Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

For those of us unlucky enough to be forced to accommodate mother nature’s whims on a monthly basis, you know that — in addition to cramps, headaches and mood swings — it can be a challenge to find time in your schedule to buy the period products you need.

Desperate trips to the pharmacy when disaster hits can suffice, but the co-founders of the tampon subscription service Athena Club, Maria Markina and Allie Griswold, thought there had to be a better way to provide women the products they need in a cheap and empowering way.

“We’ve both had our fair share of tampon war stories,” Griswold told TechCrunch. “It’s something that every woman goes through at some point in her life and it’s a universal problem that we wanted to make easier. There are so many other amazing things that women can and should be doing than worrying about [where to get tampons] every month.”

Athena Club launches today after receiving $3.8 million in seed funding from investors including Henry Kravis of KKR, the Desmarais Group and Cue Ball Capital. The company currently offers two tampon types (Premium and Organic) and a variety of absorbances (ranging from light to super+ for its Premium product and regular to super for its Organic one). The company also has plans to expand its products into pads and liners as the brand progresses.

In each order, customers can decide how many bags they need (each reusable bag includes 18 tampons), what type of tampon and what mix of absorbances they want, and how frequently they need them delivered. A selection of its Premium tampons cost $6.50/bag and its Organic selections are $7.50/bag.

For the founders, this level of customization was an important part of giving women autonomy over their periods.

“[We chose] the name Athena Club because we believe Athena is a really strong, fearless, independent woman and we’re very excited to bring that essence to our brand.” said Griswold. “Like Athena, women today have many passions and talents. They can’t all fit into one box and we want to provide [the option] to find the right customized package that works for their body.”

Athena Club also recognizes that for some women, access to tampons and period products is more than just a nuisance but a critical health issue. To help provide security and education surrounding periods and women’s health to women in need, Athena Club is committed to supporting groups like Period.org and Support the Girls. To date, Athena Club has already donated 10,000 tampons to women in need through Period.org and has plans to continue that support on a yearly basis.

Athena Club is joining a fairly crowded feminine care subscription space, but the founders say that its price point will help it stand apart from the crowd. Tampon subscription companies like LOLA offer a subscription plan priced at $10/box for 18 plastic applicator tampons (the same type and count as Athena Club) and Cora offers 18 tampons for $13/box. Other more extravagant boxes, like Hello Flo incorporate add-ons like chocolate or underwear in their boxes and can be priced upwards of $40.

And, all of these models are up against long-term, reusable period solutions like Thinx period underwear (which can cost up to $39 for two tampons worth of absorption per use) and plastic menstrual cups like the Diva Cup (which retails for $40.99.)

With so many options, Athena Club presents itself as the cheap, no-fuss solution for women who are through letting periods disrupt their lives.

Updated to reflect seed round funding contributions

Powered by WPeMatico

“Happy to spend 10 minutes on our vision and the journey we’re on, but then, really, 15 minutes on what we’ve got today, what it is we’ve achieved, what it is our AI does,” says Tractable co-founder and CEO Alexandre Dalyac when I video called him a couple of weeks ago. “You can probably speed up all of that,” I quip back.

The resulting conversation, lasting well over an hour, spanned all of the above and more, including what is required to build a successful AI business and why he and his team think they can help prevent another “AI winter.”

Founded in 2014 by Dalyac, Adrien Cohen and Razvan Ranca after going through company builder Entrepreneur First, London-based Tractable is applying artificial intelligence to accident and disaster recovery. Specifically, through the use of deep learning to automate visual damage appraisal, and therefore help speed up insurance payouts and access to other types of financial aid.

Our AI has already been trained on tens of millions of these cases, so that’s a perfect case of us already having distilled thousands of people’s work experience Alexandre Dalyac

Dalyac launches into what is clearly a well-rehearsed and evidently polished pitch. “We are on a journey to help the world recover faster from accidents and disasters. Our belief is that when accidents and disasters hit, the response could be 10 times faster thanks to AI. So what we mean there is, everything from road accidents, burst piping to large-scale floods and hurricane. Whenever any of these things happen, things get damaged.”

Those things, he says, broadly break down into cars, homes and crops, roughly equating to $1 trillion in damage each year. But, perhaps more importantly, livelihoods get impacted.

