Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

The big new round of funding for Passport’s ticketing and parking management tech proves that software can even disrupt something as mundane and seemingly low-tech as the parking lot.

The startup, which just raised $65 million in new financing from investors, is a permitting, parking and ticketing management service for cities, office parks and campuses.

The capital commitment more than doubles the North Carolina-based startup’s funding to $125 million and is actually the second big investment round of the year for a parking tech company. SpotHero, the Chicago-based marketplace for parking, raised $50 million earlier in the year, and other services related to auto care and servicing in parking lots or on-demand have raised tens of millions of dollars as well.

“In the future, almost everyone in the world will live in a city, so there’s no more important challenge to work on than how people move throughout communities and transact with cities,” said Bob Youakim, Passport co-founder and chief executive, in a statement. “We envision a world where mobility is seamless. To bring this vision to life, we are creating an open ecosystem where any entity — a connected or autonomous vehicle, a mapping app, or a parking app — can leverage our transactional infrastructure to facilitate digital parking payments.”

Passport’s application interfaces allow any government to set up electronic payments for parking tickets and with mobile readers can scan licenses to check for permits and approvals that car owners have through the company’s management service.

With the close of the new round, Habib Kairouz from Rho Capital Partners and Scott Hilleboe from H.I.G. will both take seats on the company’s board of directors.

The company processes more than 100 million transactions per year and will see $1.5 billion pass through its system this year.

Powered by WPeMatico

According to CEO Afif Khoury, we’re in the middle of “the third wave of social” — a shift back to local interactions. And Khoury’s startup Soci (pronounced soh-shee) has raised $12 million in Series C funding to help companies navigate that shift.

Soci works with customers like Ace Hardware and Sport Clips to help them manage the online presence of hundreds or thousands of stores. It allows marketers to post content and share assets across all those pages, respond to reviews and comments, manage ad campaigns and provide guidance around how to stay on-brand.

It sounds like most of these interactions are happening on Facebook. Khoury told me that Soci integrates with “40 different APIs where businesses are having conversations with their customers,” but he added, “Facebook was and continues to be the most prominent conversation center.”

Khoury and CTO Alo Sarv founded Soci back in 2012. Khoury said they spent the first two years building the product, and have subsequently raised around $30 million in total funding.

“What we weren’t building was a point solution,” he said. “What we were building was a massive platform … It took us 18 months to two years to really build it in the way we thought was going to be meaningful for the marketplace.”

Soci has also incorporated artificial intelligence to power chatbots that Khoury said “take that engagement happening on social and move it downstream to a call or a sale or something relevant to the local business.”

The new round was led by Vertical Venture Partners, with participation from Grayhawk Capital and Ankona Capital. Khoury said the money will allow Soci to continue developing its AI technology and to build out its sales and marketing team.

“Ours is a very consultative sale,” he said. “It’s a complicated world that you’re living in, and we really want to partner and have a local presence with our customers.”

Powered by WPeMatico

As Airbnb absorbs more and more of the demand for housing, it’s exploring how to monetize opportunities beyond vacation rentals. A marketplace for longer-term corporate housing could be a huge business, but rather than build that itself, Airbnb is making a strategic investment in one of the market leaders called Zeus Living, which will list its homes on the Airbnb site.

In just four years of redecorating landlords’ homes and renting them to relocated workers for 30-day stays (or longer), Zeus Living has grown to a $100 million revenue run rate. It boosted revenue 300% in 2019, and now has 250 employees and more than 2,000 homes under management. Zeus makes money by charging landlords one free month of usage, and marking up the rent charged to customers. It could rent out a $4,000 per month home for $5,000 plus take the extra month to earn $16,000 in a year.

Zeus CEO and co-founder Kulveer Taggar tells me, “I fundamentally believe that a lot of human potential is bound by location. At Zeus, we’re deeply committed to making it easier for people to live where opportunity takes them.” It’s already hosted 27,000 residents for a total of 650,000 nights.

Strong margins, swift momentum and that megatrend of more mobile workforces have earned Zeus Living a new $55 million Series B round it’s announcing on TechCrunch today. The funding comes from Airbnb, Comcast, CEAS Investments and TI Platform Management, plus existing investors Alumni Ventures Group, Initialized Capital, NFX and Spike Ventures. The funding comes at a $205 million post-money valuation.

