Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

The coronavirus pandemic has thrown the fitness space for a loop. Caliber, a startup that focuses on one-to-one personal training, is today launching a brand new digital coaching platform on the heels of a $2.2 million seed round led by Trinity Ventures.

Caliber launched in 2018 with a content model, offering an email newsletter and a library of instructional fitness content.

“My co-founders started testing the idea of coaching people individually and that’s where the light bulb really went off,” said co-founder and CEO Jared Cluff. “They saw that more than anything, people need expert guidance and a really genuinely personalized plan for their fitness routine.”

That was the origin of Caliber as it is known today.

When users join the platform they are matched with a Caliber coach. The company says that it brings on about five of every 100 applications for coaches on the platform, accepting only the very best trainers.

These coaches then take into account the goals of users and build out a personalized fitness plan in conjunction with the user, which begins with a video or phone consultation. Once the plan, which is comprised of strength training, cardio and nutrition, is finalized, the coach loads it into the app.

Users then follow the instructions from their instructor via the app and log their progress. Interestingly, these aren’t live video appointments with a trainer, but rather an asynchronous ongoing conversation with a coach that is facilitated by the app.

Users can also integrate their Apple Health app with Caliber to track nutrition and cardio, giving the coach a full 360-degree view of their progress.

Alongside providing feedback and encouragement, the coach ultimately provides a layer of accountability.

This combination of real human coaching in a less synchronous, time-intensive manner has allowed for Caliber to charge at a higher price than your standard workout generator apps but come in much lower than the average cost of an actual, in-person personal trainer.

Most Caliber users will pay between $200 and $400 per month to use the platform. Coaches, which are 1099 workers on Caliber, take home 60% of the revenue generated from users.

Pre-launch, Caliber has more than tripled its membership across the last six months and increased the number of workouts per member by 150%, according to the company. Cluff says the startup is doing north of $1 million in annual recurring revenue.

Of the 41 trainers on the platform, 37% are female and about a quarter are non-white. On the HQ team, which totals seven people, one is female and two-thirds of the founding team are LGBTQ.

“The biggest challenge is not dissimilar to the challenge we faced at Blue Apron, where I was most recently, in that we wanted to create the category around meal kits,” said Cluff. “We want to build a category around fitness training in a space that is super fragmented with no branded leader.”

Powered by WPeMatico

As companies continue to shift more quickly to the cloud, pushed by the pandemic, startups like Armory that work in the cloud-native space are seeing an uptick in interest. Armory is a company built to be a commercial layer on top of the open-source continuous delivery project Spinnaker. Today, it announced a $40 million Series C.

B Capital led the round, with help from new investors Lead Edge Capital and Marc Benioff along with previous investors Insight Partners, Crosslink Capital, Bain Capital Ventures, Mango Capital, Y Combinator and Javelin Venture Partners. Today’s investment brings the total raised to more than $82 million.

“Spinnaker is an open-source project that came out of Netflix and Google, and it is a very sophisticated multi-cloud and software delivery platform,” company co-founder and CEO Daniel R. Odio told TechCrunch.

Odio points out that this project has the backing of industry leaders, including the three leading public cloud infrastructure vendors Amazon, Microsoft and Google, as well as other cloud players like CloudFoundry and HashiCorp. “The fact that there is a lot of open-source community support for this project means that it is becoming the new standard for cloud-native software delivery,” he said.

In the days before the notion of continuous delivery, companies moved forward slowly, releasing large updates over months or years. As software moved to the cloud, this approach no longer made sense and companies began delivering updates more incrementally, adding features when they were ready. Adding a continuous delivery layer helped facilitate this move.

As Odio describes it, Armory extends the Spinnaker project to help implement complex use cases at large organizations, including around compliance and governance and security. It is also in the early stages of implementing a SaaS version of the solution, which should be available next year.

While he didn’t want to discuss customer numbers, he mentioned JPMorgan Chase and Autodesk as customers, along with less specific allusions to “a Fortune Five technology company, a Fortune 20 Bank, a Fortune 50 retailer and a Fortune 100 technology company.”

The company currently has 75 employees, but Odio says business has been booming and he plans to double the team in the next year. As he does, he says that he is deeply committed to diversity and inclusion.