“If a car gets damaged, mobility is reduced. If a home gets damaged, shelter is reduced. And if crops get damaged, food is reduced. Across all of those accidents and disasters, we’re talking hundreds of millions of lives affected.”

It is here where a little lateral (and non-artificial) thinking is required. Accident and disaster recovery starts with visual damage appraisal: look at the damage, say how much it’s going to cost, unlock the funds and rebuild. The problem (and Tractable’s opportunity) is that having an appraiser look at a car, house or field can take days to weeks depending on availability — and therefore so can accessing funds to start rebuilding — whereas the claim is that computer vision and AI technology can potentially do the same job in minutes.

“When you assess, that is basically a very powerful but very narrow visual task, which is, look at the damage, how much is it gonna cost? Today, as you can imagine, these kind of assessments are manual. And they take days to weeks. And so you instantly know that with AI that can be 10 times faster,” says Dalyac.

“In some sense this is a perfect class of AI tasks, because it’s very heavy on image classification. And image classification is a task where AI can surpass human performance as of this decade. If you have instant appraisal, that means faster recovery. Hence the mission.”

Dalyac says that part of Tractable’s secret sauce is in the many millions of proprietary labels the company has produced. This has been aided by its patented “interactive machine learning technology,” which allows it to label images faster and cheaper than typical labeling services.

The team’s focus to date has been to train its AI to understand car damage, technology it has already deployed in six countries, seeing the startup work primarily with insurers.

Related to this I’m shown a simple demo of Tractable’s car damage appraisal tool. Dalyac opens a folder of car images on his laptop and uploads them to the software. Within seconds, the AI has seemingly identified the different parts of the car and determined which parts can be repaired and which parts need to be entirely written-off and therefore replaced fully. Each has an AI-generated estimated cost.

It all happens within a matter of minutes, although I have no way of knowing how difficult the pre-determined and fully controlled task is. It’s also unclear how an AI can possibly do the full job of a human assessor based on a limited set of 2D images alone, and without the ability to peek under the hood or undertake further investigations.

“We’re trying to figure out how much damage there is to a vehicle based on photos,” explains Dalyac. “There’s some really tough correlations to pick out, which are: based on the photos of the outside, what’s the internal damage? When you’re a human you are going to have seen and torn down maybe about a thousand to two thousand cars in your whole life of 20 or 30 years of doing that. Our AI has already been trained on tens of millions of these cases, so that’s a perfect case of us already having distilled thousands of people’s work experience. That allows us to get hold of some very challenging correlations that humans just can’t do.”

You need to find real-world use cases that will make a difference, where you can surpass human performance Alexandre Dalyac

With that said, he does concede that a photo doesn’t always contain all of the necessary information, and that it might only have a certain level of accuracy. “You might need to then get a tear-down of the car and get photos of the internal damage. You might even want to get some data from the dashboard. And you can think that as cars get more sensors… the appraisal will be not just visual but also based on IoT data. But that doesn’t detract from the fact that we are convinced that it will be AI that will be doing this entirely.”

What is abundantly clear is Dalyac’s commitment to developing AI technology with real-world use that is commercially viable. If that doesn’t happen, he believes it won’t just be Tractable that will suffer, but the continued belief and investment in AI as a whole. Here, of course, he’s talking about the prospect of another so-called “AI winter,” citing a recent Crunchbase report that says funding for artificial intelligence companies in the U.S. has levelled off and even started to decline at seed stage.

“If you’re trying to make the $15 billion that has been invested into AI not fuck up and lead to something successful that will prevent an AI winter that will lead to continuous improvement, you need a really good return on that asset class. And for that you need those businesses to be successful.

“To make an AI company successful, really successful — not just an acqui-hire, not just an IP exit but a real commercial success that’s going to prevent an AI winter — you need to find real-world use cases that will make a difference, where you can surpass human performance, where you can change the way things work,” he says.

The reference to acqui-hire or IP exit takes on more meaning when you consider that Tractable was in the same cohort at Entrepreneur First as Magic Pony Technology, the AI startup acquired by Twitter for up to $150 million for its image enhancing technology. And most recently, the team behind Bloomsbury AI, another EF company, was acqui-hired by Facebook for $20-30 million.