“The opportunity here is huge, consumer spend is going toward housing and everyone needs to stay somewhere. But it’s Kulveer and Zeus’ go-to-market strategy that is impressive,” says Initialized co-founder and managing partner Garry Tan. “Zeus decided to start with corporate rentals, which we believe is the best go-to-market since it is the highest margin, and capital efficiency wins in a space with many competitors. Corporate needs are longer term, consistent and predictable, and partnering with Airbnb strengthens this approach as they expand to build a platform for every city.”

Zeus co-founder and CEO Kulveer Taggar

Zeus previously raised a $2.5 million seed and then an $11.5 million Series A led by Initialized, as well as $10 million in debt to cover taking on properties in the San Francisco Bay Area, Los Angeles, New York, Seattle and D.C. Now that it’s scaling up, Zeus could add a sizable debt facility to cover the risk of filling apartments with employees from clients like Brex, Disney, ServiceTitan and Samsara.

Instead of moving into a bland corporate housing block, struggling to find a place themselves or ending up in expensive long-term Airbnbs, workers moving to new cities can go to Zeus. It takes over apartments, handles maintenance and fills them with branded comforts like Parachute bedding and Helix mattresses that Zeus gets at bulk rates. The startup is betting that as workers move between jobs and cities more frequently, fewer will own furniture and instead look for furnished homes like those Zeus offers.

Thanks to the premium stays it provides, Zeus can charge clients a lucrative rate, while Taggar claims his service is still about half the price of standard corporate housing. For property owners, Zeus makes it easy to get a consistent rent paycheck with none of the traditional landlord work. Zeus takes care of cleaning and key exchanges so owners don’t need to do any chores like if they were running an Airbnb. Its goal is to get the first renters in within 10 days of taking on a property.

The new funding will help Zeus expand to more neighborhoods and cities while retaining a focus on breadth within each market so clients have plenty of homes from which to choose. The startup will be revamping its booking and invoicing tools for enterprise partners, and improving how it sources real estate. Meanwhile, it will be investing in customer care to maintain its high 70s NPS scores so relocated workers brag to their colleagues about how nice their new place is.

“Finding housing is stressful and time-consuming for both individuals and employers. As someone who has moved countries four times, I’ve lived through that tension,” says Taggar. “Zeus Living has built technology to remove complexity from housing, turning it into a service that enables a more mobile world.”

Taggar got into the real estate business early, remortgaging his mom’s house to buy a condo in Mumbai to rent out. After moving to the U.S., he built and sold Y Combinator-backed auction tool Auctomatic with co-founder and future Stripe starter Patrick Collison. It was while working on NFC-triggered task launcher Tagstand that Taggar recognized the hassle of both finding new corporate housing and reliably renting out one’s home. With Uber, Stripe and more startups growing huge by simplifying processes that move a lot of money around, he was inspired to do the same with Zeus Living.

“Modern professionals travel more frequently, stay longer and seek accommodations that feel like home. As more companies look to Airbnb for Work for extended-stay and relocation solutions, this segment remains a key focus for Airbnb,” says David Holyoke, global head of Airbnb for Work.

“We have great alignment with the Airbnb team in terms of serving the changing needs of business travelers that want the comforts of home when traveling for extended 30-day stays for work or a project,” Taggar follows. Airbnb can help Zeus drive demand thanks to all its inbound traffic, while Zeus offers Airbnb more supply for customers seeking longer stays.

Zeus Living’s co-founders

Zeus’ biggest threat is that it could get overextended, misjudge demand and end up on the hook to pay rent for two-year leases it can’t fill. And now with more funding, there will be added scrutiny regarding its margins, especially in the wake of the WeWork implosion.

Taggar recognizes these threats. “This is a business where we have to be focused on maximizing the gross profit we generate for the investments we make, with the least amount of risk. At Zeus Living, we’re continuously improving the ways we predict and secure demand.” He’s also building out teams on the ground in different markets to ensure regulatory compliance and push for more conducive laws around 30-day (or longer) rental stays.

Property tech has become a heated space, though, so Zeus will have heavy competition. There are traditional corporate housing providers, pure marketplaces that don’t deal with logistics and direct competitors like $66 million-funded Domio and juggernaut Sonder, which has raised a whopping $360 million. Zeus might also see its model copied abroad before it can get there. Over time, landlords and real estate investment trusts like Blackstone could force Zeus, Sonder and others to compete to pay them the most for leases, eating into all the startups’ margins.

