Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Few people thought of virtual events before the pandemic struck, but this format has fulfilled a unique and important need for companies and organizations large and small during the pandemic. But what will virtual events’ value be as more of the world attempts to return to life before COVID-19?

To find out, we caught up with top executives and investors in the sector to learn about the big trends they’re seeing — as the sequel to this survey we did in March 2020.

Certain use cases have been proven, they say. Today, you can find numerous small niche events available year-round that might have been buried in the back of a larger in-person conference before 2020. For organizations, internal virtual events can also be instrumental in helping connect and promote engagement for remote-first teams.

However, some respondents acknowledged that low-quality virtual events are growing ever more common, and everyone agreed that there is much more work to be done.

We surveyed:

With the pandemic hopefully becoming more manageable soon, do you feel a return to in-person events is inevitable?

Certain types of events will go back to in person. Obviously, something to do with a President’s Club — the company rewards you with a party in Hawaii — that kind of thing will not go virtual. I think events more focused on increasing reach will continue to trend toward virtual.

“Hybrid is just another buzzword to say that both online and offline events formats will coexist. Of course they will.”

We’re also seeing that many events are getting smaller, more niche. Before the pandemic, if we look at a general pediatric conference, for example, an attendee may only be interested in two topics out of the 200 offered. But now we’ve seen that there’s a rise in many niche events that focus on very specific topics, which helps streamline these events for attendees.

I think such events are still going to happen virtually just because they’re easier to organize and people can have more in-depth conversations. Internal virtual events for employees is another category that is getting more traction, because companies have been going remote. So many the internal events like the company happy hour — events that help employees engage better — we think that’s still going to happen virtually. So there are a number of use cases we think will continue to be virtual and are probably better virtual.

Help TechCrunch find the best growth marketers for startups.

Provide a recommendation in this quick survey and we’ll share the results with everybody.

What sort of trends do you think will emerge once in-person events are possible again?

Another important trend we’re seeing is that a lot of organizers have begun hosting events more frequently. They were doing large conferences in the past, but now they’re pivoting or they’re rethinking their strategy. They realize that hosting maybe 10 events a year is better than hosting one big event every year. A traditional conference is usually multiday, with maybe 200 different topics and 100 different speakers. Now a lot of people are thinking about spreading it out throughout the year.

Powered by WPeMatico

Berlin Brands Group (BBG) — one of the new wave of e-commerce startups hoping to build lucrative economies of scale around buying up smaller brands that sell on marketplaces like Amazon and using technology to run and scale them more efficiently — has picked up a big round of funding to fill out that mission. The startup has closed a round of $700 million, comprising both equity and debt, which it will use in part to continue building its fulfillment and logistics infrastructure, as well as its tech platform, and in part to buy more companies.

BBG confirmed that the investment — one of the biggest to date in the space — boosts its valuation to over $1 billion.

Bain Capital is leading the equity portion of this round. The deal will also see it buy out a previous investor, Ardian, for an undisclosed amount that is separate to the $700 million raise.

This funding round is the second announced by BBG this year. In January it announced it would be investing $302 million off its own balance sheet for M&A, and in April it announced a debt round of $240 million. This latest $700 million is different in that it includes the equity component alongside the equity.

BBG got its start initially developing its own products and selling them on Amazon and other marketplaces — founder and CEO Peter Chaljawski was a DJ in a previous life and started with a focus on audio equipment he developed for himself.

Over time, he saw an opportunity to diversify that into a wider consolidation play, where BBG would also acquire and merge third-party brands into its business, tapping into the opportunity to provide the owners of the third-party businesses an exit route and bring those smaller brands more scale, more marketing nous and more tech to improve the efficiency of their operations.

Today the mix totals 3,700 products and 14 own brands, including Klarstein (kitchen appliances), auna (home electronics and music equipment), Capital Sports (home fitness) and blumfeldt (garden). BBG says it has access to some 1.5 billion e-commerce customers across various marketplaces where it sells goods in Europe, the U.K., the U.S. and Asia. Notably, unlike many others in the same space as BBG, it is focused on more than Amazon, with some 100 channels in 28 countries.