“There’s actually a really big difference between diversity and inclusion, and there’s a great Vernā Myers quote that diversity is being asked to the party and inclusion is being asked to dance, and so it’s actually important for us not only to focus on diversity, but also focus on inclusion because that’s how we win. By having a heterogeneous company, we will outperform a homogeneous company,” he said.

While the company has moved to remote work during COVID, Odio says they intend to remain that way, even after the current crisis is over. “Now obviously COVID been a real challenge for the world, including us. We’ve gone to a fully remote-first model, and we are going to stay remote-first even after COVID. And it’s really important for us to be taking care of our people, so there’s a lot of human empathy here,” he said.

But at the same time, he sees COVID opening up businesses to move to the cloud and that represents an opportunity for his business, one that he will focus on with new capital at his disposal. “In terms of the business opportunity, we exist to help power the transformation that these enterprises are undergoing right now, and there’s a lot of urgency for us to execute on our vision and mission because there is a lot of demand for this right now,” he said.

Powered by WPeMatico

Flash Express, a two-year-old logistics startup that works with e-commerce firms in Thailand, said on Monday it has raised $200 million in a new financing round as it looks to double down on a rapidly growing market spurred by demand due to the coronavirus pandemic.

The funding, a Series D, was led by PTT Oil and Retail Business Public Company Limited, the marquee oil and retail businesses of Thai conglomerate PTT. Durbell and Krungsri Finnovate, two other top conglomerates in the Southeast Asian country, also participated in the round, which brings Flash Express’ to-date raise to about $400 million.

Flash Express, which operates door-to-door pickup and delivery service, claims to be the second largest private player to operate in this space. The startup, which also counts Alibaba as an investor, entered the market with delivery fees as low as 60 cents per parcel, a move that allowed it to quickly win a significant market share.

The startup has also expanded aggressively in the past year. Flash Express had about 1,100 delivery points during this time last year. Now it has more than 5,000, exceeding those of 138-year-old Thailand Post.

Flash Express currently delivers more than 1 million parcels a day, up from about 50,000 during the same time last year. The startup says it has also invested heavily in technology that has enabled it to handle over 100,000 parcels in a minute by fully automated sorting systems.

Komsan Lee, CEO of Flash Express, said the startup plans to deploy the fresh funds to introduce new services and expand to other Southeast Asian markets (names of which he did not identify). “We are also prepared to create and develop new technologies to achieve even greater delivery and logistics efficiency. More importantly we intend to assist SMEs in lowering their investment costs which we believe will provide long-term benefit for the overall Thai economy in the digital era,” he said.

Retail Business Public Company Limited plans to leverage Flash Express’ logistics network as it looks to meet the rising demand from consumers, said Rajsuda Rangsiyakull, senior executive vice president for Corporate Strategy, Innovation and Sustainability at Retail Business Public Company Limited.

Flash Express competes with Best Express — which, like Flash, is also backed by Alibaba — and Kerry Express, which filed for an initial public offering in late August.

Even as online shopping and delivery has accelerated in recent months, some estimates suggest that the overall logistics market in Thailand will see its first contraction in the history this year. Chumpol Saichuer, president of the Thai Transportation and Logistics Association, said last month Thailand’s logistics business has already been hit hard by the slowing global economy.

Powered by WPeMatico

Bangalore-headquartered Razorpay, one of a handful of Indian fintech startups that has demonstrated accelerated growth in recent years, has joined the coveted unicorn club after raising $100 million in a new financing round, the payments processing startup said on Monday.

The new financing round, a Series D, was co-led by Singapore’s sovereign wealth fund GIC and Sequoia India, the six-year-old Indian startup said. The new round valued the startup at “a little more than $1 billion,” co-founder and chief executive Harshil Mathur told TechCrunch in an interview.

Existing investors Ribbit Capital, Tiger Global, Y Combinator and Matrix Partners also participated in the round, which brings Razorpay’s total to-date raise to $206.5 million.

Razorpay accepts, processes and disburses money online for small businesses and enterprises. In recent years, the startup has expanded its offerings to provide loans to businesses and also launched a neo-banking platform to issue corporate credit cards, among other products.

