Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

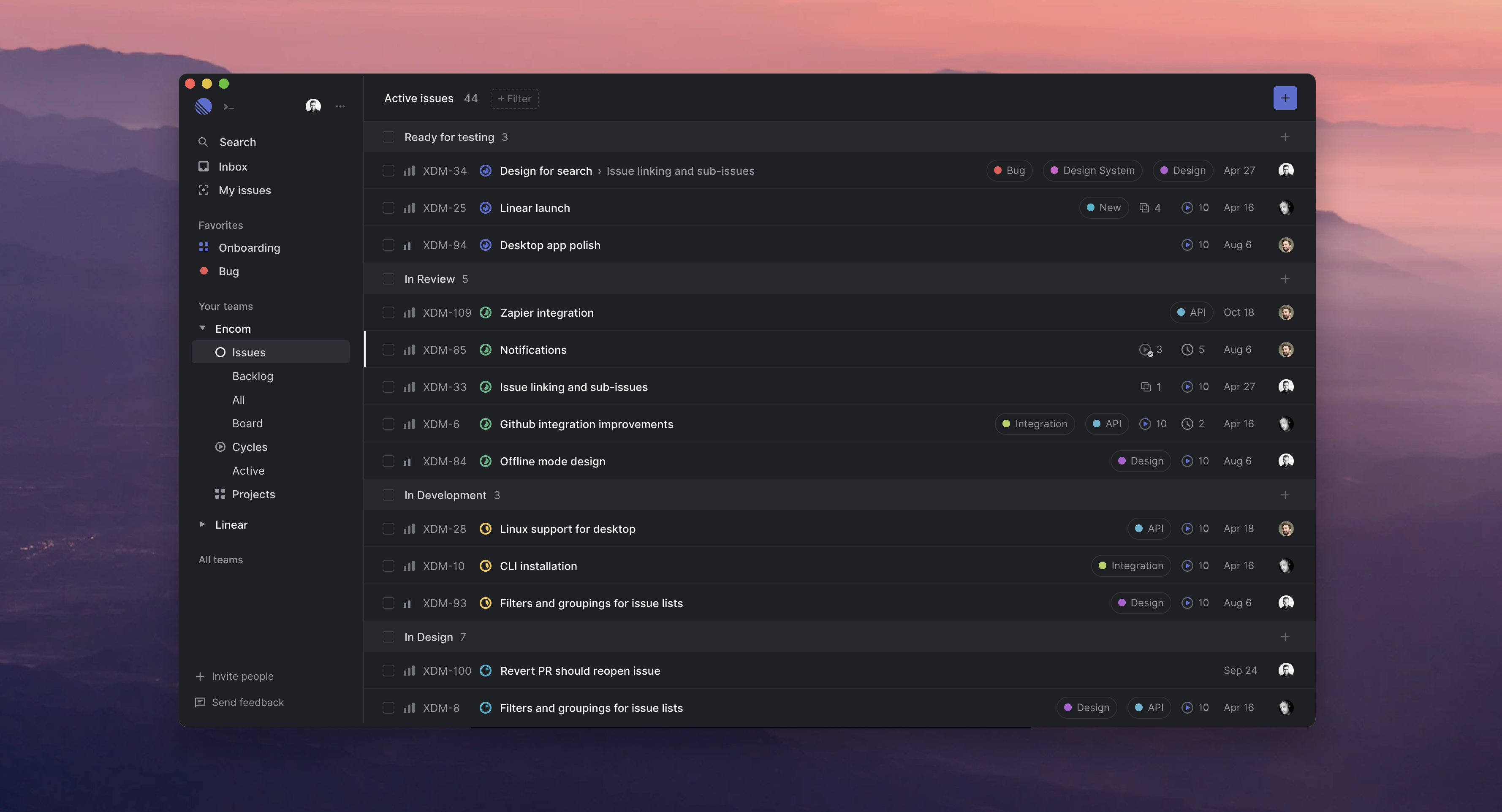

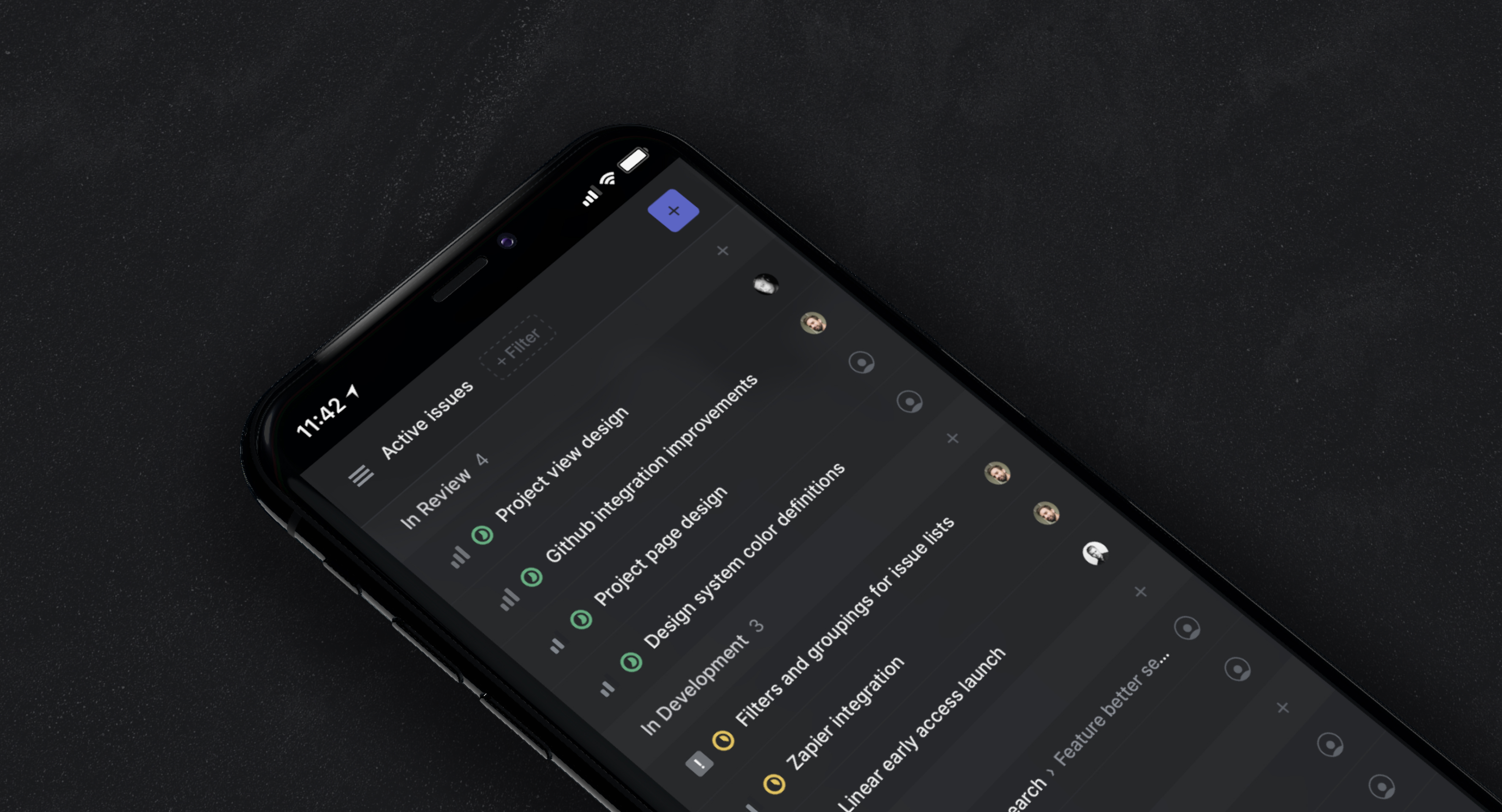

Software will eat the world, as the saying goes, but in doing so, some developers are likely to get a little indigestion. That is to say, building products requires working with disparate and distributed teams, and while developers may have an ever-growing array of algorithms, APIs and technology at their disposal to do this, ironically the platforms to track it all haven’t evolved with the times. Now three developers have taken their own experience of that disconnect to create a new kind of platform, Linear, which they believe addresses the needs of software developers better by being faster and more intuitive. It’s bug tracking you actually want to use.