That list of “many others in the same space” is a long one and seemingly growing by the day. Yesterday, two of them — Heroes and Olsam — respectively raised $200 million and $165 million. Others leveraging the opportunity of consolidating merchants that sell via Fulfillment by Amazon include Suma Brands ($150 million), Elevate Brands ($250 million), Perch ($775 million), factory14 ($200 million), Thrasio (currently probably the biggest of them all in terms of reach and money raised and ambitions), Heyday, The Razor Group, Branded, SellerX, Berlin Brands Group (X2), Benitago, Latin America’s Valoreo and Rainforest and Una Brands out of Asia.

As more startups enter the fray, battling to buy the best of the third-party brands will become more of a challenge, and so the backing of Bain should help BBG shore up against that competition.

“With Bain Capital’s commitment and the additional funding secured, we have set our next milestone on our path to building a global house of brands,” said Chaljawski in a statement. “This allows us to tackle strategic goals of acquiring and developing brands globally, as well as the operational and logistical expansion. Bain Capital’s experience working with founders worldwide will help us continue our evolution as a leading e-commerce company in scaling brands.”

“BBG is a disruptive leader in the rapidly changing consumer goods space. Their ability to develop and scale brands that meet current consumer trends through their highly efficient e-commerce platform gives the company tremendous growth potential in a fast-growing market,” added Miray Topay, MD at Bain Capital Private Equity. “We have partnered with many founder-led management teams and look forward to helping Peter and his team achieve their goal of becoming a global leader in consumer e-commerce”.

Powered by WPeMatico

In the United States, a 401(k) plan is an employer-sponsored defined-contribution pension account. However, with legacy institutional investing, most of these have at least some level of fossil fuel involvement, and, let’s face it, very few of us really know. Now a startup plans to change that.

California-based startup Sphere wants to get employees to ask their employers for investment options that are not invested in fossil fuels. To do that it’s offering financial products that make it easier — it says — for employers to offer fossil-free investment options in their 401(k) plans. This could be quite a big movement. Sphere says there are more than $35 trillion in assets in retirement savings in the U.S. as of Q1 2021.

It’s now raised a $2 million funding round led by climate tech-focused VC Pale Blue Dot. Also participating were climate-focused investors including Sundeep Ahuja of Climate Capital. Sphere is also a registered “Public Benefit Corporation,” allowing it to campaign in public about climate change.

Alex Wright-Gladstein, CEO and founder of Sphere said: “We are proud to be partnering with Pale Blue Dot on our mission to reverse climate change by making our money talk. Heidi, Hampus, and Joel have the experience and drive to help us make big changes on the short seven-year time scale that we have to limit warming to 1.5°C.” Wright-Gladstein has also teamed up with sustainable investing veteran Jason Britton of Reflection Asset Management and BITA custom indexes.

Wright-Gladstein said she learned the difficulty of offering fossil-free options in 401(k) plans when running her previous startup, Ayar Labs. She tried to offer a fossil-free option for employees, but found out it took would take three years to get a single fossil-free option in the plan.

Heidi Lindvall, general partner at Pale Blue Dot, said: “We are big believers in Sphere’s unique approach of raising awareness through a social movement while offering a range of low-cost products that address the structural issues in fossil-free 401(k) investing.”

Powered by WPeMatico

Forum Brands, an e-commerce acquisition platform, announced today that it has secured $100 million in debt funding from TriplePoint Capital.

The financing comes just over two months after the startup raised $27 million in an equity funding round led by Norwest Venture Partners.

Brenton Howland, Ruben Amar and Alex Kopco founded New York-based Forum Brands in the summer of 2020, during the height of the COVID-19 pandemic.

“We’re buying what we think are A+ high-growth e-commerce businesses that sell predominantly on Amazon and are looking to build a portfolio of standalone businesses that are category leaders, on and off Amazon,” Howland told me at the time of the company’s last raise. “A source of inspiration for us is that we saw how consumer goods and services changed fundamentally for what we think is going to be for decades and decades to come, accelerating the shift toward digital.”