To ensure that Tractable can continue its mission of applying AI to accident and disaster recovery — and presumably not sell too early — the startup has closed $20 million in Series B investment in a round led by U.S. venture capital firm Insight Venture Partners. Existing investors, including Ignition Partners, Zetta Venture Partners, Acequia Capital and Plug and Play Ventures, also participated. The new capital is to be spent on accelerating growth, expanding its research and development and entering new markets.

(The Series B also included an additional $5 million in secondary funding, seeing some investors at least partially exit. I understand Tractable’s founders sold a relatively small number of shares as they were permitted to take money off the table. Dalyac declined to comment.)

As we wrap up our call, I note that all of Tractable’s main investors, not including EF, are from the U.S. — something Dalyac says was a deliberate decision after he discovered the gulf between European and U.S. valuations.

“That’s a shame, isn’t it?” I say with my European tech ecosystem hat on.

“It isn’t; it’s enormous exports for the U.K.,” says the Tractable CEO who is French-born but raised in the U.K. “We have, as of today, the vast majority of our headcount in London. The entire product team is in London. The entire R&D team is in London. But most of the revenue comes from the United States. We are making AI an export industry of the U.K.”

Powered by WPeMatico

As the economy has chugged along, so have retail sales, which last year capped their strongest year since 2014. Online sales have been especially brisk, growing 16 percent between 2016 and 2017 alone, according to the U.S. Commerce Department, which estimates that consumers spent $453.5 billion online last year.

Of course, with every booming market comes supporting cast members that benefit. Such is the case with eight-year-old, Washington, D.C.-based Optoro, which itself just rang up $75 million in new funding. A logistics company, Optoro’s software helps retailers — both online and off — more easily re-sell inventory that has been returned by customers.

That’s a big number. The overall amount of merchandise returned as a percent of total sales last year was 10 percent in 2017, according to the National Retail Federation. In dollars, that’s $351 billion.

Right now, that includes sales from big box retailers and many other “legacy” companies that allow shoppers to buy items — and return them — in their stores. But as online sales rise, so do online returns. Indeed, Optoro co-founder and CEO Tobin Moore tells the WSJ that the “return rate from e-commerce sales is two to three times the return rate of brick-and-mortar” and “sometimes higher in fashion and apparel.” And with most retailers also paying for shipping on returns — after all, a happy customer is a repeat customer — it’s a major logistics cost for these online brands.

Little wonder that Optoro, which uses data analytics and multi-channel online marketing to determine the best path for each item (ostensibly maximizing recovery and reducing environmental waste in the process) is a hit with a growing base of customers.

A growing number of investors is getting behind the company, too. Optoro’s newest round was led by Franklin Templeton Investments, but the company has now raised at least $200 million altogether, including from Revolution Growth, Generation Investment Management, Grotech Ventures and even the UPS Strategic Enterprise Fund.

Powered by WPeMatico

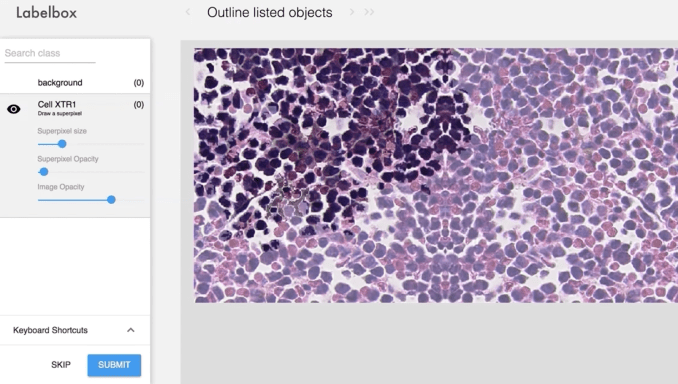

Every artificial intelligence startup or corporate R&D lab has to reinvent the wheel when it comes to how humans annotate training data to teach algorithms what to look for. Whether it’s doctors assessing the size of cancer from a scan or drivers circling street signs in self-driving car footage, all this labeling has to happen somewhere. Often that means wasting six months and as much as a million dollars just developing a training data system. With nearly every type of business racing to adopt AI, that spend in cash and time adds up.

