Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Octopus Interactive, a startup bringing an interactive TV and ad experience into Uber and Lyft rides, has raised a $10.3 million funding round led by Sinclair Digital Group.

Backseat TVs mixing show snippets and commercials have become a common part of the taxi experience in New York City and elsewhere. Octopus is offering something of a more interactive version of this concept to rideshare drivers, who can use it to keep their passengers entertained and also earn extra money.

Octopus says it provides drivers with tablets that combine games (which can include cash prizes, and can also be sponsored), ride information (like maps and weather) and advertising in a 13-minute loop. Even if the passenger doesn’t win anything, this could help keep them occupied during a long ride, which could lead to higher driver ratings. And if the passenger isn’t interested, they can just mute the screen.

The company says it’s deploying technology to make the advertising smarter, for example with geofences to target ads or increase their frequency in a certain neighborhood, and by offering real-time analytics to advertisers. It also monitors the seat to confirm that there’s actually a passenger sitting there when an ad plays.

After launching in 2018, Octopus says it’s now reaching more than 3 million people each month across 10,000 screens in markets like New York, Los Angeles, Chicago and Washington, D.C. By working with Sinclair Digital Group — an affiliate of TV giant Sinclair — the startup can bring content from local TV stations onto the platform.

“What we see here is an untapped medium with a truly captive audience that is buckled in and looking to engage,” said Sinclair Executive Chairman David Smith in a statement. “We invested in Octopus because the team has successfully created an innovative and differentiated branding opportunity that we can help scale further.”

MathCapital, an investment firm partnered with programmatic advertising company MediaMath, also participated in the funding.

Powered by WPeMatico

The property industry — covering people and businesses that invest in, build, purchase or rent and maintain property — is hugely fragmented when it comes both to data sources and the companies that work within it. Today, a New York-based startup that is building a database that helps bring all of that together is raising a round of growth funding to help it expand outside of the U.S.

Reonomy — a startup that ingests some 100 sources of data, including multiple public and proprietary data feeds and crowdsourced information, and then uses artificial intelligence to crunch it to provide market intelligence that is used by developers, investors, acquirers and anyone else who works in the area of commercial property (otherwise known as commercial real estate, CRE, ranging from buildings zoned for business through to multi-dwelling units, but not single private homes) — has closed a Series D round of $60 million.

Today, the company has more than 100,000 customers — with single customers sometimes covering multiple users — along with a database covering some 50 million properties, accounting for some 99% of the commercial inventory in the country. In all, the database also has 80 million companies, 300 million people (those affiliated with the properties), 38 million mortgages and 68 million property sales.

It’s also continuing to add more data sources: along with this round, Reonomy is announcing new partnerships with CoreLogic, Black Knight and Dun & Bradstreet.

The money comes from a mix of financial and strategic backers — underscoring both the company’s potential, and also the calibre of its current customers. Led by Georgian Partners, the funding also included Wells Fargo Strategic Capital and Citi Ventures (both Reonomy users, as part of its property financing activities), Untitled Investments and previous investors Sapphire Ventures, Bain Capital and Primary Venture Partners.

Reonomy is not disclosing its valuation, but Rich Sarkis, the founder and CEO, said that it is “definitely an up round.” The startup, founded in 2013, has raised $128 million to date, and according to PitchBook data, it was valued at $153 million post-money in its last round (in 2018). This likely means the valuation is well above $200 million now.

The expression “safe as houses” was born out of the idea that property is a strong bet, because the price eventually always goes up. But the wider development of the market in modern times has shown that it can be a significantly more volatile area — where arcane algorithms created by quants, a lot of greed and a dose of corruption and world economics can have much stronger impacts, resulting in huge booms and crushing busts of global proportions.

In that context, Reonomy positions itself both as a tool not just to get a better picture of what is going on now, but to better predict what might happen. Given the many disparate sources of information that are compiled into its bigger database, the pitch is that this is a must-have, but the alternative way to get it — building on your own — might otherwise require many man-hours and dollars of investment to achieve and understand.

While some database platforms require technical knowledge to shape and query, the idea here is to “lead users to the water” and make the proposition very non-technical.

