Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Rothy’s, a three-year-old, San Francisco-based company that makes a variety of colorful flats for women, has some more walking-around money today. According to Bloomberg, the company just closed on $35 million in funding from Goldman Sachs’ asset management unit.

The round brings the young company’s total funding to $42 million, including an early $5 million investment from Lightspeed Venture Partners, and $2 million in convertible notes, including from Finn Capital Partners, M13 and Grace Beauty Capital.

Goldman’s interest in the company isn’t surprising. Rothy’s doesn’t disclose how many pairs of shoes it has sold, but the company tells Bloomberg that it expects to see slightly more than $140 million in revenue this year, and, as the outlet surmises from some back-of-the-napkin math, that equates to roughly 1.4 million pairs of shoes sold.

Judging by its enthusiastic consumer base — it has 161,000 Instagram followers, for example — many of those are likely women who own multiple pairs, too.

What they love about the shoes, seemingly: their style, in large part. On this front, it helps that some fashion icons have gravitated toward the shoes, including actress-turned-Duchess of Sussex, Meghan Markle, who has been photographed in Rothy’s.

The company is also selling eco-conscious comfort by making the shoes out of recycled materials that include water bottles. Because of their constitution, they are also machine washable, yet another selling point.

Yet where Rothy’s has really shined is in marketing, including spending hugely on Facebook and to a lesser extent, Instagram and other social media platforms. Indeed, the company has been recognized repeatedly (including by us) for its shoes’ seeming ubiquity online. Though these platforms have grown more crowded in the short time since Rothy’s launched, it spent big on marketing from the outset — it flooded the zone, so to speak — and that campaign has seemingly paid off for the startup.

Today, the company, which runs its own 100,000-square-foot factory in China and employs roughly 500 people — including 50 people in the Bay Area — is selling four types of shoes, including its two best-known silhouettes — a $125 rounded flat shoe and a $145 pointed flat — along with loafers and, more newly, sneakers that are reminiscent of Van’s iconic shoes.

Somewhat ironically, one of the biggest threats to Rothy’s ongoing rise — other than fickle shoppers — is companies that are beginning to copy Rothy’s designs, reports Bloomberg.

The company says, for instance, that it is currently suing at least one outfit, a Virginia-based company, for selling a shoe that looks to Rothy’s alarmingly like one of its own productions.

Powered by WPeMatico

Our distinct skill sets and shortcomings mean people and robots will join forces for the next few decades. Robots are tireless, efficient and reliable, but in a millisecond through intuition and situational awareness, humans can make decisions machine can’t. Until workplace robots are truly autonomous and don’t require any human thinking, we’ll need software to supervise them at scale. Formant comes out of stealth today to “help people speak robot,” says co-founder and CEO Jeff Linnell. “What’s really going to move the needle in the innovation economy is using humans as an empowering element in automation.”

Linnell learned the grace of uniting flesh and steel while working on the movie Gravity. “We put cameras and Sandra Bullock on dollies,” he bluntly recalls. Artistic vision and robotic precision combined to create gorgeous zero-gravity scenes that made audiences feel weightless. Google bought his startup Bot & Dolly, and Linnell spent four years there as a director of robotics while forming his thesis.

Now with Formant, he wants to make hybrid workforce cooperation feel frictionless.

The company has raised a $6 million seed round from SignalFire, a data-driven VC fund with software for recruiting engineers. Formant is launching its closed beta that equips businesses with cloud infrastructure for collecting, making sense of and acting on data from fleets of robots. It allows a single human to oversee 10, 20 or 100 machines, stepping in to clear confusion when they aren’t sure what to do.

“The tooling is 10 years behind the web,” Linnell explains. “If you build a data company today, you’ll use AWS or Google Cloud, but that simply doesn’t exist for robotics. We’re building that layer.”

“This is going to sound completely bizarre,” Formant CTO Anthony Jules warns me. “I had a recurring dream [as a child] in which I was a ship captain and I had a little mechanical parrot on my should that would look at situations and help me decide what to do as we’d sail the seas trying to avoid this octopus. Since then I knew that building intelligent machines is what I would do in this world.”

So he went to MIT, left a robotics PhD program to build a startup called Sapient Corporation that he built into a 4,000-employee public company, and worked on the Tony Hawk video games. He too joined Google through an acquisition, meeting Linnell after Redwood Robotics, where he was COO, got acquired. “We came up with some similar beliefs. There are a few places where full autonomy will actually work, but it’s really about creating a beautiful marriage of what machines are good at and what humans are good at,” Jules tells me.

