Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

The internet and search engines like Google have made the world our oyster when it comes to sourcing information, but in the world of business, there remains a persistent need for more targeted market intelligence, a way to get reliable data quickly to get on with your work. Today, one of the startups hoping to build a lucrative operation of its own around that premise is announcing a round of funding to get there.

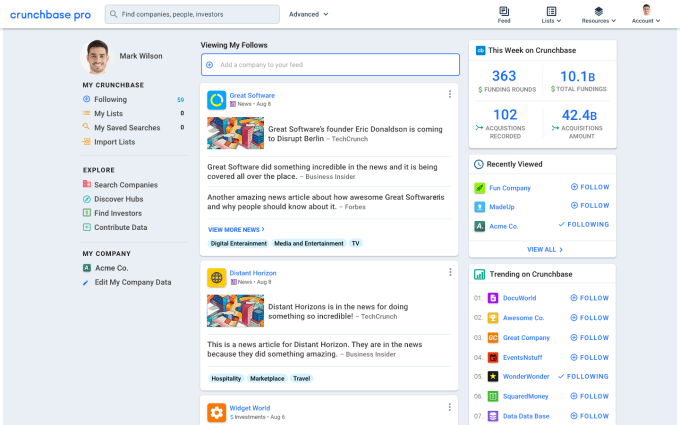

Crunchbase — a directory and database of company-related information that originally got its start as a part of TechCrunch before being spun off into a separate business several years ago — has raised $30 million, a Series C that it plans to use to continue expanding its base of paid subscribers and expanding its product to include more predictive, personalised information for its users by way of more machine learning and other AI-based technology.

CEO Jager McConnell, who has long viewed Crunchbase as the “LinkedIn for company profiles,” said that of the 55 million people who visit the site each year, the company currently has “tens of thousands” of subscribers — subscriptions are priced at $29/user/month varying by size of company contract — which works out to less than 1% of its active users. That’s “growing quickly,” he added, speaking to site’s potential.

Indeed, he noted that since its last round in 2017, when it raised $18 million, Crunchbase has tripled its employees to 120 and has 10 times more annual revenue run rate. It’s also more than doubled its traffic since being spun out.

This latest round was led by Omers Ventures, the prolific investment arm of the giant Canadian pension fund of the same name (which is, incidentally, also now opening an office in Silicon Valley to get even more active with startups there).

Existing backers Emergence, Mayfield, Cowboy Ventures and Verizon (which still owns TC) also participated. McConnell said Crunchbase is not disclosing its valuation with this round, but he did note that it was “well within the target range” that the startup had set, that it was an oversubscribed upround and that it was on the more practical than exuberant side.

“I believe we are seeing too many high valuations with low annual revenue rates, and it’s catching up with people, and we were very focused on not hitting that valuation trap in order to be successful in the future,” he said. “This is a good round but not something insane.” Strong logic I suspect could be supported by Crunchbase data. For some context, Crunchbase had a post-money valuation of $70 million in its previous round in 2017 (having raised $26 million), according to PitchBook — ironically, one of Crunchbase’s big competitors (CB Insights, Owler being others.)

With its start as a side project of TechCrunch, the DNA of Crunchbase has always been in tech companies, and that is still very much the heart of the data that is in the system today. The kind of data you can get via the site includes basics on when a company was founded, who the founders are, who the current executive leadership is, how much money it has raised and from whom and what has been written about it in the media. You also can find original content on the site by way of its own team of writers covering funding rounds and other Crunchbase-relevant content.

Then, via a number of third-party integrations with companies like Siftery and SimilarWeb, you can get deeper data around competitors and more (most of which you can only see if you are a paying, not free, user).

The company notes that it currently makes 3.9 billion annual updates to its data set — which people upload themselves in the old wiki style, or are manually or automatically uploaded, by way of some 4,000 data partnerships and syndication deals (these include the likes of Yahoo! Finance, LinkedIn, Business Insider and Amazon Alexa, which in turn make some 1.6 billion annual calls to the Crunchbase API).

The growth of that information trove, and more interesting ways of parsing it to drive subscriptions and potential licensing revenues, will be of paramount importance to the company’s bottom line. Today there is some advertising on the site, but McConnell confirmed to me that Crunchbase is in the process of winding down advertising on the platform.

“The impact on the business was not material enough to sacrifice the user experience to have ads,” he said.