The potential usefulness of Reonomy’s insights can have many endpoints, Sarkis said. While one obvious area is in sales, it’s also just as used in areas of research and more. Its customers include not just mortgage lenders and property acquirers, but those who work in the property industry in a more hands-on way, such as roofers who might want to get a list of buildings developed in a certain range of years as a way of building a list of leads for properties that might need a roof replacement.

“What our customers have in common is that they are looking for a solution to understand something about the property market,” he said. “We take the mess of data out there and make sense of it, whether the person using Reonomy is an investor or a roofer or someone that is underwriting loans.”

The company today, Sarkis said, covers about 99% of all commercial real estate in the U.S., and the plan is now to take that concept to international markets, including Canada, Asia, Australia and the U.K. and Europe, markets that are more similar to the U.S. than they are different, he added.

“Reonomy has developed a powerful platform to integrate and resolve sources of commercial real estate data into a single, unique identifier for every CRE asset in the United States,” said Emily Walsh, principal at Georgian Partners, in a statement. “This unique identifier is being leveraged by some of the largest enterprises in the world to tie together their public, proprietary and 3rd party data sources and to create a level of visibility into real estate assets that was previously unattainable.”

Powered by WPeMatico

Aircam is a new startup that allows anyone to get instant access to pictures taken by professional photographers at weddings, parties and other events.

The company was founded by brothers Evan and Ryan Rifkin, who previously co-founded Burstly, the company behind mobile app-testing service TestFlight (which was acquired by Apple).

In addition to officially launching Aircam today, they’re also announcing that the company has raised $6.5 million in seed funding led by Upfront Ventures, with participation from Comcast Ventures.

“The process of finding a great photographer still sucks and the tools photographers use to share photos are antiquated for an industry worth over $10 billion,” said Upfront Ventures Managing Partner Mark Suster in a statement. “Aircam provides real-time, location-aware and enhanced photos that today’s consumers expect with booking simplicity that will change the current playing field.”

The Rifkin brothers are pitching Aircam as “a real-time photo-sharing platform for professional and consumer photos.” To try out the technology, I visited the Aircam website and hit a button to see nearby photos. Then, as the Rifkins took photos with a DSLR camera, those photos appeared on the site nearly instantaneously. I, in turn, could send the photos to a printer in their office, or share photos from my phone.

Manufacturers already offer software to transfer photos wirelessly from their cameras to your computer. But with Aircam, the photos became accessible to everyone at an event, without requiring anyone except the photographer to install an app.

Ryan explained that the company is taking advantage of cameras’ Wi-Fi connections (it currently works with Canon, Nikon and Sony devices) to send the photos to an app on the photographer’s phone, which then uploads the photos to the cloud.

He also said the team initially believed that Aircam would become the repository for photos taken by everyone attending an event. But in early testing, they saw that “the opposite is happening — people are putting their phones away.”

In other words, once attendees realize that they have access to professional-quality photos, they can spend less time worrying about taking their own pictures with their phones and instead focus on being present at the event.

This should also make life easier for photographers, particularly since Aircam includes automated photo editing — the photos are color corrected (with nice touches like teeth whitening) without requiring any extra work from the photographer.

“If you ask photographers what’s their least favorite part of photography — one, it’s finding new business, and two, it’s the edits,” Ryan said. “Some people limit the number of events they’ll accept because of the editing work … With automatic edits, they shoot and they’re done.”

Evan Rifkin

As for finding new business, Evan said that the company tested this out by allowing photographers to offer Aircam as an additional option for their customers. (The company charges the photographers $50 per event.)

But once customers had seen Aircam in action, they wanted to order it again, so Aircam is also launching its own marketplace (currently focused on Southern California) where you can book professional photographers for $99 per hour, with the Aircam service included as part of the package.

Or, if you want to try it out without hiring a pro photographer, you’ll be able to upload photos from your iPhone for free.

The Rifkins told me they haven’t had any issues around privacy or content moderation so far, but they also noted that customers who are concerned about these issues can limit their guests’ upload capabilities. They also can create a custom URL for their event rather than making it discoverable to anyone nearby.