Formant now has SaaS pilots running with businesses in several verticals to make their “robot-shaped data” usable. They range from food manufacturing to heavy infrastructure inspection to construction, and even training animals. Linnell also foresees retail increasingly employing fleets of robots not just in the warehouse but on the showroom floor, and they’ll require precise coordination.

What’s different about Formant is it doesn’t build the bots. Instead, it builds the reins for people to deftly control them.

First, Formant connects to sensors to fill up a cloud with LiDAR, depth imagery, video, photos, log files, metrics, motor torques and scalar values. The software parses that data and when something goes wrong or the system isn’t sure how to move forward, Formant alerts the human “foreman” that they need to intervene. It can monitor the fleet, sniff out the source of errors, and suggest options for what to do next.

For example, “when an autonomous digger encounters an obstacle in the foundation of a construction site, an operator is necessary to evaluate whether it is safe for the robot to proceed or stop,” Linnell writes. “This decision is made in tandem: the rich data gathered by the robot is easily interpreted by a human but difficult or legally questionable for a machine. This choice still depends on the value judgment of the human, and will change depending on if the obstacle is a gas main, a boulder, or an electrical wire.”

Any single data stream alone can’t reveal the mysteries that arise, and people would struggle to juggle the different feeds in their minds. But not only can Formant align the data for humans to act on, it also can turn their choices into valuable training data for artificial intelligence. Formant learns, so next time the machine won’t need assistance.

With rock-star talent poached from Google and tides lifting all automated boats, Formant’s biggest threat is competition from tech giants. Old engineering companies like SAP could try to adapt to the new real-time data type, yet Formant hopes to out-code them. Google itself has built reliable cloud scaffolding and has robotics experience from Boston Dynamics, plus buying Linnell’s and Jules’ companies. But the enterprise customization necessary to connect with different clients isn’t typical for the search juggernaut.

Linnell fears that companies that try to build their own robot management software could get hacked. “I worry about people who do homegrown solutions or don’t have the experience we have from being at a place like Google. Putting robots online in an insecure way is a pretty bad problem.” Formant is looking to squash any bugs before it opens its platform to customers in 2019.

Linnell fears that companies that try to build their own robot management software could get hacked. “I worry about people who do homegrown solutions or don’t have the experience we have from being at a place like Google. Putting robots online in an insecure way is a pretty bad problem.” Formant is looking to squash any bugs before it opens its platform to customers in 2019.

With time, humans will become less and less necessary, and that will surface enormous societal challenges for employment and welfare. “It’s in some ways a continuation of the industrial revolution,” Jules opines. “We take some of this for granted but it’s been happening for 100 years. Photographer — that’s a profession that doesn’t exist without the machine that they use. We think that transformation will continue to happen across the workforce.”

Powered by WPeMatico

K Health, the startup providing consumers with an AI-powered primary care platform, has raised $25 million in Series B funding. The round was led by 14W, Comcast Ventures and Mangrove Capital Partners, with participation from Lerer Hippeau, BoxGroup and Max Ventures — all previous investors from the company’s seed or Series A rounds. Other previous investors include Primary Ventures and Bessemer Venture Partners.

Co-founded and led by former Vroom CEO and Wix co-CEO Allon Bloch, K Health (previously Kang Health) looks to equip consumers with a free and easy-to-use application that can provide accurate, personalized, data-driven information about their symptoms and health.

“When your child says their head hurts, you can play doctor for the first two questions or so — where does it hurt? How does it hurt?” Bloch explained in a conversation with TechCrunch. “Then it gets complex really quickly. Are they nauseous or vomiting? Did anything unusual happen? Did you come back from a trip somewhere? Doctors then use differential diagnosis to prove that it’s a tension headache versus other things by ruling out a whole list of chronic or unusual conditions based on their deep knowledge sets.”

