Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

San Francisco-based construction startup Versatile is announcing today that it has raised a $20 million Series A. The round was led by Insight Partners and Entree Capital, along with existing investors Robert Bosch Venture Capital GmbH, Root Ventures and Conductive Ventures.

The round follows $8.5 million in funding, including a $5.5 million seed round that arrived in August of last year.

The URBAN-X accelerator alum has developed a piece of hardware designed to be mounted to a crane. From that vantage point, it’s capable of capturing and analyzing data across the construction site.

“You can only improve what you can measure, and at Versatile we are just scratching the surface of what we can do to create value for our users and use data to turn job sites into controlled manufacturing with fast feedback loops,” co-founder and CEO Meirav Oren said in a release tied to the news.

The company says it’s able to use that information to provide a picture of construction progress, with additional information on site materials, while targeting any potential redundancy in the space.

With around $10 trillion currently spent on construction each year, the industry is prime for some big-ticket investments. Particularly those startups that can promise more efficiency in the space.

The company says the round will be spent on accelerating the availability of its technology and developing additional AI components for users.

Powered by WPeMatico

Bizay, a marketplace for small-to-medium-sized businesses allowing them to create highly customized products (such as merchandise), has raised a $38.6 million (€32 million) funding round. The Series C financing round was co-led by investors Indico Capital and the European Investment Bank, with “strong support” from Iberis Capital and existing investors including LeadX Capital Partners, Omnes Capital and Pathena.

This means Bizay has now raised a total of more than €54 million. The company previously raised a Series B financing round of €22 million. This new round will accelerate the development of further product expansion targeted at SMBs and reinforce Bizay´s operation supplying more than one million SMBs in 21 countries across Europe and America.

Bizay’s idea is to become the “Amazon” for SMBs in terms of merchandising, packaging, consumables, business essentials, decorations and uniforms, with good quality, at a fraction of the normal costs associated with these items.

Bizay’s Chief of Growth Officer José Salgado, said: “The current health crisis accelerated the shift to online ordering of customizable products at reduced prices. Our platform will be a key facilitator for businesses to recover at a faster pace. We are totally confident in achieving the goals that will allow us to enter a new level of global ambition”.

Speaking to TechCrunch Salgado added: “We are a software company, and our technology enables us to connect to industrial manufacturers that would usually work only for large corporations. We have no stock, we have no machines, no production. Using AI we aggregate multiple orders, and supply those orders using the network of industrial producers that we have in our marketplace. So we are able to offer these SMBs competitive prices for small individual orders. These industrial manufacturers would never normally supply SMBs because they are just too small.”

Stephan Morais, managing general partner at Indico Capital Partners, said: “Bizay is entering a new growth phase and this round will consolidate their presence across Europe and enable them to capture the opportunity that stems from the shift towards online ordering of personalized products for SMBs.”

Powered by WPeMatico

Last week I witnessed for myself how a new kind of robot really could — as sci-fi has been telling us for many years — create and serve us food. Today, Karakuri, a food robotics startup, unveils its first automated canteen to make meals: the “DK-One” robot. It’s also revealing an $8.4 million (£6.3 million) investment, led by firstminute capital, which includes funding from Hoxton Ventures, Taylor Brothers, Ocado Group and the U.K.’s government-backed Future Fund. It has now closed a total of £13.5 million in funding.

Karakuri’s robotic system has been initially designed to make breakfast bowls. But the technology will end up being employed in a large array of scenarios, including restaurants, canteens, buffets, hotels and supermarkets. Possibly even tending vertical farms. Its particular strength is in being able to create extremely tailor-made combinations of food, putting “personalized nutrition” within practical reach. Remember those movies where the food is tailored by a robot? That.

The post-COVID world is also highly likely to embrace this technology due to the robot’s inherent cleanliness and efficiency, compared to human-made food. That said, Karakuri is not positioned to replace humans but to augment them, taking on the boring and repetitive tasks which typically see kitchen staff have far more itinerant careers due to the sheer pressure of low-level jobs where a robot would be far more suitable.

The DK-One robot is Karakuri’s first pre-production machine, which uses the latest in robotics, sensing and control technologies. It’s capable of creating high-quality hot and cold meals, which maximize nutritional benefits, restaurant performance and minimize food waste.

Post COVID restrictions, further on-customer-site trials of the DK-One are expected to take place in the first half of 2021.

The DK-One robot zips around a circular enclosure at a rate of knots, each time measuring accurate portion sizes as determined by an app, where the customer can tailor to their tastes. It means anyone ordering something would be able to track the ingredients, nutrients, calories and quantity of literally every meal.