Today, Linear is announcing a seed round of $4.2 million led by Sequoia, with participation also from Index Ventures and a number of investors, startup founders and others that will also advise Linear as it grows. They include Dylan Field (Founder and CEO, Figma), Emily Choi (COO, Coinbase), Charlie Cheever (Co-Founder of Expo & Quora), Gustaf Alströmer (Partner, Y Combinator), Tikhon Berstram (Co-Founder, Parse), Larry Gadea (CEO, Envoy), Jude Gomila (CEO, Golden), James Smith (CEO, Bugsnag), Fred Stevens-Smith (CEO, Rainforest), Bobby Goodlatte, Marc McGabe, Julia DeWahl and others.

Cofounders Karri Saarinen, Tuomas Artman, and Jori Lallo — all Finnish but now based in the Bay Area — know something first-hand about software development and the trials and tribulations of working with disparate and distributed teams. Saarinen was previously the principal designer of Airbnb, as well as the first designer of Coinbase; Artman had been staff engineer and architect at Uber; and Lallo also had been at Coinbase as a senior engineer building its API and front end.

“When we worked at many startups and growth companies we felt that the tools weren’t matching the way we’re thinking or operating,” Saarinen said in an email interview. “It also seemed that no-one had took a fresh look at this as a design problem. We believe there is a much better, modern workflow waiting to be discovered. We believe creators should focus on the work they create, not tracking or reporting what they are doing. Managers should spend their time prioritizing and giving direction, not bugging their teams for updates. Running the process shouldn’t sap your team’s energy and come in the way of creating.”

Linear cofounders (from left): KarriSaarinen, Jori Lallo, and Tuomas Artma

All of that translates to, first and foremost, speed and a platform whose main purpose is to help you work faster. “While some say speed is not really a feature, we believe it’s the core foundation for tools you use daily,” Saarinen noted.

A ⌘K command calls up a menu of shortcuts to edit an issue’s status, assign a task, and more so that everything can be handled with keyboard shortcuts. Pages load quickly and synchronise in real time (and search updates alongside that). Users can work offline if they need to. And of course there is also a dark mode for night owls.

The platform is still very much in its early stages. It currently has three integrations based on some of the most common tools used by developers — GitHub (where you can link Pull Requests and close Linear issues on merge), Figma designs (where you can get image previews and embeds of Figma designs), and Slack (you can create issues from Slack and then get notifications on updates). There are plans to add more over time.

“We started solving the problem from the end-user perspective, the contributor, like an engineer or a designer and starting to address things that are important for them, can help them and their teams,” Saarinen said. “We aim to also bring clarity for the teams by making the concepts simple, clear but powerful. For example, instead of talking about epics, we have Projects that help track larger feature work or tracks of work.”

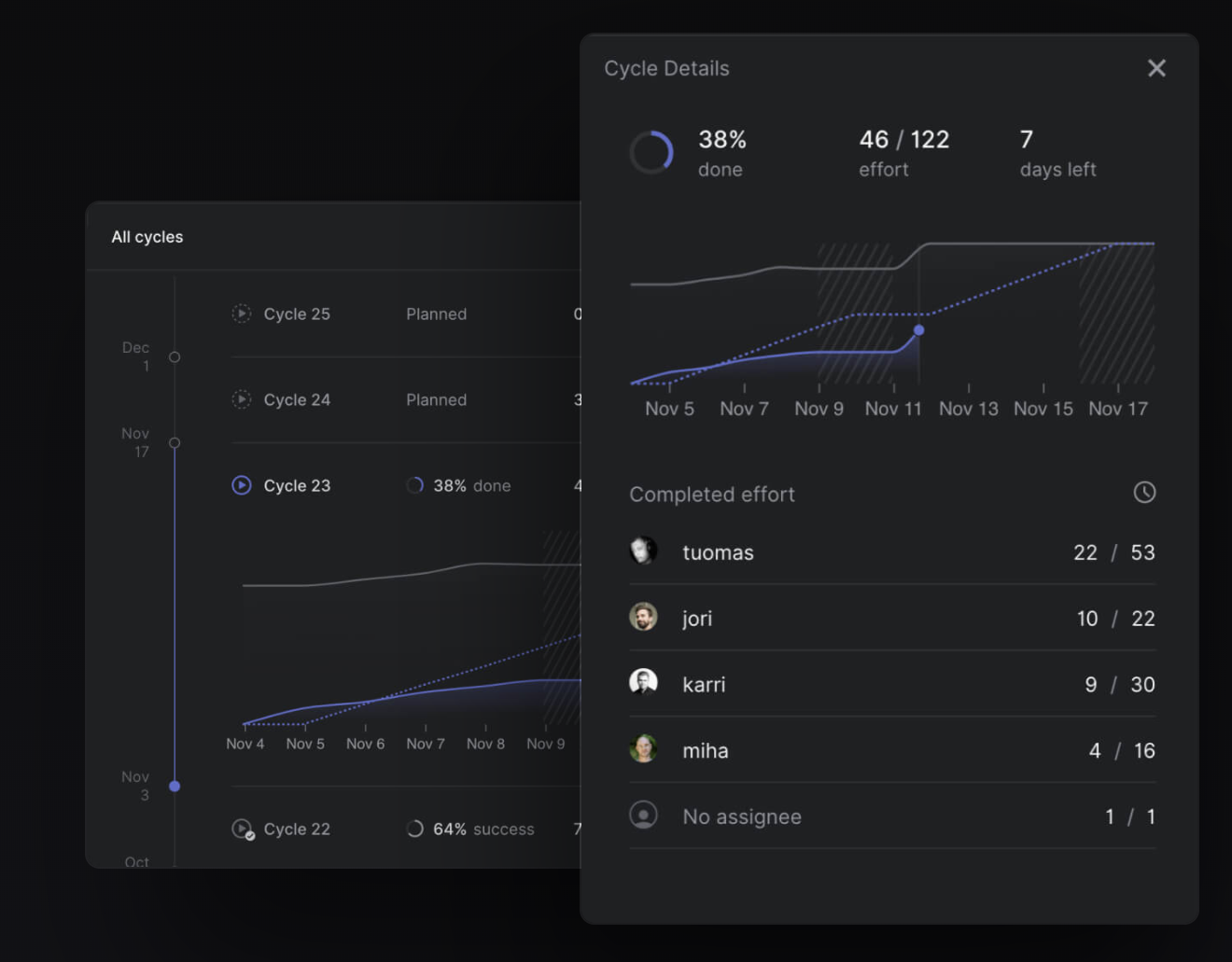

Indeed, speed is not the only aim with Linear. Saarinen also said another area they hope to address is general work practices, with a take that seems to echo a turn away from time spent on manual management and more focus on automating that process.