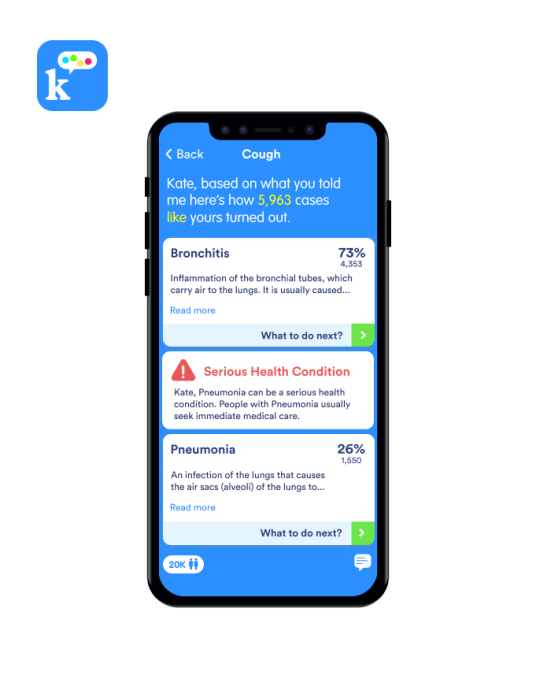

K Health’s platform, which currently focuses on primary care, effectively looks to perform a simulation and data-driven version of the differential diagnosis process. On the company’s free mobile app, users spend three-to-four minutes answering an average of 21 questions about their background and the symptoms they’re experiencing.

Using a data set of two billion historical health events over the past 20 years — compiled from doctors’ notes, lab results, hospitalizations, drug statistics and outcome data — K Health is able to compare users to those with similar symptoms and medical histories before zeroing in on a diagnosis.

With its expansive comparative approach, the platform hopes to offer vastly more thorough, precise and user-specific diagnostic information relative to existing consumer alternatives, like WebMD or, what Bloch calls “Dr. Google,” which often produce broad, downright frightening and inaccurate diagnoses.

Users are able to see cases and diagnoses that had symptoms similar to their own, with K Health notifying users with serious conditions when to consider seeking immediate care. (K Health Press Image / K Health / https://www.khealth.ai)

In addition to pure peace of mind, the utility provided to consumers is clear. With more accurate at-home diagnostic information, users are able to make better preventative health decisions, avoid costly and unnecessary trips to in-person care centers or appointments with telehealth providers and engage in constructive conversations with physicians when they do opt for in-person consultations.

K Health isn’t looking to replace doctors, and, in fact, believes its platform can unlock tremendous value for physicians and the broader healthcare system by enabling better resource allocation.

Without access to quality, personalized medical information at home, many defer to in-person doctor visits even when it may not be necessary. And with around one primary care physician per 1,000 people in the U.S., primary care practitioners are subsequently faced with an overwhelming number of patients and are unable to focus on more complex cases that may require more time and resources. The high volume of patients also forces physicians to allocate budgets for support staff to help interact with patients, collect initial background information and perform less-demanding tasks.

K Health believes that by providing an accurate alternative for those with lighter or more trivial symptoms, it can help lower unnecessary in-person visits, reduce costs for practices and allow physicians to focus on complicated, rare or resource-intensive cases, where their expertise can be most useful and where brute machine processing power is less valuable.

The startup is looking to enhance the platform’s symbiotic patient-doctor benefits further in early-2019, when it plans to launch in-app capabilities that allow users to share their AI-driven health conversations directly with physicians, hopefully reducing time spent on information gathering and enabling more-informed treatment.

With K Health’s AI and machine learning capabilities, the platform also gets smarter with every conversation as it captures more outcomes, hopefully enriching the system and becoming more valuable to all parties over time. Initial results seem promising, with K Health currently boasting around 500,000 users, most having joined since this past July.

With the latest round, the company has raised a total of $37.5 million since its late-2016 founding. K Health plans to use the capital to ramp up marketing efforts, further refine its product and technology and perform additional research to identify methods for earlier detection and areas outside of primary care where the platform may be valuable.

Longer term, the platform has much broader aspirations of driving better health outcomes, normalizing better preventative health behavior and creating more efficient and affordable global healthcare systems.

The high costs of the American healthcare system and the impacts they have on health behavior has been well-documented. With heavy co-pays, premiums and treatment cost, many avoid primary care altogether or opt for more reactionary treatment, leading to worse health outcomes overall.

Issues seen in the American healthcare system are also observable in many emerging market countries with less medical infrastructure. According to the World Health Organization, the international standard for the number of citizens per primary care physician is one for every 1,500 to 2,000 people, with some countries facing much steeper gaps — such as China, where there is only one primary care doctor for every 6,666.

The startup hopes it can help limit the immense costs associated with emerging countries educating millions of doctors for eight-to-10 years and help provide more efficient and accessible healthcare systems much more quickly.

By reducing primary care costs for consumers and operating costs for medical practices, while creating a more convenient diagnostic experience, K Health believes it can improve access to information, ultimately driving earlier detection and better health outcomes for consumers everywhere.