At least with Airbnb as an investor, Zeus won’t have to fear a bitter battle with the tech giant over corporate housing. Instead, Airbnb could keep investing to coin off this adjacent market while listing Zeus properties, or potentially acquired the startup one day. For now though, Taggar just wants to prove startups can be accountable in the real world, acknowledging that taking over people’s homes is “a lot of responsibility! Our homes represent hundreds of millions of dollars of assets we manage and we take that very seriously.”

Powered by WPeMatico

Neuron Mobility, a Singapore-based startup, has closed an $18.5 million financing round as it looks to scale its e-scooter startup in international markets — a month after the nation introduced difficult regulatory changes.

The new financing round, dubbed Series A, was funded by GSR Ventures, a venture capital firm that was the first institutional investor in Chinese ride-hailing giant DiDi Chuxing, and Square Peg, Australia’s largest venture capital firm.

Existing investors SeedPlus and SEEDS Capital also participated in the round. The three-year-old startup has raised about $23.5 million to date.

Neuron Mobility, which began its journey in Singapore, operates an eponymous e-scooter rental platform. In recent years and quarters, Neuron has expanded to cities in Malaysia, Thailand, Australia and New Zealand.

Neuron’s e-scooters are affordable in every market where they are available. In Brisbane, Australia, for instance, anyone can begin a trip with a Neuron bike by paying one Australian Dollar (68 U.S. cents) and then 38 Australian cents for each minute of the ride, Zachary Wang, co-founder and chief executive of Neuron, told TechCrunch in an interview.

These electric scooters can go as fast as 25 kilometre per hour (15.5 miles per hour), and automatically slow down at certain places, such as near a school. Wang said the startup closely works with city councils to understand how these e-scooters should operate.

In a statement, Square Peg’s Tushar Roy said, “the culture of collaboration with cities permeates through Neuron. Its entire DNA is built around working very closely with local leadership to bring new mobility solutions to citizens in a safe and sustainable way.”

On a single charge, a Neuron scooter can travel up to 60 kilometres (37.2 miles). These e-scooters are equipped with a swappable battery. Once the ride is finished, a customer can drop the bike at any nearby parking station or any suitable location. Neuron works with a large number of people who actively swap the batteries on these scooters.

Like India’s electric scooter and bike startups Bounce and Yulu, Neuron Mobility also designs its electric scooters, but relies on a Chinese equipment manufacturer for producing them. (Yulu recently inked a strategic deal with Bajaj Auto to task the Indian auto manufacturing giant with the production job.)

As Neuron expands to international markets, it has had to halt its e-scooter rental service in the home market of Singapore. Last month, Singapore said e-scooters could no longer operate on footpaths, creating major challenges for all the players. Wang and executives from other startups have expressed concerns over the decision.

Telepod, which uses e-scooters to deliver food; GrabFood, another food delivery startup; and shared e-scooter service startup Beam, said they could no longer offer the same level of customer service to their users, and had little choice but to focus on other markets.

Wang said that Neuron still has teams that work from Singapore, but they have always focused on the larger Asia Pacific region and other markets. Besides, Neuron stopped its service in Singapore months before the nation passed any new law. (Prior to the recent order, Singapore had other issues with electric scooters.)

Neuron will use the fresh capital to further its footprint in the markets where it operates and explore building new categories, Wang said. “We feel we are in the midst of a wave where a number of technologies are falling into place that could help us improve our electric scooter and build more mobility solutions.” The startup is also exploring new markets, though Wang declined to name them.

Like in the United States, electric scooters and bikes have imploded in Southeast Asian markets, where a growing number of familiar brands such as Lime, Bird, Ofo, oBike and local players are increasingly expanding their presence.

Powered by WPeMatico

Jow, the French e-grocery app — which combines recipes, recommendations and online grocery ordering — has raised $7 million in new funding.

The round is led by Stride.VC, alongside Caterina Fake and Jyri Engeström from Yes VC, and Shan-Lyn Ma, the co-founder and CEO of Zola. Previous seed backers, DST global partners and eVentures also participated.

