Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

StepLadder, another London-based startup aiming to help so-called “generation rent” get onto the housing ladder, has raised £1.5 million in seed funding.

Backing the round is Spanish banking giant BBVA and fintech VC Anthemis via the London-based venture studio on which the pair have partnered. Early investor Seedcamp also followed on, in addition to unnamed angel investors.

StepLadder says it will use the new capital and support provided by BBVA/Anthemis to further develop its “collaborative finance platform.” The startup is also eyeing international expansion.

Founded in 2015 by Matthew Addison and joined by Lucy Mullins and Mihir Bhushan, StepLadder’s collaborative deposit saving platform is designed to motivate renters to save for a deposit so they can purchase their first home.

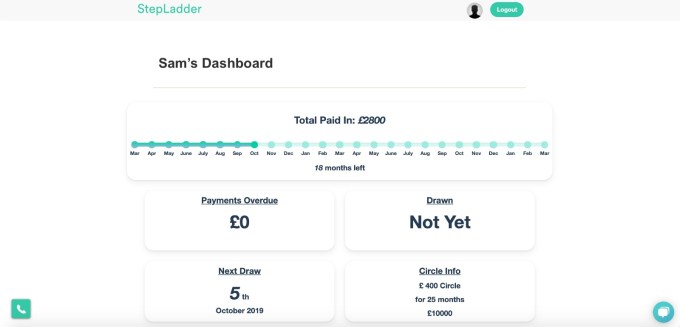

Using a financial model known as a “Rotating Credit and Savings Association” (ROSCA), StepLadder puts its members into “Circles,” whereby each individual member contributes an identical amount on a monthly basis — ranging from £25 to £1,000. A random draw then takes place each month and the winner is provided with that month’s full pot to use toward their deposit.

“For most first-time buyers, it’s really difficult to get on the property ladder,” says Addison. “Home ownership rates amongst 25 to 34-years-olds have collapsed… [with around] 250,000 fewer first-time buyers every year, for over a decade, in the U.K. alone. Raising the deposit is the biggest hurdle. At StepLadder we’re using something called a ROSCA, a form of collaborative finance where people work together in groups to help our members raise their property deposits, on average, 45% faster.”

As an example, StepLadder might match you to a £500 a month Circle for 20 months to raise £10,000. This would see it find 19 other members to be in the same Circle. “Each month the £10,000 is randomly allocated and you could be drawn at any point in that 20 months,” explains StepLadder’s Lucy Mullins. “You have to keep making your £500 a month payment for the full 20 months, so at the end everybody has paid in £10,000 and everybody has received £10,000.”

To help protect the platform from being abused, Mullins says that while a member is still part of a Circle, the startup will only release the pot to their solicitor for use as a property deposit. “So, if somebody stops paying after they have been drawn then we wouldn’t release their payout until they had made catch-up payments.”

StepLadder also supports members along the house-buying journey. The app lets members engage with a community of like-minded people and access group-buying discounts on services such as mortgages, solicitor fess and surveyors. The latter forms part of the company’s revenue stream.

“We introduce our members (at their request) to high-quality service providers, such as mortgage brokers, lending banks, surveyors and insurance providers,” says Addison. “In return, these partners pay us fees or commissions. We offer discounts on these transaction services via the combined buying power of our members in their Circles.”

In addition, there is a small monthly fee (between 2-5%) to be part of a Circle, which Mullins says covers the cost of delivering the service.

This includes holding money securely in a client money account, a payment waiver if a member were to become sick or unemployed after buying a property with their StepLadder deposit, credit bureau costs and the cost of a Circle host to support members on the journey.

“We do not aim to profit from the monthly administration fees we charge members and would usually be able to save our members much more in discounts than they pay in fees,” says Mullins.

Meanwhile, StepLadder has plans to expand the use cases for Circles and evolve the platform to also cover general savings goals and targeted “big ticket items.”