Powered by WPeMatico

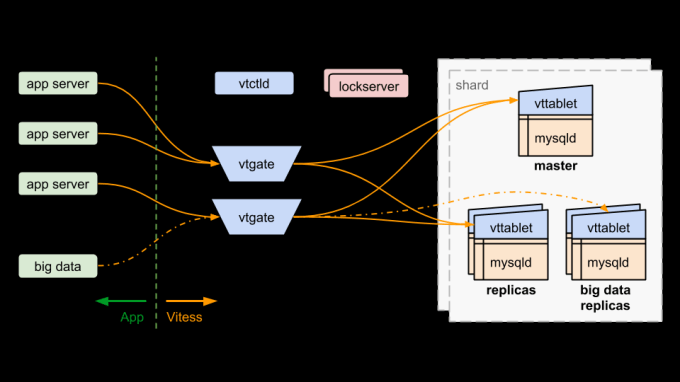

When the former CTOs of YouTube, Facebook and Dropbox seed fund a database startup, you know there’s something special going on under the hood. Jiten Vaidya and Sugu Sougoumarane saved YouTube from a scalability nightmare by inventing and open-sourcing Vitess, a brilliant relational data storage system. But in the decade since working there, the pair have been inundated with requests from tech companies desperate for help building the operational scaffolding needed to actually integrate Vitess.

So today the pair are revealing their new startup PlanetScale that makes it easy to build multi-cloud databases that handle enormous amounts of information without locking customers into Amazon, Google or Microsoft’s infrastructure. Battle-tested at YouTube, the technology could allow startups to fret less about their backend and focus more on their unique value proposition. “Now they don’t have to reinvent the wheel” Vaidya tells me. “A lot of companies facing this scaling problem end up solving it badly in-house and now there’s a way to solve that problem by using us to help.”

PlanetScale quietly raised a $3 million seed round in April, led by SignalFire and joined by a who’s who of engineering luminaries. They include YouTube co-founder and CTO Steve Chen, Quora CEO and former Facebook CTO Adam D’Angelo, former Dropbox CTO Aditya Agarwal, PayPal and Affirm co-founder Max Levchin, MuleSoft co-founder and CTO Ross Mason, Google director of engineering Parisa Tabriz and Facebook’s first female engineer and South Park Commons founder Ruchi Sanghvi. If anyone could foresee the need for Vitess implementation services, it’s these leaders, who’ve dealt with scaling headaches at tech’s top companies.

But how can a scrappy startup challenge the tech juggernauts for cloud supremacy? First, by actually working with them. The PlanetScale beta that’s now launching lets companies spin up Vitess clusters on its database-as-a-service, their own through a licensing deal, or on AWS with Google Cloud and Microsoft Azure coming shortly. Once these integrations with the tech giants are established, PlanetScale clients can use it as an interface for a multi-cloud setup where they could keep their data master copies on AWS US-West with replicas on Google Cloud in Ireland and elsewhere. That protects companies from becoming dependent on one provider and then getting stuck with price hikes or service problems.

PlanetScale also promises to uphold the principles that undergirded Vitess. “It’s our value that we will keep everything in the query pack completely open source so none of our customers ever have to worry about lock-in” Vaidya says.

PlanetScale co-founders (from left): Jiten Vaidya and Sugu Sougoumarane

He and Sougoumarane met 25 years ago while at Indian Institute of Technology Bombay. Back in 1993 they worked at pioneering database company Informix together before it flamed out. Sougoumarane was eventually hired by Elon Musk as an early engineer for X.com before it got acquired by PayPal, and then left for YouTube. Vaidya was working at Google and the pair were reunited when it bought YouTube and Sougoumarane pulled him on to the team.

“YouTube was growing really quickly and the relationship database they were using with MySQL was sort of falling apart at the seams,” Vaidya recalls. Adding more CPU and memory to the database infra wasn’t cutting it, so the team created Vitess. The horizontal scaling sharding middleware for MySQL let users segment their database to reduce memory usage while still being able to rapidly run operations. YouTube has smoothly ridden that infrastructure to 1.8 billion users ever since.

“Sugu and Mike Solomon invented and made Vitess open source right from the beginning since 2010 because they knew the scaling problem wasn’t just for YouTube, and they’ll be at other companies five or 10 years later trying to solve the same problem,” Vaidya explains. That proved true, and now top apps like Square and HubSpot run entirely on Vitess, with Slack now 30 percent onboard.