On the subject of the self-styled LinkedIn comparison, you’ve probably already noticed that LinkedIn does have company profile pages, but McConnell’s argument is that the site was built with individuals’ profiles and recruitment in mind. That makes the company pages more of an add-on and not something that can be effectively developed at this point in the way that Crunchbase has done.

“Once you do that, it’s hard to change,” he said of the direction that LinkedIn has grown. “Its company profiles are more brand representations, not a source of truth about the companies themselves.”

What’s interesting to me is to see which direction Crunchbase will evolve in the longer term. As the world has continued to grow into the bigger vision of “every company is a tech company, and every problem has a tech solution,” it seems that Crunchbase’s own ambitions have also grown.

In the company’s blog post and press release announcing the fundraise, it’s notable to me that the word technology, or any variation of it, isn’t mentioned even once in the text (the only exception being the boilerplate description of Omers).

That could point to how — as Crunchbase expands its horizons in terms of the kinds of information on businesses it can provide to users — it might see a role for itself not unlike that of LinkedIn, spanning across multiple verticals and the communities of people (or in CB’s case, businesses) that have built around them.

“We are thrilled to partner with Jager and the talented leadership team at Crunchbase,” commented Michael Yang, managing partner at OMERS Ventures, in a statement. “Crunchbase continues to show significant traction as the leader in research, information, and prospecting for private companies – an incredibly large and valuable market to address and service. By utilizing and collecting aggregated data, adding tools and apps, and continuing to customize each user experience, the lead generation and deal value Crunchbase can provide is unprecedented, and we are proud to support this next phase of growth.”

Powered by WPeMatico

Namogoo, the Herzliya, Israel-based company that has developed a solution for e-commerce and other online enterprises to prevent “customer journey hijacking,” has raised $40 million in Series C funding.

The round is led by Oak HC/FT, with participation from existing backers GreatPoint Ventures, Blumberg Capital and Hanaco Ventures. It brings total raised by Namogoo to $69 million, and sees Matt Streisfeld, partner at Oak HC/FT, join the company’s board.

Founded by Chemi Katz and Ohad Greenshpan in 2014, Namogoo’s platform gives online businesses more control over the customer journey by preventing unauthorized ad injections that attempt to divert customers to competitors. It also helps uncover privacy and compliance risks that can come from the use of third and fourth-party ad vendors.

More broadly, Namogoo says that customer journey hijacking is a growing but little-known problem that by some estimates affects 15-25% of all user web sessions and therefore costs e-commerce businesses hundreds of millions in lost revenue.

Unauthorized ads are injected into consumer web browsers — on the consumer side, typically via malware the user has unintentionally installed — meaning that e-commerce sites are often unaware that it is even happening. This results in product ads, banners and pop-ups, which appear when visiting an e-commerce site. The ads disrupt the user experience, hoping to send them to competitor sites.

Namogoo says that retailers using its technology see conversion rates increase between 2-5%, which in the first half of 2019 totaled more than $575 million in revenue for Namogoo customers. It is used by more than 150 global brands in over 38 countries, including Tumi, Asics, Argos, Dollar Shave Club, Tailored Brands, Upwork and others.

Meanwhile, Namogoo will use the new funding to further expand its client-side platform offerings, beginning with the launch of its “customer privacy protection solution.” “The solution detects and mitigates against customer privacy risks associated with third and fouth-party vendors running on company websites and applications,” explains the company.

Powered by WPeMatico

Freetrade, the U.K. challenger stockbroker that offers commission-free investing, has closed $15 million in Series A funding. The round includes a $7.5 million investment from Draper Esprit, the U.K. publicly listed venture capital firm, along with previously announced equity crowdfunding via Crowdcube.

The funding will be used by Freetrade for further growth and product development, including “doubling down” on engineering hires. The firm, which claims more than 50,000 customers, is also planning to expand to Europe next year.

In addition, Adam Dodds, CEO and founder of Freetrade, tells me there will be a marketing and content push to help reach more of the challenger stockbroker’s target millennial customers and help educate the market as a whole that investing in the stock market doesn’t have to be prohibitively expensive or complicated.

Amongst a number of new stock trading and investment apps in the U.K., London-based Freetrade was first out of the gate as a bona fide “challenger broker” after deciding early on to build its own brokerage. This included obtaining a full broker license from the FCA, rather than simply partnering with an established broker.