Since we covered the company in June, Forum Brands says it has acquired several new brands, including Bonza, a seller of pet products, and Simka Rose, a baby-focused brand specializing in eco-friendly products. Simka sells in the U.S. and the EU and is an example of how Forum is expanding globally, Amar said.

Howland and Amar emphasize that the Forum team continues to focus on quality over quantity when evaluating potential acquisitions. Although they meet with 15-20 founders a week, they are selective in which companies they choose to acquire.

“We continue to be a quality-first buyer, and not quantity-driven,” Amar said, noting that the company will still help a company build its brand even if it does not yet meet Forum’s quality threshold or if the founders are just not ready to sell.

The new funds will be used to, naturally, acquire more e-commerce companies. As part of the debt financing, Sajal Srivastava, co-CEO and co-founder of TriplePoint Capital, will be joining Forum’s board of directors.

“We are impressed not only by Forum’s long-term strategy and ability to leverage technology and deep collective e-commerce and M&A experience but also by how Forum cultivates relationships with their sellers both before and after partnering with them,” he said in a written statement.

At the time of its June raise, Forum had about 20 employees. As of today, it has about 40.

Forum’s technology employs “advanced” algorithms and over 100 million data points to populate brand information into a central platform in real time, instantly scoring brands and generating accurate financial metrics.

On August 31, we covered the news that on the heels of Heroes announcing a $200 million raise to double down on buying and scaling third-party Amazon Marketplace sellers, another startup out of London aiming to do the same announced some significant funding of its own. Olsam, a roll-up play that is buying up both consumer and B2B merchants selling on Amazon by way of Amazon’s FBA fulfillment program, closed on $165 million — a combination of equity and debt that it will be using to fuel its M&A strategy, as well as continue building out its tech platform and to hire more talent.

Powered by WPeMatico

Even without staffing shortages, local merchants have difficulty answering calls while all hands are busy, and Goodcall wants to alleviate some of that burden from America’s 30 million small businesses.

Goodcall’s free cloud-based conversational platform leverages artificial intelligence to manage incoming phone calls and boost customer service for businesses of all sizes. Former Google executive Bob Summers left Google back in January, where he was working on Area 120 — an internal incubator program for experimental projects — to start Goodcall after recognizing the call problem, noting that in fact 60% of the calls that come into merchants go unanswered.

“It’s frustrating for you and for the person calling,” Summers told TechCrunch. “Every missed call is a lost opportunity.”

Goodcall announced its launch Wednesday with $4 million in seed funding led by strategic investors Neo, Foothill Ventures, Merus Capital, Xoogler Ventures, Verissimo Ventures and VSC Ventures, as well as angel investors including Harry Hurst, founder and co-CEO of Pipe.com, and Zillow co-founder Spencer Rascoff.

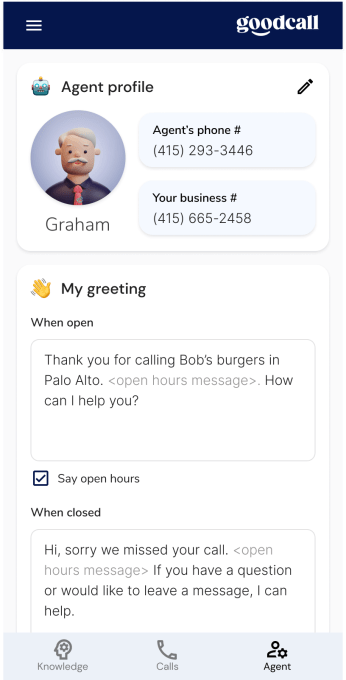

Goodcall mobile agent. Image Credits: Goodcall

Restaurants, shops and merchants can set up on Goodcall in a matter of minutes and even establish a local phone number to free up an owner’s mobile number from becoming the business’ main line. The service is initially deployed in English and the company has plans to operate in Spanish, French and Hindi by 2022.

Merchants can choose from six different assistant voices and monitor the call logs and what the calls were about. Goodcall can also capture consumer sentiment, Summers said.

