Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

U.K.-based startup Sylvera is using satellite, radar and lidar data-fuelled machine learning to bolster transparency around carbon offsetting projects in a bid to boost accountability and credibility — applying independent ratings to carbon offsetting projects.

The ratings are based on proprietary data sets it’s developed in conjunction with scientists from research organisations including UCLA, the NASA Jet Propulsion Laboratory and University College London.

It’s just grabbed $5.8 million in seed funding led by VC firm Index Ventures. All its existing institutional investors also participated — namely: Seedcamp, Speedinvest and Revent. It also has backing from leading angels, including the existing and former CEOs of NYSE, Thomson Reuters, Citibank and IHS Markit. (It confirms it has committed not to receive any investment from traditional carbon-intensive companies.) And it’s just snagged a $2 million research contract from Innovate UK.

The problem it’s targeting is that the carbon offsetting market suffers from a lack of transparency.

This fuels concerns that many offsetting projects aren’t living up to their claims of a net reduction in carbon emissions — and that “creative” carbon accountancy is rather being used to generate a lot of hot air: In the form of positive-sounding PR, which sums to meaningless greenwashing and more pollution as polluters get to keep on pumping out climate changing emissions.

Nonetheless, the carbon offset markets are poised for huge growth — of at least 15x by 2030 — as large corporates accelerate their net zero commitments. And Sylvera’s bet is that that will drive demand for reliable, independent data — to stand up the claimed impact.

How exactly is Sylvera benchmarking carbon offsets? Co-founder Sam Gill says its technology platform draws on multiple layers of satellite data to capture project performance data at scale and at a high frequency.

It applies machine learning to analyze and visualize the data, while also conducting what it bills as “deep analytical work to assess the underlying project quality”. Via that process it creates a standardised rating for a project, so that market participants are able to transact according to their preferences.

It makes its ratings and analysis data available to its customers via a web application and an API (for which it charges a subscription).

“We assess two critical areas of a project — its carbon performance, and its ‘quality’,” Gill tells TechCrunch. “We score a project against these criteria, and give them ratings — much like a Moody’s rating on a bond.”

Carbon performance is assessed by gathering “multi-layered data” from multiple sources to understand what is going on on the ground of these projects — such as via multiple satellite sources such as multispectral image, radar, and lidar data.

“We collate this data over time, ingest it into our proprietary machine learning algorithms, and analyse how the project has performed against its stated aims,” Gill explains.

Quality is assessed by considering the technical aspects of the project. This includes what Gill calls “additionality”; aka “does the project have a strong claim to delivering a better outcome than would have occurred but for the existence of the offset revenue?”.

There is a known problem with some carbon offsets claimed against forests where the landowner had no intention of logging, for example. So if there wasn’t going to be any deforestation the carbon credit is essentially bogus.

He also says it looks at factors like permanence (“how long will the project’s impacts last?”); co-benefits (“how well has the project incorporated the UN’s Sustainability Development Goals?); and risks (“how well is the project mitigating risks, in particular those from humans and those from natural causes?”).

Clearly it’s not an exact science — and Gill acknowledges risks, for example, are often interlinked.

“It is critical to assess these performance and quality in tandem,” he tells TechCrunch. “It’s not enough to simply say a project is achieving the carbon goals set out in its plan.

“If the additionality of a project is low (e.g. it was actually unlikely the project would have been deforested without the project) then the achievement of the carbon goals set out in the project does not generate the anticipated carbon goals, and the underlying offsets are therefore weaker than appreciated.”

Commenting on the seed funding in a statement, Carlos Gonzalez-Cadenas, partner at Index Ventures, said: “This is a phenomenally strong team with the vision to build the first carbon offset rating benchmark, providing comprehensive insights around the quality of offsets, enabling purchase decisions as well as post-purchase monitoring and reporting. Sylvera is putting in place the building blocks that will be required to address climate change.”

Powered by WPeMatico

BluBracket, an early-stage startup that focuses on keeping source code repositories secure, even in distributed environments, announced a $12 million Series A today.

Evolution Equity Partners led the round, with help from existing investors Unusual Ventures, Point72 Ventures, SignalFire and Firebolt Ventures. When combined with the $6.5 million seed round we reported on last year, the company has raised $19.5 million so far.

As you might imagine, being able to secure code in distributed environments came in quite handy when much of the technology world moved to work from home last year. BluBracket co-founder and COO Ajay Arora says that the pandemic forced many organizations to look carefully at how they secured their code base.

“So the anxiety organizations had about making sure their source code was secure and that it wasn’t leaking, from that standpoint that was a big tailwind for us. [With companies moving to a] completely remote development workforce, and with code being so important to their business as intellectual property, they needed to get that visibility into what vulnerabilities were there,” Arora explained.

Even prior to the pandemic, the company was finding they were gaining traction with developers and security pros by using a bottom up approach offering a free community version of the software. Having that free version as a top of the funnel for their sales motion was also helpful once COVID hit full force.

Today, Arora says the company has multiple thousands of developers, DevOps and SecOps users across dozens of organizations using the company’s suite of products. The big reference company right now is Priceline, but he says there are other big names that would prefer not to be public about it.

The company currently has 30 employees, with plans to double that by the end of the year, and he says that building diversity and inclusion into the hiring process is part of the company’s core values, and part of how the executive team gets measured.