The Freetrade app lets you invest in stocks and ETFs. Trades are “fee-free” if you are happy for your buy or sell trades to execute at the close of business each day. If you want to execute immediately, the startup charges a low £1 per trade. The idea is to put the heat on the larger incumbents that can charge up to £12 per trade, which is off-putting to people wanting to only invest a small amount or regularly refresh a modestly sized portfolio.

Meanwhile, Dodds says that next on the product roadmap will be a new investment platform that will give users the option to purchase U.K. and European “fractional” shares, not just U.S. ones, which he claims will be a first.

With that said, competition has been steadily increasing since Freetrade set up shop. Silicon Valley’s Robinhood is gearing up for a U.K. launch, having recently received regulatory approval. Bux has also recently launched commission-free trading and now bills itself as a challenger broker just like Freetrade. Then, of course, there’s Revolut, the fast-growing challenger bank that tentatively launched fee-free stock investing in August.

Noteworthy, André Mohamed, previously CTO and a co-founder of Freetrade, joined Revolut as its new head of Wealth & Trading Product, adding a bit of extra spice to that rivalry. As I wrote at the time, the circumstances that saw Mohamed depart Freetrade remain unclear. According to my sources, his contract was terminated last year and the two parties settled, with Freetrade accepting no liability.

“Freetrade are on a mission to open up investment opportunities for everyone, as are we,” says Simon Cook, CEO of Draper Esprit, in a statement. “In this sense, their mission is totally aligned with our own, as a rare tech-focused VC listed on the stock exchange. The company have shown exceptional growth in the short time since they first launched the platform last year. We could not be more delighted to support Adam, Viktor, Ian and their wider team as they enable Europe’s 100 million millennials to benefit from the world’s economic growth.”

Powered by WPeMatico

If you’ve ever tried buying a bike online, or ski equipment, or any number of expensive goods where it would be useful to know a lot more than you do, you might check out Curated, a two-year-old San Francisco-based startup that wants to help busy shoppers who know generally what they want but don’t necessarily have time to visit a specialty store to learn more.

It isn’t the first startup to help with shopping recommendations. Among its predecessors is Hunch, a company that delivered customized recommendations to users based on signals around the web (and sold to eBay in 2011). Another variation on the same theme can be traced back to the dot com era company Keen.com, a live answer community where people could get answers to their questions over the phone.

Still, Curated makes enough sense in today’s market that Forerunner Ventures, which has established a name for itself as the preeminent investor in e-commerce companies, just led its $22 million Series A round. It was the only venture firm in the round by design, says cofounder and CEO Eddie Vivas, who says the funding was filled out by the same friends and family who’d participated in Curated’s $5.5 million seed round.

As part of the deal, Forerunner founder Kirsten Green has also joined the board.

It’s easy to appreciate the company’s appeal. Curated works by matching bewildered shoppers with people who are passionate and knowledgeable and “expert” in their fields. Right now, those experts are mostly athletes or coaches, as the platform is starting out with a handful of verticals, including golf, cycling, and a few winter sports. Longer term, the idea is to launch new sections on the site every six to eight weeks, including fly fishing, kiteboarding, camping and hiking.

How the economics work: Curated strikes deals with manufacturers — say makers of snowboard equipment or mountain bikes — that sell Curated their goods at wholesale prices. Curated can then sell them at retail prices to its customers. (Curated fulfills the order itself.)

Part of that markup is used to pay its experts, who tend to be people who have jobs in related fields but could use more income and who love sharing what they know about a topic. To ensure that these experts know as much as they claim, they are vetted by other experts on the platform, answering a battery of questions as part of that process.

Vivas stresses that experts are in no way incentivized to recommend anything in particular to a customer, but he says customers can tip the experts if they wish. (Curated suggests tips of 5%, 7.5%, or 10%, and Vivas says they are sometimes given much more than that by shoppers who are thankful for their time and effort, especially when their interactions end up leading them to products that cost less than they might have paid otherwise.)

The end goal is for customers to complete transactions on the platform that they wouldn’t otherwise feel comfortable completing at a site where they aren’t actively educated.

The platform is seizing on a number of trends that make it a smart idea for this day and age. For one thing, it uses artificial intelligence to connect shoppers with the right advisors. Though everyone tosses around AI as a competitive advantage, Curated seemingly has a genuine competitive advantage on this front, owing to the background of Vivas, who sold to LinkedIn an earlier company that used AI to automate the recruiting process.