Labelbox builds artificial intelligence training data labeling software so nobody else has to. What Salesforce is to a sales team, Labelbox is to an AI engineering team. The software-as-a-service acts as the interface for human experts or crowdsourced labor to instruct computers how to spot relevant signals in data by themselves and continuously improve their algorithms’ accuracy.

Today, Labelbox is emerging from six months in stealth with a $3.9 million seed round led by Kleiner Perkins and joined by First Round and Google’s Gradient Ventures.

“There haven’t been seamless tools to allow AI teams to transfer institutional knowledge from their brains to software,” says co-founder Manu Sharma. “Now we have over 5,000 customers, and many big companies have replaced their own internal tools with Labelbox.”

Kleiner’s Ilya Fushman explains that “If you have these tools, you can ramp up to the AI curve much faster, allowing companies to realize the dream of AI.”

Sharma knew how annoying it was to try to forge training data systems from scratch because he’d seen it done before at Planet Labs, a satellite imaging startup. “One of the things that I observed was that Planet Labs has a superb AI team, but that team had been for over six months building labeling and training tools. Is this really how teams around the world are approaching building AI?,” he wondered.

Before that, he’d worked at DroneDeploy alongside Labelbox co-founder and CTO Daniel Rasmuson, who was leading the aerial data startup’s developer platform. “Many drone analytics companies that were also building AI were going through the same pain point,” Sharma tells me. In September, the two began to explore the idea and found that 20 other companies big and small were also burning talent and capital on the problem. “We thought we could make that much smarter so AI teams can focus on algorithms,” Sharma decided.

Labelbox’s team, with co-founders Ysiad Ferreiras (third from left), Manu Sharma (fourth from left), Brian Rieger (sixth from left) Daniel Rasmuson (seventh from left)

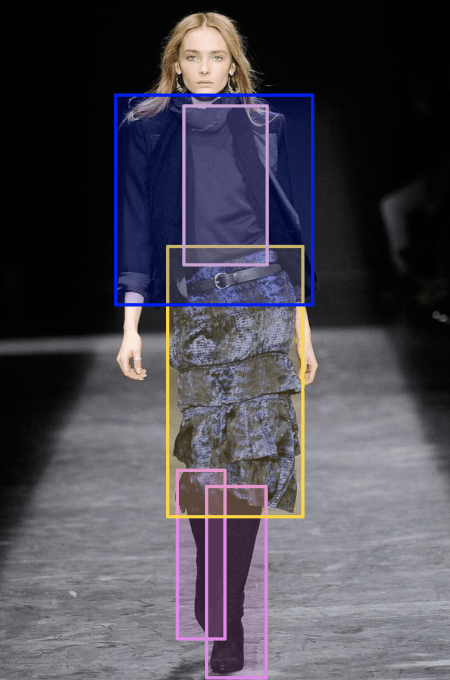

Labelbox launched its early alpha in January and saw swift pickup from the AI community that immediately asked for additional features. With time, the tool expanded with more and more ways to manually annotate data, from gradation levels like how sick a cow is for judging its milk production to matching systems like whether a dress fits a fashion brand’s aesthetic. Rigorous data science is applied to weed out discrepancies between reviewers’ decisions and identify edge cases that don’t fit the models.

“There are all these research studies about how to make training data” that Labelbox analyzes and applies, says co-founder and COO Ysiad Ferreiras, who’d led all of sales and revenue at fast-rising grassroots campaign texting startup Hustle. “We can let people tweak different settings so they can run their own machine learning program the way they want to, instead of being limited by what they can build really quickly.” When Norway mandated all citizens get colon cancer screenings, it had to build AI for recognizing polyps. Instead of spending half a year creating the training tool, they just signed up all the doctors on Labelbox.

Any organization can try Labelbox for free, and Ferreiras claims hundreds have. Once they hit a usage threshold, the startup works with them on appropriate SaaS pricing related to the revenue the client’s AI will generate. One called Lytx makes DriveCam, a system installed on half a million trucks with cameras that use AI to detect unsafe driver behavior so they can be coached to improve. Conde Nast is using Labelbox to match runway fashion to related items in their archive of content.

The big challenge is convincing companies that they’re better off leaving the training software to the experts instead of building it in-house where they’re intimately, though perhaps inefficiently, involved in every step of development. Some turn to crowdsourcing agencies like CrowdFlower, which has their own training data interface, but they only work with generalist labor, not the experts required for many fields. Labelbox wants to cooperate rather than compete here, serving as the management software that treats outsourcers as just another data input.