“Right now at many companies you have to manually move things around, schedule sprints, and all kinds of other minor things,” he said. “We think that next generation tools should have built in automated workflows that help teams and companies operate much more effectively. Teams shouldn’t spend a third or more of their time a week just for running the process.”

The last objective Linear is hoping to tackle is one that we’re often sorely lacking in the wider world, too: context.

“Companies are setting their high-level goals, roadmaps and teams work on projects,” he said. “Often leadership doesn’t have good visibility into what is actually happening and how projects are tracking. Teams and contributors don’t always have the context or understanding of why they are working on the things, since you cannot follow the chain from your task to the company goal. We think that there are ways to build Linear to be a real-time picture of what is happening in the company when it comes to building products, and give the necessary context to everyone.”

Linear is a late entrant in a world filled with collaboration apps, and specifically workflow and collaboration apps targeting the developer community. These include not just Slack and GitHub, but Atlassian’s Trello and Jira, as well as Asana, Basecamp and many more.

Saarinen would not be drawn out on which of these (or others) that it sees as direct competition, noting that none are addressing developer issues of speed, ease of use and context as well as Linear is.

“There are many tools in the market and many companies are talking about making ‘work better,’” he said. “And while there are many issue tracking and project management tools, they are not supporting the workflow of the individual and team. A lot of the value these tools sell is around tracking work that happens, not actually helping people to be more effective. Since our focus is on the individual contributor and intelligent integration with their workflow, we can support them better and as a side effect makes the information in the system more up to date.”

Stephanie Zhan, the partner at Sequoia whose speciality is seed and Series A investments and who has led this round, said that Linear first came on her radar when it first launched its private beta (it’s still in private beta and has been running a waitlist to bring on new users. In that time it’s picked up hundreds of companies, including Pitch, Render, Albert, Curology, Spoke, Compound and YC startups including Middesk, Catch and Visly). The company had also been flagged by one of Sequoia’s Scouts, who invested earlier this year

Although Linear is based out of San Francisco, it’s interesting that the three founders’ roots are in Finland (with Saarinen in Helsinki this week to speak at the Slush event), and brings up an emerging trend of Silicon Valley VCs looking at founders from further afield than just their own back yard.

“The interesting thing about Linear is that as they’re building a software company around the future of work, they’re also building a remote and distributed team themselves,” Zahn said. The company currently has only four employees.

In that vein, we (and others, it seems) had heard that Sequoia — which today invests in several Europe-based startups, including Tessian, Graphcore, Klarna, Tourlane, Evervault and CEGX — has been considering establishing a more permanent presence in this part of the world, specifically in London.

Sources familiar with the firm, however, tell us that while it has been sounding out VCs at other firms, saying a London office is on the horizon might be premature, as there are as yet no plans to set up shop here. However, with more companies and European founders entering its portfolio, and as more conversations with VCs turn into decisions to make the leap to help Sequoia source more startups, we could see this strategy turning around quickly.

Powered by WPeMatico

More than $1 trillion is spent by enterprises annually on “digital transformation” — the investments that organizations make to update their IT systems to get more out of them and reduce costs — and today one of the bigger startups that’s built a platform to help get the ball rolling is announcing a huge round of funding.

Celonis, a leader in the area of process mining — which tracks data produced by a company’s software, as well as how the software works, in order to provide guidance on what a company could and should do to improve it — has raised $290 million in a Series C round of funding, giving the startup a post-money valuation of $2.5 billion.

Celonis was founded in 2011 in Munich — an industrial and economic center in Germany that you could say is a veritable Petri dish when it comes to large business in need of digital transformation — and has been cash-flow positive from the start. In fact, Celonis waited until it was nearly six years old to take its first outside funding (prior to this Series C it had picked up less than $80 million, see here and here).

The size and timing of this latest equity injection is due to seizing the moment, and tapping networks of people to do so. It has already been growing at a triple-digit rate, with customers like Siemens, Cisco, L’Oréal, Deutsche Telekom and Vodafone among them.

“Our tech has become its own category with a lot of successful customers,” Bastian Nominacher, the co-CEO who co-founded the company with Alexander Rinke and Martin Klenk, said in an interview. “It’s a key driver for sustainable business operations, and we felt that we needed to have the right network of people to keep momentum in this market.”

To that end, this latest round’s participants lines up with the company’s strategic goals. It is being led by Arena Holdings — an investment firm led by Feroz Dewan — with Ryan Smith, co-founder and CEO of Qualtrics; and Tooey Courtemanche, founder and CEO of Procore, also included, alongside previous investors 83North and Accel.

Celonis said Smith will be a special advisor, working alongside another strategic board member, Hybris founder Carsten Thoma. Dewan, meanwhile, used to run hedge funds for Tiger Global (among other roles) and currently sits on the board of directors of Kraft Heinz.

“Celonis is the clear market leader in a category with open-ended potential. It has demonstrated an enviable record of growth and value creation for its customers and partners,” said Dewan in a statement. “Celonis helps companies capitalise on two inexorable trends that cut across geography and industry: the use of data to enable faster, better decision-making and the desire for all businesses to operate at their full potential.”

The core of Celonis’ offering is to provide process mining around an organizations’ IT systems. Nominacher said that this could include anything from 5 to over 100 different pieces of software, with the main idea being that Celonis’s platform monitors a company’s whole solar system of apps, so to speak, in order to produce its insights — providing and “X-ray” view of the situation, in the words of Rinke.

Those insights, in turn, are used either by the company itself, or by consultants engaged by the organization, to make further suggestions, whether that’s to implement something like robotic process automation (RPA) to speed up a specific process, or use a different piece of software to crunch data better, or reconfigure how staff is deployed, and so on. This is not a one-off thing: the idea is continuous monitoring to pick up new patterns or problems.

In recent times, the company has started to expand the system into a wider set of use cases, by providing tools to monitor operations and customer experience, and to apply its process mining engine to a wider set of company sizes beyond large enterprises, and by bringing in more AI to its basic techniques.

Interestingly, Nominacher said that there are currently no plans to, say, extend into RPA or other “fixing” tools itself, pointing to a kind of laser strategy that is likely part of what has helped it grow so well up to now.

“It’s important to focus on the relevant parts of what you provide,” he said. “We one layer, one that can give the right guidance.”

Powered by WPeMatico

Growing up, Selcuk Atli spent a good deal of his free time playing video games with his friends. And when I say with his friends, I mean actually with them. They’re called LAN parties, where everyone brings over their consoles and the group gets to play together virtually and in real life, all at the same time.

Atli, a grown man now, still loves games, but misses the memories made during LAN parties.

That’s how Bunch was born.

Bunch is a lot like Discord, but for mobile games. Users who download the game can connect with friends and join an audio or video chat with them. From there, users can choose a game to load and the whole party is instantly taken not just to the game, but into a multiplayer game session with their friends.

Today, Bunch has announced the close of a strategic investment round of $3.85 million from top game makers, including Supercell, Tencent, Riot Games, Miniclip and Colopl Next. Bunch’s previous investors include London Venture Partners, Founders Fund, Betaworks, Shrug Capital, North Zone, Streamlined Ventures and 500 Startups.

Bunch has a handful of first-party games on its platform to ensure that new users have a starting-off point. However, one of the biggest challenges of scaling is creating relationships with third-party game makers to eventually integrate that deep linking technology into the Bunch app.

With this new money, Bunch finds itself under the arm of a handful of some of the biggest mobile game publishers in the world. This new funding also brings Bunch’s total financing since launch to $8.5 million.

