Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Licious, a Bangalore-based startup that sells fresh meat and seafood online, has secured $30 million in a new financing round as it looks to expand its footprint in the nation.

The new financing round, dubbed Series E, for the four-year-old startup was led by Singapore-based Vertex Growth Fund, it said Monday. Existing investors 3one4 Capital, Bertelsmann India Investments, Vertex Ventures Southeast Asia and India and Sistema Asia Fund also participated in the round.

The Series E pushes Licious’ to-date raise to $94.5 million.

Licious operates an eponymous e-commerce platform to sell meat and seafood in cities in India (Bengaluru, NCR, Hyderabad, Chandigarh, Panchkula, Mohali, Mumbai, Pune, and Chennai). The startup does not stock any inventory, so any raw material it procures, it processes and ships on the same or next day. It processes more than 17,000 orders every day.

The startup, which employs more than 2,000 people, has built its own supply chain network to control sourcing and production of food, it said. Licious executives said the startup is growing at a healthy rate of 300% year-over-year and aims to generate $140 million in annual revenue by 2023.

Licious will use the fresh capital to expand to more cities in India, and launch new products, said Vivek Gupta, co-founder of the startup.

The startup competes with Bangalore-based FreshToHome, which has amassed more than 650,000 customers in 10 cities in India. As of August, when FreshToHome raised $20 million in a new funding round, the startup was handling 14,000 orders a day.

Gupta said the vast majority of the Indian meat and seafood industry remains unorganized, which has created an immense opportunity for startups to address the sector. The cold-chain market of India is estimated to grow to $37 billion in the next five years, according to industry estimates.

“The traditional meat and seafood industry are in dire need of tech intervention, quality standardisation and a skilled talent pool. Licious is working towards creating these differentiators and will stay committed towards elevating India’s meat and seafood experience,” he said.

Powered by WPeMatico

Reliance Industries, one of India’s largest industrial houses, has acquired a majority stake in NowFloats, an Indian startup that helps businesses and individuals build online presence without any web developing skills.

In a regulatory filing on Thursday, Reliance Strategic Business Ventures Limited said (PDF) it has acquired an 85% stake in NowFloats for 1.4 billion Indian rupees ($20 million).

Seven-and-a-half-year old, Hyderabad-headquartered NowFloats operates an eponymous platform that allows individuals and businesses to easily build an online presence. Using NowFloats’ services, a mom and pop store, for instance, can build a website, publish their catalog, as well as engage with their customers on WhatsApp.

The startup, which has raised about 12 million in equity financing prior to today’s announcement, claims to have helped over 300,000 participating retail partners. NowFloats counts Blume Ventures, Omidyar Network, Iron Pillar, IIFL Wealth Management, and Hyderabad Angels among its investors.

Last year, NowFloats acquired LookUp, an India-based chat service that connects consumers to local business — and is backed by Vinod Khosla’s personal fund Khosla Impact, Twitter co-founder Biz Stone, Narayana Murthy’s Catamaran Ventures and Global Founders Capital.

Reliance Strategic Business Ventures Limited, a wholly-owned subsidiary of Reliance Industries, said that it would invest up to 750 million Indian rupees ($10.6 million) of additional capital into the startup, and raise its stake to about 89.66%, if NowFloats achieves certain unspecified goals by the end of next year.

In a statement, Reliance Industries said the investment will “further enable the group’s digital and new commerce initiatives.” NowFloats is the latest acquisition Reliance has made in the country this year. In August, the conglomerate said it was buying a majority stake in Google-backed Fynd for $42.3 million. In April, it bought a majority stake in Haptik in a deal worth $100 million.

There are about 60 million small and medium-sized businesses in India. Like hundreds of millions of Indians, many in small towns and cities, who have come online in recent years thanks to world’s cheapest mobile data plans and inexpensive Android smartphones, businesses are increasingly building online presence as well.