Mathur and Shashank Kumar (pictured above), who met each other at IIT Roorkee, started Razorpay in 2014. They began to explore opportunities around a payments processing business after realizing just how difficult it was for small businesses such as young startups to accept money online less than a decade ago. There were very few payment processing firms in India then, and startups needed to produce a long list of documents.

The early team of about 11 people at Razorpay shared a single apartment as the co-founders rushed to meet with over 100 bankers to convince banks to work with them. The conversations were slow and remained in a deadlock for so long that the co-founders felt helpless explaining the same challenge to investors numerous times, they recalled in an interview last year.

To say things have changed for Razorpay would be an understatement. It’s become the largest payments provider for business in India, said Mathur. Razorpay, which competes with Prosus Ventures’ PayU, accepts a wide-range of payment options, including credit cards, debit cards, mobile wallets and UPI.

“Razorpay has established itself as a clear leader, with its strong focus on customer experience and product innovation,” said Choo Yong Cheen, chief investment officer for Private Equity at GIC, in a statement. “GIC has a long track record of partnering with leading fintech companies globally and is delighted to partner with Razorpay in its journey to transform payments and banking.”

India’s Razorpay launches corporate credit cards, current accounts support in major neo banking push

Some of Razorpay’s clients include budget lodging decacorn Oyo, fintech firm Cred, social giant Facebook, e-commerce Flipkart, top food delivery startups Zomato and Swiggy, online learning platform Byju’s, supply chain platform Zilingo, travel ticketing firms Yatra and Goibibo, and telecom giant Airtel .

The startup expects to process about $25 billion in transactions — up five times from last year — for nearly 10 million of its customers this year, said Mathur.

He attributed some of the growth to the coronavirus pandemic, which he said has accelerated the digital adoption among many businesses.

On the neo-banking and capital side, Mathur said, Razorpay expects RazorpayX and Razorpay Capital to account for about 35% of the startup’s revenue by the end of March next year.

Mathur said the startup’s payment processing service continues to be its fastest-growing business and does not need much capital to grow, so the startup will be deploying the fresh funds to expand its neo-banking offerings to include vendor payment, and expense and tax management and other features.

The startup, which aims to work with more than 50 million businesses by 2025, may also acquire a few firms as it explores opportunities around inorganic expansion in the neo-banking category, said Mathur.

“We will continue to make an impactful contribution to the growth of the industry, aid adoption in the under-served markets and drive new practices and a new thinking for the industry to follow. And this investment fits perfectly with our growth strategy,” he said.

While the coronavirus pandemic has slowed down deal-makings in India, about half a dozen startups in the country, including online learning platform Unacademy, and Pine Labs, have secured the unicorn status.

Powered by WPeMatico

GoGet, a Malaysian on-demand work platform, announced today that it has raised a $2 million Series A led by Monk’s Hill Ventures. The platform currently has 20,000 gig workers, who are called “GoGetters,” and has onboarded 5,000 businesses, including Lazada Malaysia, IKEA Malaysia, Foodpanda and flower delivery service BloomThis.

While Malaysia has other on-demand work platforms, including Supahands and Kaodim, each has its own niche. Supahands focuses on online tasks, while Kaodim offers professional services like home repairs, catering and fitness training. GoGet is more similar to TaskRabbit, with GoGetters performing errands or temp work like deliveries, moving large items, catering at events, data entry and office administration.

Chief executive officer and co-founder Francesca Chia founded GoGet in 2014. The startup decided to focus on gig workers because there is a labor gap in ASEAN (Association of Southeast Asian Nations) countries, she told TechCrunch.

“Today, the majority of ASEAN’s labor market are low- to middle-skilled, and the majority are not protected with job security, future career paths and financial services such as insurance and savings,” she said. “At the other end of the spectrum, over 70% of employment in ASEAN are from SMEs, who seek to scale without scaling full-time costs, and find it difficult to train and maintain a reliable pool of staff.”

GoGet wants to bridge the gap by connecting businesses with verified flexible workers, she added. GoGetters are able to switch between different categories of work, which Chia said gives the ability to learn new skills. Companies are provided with management features that include the ability to create a list of GoGetters they want to work with again and tools for recruiting, training and payment.