Vaidya left YouTube in 2012 and became the lead engineer at Endorse, which got acquired by Dropbox, where he worked for four years. But in the meantime, the engineering community strayed toward MongoDB-style non-relational databases, which Vaidya considers inferior. He sees indexing issues and says that if the system hiccups during an operation, data can become inconsistent — a big problem for banking and commerce apps. “We think horizontally scaled relationship databases are more elegant and are something enterprises really need.

Fed up with the engineering heresy, a year ago Vaidya committed to creating PlanetScale. It’s composed of four core offerings: professional training in Vitess, on-demand support for open-source Vitess users, Vitess database-as-a-service on PlanetScale’s servers and software licensing for clients that want to run Vitess on premises or through other cloud providers. It lets companies re-shard their databases on the fly to relocate user data to comply with regulations like GDPR, safely migrate from other systems without major codebase changes, make on-demand changes and run on Kubernetes.

The PlanetScale team

PlanetScale’s customers now include Indonesian e-commerce giant Bukalapak, and it’s helping Booking.com, GitHub and New Relic migrate to open-source Vitess. Growth is suddenly ramping up due to inbound inquiries. Last month around when Square Cash became the No. 1 app, its engineering team published a blog post extolling the virtues of Vitess. Now everyone’s seeking help with Vitess sharding, and PlanetScale is waiting with open arms. “Jiten and Sugu are legends and know firsthand what companies require to be successful in this booming data landscape,” says Ilya Kirnos, founding partner and CTO of SignalFire.

The big cloud providers are trying to adapt to the relational database trend, with Google’s Cloud Spanner and Cloud SQL, and Amazon’s AWS SQL and AWS Aurora. Their huge networks and marketing war chests could pose a threat. But Vaidya insists that while it might be easy to get data into these systems, it can be a pain to get it out. PlanetScale is designed to give them freedom of optionality through its multi-cloud functionality so their eggs aren’t all in one basket.

Finding product market fit is tough enough. Trying to suddenly scale a popular app while also dealing with all the other challenges of growing a company can drive founders crazy. But if it’s good enough for YouTube, startups can trust PlanetScale to make databases one less thing they have to worry about.

Powered by WPeMatico

The simplest needs are often the most vital: power and clean water will get you a long way. But in rural areas of developing countries they can both be hard to come by. OffGridBox is attempting to provide both, sustainably and profitably, while meeting humanitarian and ecological goals at the same time. The company just raised $1.6 million to pursue its lofty agenda.

The idea is fairly simple, though naturally rather difficult to engineer: Use solar power to provide to a small community both electricity (in the form of charged batteries) and potable water. It’s not easy, and it’s not autonomous — but that’s by design.

I met two of the OffGridBox crew, founder and CEO Emiliano Cecchini and U.S. director Troy Billett, much earlier this year at CES in Las Vegas, where they were being honored by Not Impossible, alongside the brilliant BecDot braille learning toy. The team had a lot of irons in the fire, but now are ready to announce their seed round and progress in deploying what could be a life-saving innovation.

They’ve installed 38 boxes so far, some at their own expense and others with the help of backers. Each is about the size of a small shed — a section of a shipping container, with a scaffold on top to attach the solar cells. Inside are the necessary components for storing electricity and distributing it to dozens of rechargeable batteries and lights at a time, plus a water reservoir and purifier.

Water from a nearby unsafe natural (or municipal, really) source is trucked or piped in and replenishes the reservoir. The solar cells run the purifier, providing clean water for cheap — around a third of what a family would normally pay, by the team’s estimate — and potentially with a much shorter trek. Simultaneously, charged batteries and lights are rented out at similarly low rates to people otherwise without electricity. Each box can generate as much as 12 kWh per day, which is split between the two tasks.

The alternatives for these communities would generally be small dedicated solar installations, the upfront cost of which can be unrealistic for them. The average household spend for electricity, Billett told me, is around 43 cents per day; OffGridBox will be offering it for less than half that, about 18 cents.

It doesn’t run itself: The box is administrated by a local merchant, who handles payments and communication with OffGridBox itself. Young women are targeted for this role, as they are more likely to be long-term residents of the area and members of the community. The box acts as a small business for them, essentially drawing money out of the air.

OffGridBox works with local nonprofits to find likely candidates; the women pictured above were recommended by Women for Women. They in turn will support others who, for example, deliver or resell the water or run side businesses that rely on the electricity provided. There’s even an associated local bottled water brand now — “Amaziyateke,” named after a big leaf that collects rainwater, but in Rwanda is also slang for a beautiful woman.

