Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

When the storied venture firm Sequoia likes a deal, it will sometimes not only lead one of its financing rounds but fund it exclusively — no matter how that impacts earlier investors. Given the firm’s powerful brand, it’s hard to complain (too much), even if it means that earlier backers see their stakes diluted.

Such looks to be the case with Dolls Kill, an eight-year-old, San Francisco-based online boutique for “misfits” and “miss legits,” that began selling platform shoes and other club-type clothing and has apparently grown like a weed, alongside the festivals that its customers attend, from Burning Man to Coachella.

The company has just raised $40 million in Series B funding from Sequoia, and when we talked yesterday with co-founder and CEO Bobby Farahi about the deal — which brings Dolls Kill’s funding to roughly $60 million — he said there was “no room” for earlier backers, including the consumer-focused venture firm Maveron.

He quickly added that the company’s board members — specifically Maveron partner Jason Stoffer, along with former Hot Topic CEO Betsy McLaughlin — have been instrumental in helping the company “think through growth while maintaining authenticity.”

It’s easy to appreciate enthusiasm around the brand, which employs around 400 people, has retail stores in both San Francisco and LA and sells its own clothes under an array of different labels, as well as sells the clothing of third parties whose aesthetic happens to fit that of Dolls Kill at any particular moment in time.

As says Farahi, “Right now there’s a resurgence in ’90s fashion, but in another year, we could move on to other third-party brands that we believe will resonate with our customers.”

Farahi doesn’t break out how much of the company’s clothing is made by the startup itself — in China and the U.S., among other “international” locations, according to Farahi. He shies from sharing many metrics at all, in fact. But the company, whose counter-culture approach began at the fringes of society, has seemingly gone mainstream as young shoppers increasingly ditch logos and look to express who they are through what Farahi calls their “inner IDGF.”

Adds Farahi, “The macro world changed a lot to give us a lot of tailwinds.”

Dolls Kill also has — for now, at least — a deep connection to its customers, thanks partly to its creative approach. When the company told its three million Instagram followers earlier this year that it would drive an ice cream truck filled with a particular combat boot called the Billionaire Bling Boot to dozens of U.S. cities, customers “four blocks long” waited in line to buy them, says Farahi.

In another inventive twist, it opened its LA location — which looks more like a nightclub — to shoppers at midnight on Black Friday and it stayed open the following 24 hours.

Sequoia — which reached out to the company directly — told Farahi that it had looked at a lot of fashion brands and “they said we believe you’re the next generation-defining brand, the way The Gap was in the ’80s,” recounts Farahi. “I think they see the company not just as a brand but also a movement.”

Certainly, Sequoia’s Alfred Lin — who as Zappos’s COO helped grow the company into the giant that Amazon acquired in 2009 — understands such things, given the famously strong early emphasis at Zappos on company culture and growing while remaining true to its early employees and customers.

As for the name Dolls Kill, the brand was the idea of Farahi’s wife and co-founder Shoddy Lynn, who liked the “dichotomous words, one very soft and one very hard,” says Fahari, explaining that while “the brand is very girly, these girls aren’t taking shit from anybody.”

Adds Farahi, “And the domain was available.”

Powered by WPeMatico

One of the biggest trends in the world of financial technology has been an ongoing push towards consolidation, where larger fish are snapping up smaller fish (including a proliferation of interesting startups) to get improved economies of scale in a business model where every transaction brings incremental returns. But today, a startup that has built the concept of consolidation into its basic DNA has raised another round of funding to continue doubling down on its business.

Rapyd — a London-based startup that has built an API that lets customers tap into a range of financial services spanning payments, checkout, funds collection, fund disbursements, compliance as a service, foreign exchange, card issuing and soon logistics across a wide range of geographies — has picked up an additional $20 million. Rapyd’s valuation with the funding is now at $1.2 billion (up from just under $1 billion in October).

The $20 million comes from new investment firm Durable Capital Partners.

Notably, it was only in October that Rapyd announced a $100 million raise. CEO and co-founder and Arik Shtilman said that Rapyd has now raised $180 million in total, with previous investors in the startup including Oak HC/FT Tiger Global, Coatue, General Catalyst, Target Global, Stripe and Entrée Capital. (Stripe, itself a fast-growing fintech upstart, remains only a financial investor in the company, Shtilman confirmed.)

Durable is the firm founded by Henry Ellenbogen, formerly a star investor at T. Rowe Price, in what Rapyd said was the firm’s first investment. (Note: Durable was also announced earlier as an investor in Convoy’s $400 million round, some clear signs that it’s open for business now.)

With Rapyd only recently raising a round, Shtilman said that the reason for the — err — rapid follow up was because the company is gearing up to make some acquisitions, as it too moves in on the consolidation trend by adding in more tools into its “Swiss Army Knife” of services.