Powered by WPeMatico

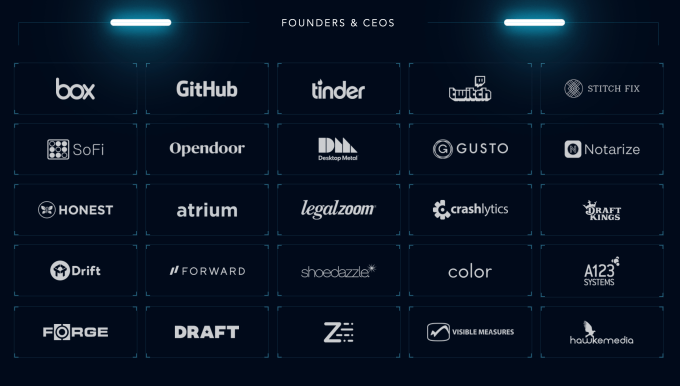

Stealth fintech startup Digits, from the same team that built Crashlytics to scale then sold to Twitter for more than $100 million, has raised a $10.5 million round of Series A funding, the company is announcing today. The round was led by Benchmark and has the backing of 72 angels, including founders and CEOs from companies like Box, GitHub, Tinder, Twitch, StitchFix, SoFi and several others.

With the round, Digits also gains a new board member, Peter Fenton, who has served on the boards at AirTable, Twitter, NewRelic, Yelp and elsewhere.

The funding is a big bet on serial entrepreneurs Wayne Chang and Jeff Seibert, who launched and sold their crash reporting service to Twitter, which itself later sold it to Google. At Twitter, the team remained to build out the product and launch new services, like Answers. After the sale to Google four years later, it was then folded into Google’s own developer platform to become the crash reporting tool for Android. Today, it’s still on nearly 5 billion monthly active devices and used inside millions of apps.

Now, the Crashlytics co-founders have returned with most of their original team to develop a new fintech startup, Digits, which describes itself vaguely as “a counting company.”

The company’s focus aims to solve a problem the founders had faced themselves when building Crashlytics.

“As builders, there is nothing more exciting than cracking the next engineering puzzle; than perfecting the next design; than delivering the next capability to customers. And there is nothing more mind-numbing than the paperwork, and spreadsheets, and financial reports, and inscrutable transaction records that are all required to actually operate the business,” a Digits blog post earlier this year explained.

“Globally, most entrepreneurs today have no formal training in business finance. We certainly didn’t. Today, you start a company to solve a real problem for real people, or to offer a service you’re skilled at, or to provide a living for you and your family. You don’t start a company because you want to operate a business—but you have to anyway,” the founders said.

While Digits isn’t talking about the specifics of its new product yet, its software is described as pairing design and machine learning in order to “democratize financial savvy.”

More specifically, it leverages APIs, classification algorithms and machine learning techniques to provide a real-time view into a business’ finances, proactively alert you to what’s important and allow you to deep dive into your data to better understand what’s driving your business.

The company believes its approach to visualizing a company’s finances is unique, and apparently a sizable number of investors agree.

Among the 70+ angels backing Digits are Box CEO Aaron Levie; Adam Bain and Dick Costolo (ex COO and CEO of Twitter); Ali Rowghani (partner at Y Combinator, ex-COO Pixar); SoFi CEO Anthony Noto; Drift CEO David Cancel; AngelList board member Jeff Fagnan; Justin Kan (CEO Atrium, co-founder Twitch, YC partner); StitchFix CEO Katrina Lake; GitHub CEO Nat Friedman; First Republic Bank COO Mike Selfridge; Desktop Metal CEO Ric Fulop; Tinder co-founder Jonathan Badeen; DraftKings CEO Jason Robins; LegalZoom co-founder Brian Lee; Gusto CEO Josh Reeves; and Notazie CEO Pat Kinsel.

Though Digits hasn’t publicly launched — the product is in invite-only status for now — it already has live customers and is seeing more than $1.5 billion in transactions processing on its platform, the company says.