Some boxes are being set up to offer Wi-Fi as well via a cellular or satellite connection, which has its own obvious benefits. And recently people have been asking for the ability to play music at home, so the company started including portable speakers. This was unexpected, but an easy demand to meet, said Billett — “It is critical to listen!”

The company does do some work to keep the tech running efficiently and safely, remotely monitoring for problems and scheduling maintenance calls. So these things aren’t just set down and forgotten. That said, they can and have run for hundreds of thousands of hours — years — without major work being done.

Each box costs about $15,000 to build, plus roughly another $10,000 to deliver and install. The business model has an investor or investors cover this initial cost, then receive a share of the revenue for the life of the box. At capacity usage this might take around two years, after which the revenue split shifts (from a negotiable initial split to 50/50); it’s a small, safe source of income for years to come. At around $10,000 of revenue per year per box with full utilization, the IRR is estimated at 15 percent.

What OffGridBox believes is that this model is better than any other for quick deployment of these boxes. Grants are an option, of course, and they can also be brought in for disaster relief purposes. Originally the idea was to sell these to rich folks who wanted to live off the grid or have a more self-sufficient mountain cabin, but this is definitely better — for a lot of reasons. (You could probably still get one for yourself if you really wanted.)

OffGridBox has been through the Techstars accelerator as part of a 2017 group, and worked through 2018, as I mentioned earlier, to secure funding from a variety of sources. This seed round totaling $1.6 million was led by the Doen and Good Energies Foundations; the Banque Populaire du Rwanda is also a partner.

Along with a series A planned for 2019, this money will support the deployment of a total of 42 box installations in Rwandan communities.

“This will help us become a major player in the energy and water markets in Rwanda while empowering women entrepreneurs, fighting biocontamination for improved health, and introducing lighting in rural homes,” said Cecchini in the press release announcing the funding.

Alternative or complementary sources of power, such as wind, are being looked into, and desalination of water (as opposed to just sterilization) is being actively researched. This would increase the range and reliability of the boxes, naturally, and make island communities much more realistic.

Those 42 boxes are just the beginning: The company hopes to deploy as many as 1,000 throughout Rwanda, and even then that would only reach a fifth of the country’s off-grid market. By partnering with local energy concerns and banks, OffGridBox hopes to deploy as many as 100 boxes a year, potentially bringing water and power to as many as 100,000 more people.

Powered by WPeMatico

When in July of last year, SoftBank’s Vision Fund led a whopping $200 million round in the Silicon Valley startup Plenty, investors behind a competing indoor farming startup across the country, New York-based Bowery, were left reeling. Just one month earlier, they’d closed on a round that brought Bowery’s total funding to $31 million. As one of Bowery’s backers told us in the immediate aftermath of Plenty’s enormous round, SoftBank’s involvement “definitely gives you pause.”

Its involvement has not, however, prompted investors to give up. On the contrary, Bowery just today announced that it has raised $90 million in fresh funding led by GV, with participation from Temasek and Almanac Ventures; the company’s Series A investors, General Catalyst and GGV Capital; and numerous of its seed investors, including First Round Capital.

It’s easy to understand investors’ unwavering interest in the company and the space, given the opportunity that Bowery, and Plenty, and hundreds of other indoor farming startups, are chasing. As Bowery outlined in a post this morning, “traditional agriculture uses 700 million pounds of pesticides annually, and fresh food takes weeks” and sometimes longer to land on the dinner table. Along the way, terrible things sometimes happen, including E.coli outbreaks, like the kind recently linked to the sale of romaine lettuce in the U.S.

Meanwhile, Bowery, which is growing crops inside two warehouses in New Jersey, can promise people in New York that their bok choy didn’t travel far at all.

Bowery also appears to be gaining the kind of momentum that VCs want to see. According to the company, it started life with five employees three years ago; today its staff has ballooned to 65 people. It has established a distribution partnership with Whole Foods. It has partnered with sweetgreen, the fast-food chain known for its farm-to-table salad bowls, and Dig Inn, a New York- and Boston-based chain of locally farm-sourced restaurants.

Unsurprisingly, the company says it plans to partner with new retail, food service and restaurant partners in the new year, too.

Bigger picture, Bowery says it plans to build a “global distributed network of farms” that are connected to each other through a kind of operating system, and that it has already begun work on the first of these outside the tri-state area.