This isn’t the first time we’ve seen a company try to bring the nostalgia of ’90s gaming into the 21st century. Discord has made quite a name for itself in the gaming world with a platform that allows gamers to communicate before, during and after a game.

However, Discord is more targeted at PC gamers, and is meant to give users the chance to meet and communicate with other gamers, rather than just hopping on a call with existing friends.

TeaTime Live, founded by QuizUp founder Thor Fridriksson, is another competitor focused squarely on mobile. However, TeaTime Live is going hard into Snapchat-like filters and avatars for video chat. And, like Discord, TTL wants users to meet other gamers, not connect with their IRL friends.

Bunch is primarily focused on connecting gamers with their actual friends. Once you’ve both loaded into a game, Bunch keeps running in the background to power voice chat. By focusing on real friends, Atli believes the impact of Bunch can be much greater for both users and the games themselves.

In fact, Atli says that user retention on a specific game grows 1.3 times with every new friend added on the platform. Indeed, between Day 7 and Day 30, Bunch Cohorts’ retention rates are 2x the retention of normal players, according to the Bunch CEO.

For now, Bunch is focused entirely on user acquisition and scaling to more games, but could see an opportunity to generate revenue through a subscription or in-app purchase model around premium Bunch features.

Powered by WPeMatico

Clumio, a 100-people startup that offers a SaaS-like service for enterprise backup, today announced that it has raised a $135 million Series C round, led by existing investor Sutter Hill Ventures and new investor Altimeter Captial. The announcement comes shortly after the company’s disclosure in August that it had quietly raised a total of $51 million in Series A and B rounds in 2017 and 2018. The company says it plans to use this new funding to “accelerate its vision to deliver a globally consolidated data protection service in and for the public cloud.”

Given the amount of money invested in the company, chances are Clumio is getting close to a $1 billion valuation, but the company is not disclosing its valuation at this point.

The overall mission of Clumio is to build a platform on public clouds that gives enterprises a single data protection service that can handle backups of their data in on-premises, cloud and SaaS applications. When it came out of stealth, the company’s focus was on VMware on premises. Since then, the team has expanded this to include VMware running on public clouds.

“When somebody moves to the cloud, they don’t want to be in the business of managing software or infrastructure and all that, because the whole reason to move to the cloud was essentially to get away from the mundane,” explained Clumio CEO and co-founder Poojan Kumar.

The next step in this process, as the company also announced today, is to make it easier for enterprises to protect the cloud-native applications they are building now. The company today launched this service for AWS and will likely expand it to other clouds like Microsoft Azure, soon.

The market for enterprise backup is only going to expand in the coming years. We’ve now reached a point, after all, where it’s not unheard of to talk about enterprises that run thousands of different applications. For them, Clumio wants to become the one-stop-shop for all things data protection — and its investors are obviously buying into the company’s vision and momentum.

“When there’s a foundational change, like the move to the cloud, which is as foundational a change, at least, as the move from mainframe to open systems in the 80s and 90s,” said Mike Speiser, Managing Director at Sutter Hill Ventures . “When there’s a change like that, you have to re-envision, you have to refactor and think of the world — the new world — in a new way and start from scratch. If you don’t, what’s gonna end up happening is people make decisions that are short term decisions that seem like they will work but end up being architectural dead ends. And those companies never ever end up winning. They just never end up winning and that’s the opportunity right now on this big transition across many markets, including the backup market for Clumio.”

Speiser also noted that SaaS allows for a dramatically larger market opportunity for companies like Clumio. “What SaaS is doing, is it’s not only allowing us to go after the traditional Silicon Valley, high end, direct selling, expensive markets that were previously buying high-end systems and data centers. But what we’re seeing — and we’re seeing this with Snowflake and […] we will see it with Clumio — is there’s an opportunity to go after a much broader market opportunity.”

Starting next year, Clumio will expand that market by adding support for data protection for a first SaaS app, with more to follow, as well as support for backup in more regions and clouds. Right now, the service’s public cloud tool focuses on AWS — and only in the United States. Next year, it plans to support international regions as well.

Kumar stressed that he wants to build Clumio for the long run, with an IPO as part of that roadmap. His investors probably wouldn’t mind that, either.

Powered by WPeMatico

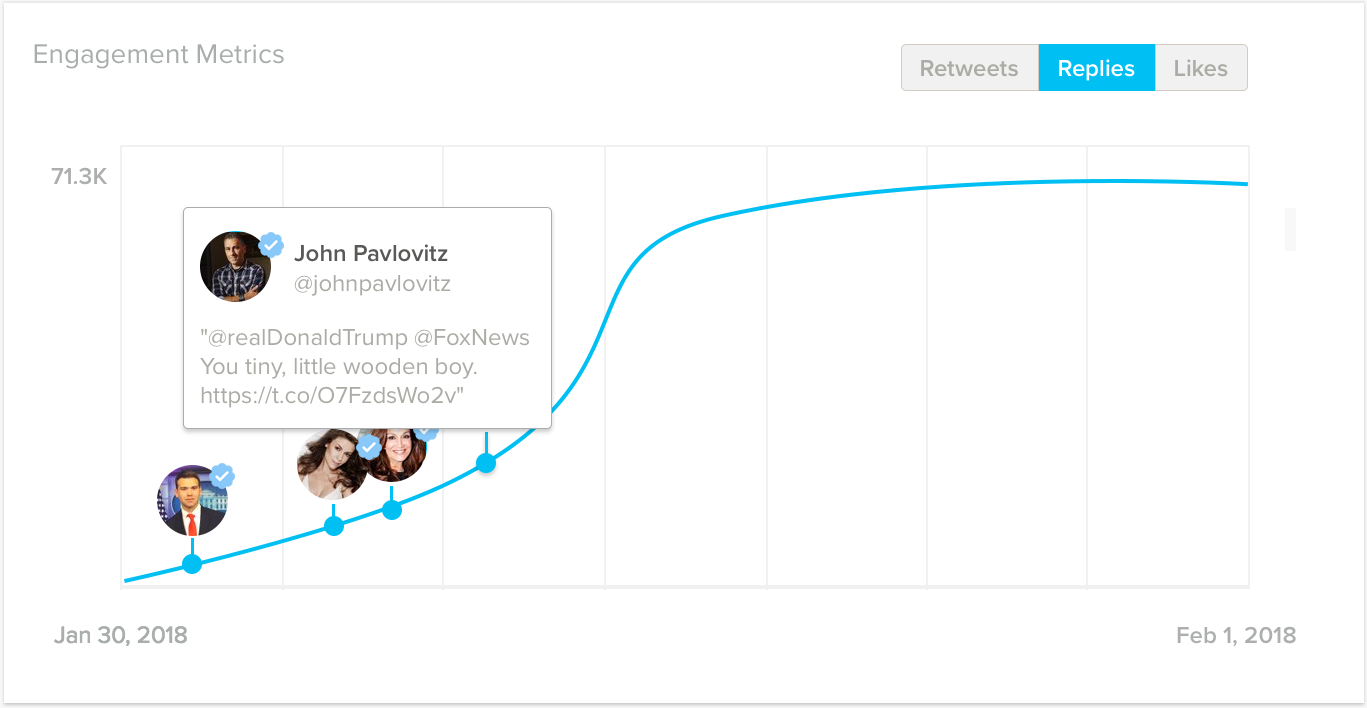

What do you do when your startup idea doesn’t prove big enough? Run it as a scrawny but profitable lifestyle business? Or sell it to a competitor and take another swing at the fences? Social audience analytics startup SocialRank chose the latter and is going for glory.