“We’re big believers in putting our money where our mouth is and one of the OKRs for me and my co-founder [CEO Prakash Linga], or one of the things that we’re actually compensated for, is how well we are doing in building diversity and inclusion on the team,” he said. He adds that the recruiters that they are using are also being held to the same standard when it comes to providing a diverse set of candidates for open positions.

The company launched in 2018 and the founding team came from Vera, a startup that helped secure documents in motion. That company was sold to HelpSystems in December 2020 after Arora and Linga had left to start BluBracket.

Powered by WPeMatico

As the famous phrase goes, “software is eating the world” — and now software is eating dentistry. Or, perhaps more accurately, the arena of orthodontics — the specialty of dentistry that deals with things like braces — is slowly but surely being digitalized.

To whit, Impress, a Southern European player in direct-to-consumer orthodontics, has raised a $50 million Series A funding round led by CareCapital (a dental division of Hillhouse Capital in Asia), along with Nickleby Capital, UNIQA Ventures and investors including Michael Linse, Valentin Pitarque, Peter Schiff, Elliot Dornbusch and others. All existing shareholders, such as TA Ventures and Bynd VC, also participated.

Impress is an homage to the direct-to-consumer startups in this area in the U.S., such as SmileDirect, and now plans to scale across Europe from its existing bases in Spain, Italy, Portugal, the U.K. and France.

The company was founded in 2019 in Barcelona by orthodontist Dr. Khaled Kasem and serial entrepreneurs Diliara and Vladimir Lupenko.

Speaking from Barcelona, Lupenko told me that the idea was to “combine the best orthodontic tradition with the most innovative technology in the sector.”

As things stand, most of the time, consumers can usually only access cosmetic teeth alignment treatments or orthodontic medical treatments in conventional clinics. The new wave of clinics employs 3D scans and panoramic X-rays to check nerve and bone health.

Impress’s model is to offer these high-quality medical treatments directly to consumers, by developing its own chain of orthodontic clinics, which also put an emphasis on design and a “modern” patient experience, it says.

As Diliara Lupenko says: “We didn’t copy what other companies in the space were doing and approached the market from a different angle from the get-go. We doubled down on the doctor-led digital model which brought us way better conversion rates and treatment quality even though on paper it looked complex in the beginning. It’s still very complex but we were able to crack it and scale exponentially.”

Impress now has 75 clinics in Spain, Italy, the U.K., France and Portugal, which optimize costs and automate key parts of the value chain.

It now says it’s approaching €50 million in annual run-rate and is projected to grow to €150 million of revenue in 12 months.

Andreas Nemeth, managing partner of UNIQA Ventures GmbH commented: “Impress’s customer-centric focus, as well as its demonstrated ability to blitzscale, attracted us to the business. Vladimir and his team leverage technology to create a seamless customer journey for invisible orthodontics and optimized their cost structure in a unique way using software.”

Powered by WPeMatico

Having a great idea for an app or game is one thing, but scaling it to become a successful business is quite another. A new fintech startup called Sanlo aims to help. The company, which is today announcing an oversubscribed $3.5 million seed round, offers small to medium-sized game and app companies access to tools to manage their finances and capital to fuel their growth.

To be clear, Sanlo is not an investor that’s taking an equity stake in the apps and games it finances. Instead, it’s offering businesses access to technology, tools and insights that will allow them to achieve smart and scalable growth while remaining financially healthy — even if they’re a smaller company without time to sit down and structure their finances. Then, when Sanlo’s proprietary algorithms determine the business could benefit from the smart deployment of capital, it will assist by offering financing.

The idea for Sanlo hails from co-founders Olya Caliujnaia and William Liu, who both have backgrounds in fintech and gaming.

Caliujnaia began her career in venture capital in one of the first mobile-focused funds, before moving to operator roles in gaming, stock photography and fintech at EA, Getty Images and SigFig, respectively. She later joined early-stage fintech and enterprise fund XYZ.vc as an Entrepreneur in Residence.

Liu, meanwhile, worked in gaming at EA, but later switched to fintech, working at startups like Earnest and Branch.

After reconnecting in San Francisco, the co-founders realized they could put their combined experience to work in order to help smaller businesses just starting out recognize when it’s time to scale, what areas of the business to invest in and how much capital they need to grow.

Image Credits: Sanlo’s Olya Caliujnaia and William Liu / Sanlo

Caliujnaia has seen how the app and gaming market has evolved over the years, and she realized the difficulties new developers now face.

“You have this explosion of the app economy that’s growing insanely,” she says. “That’s the exciting part of it. That creativity. That passion and that desire to build — that’s so admirable.”

Today, companies benefit from having access to better development tools, broader access to talent, consumer demand, and other forces, she notes, compared with those in the past. But on the flip side, it’s become incredibly difficult to scale a consumer app or game.

“I think a lot of that comes down to, one, that there are dynamics around the free-to-play model — how you monetize and therefore, what kind of players and users you bring on board,” Caliujnaia says. “And then the second aspect is that it’s just harder to get noticed. So, ultimately, it comes down to marketing.”

Many of the decisions that a company has to make on this front are predictable, however. That means Sanlo doesn’t have to sit down with businesses and consult with them one-on-one, the way a financial advisor working in wealth management would do with their clients.

Instead, Sanlo asks companies for certain types of data to get started. This includes product data about how well the app or game monetizes and customer acquisition and retention, for example, as well as marketing data and a subset of financial data. Its predictive algorithms then continually monitor the company’s growth trajectory to surface insights to identify where and how the business can grow.