Explains Addison: “In Brazil, ROSCAs are used by nine million consumers for everything from dishwashers to cars to homes. We have already begun to demonstrate this potential with both our First Step offering (smaller circles from £25 a month) and proposed partnered launches.”

Powered by WPeMatico

Mobile banking app Current, which began as a teen debit card controlled by parents, expanded to offer personal checking accounts earlier this year. Now the company says it has grown to host more than 500,000 accounts on its service and has closed on $20 million in Series B funding to further its growth.

The round included new investors Wellington Management Company, Galaxy Digital EOS VC Fund and CMFG Ventures — the venture capital arm of the CUNA Mutual Group, a mutual insurance company serving credit unions and their 120 million members. Returning investors included QED Investors, Expa and Elizabeth Street Ventures.

The first version of Current, which debuted in 2017, was focused on giving parents a more modern way to dole out allowances and reward their kids for chores. But over time, the product became more like a real bank account for teens, culminating with the addition of routing and account numbers late last year. This allowed working teens to direct their paycheck to Current, as they could with a traditional bank.

The first version of Current, which debuted in 2017, was focused on giving parents a more modern way to dole out allowances and reward their kids for chores. But over time, the product became more like a real bank account for teens, culminating with the addition of routing and account numbers late last year. This allowed working teens to direct their paycheck to Current, as they could with a traditional bank.

This year, Current launched personal checking using the same core technology powering its teen banking product. The product includes features like faster direct deposits, gas hold crediting and merchant blocking without charging overdraft fees, hidden fees or requiring minimum balances.

While the teen checking account users have an average age of 15, the average age for the new personal checking account users is 27.

Although personal checking was only launched in late January, it already accounts for about half of Current’s accounts. It also benefits from conversions from Current’s teen users who turn 18 and want to graduate to their own banking app. (Around 98% of teens on Current move to the personal checking app when they come of age, the company noted.)

This puts Current in a more competitive market, where a number of banking apps are now targeting a younger, more mobile generation that has begun to favor modern, feature-rich apps over brick-and-mortar banks. Among its rivals are apps like Step, Cleo, N26, Chime, Simple, Stash and others.

Like many in this space, Current isn’t actually a bank — its banking services are provided by Choice Financial Group and Metropolitan Commercial Bank, which allows it to offer FDIC insurance up to $250,000. Instead, many of the banking apps focus instead on the feature set and user experience they can offer.

Both of Current’s products include a Visa co-branded debit card tied to the Current account. Along with the funding, Current and Visa are also announcing an expanded joint marketing partnership, which will help Current reach new customers.

“We believe everyone should have access to affordable financial services that improve the chances for a better life,” said Stuart Sopp, Current founder and CEO. “We have made this a reality through rebuilding financial infrastructure with the Current Core. It allows us to build more products that offer new ways to interact with money. Our rapid growth to half a million accounts serves as a testament to the ways our products and cost savings are bringing better financial outcomes and we anticipate bringing those benefits to over 1,000,000 customers by mid-2020.”

The company is planning to launch more features starting next year, including a cash-back system with brands and merchants in Q1, and further down the road, it’s considering things like a credit product and maybe Bitcoin investing. But this will require further education and careful attention to do well.

“It’s expensive to be poor — it really is,” he says. “If you don’t have much money, you’re paying 30% or 35% for your credit, whereas if you’re rich you’re paying 5%. So it’s like the world is inverted for you and it holds you down,” Sopp says. “So if we were to do [credit], we are going to do it right.”

In the near-term, the focus is on offering better budgeting tools and more ways for users to save money. This, Sopp argues, is what Current’s young users need most.

To date, Current has raised $45 million in funding.

Powered by WPeMatico

Grafana Labs, the commercial company built to support the open-source Grafana project, announced a healthy $24 million Series A investment today. Lightspeed Venture Partners led the round with participation from Lead Edge Capital.

Company CEO and co-founder Raj Dutt says the startup started life as a way to offer a commercial layer on top of the open-source Grafana tool, but it has expanded and now supports other projects, including Loki, an open-source monitoring tool not unlike Prometheus, which the company developed last year.