The company offers three options, including its freemium service for solopreneurs and business owners, which includes up to 500 minutes per month of Goodcall services for a single phone line. Up to five additional locations and five staff members costs $19 per month for the Pro level, or the Premium level provides unlimited locations and staff for $49 per month.

During the company’s beta period, Goodcall was processing several thousands of calls per month. The new funding will be used to continue to offer the free service, hire engineers and continue product development.

In addition to the funding round, Goodcall is unveiling a partnership with Yelp to tap into its database of local businesses so that those owners and managers can easily deploy Goodcall. Yelp data shows that more than 500,000 businesses opened during the pandemic. The company pulls in from Yelp a merchant’s open hours, location, if they offer Wi-Fi and even their COVID policy.

“We are partnering with Yelp, which has the best data on small businesses, and other large distribution channels to get our product to market,” Summers said. “We are bringing technology into an industry that hasn’t innovated since the 1980s and democratizing conversational AI for small businesses that are the main driver of job creation, and we want to help them grow.”

Powered by WPeMatico

Duda announced Wednesday that it acquired Canada-based Snipcart, a startup that enables businesses to add a shopping cart to their websites.

The acquisition is Palo Alto-based Duda’s first deal, and follows the website development platform’s $50 million Series D round in June that brings its total funding to $100 million to date. Duda co-founder and CEO Itai Sadan declined to comment on the acquisition amount.

Duda, which works with digital agencies and SaaS companies, has approximately 1 million published paying sites, and the acquisition was driven by the company seeing a boost in e-commerce websites as a result of the global pandemic, he told TechCrunch.

This was not just about a technology acquisition for Duda, but also a talented team, Sadan said. The entire Snipcart team of 12 is staying on, including CEO Francois Lanthier Nadeau; the companies will be fully integrated by 2022 and the first collaborative versions will come out.

When he met the Snipcart team, Sadan thought they were “super experienced and held the same values.”

“We share many of the same types of customers, many of which are API-first,” he added. “If our customers need more headless commerce, they can build their own front end using Snipcart. Their customers will benefit from us growing the team — we plan to double it in the next year and roll out more features at a faster pace.”

The global retail e-commerce market is estimated to grow by 50% to $6.3 trillion by 2024, according to Statista. Duda itself has experienced a year over year increase of 265% in e-commerce sites being built on its platform, which Sadan said was what made Snipcart an attractive acquisition to further accelerate and manage its growth that includes over 17,000 customers.

Together, the companies will offer new capabilities, like payment and membership tools inside of the Duda platform. Many of Duda’s customers come with inventory and don’t want to manage it on another e-commerce platform, so Snipcart will be that component for taking their inventory and making it shoppable on the web.

“Everyone is thinking about how to introduce transactions into their websites and web experiences, and that is what we were looking for in an e-commerce platform,” Sadan said.

Powered by WPeMatico

Direct to consumer online sales have helped a number of female-focused startups get products to market in recent years — often pitching better designed and generally more thoughtful feminine hygiene products than mainstream staples.

The lack of innovation in the mainstream market for feminine hygiene has certainly created a gap for startups to address. Examples in recent years include companies like Thinx (absorbent panties for menstruation) and Flex (a disc-shaped tampon alternative for wearing during sex). Or Daye — which makes CBD tampons for simultaneously treating period cramps.

Even so, there still hasn’t been a critical mass of product innovation in the category — to the point where alternatives can trickle down (no pun intended) and influence the trajectory of the mainstream market. The core products on shelves are, all too often, depressingly familiar — disposable pads and tampons — even if they may (sometimes) now be made of organic cotton or have some other mild design tweaks.

The most notable change to the available product mix is probably period pants — which have recently started to appear on mainstream shop shelves and seem to be selling well in markets like the U.K., as The Guardian reported recently.

In the average drug store, the other non-disposable alternative you’ll most likely see is the menstrual cup. Which is not at all new — but has finally got traction beyond its original (very) niche community of users, which is another signal that consumers are more open to trying different solutions to deal with their monthly bleeding versus the same old throwaway wadding.