At the time, in 2014, it was LinkedIn’s biggest acquisition ever. And Vivas stayed at LinkedIn for another 3.5 years as the head of product within its talent solutions business, which is where LinkedIn derives most of its revenue. (In fact, it’s where he met some of the 32 people who now work at Curated.)

Curated is also putting to work far-flung knowledge workers who, like a lot of Americans, increasingly work for themselves or in part-time roles that they’re looking to supplement with other part-time roles.

But perhaps most meaningfully, Curated is a kind of antidote to Amazon, where shoppers can turn when they need something fast but that’s incredibly limited when it comes to providing the kind of information needed to comfortably make big purchases. Consumers may pull the trigger on items anyway, but often, they end up with merchandise that they then have to send back or never wind up using.

The question now is whether the company can scale. To do so, it’ll need to rise above the din of other e-commerce platforms to attract enough customers to support its network of experts (and vice versa), and it’s a pretty crowded landscape out there, even with the magic of search-engine optimization and Facebook ads.

Curated will also need to strike enough deals with goods manufacturers to make the platform compelling for shoppers, and to ensure that the level of the advice that’s provided to those consumers is, and remains, high.

Perhaps unsurprisingly, Vivas doesn’t sound concerned. He thinks he’s built a strong team. He’s also excited about the growing network of experts the team has pieced together since founding the company in the summer of 2017.

“You take someone who is passionate about something and you let them make money off it, and good things happen,” he says.

“In allowing people to monetize their knowledge, the unlock is just unbelievable.”

Time will tell. The service launches publicly today.

Powered by WPeMatico

The cloud kitchen craze has reached Latin America. Food tech startup Muy landed a fresh $15 million Series B to expand into Mexico and soon Brazil. The service is currently operative in Colombia.

Muy is a “cloud kitchen meets Chipotle,” says one investor. The company describes itself as a virtual kitchen and smart chef system that uses AI to produce food based on forecasts of demand, which can help to reduce food waste. Muy, translated from Spanish to English as “very,” allows users to place personalized orders in one of Muy’s physical restaurants or through a mobile app. Muy’s concept also exists as 20 physical dining locations offering what it says are quick, fresh and personalized dishes. Founder Jose Calderon says Muy is serving more than 200,000 dishes per month.

The round was led by Mexico-based investor ALLVP, with previous investor Seaya returning. The $15 million Series B brings MUY’s total funding to $20.5 million.

Calderon is no newcomer to the takeaway experience space. He previously raised $47.7 million for a Colombian online food ordering startup called Domicilios, which he exited to Delivery Hero.

The explosion of delivery apps has kept options competitive for customers not only in the U.S. but across Latin America. The congested highways of São Paulo, Mexico City, Bogotá and beyond are filled with motor couriers running deliveries with Rappi, UberEATS and the like.

Calderon notes that cloud kitchens are poised to make on-demand ordering and delivery more efficient in these high-density cities due to the long commute times that keep the growing middle class out of their homes for extended periods of 12 hours or more.

A MUY customer orders at one of the company’s physical locations in Colombia

Alternatives like full service restaurants can be prohibitively expensive and time consuming, and traditional casual restaurants don’t meet quality standards. A large part of the market, around 40%, brings a lunch to work, says Calderon. But as disposable income increases, he predicts that more people will avoid cooking at home and will opt for faster and higher-quality options like Muy.

Cloud kitchens — the fully equipped, shared, commercial grade spaces for restaurant owners — have left U.S. investors balking. Journalists have described these virtual spaces as “ghost kitchens” and many have noted the threat they pose to independently owned restaurants. My colleague Danny Crichton wrote that “cloud kitchens are the WeWork for restaurant kitchens,” adding that suddenly sharable kitchen space will lead to bidding wars between these virtual food brands.

This rhetoric isn’t hindering the rise of cloud kitchens and the services that support them from launching in the U.S. and down to Latin America. According to Calderon, the food service market opportunity in Latin America will reach $270 billion by 2021.

The founder also notes that the Latin America market is highly fragmented; the top 10 chains only hold around 5% of market share in comparison to countries like the U.S. where this figure reaches 24%. “Large players will consolidate and win, and small ones will face pressure,” he says.

