Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Steve Sy, CEO of Great Deals, and William Chiongbian II, CEO of Fast Group, sign the contract for the companies’ strategic partnership. Image Credits: Great Deals

Founded in 2014, Great Deals is an e-commerce enabler that helps brands like Abbot, L’Oréal and Unilever build their online retail operations in the Philippines. The startup announced today that it has raised $30 million in Series B funding led by Fast Group, one of the Philippines’ biggest logistics firms, with support from CVC Capital Partners. Navegar, which led Great Deals’ Series A, also returned for this round.

The transaction was advised by Rocket Equities. The investment by Fast Group, which has a fleet of more than 2,500 vehicles and 90,000 stores in its distribution network, marks the beginning of a strategic partnership. Great Deals will use part of the new capital to build an automated fulfillment center, and the deal will help it increase its penetration outside the Greater Manila Area and offer more Instant Commerce, or deliveries under one hour.

Great Deals currently operates only in the Philippines, but plans to expand regionally next year, founder and chief executive officer Steve Sy told TechCrunch.

In a statement, Fast Group president and chief executive officer William Chiongbian II said, “The Fast Group sees a lot of synergies with Great Deals in building capacity. We are privileged to contribute to the growth of Philippine e-commerce, as it relies heavily on a strong supply chain backbone.”

Some of Great Deals’ other clients include Nestlé, Samsonite, GSK, Bayer and Fila. In addition to serving as an e-commerce distributor, it offers an end-to-end services for brands, including digital content production, marketing campaign coordination and management of marketplace listings (Great Deals’ partners include Lazada, Shopee, Zalora, Zilingo, Shopify and Magento).