While free bleeding — an old movement which has also seen a bit of wider pickup in recent years — can also be seen, at least in part, as a protest against the poor quality of mainstream products for periods.

All of which makes this forthcoming product launch rather interesting: Meet LastPad, a reusable (rather than disposable) sanitary towel.

Image Credits: LastPad

The first thing you’ll likely notice is that the pad is black in color — which certainly rings the changes versus the usual white stick-on fodder. The company behind LastPad says it worked with an unnamed “luxury lingerie manufacture” on look and feel — and, well, judging by the product shots alone it shows.

The bigger behind-the-scenes change is that it’s been designed for sustained, repeat usage. So each LastPad comes with its own fabric pouch (in a range of colors) for folding up and storing after use (and until you get a chance to pop it in the wash). The pad can also stay in its pouch for washing so there’s no need for additional handling until you’re getting it out of the washing machine to dry.

LastPad is the brainchild of Danish designer and entrepreneur Isabel Aagaard, whose company LastObject has — for the past three years — been taking aim at the wastefulness of single-use hygiene and beauty products, designing reusable alternatives for what are unlovely but practical items — like Q-Tips and tissues*.

In total, LastObject has sold around 1.5 million products so far — across its existing range of beauty, hygiene and travel-focused items. But LastPad marks its first push into a really female-focused product category.

A reusable (washable) sanitary pad is clearly a big step up on the design challenge front versus making reusable (silicone) Q-Tips or (cotton) tissues or makeup rounds — because of the complexity involved with designing a wearable, intimate hygiene product that can handle the variable and often messy nature of periods, and keep doing so, use after use.

It needs to be both comfortable and reliable — as so many disposable pads actually aren’t.

So it’s not too surprising that, per Aagaard, the company has been working on designing and prototyping LastPad for two years. Now they’re finally ready to bring it to market — launching the LastPad on Kickstarter today — with a goal of shipping to early backers next February.

“We’re seeing amazing conversions [for the LastPad pre-campaign],” she says, discussing how much demand they’re expecting. “This is our sixth [crowdfunder] campaign — and it’s looking really good. So I think the demand is bigger than I actually imagined. Because this is also the first product that is only for women. And we were very much in doubt that we should put it on Kickstarter because it’s a very male-dominated platform but it’s looking really positive.”

“We already started working on this two years ago so it’s really been a process. And also because we wanted it to be really innovative. Because right now you can see on the market there’ll be pads that are more like home sewn or do it yourself — and we wanted to really make an exclusive, very, very innovative version of that — that has a lot of the benefits that the single-use version has.”

Image Credits: LastPad

Each LastPad is made up of three layers: A woven top to help keep the pad feeling dry against the skin by quickly funnelling menstrual fluids down into — layer two — a central absorbent section (made of bamboo) — which sits above a TPU base to ensure no risk of leaks.

“The first layer is a woven material that is really, really fine — it has a little bit of silver in it so that the odours will disappear. It’s also woven with small funnels so that the blood disappears very quickly into the middle layer — because it’s so important that you’re not like wet. Because that’s awful. So it dries quite quickly when you’re wearing it,” explains Aagaard. “And then the middle layer is 100% bamboo — it’s absorbent like crazy; 40% more absorbent than, for example, cotton. And it also has anti-bacterial properties. And then the bottom layer is a TPU [Thermoplastic Polyurethane] — which is just a leakproof cover; it’s comfortable, it’s not like a plastic bag but it does make sure that you cannot bleed through it.”

While disposable sanitary towels rely on an adhesive layer to enable the consumer fix the pad to their panties, LastPad has to do that a bit differently too given it’ll be going through the wash. So the pads have wings — which wrap around the gusset of the panties and fix together underneath with a (soft) Velcro fastening.

That’s not all: There’s a (sticky) silicone strip running around the back side of the pad which helps prevent it from moving around — and, per Aagaard, will happily survive repeat washing (in fact if it’s not used for a time, she says dust may temporarily reduce the stickiness — but says that immediately resolves just by wetting it again).