And unlike Crashlytics, which was based in Boston, Digits is a 100% remote operation. LinkedIn shows just 10 employees, including co-founders Chang and Seibert.

The team hasn’t said when Digits itself will be publicly unveiled or opened to sign-ups.

Powered by WPeMatico

Wardrobe, a new peer-to-peer fashion rental marketplace, has today announced the close of a $1.5 million seed round and its public launch out of beta.

The funding was led by angel investor Cyan Banister and Ludlow Ventures, with participation from GroundUp Ventures, Airbnb co-founder Nate Blecharczyk and HQ Trivia founder Rus Yusupov, among others.

Wardrobe was founded by Adarsh Alphons after he had an epiphany about just how many items of clothes in his own house went mostly unused. In fact, The WSJ suggests that most people only wear around 20% of their wardrobe on a regular basis. Alphons says that the average woman has 57 items of clothes in her closet that she doesn’t even wear once a year.

So began Wardrobe.

Wardrobe is a peer-to-peer rental marketplace for vintage, designer and luxury brand clothing. However, unlike Rent the Runway or other sharing economy fashion platforms, Wardrobe uses dry cleaners as hubs for the inventory. This not only allows the company to scale more quickly from geography to geography, but also to remain lean without taking on the risk of big warehouses and complicated logistics around shipping.

Here’s how it works:

Folks who want to rent their clothes on Wardrobe simply fill out a few answers to questions and receive a shipping label in the mail. Once their clothes are approved, they’re sent to a local dry cleaner where they wait to be rented for either 4, 10 or 20 days.

Wardrobe HQ handles everything from storage to shipping to photographing the pieces for the app.

The owner of the clothes makes between 70 and 75% of the rental cost after the cost of dry cleaning.

Interestingly, Alphons learned in beta that users want to not only browse the app for clothes, but follow specific users and closets that they particularly like. So the app is now tailored to let users follow one another and watch each other’s closets, creating an environment that may attract influencers to the platform.

Wardrobe currently has partnerships with more than 40 Manhattan dry cleaners, serving all of the island below 110th Street. Alphons says that each dry cleaner can hold between 100 and 1,000 items of clothing at a time.

Powered by WPeMatico

Neural Magic, a startup founded by a couple of MIT professors, who figured out a way to run machine learning models on commodity CPUs, announced a $15 million seed investment today.

Comcast Ventures led the round, with participation from NEA, Andreessen Horowitz, Pillar VC and Amdocs. The company had previously received a $5 million pre-seed, making the total raised so far $20 million.

The company also announced early access to its first product, an inference engine that data scientists can run on computers running CPUs, rather than specialized chips like GPUs or TPUs. That means that it could greatly reduce the cost associated with machine learning projects by allowing data scientists to use commodity hardware.

The idea for this solution came from work by MIT professor Nir Shavit and his research partner and co-founder Alex Mateev. As he tells it, they were working on neurobiology data in their lab and found a way to use the commodity hardware he had in place. “I discovered that with the right algorithms we could run these machine learning algorithms on commodity hardware, and that’s where the company started,” Shavit told TechCrunch.

He says there is this false notion that you need these specialized chips or hardware accelerators to have the necessary resources to run these jobs, but he says it doesn’t have to be that way. He says his company not only allows you to use this commodity hardware, it also works with more modern development approaches, like containers and microservices.

“Our vision is to enable data science teams to take advantage of the ubiquitous computing platforms they already own to run deep learning models at GPU speeds — in a flexible and containerized way that only commodity CPUs can deliver,” Shavit explained.

He says this also eliminates the memory limitations of these other approaches because CPUs have access to much greater amounts of memory, and this is a key advantage of his company’s approach over and above the cost savings.

“Yes, running on a commodity processor you get the cost savings of running on a CPU, but more importantly, it eliminates all of these huge commercialization problems and essentially this big limitation of the whole field of machine learning of having to work on small models and small data sets because the accelerators are kind of limited. This is the big unlock of Neural Magic,” he said.