Powered by WPeMatico

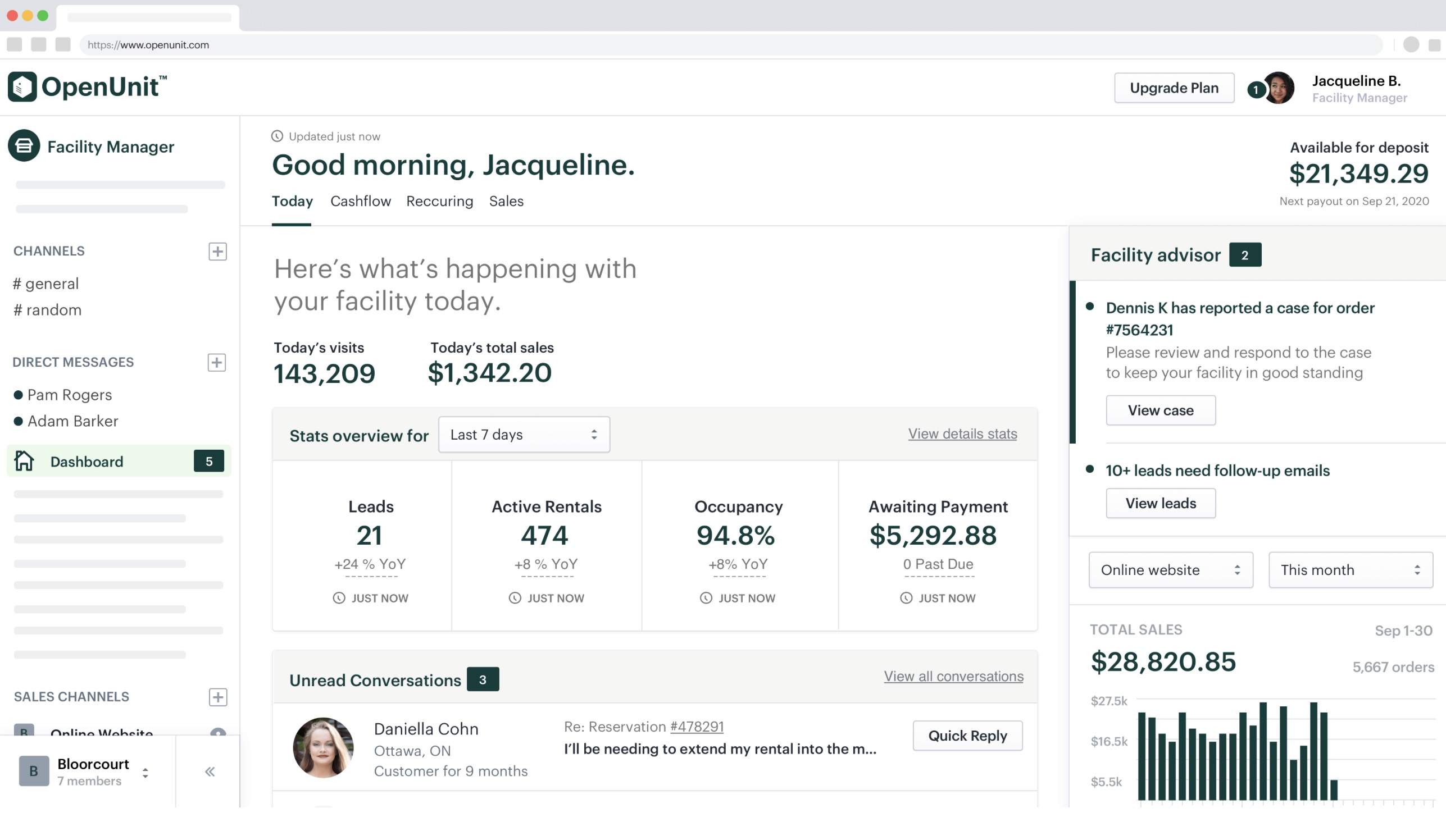

How are mom-and-pop self-storage facilities meant to keep up with the tech offered by the massive, ever-growing chains?

That’s a key part of the idea behind OpenUnit, a team I first wrote about in August of last year. You bring the storage units, they bring the website, payment processing and backend tools you need to manage them. They don’t charge facility owners a monthly subscription fee, instead taking a cut of each payment as the payments processor.

OpenUnit has now raised a $1 million seed round, and acquired the IP of a fellow YC company along the way.

Since we last heard from OpenUnit, they’ve been expanding to locations around the U.S. and Canada, and now have a waitlist over 800 facilities deep, the team tells me.

Image Credits: OpenUnit

OpenUnit co-founder Taylor Cooney was quick to point out that this seed round is as much about strategic partnerships as it is about the money. Neither Taylor nor co-founder Lucas Playford had much to do with the storage industry until a knock at the door led them down a rabbit hole. As I wrote back in August:

…Taylor’s landlords came to him with an offer: they wanted to sell the place he was renting, and they’d give him a stack of cash if he could be out within just a few days. Pulling that off meant finding a place to keep all of his stuff while he looked for a new home, which is when he realized how antiquated the self-storage process could be.

Of the 20+ investors participating in the round, six are from the self-storage industry, from prior/current facility owners to the director of the Canadian Self Storage Association. For some of them, it’s their first time investing in a tech or software company — but all potentially bring something to the table beyond money.

Of course, that’s not to say they’re just letting that money sit around. They’ve grown the team from just Taylor and Lucas up to five, and are still looking to grow. Meanwhile, Taylor tells me the company has acquired the IP of fellow Y Combinator W20 batchmate Affiga, a product that aimed to automatically provide insights about a new customer after a transaction is made.

Writes Taylor: “As self-storage companies move services like rentals, leases, and payments online, it’s becoming increasingly difficult for them to ‘know’ their customers. We see the integration into our product as a way to help self-storage operators bridge the gap between their online and in-store customer experiences, where the personal touch tends to be lost.”

Affiga initially shut down its operations back in 2020. After OpenUnit realized they wanted something similar in their product, they set out to buy rather than build. “With a decade in e-commerce under their belt,” Taylor tells me, “their founder had a much better approach to this then we would’ve come up with.”

So what’s next? Besides getting more people off the waitlist and onto the platform, they’re exploring other opportunities, including potentially providing loans to facilities looking to expand or renovate. Because OpenUnit is both the management platform and the payments provider, they have deep insights on how a facility is doing; they know how much a location makes, how punctual their customers are with payments, etc. Take that data and mash it up with insights on what improvements can increase revenue, and it seems like a pretty straightforward formula.

This round includes investment from Garage Capital, Advisors Fund, Insite Property Group, SquareFoot co-founder Jonathan Wasserstrum, and a number of angel investors.

Powered by WPeMatico

Part of learning to be an engineer is understanding the tools you’ll have to work with — voltmeters, spectrum analyzers, things like that. But why use two, or eight for that matter, where one will do? The Moku:Go combines several commonly used tools into one compact package, saving room on your workbench or classroom while also providing a modern, software-configurable interface. Creator Liquid Instruments has just raised $13.7 million to bring this gadget to students and engineers everywhere.