Launched in 2018 and now supporting five of France’s leading grocery retailers (Monoprix, Carrefour, Auchan, Chronodrive and E.Leclerc), Jow’s app claims to let you complete your weekly online food shop in as little as a minute (once you’ve been on-boarded, of course).

It does this by creating customised menus, tailored to each user and household, and then automatically fills your online shopping cart with the required ingredients. The idea is to answer the question: “what’s for dinner tonight?” while providing a more cost-effective alternative to recipe kits such as Blue Apron or HelloFresh, and less reliance on take-outs from the likes of Deliveroo or Uber Eats.

“Doing your weekly shopping online can take you up to one hour,” says Jow co-founder and CEO Jacques-Edouard Sabatier. “You waste a lot of time looking for the right product category, sub category, scrolling through hundreds of references, you finally find your product, put it in your cart, and repeat this process up to 40 times (the number of items in your cart)! It’s a horrendous experience, with no added value at all for the customer.”

That’s in contrast to brick and mortar grocery shopping, argues Sabatier, where there is an opportunity to “feel, taste and smell the products.” He says it’s the terrible user experience of grocery shopping online that has limited its e-grocery growth. Jow aims to change that.

“Jow creates a customised menu, just for you, with simple and delicious recipes,” explains Sabatier. “Our food recommendation engine considers your tastes, your kitchen appliances, whether or not you have children and checks the availability of the ingredients in your supermarket. Jow then automatically fills your cart with all the ingredients you need to cook the meals.”

In addition, Jow offers a customised list of your repeat purchases, and its recommendation engine claims to help you choose the exact quantities needed to avoid waste. You also can check out with a single click, and the app will synchronise with your chosen supermarket delivery or pickup service.

Noteworthy is that the app’s recipe-to-cart feature represents on average 75% of the products Jow users add to their cart. Staple products such as toilet paper, beverages, toothpaste etc. make up the remaining 25%.

The app is free for end users, seeing the Paris and New York-based startup generate affiliate revenue from supermarkets that want to use the service to acquire younger, mobile-first customers. The business model is asset light, too, as Jow is largely built on top of the existing infrastructure and capabilities of larger supermarkets.

“Apart from the 50x improvement on the e-grocery funnel, it’s unbelievable to see that to date, in a world where you have tailored and recommended experiences around music, video etc., you have no strong recommendation engine or experiences around food,” adds Sabatier.

In addition, the startup believes that more broadly it has created a mobile e-grocery experience that actually works. “E-grocery is one of the only e-commerce segments where desktop still prevails,” says Sabatier. “[Bucking this trend], 90% of Jow’s customers shop using their mobile devices, the experience is so smooth and fast that you can do your weekly shopping in just one minute on the subway or the bus.”

Powered by WPeMatico

Meatable, the Dutch startup developing cruelty-free technologies for manufacturing cultured meat, is pivoting to pork production as a swine flu epidemic ravages one quarter of the world’s pork supply — and has raised $10 million in financing to support its new direction.

When the company unveiled its technology last year, it was one of several companies working on the production of meat derived from animal cells — a method of meat production that theoretically has a far smaller carbon emissions footprint and is better for the environment than traditional animal farming.

At the time, it was one of several companies — including Memphis Meats, Future Meat Technologies, Aleph Farms, HigherSteaks and many, many pursuing technologies — to bring cultured beef to market. Now, as pork prices rise globally, Meatable becomes one of the first companies to publicly shift gears and turn its attention to the other white meat.

That’s not the only way the company is setting itself apart from its peers in the market. Meatable is also an early claimant to a commercially viable, patented process for manufacturing meat cells without the need to kill an animal as a prerequisite for cell differentiation and growth.

Other companies have relied on fetal bovine serum or Chinese hamster ovaries to stimulate cell division and production, but Meatable says it has developed a process where it can sample tissue from an animal, revert that tissue to a pluripotent stem cell, then culture that cell sample into muscle and fat to produce the pork products that palates around the world crave.

“We know which DNA sequence is responsible for moving an early-stage cell to a muscle cell,” says Meatable chief executive Krijn De Nood.

To pursue its new path, the company has raised $7 million from a slew of angel and institutional investors and a $3 million grant from the European Commission . Angel investors include Taavet Hinrikus, the chief executive and co-founder of TransferWise, and Albert Wenger, a managing partner at the New York-based venture firm Union Square Ventures.