Gil Beyda, managing director at lead investor Comcast Ventures, sees a huge market opportunity with an approach that lets people use commodity hardware. “Neural Magic is well down the path of using software to replace high-cost, specialized AI hardware. Software wins because it unlocks the true potential of deep learning to build novel applications and address some of the industry’s biggest challenges,” he said in a statement.

Powered by WPeMatico

Immersive Labs, a cybersecurity skills platform, has raised $40 million in its Series B, the company’s second round of funding this year following an $8 million Series A in January.

Summit Partners led the fundraise, with Goldman Sachs participating, the Bristol, U.K.-based company confirmed.

Immersive, led by former GCHQ cybersecurity instructor James Hadley, helps corporate employees learn new security skills by using real, up-to-date threat intelligence in a “gamified” way. Its cybersecurity learning platform uses a variety of techniques and psychology to build up immersive and engaging cyber war games to help IT and security teams learn. The platform aims to help users better understand cybersecurity threats, like detecting and understanding phishing and malware reverse-engineering.

It’s a new take on cybersecurity education, as the company’s founder and chief executive Hadley said the ever-evolving threat landscape has made traditional classroom training “obsolete.”

“It creates knowledge gaps that increase risk, offer vulnerabilities and present opportunities for attackers,” said Hadley.

The company said it will use the round to expand further into the U.S. and Canadian markets from its North American headquarters in Boston, Mass.

Since its founding in 2017, Immersive already has big customers to its name, including Bank of Montreal and Citigroup, on top of its U.K. customers, including BT, the National Health Service and London’s Metropolitan Police.

Goldman Sachs, an investor and customer, said it was “impressed” by Immersive’s achievements so far.

“The platform is continually evolving as new features are developed to help address the gap in cyber skills that is impacting companies and governments across the globe,” said James Hayward, the bank’s executive director.

Immersive said it has 750% year-over-year growth in annual recurring revenues and more than 100 employees across its offices.

Powered by WPeMatico

Search and personalization services continue to be a major area of investment among enterprises, both to make their products and services more discoverable (and used) by customers, and to help their own workers get their jobs done, with the market estimated to be worth some $100 billion annually. Today, one of the big startups building services in this area raised a large round of growth funding to continue tapping that opportunity.

Coveo, a Canadian company that builds search and personalization services powered by artificial intelligence — used by its enterprise customers by way of cloud-based, software-as-a-service — has closed a C$227 million ($172 million in U.S. dollars) round, which CEO Louis Tetu tells me values the company at “well above” $1 billion, “Canadian or U.S. dollars.”

Specifically, the equity stake of this round is 15.5%, equating to a valuation of $1.46 billion Canadian dollars, or $1.1 billion in U.S. dollars.

The round is being led by Omers Capital Private Growth Equity Group, the investing arm of the Canadian pensions giant that makes large, later-stage bets (the company has been stepping up the pace of investments lately), with participation also from Evergreen Coast Capital, FSTQ and IQ Ventures. Evergreen led the company’s last round of $100 million in April 2018, and in total the company has now raised just over $402 million with this round.

The valuation appears to be a huge leap in the context of Coveo’s funding history: in that last round, it had a post-money valuation of about $370 million, according to PitchBook data.

Part of the reason for that is because of Coveo’s business trajectory, and part is due to the heat of the overall market.

Coveo’s round is coming about two weeks after another company that builds enterprise search solutions, Algolia, raised $110 million. The two aim at slightly different ends of the market, Tetu tells me, not directly competing in terms of target customers, and even services.

“Algolia is in a different ZIP code,” he said. Good thing, too, if that’s the case: Salesforce — which is one of Coveo’s biggest partners and customers — was also a strategic investor in the Algolia round. Even if these two do not compete, there are plenty of others vying for the same end of the enterprise search and personalization continuum — they include Google, Microsoft, Elastic, IBM, Lucidworks and many more. That, again, underscores the size of the market opportunity.

In terms of Coveo’s own business, the company works with some 500 customers today and says SaaS subscription revenues grew more than 55% year-over-year this year. Five hundred may sound like a small number, but it covers a lot of very large enterprises spanning web-facing businesses, commerce-based organizations, service-facing companies and enterprise solutions.