This concept alone could have worked as a services business for mobile studios, but Sanlo takes the next step beyond advice to actually provide companies with access to capital. The amount of financing provided will vary based on the life stage of the company and risk profile, but it’s non-dilutive capital. That is, Sanlo takes no ownership stake in the companies it finances.

Image Credits: Sanlo

Caliujnaia said it made more sense to go this route rather than return to the VC world, because of potential to reach a wider group.

“There’s this long tail of developers and it’s more about enabling them, rather than producing more hits,” she says. “It’s very different mindsets, different markets that we’re going for.”

Sanlo doesn’t have a lot of direct competitors beyond perhaps, Silicon Valley Bank and other financial lenders, as well as mobile gaming publishers. But the publisher model often implies some sort of ownership, which is a significant differentiating factor. In some cases, you may see a larger gaming company extending debt financing to a smaller one. That was the case with Finnish mobile games company Metacore, which recently raised another debt round from gaming giant Supercell, for example.

Caliujnaia points out that most smaller companies don’t have that kind of access to financing. Now they could, through Sanlo.

“The idea is to have a healthier layer of companies that are able to survive for the long-term,” she says.

That means more companies that won’t have to stress about their futures, leading them to aggressively monetize their users, and later, scrambling for an exit when their financial runway comes to an end.

Sanlo is currently pilot testing its system with a small group of mobile game studios who will serve as its initial customer base, but plans to later support consumer apps, which have similar struggles with customer acquisition costs and growth.

The San Francisco-headquartered startup itself was founded in 2020 and began raising money. It has now raised a total of $3.5 million in seed funding co-led by Index Ventures and Initial Capital, with participation from LVP, Portag3 Ventures and XYZ Venture Capital. Angel investors include Kristian Segestrale (Super Evil Megacorp CEO), Gokul Rajaram and Charley Ma.

Initial Capital co-founder and partner Ken Lamb became a board director with the fundraise, while Index partner Mark Goldberg and XYZ managing partner Ross Fubini joined as board observers.

“Sanlo cracked the code to help mobile gaming and app companies reach maturity with a new level of speed, scale, and fiscal wellbeing,” said Goldberg, in a statement. “The company is building a very sophisticated fintech offering that will give those companies superpowers.”

Sanlo plans to use the funds to grow its team and product suite ahead of its public launch later this year.

Powered by WPeMatico

Charity Dean has been in the national spotlight lately because she was among a group of doctors, scientists and tech entrepreneurs who sounded the pandemic alarm early last year and who are featured in a new book by Michael Lewis about the U.S. response, called The Premonition.

It’s no wonder the press — and, seemingly moviemakers, too — are interested in Dean. Surgery is her first love, but she also studied tropical diseases and not only applied what she knows about outbreaks on the front lines last year, but also came to appreciate an opportunity that only someone in her position could see. Indeed, after the pandemic laid bare just how few tools were available to help the U.S. government to track how the virus was moving and mutating, she helped develop a model that has since been turned into subscription software to (hopefully) prevent, detect, and contain costly disease outbreaks in the future.

It’s tech that companies with global operations might want to understand better. It has also attracted $8 million in seed funding Venrock, Alphabet’s Verily unit, and Sweat Equity Ventures. We talked late last week with Dean about her now 20-person outfit, called The Public Health Company, and why she thinks disease-focused risk management will be as crucial for companies going forward as cybersecurity software. Our chat has been edited for length; you can also listen to our longer conversation here.

TC: You went to medical school but you also have a master’s degree in public health and tropical medicine. Why was the latter an area of interest for you?

CD: Neither of my parents had college degrees. I grew up in a very modest setting in rural Oregon. We were poor and by the grace of a full ride scholarship to college I got to be premed. When I was a little girl some missionaries came to our church and talked about disease outbreaks in Africa. I was seven years old, and driving home that evening with my parents, I said, ‘I’m going to be a doctor, and I’m going to study disease.’ It was outrageous because I didn’t know a single person with a college degree. But . . my heart was set on that, and it never deviated from it.

TC: How did you wind up at the Santa Barbara County Public Health Department, instead of in private practice?

CD: It’s funny, when I was finishing up my residency — which I started doing general surgery, then I pivoted into internal medicine — I had a number of different doctors’ private practices come to me and try to recruit me because of the shortage of women physicians.

[At the same time] the medical director from the county public health department came and found me and he said, ‘Hey, I hear you have a master’s in tropical medicine.’ And he said, ‘Would you consider coming to work as the deputy health officer, and communicable disease controller, and tuberculosis controller, and [oversee the] HIV clinic and homeless clinic?’ And . . . it was, for me, a fairly easy choice.

TC: Because there was so little attention being paid to all of these other issues?

CD: What caught my attention is when he said communicable disease controller and tuberculosis controller. I had lived in Africa [for a time] and learned a lot about HIV, AIDS, tuberculosis, vaccine-preventable diseases — things you don’t see in the United States. [And the job] was so in lockstep with who I was because it’s the safety net. [These afflicted individuals] don’t have health insurance. Many are undocumented. Many have nowhere else to go for health care, and the county clinic truly serves the communities that I cared about, and that’s where I wanted to be.

TC: In that role — and later at the California Department of Public Health — you developed expertise in multi-drug-resistant tuberculosis. Was your understanding of how it is transmitted — and how the symptoms present differently — what made you attuned to what was headed for the U.S. early last year?