The Series A will be used to expand GoGet in Malaysia. One of the things many companies whose business models revolve around the gig economy need to grapple with as they scale include workers who are frustrated by uneven work, low pay and the lack of benefits they would receive as full-time employees. In California, for example, this has resulted in a political battle as companies like Uber, DoorDash and Lyft try to roll back legislation that would force them to classify more gig workers as full-time employees.

Chia said GoGet’s “vision is to bring flexible work to the world in a sustainable manner.” Part of this entails giving GoGet’s gig workers access to benefits like on-demand savings and insurance plans that are similar to what full-time employees receive. GoGet’s platform also has career-building features, including online trainings and networking tools, so workers can prepare for jobs that require different skill sets.

While GoGet’s short-term plan is to focus on growth in Malaysia, it eventually plans to enter other ASEAN countries, too.

In a press statement about the investment, Monk’s Hill Ventures co-founder and managing partner Kuo-Yi Lim said, “The nature of work is being redefined as companies and workers seek both flexibility and fit. This trend has been accelerated by the pandemic, as businesses are transforming in response and require more elastic workforce. GoGet provides a community of motivated and well-trained workers, but more importantly, its platform extends the corporate people management systems to ensure quality, compliance and seamless workflow.”

Powered by WPeMatico

As paid newsletters grow in popularity, Snigdha Sur, the founder of South Asian-focused media company The Juggernaut, has no qualms about avoiding the approach entirely. In October 2017, Sur started The Juggernaut as a free newsletter, called InkMango. As she searched for news on the South Asian diaspora, she found that articles lacked original reporting, aggregation was becoming repetitive and mainstream news organizations weren’t answering big questions.

Then InkMango crossed 700 free readers, and Sur saw an opportunity for a full-bodied media company, not just a newsletter.

One year and a Y Combinator graduation later, The Juggernaut has worked with more than 100 contributors (both journalists and illustrators) to provide analysis on South Asian news. Recent headlines on The Juggernaut include: The Evolution of Padma Lakshmi; How Ancestry Test Results Became Browner; and How the Death of a Bollywood Actor Became a Political Proxy War. The network approach, instead of a single newesletter approach,aggreff is working so far: Sur says that The Juggernaut has garnered “thousands of subscribers.” During COVID-19, The Juggernaut’s net subscribers have grown 20% to 30% month over month, she said.

On the heels of this growth, The Juggernaut announced today that it has raised a $2 million seed round led by Precursor Ventures to hire editors and a full-time growth engineer, and expand new editorial projects. Other investors in the round include Unpopular Ventures, Backstage Capital, New Media Ventures and Old Town Media. Angels include former Andreessen Horowitz general partner Balaji Srinivasan; co-founder of Kabam, Holly Liu; and co-founder of sports-focused publication The Athletic, Adam Hansmann.

Currently, The Juggernaut charges $3.99 a month for an annual subscription, $9.99 a month for a monthly subscription and $249.99 for a lifetime subscription to the news outlet. It also offers a seven-day free trial (with a conversation rate to paid at over 80%) and has a free newsletter, which Sur says will remain free to bring in top-of-the-funnel customers.

The Juggernaut is part of a growing number of media companies trying to directly monetize off of subscriptions instead of advertisements, such as The Information, The Athletic, and even our very own Extra Crunch. If successful, the hope is that paid subscriptions will prove more sustainable and lucrative than advertising, which still dominates in media.

But Sur is purposely pacing herself when it comes to expenses in the early days. The team currently has only three full-time staff, including Sur, culture editor Imaan Sheikh and one full-time writer, Michaela Stone Cross.

Snigdha Sur, the founder of The Juggernaut.

“Sometimes at media companies people over-hire and over-promise, and then don’t deliver on the profitability or return,” she said. For this reason, The Juggernaut largely works with “freelancers who would probably never join any specific publication,” Sur said. While The Juggernaut hopes to have full-time staff writers eventually, the contributor approach helps temper spending.

Beyond pace, The Juggernaut is looking to build up its subscriber base by writing stories that require deep, creative thinking. The publication intentionally does not cover commoditized breaking news, which could have the potential to bring in more inbound traffic, or anything that doesn’t have a South Asian connection.