In addition to Salesforce, it includes Visa, Tableau (also Salesforce now!), Honeywell, a Fortune 50 healthcare company (whose name is not getting disclosed) and what Tetu described to me as an Amazon competitor that does $21 billion in sales annually but doesn’t want to be named.

Coveo’s basic selling point is that the better discoverability and personalization that it provides helps its customers avoid as many call-center interactions (reducing operating expenditures), improves sales (boosting conversions and reducing cart abandonment) and helps companies themselves just work faster.

Significantly, the area that Coveo works in is going through a noticeable shift these days.

A swing toward stronger data protection and consumers’ preference for having more control over how their data is used and for what — spurred by high-profile revelations detailing how different organizations manipulated user data across social networking sites and other platforms to target people with sneaky political content and advertising to influence voting, subsequently cracking open the wasp nest to reveal just how much of our data is harvested and used all the time — has meant that there are at times fewer tools than there used to be to provide the kind of “discoverability” and “personalization” that companies like Coveo build for their clients.

Tetu believes there is a way to deliver personalization without compromising how a person wants to exist in the digital world.

“The whole notion is to be able to control data but also have personalizaton in the future,” he said. But there are two dimensions to this, he added:

“The continued and growing regulatory pressure around privacy [such as GDPR] is good, it’s the will of the people and legislation will go that way. The world is going cookie-less,” he said. “But we can’t ignore the arbitrage between privacy and utility. If I understand what you will do with my data and use it to provide more relevance, that can be excellent, too.”

He calls himself an “Amazon addict” but points out that it highlights the two sides of the data coin: “Is it predatory or excellent in doing the job it does? I can’t decide on an answer. I think they are both.”

All the same, it’s working on ways around the “cookie-less” future. The company Coveo acquired in Milan earlier this year, Tetu said, “can do machine learning detection. In five clicks it can detect your propensity to buy and your interest. It means you can’t blame anyone for observing you.”

So, while there are a lot of players out there chasing the same discoverability and personalization market, the attraction here is not just about a company doing it well, but looking to skate to where the puck is going (see what I did there, Canadian startup?).

“We believe that Coveo is the market leader in leveraging data and AI to personalize at scale,” said Mark Shulgan, managing director and head of Growth Equity at Omers, in a statement. “Coveo fits our investment thesis precisely: an A-plus leadership team with deep expertise in enterprise SaaS, a Fortune 1000 customer base who deeply love the product, and a track record of high growth in a market worth over $100 billion. This makes Coveo a highly-coveted asset. We are glad to be partnering to scale this business.”

Alongside business development on its own steam — the company now has around 500 employees — Coveo is going to be using this funding for acquisitions. Tetu notes that Coveo still has a lot of money in the bank from previous rounds.

“We are a real company with real positive economics,” he said. “This round is mostly to have dry powder to invest in a way that is commensurate in the AI space, and within commerce in particular.” To get the ball rolling on that, this past July, Coveo acquired Tooso, a specialist in AI-based digital commerce technology.

Powered by WPeMatico

Chronosphere, a startup from two ex-Uber engineers who helped create the open-source M3 monitoring project to handle Uber-level scale, officially launched today with the goal of building a commercial company on top of the open-source project.

It also announced an $11 million investment led by Greylock, with participation from venture capitalist Lee Fixel.

While the founders, CEO Martin Mao and CTO Rob Skillington, were working at Uber, they recognized a gap in the monitoring industry, particularly around cloud-native technologies like containers and microservices. There weren’t any tools available on the market that could handle Uber’s scaling requirements — so like any good engineers, they went out and built their own.

“We looked around at the market at the time and couldn’t find anything in open source or commercially available that could really scale to our needs. So we ended up building and open sourcing our solution, which is M3. Over the last three to four years we’ve scaled M3 to one of the largest production monitoring systems in the world today,” Mao explained.

The essential difference between M3 and other open-source, cloud-native monitoring solutions like Prometheus is that ability to scale, he says.