“We’ve started to look at two acquisitions that were bigger than what we originally planned, with prices more in the range of $100 million,” he said. Up to now, Rapyd has largely built its technology from the ground up, but this will be about “getting at new business very quickly,” he added. Both deals are in progress now and are likely to close in February / March. One is of a card issuing platform (a la Marqeta), and the other is of a company based in Asia Pacific that is a significant player in payments in the region.

The focus on Asia Pacific both for testing out new services and acquisitions is in part because this, along with Latin America, have shaped up to be important geographies for the company. In the last three months, Rapyd has signed on 20 additional large-scale companies, Shtilman said, with several of them based out of, or serving, customers out of the two regions.

In fact, Rapyd doesn’t talk much about actual customers, but they include e-commerce merchants, gig-economy platforms — including Uber — financial institutions, and technology providers. The basic pitch is that financial services are complex, and providing one like payments often means having to offer others. Building these from scratch if this is not your core competency can be time-consuming and costly, and so that is where a company like Rapyd steps in with its API.

This is what attracted its newest investor, too. “Durable Capital Partners LP has a vision to identify and invest in promising early stage growth companies and invest in teams that have bold ideas but can also execute at a world-class level and build much larger companies,” said Ellenbogen in a statement. “I believe the Fintech-as-a-Service category has tremendous potential as companies seek to embed financial services as an integral part of the next generation technology stack. I believe Rapyd is very well positioned to drive this trend and I believe Arik’s track record in scaling cloud-based businesses will deliver success in this sector.”

When we last talked with Rapyd in October, we asked Shtilman about whether the company would ever move into logistics as part of its range of tools. After all, when you think about the complexities of procuring, storing and moving goods, it’s clear that logistics is one of the cornerstones you need to get right in an online business.

He said that this was on the company’s roadmap, and now Rapyd is in a pilot in Indonesia — an interesting test bed, considering that the country’s is spread across thousands of islands — where it has integrated a logistics service and given access to a single merchant as stage one of its closed beta. It’s also in discussions with other companies about how it can incorporate their services into the Rapyd platform to provide further “logistics as a service” to customers. He also confirmed the Durable has been a help here, by making an introduction to Convoy as part of that wider strategy.

Powered by WPeMatico

After growing its lending business in West Africa, emerging markets credit startup Migo is expanding to Brazil on a $20 million Series B funding round led by Valor Capital Group.

The San Franicso-based company — previously branded Mines.io — provides AI-driven products to large firms so those companies can extend credit to underbanked consumers in viable ways.

That generally means making lending services to low-income populations in emerging markets profitable for big corporates, where they previously were not.

Founded in 2013, Migo launched in Nigeria, where the startup now counts fintech unicorn Interswitch and Africa’s largest telecom, MTN, among its clients.

Offering its branded products through partner channels, Migo has originated more than 3 million loans to over 1 million customers in Nigeria since 2017, according to company stats.

“The global social inequality challenge is driven by a lack of access to credit. If you look at the middle class in developed countries, it is largely built on access to credit,” Migo founder and CEO Ekechi Nwokah told TechCrunch.

“What we are trying to do is to make prosperity available to all by reinventing the way people access and use credit,” he explained.

Migo does this through its cloud-based, data-driven platform to help banks, companies and telcos make credit decisions around populations they previously may have bypassed.

These entities integrate Migo’s API into their apps to offer these overlooked market segments digital accounts and lines of credit, Nwokah explained.

“Many people are trying to do this with small micro-loans. That’s the first place you understand risk, but we’re developing into point of sale solutions,” he said.

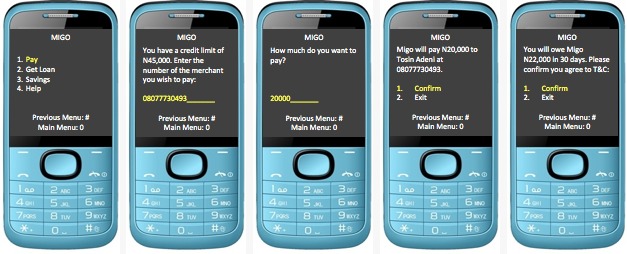

Migo’s client consumers can access their credit lines and make payments by entering a merchant phone number on their phone (via USSD) and then clicking on “Pay with Migo.” Migo can also be set up for use with QR codes, according to Nwokah.

He believes structural factors in frontier and emerging markets make it difficult for large institutions to serve people without traditional credit profiles.

“What makes it hard for the banks is its just too expensive,” he said of establishing the infrastructure, technology and staff to serve these market segments.

Nwokah sees similarities in unbanked and underbanked populations across the world, including Brazil and African countries such as Nigeria.

“Statistically, the number of people without credit in Nigeria is about 90 million people and its about 100 million adults that don’t have access to credit in Brazil. The countries are roughly the same size and the problem is roughly the same,” he said.