The idea behind Moku:Go is largely the same as the company’s previous product, the Moku:Lab. Using a standard input port, a set of FPGA-based tools perform the same kind of breakdowns and analyses of electrical signals as you would get in a larger or analog device. But being digital saves a lot of space that would normally go toward bulky analog components.

The Go takes this miniaturization further than the Lab, doing many of the same tasks at half the weight and with a few useful extra features. It’s intended for use in education or smaller engineering shops where space is at a premium. Combining eight tools into one is a major coup when your bench is also your desk and your file cabinet.

Those eight tools, by the way, are: waveform generator, arbitrary waveform generator, frequency response analyzer, logic analyzer/pattern generator, oscilloscope/voltmeter, PID controller, spectrum analyzer and data logger. It’s hard to say whether that really adds up to more or less than eight, but it’s definitely a lot to have in a package the size of a hardback book.

You access and configure them using a software interface rather than a bunch of knobs and dials — though let’s be clear, there are good arguments for both. When you’re teaching a bunch of young digital natives, however, a clean point-and-click interface is probably a plus. The UI is actually very attractive; you can see several examples by clicking the instruments on this page, but here’s an example of the waveform generator:

Love those pastels.

The Moku:Go currently works with Macs and Windows but doesn’t have a mobile app yet. It integrates with Python, MATLAB and LabVIEW. Data goes over Wi-Fi.

Compared with the Moku:Lab, it has a few perks. A USB-C port instead of a mini, a magnetic power port, a 16-channel digital I/O, optional power supply of up to four channels and of course it’s half the size and weight. It compromises on a few things — no SD card slot and less bandwidth for its outputs, but if you need the range and precision of the more expensive tool, you probably need a lot of other stuff too.

Since the smaller option also costs $500 to start (“a price comparable to a textbook”… yikes) compared with the big one’s $3,500, there’s major savings involved. And it’s definitely cheaper than buying all those instruments individually.

The Moku:Go is “targeted squarely at university education,” said Liquid Instruments VP of marketing Doug Phillips. “Professors are able to employ the device in the classroom and individuals, such as students and electronic engineering hobbyists, can experiment with it on their own time. Since its launch in March, the most common customer profile has been students purchasing the device at the direction of their university.”

About a hundred professors have signed on to use the device as part of their fall classes, and the company is working with other partners in universities around the world. “There is a real demand for portable, flexible systems that can handle the breadth of four years of curriculum,” Phillips said.

Production starts in June (samples are out to testers), the rigors and costs of which likely prompted the recent round of funding. The $13.7 million comes from existing investors Anzu Partners and ANU Connect Ventures, and new investors F1 Solutions and Moelis Australia’s Growth Capital Fund. It’s a convertible note “in advance of an anticipated Series B round in 2022,” Phillips said. It’s a larger amount than they intended to raise at first, and the note nature of the round is also not standard, but given the difficulties faced by hardware companies over the last year, some irregularities are probably to be expected.

No doubt the expected B round will depend considerably on the success of the Moku:Go’s launch and adoption. But this promising product looks as if it might be a commonplace item in thousands of classrooms a couple years from now.

Powered by WPeMatico

The podcasting world remains one of the most vibrant formats in media (and I am not just saying that since the Equity crew won a Webby yesterday for our not-that-humble podcast). Its openness, diversity, freedom and ease-of-authoring has broadened the medium to all sorts of hosts on every subject imaginable.

We experience that dynamism and verve in our own audio listening, but then we start to tune into our company’s internal communications, and, well, you certainly don’t need sleeping pills to zone out. Top-down, formal, banal — corporate comms remains mired in a 1950s way of speaking that is completely out-of-sync with the millennials and Gen Z majority of workers who expect something actually worth watching and listening to.

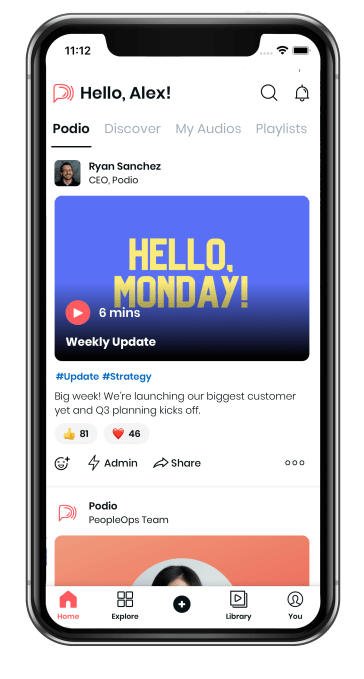

Spokn wants to make company-wide podcasting a must-listen event, not just for leaders to talk to their employees, but for every worker to have a voice and share their expertise and stories across their workplaces. Through its app, companies can deliver personalized podcast feeds on everything from a daily standup or weekly AMA to training and development content, all of which is secure and kept for internal use.