Today, SocialRank announced it’s sold its business, brand, assets, and customers to influencer marketing campaign composer and distributor Trufan which will run it as a standalone product. But SocialRank’s team isn’t joining up. Instead, the full six-person staff is sticking together to work on a mobile-first professional social network called Upstream aiming to nip at LinkedIn.

SocialRank co-founder and CEO Alex Taub

Started in 2014 amidst a flurry of marketing analytics tools, SocialRank had raised $2.1 million from Rainfall Ventures and others before hitting profitability in 2017. But as the business plateaued, the team saw potential to use data science about people’s identity to get them better jobs.

“A few months ago we decided to start building a new product (what has become Upstream). And when we came to the conclusion to go all-in on Upstream, we knew we couldn’t run two businesses at the same time” SocialRank co-founder and CEO Alex Taub tells me. “We decided then to run a bit of a process. We ended up with a few offers but ultimately felt like Trufan was the best one to continue the business into the future.”

The move lets SocialRank avoid stranding its existing customers like the NFL, Netflix, and Samsung that rely on its audience segmentation software. Instead, they’ll continue to be supported by Trufan where Taub and fellow co-founder Michael Schonfeld will become advisors.

“While we built a sustainable business, we essentially knew that if we wanted to go real big, we would need to go to the drawing board” Taub explains.

SocialRank

Two-year-old Trufan has raised $1.8 million Canadian from Round13 Capital, local Toronto startup Clearbanc’s founders, and several NBA players. Trufan helps brands like Western Union and Kay Jewellers design marketing initiatives that engage their customer communities through social media. It’s raising an extra $400,000 USD in venture debt from Round13 to finance the acquisition, which should make Trufan cash-flow positive by the end of the year.

Why isn’t the SocialRank team going along for the ride? Taub said LinkedIn was leaving too much opportunity on the table. While it’s good for putting resumes online and searching for people, “All the social stuff are sort of bolt-ons that came after Facebook and Twitter arrived. People forget but LinkedIn is the oldest active social network out there”, Taub tells me, meaning it’s a bit outdated.

Trufan’s team

Rather than attack head-on, the newly forged Upstream plans to pick the Microsoft-owned professional network apart with better approaches to certain features. “I love the idea of ‘the unbundling of LinkedIn’, ala what’s been happening with Craigslist for the past few years” says Taub. “The first foundational piece we are building is a social professional network around giving and getting help. We’ll also be focused on the unbundling of the groups aspect of LinkedIn.”

Taub concludes that entrepreneurs can shackle themselves to impossible goals if they take too much venture capital for the wrong business. As we’ve seen with SoftBank, investors demand huge returns that can require pursuing risky and unsustainable expansion strategies.

“We realized that SocialRank had potential to be a few hundred million dollar in revenue business but venture growth wasn’t exactly the model for it” Taub says. “You need the potential of billions in revenue and a steep growth curve.” A professional network for the smartphone age has that kind of addressable market. And the team might feel better getting out of bed each day knowing they’re unlocking career paths for people instead of just getting them to click ads.

Powered by WPeMatico

French startup Luko has raised a $22 million Series A round led by Accel (€20 million). Founders Fund and Speedinvest are also participating in today’s funding round.

When you rent a place in France, you have to provide a certificate to your landlord saying that you are covered with a home insurance product. And, of course, you might want to insure your place if you own it.

While the market is huge, legacy insurance companies still dominate it. That’s why Luko wants to shake things up in three different ways.

First, it’s hard to sign up to home insurance in France. It usually involves a lot of emails, a printer, some signatures, etc. It can quickly add up if you want to change your coverage level or add some options.

As expected, Luko’s signup process is pretty straightforward. You fill out a form on the company’s website and you get an insurance certificate minutes later.

Luko partners with La Parisienne Assurances to issue insurance contracts. So far, 15,000 people have signed up to Luko.

Second, if there’s some water damage or a fire, it can take a lot of time to get it fixed. Worse, if somebody breaks into your place, you’re not going to get your money back that quickly.

Luko wants to speed things up. You can make a claim via chat, over the phone or with a video call using the mobile app. The company tries its best to detect fraud and pay a claim as quickly as possible. Luko also recently announced an integration with Lydia, a popular peer-to-peer payment app in France, so that your payment is instant.

Third, Luko has a bold vision to make home insurance even more effective. The startup wants to detect issues before it’s too late. For instance, you could imagine receiving a water meter from Luko to detect leaks, or a door sensor to detect when somebody is trying to get in. We’ll find out if people actually want to put connected objects everywhere.

Finally, Luko has partnered with a handful of nonprofits to redistribute some of its revenue — it has received the BCorp certification. The startup makes revenue by taking a flat fee on your monthly subscription. If there’s money left at the end of the year, Luko donates it to charities. Investors signed a pledge so that Luko doesn’t trade this model for growth.

Powered by WPeMatico

Venture capitalists often mutter, “I haven’t seen anything I like lately.” Founders frequently complain that “investors are back-seat drivers who won’t get their hands dirty.” A $55 million fund with a fresh approach is aiming to address both those issues.

Steve Jang and Kanyi Maqubela are two exceedingly smart and sweet guys who couldn’t help but come up with ideas for startups. Jang co-founded music apps Imeem and Soundtracking, meanwhile serving as an early Uber advisor and angel investor in Coinbase. Maqubela worked in operations at career network Doostang (acquired by Universum Global) and solar startup One Block Off the Grid (acquired by NRG) before rising to general partner at Collaborative Fund.

Today the pair officially launch Kindred Ventures to form startups as well as fund them.

“We don’t want to wait for people to come around and solve the problems we think matter,” says Jang. “We’d rather proactively assemble an amazing team to go tackle that problem,” Maqubela follows up. But Kindred Ventures will also step up and lead seed rounds, then help startups orchestrate their follow-on fundraises.

Kindred Ventures partner and co-founder Steve Jang

“The ethos is empathy — to take a very adaptive coaching and mentorship model,” Jang tells me. That means partnering with startups, not merely offering arm’s-length investing. By keeping the portfolio size low, Jang and Maqubela plan to turn concentrated conviction and outsized, hands-on effort into big stakes in tomorrow’s top companies.

“I originally wanted to call the fund Kindred Spirits, but it sounds a little too woo-woo,” Jang says with a laugh. From multiple interviews with the team and its portfolio, though, that’s really the vibe Kindred Ventures is going for — to be the first people founders call when they’re in crisis… whether they need answers or just some cheering up.

Beyond the warm smiles, Kindred already has a strong track record from its prototype phase under Jang’s solo operation since 2014. He’d made a reputation for himself as a fixer through his advising work during Uber’s scrappy early years starting in 2009. It began with Jang writing Garrett Camp a check for his side-project. As the company blossomed without full-time employees, Jang pitched in wherever he could.

After Imeem’s sale to Myspace and later Soundtracking’s acquisition by Rhapsody, Jang made about 50 angel investments of around $25,000 to $250,000 in companies like Coinbase, Blue Bottle Coffee, Postmates and Zymergen under the name Kindred Ventures. Instead of just throwing money around, “I’d help a co-founder — sit down and work with them on product, their presentation for seed funding, hiring their first employees, finding a co-founder — it was quite different from how VCs operate.” Still, he wanted to lead more investments like his favorite seed funds First Round and True Ventures while remaining a thick-or-thin squire to his startups.