On clients in Brazil, Migo has a number of deals in the pipeline — according to Nwokah — and has signed a deal with a big-name partner in the South American country of 210 million, but could not yet disclose which one.

Migo generates revenue through interest and fees on its products. With lead investor Valor Capital Group, Velocity Capital and The Rise Fund joined the startup’s $20 million Series B.

Increasingly, Africa — with its large share of the world’s unbanked — and Nigeria — home to the continent’s largest economy and population — have become proving grounds for startups looking to create scalable emerging market finance solutions.

Migo could become a pioneer of sorts by shaping a fintech credit product in Africa with application in frontier, emerging and developed markets.

“We could actually take this to the U.S. We’ve had discussions with several partners about bringing the technology to the U.S. and Europe,” said founder Ekechi Nwokah. In the near-term, though, Migo is more likely to expand to Asia, he said.

Powered by WPeMatico

Cuvva, the app-based insurance provider that began life offering pay-as-you-go driving cover but has since expanded to also sell travel insurance, has raised £15 million in Series A funding.

Backing comes from RTP Global, Breega and Digital Horizon, joining existing investors LocalGlobe, Techstars Ventures, Tekton and Seedcamp. A number of angels also joined the round, including Dominic Burke, the CEO of Jardine Lloyd Thompson, and Faisal Galaria, the former chief strategy and investments officer of GoCompare.

Launched in 2016 when founder Freddy Macnamara (pictured) become frustrated he couldn’t let others drive his car intermittently because of lack of insurance cover, Cuvva was an early pioneer of pay-as-you-go car insurance.

The idea, which was easier explained than done, was to make it possible to insure a car only when it was being driven, and therefore be cheaper for low-mileage drivers, and, via an app and access to the DVLA database, make it easier to on-board new drivers for pay-as-you-drive cover.

The insurtech still offers hourly car insurance, but its product line has since been expanded to daily covery, as well as a product specifically aimed at learner drivers. In addition, Cuvva entered the travel insurance space, no doubt spotting overlap with its presumably younger, millennial demographic.

To that end, Cuvva says it will use the new capital to launch a new pay-monthly motor product in early 2020 that it says could cut average annual bills for car owners “significantly.” It will do this by cutting out various middle people, including brokers and comparison websites, which it says charge insurers about £70 on each policy sold.

“Unlike legacy insurers, Cuvva will not charge a fee to spread payments over the year and it will not penalise loyal customers with dual pricing,” says the startup. Cuvva also says it will offer the same savings, whether you are signing up as a new customer or are a returning customer, and won’t charge admin fees to alter personal details registered with your policy.

Cue canned statement from Macnamara: “I started Cuvva when I couldn’t find flexible insurance to help me share my car. Four years on from launch we are still discovering how big the problem we are solving really is. We’re now selling 3% of all UK motor insurance policies but we’ve got so much further to go. Cuvva is going to be the place where you buy all your insurance, all through our mobile app.”

Powered by WPeMatico

Singapore-headquartered FinAccel has secured $90 million in one of the largest funding rounds for a fintech startup in Southeast Asia as it looks to further grow its credit lending app Kredivo and build more financial services.

The financing round, dubbed Series C, for the three-and-a-half-year-old startup was jointly led by Asia Growth Fund — a joint venture between Mirae Asset and Naver — and Square Peg.

Singtel Innov8, TMI (Telkomsel Indonesia), Cathay Innovation, Kejora-InterVest, Mirae Asset Securities, Reinventure and DST Partners participated in the “oversubscribed” financing round, the startup said.

FinAccel said it has raised more than $200 million in debt and equity this year itself. It has raised $140 million in equity to date.

FinAccel operates credit lending app Kredivo in Indonesia, where it has amassed more than a million customers and is growing by a whopping 300% each year, Akshay Garg, chief executive of FinAccel, told TechCrunch in an interview.

The app enables customers to secure credit between $100 and $2,200. If a customer pays it back in full in a month, FinAccel does not charge them any fee. Otherwise, the service levies an interest rate of 2.95%, he explained.

Kredivo’s payments option is also integrated with a number of e-commerce firms, including Lazada and Shoppe, and food delivery startups in Indonesia, so users can quickly access the credit to purchase things and pay the app later.

Credit lending apps are increasingly gaining popularity across the globe, but especially in Southeast Asian markets, where the penetration of credit cards remains low — hence, there are very few people with a traditional credit score. This has created an opportunity for startups to look at other metrics to determine who should get a loan.

FinAccel’s team poses for a picture

Garg said Kredivo looks at a range of data points, including the kind of smartphone model a customer is using, and the apps they have installed on it. “Basically what we’re doing is almost like creating a user profile about the user using a combination of different data signals that come from the existing credit bureaus, the telcos, the e-commerce accounts, the bank accounts and the users themselves,” he said.