Meatable’s De Nood says that the new cash will be used to accelerate the development of its prototype. The small-scale bioreactor the company had initially targeted for development in 2021 will now be ready by 2020 and the company is hoping to have an industry-scale plant online manufacturing thousands of kilograms of meat by 2025, according to De Nood.

Industrial farming is responsible for between 14% and 18% of the greenhouse gas emissions linked to global climate change and Meatable argues that cultured (lab-grown) meat has the potential to use 96% less water and 99% less land than industrial farming. Powering facilities using renewable energy could further reduce emissions associated with meat production, according to Meatable.

Powered by WPeMatico

It didn’t take much for the founders of Cora, Brazil’s newest startup to tackle some aspect of the broken financial services industry in the country, to raise their first $10 million.

Igor Senra and Leo Mendes had worked together before — founding their first online payments company, MOIP, in 2005. That company sold to WireCard in 2016 and after three years the founders were able to strike out again.

They built their initial business servicing the small and medium-sized businesses that make up roughly two-thirds of the Brazilian economy and represent some trillion dollars’ worth of transactions. But at WireCard, they increasingly were told to approach larger customers that didn’t have the same kind of demand for their services, according to Mendes.

So they built Cora — a technology-enabled lender to the small and medium-sized businesses that they knew so well.

The round was led by Kaszek Ventures, one of Latin America’s largest and most successful investment funds, with participation from Ribbit Capital — one of the most influential early-stage fintech investment firms globally.

“We created Cora to pursue our life purpose, which is to solve the financial problems faced by small and medium businesses. These businesses

The company is currently operating in closed beta and plans to launch its first product, a free SME-only mobile account, in the first half of 2020, according to the statement. Cora will later release a portfolio of payments, credit-related products and financial management tools that are currently being developed.

“So far, large financial institutions have mainly built products that focus either on individuals or on large corporate clients and have totally ignored small and medium sized enterprises, who are the most relevant creators of value in our economies,” said Mendes in a statement. “We want to offer a high-quality, customer-centric suite of financial products that addres

Powered by WPeMatico

Data breaches that could cause millions of dollars in potential damages have been the bane of the life of many a company. What’s required is a great deal of real-time monitoring. The problem is that this world has become incredibly complex. A SANS Institute survey found half of company data breaches were the result of account or credential hacking.

GitGuardian has attempted to address this with a highly developer-centric cybersecurity solution.

It’s now attracted the attention of major investors, to the tune of $12 million in Series A funding, led by Balderton Capital . Scott Chacon, co-founder of GitHub, and Solomon Hykes, founder of Docker, also participated in the round.

The startup plans to use the investment from Balderton Capital to expand its customer base, predominantly in the U.S. Around 75% of its clients are currently based in the U.S., with the remainder being based in Europe, and the funding will continue to drive this expansion.

Built to uncover sensitive company information hiding in online repositories, GitGuardian says its real-time monitoring platform can address the data leaks issues. Modern enterprise software developers have to integrate multiple internal and third-party services. That means they need incredibly sensitive “secrets,” such as login details, API keys and private cryptographic keys used to protect confidential systems and data.

GitGuardian’s systems detect thousands of credential leaks per day. The team originally built its launch platform with public GitHub in mind; however, GitGuardian is built as a private solution to monitor and notify on secrets that are inappropriately disseminated in internal systems as well, such as private code repositories or messaging systems.

Solomon Hykes, founder of Docker and investor at GitGuardian, said: “Securing your systems starts with securing your software development process. GitGuardian understands this, and they have built a pragmatic solution to an acute security problem. Their credentials monitoring system is a must-have for any serious organization.”

Do they have any competitors?

Co-founder Jérémy Thomas told me: “We currently don’t have any direct competitors. This generally means that there’s no market, or the market is too small to be interesting. In our case, our fundraise proves we’ve put our hands on something huge. So the reason we don’t have competitors is because the problem we’re solving is counterintuitive at first sight. Ask any developer, they will say they would never hardcode any secret in public source code. However, humans make mistakes and when that happens, they can be extremely serious: it can take a single leaked credential to jeopardize an entire organization. To conclude, I’d say our real competitors so far are black hat hackers. Black hat activity is real on GitHub. For two years, we’ve been monitoring organized groups of hackers that exchange sensitive information they find on the platform. We are competing with them on speed of detection and scope of vulnerabilities covered.”