CD: It was probably the single biggest contributor to my thinking. When we have a novel pathogen as a doctor, or as a communicable disease controller, our minds think in terms of buckets of pathogen: some are airborne, some are spread on surfaces, some are spread through fecal material or through water. In January [of last year], as I was watching the news reports emerge out of China, it became clear to me that this was potentially a perfect pathogen. What does that mean? It would mean it had some of the attributes of things like tuberculosis or measles or influenza — that it had the ability to spread from person to person, likely through the air, that it made people sick enough that China was standing up hospitals in two weeks, and that it moved fast enough through the population to grow exponentially.

TC: You are credited with helping to convince California Governor Gavin Newsom to issue lock-down orders when he did.

CD: Everything I’ve done is as part of a team. In March, some amazing heroes parachuted in from the private sector, including [former U.S Chief Technology Officer] Todd Park, [famed data scientist] DJ Patil, [and Venrock’s] Bob Kocher, to help the state of California develop a modeling effort that would actually show, through computer-generated models, in what direction the pandemic was headed.

TC: How did those efforts and thinking lead you to form The Public Health Company last August?

CD: What we are doing at The Public Health Company is incorporating the genomic variant analysis — or the fingerprint of the virus of COVID virus as it mutates and as it moves through a population — with epidemiology investigations and [porting these with] the kind of traditional data you might have from a local public health officer into a platform to make those tools readily available and easy to use to inform decision makers. You don’t have to have a mathematician and a data scientist and an infectious disease doctor standing next to you to make a decision; we make those tools automated and readily available.

TC: Who are your customers? The U.S. government? Foreign governments?

CD: Are the tools that we are developing useful for government? Absolutely. We’re engaged in a number of different partnerships where this is of incredible service to governments. But they are as useful, if not even more useful, to the private sector because they haven’t had these tools. They don’t have a disease control capability at their fingertips and many of them have had to essentially stand up their own internal public health department, and figure it out on the fly, and the feedback that we’re seeing from private sector businesses has been incredible.

TC: I could see hedge funds and insurance companies gravitating quickly to this. What are some customers or types of customers that might surprise readers?

CD: One bucket that might not occur to people is in the risk management space of a large enterprise that has global operations like a warehouse or a factory in different places. The risk management of COVID-19 is going to look very different in each one of those locations based on: how the virus is mutating in that location, the demographics of their employees, the type of activities they’re doing, [and] the ventilation system in their facility. Trying to grapple with all of those different factors . . .is something that we can do for them through a combination of our tech-enabled service, the expertise we have, the modeling, and the genetic analysis.

I don’t know that risk management in terms of disease control has been a big part of private sector conversations, [but] we think of it similar to cyber security in that after a number of high-profile cyber security attacks, it became clear to every insurance agency or private sector business that risk management had to include cyber security they had to stand up. We very much believe that disease control in risk management for continuity of operations is going to be incredibly important moving forward in a way that I couldn’t have explained before COVID. They see it now and they understand it’s an existential threat.

Powered by WPeMatico

Panaseer, which takes a data science approach to cybersecurity, has raised $26.5 million in a Series B funding led by AllegisCyber Capital. Existing investors, including Evolution Equity Partners, Notion Capital, AlbionVC, Cisco Investments and Paladin Capital Group, as well as new investor National Grid Partners, also participated. Panaseer has now raised $43 million to date.

Panaseer’s special sauce and sales pitch amount to what it calls “Continuous Controls Monitoring” (CCM). In plainer English that means correlating a great deal of data from all available security tools to check assets, control gaps, you name it.

As a result, the company says it can identify zero-day and other exposures faster, or exposure to, say, FireEye or SolarWinds vulnerabilities.

Jonathan Gill, CEO, Panaseer said: “Most enterprises have the tools and capability to theoretically prevent a breach from occurring. However, one of the key reasons that breaches occur is that there is no technology to monitor and react to failed controls. CCM continuously validates and measures levels of protection and provides notifications of failures. Ultimately, CCM enables these failures to be fixed before they become security incidents.”

Speaking to me on a call he added: “The investment, allows us to scale our organization to meet those demands of customers with a team of people to implement the platform and help them get tremendous value and to evolve the product. To add more and more capability to that technology to support more and more use cases. So they’re the two main directions, and there’s a market we think of tens of thousands of organizations of a certain size, who are regulated or they have assets worth protecting and a level of complexity that makes it difficult to solve the problem themselves. And our Advisory Board and the customers I’ve spoken with think maybe there are barely 20 companies in the world who can solve this problem. And everybody else gets stuck on the fact that it’s a really difficult data science problem to solve. So we want to scale that and take that to more organizations.”

And why did they pick these investors: “I think we picked them and they picked us, we’ve been on that journey together. It takes months to find the best combination. The dollars are all the same when it comes to investors, but I think they can help improve as an organization and grow just like the existing investors do. They give us access and reach into parts of the market and help make us better as organizations as well.”

Bob Ackerman, founder and managing director of AllegisCyber Capital, and co-founder of DataTribe said: “The emergence of Continuous Controls Monitoring as a new cybersecurity category demonstrates a ‘coming of age’ for cybersecurity. Cyber is the existential threat to the global digital economy. All levels of the enterprise, from the CISO, to Chief Risk Officer, to the Board of Directors are demanding comprehensive visibility, transparency and hard metrics to assess cyber situational awareness.”