“All of that creates a 360-degree overview of the customer that helps us determine the risk factors and decide whether to issue the credit,” he added. As of today, Kredivo is only approving about one-third of the applications it receives.

Jikwang Chung, managing director of Mirae Asset Capital, the strategic investment arm of Mirae Asset, said in a statement that FinAccel is one of the leading companies in Southeast Asia that is able to “combine a strong technology DNA with top-tier risk management and a bold vision of financial inclusion.”

FinAccel, which works with banks to finance the credit to customers, has evaluated more than 3 million applications to date and disbursed nearly 30 million loans. Garg said the startup is now working to develop more financial services, such as low-interest education and healthcare loans.

In the next three to four years, it aims to grow to 10 million users and expand to other Southeast Asian markets such as the Philippines, Thailand, and Vietnam.

A handful of other startups also operate in this space in Indonesia. C88, which also offers credit to customers, last year raised $28 million in a financing round led by Experian.

Powered by WPeMatico

La Jolla, Calif.-based Fulcrum, a job-placement company for technical projects, has raised $1 million in a seed round of funding, led by local technology investment firm Greatscale Ventures with participation from several private co-investors, the company said.

The company has what it calls a fully compliant service for hiring freelancers onto technical projects that had previously only been the purview of full-time staffers — or work that would have been outsourced to pricey consulting firms.

Fulcrum says that its job-placement platform meets the regulatory requirements in 90 countries and is designed to give businesses the ability to design, manage and execute projects on demand.

The company scrapes all marketplaces that freelancers currently use and onboards them through its own service so that they can work effectively with large corporations.

Powered by WPeMatico

Uncapped, a London-headquartered and Warsaw-based startup that wants to provide “revenue-based” finance to growing European businesses, is officially launching today and disclosing that it has raised £10 million in funding.

The capital is a mixture of equity funding and debt (money it can use for lending), and sees the fintech company backed by Rocket Internet’s Global Founders Capital, White Star Capital and Seedcamp.

I understand a number of angel investors also participated. They include Robert Dighero (partner at Passion Capital), Carlos Gonzalez-Cadenas (COO of GoCardless) and David Nolan and Kevin Glynn (founders of Butternut Box).

Founded by “serial entrepreneur” Asher Ismail (who was most recently CEO of Midrive) and former VC Piotr Pisarz, Uncapped has set out to use various marketing, sales and accounting data to be able to offer finance for young businesses based on their current (and projected) revenue.

Specifically, Uncapped says it will enable founders to access working capital between £10,000 and £1 million for a flat fee of 6%. It’s being pitched as a smart alternative for growing companies that don’t want to give away equity in return for capital to help grow.

“The first decision that entrepreneurs need to make when raising finance is whether to give away a portion of equity in their company or take on debt,” explains Ismail. “Equity is a slow and very expensive way to fund growth, while loans add more risk. We’re creating an alternative that sits between debt and equity financing, while offering the benefits of both. We started Uncapped so that entrepreneurs wouldn’t have to give up a piece of their company or put up their house.”

Ismail says that Uncapped provides entrepreneurs with access to capital without the need for “personal guarantees, credit checks, warrants or equity,” and promises to move a lot quicker than investors, or for that matter, more traditional forms of debt finance, can.

“We don’t require customers to share any business plans, cap tables or pitch decks,” he adds. “All we need is to verify their business performance. We connect to the business’ existing sales and marketing platforms, like Stripe, Shopify and Facebook. Revenue-based finance also gives founders the flexibility to repay less when their sales slow or the market hits a downturn.”

The only stipulation is that businesses must be based on online payments and have at least nine months trading history. This makes Uncapped particularly suitable for companies operating e-commerce, SaaS, direct-to-consumer, gaming and app development businesses.

“For example, our first customer was online menswear brand, L’Estrange,” Pisarz tells me. “For e-commerce businesses, December is typically the most challenging time to invest in growth, as inventory and marketing costs are at a peak but Christmas sales have not yet come through. We were able to provide the business with an advance within three days.”

Meanwhile, Ismail claims that Uncapped is the first company of its kind to launch in Europe (which is somewhat of a stretch) and that venture capital — although very different — is probably the closest alternative form of financing.

“Despite the $35 billion invested in Europe by VCs this year, many companies do not fit the venture model,” he says. “They might be a family business that doesn’t intend to sell, an entrepreneur focused on more of a niche market or minority who may be overlooked by traditional funders. Whilst VCs will often meet 1,500 companies and back just five of them a year, we have the ability to provide hundreds of businesses with growth capital for a flat fee much faster and without sacrificing equity at an early stage.”