Up to 18 ingredients can be dispensed per installation, with each ingredient temperature controlled. It will dispense of any ingredient type, including wet, dry, soft or hard food onto plates, bowls or a range of meal containers.

Because it’s so accurate it therefore reduces food waste around portions and allows for real-time data on ingredients. The thin margins restaurateurs typically have could be improved by using such a robot in repetitive tasks, and means employees can be tasked with more complex and fruitful and fulfilling work. It’s also easily integrated into existing commercial kitchens.

Barney Wragg, CEO and co-founder of Karakuri, said in a statement: “This will be the first time we can use a pre-production machine to demonstrate the DK-One’s commercial and nutritional benefits in the real world and thus demonstrate our vision for the future of food.”

Karakuri was founded by Simon Watt and Wragg, two longtime friends and colleagues who previously worked together at ARM. In April 2018 the Founders Factory venture studio invested in Karakuri and Brent Hoberman joined the board as chairman (and is also listed as a co-founder).

Powered by WPeMatico

There are now about 50 million people with dementia globally, a number the World Health Organization expects to triple by 2050. Alzheimer’s is the leading cause of dementia and caregivers are often overwhelmed, without enough support.

Neuroglee, a Singapore-based health tech startup, wants to help with a digital therapeutic platform created to treat patients in the early stages of the disease. Founded this year to focus on neurodegenerative diseases, Neuroglee announced today it has raised $2.3 million in pre-seed funding.

The round was led by Eisai Co., one of Japan’s largest pharmaceutical companies, and Kuldeep Singh Rajput, the founder and chief executive officer of predictive healthcare startup Biofourmis.

Neuroglee’s prescription digital therapy software for Alzheimer’s, called NG-001, is its main product. The company plans to start clinical trials next year. NG-001 is meant to complement medication and other treatments, and once it is prescribed by a clinician, patients can access its cognitive exercises and tasks through a tablet.

The software tracks patients’ progress, such as the speed of their fingers and the time it takes to complete an exercise, and delivers personalized treatment programs. It also has features to address the mental health of patients, including one that shows images that can bring up positive memories, which in turn can help alleviate depression and anxiety when used in tandem with other cognitive behavioral therapy techniques.

For caregivers and clinicians, NG-001 helps them track patient progress and their compliance with other treatments, like medications. This means that healthcare providers can work closely with patients even remotely, which is especially important during the COVID-19 pandemic.

Neuroglee founder and CEO Aniket Singh Rajput told TechCrunch that its first target markets for NG-001 are the United States and Singapore, followed by Japan. NG-001 needs to gain regulatory approval in each country, and it will start by seeking U.S. Food and Drug Administration clearance.

Once it launches, clinicians will have two ways to prescribe NG-001, through their healthcare provider platform or an electronic prescription tool. A platform called Neuroglee Connect will give clinicians, caregivers and patients access to support and features for reimbursement and coverage.

Powered by WPeMatico

Studying for med school is tough. What if it was more Pixar-like?

Sketchy, a visual learning platform, takes complex material that a med student might need to memorize for an exam, and puts the information in an illustrated scene. For example, it uses a countryside kingdom to explain the coronavirus, or a salmon dinner to explain Salmonella. The goal is for a student to be able to mentally go back to the scene while taking an exam, walk through it and retrieve all of the information.

While Sketchy’s strategy might seem odd, it’s actually well-known. The “memory palace” technique matches objects to concepts for easier memorization. So far, Sketchy has more than 30,000 paid subscribers and is on track to hit $7 million in revenue this year.

To charge this growth and break into new content verticals, Sketchy is taking venture capital on for the first time in its seven-year history. Last month, the team announced that it has raised a $30 million Series A led by The Chernin Group (TCG). Today, some of those shares were sold in a secondary transaction Reach Capital, which now accounts for $3 million of the financing. It’s a big combined investment for a company that has been bootstrapping since birth — and the deal could help us see where online education is heading.

The capital comes as Sketchy itself looks to grow past a content service for med students, and into an education platform tackling information in critical fields, from legal to nursing. With the new money, Sketchy plans to build an in-house animation studio and hire more artists and doctors, some of whom are currently consultants.

A big part of Sketchy’s magic, and effectiveness, comes from the fact that all of its founding team have experience in medicine.