All of this in the service of connecting to data sources and monitoring data. “Grafana has always been about connecting data together no matter where it lives, whether it’s in a proprietary database, on-prem database or cloud database. There are over 42 data sources that Grafana connects together,” Dutt explained.

But the company has expanded far beyond that. As it describes the product set, “Our products have begun to evolve to unify into a single offering: the world’s first composable open-source observability platform for metrics, logs and traces. Centered around Grafana.” This is exactly where other monitoring and logging tools like Elastic, New Relic and Splunk have been heading this year. The term “observability” is a term that’s been used often to describe these combined capabilities of metrics, logging and tracing.

Grafana Labs is the commercial arm of the open-source projects, and offers a couple of products built on top of these tools. First of all it has Grafana Enterprise, a package that includes enterprise-focused data connectors, enhanced authentication and security and enterprise-class support over and above what the open-source Grafana tool offers.

The company also offers a SaaS version of the Grafana tool stack, which is fully managed and takes away a bunch of the headaches of trying to download raw open-source code, install it, manage it and deal with updates and patches. In the SaaS version, all of that is taken care of for the customer for a monthly fee.

Dutt says the startup took just $4 million in external investment over the first five years, and has been able to build a business with 100 employees and 500 customers. He is particularly proud of the fact that the company is cash flow break-even at this point.

Grafana Labs decided the time was right to take this hefty investment and accelerate the startup’s growth, something they couldn’t really do without a big cash infusion. “We’ve seen this really virtuous cycle going with value creation in the community through these open-source projects that builds mind share, and that can translate into building a sustainable business. So we really want to accelerate that, and that’s the main reason behind the raise.”

Powered by WPeMatico

Tines, a Dublin-based startup that lets companies automate aspects of their cybersecurity, has raised $4.1 million in Series A funding. Leading the round is Blossom Capital, the venture capital firm co-founded by ex-Index Ventures and LocalGlobe VC Ophelia Brown.

Founded in February 2018 by ex-eBay, PayPal and DocuSign security engineer Eoin Hinchy, who was subsequently joined by former eBay and DocuSign colleague Thomas Kinsella, Tines automates many of the repetitive manual tasks faced by security analysts so they can focus on other high-priority work. The pair have bootstrapped the company until now.

“It was while I was at DocuSign that I felt there was a need for a platform like Tines,” explains Hinchy. “We had a team of really talented engineers in charge of incident response and forensics but they weren’t developers. I found they were doing the same tasks over and over again so I began looking for a platform to automate these repetitive tasks and didn’t find anything. Certainly nothing that did what we needed it to, so I came up with the idea to plug this gap in the market.”

To that end, Tines lets companies automate parts of their manual security processes with the help of six software “agents,” with each acting as a multipurpose building block. Therefore, regardless of the process being automated, it only requires combinations of these six agent types configured in different ways to replicate a particular workflow.

“I wanted there to be as few agent types as possible, to simplify the system, and I haven’t discovered a workflow in which tasks sit outside of these agents yet,” says Hinchy. “Once a customer signs up they can start automating their own workflows immediately, and most of our customers see value from day one. If they need a hand, my team works with them to establish how they currently manually carry out tasks, such as identifying and dealing with a phishing attack. Each step of dealing with the attack — from cross-checking the email address with trusted contacts or a blacklist, to scanning attachments for viruses or examining URLs — will be performed by one of the six agent types. This means we can assign these tasks to an agent to create the workflow, or as we call it, the “story.”

So, for example, once a phishing email triggers the first agent, the following steps in the “story” are automatically carried out. In this way, Tines might be described as akin to IFTTT, “but an exceptionally powerful, enterprise version of the IFTTT concept, designed to manage much more complex workflows.”

Competitors are cited as Phantom, which last year was acquired by Splunk, and Demisto, which was bought by Palo Alto Networks. However, Hinchy argues that a key differentiator is that Tines doesn’t rely on pre-built integrations to interact with external systems. Instead, he says the software is able to plug in to any system that has an API.