Powered by WPeMatico

The tabletop gaming industry has exploded over the last few years as millions discovered or rediscovered its joys, but it too is evolving — and The Last Gameboard hopes to be the venue for that evolution. The digital tabletop platform has progressed from crowdfunding to $4 million seed round, and having partnered with some of the biggest names in the industry, plans to ship by the end of the year.

As the company’s CEO and co-founder Shail Mehta explained in a TC Early Stage pitch-off earlier this year, The Last Gameboard is a 16-inch square touchscreen device with a custom OS and a sophisticated method of tracking game pieces and hand movements. The idea is to provide a digital alternative to physical games where that’s practical, and do so with the maximum benefit and minimum compromise.

If the pitch sounds familiar… it’s been attempted once or twice before. I distinctly remember being impressed by the possibilities of D&D on an original Microsoft Surface… back in 2009. And I played with another at PAX many years ago. Mehta said that until very recently there simply wasn’t the technology and the market wasn’t ready.

“People tried this before, but it was either way too expensive or they didn’t have the audience. And the tech just wasn’t there; they were missing that interaction piece,” she explained, and certainly any player will recognize that the, say, iPad version of a game definitely lacks physicality. The advance her company has achieved is in making the touchscreen able to detect not just taps and drags, but game pieces, gestures and movements above the screen, and more.

“What Gameboard does, no other existing touchscreen or tablet on the market can do — it’s not even close,” Mehta said. “We have unlimited touch, game pieces, passive and active… you can use your chess set at home, lift up and put down the pieces, we track it the whole time. We can do unique identifiers with tags and custom shapes. It’s the next step in how interactive surfaces can be.”

It’s accomplished via a not particularly exotic method, which saves the Gameboard from the fate of the Surface and its successors, which cost several thousand dollars due to their unique and expensive makeups. Mehta explained that they work strictly with ordinary capacitive touch data, albeit at a higher framerate than is commonly used, and then use machine learning to characterize and track object outlines. “We haven’t created a completely new mechanism, we’re just optimizing what’s available today,” she said.

At $699 for the Gameboard it’s not exactly an impulse buy, either, but the fact of the matter is people spend a lot of money on gaming, with some titles running into multiple hundreds of dollars for all the expansions and pieces. Tabletop is now a more than $20 billion industry. If the experience is as good as they hope to make it, this is an investment many a player will not hesitate (much, anyway) to make.

Of course, the most robust set of gestures and features won’t matter if all they had on the platform were bargain-bin titles and grandpa’s-parlor favorites like “Parcheesi.” Fortunately, The Last Gameboard has managed to stack up some of the most popular tabletop companies out there, and aims to have the definitive digital edition for their games.

Asmodee Digital is probably the biggest catch, having adapted many of today’s biggest hits, from modern classics “Catan” and “Carcassonne” to crowdfunded breakout hit “Scythe” and immense dungeon-crawler “Gloomhaven.” The full list of partners right now includes Dire Wolf Digital, Nomad Games, Auroch Digital, Restoration Games, Steve Jackson Games, Knights of Unity, Skyship Studios, EncounterPlus, PlannarAlly and Sugar Gamers, as well as individual creators and developers.

These games may be best played in person, but have successfully transitioned to digital versions, and one imagines that a larger screen and inclusion of real pieces could make for an improved hybrid experience. There will be options both to purchase games individually, like you might on mobile or Steam, or to subscribe to an unlimited access model (pricing to be determined on both).

It would also be something that the many gaming shops and playing venues might want to have a couple of on hand. Testing out a game in-store and then buying a few to stock, or convincing consumers to do the same, could be a great sales tactic for all involved.

In addition to providing a unique and superior digital version of a game, the device can connect with others to trade moves, send game invites and all that sort of thing. The whole OS, Mehta said, “is alive and real. If we didn’t own it and create it, this wouldn’t work.” This is more than a skin on top of Android with a built-in store, but there’s enough shared that Android-based ports will be able to be brought over with little fuss.

Head of content Lee Allentuck suggested that the last couple years (including the pandemic) have started to change game developers’ and publishers’ minds about the readiness of the industry for what’s next. “They see the digital crossover is going to happen — people are playing online board games now. If you can be part of that new trend at the very beginning, it gives you a big opportunity,” he said.

CEO Shail Mehta (center) plays Stop Thief on the Gameboard with others on the team. Image Credits: The Last Gameboard

Allentuck, who previously worked at Hasbro, said there’s widespread interest in the toy and tabletop industry to be more tech-forward, but there’s been a “chicken and egg scenario,” where there’s no market because no one innovates, and no one innovates because there’s no market. Fortunately things have progressed to the point where a company like The Last Gameboard can raise $4 million to help cover the cost of creating that market.

The round was led by TheVentureCity, with participation from SOSV, Riot Games, Conscience VC, Corner3 VC and others. While the company didn’t go to HAX’s Shenzhen program as planned, they are still HAX-affiliated. SOSV partner Garrett Winther gave a glowing recommendation of its approach: “They are the first to effectively tie collaborative physical and digital gameplay together while not losing the community, storytelling or competitive foundations that we all look for in gaming.”

Mehta noted that the pandemic nearly cooked the company by derailing their funding, which was originally supposed to come through around this time last year when everything went pear-shaped. “We had our functioning prototype, we had filed for a patent, we got the traction, we were gonna raise, everything was great… and then COVID hit,” she recalled. “But we got a lot of time to do R&D, which was actually kind of a blessing. Our team was super small so we didn’t have to lay anyone off — we just went into survival mode for like six months and optimized, developed the platform. 2020 was rough for everyone, but we were able to focus on the core product.”