Powered by WPeMatico

You may have heard the pitch before, Facebook, Twitter and Instagram aren’t homes for your real friends anymore because they’re too big, too commercial and too influencer-y, the result is that your most important relationships have been relegated to the lowest common denominator tool on your phones: your texting app.

Cocoon, a startup from a couple of ex-Facebook employees that went through YC earlier this year, is hoping to create the dedicated software that you use for that most important group chat in your life. The iOS-only app is a bit of a cross between Life360, Slack and Path.

While Life360 is the app for concerned parents, Cocoon wants to be the app for curious long-distance families who want to check on their family and closest friends more easily. The app is structured around a Slack channel-like feed where photo, text and location updates can be pushed alongside threaded replies. Like Life360, you can can also access a dashboard of a group’s users and see where they are located in the world and whether they’re at home or work based on group-designated locations. It’s the app’s focus on close friends that has drawn comparisons to Dave Morin’s oft-loved social networking app Path.

“I am always super open and welcome to comparisons to Path because I loved it and it was totally an awesome app,” co-founder Alex Cornell tells TechCrunch. “When you look at our narratives and what we’re trying to accomplish — the goals of supporting close friends and family — there is a lot of similarity there. But at the core, our solution is actually quite different.”

That core difference, the founders tell me, is that Cocoon isn’t a social network. People are signing up to be in this small group with a few close friends of family members but the groups are closed and users aren’t (currently) logging into multiple groups.

“The main thing with a network is like that people aren’t necessarily all connected to one another, it’s asymmetrical so my friends aren’t friends with your friends and when I post a photo, you’re seeing comments from people you don’t know,” Cornell adds.

There are some clean parallels to other consumer apps, but the biggest competitor to Cocoon is what goes down in the small groups you have in iMessage or any of your other chat apps. Cocoon wants to be a properly-interfaced social network inside a group chat where everything is for the group’s benefit only. A lot is still in flux just one day after launch and the founders are hoping they can learn more about what people want from the app from its earliest users.

Like Path, the startup has a noble goal but a social app with dramatically lessened network effects certainly seems like it might have some sustainability issues. The app is currently free, but the founders say that they won’t be selling any user data or surfacing ads, hoping to add in a subscription pricing model to sustain the business. “It’s definitely top of mind and something that we want to do sooner rather than later,” CEO Sachin Monga tells us.

The company has a bit of cash to sustain things on their own for a while. Cocoon wrapped a $3 million seed round in May led by Lerer Hippeau with Y Combinator, Susa Ventures, Norwest Venture Partners, Advancit Capital, Foundation Capital, iNovia, Shrug Capital and SV Angel also participating.

Powered by WPeMatico

Why are we all trapped in enterprise chat apps if we talk 6X faster than we type, and our brain processes visual info 60,000X faster than text? Thanks to Instagram, we’re not as camera-shy anymore. And everyone’s trying to remain in flow instead of being distracted by multi-tasking.

That’s why now is the time for Loom. It’s an enterprise collaboration video messaging service that lets you send quick clips of yourself so you can get your point across and get back to work. Talk through a problem, explain your solution, or narrate a screenshare. Some engineering hocus pocus sees videos start uploading before you finish recording so you can share instantly viewable links as soon as you’re done.