It’s an idea that has quickly attracted investor attention. The startup, which was part of Y Combinator’s most recent Winter 2021 batch, closed on a $4 million seed round two weeks before Demo Day led by Ann Bordetsky, a partner at NEA who joined earlier this year and previously served as COO of Rival. This is her first investment with the firm.

The company was founded by Fawzy Abu Seif, Mariel Davis and Mohammad Galal Eldeen. Abu Seif and Davis met each other in an Egyptian jazz club in November 2017, about a week after he had quit his job. They eventually came together not just as a couple — they got married in the fall of 2019 — but as business partners, linking up with Galal Eldeen and incorporating Spokn in April 2018.

Spokn’s Mohammad Galal Eldeen, Mariel Davis and Fawzy Abu Seif. Image Credits: Spokn

Spokn’s product evolved across three iterations. First, the team tried to create audio narrations of evergreen content at major publishers like The New York Times. The idea was to help publishers reuse their best content as a new revenue source while connecting more listeners into these brands. Getting publishers to commit was tough though. “The consumer app wasn’t doing that great, and we started hunting around the data to see if something was working,” Davis said.

What they found was that professional development podcasts were much more popular compared to other topics, and so they had an opportunity to re-jigger the product to focus on training and specifically target enterprises. The idea was “let’s empower companies with the same tools we had as a consumer company,” Abu Seif said.

Prior to Spokn, Davis had worked with an entrepreneur in the Middle East building out a social enterprise network focused on skills training, a role in which she handled internal communications. She saw just how little impact media like email made for employees, particularly in the distributed workforce she was attempting to engage. The new direction for Spokn was far more enticing.

The newly married couple moved to New York City from Egypt and signed an apartment lease in early March 2020 — just as the COVID-19 pandemic spread widely in the region. We “multiplied the living expenses by 8-10x while doing the same Zoom calls we could make from there,” Abu Seif joked.

Eventually, the company realized that it could do much more than just training, and expanded into broader internal comms. “Async audio is a lot more personal than email,” Abu Seif said. This latest product iteration launched in November 2020, and included push notifications, an app for streaming, personalization features and analytics to allow companies to track what was working and what was not for employees.

Spokn’s app offers a personalized feed of company podcasts. Image Credits: Spokn

Perhaps most importantly, companies can tailor the access lists for individual podcasts to particular groups of people, such as senior execs, people managers, sales employees or any other logical grouping. We “get a lot of inbound from companies that are trying to duct-tape solutions together,” Davis said. For Abu Seif, “all the tools that marketers have to engage consumers, we are empowering companies to engage with their employees.”

Despite the startup and product’s youth, it has attracted a quick following among companies, with customers including Podium, ShipBob, Cedar, Mixpanel, ServiceNow and Superhuman. Podium’s CEO, for example, records weekly podcasts that are shipping on Spokn, and apparently even installed a podcast studio near his office just to make it easier to produce his shows.

Podcasting inside companies fixes a lot of problems with traditional internal comms. First and foremost, it can create a deeper connection where email cannot. Audio can feel more personal than even video, and also can be played in the background. It’s also asynchronous, unlike live video, allowing employees in different time zones to connect with key stories at an appropriate time.

Plus, employees can avoid all the fatigue that comes from being onscreen. “No one wants Zoom zombies,” Bordetsky of NEA said. “We need intuitive and asynchronous communication tools like Spokn to build connection and community in the workplace.” Her thesis for the investment is that “flexible, distributed work is here to stay and employee communication is at the heart of building a modern, virtual-first employee experience.”

Buyers of Spokn range from heads of people to sales teams, and the company is also focused on recruiting and retention as well. “Companies are pretty freaked out about retaining their great talent,” Davis said. Some companies are now sharing “stories with prospects even before their first day at the company.”

While the product is mostly used by leaders today, Spokn wants to expand that remit to employees talking with their peer colleagues, helping to build community in hybrid offices where it is harder than ever to make a connection with others.