Long-term, the risk for Labelbox is that it’s arrived too early for the AI revolution. Most potential corporate customers are still in the R&D phase around AI, not at scaled deployment into real-world products. The big business isn’t selling the labeling software. That’s just the start. Labelbox wants to continuously manage the fine-tuning data to help optimize an algorithm through its entire life cycle. That requires AI being part of the actual engineering process. Right now it’s often stuck as an experiment in the lab. “We’re not concerned about our ability to build the tool to do that. Our concern is ‘will the industry get there fast enough?’” Ferreiras declares.

Long-term, the risk for Labelbox is that it’s arrived too early for the AI revolution. Most potential corporate customers are still in the R&D phase around AI, not at scaled deployment into real-world products. The big business isn’t selling the labeling software. That’s just the start. Labelbox wants to continuously manage the fine-tuning data to help optimize an algorithm through its entire life cycle. That requires AI being part of the actual engineering process. Right now it’s often stuck as an experiment in the lab. “We’re not concerned about our ability to build the tool to do that. Our concern is ‘will the industry get there fast enough?’” Ferreiras declares.

Their investor agrees. Last year’s big joke in venture capital was that suddenly you couldn’t hear a startup pitch without “AI” being referenced. “There was a big wave where everything was AI. I think at this point it’s almost a bit implied,” says Fushman. But it’s corporations that already have plenty of data, and plenty of human jobs to obfuscate, that are Labelbox’s opportunity. “The bigger question is ‘when does that [AI] reality reach consumers, not just from the Googles and Amazons of the world, but the mainstream corporations?’”

Labelbox is willing to wait it out, or better yet, accelerate that arrival — even if it means eliminating jobs. That’s because the team believes the benefits to humanity will outweigh the transition troubles.

“For a colonoscopy or mammogram, you only have a certain number of people in the world who can do that. That limits how many of those can be performed. In the future, that could only be limited by the computational power provided so it could be exponentially cheaper” says co-founder Brian Rieger. With Labelbox, tens of thousands of radiology exams can be quickly ingested to produce cancer-spotting algorithms that he says studies show can become more accurate than humans. Employment might get tougher to find, but hopefully life will get easier and cheaper too. Meanwhile, improving underwater pipeline inspections could protect the environment from its biggest threat: us.

“AI can solve such important problems in our society,” Sharma concludes. “We want to accelerate that by helping companies tell AI what to learn.”

Powered by WPeMatico

Jeffrey Katzenberg’s new mobile video startup NewTV, which snagged Meg Whitman as CEO in January, has now closed on $1 billion in funding, according to a report out today in CNN. Investors in the round include Disney, 21st Century Fox, Warner Bros, Entertainment One and other media companies, with a combined $200 million investment, while institutional investors from the U.S. and China made up the rest.

The news follows a May report from Bloomberg, which said NewTV had then raised around $800 million. It had also said 21st Century Fox and Warner Bros. were investors.

Last fall, an SEC filing revealed WndrCo was looking to raise as much as $2 billion. That could indicate that the round CNN is reporting is still in the process of raising.

NewTV declined to comment, when TechCrunch reached them for confirmation.

Details are still fairly sparse on NewTV, which is being incubated by Katzenberg’s WndrCo, a holding company that’s also invested in startups including Mixcloud, Axios, Node, Flowspace, Whistle Sports, and TYT Network.

So far, we know NewTV aims to bring high-quality Hollywood production values and storytelling to mobile, but in a different format. Instead of producing regular-length TV shows, it aims to release content in “bite-sized formats of 10 minutes or less.” This will also involve custom-designed technology built specifically for mobile, it claims.

But it’s unclear why – beyond having Katzenberg and now Whitman’s names attached – this makes the company worth a billion dollar investment. The market for this type of content hasn’t really been proven out. After all, today’s youngest video consumers are happy with YouTube – their TV alternative of sorts – which is filled with short-form video.

And while YouTubers’ grasp of production values and storytelling chops may fall short of “Hollywood” standards, streaming services like Amazon, Netflix, Hulu and others are filling in the gaps in terms of quality, and are growing sizable subscriber bases.