Sur is living the stories that she is working to tell. Born in Chhattisgarh, India, she grew up in the Bronx and Queens in New York City, and spent time living and working in Mumbai, India. Since founding The Juggernaut, her goal for the publication has been to be a place for not just South Asians, but for “anyone who has a form of curiosity and appreciation” for South Asian culture.

“We try not to translate words we don’t have to do, we’re not trying to dumb this down, we’re not trying to write for the white teen,” she said. “We’re trying to write for the smart, curious person. And we’re going to assume you know stuff.”

Powered by WPeMatico

These days when you found a startup, you don’t go out and buy a rack of servers. And you don’t build an in-house data center team. Instead, you farm out your infrastructure needs to the major cloud platforms, namely Amazon AWS, Microsoft Azure and Google Cloud.

That’s all well and good, but over time, any startup’s cloud setup will become more complex, varied and perhaps multi-provider. Throw in microservices and one can wind up with a big muddle, and an even bigger bill. That’s the problem that Yotascale wants to attack.

And there’s money backing the startup’s progress, including $13 million in new capital. The round, a Series B, was led by Aydin Senkut at Felicis, with participation from other capital pools, including Engineering Capital, Pelion Ventures and Crosslink Capital. Yotascale has now raised $25 million in total.

The funding event caught my eye, as I’ve heard startup CEOs discuss their public cloud spends in somewhat bitter terms; it’s hard for most startups to change infrastructure direction after they get off the ground, which means that as they grow, so too does their outflow of dollars to the major tech companies — the same megacaps that might turn around and compete with the very same startups that are pumping up their revenues and margins.

So spending less on AWS or Azure would be nice for startups. Yotascale wants to be the helper for lots of companies to better understand and attribute that spend to the correct part of their platform or service, perhaps lowering aggregate spend at the same time.

Let’s talk about how Yotascale got to where it is today.

The startup’s CEO, Asim Razzaq, talked TechCrunch through his company’s history, which didn’t get started until after he had wrapped up tenure at both another startup and PayPal.

When he set out to found Yotascale, Razzaq didn’t fire up a deck, raise capital and then get right to building. Instead, he first went out to do customer discovery work. That effort led him to the perspective that current solutions aimed at understanding cloud spend were insufficient and led to data being used against infrastructure teams in arguments for lower spend when it wasn’t a good idea (cutting backup expenses, for example).

During that time he also determined who Yotascale’s target customer is, namely the head of platform engineering at a company.

The startup self-funded for a while, with Razzaq telling TechCrunch that he wanted to be completely sure that he had conviction concerning the project before moving ahead.

After starting to work on Yotascale in mid 2015, the company raised some capital in 2016. It set out to solve the spend attribution problem that companies with public cloud contracts deal with — including having to contend with modern architecture and its related issues — while earning the trust of engineers, according to Razzaq.

From its period of customer discovery to working on product market fit after raising funds from Engineering Capital, Yotascale raised a Series A in mid-2018. Why? Because, Razzaq, told TechCrunch, as ones gains conviction, one must scale their team. And thus more capital was required.

During our chat with the CEO, it was notable how sequential his company-building process has proven. From talking to potential customers, to working to understand who his buyer is, to waiting on scaling the startup’s go-to-market efforts until he was confident in product-market fit, Yotascale seems to follow the inverse of the “raise lots and spend fast and try to win right away” model that became quite popular during the unicorn era.

How did Yotascale know when it found product market fit? According to its CEO, when companies started pulling the startup into their operations, and not the other way around.

Yotascale reported 4x year-over-year annual recurring revenue (ARR) growth at some point this year, though Razzaq was diffident about sharing specifics concerning the metric.

Sticking to the theme of reasonableness and caution, when asked about why his Series B is modest in size, Razzaq said that he was not interested in raising big rounds, and that $13 million is an amount of money that can move his company forward. What’s coming from the company? Yotascale wants to add support for Azure and Google Cloud in addition to its AWS work of today, to pick an example.

(You can find other hints that Yotascale is perhaps more mature than its peers at its current age. For example, in 2018 the company hired a new chief revenue officer, even putting out a release on the matter.)