Larger incumbents have already begun to dip into the cloud kitchen opportunity. Earlier this year, Amazon took a $575 million bite into Deliveroo, which opened its first shared kitchen in Paris in 2018. City Storage Systems, the holding company of CloudKitchens, was backed with a $150 million controlling stake from Uber founder and ex-CEO Travis Kalanick.

For better or worse, delivery apps and cloud kitchens are revolutionizing the way we eat in the U.S., Asia and now in Latin America. The winners among the various global delivery apps, cloud kitchens and controlling incumbents have yet to emerge, but what we do know is that everyone needs to eat lunch.

Powered by WPeMatico

Particle, a platform for Internet of Things devices, has raised $40 million in its latest round of funding.

Qualcomm Ventures and Energy Impact Partners led the Series C raise, with backing from existing investors including Root Ventures, Bonfire Ventures, Industry Ventures, Spark Capital, Green D Ventures, Counterpart Ventures and SOSV.

With its latest round of funding, Particle has raised $81 million to date.

The San Francisco-based startup provides the back-end for its customers to bring Internet of Things devices to market without having to shell out for their own software infrastructure. The platform aims to be the all-in-one solution for IoT devices, with encryption and security, as well as data autonomy and scalability.

That means more traditional businesses can buy a fleet of sensors and other monitoring devices, hook them up to their own machines and use Particle’s infrastructure for monitoring.

That’s a common theme that Particle sees, according to Zach Supalla, the company’s chief executive.

“More and more of our customers are in old-fashioned, even unglamorous, businesses like stormwater management, industrial equipment, shipping or monitoring any number of compressors, pumps and valves,” he said in remarks. “These businesses are diverse, but the common thread is that they need to monitor and control mission-critical machines, and we see it as our mission to help bring their machines, vehicles and devices into the 21st century.”

Particle said the funding round follows “significant growth” for its enterprise platform, seeing 150% year-over-year growth in revenue.

The company currently has 100 staff working to support 85 enterprise clients across agriculture, automotive, smart city and other industries.

Powered by WPeMatico

Stampli, the Mountain View-based company looking to automate invoice management, has today announced the close of a $25 million Series B round. The funding round was led by SignalFire, with participation from existing investors such as Hillsven Capital and Bloomberg Beta, as well as new investors such as NextWorld Capital.

Stampli launched in 2015 to build software specifically focused on invoice management. Part of the problem with invoice management is that many people in the organization procure services and contract vendors, but the people who deal with the majority of the paperwork are siloed off from that process. This means the folks in the finance department are often tasked with chasing down co-workers from other departments to resolve their issues.

With Stampli, the entire procure to pay process happens in a collaborative software suite. Each invoice is turned into its own communications hub, allowing people across departments to fill in the blanks and answer questions so that payments are handled as efficiently as possible. Moreover, Stampli uses machine learning to recognize patterns around how the organization allocates cost, manages approval workflows and what data is extracted from invoices.

In other words, over time, Stampli gets better and better for each individual organization.

Stampli charges based on the amount of transactions an organization has in the system, as well as how many “advanced users” are taking part in that action. Stampli recognizes the difference between users in the finance department, making high-level decisions, and other users from the organization who are simply collaborating on the platform much more infrequently.

Co-founder and CEO Eyal Feldman believes that another big differentiator for the company is that it has specifically decided to be payments-agnostic, letting customers choose their payments provider and maintain control of that part of the system.

As of right now, Stampli is processing more than $12 billion in invoices annually, with more than 1,900 businesses and 40,000 users on the platform.

This new round comes on the heels of a $6.7 million Series A round from August 2018, also led by SignalFire, with participation from UpWest Labs, Bloomberg Beta and Hillsven Capital. This brings Stampli’s total funding to $34.7 million.

Powered by WPeMatico

The ubiquity of APIs and cloud solutions have opened up a world of interesting ways for businesses to create a service without having to build every part of it themselves. But they have unleashed something else, too: an increased risk of breaches resulting from data being moved and used in multiple places and in multiple ways. Now, a startup that has built a way to help safeguard against that threat — using homomorphic encryption — is announcing funding, a sign of market demand and the opportunity it presents for cybersecurity.

Duality, which builds solutions based on homomorphic encryption — a technique that encrypts an organization’s data in a way that lets it stay encrypted even as the company collaborates with third parties that also process the data — is today announcing that it has raised $16 million in funding.