Now the company is poised to start its beta program over the summer and (following feedback from that) ship its first production units before the holiday season when purchases like this one seem to make a lot of sense.

(This article originally referred to this raise as The Last Gameboard’s round A — it’s actually the seed. This has been updated.)

Powered by WPeMatico

Long before COVID-19 precipitated “digital transformation” across the world of work, customer services and support was built to run online and virtually. Yet it too is undergoing an evolution supercharged by technology.

Today, a startup called SightCall, which has built an augmented reality platform to help field service teams, the companies they work for, and their customers carry out technical and mechanical maintenance or repairs more effectively, is announcing $42 million in funding, money that it plans to use to invest in its tech stack with more artificial intelligence tools and expanding its client base.

The core of its service, explained CEO and co-founder Thomas Cottereau, is AR technology (which comes embedded in their apps or the service apps its customers use, with integrations into other standard software used in customer service environments including Microsoft, SAP, Salesforce and ServiceNow). The augmented reality experience overlays additional information, pointers and other tools over the video stream.

This is used by, say, field service engineers coordinating with central offices when servicing equipment; or by manufacturers to provide better assistance to customers in emergencies or situations where something is not working but might be repaired quicker by the customers themselves rather than engineers that have to be called out; or indeed by call centers, aided by AI, to diagnose whatever the problem might be. It’s a big leap ahead for scenarios that previously relied on work orders, hastily drawn diagrams, instruction manuals and voice-based descriptions to progress the work in question.

“We like to say that we break the barriers that exist between a field service organization and its customer,” Cottereau said.

The tech, meanwhile, is unique to SightCall, built over years and designed to be used by way of a basic smartphone, and over even a basic mobile network — essential in cases where reception is bad or the locations are remote. (More on how it works below.)

Originally founded in Paris, France before relocating to San Francisco, SightCall has already built up a sizable business across a pretty wide range of verticals, including insurance, telecoms, transportation, telehealth, manufacturing, utilities and life sciences/medical devices.

SightCall has some 200 big-name enterprise customers on its books, including the likes of Kraft-Heinz, Allianz, GE Healthcare and Lincoln Motor Company, providing services on a B2B basis as well as for teams that are out in the field working for consumer customers, too. After seeing 100% year-over-year growth in annual recurring revenue in 2019 and 2020, SightCall’s CEO says it’s looking like it will hit that rate this year as well, with a goal of $100 million in annual recurring revenue.

The funding is being led by InfraVia, a European private equity firm, with Bpifrance also participating. The valuation of this round is not being disclosed, but I should point out that an investor told me that PitchBook’s estimate of $122 million post-money is not accurate (we’re still digging on this and will update as and when we learn more).

For some further context on this investment, InfraVia invests in a number of industrial businesses, alongside investments in tech companies building services related to them such as recent investments in Jobandtalent, so this is in part a strategic investment. SightCall has raised $67 million to date.

There has been an interesting wave of startups emerging in recent years building out the tech stack used by people working in the front lines and in the field, a shift after years of knowledge workers getting most of the attention from startups building a new generation of apps.

Workiz and Jobber are building platforms for small business tradespeople to book jobs and manage them once they’re on the books; BigChange helps manage bigger fleets; and Hover has built a platform for builders to be able to assess and estimate costs for work by using AI to analyze images captured by their or their would-be customers’ smartphone cameras.

And there is Streem, which I discovered is a close enough competitor to SightCall that they’ve acquired AdWords ads based on SightCall searches in Google. Just ahead of the COVID-19 pandemic breaking wide open, General Catalyst-backed Streem was acquired by Frontdoor to help with the latter’s efforts to build out its home services business, another sign of how all of this is leaping ahead.

What’s interesting in part about SightCall and sets it apart is its technology. Co-founded in 2007 by Cottereau and Antoine Vervoort (currently SVP of product and engineering), the two are long-time telecoms industry vets who had both worked on the technical side of building next-generation networks.

SightCall started life as a company called Weemo that built video chat services that could run on WebRTC-based frameworks, which emerged at a time when we were seeing a wider effort to bring more rich media services into mobile web and SMS apps. For consumers and to a large extent businesses, mobile phone apps that work “over the top” (distributed not by your mobile network carrier but the companies that run your phone’s operating system, and thus partly controlled by them) really took the lead and continue to dominate the market for messaging and innovations in messaging.

After a time, Weemo pivoted and renamed itself as SightCall, focusing on packaging the tech that it built into whichever app (native or mobile web) where one of its enterprise customers wanted the tech to live.

The key to how it works comes by way of how SightCall was built, Cottereau explained. The company has spent 10 years building and optimizing a network across data centers close to where its customers are, which interconnects with Tier 1 telecoms carriers and has a lot of latency in the system to ensure uptime. “We work with companies where this connectivity is mission critical,” he said. “The video solution has to work.”

As he describes it, the hybrid system SightCall has built incorporates its own IP that works both with telecoms hardware and software, resulting in a video service that provides 10 different ways for streaming video and a system that automatically chooses the best in a particular environment, based on where you are, so that even if mobile data or broadband reception don’t work, video streaming will. “Telecoms and software are still very separate worlds,” Cottereau said. “They still don’t speak the same language, and so that is part of our secret sauce, a global roaming mechanism.”