Of course, companies can screw up podcasting just as much as they have screwed up every other medium to communicate like humans, and Davis says it’s become her full-time job to help them think through storytelling and how to connect better with their own employees. We “work to find the right storytellers in the company,” she said.

Outside NEA, other investors in the seed round included Reach Capital, Funders Club, Liquid2, Share Capital, SOMA Capital, Scribble VC and Hack VC.

Powered by WPeMatico

Britive, an early-stage startup that is trying to bring privileged access control to a multi-cloud world, announced a $10 million Series A this morning. Crosslink Capital led the investment, with participation from previous investors Upfront Ventures and One Way Ventures.

The company helps automate permissioning across multiple cloud vendors and software services, whether that involves a human or a machine seeking permission. In a world of increasing automation, it’s often a machine seeking access, and that makes permissioning all the more critical, says Britive co-founder and CEO Art Poghosyan.

“What we offer is an automated approach to access, [moving from] what we call statically granted access, which constantly gets added all the time […] to completely ‘just in time access’,” he said. That means that after you define a policy, it sets the ground rules for access, and grants it based on that policy for the time required, and nothing more, whether you’re a human or a machine.

In today’s complex development, world that could take many forms, including API keys and secrets. “Yes, sometimes those things are granted to a human actor like a DevOps engineer, but a lot of times it also needs to be granted — quote, unquote — to a Terraform script or to GitHub to go and build out application infrastructure or deploy an application,” he said.

The company currently has 40 employees, a number that Poghosyan expects to double in the next 12 months as he puts this capital to work. As a first-generation Armenian immigrant, Poghosyan says that he takes diversity and inclusion extremely seriously as he hires more employees.

“We’ve always been committed — in this business and our previous startup — to providing equal opportunities to talented people, no matter what background they come from. I’m really proud that even as a small company — we’re 40 at the moment — we have more than 50% of our workforce which comes from ethnic minority groups,” he said.

Britive, which is based in Los Angeles, launched in 2018 and brought its first product to market in 2019. The company raised a $5.4 million seed round last July, which it announced in September, making the total raised so far approximately $15.4 million.

Powered by WPeMatico

Fintech startup StudentFinance — which allows educational institutions to offer success-based financing for students — has raised a $5.3 million (€4.5 million) seed round co-led by Giant Ventures and Armilar Venture Partners. It’s now raised $6.6 million total, to date.

StudentFinance launched in Spain first, followed by Germany and Finland, with the U.K. planned this year. Existing investors Mustard Seed Maze and Seedcamp, along with Sabadell Venture Capital, also participated.

The startup, which launched at the beginning of 2020, provides the tech back end for institutions to offer flexible payment plans in the form of ISAs (income-share agreements). It also provides data intelligence on the employment market to predict job demand.

It now has 35 education providers signed up, managing over €5 million worth of ISAs. It also works with upskilling platforms including Ironhack and Le Wagon. StudentFinance’s competitors include (in the USA) Blair, Leif, Vemo Education, Chancen (Germany-based) and EdAid (U.K.-based).

As for why StudentFinance stands out from those companies, Mariano Kostelec, co-founder and CEO of StudentFinance, said: “StudentFinance is the only platform in this space providing the full end-to-end, cross-border infrastructure to deliver ISAs for students whilst helping to plug the growing skills gap. Not only do we provide the infrastructure to support the ISA financing model, but we also provide data intelligence on the employment market and a career-as-a-service platform that focuses on placing students in the right job. We are creating an equilibrium between supply and demand.”

With an ISA, students only start paying back tuition once they are employed and earning above a minimum income threshold, with payments structured as a percentage of their earnings. This makes it a “success-based model”, says StudentFinance, which shifts the risk away from the students. They are likely to be popular as workers need to reskill with the onset of digitization and the pandemic’s effects.

The startup was founded in 2019 by Kostelec, Marta Palmeiro, Sergio Pereira and Miguel Santo Amaro. Kostelec and Santo Amaro previously built Uniplaces, which raised $30 million as a student housing platform in Europe.

Cameron Mclain, managing partner of Giant Ventures, commented: “What StudentFinance has built empowers any educational institution to offer ISAs as an alternative to upfront tuition or student loans, broadening access to education and opportunity.”