The Series A round is being led by Intel Capital, with participation from Hearst Ventures and Team8.

Team8 is the heavyweight Israeli cybersecurity incubator that counts Intel as a strategic partner and itself has an impressive list of backers, including Microsoft, Walmart, Eric Schmidt and Accenture.

Intel is a financial and strategic backer here: last year the two worked on a project to expose the security challenges of AI workloads, which utilised homomorphic encryption on Intel platforms in order to minimise data exposure. Intel’s are used in a wide range of use cases that include cloud services and massive hardware companies; you could see where the two might work together more in the future.

Other companies that Duality works with are in the financial markets, healthcare and insurance, although it says it cannot disclose who because of NDAs. One customer it did name was the CDA, the Cyber Defense Alliance, in the U.K., a cross-bank security alliance.

Another may well be Hearst, the other investor named in this round.

“As a leading global, diversified media, information and services company with more than 360 businesses across industries, we are acutely aware of the increasing importance of data and data collaboration in companies across many market segments,” said Kenneth Bronfin, senior managing director of Hearst Ventures, in a statement. “Sensitive data is constantly being generated by both individuals and businesses; there needs to be technology available that protects such data while allowing us to extract insights. We are excited by Duality’s mission and its ability to deliver complex technology to real-world use cases and applications.”

There are a handful of cybersecurity startups and larger companies emerging that are building solutions on the principle of homomorphic encryption.

They include Enveil, CryptoNext Security and IBM. Duality, however, has an interesting pedigree when it comes to the field: one of its co-founders, Shafi Goldwasser, won a Turing Award for her groundbreaking work in cryptographic algorithms that form the basis of homomorphic encryption.

As with a lot of high-level math, that work is largely theoretical, and so the work that Duality — led by its other co-founders Alon Kaufman, Rina Shainski, Vinod Vaikuntanathan and Kurt Rohloff, all of whom also have long lists of cybersecurity and data science credentials — has done has involved making the algorithms into something that is commercially viable and usable by most businesses.

That being said, there is still a lot of time and computing energy needed to process encrypted data, and so the idea with Duality is that it’s used on a company’s most sensitive information. With some of the funding going toward R&D, it will be interesting to see whether algorithms can improve enough to extend that kind of encryption in a practical way to wider data sets.

“There is no free lunch here,” said Kaufman, the CEO, in an interview this week. “Homomorphic encryption is the Holy Grail of security and privacy since it removes huge challenges. But there are overheads. When we deploy it with a customer, we don’t say, ‘from now on encrypt everything and assume nothing is open.’ That’s because it’s a storage and computational overhead. That is why we focus on sensitive data sets.” He added that one of Duality’s unique qualities is that its overhead is dramatically improved compared to others that are also building solutions on this principle, but all the same, “you apply it only when you need to.”

“The ability to secure data during analysis is a critical component in the future computation stack, specifically in the context of AI. Intel Capital has been following the space closely, and we are excited to see secure computing and homomorphic encryption becoming practical and broadly applicable,” said Anthony Lin, vice president and senior managing director of Intel Capital, in a statement. “We believe privacy-preservation in AI and ML represents a huge market need, and we’re investing in Duality because of its unique founding team and world-leading expertise in both advanced cryptography and data science.”

Powered by WPeMatico

Workiz, a startup whose software helps field service professionals manage their work, said today it has raised $5 million in Series A funding. The funding was led by Magenta Venture Partners, with participation from returning investor Aleph. The company announced the launch of Workiz Voice, an Amazon Alexa-powered feature that allows the app to be controlled with voice commands, making it safer to use while field service workers are driving.

Magenta Venture Partners general partner Ran Levitzky will join Workiz’s board of directors. The Series A brings Workiz’s total funding so far to $7.3 million. The company says it grew 247% last year and CEO Adi Azaria told TechCrunch that the company currently has thousands of customers in the U.S. and Canada. Many are home or equipment maintenance companies, including locksmiths, garage door repair, junk removal, appliance repair and carpet cleaning businesses. The software has also been used by medical transport companies, including Trinity Air Medical, to manage highly time-sensitive delivery of organ donations to their recipients. The company targets field services businesses with fewer than 50 employees, but can scale up to organizations with many more technicians and franchises.

Workiz’ new funding is being used on its automation platform for field service workers and Workiz Voice, as well as hiring for its North American team and operations.