But vast majority of them are still offline, a fact that has created immense opportunities for startups — and VCs looking into this space — and major technology giants. New Delhi-based BharatPe, which helps merchants accept online payments and provides them with working capital, raised $50 million in August. Khatabook and OkCredit, two digital bookkeeping apps for merchants, have also raised significant amount of money this year.

In recent years, Google has also looked into the space. It has launched tools — and offered guidance — to help neighborhood stores establish some presence on the web. In September, the company announced that its Google Pay service, which is used by more than 67 million users in India, will now enable businesses to accept digital payments and reach their customers online.

Powered by WPeMatico

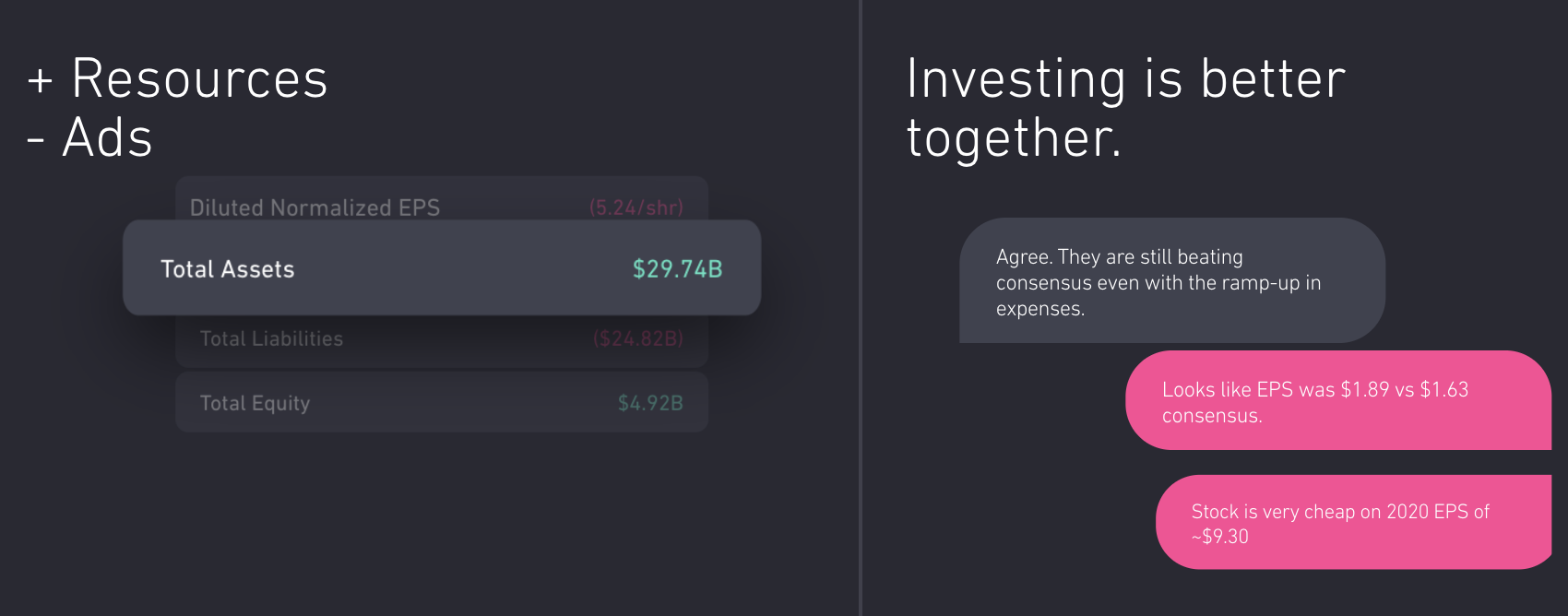

If you want to win on Wall Street, Yahoo Finance is insufficient but Bloomberg Terminal costs a whopping $24,000 per year. That’s why Atom Finance built a free tool designed to democratize access to professional investor research. If Robinhood made it cost $0 to trade stocks, Atom Finance makes it cost $0 to know which to buy.