One of the main reasons they left to start a company, with the blessing of Uber, was that the community began asking for features that didn’t really make sense for Uber. By launching Chronosphere, Mao and Skillington would be taking on the management of the project moving forward (although sharing governance for the time being with Uber), while building those enterprise features the community has been requesting.

The new company’s first product will be a cloud version of M3 to help reduce some of the complexity associated with managing an M3 project. “M3 itself is a fairly complex piece of technology to run. It is solving a fairly complex problem at large scale, and running it actually requires a decent amount of investment to run at large scale, so the first thing we’re doing is taking care of that management,” Mao said.

Jerry Chen, who led the investment at Greylock, saw a company solving a big problem. “They were providing such a high-resolution view of what’s going on in your cloud infrastructure and doing that at scale at a cost that actually makes sense. They solved that problem at Uber, and I saw them, and I was like wow, the rest of the market needs what guys built and I wrote the Series A check. It was as simple as that,” Chen told TechCrunch.

The cloud product is currently in private beta; they expect to open to public beta early next year.

Powered by WPeMatico

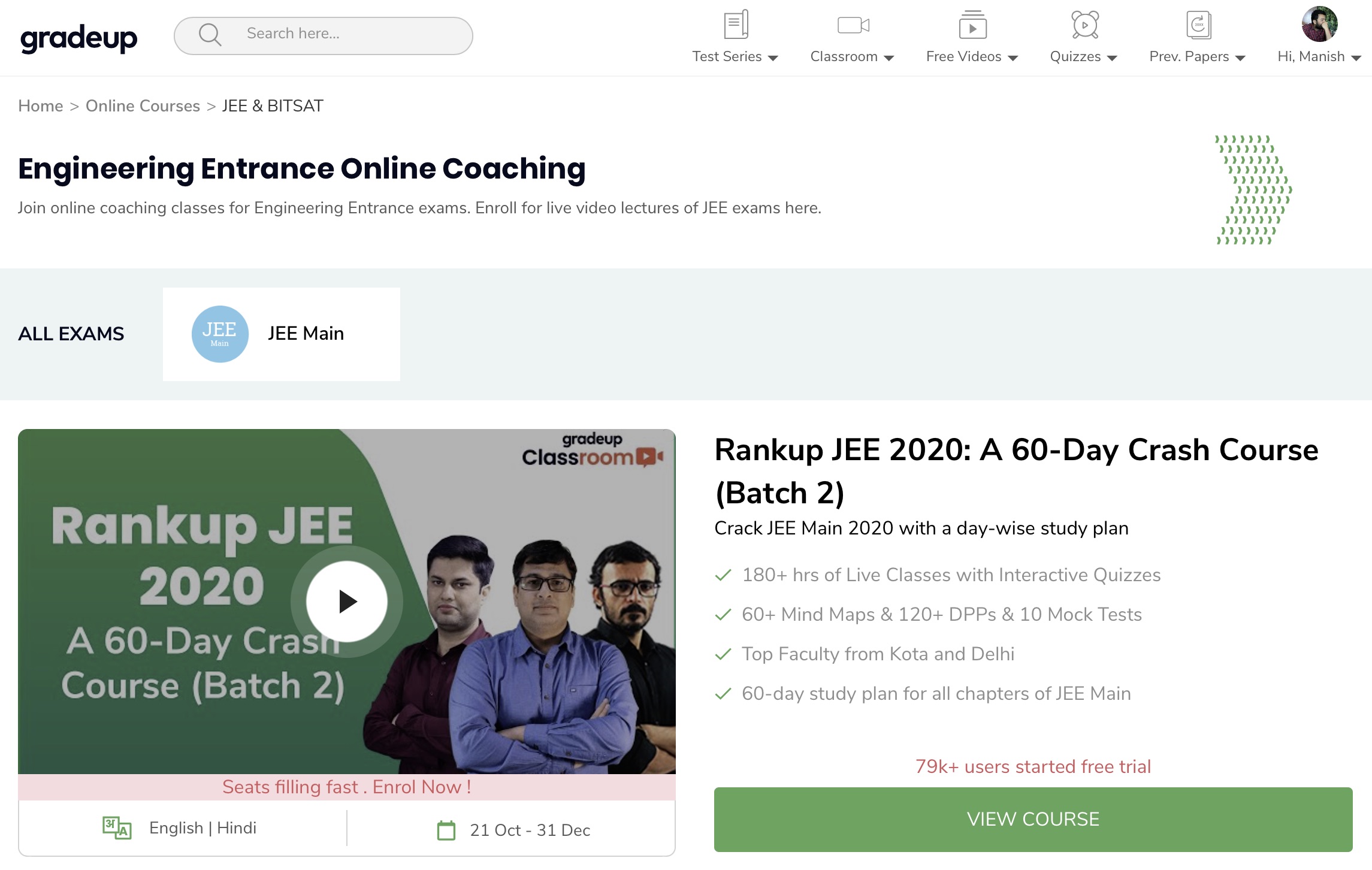

Gradeup, an edtech startup in India that operates an exam preparation platform for undergraduate and postgraduate-level courses, has raised $7 million from Times Internet as it looks to expand its business in the country.

Times Internet, a conglomerate in India, invested $7 million in Series A and $3 million in seed financing rounds of the four-year-old Noida-based startup, it said. Times Internet is the only external investor in Gradeup, they said.

Gradeup started as a community for students to discuss their upcoming exams, and help one another with solving questions, said Shobhit Bhatnagar, co-founder and CEO of Gradeup, in an interview with TechCrunch.

While those functionalities continue to be available on the platform, Gradeup has expanded in the last year to offer online courses from teachers to help students prepare for exams, he said. These courses, depending on their complexity and duration, cost anywhere between Rs 5,000 ($70) and Rs 35,000 ($500).

“These are live lectures that are designed to replicate the offline experience,” he said. The startup offers dozens of courses and runs multiple sessions in English and Hindi languages. As many as 200 students tune into a class simultaneously, he said.