Whether it succeeds in that vision is anyone’s guess at this point. It’s hard to know how big an impact that Bowery, or Plenty (which plans to build 300 indoor farms in or near Chinese cities) or any of its many competitors will ultimately have. But given that we’ll need to feed two billion more people by 2050 without overwhelming the planet, it’s also easy to understand from a humanitarian standpoint why investors might be keen to write these companies big checks. In fact, the rest of us should probably be rooting them on, too.

Powered by WPeMatico

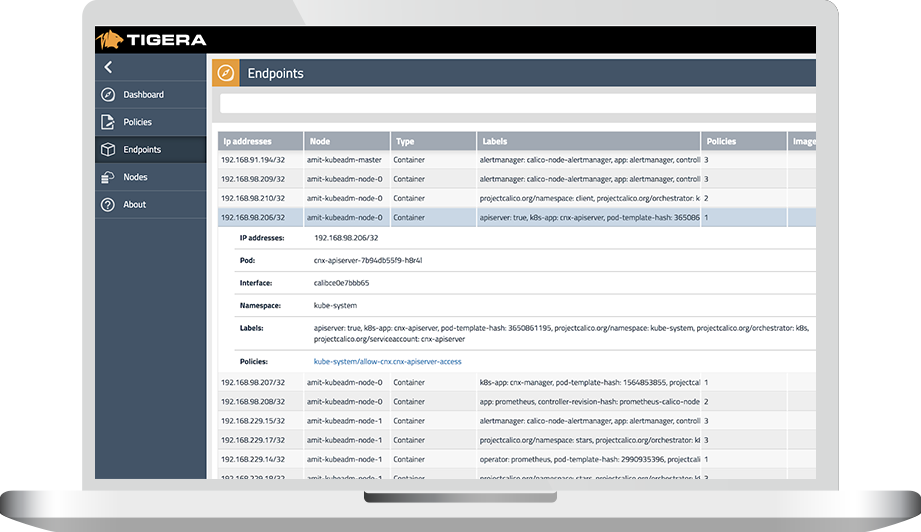

Tigera, a startup that offers security and compliance solutions for Kubernetes container deployments, today announced that it has raised a $30 million Series B round led by Insight Venture Partners. Existing investors Madrona, NEA and Wing also participated in this round.

Like everybody in the Kubernetes ecosystem, Tigera is exhibiting at KubeCon this week, so I caught up with the team to talk about the state of the company and its plans for this new raise.

“We are in a very exciting position,” Tigera president and CEO Ratan Tipirneni told me. “All the four public cloud players [AWS, Microsoft Azure, Google Cloud and IBM Cloud] have adopted us for their public Kubernetes service. The large Kubernetes distros like Red Hat and Docker are using us.” In addition, the team has signed up other enterprises, often in the healthcare and financial industry, and SaaS players (all of which it isn’t allowed to name) that use its service directly.

The company says that it didn’t need to raise right now. “We didn’t need the money right now, but we had a lot of incoming interest,” Tipirneni said. The company will use the funding to expand its engineering, marketing and customer success teams. In total, it plans to quadruple its sales force. In addition, it plans to set up a large office in Vancouver, Canada, mostly because of the availability of talent there.

In the legacy IT world, security and compliance solutions could rely on the knowledge that the underlying infrastructure was relatively stable. Now, though, with the advent of containers and DevOps, workloads are highly dynamic, but that also makes the challenge of securing them and ensuring compliance with regulations like HIPAA or standards like PCI more complex, too. The promise of Tigera’s solution is that it allows enterprises to ensure compliance by using a zero-trust model that authorizes each service on the network, encrypts all the traffic and enforces the policies the admins have set for their company and needs. All of this data is logged in detail and, if necessary, enterprises can pull it for incident management or forensic analysis.

Powered by WPeMatico

AtScale, the startup that helps companies move massive amounts of data into business intelligence and analytics tools, announced a $50 million Series D round today.

Morgan Stanley led the round, with previous investors Storm Ventures and Atlantic Bridge joining in. New investor Wells Fargo also participated. The funding comes almost exactly a year after the company announced its $25 million Series C. Today’s funding brings the total amount raised to $120 million.

Bringing on an institutional investor like Morgan Stanley is often a signal that the company has reached the stage where it is at least beginning to think about the possibility of going public at some point in the future. AtScale CEO Chris Lynch acknowledged such a connection without making any broad commitment (as you would expect). “We are not close to being IPO-ready, but that was a future consideration in selecting Morgan Stanley,” Lynch told TechCrunch.