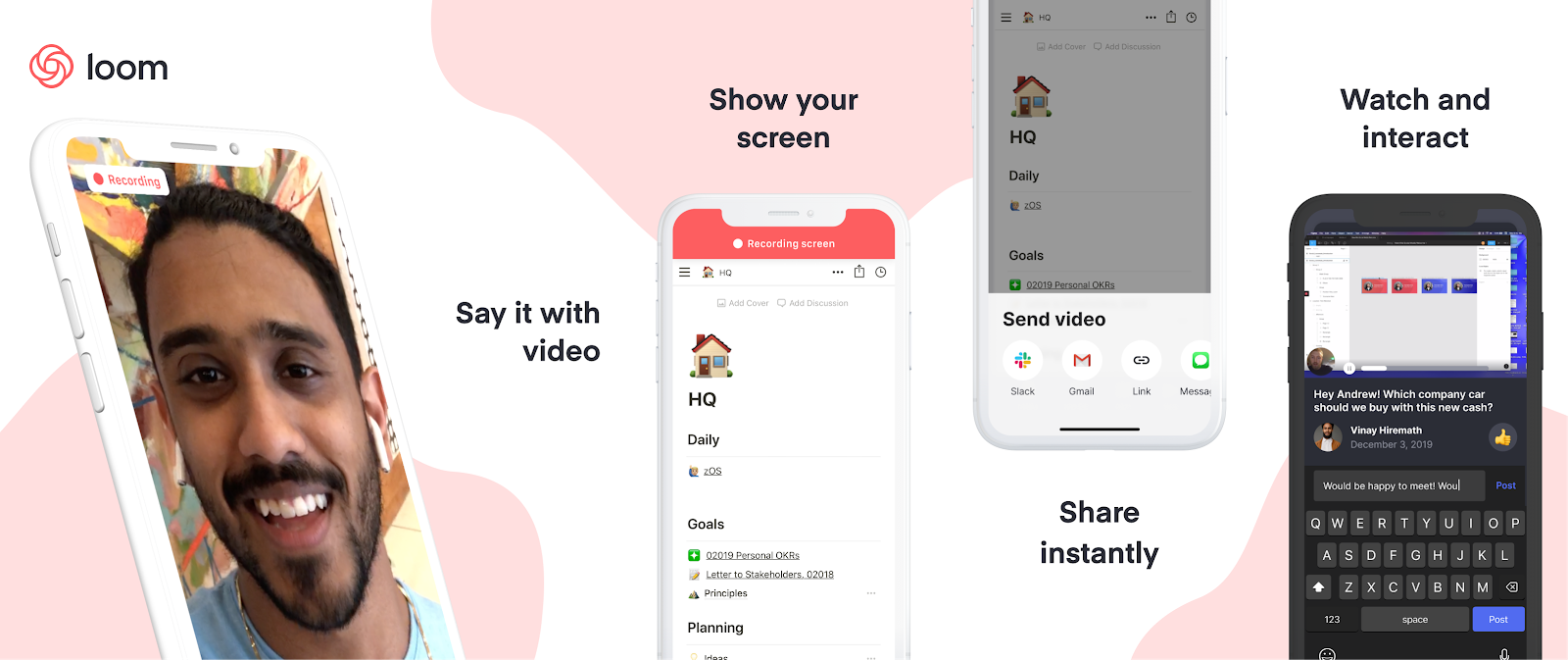

Loom video messaging on mobile

“What we felt was that more visual communication could be translated into the workplace and deliver disproportionate value” co-founder and CEO Joe Thomas tells me. He actually conducted our whole interview over Loom, responding to emailed questions with video clips.

Launched in 2016, Loom is finally hitting its growth spurt. It’s up from 1.1 million users and 18,000 companies in February to 1.8 million people at 50,000 businesses sharing 15 million minutes of Loom videos per month. Remote workers are especially keen on Loom since it gives them face-to-face time with colleagues without the annoyance of scheduling synchronous video calls. “80% of our professional power users had primarily said that they were communicating with people that they didn’t share office space with” Thomas notes.

A smart product, swift traction, and a shot at riding the consumerization of enterprise trend has secured Loom a $30 million Series B. The round that’s being announced later today was led by prestigious SAAS investor Sequoia and joined by Kleiner Perkins, Figma CEO Dylan Field, Front CEO Mathilde Collin, and Instagram co-founders Kevin Systrom and Mike Krieger.

“At Instagram, one of the biggest things we did was focus on extreme performance and extreme ease of use and that meant optimizing every screen, doing really creative things about when we started uploading, optimizing everything from video codec to networking” Krieger says. “Since then I feel like some products have managed to try to capture some of that but few as much as Loom did. When I first used Loom I turned to Kevin who was my Instagram co-founder and said, ‘oh my god, how did they do that? This feels impossibly fast.’”

Systrom concurs about the similarities, saying “I’m most excited because I see how they’re tackling the problem of visual communication in the same way that we tried to tackle that at Instagram.” Loom is looking to double-down there, potentially adding the ability to Like and follow videos from your favorite productivity gurus or sharpest co-workers.

Loom is also prepping some of its most requested features. The startup is launching an iOS app next month with Android coming the first half of 2020, improving its video editor with blurring for hiding your bad hair day and stitching to connect multiple takes. New branding options will help external sales pitches and presentations look right. What I’m most excited for is transcription, which is also slated for the first half of next year through a partnership with another provider, so you can skim or search a Loom. Sometimes even watching at 2X speed is too slow.