Duarte Mineiro, partner at Armilar Venture Partners, commented: “StudentFinance is a great opportunity to invest in because aside from its very compelling core purpose, this is a sound business where its economics are backed by a solid proprietary software technology.”

Sia Houchangnia, partner at Seedcamp, commented: “The need for reskilling the workforce has never been as acute as it is today and we believe StudentFinance has an important role to play in tackling this societal challenge.”

Angel backers include investors, which includes: Victoria van Lennep (founder of Lendable); Martin Villig (founder of Bolt); Ed Vaizey (the U.K.’s longest-serving Culture & Digital Economy Minister); Firestartr (U.K.-based early-stage VC); Serge Chiaramonte (U.K. fintech investor); and more.

Powered by WPeMatico

Roofer Pro. Roof Snap. Acculynx. There’s suddenly no shortage of companies offering software to make easier the lives of roofers and their customers. Among these is Roofr, a five-year-old, San Francisco-based, 31-person sales platform for roofing contractors that just raised $4.25 million in post-seed funding led by Bullpen Capital, with participation from Avidbank and previous backer Crosslink Capital.

Co-founder and CEO Rich Nelson is aware of the competition. But as a third-generation roofer by trade, he also knows well that the industry is far from overcoming its reputation as rife with sketchy, flaky contractors whose customers often question whether they need a new roof or suspect the estimates they are given are wildly inflated.

He also knows — as do his investors — how big a market opportunity Roofr and its rivals are chasing. “It’s a massive, massive market,” says Nelson. “On average, every year, roughly five million buildings in the U.S. have their roof replaced,” and they spend $50 billion toward that end, he says.

Right now, Roofr is focused exclusively on helping close that initial sale. It all starts with a picture of a roof that Roofr obtains from partner companies like Nearmap, whose planes cover cities at low altitude to take high-definition pictures, including of roofs. Roofr software then allows these contractors to draw their own roof measurement reports through these drone, blueprint and satellite images and produce a report, or they can pay Roofr $10 per report to measure the roof for them.

Unsurprisingly, COVID-19 made the software more attractive to both roofing contractors and customers who weren’t keen on being in close proximity during the pandemic. Offerings like Roofr’s made it possible to quickly and easily send a potential customer a quote without visiting the job site. The bet now is that growing awareness over the product will continue to fuel that momentum.

The company also has new offerings in the pipeline that may make it more compelling to both roofers and their clients. In addition to quickly providing roofers with measurement data, for example, roofers can now pay a monthly fee to have Roofr auto-populate an estimate based on a specific materials list, as well as the profit margin the roofer wants to incorporate; it also now provides and preserves digital contracts.

As for its current customer base, Nelson says that it includes the largest roofing contractors in North America, but that Roofr is even more interested in small businesses, which, while fragmented, represent a much bigger opportunity. He says that there are more than 100,000 registered roofing businesses in the U.S., and that the vast majority are comprised of five employees or fewer. (Roofr also sells its software to independent insurance adjusters.)

The new round brings Roofr’s total funding to $8.25 million. Crosslink led its initial seed round in early 2019. Roofr also raised money from Y Combinator when it passed through the accelerator program in 2017.

Pictured above from left to right: Roofr co-founders Kevin Redman and Rich Nelson. Redman is the company’s CTO; Nelson is its CEO.

Powered by WPeMatico

Electric aviation startup Beta Technologies closed a $368 million Series A funding round on Tuesday, with investments from Amazon’s Climate Pledge Fund. The new capital is the second round of funding announced by the company this year, after the company raised $143 million in private capital in March.

The funding round was led by Fidelity Management & Research Company, with undisclosed additions from Amazon’s Climate Pledge Fund, a $2 billion fund established in September 2019 to advance the development of sustainable technologies. The Climate Pledge fund has also made contributions toward electric vehicle manufacturer Rivian, battery recycler Redwood Materials and ZeroAvia, a hydrogen fuel cell aviation company.

The company’s valuation is now at $1.4 billion, CNBC reported, putting it in a small circle of electric vertical take-off and landing (eVTOL) companies to have achieved valuations at over a billion dollars.

Unlike developers Joby Aviation and Archer Aviation, which have each also achieved valuations over the billion-dollar mark, Beta is not primarily focused on air taxis. Instead, it’s been targeting defense applications, cargo delivery and medical logistics, as well as building out its network of rapid-charging systems in the northeast U.S. Its debut aircraft, the ALIA-250c, was built to serve these various solutions by being capable of carrying six people or a pilot and 1,500 pounds.