The company began in 2013 when then-med students Saud Siddiqui and Andrew Berg were in desperate need of a better study solution for microbiology. To liven up their studying, Berg and Siddiqui began weaving characters into stories to try to memorize concepts — and after a few good test scores, they started creating stories for their classmates.

“Neither Saud or I were artists, so they were pretty bad,” Berg said. As demand continued, the duo put their scraggly sketches on YouTube. Eventually, Siddiqui and Berg roped in classmate Bryan Lemieux, a good artist, to tell the stories with them. Eventually Bryan brought on his twin brother, Aaron, and the founding team was born.

Fast-forward to today: Siddiqui and Berg have finished their residencies in emergency medicine, while the Lemieux brothers chose to leave medicine. All have moved full-time to the company after trying to balance both jobs. Still, the knowledge from working in the field continues to be useful.

The startup’s name has evolved: born as SketchyMedical, it has since rebranded to just Sketchy. While the team chose the name to nod toward its focus on art, the name also has negative connotations. Expect a rebrand in the future.

Despite this, the company claims that it is used by a third of med students in the United States. The majority of its revenues come from 12-month subscriptions for students looking to prep for med school exams like Step 1, and Step 2.

While B2C is a promising business model for many reasons (it’s always easier to convince a human to pay instead of a entire, red-tape-bound institution), the company has also posted promising B2B growth. So far, 20% of its revenue comes from direct contracts it has with medical schools. The founders said that they will pursue both growth methods for now, but based on the price of med school (and student debt crisis), it would be great to see them grow through school contracts so students don’t have to face the brunt of costs.

Reach Capital’s Jennifer Carolan, an investor in Sketchy, said that Sketchy’s product market fit with med students is a “strong signal that their content is worth it.” Even with competitors such as Picorize and Medcomic, she’s confident that Sketchy’s product is defensible and can expand into new verticals. Part of the reason the firm approached Sketchy to invest in them is because of low customer acquisition costs, Carolan notes in a blog post.

That said, unlike most edtech companies, which have enjoyed surging new user demand thanks to remote learning, Sketchy didn’t have a huge COVID-19 boom.

“We weren’t one of those people that hadn’t found product market fit and then exploded after COVID,” said Berg. “We’ve always been there and been growing.”

So the real trigger for today’s fundraise wasn’t COVID-19 momentum, but instead, a push to capitalize its sustained growth into more digital curriculum verticals.

Long-term, think of Sketchy as joining a chorus of startups, including Top Hat Jr and Newsela, that want to replace textbook publishers. In a remote world, live, moving content is more rapidly losing value, and upstarts are trying to replace them with more effective and engaging content.

“One of the challenges is just to make sure we don’t go too fast,” Siddiqui said. “We want to keep that degree of quality we’ve maintained for so many years, and do it at scale.”

Editor’s note: The original version of this story stated that Sketchy had raised $32 million. This is incorrect. The company raised $30 million along with a secondary transaction from Reach Capital.

Powered by WPeMatico

Amount, a new service that helps traditional banks compete in a digital world, has raised $81 million from none other than Goldman Sachs as it looks to help legacy fintech players compete with their more nimble digital counterparts.

The company, which spun out from the startup lending company Avant in January of this year, has already inked deals with Banco Popular, HSBC, Regions Bank and TD Bank to power their digital banking services and offer products like point-of-sale lending to compete with challenger banks like Chime and lenders like Affirm or Klarna.

“Most banks are looking for resources and infrastructure to accelerate their digital strategy and meet the demands of today’s consumer,” said Jade Mandel, a vice president in Goldman Sachs’ growth equity platform, GS Growth, who will be joining the board of directors at Amount, in a statement. “Amount enables banks to navigate digital transformation through its modular and mobile-first platform for financial products. We’re excited to partner with the team as they take on this compelling market opportunity.”

Complementing those customer-facing services is a deep expertise in fraud prevention on the back-end to help banks provide more loans with less risk than competitors, according to chief executive Adam Hughes.

It’s the combination of these three services that led Goldman to take point on a new $81 million investment in the company, with participation from previous investors August Capital, Invus Opportunities and Hanaco Ventures — giving Amount a post-money valuation of $681 million and bringing the company’s total capital raised in 2020 to a whopping $140 million.

Think of Amount as a white-labeled digital banking service provider for Luddite banks that hadn’t upgraded their services to keep pace with demands of a new generation of customers or the COVID-19 era of digital-first services for everything.

Banks pay a pretty penny for access to Amount’s services. On top of a percentage for any loans that a bank processes through Amount’s services, there’s an up-front implementation fee that typically averages at $1 million.