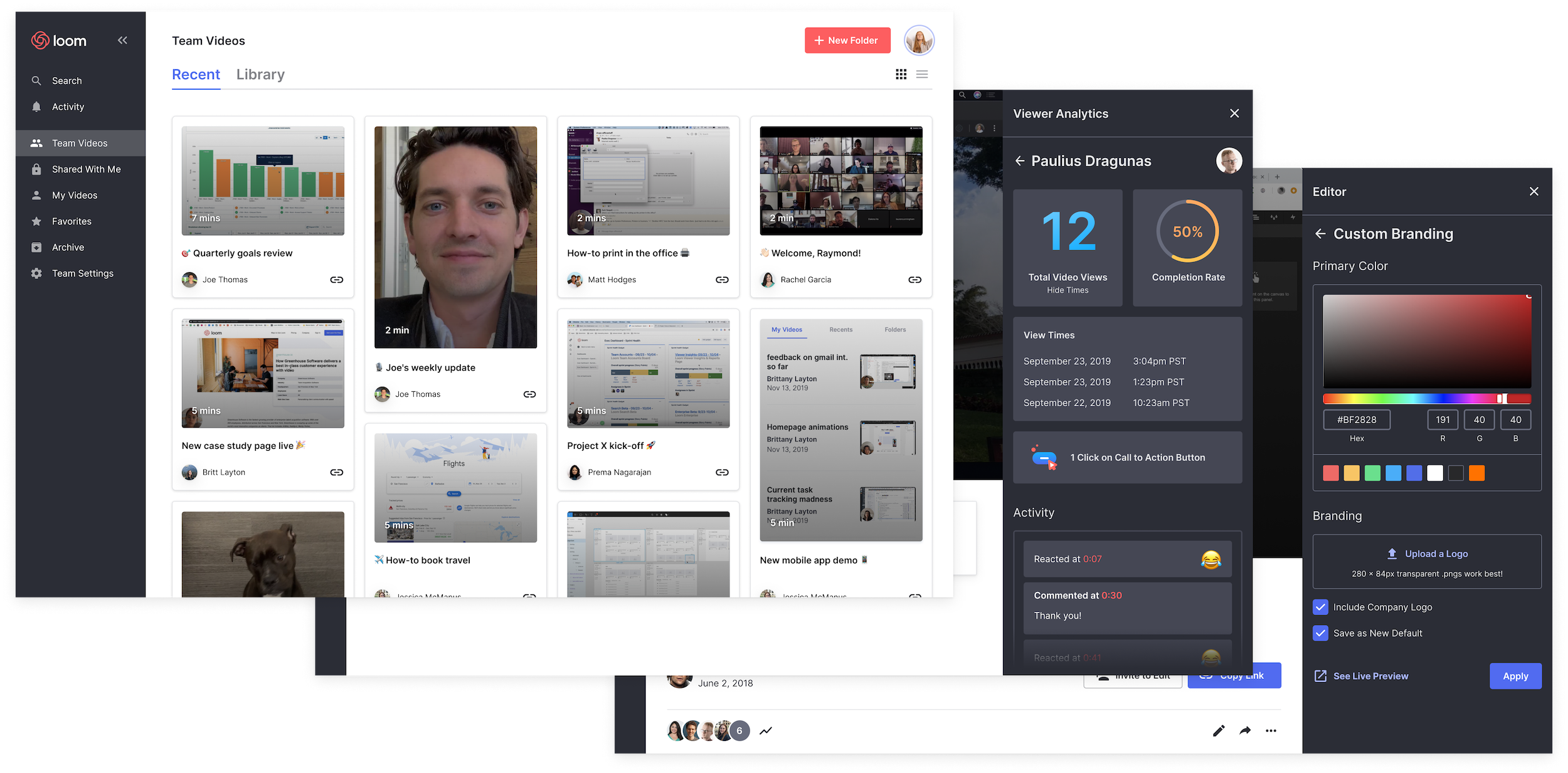

But the point of raising a massive $30 million Series B just a year after Loom’s $11 million Kleiner-led Series A is to nail the enterprise product and sales process. To date, Loom has focused on a bottom-up distribution strategy similar to Dropbox. It tries to get so many individual employees to use Loom that it becomes a team’s default collaboration software. Now it needs to grow up so it can offer the security and permissions features IT managers demand. Loom for teams is rolling out in beta access this year before officially launching in early 2020.

Loom’s bid to become essential to the enterprise, though, is its team video library. This will let employees organize their Looms into folders of a knowledge base so they can explain something once on camera, and everyone else can watch whenever they need to learn that skill. No more redundant one-off messages begging for a team’s best employees to stop and re-teach something. The Loom dashboard offers analytics on who’s actually watching your videos. And integration directly into popular enterprise software suites will let recipients watch without stopping what they’re doing.

To build out these features Loom has already grown to a headcount of 45, though co-founder Shahed Khan is stepping back from company. For new leadership, it’s hired away former head of web growth at Dropbox Nicole Obst, head of design for Slack Joshua Goldenberg, and VP of commercial product strategy for Intercom Matt Hodges.

Still, the elephants in the room remain Slack and Microsoft Teams. Right now, they’re mainly focused on text messaging with some additional screensharing and video chat integrations. They’re not building Loom-style asynchronous video messaging…yet. “We want to be clear about the fact that we don’t think we’re in competition with Slack or Microsoft Teams at all. We are a complementary tool to chat” Thomas insists. But given the similar productivity and communication ethos, those incumbents could certainly opt to compete. Slack already has 12 million daily users it could provide with video tools.