The startup was founded in 2015 by Saar Kohanovitch, Idan Kadosh and Erez Marom. Kadosh and Marom worked as locksmiths for more than 15 years in San Diego, Calif. They were frustrated by the field service management software options available and reliance on pen, paper and Excel spreadsheets to manage their business. They also carried multiple cell phones, as most customer appointments were arranged by phone calls and they could not hide their personal numbers.

Workiz was created to give field service companies a full set of tools, including the ability to monitor interactions between technicians and customers, keep detailed records of client calls and texts, send clients reminders, track advertising spending and effectiveness and process credit card payments.

“At Workiz, we have a vision to transform tradespeople into business professionals, and the Workiz platform is able to successfully do so. While 75% of small businesses close within their first five years of business, businesses who are using Workiz are able to slash that number down to just 20%,” said Azaria.

About 52% of field services companies still rely on pen and paper to manage their businesses, presenting a growth opportunity for Workiz. To get them to switch, Workiz provides free help for onboarding, which can be completed in as little as one or two days. The software syncs with QuickBooks or CSV files.

The startup says Workiz Voice, which enables workers to look up job schedules, sort through leads, communicate with team members or clients and find directions to their next job, is the first feature of its kind on the market. It helps Workiz Voice differentiate from other field service management software like Jobber or HouseCall Pro.

In a press statement, Levitzky said “We are constantly on the lookout for exciting companies transforming industries, and Workiz ticked all of the boxes. The company’s approach levels the playing field so that businesses of all sizes can better secure and manage job opportunities, given the on-demand nature of the field service industry.”

Powered by WPeMatico

Millions of neighborhood stores that dot large and small cities, towns and villages in India and have proven tough to beat for e-commerce giants and super-chain retailers are at the center of a new play in the country. A score of e-commerce companies, offline retail chains and fintech startups are now racing to work with these mom and pop stores as they look to tap a massive untapped opportunity.