But to pour that kind of sweat into the portfolio, Jang needed the help of someone who could dig deep and become an ally to founders in any vertical. He needed someone like Kanyi.

After his stints in operations, Maqubela went on to work at Collaborative Fund for seven years, rising to partner at the firm looking for the intersection of positive impact and profit. He tells me developed a thesis about “what does it mean to be a techno-optimist?: to believe that technology is amoral but can be oriented towards good.”

Maqubela’s super-power is learning. I knew him from Stanford, and now the same reputation precedes him through his portfolio of angel investments like Earnest and Buffer. He’ll immerse himself in any topic or industry, read and call people until he truly gets it and then wedge his entrepreneurial skill set into the cracks to firm up an idea. Still relatively new to venture, Maqubela was seeking someone with a well-worn process for investing and a big heart for what founders go through. He was looking for Steve.

Kindred Ventures partner and co-founder Kanyi Maqubela

The coincidental co-investors became friends, then deliberately funded startups side by side, and now are taking the leap as Kindred Ventures. Together they want to redefine “What does it mean to invest at t=0?. What do they really need?,” Maqubela says.

The plan is to fund about 25 companies through pre-seed and seed per fund, which they’ll raise every two to three years. Kindred is vertical agnostic, but it has a soft spot for the future of cities, work and living. It’s also keen on marketplaces, material science, food innovation, deep tech, enterprise SAAS and developer tools.

Jang and Maqubela are learning from each other day by day, at home and in the office. They’ve each got their own toddler son to juggle alongside Kindred. Added responsibility seems to have made both of them conscious of how each minute counts, no matter who they’re with. The result is you’ll often hear the word “nicest” whenever people describe the pair.

So far Kindred Ventures has funded nine startups from its $55 million initial fund. It’s helped form two companies and hopes to do four to eight per fund. But Kindred won’t be taking founder-level equity in those. Instead it just wants the opportunity to lead the seed round and own 10% to 20% by the time of the Series A.

That makes Kindred Ventures distinct from most startup studios like Atomic that aim for bigger ~30% stakes. “The Studios are creating whole platform teams, services teams, only work on their own ideas, and own a considerable amount of equity,” Jang notes. By leaving more shares for the real CEO, “We’d be able to work with a stronger profile of founders” while avoiding spending so much time per company that the model becomes unscalable. “We’re there at the formation of the company, but it’s not our company.”

Kindred’s two formations come from the disparate medicine and blockchain worlds. Maqubela became an expert in cardiology to help start Heartbeat, which does in-person and remote heart-health diagnostics. “I have a clear bullshit meter for when non-healthtech people try to get into it,” but Maqubela really figured it out, Heartbeat CEO Jeff Wessler, MD, tells me.

On his experience with Kindred, “It’s ‘we’re there for you when you need us’ rather than ‘we’re there for you when we fund you and then we move on,’ ” Wessler says. “Very quickly this evolved into Steve and Kanyi being my absolute numbers 1 and 2.” The investors gave Wessler Entrepreneurship 101 coaching, provided Heartbeat’s first funding and helped it build a team. With their help, the first-time founder has sidestepped common pitfalls and is already turning patients into customers with its $2.5 million in funding.

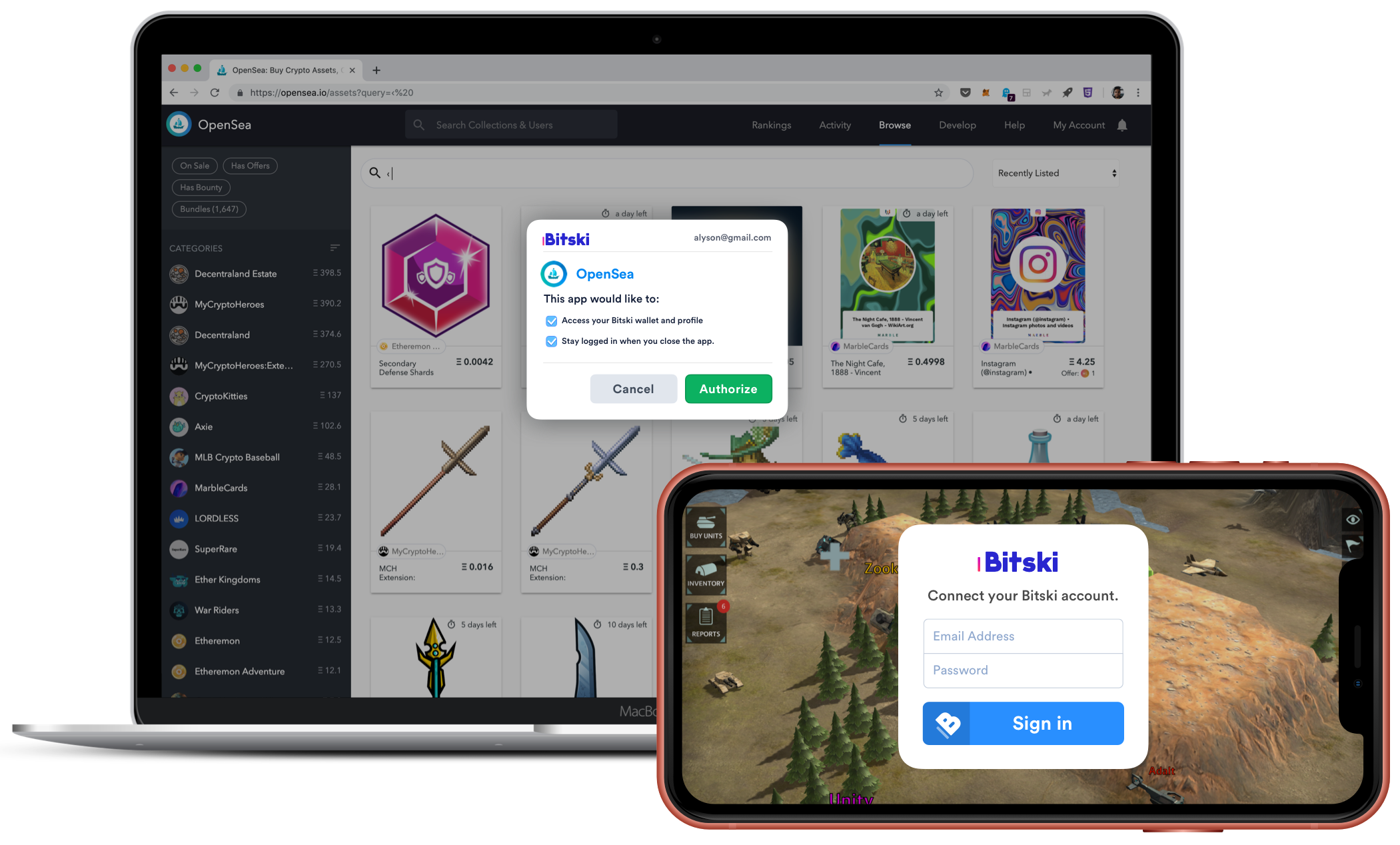

Bitski, a blockchain app login platform, has quickly leveraged Kindred’s support with formation into big funding from top investors. Bitski CEO Donnie Dinch tells me, “In the early days, Steve would be in the office with us, late night jamming on ideas around the evolution of the blockchain space, fundamental products that needed to exist, early use cases etc. There’s a lot of money available for seed-stage projects, but it can be difficult to find an investor willing to grind with the team through the days of pre product-market fit.”