That’s enough on this particular round. What will prove interesting is how far Yotascale can push its ARR up by the end of Q3 2021. And if it raises again before then.

Powered by WPeMatico

The U.S. economy may be in a precarious state right now, with a presidential election looming on the horizon and the country still in the grips of the coronavirus pandemic. But partly thanks to lower interest rates, the housing market continues to rise, and today a startup that has built technology to help it run more efficiently is announcing a major growth round of funding.

Snapdocs, which is used by some 130,000 real estate professionals to digitally manage the mortgage process and other paperwork and stages related to buying a home, has raised $60 million in new equity funding on the heels of a few bullish months of business.

In August 2020 — a peak in home sales in the U.S., reaching their highest level in 14 years — the startup saw 170,000 home sales, totaling some $50 million in transactions, closed on its platform. This accounted for almost 15% of all deals done that month in the U.S. Snapdocs is now on track to close 1.5 million deals this year, double its 2019 volume.

On top of this, the startup’s platform is being used by more than 70% of settlement agents nationally, with customers including Bell Bank, LeaderOne Financial Corporation, Googain and Georgia United Credit Union among its customers.

The Series C is being led by YC Continuity (Snapdocs was part of Y Combinator’s Winter 2014 cohort), with existing investors Sequoia Capital, F-Prime Capital and Founders Fund, and new backers Lachy Groom (formerly of Stripe and now a prolific investor) and DocuSign, a strategic backer, also participating.

“Like us they are on a mission to defragment an ecosystem,” King said, referring to it as a “perfect complement” to Snapdocs’ own efforts.

Snapdocs is not talking about its valuation. Aaron King, the founder and CEO, said in an interview that he believes disclosing it is nothing more than “grandstanding” — which is interesting considering that the industry he focuses on, real estate, is all about public disclosures of valuation — but he noted that most of the $103 million that the startup has raised to date is still in the bank, which says something about the company’s overall financial health.

And for some further context, according to PitchBook data estimates, Snapdocs was valued at $200 million in its last round, in October 2019.

Snapdocs’ central premise is that buying a house requires not just a lot of paperwork but also a lot of different parties to be on the same page, so to speak, to set the wheels in motion and get a deal done. There is not just the mortgage (with its multiple parties) to settle; you also have real estate brokers and agents, the home sellers, inspectors and appraisers, the insurance company, the title company and more — some 15 parties in all.

The complexity of all of them working together in a quick and efficient way often means the process of buying and selling a house can be long and costly. And that’s before the pandemic — with the problems associated with social distancing and remote working — hit us.

Snapdocs’ solution has been to build one platform in the cloud that helps to manage the documents needed by all of these different parties, providing access to data and the ability to flag or approve things remotely, to speed the process along. It also has built a number of features, using AI technology and analytics, to also help identify what might be potential issues early on and get them fixed.

King is not your typical tech startup entrepreneur. He began working in mortgages as a notary when he was still in high school — he’s effectively been in the industry for 23 years, he said — and his earliest startup efforts were focused on one aspect of the complexities that he knew first-hand: he saw an opportunity to lean on technology to get notarized signatures sorted out in a legal, orderly and quicker way.

He then got deeper into identifying the possibilities of how tech could be used to improve the larger process, and that is how Snapdocs came into existence.

Given how big the real estate market is — it’s the largest asset class in the world, by many estimates — and how many other industries tech has “disrupted” over the years, it’s interesting that there have been so few attempting to solve it. One of the reasons, it seems, is that there hasn’t been enough of a crossover between tech experts and mortgage experts, and Snapdocs is a testament to the virtues of building a startup specifically around a hard problem that you happen to know really well.

“Most people have identified this as a tech problem, and a lot of the tech — such as e-signatures — has existed for 20 years, but the fragmentation of real estate is the issue,” he said. “We’re talking about a mass constellation of companies and workflow. But we’re obsessed about the workflow of all of these constituents.”

That’s a position that has helped Snapdocs build its standing with the industry, as well as with investors.