Powered by WPeMatico

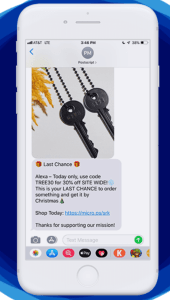

Back in February, we wrote that Postscript “wants to be the Mailchimp for SMS.” Now they’ve raised $4.5 million to help get it done.

This round was led by Accomplice, and backed by Kayak co-founder Paul English, Wufoo co-founder Kevin Hale, Klaviyo co-founder Andrew Bialecki, Drift co-founder Elias Torres, Front co-founder Mathilde Collin and Podium co-founders Eric Rea and Dennis Steele. The Postscript team is currently made up of 14 people.

Postscript is meant to help e-commerce companies — specifically Shopify shops, currently — connect with their existing customers over SMS. Their Shopify plugin lets store owners run SMS marketing campaigns with customers who’ve opted in, have two-way conversations with users who respond and analyze the data to figure out what’s working.

Got a new product hitting the shelves and want to let your most frequent customers know first? Plug the message into Postscript’s dashboard, tell it what segment of your customer base you want to receive it and send away. Their analytics backend will tell you how many people received it, how many actually clicked through and how much revenue you pulled in from those clicks.

If a customer types out a text and responds, it’ll pop up in the backend like a support ticket. Shop owners and employees can respond and have direct conversations, answer questions and close out the ticket through the dashboard — or they can automatically pipe them into services like Zendesk or Zapier.

But what about spam? Our text message inboxes tend to feel like the last refuge from the overwhelming onslaught of marketing messages that have ruined e-mail; do we really want shops pinging our phones directly every time they’ve got a new pair of pants?

It seems like Postscript is pretty mindful of this, and is building things in a way that limits just how “spammy” anyone on the platform can be — partly because (as we’ve seen with e-mail) flooding users with unwanted messages ensures that messages just don’t get opened, and partly because SMS is much more tightly regulated than many other messaging protocols. Under the Telephone Consumer Protection Act (TCPA) in the U.S., for example, SMSing marketing messages to someone without an explicit opt-in can get the company nailed with fines of thousands of dollars per text.

As Lucas Matney wrote in February:

The opt-in process for phone communications is already a bit more codified in the U.S., and as companies attempt to stay in the good graces of GDPR for fear of the EU god, it might be more likely they tread carefully.

As such, everything is opt-in, and easily opted out of if a user changes their mind. It also helps, of course, that sending SMS isn’t free for the companies. Each SMS you send to a customer who doesn’t care is money wasted — so there’s interest on all sides on limiting messages to just the folks who actually want them.

Postscript pricing varies depending on how many messages a shop is looking to send each month. Paid plans start at $50 a month for 1,500 SMS, climbing up to $2,000 per month for 83,000 messages — after that, they ask shops to reach out for a custom plan. Postscript co-founder Alex Beller tells me the company currently has around 530 paying customers, each spending anything from $50 per month to “the mid five figures.”

Powered by WPeMatico

Three months after Goldman Sachs lent $100 million to Mexican fintech Konfio, SoftBank has invested another $100 million into the financial services company. The investment confirms Reuters’ August report that SoftBank was in advanced talks with the startup — now one of the most heavily funded fintechs in Mexico.

SoftBank is continuing to expand its Mexican portfolio, which now includes used car buying platform Kavak and payments startup Clip. Aside from Mexico, SoftBank has primarily focused its $5 billion Latin America fund on Brazil — and recently marked its entry into Argentina with an injection into financial services company Uala in a $150 million investment co-led by Tencent.

As traditional banks shy away from small to medium-sized business loans in Mexico, Konfio’s credit underwriting service provides a faster alternative. Konfio uses a data-first approach to enable fast credit assessment for SMBs looking to grow their businesses. The service can disburse credit in a one-day turnaround, as opposed to locking users into a traditional months-long approval process that can often require collateral.

Meanwhile, if you’re a startup gathering massive amounts of data on Latin America’s growing middle class, SoftBank might be interested in your growth funding. The Japanese conglomerate seems to want to know everything it can about Latin America’s consumer spending habits, mobile usage and personal banking user behavior.

Watch Konfio founder and CEO David Arana’s panel at TechCrunch’s São Paulo event here.

Powered by WPeMatico