“Where I felt that we really made a huge difference is that on the back side of the pad — it has wings [with] a Velcro [fastener] that’s completely soft and you don’t feel it; even if you’re biking — that was like the big test — and then it has a silicone strip in the back and at the bottom, like a sticky silicone… so it doesn’t move around in your pants.”

Practically speaking, it won’t be possible for a LastPad user to use just one LastPad to see them through their period — given the need to wash and dry them between uses. So a pack of several reusable pads will be necessary to entirely replace disposable pads and ensure there’s always a clean towel available to swap out the used pad.

But LastObject’s idea is, much like you own several pairs of socks and briefs, you’ll have a set of LastPads to see you through until after laundry day.

The product comes in three different sizes and thicknesses to cater to different flow levels, too. So the consumer may end up owning a range of reusable LastPads — from a panty liner option to a day flow and heavier-duty night pads.

Image Credits: LastPad

“It wasn’t as simple as I thought it was going to be — but that’s also because you have to understand the viscoses of blood, for example, compared to water,” Aagaard tells TechCrunch. “And also a flow — it’s not just blood. There’s a lot of other stuff that come out. So it’s taking all of these things into consideration.”

“We’ve been testing it for so long,” she goes on. “That was our main thing with this product. A lot of the other [LastObject products] were very much about printing it, looking at it. Using it of course — but it took us long before we had it in actually a silicone form. Because that is also expensive. Whereas [LastPad] we could sew quite quickly just here at the office and [test it]… So we’ve just been testing it constantly — how’s the feeling? Getting it out to a lot of different women that wear different panties that have different cycles. So it’s really been about testing.”

Pricing for LastPad will be around $60 for three pads — so around $20 per pad. Which is obviously a lot more expensive than the per unit cost of disposable towels. But LastObject says it will offer packs so if a consumer buys more pads it should shrink the per pad cost a little.

Aagaard says the product has been tested to withstand at least 240 washes — which she suggests will mean it’s able to last at least a couple of years, saving likely hundreds of disposable pads from being consumed in its stead.

Although it’s maybe less likely to save consumers money — depending on which disposable pads you’d buy and how many you’d used per cycle (basic disposable pads can cost as little as ~20c each) — as LastObject recommends owning nine of its LastPads which could cost around $80 or more). But the target user is evidently someone with enough disposable income to be able to pay a premium for an eco alternative.

Given the price-point, it does also look more expensive than the menstrual cup — an existing and highly practical alternative to disposable menstrual products — which can cost around $30 (for one reusable cup; and you can get away with owning just one) and, typically, a cup will also last for years as it’s made of silicone.

However the menstrual cup won’t suit every woman — and does require access to clean water to rinse and sanitize — so having more non-disposable alternatives for periods is great.

Aagaard says she’s a fan of the menstrual cup but suggests LastPad can still be useful for its users as a back-up to catch any leaks and/or provide an added layer of reassurance.

While, with period pants, she says the issue she finds unpleasant is the feeling of wetness when wearing them.

On LastPad’s environmental credentials, the washing process required to keep reusing the pad does obviously require some resources (water, soap etc.) but — as is the case with other LastObject products — the company’s claim is that it’s still substantially greener to wash and reuse its non-disposable products versus consuming and binning single-use items that have to be continually produced and shipped out (generating ongoing CO2). Such products can also pollute the environment after they’ve been thrown away — and plastic waste is of course a huge global problem (including from thrown-away sanitary products).

LastObject will be publishing a third-party LCA (lifecycle assessment) for LastPad to back up its eco claims for the reusable product — comparing it to using disposable sanitary pads. But Aagaard is confident it will be substantially better when compared against most disposable alternatives.

“You’ll be putting a wash on anyway; [LastPads] don’t take up that much space; you’re not going to wash them just them; it is with your other laundry; and if you wash them at a cold wash I think that the LCA report will look really good,” she suggests when we ask about the eco credentials.

“We’re doing this with all our products where we’re taking them through a third party who’s testing everything and putting them up against [alternatives] and having these considerations with CO2, with water, with chemicals — with the whole pack… So we’ll be doing that more specifically; right now… the alternative of a [disposable] pad — they are so differently produced. It’s crazy. So I could say the worst [for comparative purposes] or I could say the best — and ours is about 12x better than that.”