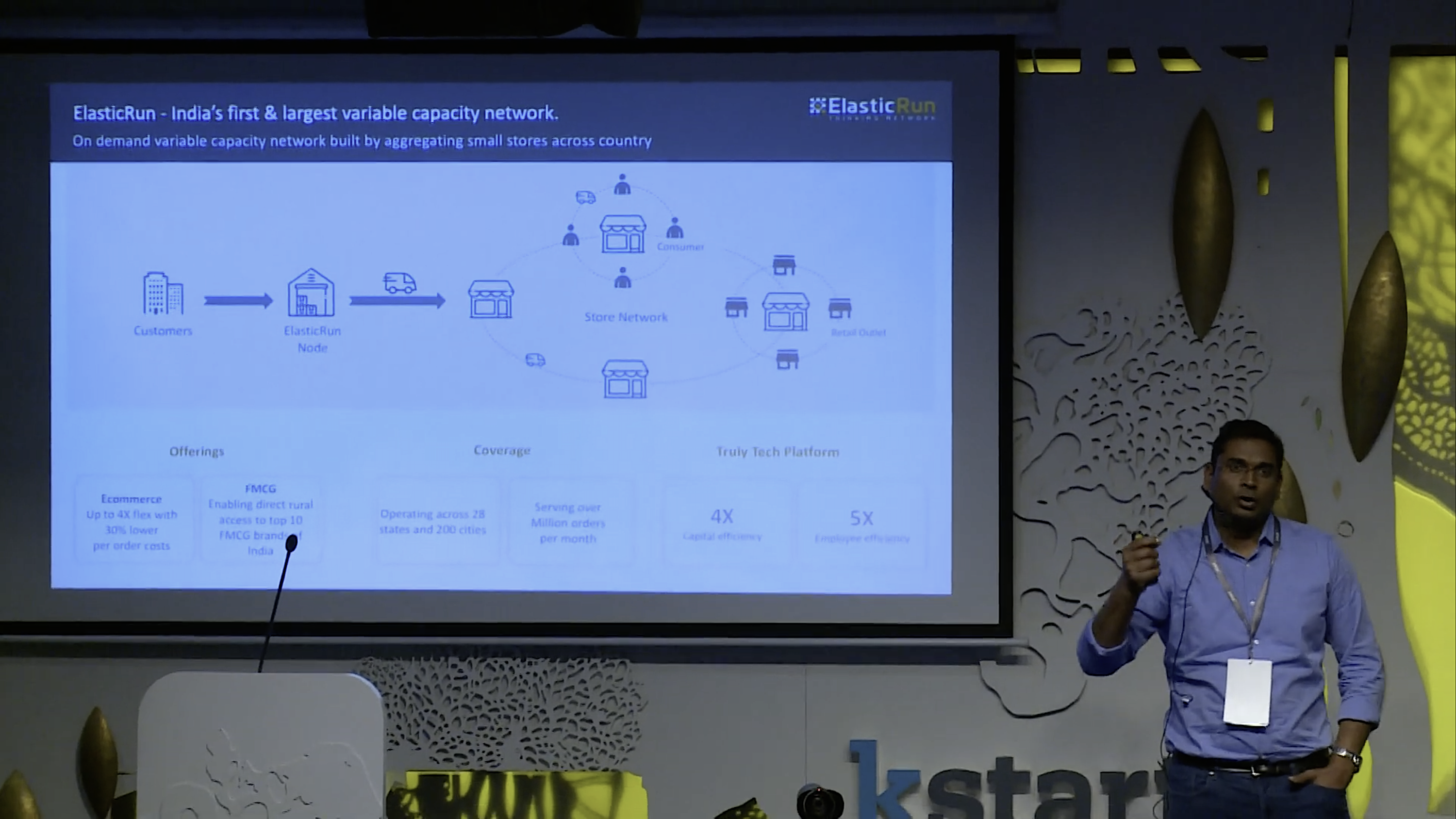

A Pune-based startup with an idea to build a logistics network using these kirana stores said today it has won the backing of a major international investor. Three-and-a-half-year-old ElasticRun said it has raised $40 million in a Series C financing round led by Prosus Ventures (formerly Naspers Ventures). Existing investors Avataar Ventures and Kalaari Capital also participated in the round.

The startup has raised $55.5 million to date, Sandeep Deshmukh, co-founder and CEO of ElasticRun, told TechCrunch in an interview.

Most of these kirana stores each day go through hours of down time — when the footfall is low and the business is slow. ElasticRun works with hundreds of thousands of these stores across 200 Indian cities to have them deliver goods to other kirana stores and consumers.

Supplying goods to these stores are FMCG (fast moving consumer goods) brands that are trying to reach the last mile in the nation. Nearly every top FMCG brand in the country today is a partner of ElasticRun, said Deshmukh.

Deshmukh, co-founder and CEO of ElasticRun, talking about the startup’s business at a recent conference

It’s a win-win scenario for every stakeholder, Deshmukh said. Stores are getting access to more goods than ever, and also getting the opportunity to increase their business in slow hours. And for brands and e-commerce companies, access to such a wide-reaching delivery pool has never been easier, he said.

Deshmukh, who previously worked at Amazon and helped the e-commerce company build its transportation network in India, said he and his other co-founders built ElasticRun because traditional logistics networks are beginning to show cracks.

India’s trucking system, for instance, has long been a laggard in India’s economy. A World Bank report five years ago noted that lorries in India spend about 60% of their time sitting idle.

Because there is a digital log of each transaction, Deshmukh said the startup has a good idea about the financial capacity of these kirana stores. This has enabled it to connect them with relevant financial partners to access working capital, he said.

Deshmukh said the startup will use the fresh capital to on-board more neighborhood stores and deepen its penetration in the country. ElasticRun is also working on new products to expand its offerings for brands and kirana stores and improving its analytics and machine learning algorithms to tackle larger scale.

“By working with the network of small stores across the country, we solve that problem while helping the store owners grow their businesses at the same time. In addition, offering a flexible logistics extension to consumer goods companies to directly reach these small retail shops is a huge advantage over traditional distribution networks,” he said.

In a statement, Ashutosh Sharma, head of Investments for India, Prosus Ventures, said, “ElasticRun is one of those rare businesses that identified a massive need in the market, matched it with a local solution paired with technology, for the benefit of all parties involved. Consumers get faster deliveries and greater choice of goods, store owners realize increased revenues and touchpoints with their customers, and consumer goods companies get better access and insight into their target audiences.”

Update: At an event organised by Prosus Ventures this evening, Deshmukh said while ElasticRun is focused on building solutions, in the future he may consider expanding to some Southeast Asian markets that are facing similar challenges.

Powered by WPeMatico