What the company does is help take big data and move it into tools where customers can make better use of it. AtScale co-founder Dave Mariani used to be at Yahoo where he helped pioneer the use of big data in the 2009/2010 timeframe. Unfortunately, systems at the time couldn’t deal with the volume of data — and that is still a problem, one that AtScale says it is designed to solve. “We take a bunch of data silos and put a semantic layer across the data platforms and expose them in a consistent way,” Mariani told TechCrunch last year at the time of the Series C round. This allows a company to get a big picture view of their data, rather than consuming it in smaller chunks.

AtScale reported a banner year, bringing on 50 new customers across their target verticals of retail, financial services, advertising and digital sales. These include Rakuten, Dell Technologies, TD Bank and Toyota. What’s more, the company stretched out this year, taking advantage of the last funding round to expand more into international markets in Europe and Asia.

The company was founded in 2013 and is based in San Mateo, California.

Powered by WPeMatico

In a disappointing year for female-founded startups — at least those looking to raise venture capital — The Riveter not only closed its first institutional funding round, but it’s today announcing a $15 million Series A funding, bringing its total backing to $20.5 million.

The Seattle-based co-working startup, led by co-founder and chief executive Amy Nelson (pictured), has raised the capital from lead investor Alpha Edison, with support from Madrona Venture Group, New America president and CEO Anne-Marie Slaughter, fashion designer Liz Lange and TOMS founder Blake Mycoskie .

As of November, startups founded by all-female teams had closed 391 deals worth $2.3 billion, an increase from the $2 billion invested in 2017, though still just 2.2 percent of all VC invested this year.

Nelson, an advocate for female entrepreneurs who’s spoken publicly about women’s struggles in the workplace, the difficulties of launching a business in a man’s world and raising venture dollars as a solo female founder, started The Riveter in 2016 after a decade-long career as a lawyer. Today, the startup operates five locations in the U.S., with ambitious plans to open another 100 female-focused co-working spaces by 2022.

“I want The Riveter to be the place people think of when they think of women and work,” Nelson told TechCrunch.

The Riveter has 2,000 members throughout its locations in Seattle, Bellevue, Wash. and Los Angeles. Its expansion plans include new spots in Texas, Colorado and Portland.

The spaces are built with women in mind but are not exclusive to one gender. Nelson tells us The Riveter’s membership is 25 percent male, setting it apart from spaces like The Wing, which is only available to female-identifying people.

A look inside one of The Riveter’s Seattle co-working spaces

“I don’t think the future is female, I think the future is fluid,” she said. “Gender is becoming an outdated idea but at the same time, it’s important to think of women when we build these spaces … There is a lot of value to women’s only spaces but our take on it is we want to redefine the future of work for women and we want everyone to be part of it.”

The Riveter provides space to work and collaborate; a digital network, currently in beta, for its members to connect; and programming ranging from office hours with venture capitalists to “self-care Saturday.”

Other investors in the startup include Brilliant Ventures, The Helm and X Factor Ventures.

Powered by WPeMatico

Apparently, a lot of people realize at the last minute that they don’t have either beer, wine or liquor in their home when they need it.

It’s certainly the most obvious explanation for a sizable new round of funding into Drizly, a six-year-old, Boston-based on-demand delivery app for alcohol that works with roughly 1,000 brick-and-mortar liquor stores across the U.S. and Canada to deliver spirits to customers in what it says is less than an hour. Indeed, according to a new SEC filing, the company has just locked down $34.5 million in funding, which roughly doubles the company’s previous $33 million in funding. Investors include Polaris Partners, which led the company’s Series B round a couple of years ago, along with Baird Capital. Altogether, shows the filing, 17 investors took part in the offering.

The Drizly app shows shoppers different prices on the beer, wine and liquor that they’re looking for at local shops, along with different delivery or pick-up options. There have been some recent changes behind the scenes as the company has grown, too. In late summer, co-founder and original CEO Nick Rellas moved into an advisory role, while his co-founder and cousin, Cory Rellas, who had been the company’s chief operating officer, took over as chief executive. (Nick Rellas remains on the company’s board.) Drizly published a statement at the time, stating: “Having taken on a more critical role in the operations of the company over the past few years, coupled with his experience at Bain Capital, Cory is poised to lead Drizly through the next stage of its growth.”

Drizly also added a CMO, CFO and head of HR to its leadership team over the past year, as the Boston Globe reported in August.

Another sign that the company is maturing: it made its first acquisition in July, absorbing Buttery, an on-demand alcohol e-commerce company that was only active in four cities but whose backend technology and employees were integrated into Drizly. Terms of the deal were not disclosed.

Powered by WPeMatico