“When we got the LCA report for the LastTissue and LastSwab they were so much better than I have imagined,” she adds.

From this year the European Union has started banning the sale of some single-use plastic items (such as Q-tips and disposable cutlery) as reducing plastic waste is one of the goals for regional lawmakers. And — globally — regulators are increasingly looking for quick wins to shrink the environmental impact of the fast moving consumer goods market’s long standing love affair with plastic.

But some disposable product categories are simply more essential than others — which makes it hard for lawmakers to just ban plenty of wasteful, polluting products. So developing innovative, reusable alternatives is one way to help lighten the usage load.

“The most sustainable pad that you can ever have is actually the one that you don’t produce but that would just be free bleeding — and I think that 99% of women are not ready for that,” adds Aagaard. “So can we make some solutions on some of the things that we actually have to take care of?”

While LastObject is sticking with Kickstarter to get LastPad to market, Aagaard confirms that once they see how much early adopter demand it’s getting they plan to produce enough to also sell via some of the other outlets where they currently sell their products — such as e-commerce sites like Amazon and of course their own web shop.

So far, the U.S. has been the main market for LastObject’s reusable wares, per Aagaard — which she attributes to mostly using Kickstarter to build a community of users. But she adds that the company is starting to see more traction in Europe as it’s increased the number of regional distributors it works with.

So what’s next for the company after LastPad? The product direction they’ll take is an active discussion, she says.

“We can keep going the beauty way, we can go more personal care but we have to also [not] go in too many directions. I personally have a lot of fun things I want to do in the bathroom still, because I feel like it’s a space where not a lot of designers have actually really been investigating some of the products that we’re using. Both in beauty but also in personal care. Like in the floss and toothbrush but also in diapers and wipes and all of that. So I think that there’s some innovation that could be really fun. But… this one took two years and I’m so happy about the result and I couldn’t have spent two months less on it. Then we wouldn’t have had the solutions that we’ve gotten to. So that feels very important.”

Image Credits: LastPad

*Washable tissues are also of course not new. Indeed, Wikipedia credits the invention of pocket squares to wipe the nose to King Richard II of England who reigned in the 14th century. But the traditional (fabric) handkerchief — which was used, laundered and reused — became yet another casualty of the switch to single-use, disposable, cheap consumer goods that’s since been shown to have such high environmental costs. So perhaps reversing this damaging default will bring more ‘historical product innovation’ back into fashion as societies look to apply a modern ‘circular economy’ lens.

Powered by WPeMatico

Itamar Jobani was a software developer working for a medical company and “hated that time of the month” when he had to use the company’s chosen reimbursement tool.

“It was full of friction and as part of the company’s wellness team, I felt an urge to take care of the employee experience and find a better tool,” Jobani told TechCrunch. “I looked for something, but didn’t find it, so I tried to build it myself.”

What resulted was PayEm, an Israeli company he founded with Omer Rimoch in 2019 to be a spend and procurement platform for high-growth and multinational organizations. Today, it announced $27 million in funding that includes $7 million in seed funding, led by Pitango First and NFX, with participation by LocalGlobe and Fresh Fund, as well as $20 million in Series A funding led by Glilot+.

The company’s technology automates the reimbursement, procurement, accounts payable and credit card workflows to manage all of the requests and invoices, while also creating bills and sending payments to over 200 territories in 130 currencies.

It gives company finance teams a real-time look at what items employees are asking for funds to buy, and what is actually being spent. For example, teams can submit a request and go through an approval flow that can be customized with purchasing codes tied to a description of the transaction. At the same time, all transactions are continuously reconciled versus having to spend hours at the end of the month going through paperwork.

“Organizations are running in a more democratized way with teams buying things on behalf of the organization,” Jobani said. “We built a platform to cater to those needs, so it’s like a disbursement platform instead of a finance team always being in charge.”