“I’ve known the Snapdocs team for many years and have always been amazed by their focus and execution toward bringing each stakeholder in the mortgage process online,” said Anu Hariharan, partner at YC Continuity, in a statement. “In 2013, Snapdocs began as a notary marketplace before expanding horizontally to service title companies and, more recently, lenders. By connecting the numerous parties involved in a mortgage on a single platform, Snapdocs is quickly becoming the “operating system” for mortgage closings. Mortgages, much like commerce, will shift online, bringing improved efficiency and a far better customer experience to the outdated home-closing process.” Hariharan has real estate experience herself and is joining the board with this round.

There have been a number of companies taking new, tech-based approaches to the market to find new and faster ways of doing things, and to open up new kinds of value in the market.

Opendoor, for example, has rethought the whole process of selling and buying houses, taking on a role as a middleman in the process both to take on a lot of the harder work of fixing up a home, and handling all of the difficult stages in the sales process: it’s a role that has recently seen the company catapult to a valuation of $4.8 billion by way of a SPAC-based public listing. An interesting idea, King said, but still only accounting for a small sliver of house sales.

Others, like Orchard, Reonomy and Zumper, have all also raised large rounds on the back of a lot of promise of the market continuing to grow and the opportunity to take part in that process through new approaches. It’s a sign that “safe as houses” still has a place in the market, even with all the other unknowns in play.

“Over the next five years the real estate industry will be completely digitized, so a lot of companies are trying to figure out what their place are, and how to provide value,” King said.

Powered by WPeMatico

Instacart announced today that it has raised $200 million in a new funding round featuring prior investors. D1 Capital and Valiant Peregrine Fund led the investment. Instacart is now worth $17.7 billion, post-money, or $17.5 billion pre-money. The plan is to use the funding to focus on introducing new features and tools to improve the customer experience, and further support Instacart’s enterprise and ads businesses, according to a blog post.

Previously in 2020, Instacart raised $100 million in July, and $225 million in June. The June round valued the company at around $13.7 billion, meaning that the unicorn’s new funding round — raised just months later — came at a much higher price.

Instacart, like some other tech, and tech-enabled businesses, has seen demand for its service expand during the pandemic. It’s not hard to trace a connection between COVID-19 and its business results, as folks wanting to stay at home have turned to on-demand services to keep themselves safe.

The growth shown by Uber’s food delivery business is another example of this trend.

Instacart’s valuation has more than doubled since its 2018 Series F, when it was worth around $7.9 billion. The pace at which Instacart has created paper value is impressive, though its IPO plans appear murky from the outside and how much of its COVID-bump will be retained when the pandemic ends is not yet clear.

The startup famously turned a profit during a month in Q2, worth around $10 million per The Information. The same report indicated that Instacart lost around $300 million in 2019. What the company’s full-year profitability profile will look like is not known.

TechCrunch sent a number of questions to the firm, including if it has had any further profitable months in 2020, and how quickly it grew in Q3 2020. The company’s spokespeople did not answer those questions.

“Today’s investment is a testament to the strong conviction our existing investors have in the strength of our teams and the important role Instacart plays for customers, partners, and the entire grocery ecosystem,” Instacart CEO Apoorva Mehta said in a press release. “I’m incredibly proud of our team’s work to scale our business this past year and rise to meet the unprecedented consumer demand and growth.”

Instacart is one of the company’s caught up in a regulatory war after California passed AB5, which changed the state’s rules on gig workers. A voter proposition — Prop 22 — that would keep rideshare drivers and delivery workers classified as independent contractors, is coming up for a vote in California. Instacart is in favor of the proposition, along with Uber, Lyft, DoorDash and Postmates (now owned by Uber).

Uber, Lyft, Instacart and DoorDash have collectively contributed $184,008,361.46 to the Yes on 22 campaign. Those contributions have been monetary, non-monetary and have come in the form of loans. In September, the four companies each committed another $17.5 million to Yes on Prop 22 in monetary contributions. Of all the measures on this November’s ballot, Yes on Prop 22 has received the most contributions, according to California’s Fair Political Practices Commission.

Beyond Prop 22, Instacart is facing a lawsuit from Washington, D.C. District Attorney General Karl A. Racine that alleges the company charged customers millions of dollars in “deceptive service fees” and failed to pay hundreds of thousands of dollars’ worth of sales tax. The suit seeks restitution for customers who paid those service fees, as well as back taxes and interest on taxes owed to D.C. Specifically, it alleges Instacart misled customers regarding the 10% service fee to think it was a tip for the delivery person, from September 2016 to April 2018.