The tech that the startup has built to date not only has given it a firm grounding against others who might be looking to build in this space, but has led to strong traction with customers. The next steps will be to continue building out that technology to tap deeper into the automation that is being adopted across the industries that already use SightCall’s technology.

“SightCall pioneered the market for AR-powered visual assistance, and they’re in the best position to drive the digital transformation of remote service,” said Alban Wyniecki, partner at InfraVia Capital Partners, in a statement. “As a global leader, they can now expand their capabilities, making their interactions more intelligent and also bringing more automation to help humans work at their best.”

“SightCall’s $42M Series B marks the largest funding round yet in this sector, and SightCall emerges as the undisputed leader in capital, R&D resources and partnerships with leading technology companies enabling its solutions to be embedded into complex enterprise IT,” added Antoine Izsak of Bpifrance. “Businesses are looking for solutions like SightCall to enable customer-centricity at a greater scale while augmenting technicians with knowledge and expertise that unlocks efficiencies and drives continuous performance and profit.”

Cottereau said that the company has had a number of acquisition offers over the years — not a surprise when you consider the foundational technology it has built for how to architect video networks across different carriers and data centers that work even in the most unreliable of network environments.

“We want to stay independent, though,” he said. “I see a huge market here, and I want us to continue the story and lead it. Plus, I can see a way where we can stay independent and continue to work with everyone.”

Powered by WPeMatico

Israeli security startup Cycode, which specializes in helping enterprises secure their DevOps pipelines and prevent code tampering, today announced that it has raised a $20 million Series A funding round led by Insight Partners. Seed investor YL Ventures also participated in this round, which brings the total funding in the company to $24.6 million.

Cycode’s focus was squarely on securing source code in its early days, but thanks to the advent of infrastructure as code (IaC), policies as code and similar processes, it has expanded its scope. In this context, it’s worth noting that Cycode’s tools are language and use case agnostic. To its tools, code is code.

“This ‘everything as code’ notion creates an opportunity because the code repositories, they become a single source of truth of what the operation should look like and how everything should function, Cycode CTO and co-founder Ronen Slavin told me. “So if we look at that and we understand it — the next phase is to verify this is indeed what’s happening, and then whenever something deviates from it, it’s probably something that you should look at and investigate.”

The company’s service already provides the tools for managing code governance, leak detection, secret detection and access management. Recently it added its features for securing code that defines a business’ infrastructure; looking ahead, the team plans to add features like drift detection, integrity monitoring and alert prioritization.

“Cycode is here to protect the entire CI/CD pipeline — the development infrastructure — from end to end, from code to cloud,” Cycode CEO and co-founder Lior Levy told me.

“If we look at the landscape today, we can say that existing solutions in the market are kind of siloed, just like the DevOps stages used to be,” Levy explained. “They don’t really see the bigger picture, they don’t look at the pipeline from a holistic perspective. Essentially, this is causing them to generate thousands of alerts, which amplifies the problem even further, because not only don’t you get a holistic view, but also the noise level that comes from those thousands of alerts causes a lot of valuable time to get wasted on chasing down some irrelevant issues.”

What Cycode wants to do then is to break down these silos and integrate the relevant data from across a company’s CI/CD infrastructure, starting with the source code itself, which ideally allows the company to anticipate issues early on in the software life cycle. To do so, Cycode can pull in data from services like GitHub, GitLab, Bitbucket and Jenkins (among others) and scan it for security issues. Later this year, the company plans to integrate data from third-party security tools like Snyk and Checkmarx as well.

“The problem of protecting CI/CD tools like GitHub, Jenkins and AWS is a gap for virtually every enterprise,” said Jon Rosenbaum, principal at Insight Partners, who will join Cycode’s board of directors. “Cycode secures CI/CD pipelines in an elegant, developer-centric manner. This positions the company to be a leader within the new breed of application security companies — those that are rapidly expanding the market with solutions which secure every release without sacrificing velocity.”

The company plans to use the new funding to accelerate its R&D efforts, and expand its sales and marketing teams. Levy and Slavin expect that the company will grow to about 65 employees this year, spread between the development team in Israel and its sales and marketing operations in the U.S.

Powered by WPeMatico

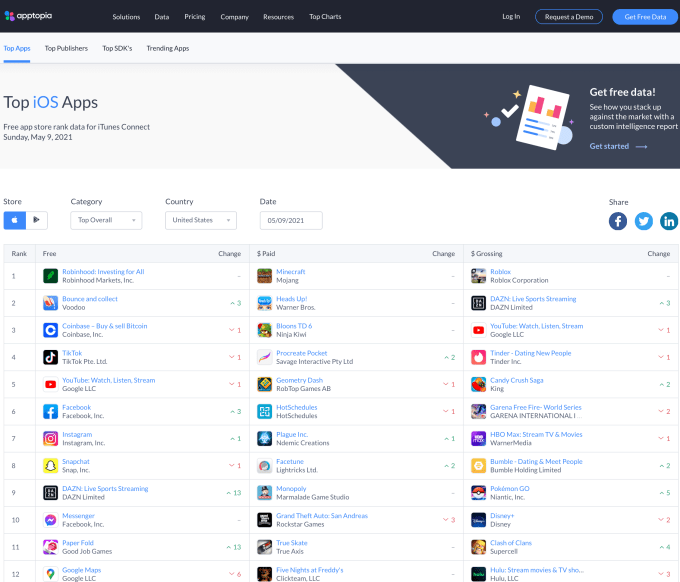

Boston-based Apptopia, a company providing competitive intelligence in the mobile app ecosystem, has closed on $20 million in Series C funding aimed at fueling its expansion beyond the world of mobile apps. The new financing was led by ABS Capital Partners, and follows three consecutive years of 50% year-over-year growth for Apptopia’s business, which has been profitable since the beginning of last year, the company says.