The hefty price tag is a sign of how concerned banks are about their digital challengers. Hughes said that they’ve seen a big uptick in adoption since the launch of their buy-now-pay-later product designed to compete with the fast growing startups like Affirm and Klarna .

Indeed, by offering banks these services, Amount gives Klarna and Affirm something to worry about. That’s because banks conceivably have a lower cost of capital than the startups and can offer better rates to borrowers. They also have the balance sheet capacity to approve more loans than either of the two upstart lenders.

“Amount has the wind at its back and the industry is taking notice,” said Nigel Morris, the co-founder of Capital One and an investor in Amount through the firm QED Investors. “The latest round brings Amount’s total capital raised in 2020 to nearly $140 million, which will provide for additional investments in platform research and development while accelerating the company’s go-to-market strategy. QED is thrilled to be a part of Amount’s story and we look forward to the company’s future success as it plays a vital role in the digitization of financial services.”

FT Partners served as advisor to Amount on this transaction.

Powered by WPeMatico

Given the attention that TechCrunch pays to Y Combinator’s Demo Days, we also try to keep tabs on the same startups as they scale and raise more capital. Yesterday we covered YC Winter 2020 participant BuildBuddy, for example. Today we’re taking a look at Heru, a startup based in Mexico City that is announcing a $1.7 million raise after taking part in YC’s Summer 2019 session.

The pre-seed round was led by Mountain Nazca, and participated in by Magma Partners, Xtraordinary Venture Partners, Flourish Ventures, YC itself and a handful of angels. The investment was raised in two pieces: a $500,000 check in February and the other $1.2 million closing a few weeks ago.

Heru wants to provide software-based services for gig workers in Mexico, and eventually other countries. Its founders, Mateo Jaramillo and Stiven Rodríguez Sánchez, are both ex-Uber employees, which is how they wound up in Mexico from their native Colombia.

But Heru didn’t have a straightforward path to existence. The founding duo told TechCrunch their original idea, something similar to OYO, was what they went through Y Combinator and initially raised money for. But after finding OYO already in their target market, the company took three months to rethink and, keeping investors on board, pivoted to Heru.

Heru is a package of software products aimed at delivery drivers and the like, helping provide insurance, credit and tax preparation support. The tax element is key, as the company’s founders explained to TechCrunch that Mexico now expects independent workers to file taxes on a monthly basis. Folks need help with that, so Heru built them a tool to do so.

There’s competition to that element of its product, Heru said, noting that there are accountants in the market that will do the work for $25 to $30. Heru’s tax service, in contrast, costs a smaller $5 each month (100 pesos). Insurance is another $5 each month for accident-related coverage. The startup worked with an insurance provider to build what it describes as a “tailor-made” policy for gig workers who need low-cost coverage.

The founding duo, via the company.

Heru is not only targeting Uber drivers and their like, however. The company noted that it also wants to support freelancers more broadly, a population that is much larger than the three million gig workers it counts in the Mexican market.

The company’s app has been soft-launched in the market for a few weeks, with the startup now making more noise about its existence. According to its founders, around 1,200 users were accepted during its test period. Another 20,000 are in line.

Among its early user base, customers are buying on average 1.2 Heru products, a number that I’ll track as the startup scales.

Heru’s app is neat, its market large and the need it is serving material. But in the background of the software story is a brick-and-mortar tale. The startup, in addition to building its app, put together a number of so-called “Heru Casas,” places where gig workers can recharge their phones and use a bathroom. You need the app to enter a Heru Casa, helping the startup find early users.

Currently all Heru Casas are located in Mexico City. The startup is not sure about expanding that part of its efforts to more cities where its app may attract users. Why? It’s hard to scale physical build-outs, it told TechCrunch. Software is much better for quick expansion, and as that’s the name of the startup game, holding off on more physical locations could make good sense until the company can raise more capital.

Heru has big plans to double-down its product work, and eventually add more countries to its roster. The Latin American market is a ripe place for startups to shake things up. Let’s see how quickly Heru can make its mark.

Powered by WPeMatico

Orbit, a startup that is building tools to help organizations build communities around their proprietary and open-source products, today announced that it has raised a $4 million seed funding round led by Andreessen Horowitz’s Martin Casado. A number of angel investors, including Chris Aniszczyk, Jason Warner and Magnus Hillestad, as well as the a16z’s Cultural Leadership Fund, also participated, in addition to previous backers Heavybit and Harrison Metal.

