enabled clients of any size to test and run their own applications on AWS’ virtual machines.

To learn more about a fundamental technological shift that “would help fuel a whole generation of startups,” Ron interviewed EC2 VP Dave Brown, who built and led the Amazon EC2 Frontend team.

Image Credits: Jasmin Merdan (opens in a new window)/ Getty Images

Most managers agree that OKRs foster transparency and accountability, but running a team effectively has different challenges when workers are attending all-hands meetings from their kitchen tables.

Instead of just discussing key metrics before board meetings or performance reviews, make them part of the day-to-day culture, recommends Jeremy Epstein, Gtmhub’s CMO.

“Strengthen your team by creating authentic workplace transparency using numbers as a universal language and providing meaning behind your team’s work.”

Image Credits: Getty Images under an Andrii Yalanskyi (opens in a new window) license

Many founders must overcome a few emotional hurdles before they’re comfortable pitching a potential investor face-to-face.

To alleviate that pressure, Unicorn Capital founder Evan Fisher recommends that entrepreneurs use pre-pitch meetings to build and strengthen relationships before asking for a check:

“This is the ‘we actually aren’t looking for money; we just want to be friends for now’ pitch that gets you on an investor’s radar so that when it’s time to raise your next round, they’ll be far more likely to answer the phone because they actually know who you are.”

Pre-pitches are good for more than curing the jitters: These conversations help founders get a better sense of how VCs think and sometimes lead to serendipitous outcomes.

“Investors are opportunists by necessity,” says Fisher, “so if they like the cut of your business’s jib, you never know — the FOMO might start kicking hard.”

Image Credits: MirageC (opens in a new window) / Getty Images

FischerJordan’s Deeba Goyal and Archita Bhandari break down the pandemic’s impact on alternative lenders, specifically what they had to do to survive the crisis, taking a look at smaller lenders including Credibly, Kabbage, Kapitus and BlueVine.

“Only those who were able to find a way through the complexities of their existing capital sources were able to maintain their performance, and the rest were left to perish or find new funding avenues,” they write.

Image Credits: Nigel Sussman (opens in a new window)

Customer engagement software company Freshworks’ S-1 filing depicts a company that’s experiencing accelerating revenue growth, “a great sign for the health of its business,” reports Alex Wilhelm in this morning’s The Exchange.

“Most companies see their growth rates decline as they scale, as larger denominators make growth in percentage terms more difficult.”

Studying the company’s SEC filing, he found that “Freshworks isn’t a company where we need to cut it lots of slack, as we might with an adjusted EBITDA number. It is going public ready for Big Kid metrics.”

Powered by WPeMatico