Today Atom launches its mobile app with access to its financial modeling, portfolio tracking, news analysis, benchmarking and discussion tools. It’s the consumerization of finance, similar to what we’ve seen in enterprise SaaS. “Investment research tools are too important to the financial well-being of consumers to lack the same cycles of product innovation and accessibility that we have experienced in other verticals,” CEO Eric Shoykhet tells me.

In its first press interview, Atom Finance today revealed to TechCrunch that it has raised a $10.6 million Series A led by General Catalyst to build on its quiet $1.9 million seed round. The cash will help the startup eventually monetize by launching premium tiers with even more hardcore research tools.

Atom Finance already has 100,000 users and $400 million in assets it’s helping steer since soft-launching in June. “Atom fundamentally changes the game for how financial news media and reporting is consumed. I could not live without it,” says The Twenty Minute VC podcast founder and Atom investor Harry Stebbings.

Individual investors are already at a disadvantage compared to big firms equipped with artificial intelligence, the priciest research and legions of traders glued to the markets. Yet it’s becoming increasingly clear that investing is critical to long-term financial mobility, especially in an age of rampant student debt and automation threatening employment.

“Our mission is two-fold,” Shoykhet says. “To modernize investment research tools through an intuitive platform that’s easily accessible across all devices, while democratizing access to institutional-quality investing tools that were once only available to Wall Street professionals.”

Shoykhet saw the gap between amateur and expert research platforms firsthand as an investor at Blackstone and Governors Lane. Yet even the supposedly best-in-class software was lacking the usability we’ve come to expect from consumer mobile apps. Atom Finance claims that “for example, Bloomberg hasn’t made a significant change to its central product offering since 1982.”

The Atom Finance team

So a year ago, Shoykhet founded Atom Finance in Brooklyn to fill the void. Its web, iOS and Android apps offer five products that combine to guide users’ investing decisions without drowning them in complexity:

“Our Sandbox feature allows users to create simple financial models directly within our platform, without having to export data to a spreadsheet,” Shoykhet says. “This saves our users time and prevents them from having to manually refresh the inputs to their model when there is new information.”

Shoykhet positions Atom Finance in the middle of the market, saying, “Existing solutions are either too rudimentary for rigorous analysis (Yahoo Finance, Google Finance) or too expensive for individual investors (Bloomberg, CapIQ, Factset).”

With both its free and forthcoming paid tiers, Atom hopes to undercut Sentieo, a more AI-focused financial research platform that charges $500 to $1,000 per month and raised $19 million a year ago. Cheaper tools like BamSEC and WallMine are often limited to just pulling in earnings transcripts and filings. Robinhood has its own in-app research tools, which could make it a looming competitor or a potential acquirer for Atom Finance.

Shoykhet admits his startup will face stiff competition from well-entrenched tools like Bloomberg. “Incumbent solutions have significant brand equity with our target market, and especially with professional investors. We will have to continue iterating and deliver an unmatched user experience to gain the trust/loyalty of these users,” he says. Additionally, Atom Finance’s access to users’ sensitive data means flawless privacy, security, and accuracy will be essential.

The $12.5 million from General Catalyst, Greenoaks, Global Founders Capital, Untitled Investments, Day One Ventures and a slew of angels gives Atom runway to rev up its freemium model. Robinhood has found great success converting unpaid users to its subscription tier where they can borrow money to trade. By similarly starting out free, Atom’s eight-person team hailing from SoFi, Silver Lake, Blackstone and Citi could build a giant funnel to feed its premium tiers.

Fintech can feel dry and ruthlessly capitalistic at times. But Shoykhet insists he’s in it to equip a new generation with methods of wealth creation. “I think we’ve gone long enough without seeing real innovation in this space. We can’t be complacent with something so important. It’s crucial that we democratize access to these tools and educate consumers . . . to improve their investment well-being.”