The company describes its service as a “community experience platform.” Currently, Orbit’s focus is on Developer Relations and Community teams, as well as open-source maintainers. There’s no reason the company couldn’t branch out into other verticals as well, though, given that its overall framework is really applicable across all communities.

As Orbit co-founder Patrick Woods told me, community managers have generally had a hard time figuring out who was really contributing to their communities because those contributions can come in lots of forms and often happen across a wide variety of platforms. In addition, the sales and marketing teams also often don’t understand how a community impacts a company’s bottom line. Orbit aggregates all of these contributions across platforms.

“There is a lack of understanding around the ways in which community impacts go-to-market and business value,” Woods told me when I asked him about the genesis of the idea. “There’s a big gap in terms of the tooling associated with that. Many companies agree that community is important, but if you put $1 in the community machine today, it’s hard to know where that’s going to come out — and is it going to come out in terms of $0.50 or $100? This was a set of challenges that we noticed across companies of all sizes.”

Especially in open-source communities, there will always be community members who create a lot of value but who don’t have a commercial relationship with a company at all. That makes it even harder for companies to quantify the impact of their communities, even if they agree that community is an important way to grow their business and that, in Orbit’s words, “community is the new pre-sales.”

At the core of Orbit (the company) is Orbit the open-source community framework. The founding team of Woods (CEO) and Josh Dzielak (CTO) developed this framework to help organizations understand how to best build what the team calls a “high gravity community” to attract new members and retain existing ones — and how to evaluate them. You can read more about the concept here.

“We’re trying to reframe the discussion away from an extractive worldview that says how much value can we generate from this lead? It’s actually more about how much love can we generate from these community members,” Woods said. “Because, if you think about the culture associated with what we’re trying to do, it’s fundamentally creative and generative. And our goal is really to help people think less about value extraction and more about value creation.”

At the end of the day, though, no matter the philosophy behind your community-building efforts, there has to be a way to measure ROI and turn some of those community members into paying customers. To do that, Orbit currently pulls in data from sources like GitHub, Twitter and Discourse, with support for Slack and other tools coming soon. With that, the service makes it far easier for community managers to keep tabs on what is happening inside their community and who is participating.

In addition to the built-in dashboards, Orbit also provides an API to help integrate all of this data into third-party services as well.

“One of the key understandings that drives the Orbit vision is that a community is not a funnel and building a community is not about conversions, but making connections; cultivating dialog and engagement; being open and giving back; and creating value versus trying to capture it,” a16z’s Casado writes. “The model has proven to be very effective, and now Orbit has built a product around it. We strongly believe Orbit is a must-have product for those building developer-focused companies.”

The company is already working with just under 150 companies and its users include the likes of Postman, CircleCI, Kubernetes and Apollo GraphQL.

The company will use the new round, which closed a few weeks ago, to, among other things, build out its go-to-market efforts and develop more integrations.

Powered by WPeMatico

Wellory, a startup that bills itself as taking an “anti-diet approach” to nutrition and wellness, is announcing that it has raised $4.2 million in funding.

The round was led by Story Ventures, with participation from Harlem Capital, Tinder co-founders Sean Rad and Justin Mateen, Ground Up Ventures, NBA player Wayne Ellington, Hannah Bronfman and others.

Wellory founder and CEO Emily Hochman (who was previously the head of customer success at WayUp) told me that she struggled with dieting in college, to the point where she was risking chronic illness and infertility. As a result, she became determined to gain a better understanding of nutrition and her own health, eventually studying and becoming a certified health coach at the Institute for Integrative Nutrition.

Hochman said that through Wellory, she wants to offer that same understanding to others, which she said has created a “managed marketplace” matching users with a licensed nutritionist, registered dietitian or certified health coach. Those coaches create a personalized plan for losing weight or achieving other health goals, then continue to provide feedback as users share photos of each meal and additional health data.

For example, she said that a customer who had just given birth and was interested in postpartum weight loss would get matched with a coach who specializes in that area.

“The thing that is so important is that we build personalized plans,” she added. “We don’t have anything that says, ‘At Wellory, we do these 10 things and that’s a standard diet.’ We’re actually going to help you learn how to make smart and healthy decisions.”

Wellory CEO Emily Hochman (Image Credit: Wellory)

Wellory officially launched in September, but Hochman said some beta testers have been using the service for nine, 10 or 11 months. She said early customers include people who are interested in weight loss, those who need nutrition advice due to chronic illness and “optimizers” who simply want to make sure they’re eating as healthily as possible.