Meanwhile, Tines says it will use the new funding to hire engineers in Dublin who can help improve the platform through R&D, as well as grow its customer base with companies in the U.S. and in Europe. Notably, the startup plans to expand beyond cybersecurity automation, too.

“Our background is in security, so with Tines, we’ve initially focused on helping security teams automate their repetitive, manual processes,” says Hinchy. “What makes us different is that nowhere does it say we can’t expand beyond this, to help other teams and sectors automate tasks. The advantage of our direct-integration model is that Tines doesn’t care if you’re talking to a security tool, HR system or CRM, it treats them the same. In the next 18 months, we plan to expand Tines outside security, hire more talent and increase the product team from 8 to 20.”

Powered by WPeMatico

Koan, a three-year-old online platform that aims to help teams achieve their objectives and stay engaged, has raised $3 million in seed funding led by Uncork Capital and Crosslink.

Koan, co-founded and led by CEO Matt Tucker — who previously co-founded Jive Software, an outfit that made social software for businesses and went public in 2011, then sold in 2017 — is trying to set itself apart from the many other performance management tools in the world by catering less to HR departments and targeting instead the chief operating officer or chief of staff.

Though these individuals today rely heavily on emails and spreadsheets — static products that can slow down execution — Koan tries to make them more efficient by providing them with a dashboard that makes it easier to track goals, provide feedback and execute other people-management tasks.

The company is also targeting leaders of small to mid-size companies. The broader idea is to help them with goal management, and to make it easier for them to make progress against their own metrics and goals.

Koan, which integrates with a wide number of third parties, from Salesforce to Slack, employs just 10 people at this point and is based in Portland, Ore., though Tucker works from Palo Alto, where, interestingly, he and his wife also operate a company called Blind Tiger Ice.

Inspired by their international travels to upgrade in some way their local dining (and drinks) experience, the couple’s nearly two-year-old company is becoming known in some tech circles for its “high-quality cocktail ice,” as Tucker describes it. Among its customers: Netflix, Facebook, Google and the world-famous Yountville, Calif.-based restaurant French Laundry.

Every once in a while, too, says Tucker, his worlds collide. Recently, for example, the venture firm CRV called Blind Tiger to order ice for a party it was throwing. The portfolio company it was celebrating: Iterable, a growth marketing startup and also a Koan customer.

Koan has now raised $5 million. Earlier investors include the Webb Investment Network, SV Angel and Spider Capital, all of which participated in the company’s newest round.

Above, left to right: Co-founders Matt Tucker and Scott Campbell, an early salesperson at Jive Software.

Powered by WPeMatico

Personal finance startup Truebill announced today that it has raised $15 million in Series B funding.

The new funding was led by Eldridge Industries, with participation from Evolution VC and previous investors, including Cota Capital, Lucas Venture Group and YouTube co-founder Jawed Karim.

When the Y Combinator-backed startup raised seed funding back in 2016, it was focused on what Chief Revenue Officer Yahya Mokhtarzada now describes as “a single function” — helping users track all their subscriptions and recurring expenses, and then to cancel them when desired.

Mokhtarzada said the Truebill team subsequently saw an opportunity, given “the increasing degree of financial complexity in people’s lives,” to take “a more holistic view of personal finance.”

Truebill still offers subscription tracking, and Mokhtarzada said that’s usually what brings new users in. But it’s also added capabilities like automated budgeting, automated saving and bill negotiation. And this fall, it plans to launch additional features, including bill pay, credit score monitoring and a rewards program.

Consumers have plenty of other personal finance tools to choose from, but Mokhtarzada said most of them are focused on fulfilling a specific need and will likely become less relevant as your financial situation changes.

“The other half is, if you look at the App Store, it’s filled with single point solutions,” he said. “As your financial life gets more sophisticated and complex, the consumer is ending up with five or more different point solutions. All of that needs to be consolidated into one place.”