Powered by WPeMatico

This week Gtmhub announced a $9 million Series A led by CRV. The investment was not a large round, even for an A. But the capital found its way into one of the fastest-growing SaaS companies that we’ve spoken with recently, which made it interesting all the same.

And, the firm was willing to talk about its financial performance in some detail. The combination made its Series A impossible to ignore.

TechCrunch caught up with Gtmhub’s CMO Seth Elliott this morning to learn more.

Let’s start with OKRs. Objectives and key results, better known as OKRs, are a method for organizational planning. They are famous thanks to their roots in Google’s success, but have since broken free of the technology world and become a well-known planning method for corporations of all sizes and types.

Gtmhub deals with them, providing software and services around OKR implementation, training and tracking. (If you an OKR neophyte, head here for a quick overview of what they are.)

Making OKR software isn’t a differentiator in today’s market. Ally does it (it also raised capital recently), along with WorkBoard, Koan and Lattice, among others.

Given the crowded market, Gtmhub stressed during our call how it thinks of itself as differentiated. The company has three things that it hopes will give it an edge in the market. The first is a focus on enterprise customers. According to Elliott, enterprise-sized clients are his company’s “bread and butter,” from a revenue perspective. Instead of starting with a small or mid-sized business target market and later targeting enterprise-scale customers, Gtmhub is going after the top-end of the market first.

Second, the company’s software is designed to interface with external tooling, allowing for real-time OKR tracking as it ingests information to help teams vet how they are progressing against their goals. And, the firm is working on a marketplace where, over time, customers will be able to learn from existing OKR setups and leverage analytics setups that help with data importation and visibility.

In its own words, Gtmhub is an OKR-centric software company, while “provid[ing] a long-term vision and the execution process necessary to bridge the strategy/execution gap,” according to Elliot.

Notably, Gtmhub, despite its enterprise focus, is not abandoning smaller companies. According to Elliot, the startup is announcing a new, stripped-down, $1 per user per month plan next week called START, aimed at smaller firms.

If START is an attempt to onboard companies when they are small so they can be upsold later, or if it is more a contra-competitor move, isn’t clear. But the new, cheap plan (priced at about 10% of other Gtmhub tiers) could shake up the OKR software space by making table-stakes features worth less than they were before.

Gtmhub is a distributed company, with offices in Denver, Sofia, Berlin and London for its roughly 60 workers. You might think, given its global footprint and number of employees, that the company had raised lots of capital to fund its operations. The opposite, as it turns out.

The startup’s $9 million Series A dwarfs its preceding rounds, including about $1.3 million in seed capital raised (here) in February of 2018. Aside from those checks and the new capital, all we know about Gtmhub’s fundraising history is that it picked up $100,000 in angel money in early 2017.

All told, Gtmhub has raised just over $10 million to date, making its Series A about 87% of its known raised capital. That’s not the mark of a company built on burn.

Of course, if Gtmhub kept a lid on its expenses by growing slowly, its parsimony might be more sin than virtue; after all, private companies backed with venture dollars are built for expansion.

The opposite, as it turns out.

Elliot shared a number of notable metrics with TechCrunch that we’ve prepared for you below, in an ingestible format:

Take a moment and square those results with how much capital Gtmhub raised and ask yourself if the performance matches the raise. It doesn’t. I suspect that Gtmhub could have raised a lot more money than it chose to, given its growth rate and other marks of financial health.

But, after expanding to 60 people on less than $3.5 million in known venture, the company probably isn’t too unprofitable, and can do a lot with just $9 million. (Gtmhub could also raise more if it needed to, given its metrics.)

With Gtmhub and Ally each flush with new cash, it’s going to be enjoyable to watch the OKR and OKR-empowered software space grow over the next few years. There will be eventual consolidation, right?