If there is actually demand for “high-quality short-form” video, it seems content producers could just sell to existing distributors directly.

It’s also unclear for now if NewTV aims to own and distribute its content to others, act as its own standalone streaming service, or plans for a mixture of both.

In any event, as CNN points out, even a large round like this is a small bet for the bigger media companies involved. In addition, they don’t want to miss a shot at backing Katzenberg’s latest – especially given his prior successes at Paramount, Disney and DreamWorks.

Powered by WPeMatico

Knock Knock, a startup building games for platforms like Facebook Messenger and WeChat, is announcing that it has raised $2 million in seed funding.

The goal isn’t to build interactive chat fiction, but rather fully fledged mobile games that are accessed from messaging apps, while also taking advantages of the opportunities offered by incorporating messaging and chatbots into the game mechanics.

“This is the most frictionless an experience can get,” said CEO Andrew Friday. “There’s no download, it’s hooked up to a fast messaging medium that you’re already using and people can bring their friends into the experience seamlessly.”

Friday was a senior product manager for chat games at Zynga, while his co-founder Andrew N. Green was previously the head of business operations at TinyCo. They plan to release their first game for Facebook Messenger later this year, and then a WeChat title in early 2019.

When I asked if there are any specific genres that will do best on messaging, Friday suggested that there’s actually “an embarrassment of riches.”

“Most great mobile game genres, and game genres in general, are good for the platform,” he said. “It’s just that if you try to just port those designs to the platform, it’s not going to work. If you rethink or reimagine these mechanics, how they would work best, how they would be most fun on the platform, there are so many genres that can work on chat.”

He also suggested that compared to FRVR, another recently funded startup looking to build chat games, Knock Knock is less focused on “hypercasual” games and instead taking “a deeper, more thoughtful approach.” Although thoughtfulness and depth are relative — Friday suggested that Knock Knock could still create the initial versions of its games in 90 days.

The funding was led by Raine Ventures, with participation from London Venture Partners, Ludlow Ventures and Gregory Milken.

“Knock Knock has the potential to usher in the next wave of chat games that will redefine the market,” said Courtney Favreau, a venture capital partner at Raine, in the funding announcement. “The founding team has an impressive track record in the mobile and chat gaming spaces and we’re very excited to help them bring their vision to life.”

Powered by WPeMatico

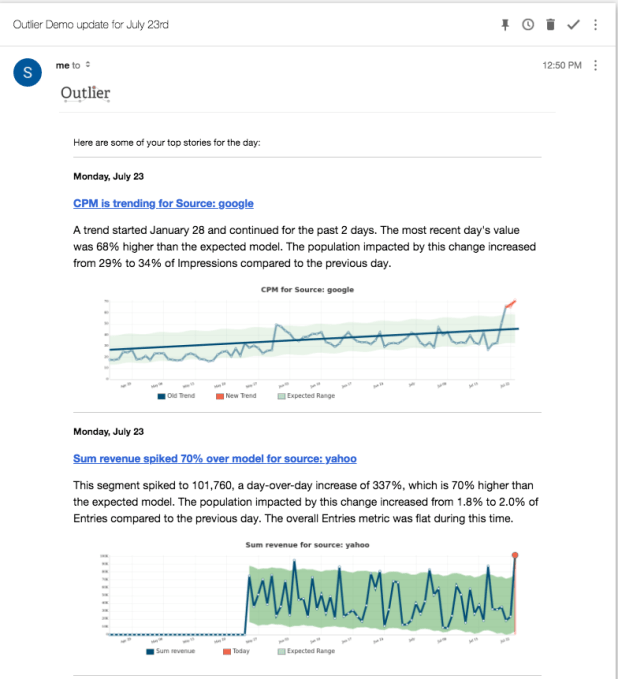

Traditionally, companies have gathered data from a variety of sources, then used spreadsheets and dashboards to try and make sense of it all. Outlier wants to change that and deliver a handful of insights right to your inbox that matter most for your job, company and industry. Today the company announced a $6.2 million Series A to further develop that vision.

The round was led by Ridge Ventures with assistance from 11.2 Capital, First Round Capital, Homebrew, Susa Ventures and SV Angel. The company has raised over $8 million.