Existing investors, including Blossom Street Ventures, also participated in the round. ABS Capital’s Mike Avon, a co-founder of Millennial Media, and Paul Mariani, are joining Apptopia’s board with this round.

The funding follows what Apptopia says has been increased demand from brands to better understand the digital aspects of their businesses.

Today, Apptopia’s customers include hundreds of corporations and financial institutions, including Google, Visa, Coca-Cola, Target, Zoom, NBC, Unity Technologies, Microsoft, Adobe, Glu, Andreessen Horowitz and Facebook.

In the past, Apptopia’s customers were examining digital engagement and interactions from a macro level, but now they’re looking to dive deeper into specific details, requiring more data. For example, a brand may have previously wanted to know how well a competitor’s promotion fared in terms of new users or app sessions. But now they want to know the answers to specific questions — like how many unique users participated, whether those users were existing customers, whether they returned after the promotion ended, and so on.

The majority of Apptopia’s business is now focused on delivering these sorts of answers to enterprise customers who subscribe to Apptopia’s data — and possibly, to the data from its competitors like Sensor Tower and App Annie, with the goal of blending data sets together for a more accurate understanding of the competitive landscape.

Apptopia’s own data, historically, was not always seen as being the most accurate, admits Apptopia CEO Jonathan Kay. But it has improved over the years.

Kay, previously Apptopia COO, is now taking over the top role from co-founder Eliran Sapir, who’s transitioning to chairman of the board as the company enters its next phase of growth.

Apptopia’s rivals like Sensor Tower and App Annie use mobile panels to gather app data, among other methods, Kay explains. These panels involve consumer-facing apps like VPN clients and ad blockers, which users would download not necessarily understanding that they were agreeing to having their app usage data collected. This led to some controversy as the app data industry’s open secret was exposed to consumers, and the companies tweaked their disclosures, as a result.

But the practice continues and has not impacted the companies’ growth. Sensor Tower, for example, raised $45 million last year, as demand for app data continued to grow. And all involved businesses are expanding with new products and services for their data-hungry customer bases.

Image Credits: Apptopia

Apptopia, meanwhile, decided not to grow its business on the back of mobile panels. (Though in its earlier days it did test and then scrap such a plan.)

It gains access to data from its app developer customers — and this data is already aggregated and anonymized from the developers’ Apple and Google Analytics accounts.

Initially, this method put Apptopia at a disadvantage. Rivals had more accurate data from about 2016 through 2018 because of their use of mobile panels, Kay says. But Apptopia made a strategic decision to not take this sort of risk — that is, build a business that Apple or Google could shut off at any time.

“Instead, what we did is we spent years investing into data science and algorithms,” notes Kay. “We figured out how to extract an equal or greater signal from the same data set that [competitors] had access to.”

Using what Kay describes as “huge, huge amounts of historical data,” Apptopia over time learned what sort of signals went into an app’s app store ranking. A lot of people still think an app’s rank is largely determined by downloads, but there are now a variety of signals that inform rank, Kay points out.

“Really, a rank is just an accumulation of analytical data points that Apple and Google give points for,” he explains. This includes things like number of sessions, how many users, how much time is spent in an app, and more. “Because we didn’t have these panels, we had to spend years figuring out how to do reverse engineering better than our competitors. And, eventually, we figured out how to get the same signal that they could get from the panel from rank. That’s what allowed us to have such a fast-growing, successful business over the past several years.”

As Apptopia was already profitable, it didn’t need to fundraise. But the company wanted to accelerate its expansion into new areas, including its planned expansion outside of mobile apps.

Today, consumers use “apps” on their computers, on their smartwatches and on their TVs, in addition to their phones and tablets. And businesses no longer want to know just what’s happening on mobile — they want the full picture of “app” usage.

“We figured out a way to do that that doesn’t rely on any of what our competitors have done in the past,” says Kay. “So, we will not be using any apps to spy on people,” he states.*

[*Sensor Tower, in response to Kay’s statements, said the following: “We have never collected any personally identifying information (PII) on individual users, nor have we received any of the anonymous usage and engagement metrics our panel provides without user consent.”]

Apptopia was not prepared to offer further details around its future product plans at this time. But Kay said they would not rule out partnerships or being acquisitive to accomplish its goals going forward.

The company also sees a broader future in making its app data more accessible. Last year, for instance, it partnered with Bloomberg to bring mobile data to investors via the Bloomberg App Portal on the Bloomberg Terminal. And it now works with Amazon’s AWS Data Exchange and Snowflake to make access to app data available in other channels, as well. Future partnerships of a similar nature could come into play as another means of differentiating Apptopia’s data from its rivals.

The company declined to offer its current revenue run rate or valuation, but notes that it tripled its valuation from its last fundraise at the end of 2019.

In addition to product expansions, the company plans to leverage the funds to grow its team of 55 by another 25 in 2021, including in engineering and analysts. And it will grow its management team, adding a CFO, CPO and CMO this year.

To date, Apptopia has raised $30 million in outside capital.

Powered by WPeMatico