Bitski actually started as collaborative video production app Riff. But Jang and Maqubela’s advice helped it solidy pivot into developer tools for decentralized apps. It’s since gone on to raise $3.5 million from SV Angel, Coinbase, Galaxy Digital and the Winklevoss twins. “The collaborative tone of the relationship really stands out,” says Dinch of Kindred. “Obviously, operating with a high-touch model can take more of the partners’ time, but we haven’t noticed any drop in availability or support.”

Plenty of funds talk a lot about getting their hands dirty. Often that means hiring big teams they can assign to help founders, though, while the partners focus elsewhere. With just two support staff, Jang and Maqubela don’t have that luxury. They’re in constant contact with their investments by WhatsApp, phone and email to work through snags directly.

“They’re always super responsive,” says Michael Karnjarnaprakorn, co-founder of collectibles investing startup Otis that was backed by Kindred’s prototype fund. He cites three big value-adds. Strategy: “Anytime I’m thinking through a big decision, I call them to help me think through it,” including fundraising and product launches. Network: “They have an extremely strong network and are usually one to two degrees away from anyone.” And “everything else,” from mentorship on founder psychology to company building.

Undertaking such intense involvement in their whole portfolio would likely surface concerns about a green VC. But “Steve has essentially been doing this for a decade or so not formalized, so I don’t see any reason it can’t work,” says one of Kindred’s stealth startup founders Brian Norgard. “As companies begin to scale, my sense is they will be less effective because that’s a different game that’s more on the operations side. Still, I see a lot of value that can be created in the early innings.”

Kindred had a sort of grit and passion for early-stage founders and teams that we thought would give us an edge as we started to grow quickly,” says health insurance company Catch‘s co-founder Kristen Tyrrell.” They have been genuinely interested in our mental health. Having Steve fly in to take us to dinner and tell us we’re doing OK is surprisingly meaningful when you’re fighting on every side.”

NEW YORK, NY – MAY 10: Kanyi Maqubela of Collaborative Fund speaks onstage during TechCrunch Disrupt NY 2016 at Brooklyn Cruise Terminal on May 10, 2016 in New York City. (Photo by Noam Galai/Getty Images for TechCrunch)

But being high-touch and concerned with entrepreneurs’ well-being doesn’t mean becoming a push-over yes-man. “Founder empathy is not always founder-friendly,” says Maqubela. “It’s being able to disagree with founders, even very passionately, and still constructively working together. To be able to tell them they’re wrong but come out the other side.”

That means Kindred Ventures isn’t for every founder. Those who want their investors firmly belted in the backseat or locked in the trunk may want to look elsewhere for cash. Smart founders will take all the help they can get, and Kindred strives to give the most per dollar. Jang concludes that, “The idea may come from them or come from us, but we want to back amazing founders on a mission. It’s scratching both itches for us.”

Powered by WPeMatico

Looks like there’s still money to be made in news aggregation — at least according to the investors backing the news app SmartNews.

The company is announcing the close of a $92 million round of funding at a valuation of $1.2 billion. The funding was led by Japan Post Capital Co. and ACA Investments, with participation from Globis Capital Partners Co., Dentsu and D.A. Consortium.

This includes the $28 million that SmartNews announced in August, and it brings the startup’s total funding to $182 million.

News aggregation apps seemed to everywhere a few years ago, and while they haven’t exactly disappeared, they didn’t turn into unicorns, with many of them acquired or shut down.

However, Vice President of U.S. Marketing Fabien-Pierre Nicolas told me that SmartNews has a few unique advantages. For one thing, it uses machine learning rather than human curation to “thoughtfully generate a news discovery experience” that’s personalized to each user.

Secondly, he said that many news aggregators treat the publishers creating the content that they rely on “like a commodity,” whereas SmartNews treats them as “true partners.” For example, it’s working with select publishers like Business Insider, Bloomberg, BuzzFeed and Reuters on a program called SmartView First, where articles are presented in a custom format that gives publishers more revenue opportunities and better analytics.

Lastly, he said SmartNews has focused on only two key markets — Japan (where the company started) and the United States. And it sounds like one of the main goals with the new funding is to continue growing in the United States.

Nicolas also suggested that there are some broader trends that SmartNews is taking advantage of, like the fact that the shift to mobile news consumption is still underway, particularly for older readers.

And then there’s “the loss of trust in some news sources — political news, especially,” which makes SmartNews’ curated approach seem more valuable. (It also recently launched a News From All Sides feature to show coverage from different political perspectives.)

As for monetization, he said SmartNews remains focused on advertising.

Yes, there’s a growing interest in subscriptions and paywalls, which is also reflected in subscription news aggregators like Apple’s News+, but Nicolas said, “Eighty-five to ninety percent of Americans are not subscribing to news media. We believe those 85 to 90 percent have a right to have quality information as well.”

Update: Also worth noting is that SensorTower says SmartNews has been downloaded 45 million times since the beginning of 2014, with 11 million of those downloads in 2019.

Powered by WPeMatico

The world has gotten so much faster. Amazon has made two-day shipping the standard and same- or next-day shipping commonplace. And that doesn’t even include the collection of on-demand players that can get us everything from groceries to alcohol to services like concierge storage and in-home cleaning with the press of a button.

But the logistics around same- or next-day delivery are incredibly complicated, which usually means that only the biggest, most successful brands and platforms can pull it off.

Enter Ohi.

Ohi was founded last year by Ben Jones, with a mission to democratize e-commerce by offering Amazon-level speed to smaller brands. The company today announced the close of a $2.75 million seed round led by Flybridge Capital Partners .

Ohi partners with landlords to turn what would normally be leased as commercial retail property or office space into micro-warehouses within major cities. The company then offers those warehouses on flexible leases that can be as short as three months, which help D2C brands distribute their inventory and power same- or next-day delivery of their products. Ohi employs 1099 workers to handle pick and pack at warehouses, and partners with Postmates and Doordash for last-mile courier services.

Eventually, Ohi has plans to turn this into a full-fledged platform, paying landlords based on volume. For now, however, the startup is doing traditional leases with landlords, taking on more of a financial risk with the spaces, as it scales up the brand side of the platform.

Ohi charges brands a fixed monthly access fee to the platform, which starts at $750/month. More expensive tiers unlock premium intelligence features around matching inventory to warehouse location, as well as access to more spaces. At the transaction level, Ohi asks for a fee of $2.50 for pick and pack.

Jones says that delivery is actually a higher cost for brands than storage, and that same-day shipping can cost upwards of $50/package for a brand, with same-day pick and pack costing about $10/item. The hope is that Ohi can bring down the price of same-day and next-day delivery by using this Ohi network of commercial space, pick and pack and courier services to compete with Amazon.

Moreover, Ohi believes that the platform can go well beyond bringing down the price of same-day delivery. The company says its brands are also seeing a decrease in cart abandonment when customers see that same-day or next-day delivery option.

Plus, through the data it collects by handling fulfillment for brands, Ohi expects to be able to use its tech to predict demand based on geography and category, helping brands understand their own customers and customers shopping in their particular category.

“There is a lot of positive momentum behind what we’re doing,” said Jones. “Every brand we talk to knows this is the future.”

Jones came up with the idea for Ohi after suffering a serious back injury that left him for more than a year unable to get around easily or carry things. This forced him into a situation where e-commerce was his only option for just about everything. Many of the orders he placed offered three- to five-day shipping, leaving him waiting for what he needed.

He started to investigate how a service could democratize the convenience of same-day and next-day delivery for brands and their customers. And Ohi was born.