The startup is trying to solve a difficult problem around delivering meaningful insight without requiring the customer to ask the right questions. With traditional BI tools, you get your data and you start asking questions and seeing if the data can give you some answers. Outlier wants to bring a level of intelligence and automation by pointing out insight without having to explicitly ask the right question.

Company founder and CEO Sean Byrnes says his previous company, Flurry, helped deliver mobile analytics to customers, but in his travels meeting customers in that previous iteration, he always came up against the same question: “This is great, but what should I look for in all that data?”

It was such a compelling question that after he sold Flurry in 2014 to Yahoo for more than $200 million, that question stuck in the back of his mind and he decided to start a business to solve it. He contends that the first 15 years of BI was about getting answers to basic questions about company performance, but the next 15 will be about finding a way to get the software to ask good questions based on the huge amounts of data.

Byrnes admits that when he launched, he didn’t have much sense of how to put this notion into action, and most people he approached didn’t think it was a great idea. He says he heard “No” from a fair number of investors early on because the artificial intelligence required to fuel a solution like this really wasn’t ready in 2015 when he started the company.

He says that it took four or five iterations to get to today’s product, which lets you connect to various data sources, and using artificial intelligence and machine learning delivers a list of four or five relevant questions to the user’s email inbox that points out data you might not have noticed, what he calls “shifts below the surface.” If you’re a retailer that could be changing market conditions that signal you might want to change your production goals.

Outlier email example. Photo: Outlier

The company launched in 2015. It took some time to polish the product, but today they have 14 employees and 14 customers including Jack Rogers, Celebrity Cruises and Swarovski.

This round should allow them to continuing working to grow the company. “We feel like we hit the right product-market fit because we have customers [generating] reproducible results and really changing the way people use the data,” he said.

Powered by WPeMatico

Rescale, the startup that wants to bring high performance computing to the cloud, announced a $32 million Series B investment today led by Initialized Capital, Keen Venture Partners and SineWave Ventures.

They join a list of well-known early investors that included Sam Altman, Jeff Bezos, Richard Branson, Paul Graham, Ron Conway, Chris Dixon, Peter Thiel and others. Today’s investment brings the total amount raised to $52 million, according to the company.

Rescale works with engineering, aerospace, scientific and other verticals and helps them move their legacy high performance computing applications to the cloud. The idea is to provide a set of high performance computing resources, whether that’s on prem or in the cloud, and help customers tune their applications to get the maximum performance.

Traditionally HPC has taken place on prem in a company’s data center. These companies often have key legacy applications they want to move to the cloud and Rescale can help them do that in the most efficient manner, whether that involves bare metal a virtual machine or a container.

“We help take a portfolio of [legacy] applications running on prem and help enable them in the cloud or in a hybrid environment. We tune and optimize the applications on our platform and take advantage of capital assets on prem, then we help extend that environment to different cloud vendors or tune to best practices for the specific application,” company CEO and co-founder Joris Poort explained.

Photo: Rescale

Ben Verwaayen, who is a partner at one of the lead investors, Keen Venture Partners, sees a company going after a large legacy market with a new approach. “The market is currently 95% on-premise, and Rescale supports customers as they move to hybrid and eventually to a fully cloud native solution. Rescale helps CIOs enable the digital transformation journey within their enterprise, to optimize IT resources and enable meaningful productivity and cost improvements,” Verwaayen said in a statement.

The new influx of cash should help Rescale, well, scale, and that will involve hiring more developers, solutions architects and the like. The company wants to also use the money to expand its presence in Asia and Europe and establish relationships with systems integrators, who would be a good fit for a product like this and help expand their market beyond what they can do as a young startup.

The company, which is based in San Francisco, was founded in 2011 and has 80 employees. They currently have 150 customers including Sikorsky Innovation, Boom Aerospace and Trek Bikes.

Powered by WPeMatico

Xage (pronounced Zage), a blockchain security startup based in Silicon Valley, announced a $12 million Series A investment today led by March Capital Partners. GE Ventures, City Light Capital and NexStar Partners also participated.

The company emerged from stealth in December with a novel idea to secure the myriad of devices in the industrial internet of things on the blockchain. Here’s how I described it in a December 2017 story:

Xage is building a security fabric for IoT, which takes blockchain and synthesizes it with other capabilities to create a secure environment for devices to operate. If the blockchain is at its core a trust mechanism, then it can give companies confidence that their IoT devices can’t be compromised. Xage thinks that the blockchain is the perfect solution to this problem.