The global B2B payments market is valued at $120 trillion annually and is expected to reach $200 trillion by 2028, according to payment industry newsletter Nilson Report. PayEm is among many B2B payments startups attracting venture capital — for example, last month, Nium announced a $200 million in Series D funding at a $1 billion valuation. Paystand raised $50 million in Series C funding to make B2B payments cashless, while Dwolla raised $21 million for its API that allows companies to build and facilitate fast payments.

Meanwhile, PayEm itself saw accelerated growth in the second quarter of 2021, including increasing its transaction volume by four times over the previous quarter and generating millions of dollars in revenue. It now boasts a list of hundreds of customers like Fiverr, JFrog and Next Insurance. It also launched new features like the ability to create corporate cards.

The company, which also has an office in New York, has 40 employees currently, and the new funds will enable the company to triple its headcount, focusing on hiring in the United States, and to bring additional features and payment capabilities to market.

“Each person can have a budget and a time frame for making the purchase, while accounting still feels in control,” Jobani added. “Everyone now has the full context and the right budget line item.”

Powered by WPeMatico

After a 17-hour marathon through nearly 200 startup pitches, the Equity team was fired up to get back on Twitter and chat through some early trends and favorites from the first day of Y Combinator’s demo party. We’ll be back on the air tomorrow, so make sure you’re following the show on Twitter so you don’t miss out.

What did Natasha and Alex chat about? The following:

TechCrunch has extensive coverage of the day on the site, so there’s lots to dig into if you are in the mood. More tomorrow!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

In the customer service industry, your accent dictates many aspects of your job. It shouldn’t be the case that there’s a “better” or “worse” accent, but in today’s global economy (though who knows about tomorrow’s) it’s valuable to sound American or British. While many undergo accent neutralization training, Sanas is a startup with another approach (and a $5.5M seed round): using speech recognition and synthesis to change the speaker’s accent in near real time.

The company has trained a machine learning algorithm to quickly and locally (that is, without using the cloud) recognize a person’s speech on one end and, on the other, output the same words with an accent chosen from a list or automatically detected from the other person’s speech.

It slots right into the OS’s sound stack so it works out of the box with pretty much any audio or video calling tool. Right now the company is operating a pilot program with thousands of people in locations from the USA and UK to the Philippines, India, Latin America, and others. Accents supported will include American, Spanish, British, Indian, Filipino and Australian by the end of the year.

To tell the truth, the idea of Sanas kind of bothered me at first. It felt like a concession to bigoted people who consider their accent superior and think others below them. Tech will fix it… by accommodating the bigots. Great!

But while I still have a little bit of that feeling, I can see there’s more to it than this. Fundamentally speaking, it is easier to understand someone when they speak in an accent similar to your own. But customer service and tech support is a huge industry and one primarily performed by people outside the countries where the customers are. This basic disconnect can be remedied in a way that puts the onus of responsibility on the entry-level worker, or one that puts it on technology. Either way the difficulty of making oneself understood remains and must be addressed — an automated system just lets it be done more easily and allows more people to do their job.

It’s not magic — as you can tell in this clip, the character and cadence of the person’s voice is only partly retained and the result is considerably more artificial sounding:

But the technology is improving and like any speech engine, the more it’s used, the better it gets. And for someone not used to the original speaker’s accent, the American-accented version may very well be more easily understood. For the person in the support role, this likely means better outcomes for their calls — everyone wins. Sanas told me that the pilots are just starting so there are no numbers available from this deployment yet, but testing has suggested a considerable reduction of error rates and increase in call efficiency.

It’s good enough at any rate to attract a $5.5M seed round, with participation from Human Capital, General Catalyst, Quiet Capital, and DN Capital.

“Sanas is striving to make communication easy and free from friction, so people can speak confidently and understand each other, wherever they are and whoever they are trying to communicate with,” CEO Maxim Serebryakov said in the press release announcing the funding. It’s hard to disagree with that mission.

While the cultural and ethical questions of accents and power differentials are unlikely to ever go away, Sanas is trying something new that may be a powerful tool for the many people who must communicate professionally and find their speech patterns are an obstacle to that. It’s an approach worth exploring and discussing even if in a perfect world we would simply understand one another better.

Powered by WPeMatico