Correction: This post misstated the amount of capital raised by Gtmhub before its Series A and has been corrected.

Photo by Startaê Team on Unsplash

Powered by WPeMatico

Childcare is one of the biggest expenses for American parents — and it’s not just families that are taking a hit. Childcare issues cost the United States’ economy an estimated $4.4 billion in lost productivity each year and also impacts employee retention rates. Kinside wants to help with a platform that not only enables families to get the most out of their family care benefits, but also find the right providers for their kids. The startup announced the public launch of its platform today, along with $3 million in a new funding round led by Initialized Capital.

This brings Kinside’s total raised since it was founded 18 months ago to $4 million. Its other investors include Precursor Ventures, Kairos, Jane VC and Escondido Ventures.

Founded by Shadiah Sigala, Brittney Barrett and Abe Han, Kinside began its private beta with 10 clients while participating in Y Combinator last summer. Over the past year, it has signed up more than 1,000 employers, underscoring the demand for childcare benefits.

“Getting meetings with employers has not been the hard part,” Sigala, Kinside’s CEO, tells TechCrunch. “Any subject line that says ‘do you want childcare for your employees?’ immediately gets a response. We hit a nerve there and when we talked with them, we found that the biggest pain they expressed was that their employees were having a hard time finding childcare.”

The U.S. is the only industrialized country without a national law that guarantees paid parental leave. Companies like Microsoft, Netflix and Deloitte offer strong family benefits in order to recruit and retain talent, but offering similar packages remains a challenge, especially for small to medium-sized businesses. As a result, many employees, especially women, leave their jobs to care for their children, even if they had planned to continue working.

“The worst case for bigger, more mature companies is a delayed return to work, which has a real impact on the bottom line because of lost productivity, but the deeper pain is when we lose the women,” Sigala says. “It’s documented that 43% of women in the professional sector will leave the workforce within one to two years of having a baby.”

Other startups focused on early childhood care that have recently raised funding include Winnie, for finding providers; Wonderschool, which helps people start in-home daycares and preschools;and London-based childcare platform Koru Kids.

Before Kinside, Sigala co-founded Honeybook, a business management platform for small businesses and freelancers. When she got pregnant, Sigala began developing the company’s family benefit policies and became familiar with the hurdles small companies face.

While in Y Combinator, Kinside focused on streamlining the process of using dependent care flexible spending accounts (FSA), or pre-tax benefits, for caregiving costs, after its founders saw that the complicated claims process meant only a fraction of eligible parents get full use of the program. Kinside still helps parents with their accounts by partnering with FSA administrators. Now their app also includes a network of pre-screened early childcare providers, ranging from home-based daycares to large preschools across the country.

The startup pre-negotiates reserved spots and discounted rates for its users and gives them access to a “concierge” made up of childcare professionals to answer questions. Parents can search for providers based on location, cost and childcare philosophy. Sigala says the startup’s team found that many childcare providers have a 20% to 30% vacancy rate, which Kinside addresses by helping them manage openings and find families who are willing to commit to a spot. In addition to its app, Kinside also plans to integrate into human resources systems.

Initialized was co-founded by Alexis Ohanian, also a founder of Reddit, and a vocal advocate of paid parental leave. One of the areas the firm focuses on is “family tech,” and its portfolio also includes startups like the Mom Project, a job search platform for mothers returning to work.

In an email, Initialized partner Alda Leu Dennis said the firm invested in Kinside because “we have this fundamental problem of gender inequality which can be partially attributed to imbalances in the workplace and at home. We have a gender wage gap and domestic responsibilities, still, largely falling on the mother. By solving a problem that men and women have—access to affordable and high-quality childcare—we can improve this situation.”

Dennis added, “the business model innovation that Kinside brings to the table is to involve employers in the process of bringing peace of mind and stability to their employees’ home lives and in turn making their employees more productive.”