Truebill says it currently has 500,000 active users. The basic product is free, then users can pay a price of their choosing for premium features like custom budget categories; Truebill also takes a cut of the savings when it negotiates lower bills.

The company recently opened new headquarters in Silver Spring, Md. Mokhtarzada said Truebill still has an office in San Francisco, but he noted that he and his co-founders/brothers previously built Webs.com in Silver Spring.

“San Francisco obviously has a very competitive market — it’s harder to hire and very difficult to retain talent,” he added. “With the D.C. area, it feels like we’ve found an untapped market, with very talented engineers working for the government, working in an area of technology that’s not very exciting for them.”

Powered by WPeMatico

Vendr has developed an enterprise SaaS solution for managing enterprise SaaS.

The new startup, founded by InVision’s former head of enterprise sales Ryan Neu, is another standout from Y Combinator’s latest batch. Contrary to the majority of those businesses, however, Vendr is already profitable.

In classic YC fashion, the company has created software to sell to other startups, and, as such, it was quick to gain the confidence of top venture capital investors. Headquartered in Boston, Vendr has raised a $2 million round led by F-Prime Capital, with participation from Ashton Kutcher’s Sound Ventures, Joe Montana’s Liquid2 Ventures, Garage VC and angel investors including Canva co-founder and chief operating officer Cliff Obrecht and HubSpot COO JD Sherman.

The company offers subscription-based software, priced depending on company headcount, that helps fast-growing businesses buy and manage enterprise SaaS. In short, the product cuts the human out of the sales process, allowing companies to purchase or upgrade software using software. The goal isn’t to eliminate the sales profession, rather to put an end to “persuasion driven” sales, Neu explains, and to make enterprise software purchases as easy as consumer product purchases.

Boston-based Vendr graduated from the Y Combinator startup accelerator earlier this year

“We see software sales actually going away because most people are tired of being sold to, they are tired of being persuaded, they want to transact,” Neu, who previously led sales at HubSpot, tells TechCruch. “Vendr was created to allow people to transact software without actually having to talk to people.”

Founded 14 months ago, Vendr has reached $1 million in annual recurring revenue, which, for context, has historically been amongst the benchmarks necessary for a SaaS startup to raise its Series A. Neu says the company is growing 15% month-over-month with monthly recurring revenue currently sitting at $96,500. Already profitable, Neu says they want to put themselves in a position in which they don’t have to raise any additional outside capital.

“I can’t imagine looking at the bank account every month and watching it deplete,” Neu said. “We want to be in a position where we can control our own destiny.”

Vendr currently operates with a team of six employees and 19 customers, including Canva, Grammarly, GitLab, Brex, HubSpot and InVision. The company is also backed by Okta’s general counsel Jon Runyan, AppDynamics’ COO Dan Wright and YC partner Aaron Epstein.

Powered by WPeMatico

America has an addiction problem.

It’s a problem that serial entrepreneur Josh Bruno has seen first hand. And it’s why he has launched a new company called Path, which pitches access to specialized substance addiction treatment professionals as an employee health benefit, to do something about it.

“I have unfortunately lost five friends now to alcohol and opioid overdoses. I went to five funerals in three years,” says Bruno. “Every time I would end up talking to friends and family afterwards… and everyone would ask, ‘What could we have done?’ “

Now Bruno is doing something.

While Alcoholics Anonymous and rehabilitation facilities provide one solution, Bruno says that neither one has the scope to address the enormity of the problem.

Bruno thinks Path may be the avenue to best address the issue. The idea is to provide near-instant access to specialized providers of substance abuse treatment as a benefit that employers can offer to their staff.

As the founder of HomeTeam, which provided in-home senior care and a software toolkit to manage that care, Bruno already has an understanding of the healthcare marketplace.

“We plug in to an employer and provide a holistic solution for the employees. We bring a doctor, a therapy and a coach,” says Bruno of the new service he’s launching. “We’re not a provider ourselves and we bring a network of providers.”