It’s an interesting approach, one that attracted Duncan Greatwood to the company. As he told me in December his previous successful exits — Topsy to Apple in 2013 and PostPath to Cisco in 2008 — gave him the freedom to choose a company that really excited him for his next challenge.

When he saw what Xage was doing, he wanted to be a part of it, and given the unorthodox security approach the company has taken, and Greatwood’s pedigree, it couldn’t have been hard to secure today’s funding.

The Industrial Internet of Things is not like its consumer cousin in that it involves getting data from big industrial devices like manufacturing machinery, oil and gas turbines and jet engines. While the entire Internet of Things could surely benefit from a company that concentrates specifically on keeping these devices secure, it’s a particularly acute requirement in industry where these devices are often helping track data from key infrastructure.

GE Ventures is the investment arm of GE, but their involvement is particularly interesting because GE has made a big bet on the Industrial Internet of Things. Abhishek Shukla of GE Ventures certainly saw the connection. “For industries to benefit from the IoT revolution, organizations need to fully connect and protect their operation. Xage is enabling the adoption of these cutting edge technologies across energy, transportation, telecom, and other global industries,” Shukla said in a statement.

The company was founded just last year and is based in Palo Alto, California.

Powered by WPeMatico

SessionM announced a $23.8 million Series E investment led by Salesforce Ventures. A bushel of existing investors including Causeway Media Partners, CRV, General Atlantic, Highland Capital and Kleiner Perkins Caufield & Byers also contributed to the round. The company has now raised over $97 million.

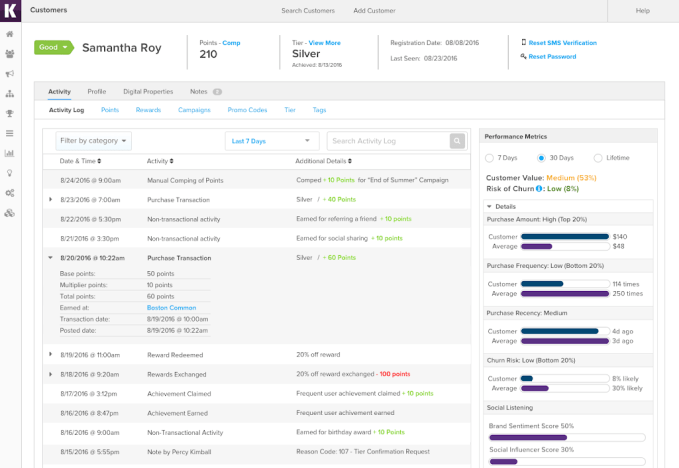

At its core, SessionM aggregates loyalty data for brands to help them understand their customer better, says company co-founder and CEO Lars Albright. “We are a customer data and engagement platform that helps companies build more loyal and profitable relationships with their consumers,” he explained.

Essentially that means, they are pulling data from a variety of sources and helping brands offer customers more targeted incentives, offers and product recommendations “We give [our users] a holistic view of that customer and what motivates them,” he said.

Screenshot: SessionM (cropped)

To achieve this, SessionM takes advantage of machine learning to analyze the data stream and integrates with partner platforms like Salesforce, Adobe and others. This certainly fits in with Adobe’s goal to build a customer service experience system of record and Salesforce’s acquisition of Mulesoft in March to integrate data from across an organization, all in the interest of better understanding the customer.

When it comes to using data like this, especially with the advent of GDPR in the EU in May, Albright recognizes that companies need to be more careful with data, and that it has really enhanced the sensitivity around stewardship for all data-driven businesses like his.

“We’ve been at the forefront of adopting the right product requirements and features that allow our clients and businesses to give their consumers the necessary control to be sure we’re complying with all the GDPR regulations,” he explained.

The company was not discussing valuation or revenue. Their most recent round prior to today’s announcement, was a Series D in 2016 for $35 million also led by Salesforce Ventures.

SessionM, which was founded in 2011, has around 200 employees with headquarters in downtown Boston. Customers include Coca-Cola, L’Oreal and Barney’s.

Powered by WPeMatico