Students can interact with the teacher through a chatroom. Each class also has a “student success rate” team assigned to it that follows up with each student to check if they had any difficulties in learning any concept and take their feedback. These extra efforts have helped Gradeup see more than 50% of its students finish their courses — an industry best, Bhatnagar said.

Each year in India, more than 30 million students appear for competitive exams. A significant number of these students enroll themselves to tuitions and other offline coaching centers.

“India has over 200 million students that spend over $90 billion on different educational services. These have primarily been served offline, where the challenge is maintaining high quality while expanding access,” said Satyan Gajwani, vice chairman of Times Internet.

In recent years, a number of ed tech startups have emerged in the country to cater to larger audiences and make access to courses cheaper. Byju’s, backed by Naspers and valued at more than $5.5 billion, offers a wide range of self-learning courses. Vedantu, a Bangalore-based startup that raised $42 million in late August, offers a mix of recorded and live and interactive courses.

Co-founders of Noida-based ed tech startup Gradeup

But still, only a fraction of students take online courses today. One of the roadblocks in their growth has been access to mobile data, which until recent years was fairly expensive in the country. But arrival of Reliance Jio has solved that issue, said Bhatnagar. The other is acceptance from students and, more importantly, their parents. Watching a course online on a smartphone or desktop is still a new concept for many parents in the country, he said. But this, too, is beginning to change.

“The first wave of online solutions were built around on-demand video content, either free or paid. Today, the next wave is online live courses like Gradeup, with teacher-student interactivity, personalisation and adaptive learning strategies, delivering high-quality solutions that scale, which is particularly valuable in semi-urban and rural markets,” said Times Internet’s Gajwani.

“These match or better the experience quality of offline education, while being more cost-effective. This trend will keep growing in India, where online live education will grow very quickly for test prep, reskilling and professional learning,” he added.

Gradeup has amassed more than 15 million registered students who have enrolled to live lectures. The startup plans to use the fresh capital to expand its academic team to 100 faculty members (from 50 currently) and 200 subject matters and reach more users in smaller cities and towns in India.

“Students even in smaller cities and towns are paying a hefty amount of fee and are unable to get access to high-quality teachers,” Bhatnagar said. “This is exactly the void we can fill.”

Powered by WPeMatico