Ohi currently offers its service in Manhattan and Brooklyn in New York City, and is launching in Los Angeles this week.

“The greatest challenge we face is how to scale quickly without making mistakes,” said Jones. “It’s not quite as simple as a piece of software that has one-to-many distribution. We’re actually holding brands’ inventory and there’s a physical aspect to this business that makes it more complex. Making sure we can scale that efficiently without making mistakes is going to be one of the biggest challenges.”

Powered by WPeMatico

Silicon is apparently the new gold these days, or so VCs hope.

What was once a no-go zone for venture investors, who feared the long development lead times and high technical risk required for new entrants in the semiconductor field, has now turned into one of the hottest investment areas for enterprise and data VCs. Startups like Graphcore have reached unicorn status (after its $200 million series D a year ago) while Groq closed $52M from the likes of Chamath Palihapitiya of Social Capital fame and Cerebras raised $112 million in investment from Benchmark and others while announcing that it had produced the first trillion transistor chip (and who I profiled a bit this summer).

Today, we have another entrant with another great technical team at the helm, this time with a Santa Clara, CA-based startup called NUVIA. The company announced this morning that it has raised a $53 million series A venture round co-led by Capricorn Investment Group, Dell Technologies Capital (DTC), Mayfield, and WRVI Capital, with participation from Nepenthe LLC.

Despite only getting started earlier this year, the company currently has roughly 60 employees, 30 more at various stages of accepted offers, and the company may even crack 100 employees before the end of the year.

What’s happening here is a combination of trends in the compute industry. There has been an explosion in data and by extension, the data centers required to store all of that information, just as we have exponentially expanded our appetite for complex machine learning algorithms to crunch through all of those bits. Unfortunately, the growth in computation power is not keeping pace with our demands as Moore’s Law slows. Companies like Intel are hitting the limits of physics and our current know-how to continue to improve computational densities, opening the ground for new entrants and new approaches to the field.

There are two halves to the NUVIA story. First is the story of the company’s founders, which include John Bruno, Manu Gulati, and Gerard Williams III, who will be CEO. The three overlapped for a number of years at Apple, where they brought their diverse chip skillsets together to lead a variety of initiatives including Apple’s A-series of chips that power the iPhone and iPad. According to a press statement from the company, the founders have worked on a combined 20 chips across their careers and have received more than 100 patents for their work in silicon.

Gulati joined Apple in 2009 as a micro architect (or SoC architect) after a career at Broadcom, and a few months later, Williams joined the team as well. Gulati explained to me in an interview that, “So my job was kind of putting the chip together; his job was delivering the most important piece of IT that went into it, which is the CPU.” A few years later in around 2012, Bruno was poached from AMD and brought to Apple as well.

Gulati said that when Bruno joined, it was expected he would be a “silicon person” but his role quickly broadened to think more strategically about what the chipset of the iPhone and iPad should deliver to end users. “He really got into this realm of system-level stuff and competitive analysis and how do we stack up against other people and what’s happening in the industry,” he said. “So three very different technical backgrounds, but all three of us are very, very hands-on and, you know, just engineers at heart.”

Gulati would take an opportunity at Google in 2017 aimed broadly around the company’s mobile hardware, and he eventually pulled over Bruno from Apple to join him. The two eventually left Google earlier this year in a report first covered by The Information in May. For his part, Williams stayed at Apple for nearly a decade before leaving earlier this year in March.

The company is being stealthy about exactly what it is working on, which is typical in the silicon space because it can take years to design, manufacture, and get a product into market. That said, what’s interesting is that while the troika of founders all have a background in mobile chipsets, they are indeed focused on the data center broadly conceived (i.e. cloud computing), and specifically reading between the lines, to finding more energy-efficient ways that can combat the rising climate cost of machine learning workflows and computation-intensive processing.

Gulati told me that “for us, energy efficiency is kind of built into the way we think.”

The company’s CMO did tell me that the startup is building “a custom clean sheet designed from the ground up” and isn’t encumbered by legacy designs. In other words, the company is building its own custom core, but leaving its options open on whether it builds on top of ARM’s architecture (which is its intention today) or other architectures in the future.

Outside of the founders, the other half of this NUVIA story is the collective of investors sitting around the table, all of whom not only have deep technical backgrounds, but also deep pockets who can handle the technical risk that comes with new silicon startups.

Capricorn specifically invested out of what it calls its Technology Impact Fund, which focuses on funding startups that use technology to make a positive impact on the world. Its portfolio according to a statement includes Tesla, Planet Labs, and Helion Energy.

Meanwhile, DTC is the venture wing of Dell Technologies and its associated companies, and brings a deep background in enterprise and data centers, particularly from the group’s server business like Dell EMC. Scott Darling, who leads DTC, is joining NUVIA’s board, although the company is not disclosing the board composition at this time. Navin Chaddha, an electrical engineer by training who leads Mayfield, has invested in companies like HashiCorp, Akamai, and SolarCity. Finally, WRVI has a long background in enterprise and semiconductor companies.

I chatted a bit with Darling of DTC about what he saw in this particular team and their vision for the data center. In addition to liking each founder individually, Darling felt the team as a whole was just very strong. “What’s most impressive is that if you look at them collectively, they have a skillset and breadth that’s also stunning,” he said.

He confirmed that the company is broadly working on data center products, but said the company is going to lie low on its specific strategy during product development. “No point in being specific, it just engenders immune reactions from other players so we’re just going to be a little quiet for a while,” he said.

He apologized for “sounding incredibly cryptic” but said that the investment thesis from his perspective for the product was that “the data center market is going to be receptive to technology evolutions that have occurred in places outside of the data center that’s going to allow us to deliver great products to the data center.”

Interpolating that statement a bit with the mobile chip backgrounds of the founders at Google and Apple, it seems evident that the extreme energy-to-performance constraints of mobile might find some use in the data center, particularly given the heightened concerns about power consumption and climate change among data center owners.

DTC has been a frequent investor in next-generation silicon, including joining the series A investment of Graphcore back in 2016. I asked Darling whether the firm was investing aggressively in the space or sort of taking a wait-and-see attitude, and he explained that the firm tries to keep a consistent volume of investments at the silicon level. “My philosophy on that is, it’s kind of an inverted pyramid. No, I’m not gonna do a ton of silicon plays. If you look at it, I’ve got five or six. I think of them as the foundations on which a bunch of other stuff gets built on top,” he explained. He noted that each investment in the space is “expensive” given the work required to design and field a product, and so these investments have to be carefully made with the intention of supporting the companies for the long haul.

That explanation was echoed by Gulati when I asked how he and his co-founders came to closing on this investor syndicate. Given the reputations of the three, they would have had easy access to any VC in the Valley. He said about the final investors:

They understood that putting something together like this is not going to be easy and it’s not for everybody … I think everybody understands that there’s an opportunity here. Actually capitalizing upon it and then building a team and executing on it is not something that just anybody could possibly take on. And similarly, it is not something that every investor could just possibly take on in my opinion. They themselves need to have a vision on their side and not just believe our story. And they need to strategically be willing to help and put in the money and be there for the long haul.

It may be a long haul, but Gulati noted that “on a day-to-day basis, it’s really awesome to have mostly friends you work with.” With perhaps 100 employees by the end of the year and tens of millions of dollars already in the bank, they have their war chest and their army ready to go. Now comes the fun (and hard) part as we learn how the chips fall.

Update: Changed the text to reflect that NUVIA is intending to build on top of ARM’s architecture, but isn’t a licensed ARM core.

Powered by WPeMatico