She also noted that although customers usually sign up with a specific goal in mind, “once they hit their goal, because of the power of a strong relationship, they say, ‘I don’t want to go back to where I was, let’s keep building, let’s make sure I can sustain this.’ ”

The app is available on iOS and Android and currently costs $59.99 per month. Hochman plans to introduce additional pricing tiers. and she said the funding will allow Wellory to expand the technology and marketing teams, and to explore new partnerships.

“As a data technology investor, we get approached by different types of wearable or diagnostic companies nearly every week,” said Jake Yormak of Story Ventures in a statement. “We love the category but what we saw in Wellory was a way to put a human coach at the center of understanding this health data. With nutrition as the wedge, Wellory has built a trusted relationship with people who affirmatively want to better understand and improve their wellbeing.”

Powered by WPeMatico

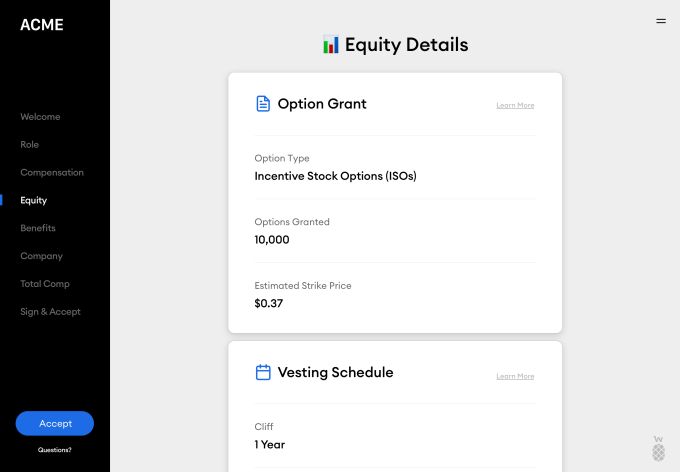

Welcome, the HR software that helps organizations make and close offers to new candidates, announced the close of a $6 million seed round today, led by FirstMark Capital. Participating investors include Ludlow Ventures, Nat Turner and Zach Weinberg, and Keenan Rice and Ben Porterfield (which were existing investors), as well as a wide array of angels.

TechCrunch last covered Welcome in August, when it announced a $1.4 million funding round. That the startup was able to raise more as quickly as it has is testament to how hot the early-stage venture capital market is today, and likely an endorsement of Welcome’s economic profile and recent growth.

Past the new capital, Welcome is also launching a new product today called Total Rewards, which helps not just new candidates but also existing employees get a complete, easy-to-understand picture of their compensation, across salary, benefits, equity, etc.

But let’s back up.

Welcome was founded in 2019 by Nick Gavronsky and Rick Pereira, with a mission to help organizations close offers on candidates by providing a much clearer picture of compensation, particularly around equity. Co-founder and CEO Nick Gavronsky explained that many candidates don’t truly understand the value of the equity they’re offered, or how it works.

“A lot of recruiting teams aren’t well-equipped to use it as a selling tool and explain it effectively and showcase the value to candidates to help them think about their ownership at the company,” he added.

Image Credits: Welcome

Welcome allows companies to organize their compensation offers based on level and position, and deliver that information digitally to candidates in a way that makes sense.

The startup integrates with a variety of other software providers, including Slack, Lever, Greenhouse, ADP and Justworks to name a few, simplifying onboarding for Welcome clients and bringing a broad array of information into one place.

Offers sent through Welcome show a description of the role, equity details, total compensation and even include a welcome note and video. This is in stark contrast to the black and white legal PDF often sent to candidates.

Image Credits: Welcome

The next phase for the company comes in the form of the launch of Total Rewards, which is meant to help retain existing employees, helping them understand their compensation value and their potential at the company.

“Painting a better picture becomes a pre-retention tool,” said Gavronsky. “An employee will sometimes leave thousands of dollars on the table because they don’t understand what they’re walking away from. A lot of times companies will wait until that person is going to resign. Let me now bring up all the things that are great about our company and talk through your stock options. But the decision’s already made. So we wanted something that we can kind of put in with performance reviews.”

Welcome also has plans to offer a third product pillar in the form of real-time accurate industry-wide compensation data, helping companies understand where they fit into the larger ecosystem with regards to compensation.

Thus far, Welcome has 40 companies on the platform, including Uncork and Betterment, with hundreds on the waitlist, according to the co-founders. The company plans to use the funding to build out the team and the product.

Powered by WPeMatico