The business model evolved as Bruno began researching how things are currently done. “I have volunteered at AA and rehab facilities [and] I talked to labor union leaders across the country,” says Bruno. He also reached out to the nation’s 23 largest employers and shadowed treatment specialists to see how substance abuse treatment is currently handled.

“The first thing I saw is that 10% — or one in 10 adults across the U.S. — have a substance abuse disorder,” says Bruno. “That shocked people because it’s more than diabetes.”

What’s more, about 33% of mental health issues are actually addiction-related, which can add additional stress on an employers’ healthcare costs.

The founding team at Path, which includes Bruno and Gabriel Diop, who heads partnerships, and Greg Moore, who leads product development, all think of substance abuse treatment as an access issue. People looking for treatment simply don’t know where to go to get the most effective and affordable help.

“Today the health insurance company would give a list of in-network providers and it’s up to the patient to figure out where to go [and] 50% of time they go out of network,” says Bruno.

When Path works with a large employer, a phone call is made directly to the company and that call goes to a clinical social worker, who handles the intake of a prospective patient. The company has deals with addiction doctors in the geographies where it operates and can ensure that an assessment can be done within 48 hours.

After the assessment, a treatment plan is drawn up and the company will manage that process for the employer, and the physician as well.

Path is already talking to two Fortune 100 companies about deploying its service. “It’s a targeted, regional service,” says Bruno. “Not a national service.”

The Los Angeles-based company has raised $5.35 million to date in a round of funding led by Upfront Ventures, with participation from Sequoia Benefits, Radian Street Capital and angel investors including Barbara Wachsman, the former head of benefits at Disney; Amy Shannon, the former head of benefits at Chevron; and Howard Cherny, the former head of benefits at Cisco.

“Put simply, Path plans to work with the best addiction treatment providers across the continuum in the U.S., which is exactly what is needed. Finally, a team is focusing on core issues of quality and cost-effective treatment,” said Kelly Clark, a member of the Path Clinical Advisory Board, and the former president of the American Society of Addiction Medicine.

Not only can Path help to roll out access to treatment at scale, but the company can also reduce healthcare costs for companies, according to Bruno.

“It will lower the expense to the plan,” he says. “Approximately 30% to 50% of employees are going out of network for addiction treatment… that’s $25,000 to $50,000 per month.”

Path’s costs are substantially lower, and the company is only paid if members use the network, he said.

“Employers have made a commitment to the health and well-being of their employees. If mental health is a top priority for your organization, you can’t ignore [substance use disorders],” said Wachsman, in a statement.

Powered by WPeMatico

Demodesk, an early-stage startup that wants to change how sales meetings are conducted online, announced a $2.3 million seed investment today.

Investors included GFC, FundersClub, Y Combinator, Kleiner Perkins and an unnamed group of angel investors. The company was a member of the Y Combinator Winter 2019 cohort.

CEO and co-founder Veronika Riederle says that the fact it’s so closely focused on sales separates it from other more general meeting tools like Zoom, WebEx or GoToMeeting. “We are building the first intelligent online meeting tool for customer-facing conversations. So that is for inside sales and customer service professionals,” Riederle explained.

One of the key pieces of technology is what Riederle calls “a unique approach to screen sharing.” Whereas most meeting software involves downloading software to use the tool, Demodesk doesn’t do this. You simply click a link and you’re in. The two parties online are seeing a live screen and each can interact with it. It’s not just a show and tell.

What’s more, in a sales scenario with a slide presentation, the customer sees the same live screen as the salesperson, but while the salesperson can see their presentation notes, the customer cannot.

She said while this could work for any number of scenarios, from customer service to IT Help desks, at this stage in the company’s development she wants to concentrate on the sales scenario, then expand the vision over time. The service works on a subscription model with tiered per user pricing starting at $19 per user, per month.