Loom co-founder and CEO Joe Thomas

Hodges, Loom’s head of marketing, tells me “I agree Slack and Microsoft could choose to get into this territory, but what’s the opportunity cost for them in doing so? It’s the classic build vs. buy vs. integrate argument.” Slack bought screensharing tool Screenhero, but partners with Zoom and Google for video chat. Loom will focus on being easily integratable so it can plug into would-be competitors. And Hodges notes that “Delivering asynchronous video recording and sharing at scale is non-trivial. Loom holds a patent on its streaming, transcoding, and storage technology, which has proven to provide a competitive advantage to this day.”

The tea leaves point to video invading more and more of our communication, so I expect rival startups and features to Loom will crop up. Vidyard and Wistia’s Soapbox are already pushing into the space. As long as it has the head start, Loom needs to move as fast as it can. “It’s really hard to maintain focus to deliver on the core product experience that we set out to deliver versus spreading ourselves too thin. And this is absolutely critical” Thomas tells me.

One thing that could set Loom apart? A commitment to financial fundamentals. “When you grow really fast, you can sometimes lose sight of what is the core reason for a business entity to exist, which is to become profitable. . . Even in a really bold market where cash can be cheap, we’re trying to keep profitability at the top of our minds.”

Powered by WPeMatico

E-commerce now accounts for 14% of all retail sales, and its growth has led to a rise in the fortunes of startups that build tools to enable businesses to sell online. In the latest development, a company called VTEX — which originally got its start in Latin America helping companies like Walmart expand their business to new markets with an end-to-end e-commerce service covering things like order and inventory management, front-end customer experience and customer service — has raised $140 million in funding, money it will be using to continue taking its business deeper into more international markets.

The investment is being led by SoftBank, specifically via its Latin American fund, with participation also from Gávea Investimentos and Constellation Asset Management. Previous investors include Riverwood and Naspers; Riverwood continues to be a backer, the company said.

Mariano Gomide, the CEO who co-founded VTEX with Geraldo Thomaz, said the valuation is not being disclosed, but he confirmed that the founders and founding team continue to hold more than 50% of the company. In addition to Walmart, VTEX customers include Levi’s, Sony, L’Oréal and Motorola . Annually, it processes some $2.4 billion in gross merchandise value across some 2,500 stores, growing 43% per year in the last five years.

VTEX is in that category of tech businesses that has been around for some time — it was founded in 1999 — but has largely been able to operate and grow off its own balance sheet. Before now, it had raised less than $13 million, according to PitchBook data.

This is one of the big rounds to come out of the relatively new SoftBank Innovation Fund, an effort dedicated to investing in tech companies focused on Latin America. The fund was announced earlier this year at $2 billion and has since expanded to $5 billion. Other Latin American companies that SoftBank has backed include online delivery business Rappi, lending platform Creditas and property tech startup QuintoAndar.

The common theme among many SoftBank investments is a focus on e-commerce in its many forms (whether that’s transactions for loans or to get a pizza delivered), and VTEX is positioned as a platform player that enables a lot of that to happen in the wider marketplace, providing not just the tools to build a front end, but to manage the inventory, ordering and customer relations at the back end.

“VTEX has three attributes that we believe will fuel the company’s success: a strong team culture, a best-in-class product and entrepreneurs with profitability mindset,” said Paulo Passoni, managing investment partner at SoftBank’s Latin America fund, in a statement. “Brands and retailers want reliability and the ability to test their own innovations. VTEX offers both, filling a gap in the market. With VTEX, companies get access to a proven, cloud-native platform with the flexibility to test add-ons in the same data layer.”

Although VTEX has been expanding into markets like the U.S. (where it acquired UniteU earlier this year), the company still makes some 80% of its revenues annually in Latin America, Gomide said in an interview.

There, it has been a key partner to retailers and brands interested in expanding into the region, providing integrations to localise storefronts, a platform to help brands manage customer and marketplace relations, and analytics, competing against the likes of SAP, Oracle, Adobe and Salesforce (but not, he said in answer to my question, Commercetools, which builds Shopify -style API tools for mid and large-sized enterprises and itself raised $145 million last month).

E-commerce, as we’ve pointed out, is a business of economies of scale. Case in point: While VTEX processes some $2.5 billion in transactions annually, it makes a relatively small return on that — $69 million, to be exact. This, plus the benefit of analytics on a wider set of big data (another economy of scale play), are two of the big reasons VTEX is now doubling down on growth in newer markets like Europe and North America. The company now has 122 integrations with localised payment methods.

“At the end of the day, e-commerce software is a combination of knowledge. If you don’t have access to thousands of global cases you can’t imbue the software with knowledge,” Gomide said. “Companies that have been focused on one specific region are now realising that trade is a global thing. China has proven that, so a lot of companies are now coming to us because their existing providers of e-commerce tools can’t ‘do international.’ ” There are very few companies that can serve that global approach and that is why we are betting on being a global commerce platform, not just one focused on Latin America.”

Powered by WPeMatico