The Vermont-based startup has already scored major partnerships in all of these industries, including with United Therapeutics to transport synthetic organs for human transplant; UPS, which purchased 10 ALIA aircraft with the option of buying 140 more; and the U.S. Air Force.

The company has not entirely ignored passenger transportation, however, announcing last month a partnership with Blade Urban Air Mobility for five aircraft to be delivered in 2024.

Beta was the first company to be awarded airworthiness approval from the U.S. Air Force. The company expects to sign a contract in June with the Air Force to allow access to Beta’s aircraft and flight simulators in Washington, D.C. and Springfield, Ohio. However, it still must achieve certification with the Federal Aviation Administration.

The funds will be used to refine the ALIA’s electric propulsion system and controls, as well as to build out manufacturing space, including expanding its footprint in Vermont on land at the Burlington International Airport, the company said in a news release Tuesday.

Powered by WPeMatico

Commission-free trading app Stake, which is available in the U.K., Brazil and New Zealand, has raised $30 million from Tiger Global and partners of London-based DST Global to expand into Europe.

Matt Leibowitz, founder and CEO of Stake said: “We’re really excited to get to this point but it’s just the start. We set out to change the game for retail investors and were self-funded for the first four years of our journey. We’ve proven the model and now have the chance to expand our product and bring our zero-brokerage service to more retail investors.”

Since launching in the U.K. in early 2020, Stake claims to have grown its total customer base more than six times over, with 25% month-on-month customer growth on average and hitting over 330,000 customers globally.

It was the first to offer commission-free access to the U.S. market in Australia, offering retail investors access to over 4,400 U.S. stocks & ETFs without a brokerage fee.

In the U.K. it competes with eToro, Libertex, Fineco, Plus500 and IG, among others.

Powered by WPeMatico

Meet Finary, a new French startup that wants to change how you manage your savings, investments, mortgage, real estate assets and cryptocurrencies. The company lets you aggregate all your accounts across various banks and financial institutions so you can track your wealth comprehensively over time.

After attending Y Combinator, the startup has just closed a $2.7 million (€2.2 million) seed round led by Speedinvest, with Kima Ventures and angel investors such as Raphaël Vullierme also participating.

If you know people who have a ton of money, chances are they tend to be at least 40 or 50 years old — you don’t become rich overnight, after all. And they tend to manage their investment portfolio through a wealth management service with tailor-made services.

“There’s very little tech in wealth management. Advisors are also incentivized to sell you some financial products in particular,” co-founder and CEO Mounir Laggoune told me. In that situation, the company in charge of the financial product is generating revenue for the advisor — not the client.

At the same time, a new generation of investors is starting to accumulate a lot of wealth. And yet, they don’t have the right tools to allocate it properly. Younger people want to see information directly. They want a way to track information in real time, or near real time. And they want to be able to take some actions based on that data.

Finary wants to build that service based on those principles. It starts with an API-based aggregator. When you create a Finary account, you can connect it with all your other accounts — bank accounts, brokerage accounts, mortgage and real estate, gold, cryptocurrencies, etc.

The startup leverages various open banking APIs to be as exhaustive as possible. For instance, “you can connect a Robinhood account and a Crédit Mutuel de Bretagne account,” Laggoune said. Behind the scenes, Finary uses Plaid and Budget Insight, runs its own bitcoin and Ethereum nodes to track wallet addresses, and estimates the value of your home through public data and a proprietary algorithm.

After that, you can see how much money you have, how it is divided between your investment pools, the current value of your gold and cryptocurrency assets and more.

“Our long-term vision is that we want to build a virtual wealth manager for Europe,” Laggoune said.

That’s why Finary recently launched its premium subscription called Finary+. With a premium account, you can see how much you’re paying in fees and track your performance — more features will get added over time.

A few months after launching its platform, Finary already tracks €2 billion in assets across thousands of users. With today’s funding round, the startup will roll out its service to more countries and more financial institutions in France, Europe and the U.S. The company is also working on mobile apps.

This is an interesting take on wealth management, as Finary doesn’t try to reinvent the wheel. Legacy players want you to use a single bank for all your financial needs. But you end up paying a lot of fees and you have to use old and clunky interfaces.

Finary isn’t yet another wealth management service. It’s a holistic service that lets you use multiple banks and services while remaining on top of your assets.

Image Credits: Finary

Powered by WPeMatico