When they got to Y Combinator, the company already had a working product and paying customers, but Riederle says the experience has helped them grow the business to moew than 100 customers. “YC was extremely important for us because we immediately got access to an extremely valuable network of founders and potential customers, and also just a base for us to really [develop] the business.

Riederle founded the company with CTO Alex Popp in 2017 in Munich. Prior to this seed round, the founders mostly bootstrapped the company. With the $2.3 million, it should be able to hire more people and begin building out the product further, while investing in sales and marketing to expand its customer base.

Powered by WPeMatico

LabGenius, a London-based startup applying AI and “robotic automation” to protein drug discovery, has raised $10 million in Series A funding.

The round is led by Lux Capital and Obvious Ventures, with participation from Felicis Ventures, Inovia Capital, Air Street Capital and existing investors. Also investing is Recursion Pharmaceuticals’ founder and CEO Chris Gibson, as well as Inovia Capital General Partner Patrick Pichette, who was formerly Google’s CFO.

Lux Capital’s Zavain Dar and Obvious Ventures’ Nan Li will join the LabGenius board of directors. Notably, the U.K. company’s early investors include Nathan Benaich, Torsten Reil, EF’s Matt Clifford, and Philipp Moehring, to name just a few.

“LabGenius is a full-stack protein engineering company: we combine artificial intelligence (AI), robotic automation and synthetic biology to evolve next-generation protein therapeutics,” founder and CEO Dr. James Field tells me.

“My central thesis, the thing that’s really the driving force behind the company, is the conviction that we’re entering an age in which humans will no longer be the sole agents of innovation. Instead, new knowledge, technologies and sophisticated real-world products will be invented by smart robotic platforms called empirical computation engines. An empirical computation engine is an artificial system capable of recursively and intelligently searching a solution space.”

LabGenius’ flagship technology is called “EVA,” which Field describes as a “machine learning-driven, robotic platform” capable of evolving new proteins. “As a smart robotic platform, EVA is capable of designing, conducting and critically learning from its own experiments,” he says.

The goal: to discover and develop new protein therapeutics that are currently hard for humans alone to find.

“For decades, scientists, engineers and technologists have dreamt of building ‘robot scientists’ capable of autonomously discovering new knowledge, technologies and sophisticated real-world products,” explains Field.

“For protein engineers, that dream has now entered the realm of possibility. The rapid pace of technological development across the fields of synthetic biology, robotic automation and ML has given us access to all the essential ingredients required to create a smart robotic platform capable of intelligently discovering novel therapeutic proteins.”

To that end, Field frames the development of EVA as a “long-term, ambitious undertaking” that he says will enable the startup to address previously unsolvable protein engineering challenges and in doing so, develop urgently needed therapeutics.

“My ultimate goal for LabGenius is to establish a fully integrated biopharmaceutical company powered by the world’s most advanced protein engineering platform,” he adds. “Quite honestly, this is a gargantuan undertaking and, while we’ve already established one of the world’s most technically sophisticated protein engineering operations, we’re only just scratching the surface of what’s possible.”

More broadly, there is a tension that many deep tech companies face, which is determining how best to develop technology that’s tightly aligned to real-world commercial needs (before running out of capital!). “For LabGenius, we’ve achieved this in a highly intentional way by undertaking a series of commercial projects of increasing complexity from the company’s earliest days,” Field says.

One on-going project is with Tillotts Pharma AG to identify and develop new drug candidates for the treatment of inflammatory bowel disease (IBD).

“Our business model is pretty simple,” says the LabGenius founder. “We use EVA to discover and characterise new drug molecules and then partner with pharma companies who can take these molecules to market. For example in a typical partner-financed early discovery program, we’ll take a project from concept to early pre-clinical stage. Typical deal structures include a blend of R&D payments, milestones & royalties.”

Meanwhile, LabGenius will use the capital to scale its team, expand the scope of its discovery platform and initiate an “internal asset development program.” The next goal is to evolve novel antibody fragments capable of treating conditions that cannot be addressed using conventional antibody formats.

Powered by WPeMatico