Meanwhile, amid the pandemic and wildfires in California, workers have demanded personal protective equipment and better pay, and, most recently, disaster relief.

Powered by WPeMatico

Veritonic is announcing that it has raised $3.2 million in Series A funding led by Greycroft, with participation from Lerer Hippeau and Amazon-owned audiobook service Audible.

CEO Scott Simonelli, who founded the New York startup with COO Andrew Eisner and CTO Kevin Marshall, told me that his goal is to create a new category of “audio intelligence” — namely, measuring and predicting the effectiveness of any piece of audio content or advertising.

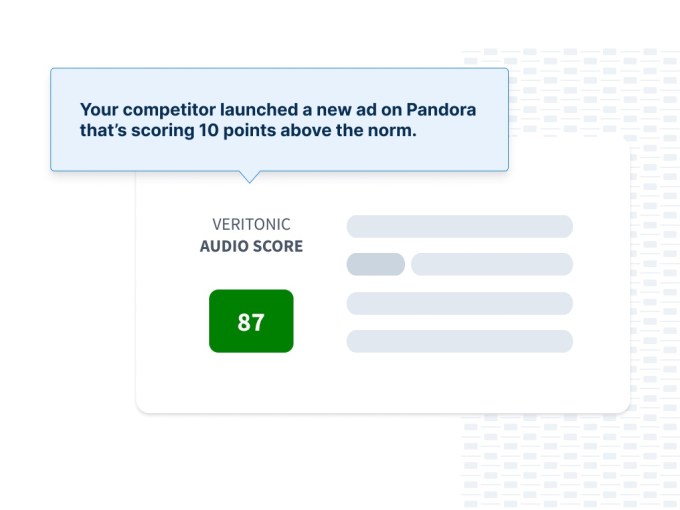

The company is focused on marketing initially, with its first product, Creative Measurement, analyzing any audio ad and showing marketers how it scores compared to similar content, as well as identifying which parts of the audio are most effective. And Veritonic is launching a new product, Competitive Intelligence, which helps businesses see how and where their competitors are spending on advertising and provides alerts when those competitors launch a new ad.

Simonelli said that until now, audio measurement has been limited to things like creating audience panels with a few hundred people, which simply doesn’t scale, given the enormous growth in the audio market.

Veritonic, on the other hand, has analyzed thousands of audio files, correlating the content with data about how people responded and using that analysis to predict how people will respond to new audio. Simonelli said the company can add more “fuel” by going out and gathering more human response data, but even without additional data, it can provide an instant prediction on an ad or campaign’s effectiveness.

Image Credits: Veritonic

Simonelli also noted that Veritonic has spent the past five years developing technology that’s specifically attuned to the challenges of measuring audio effectiveness — like the fact that audio is experienced over time and, even more than other media, needs to be memorable.

“We can look at a sonic profile and predict and evaluate how somebody is going to respond,” he said.

The ultimate goal, he added, is to create the “benchmark for audio advertising,” which means working with a variety of players in the industry. For example, he said that when you look at other audio investments in Greycroft’s portfolio (such as podcast network Wondery or podcast analytics company Podsights): “Veritonic makes every one of those audio investments more valuable.”

Veritonic’s made pretty good progress on that goal already, with partners including Pandora, SiriusXM and NPR, and brand clients like Pepsi, Visa and Subway. It was previously backed by Newark Venture Partners (whose founder Don Katz previously founded Audible).

“We are excited to be a part of Veritonic’s continued growth and success,” said Greycroft’s Alan Patricof in a statement. “I’m personally very passionate about the future of voice, and the team at Veritonic deeply understands how to use audio to drive recall, stickiness and brand awareness — which is hugely important in a highly-competitive consumer brand landscape.”

Simonelli added that Veritonic will use the new funding to expand its data science and sales teams. Eventually, he hopes to start analyzing non-advertising content as well — for example, since Audible is an investor, he said, “Analyzing every audiobook on the planet is something we’re ready for and excited to do.”

Powered by WPeMatico