Sigala says Kinside sees itself as part of the benefits equity movement, including paid parental leave and, eventually, universal childcare for all working parents. The platform’s users are split equally between men and women, highlighting that the need for caregiving benefits cross gender lines and impact an entire household.

“It’s a complex issue. Our infrastructure and society is still designed for single breadwinner households and yet the economy means that for most households, being able to pay the bills depends on having two parents working,” she adds. “I see this as a movement. It’s the right time.”

Powered by WPeMatico

It was just a couple of months ago that Tines, the cybersecurity automation startup, raised $4.1 million in Series A funding led by Blossom Capital. The Dublin-based company is now disclosing an $11 million extension to the round.

This additional Series A funding is led by venture capital firm Accel, with participation from Index Ventures and previous backer Blossom Capital. The extra cash will be used to continue developing its cybersecurity automation platform and for further expansion into the U.S. and Europe.

Founded in February 2018 by ex-eBay, PayPal and DocuSign security engineer Eoin Hinchy, and subsequently joined by former eBay and DocuSign colleague Thomas Kinsella, Tines automates many of the repetitive manual tasks faced by security analysts so they can focus on other high-priority work. The pair had bootstrapped the company as recently as October.

“It was while I was at DocuSign that I felt there was a need for a platform like Tines,” explained Hinchy at the time of the initial Series A. “We had a team of really talented engineers in charge of incident response and forensics but they weren’t developers. I found they were doing the same tasks over and over again so I began looking for a platform to automate these repetitive tasks and didn’t find anything. Certainly nothing that did what we needed it to, so I came up with the idea to plug this gap in the market.”

To remedy this, Tines lets companies automate parts of their manual security processes with the help of six software “agents,” with each acting as a multipurpose building block. The idea is that, regardless of the process being automated, it only requires combinations of these six agent types configured in different ways to replicate a particular workflow.

In addition, the platform doesn’t rely on pre-built integrations to interact with external systems. Instead, Tines is able to plug in to any system that has an API. “This means integration with commercial, off-the-shelf products, or existing in-house tools is quick and simple, with most security teams automating stories (workflows) within the first 24 hours,” says the startup. Its software is also starting to find utility beyond cybersecurity processes, with several Tines customers using it in IT, DevOps and HR.

“We heard that Eoin, a senior member of the security team at DocuSign (another Accel portfolio company), had recently left to start Tines, so we got in touch,” Accel’s Seth Pierrepont tells TechCrunch. “They were in the final stages of closing their Series A. However, we were so convinced by the founders, their product approach and the market timing, that we asked them to extend the round.”

Pierrepont also points out that a unique aspect of the Dublin ecosystem is that many of the world’s largest tech companies have their European headquarters in the country (often attracted by relatively low corporation tax), “so it’s an incredibly rich talent pool despite being a relatively small city.”

Asked whether Accel views Tines as a cybersecurity automation company or a more general automation play that puts automation in the hands of non-technical employees for a multitude of possible use cases, Pierrepont says, given Hinchy and Kinsella’s backgrounds, the cybersecurity automation sector should be the primary focus for the company in the short term. However, longer term it is likely that Tines will be adopted across other functions as well.

“From our investment in Demisto (which was acquired by Palo Alto Networks earlier this year), we know the security automation or SOAR category (as Gartner defines it) very well,” he says. “Demisto pioneered the category and was definitively the market leader when it was acquired. However, we think the category is just getting started and that there is still a ton of whitespace for Tines to go after.”

Meanwhile, in less than a year, Tines says it has on-boarded 10 enterprise customers across a variety of industries, including Box, Auth0 and McKesson, with companies automating on average 100,000 actions per day.

Powered by WPeMatico

Zetwerk, an Indian business-to-business marketplace for manufacturing items, has closed a significantly large financing round as it scales its operations in the nation and also helps local businesses find customers overseas.

The 18-month-old startup said on Wednesday it has raised $32 million in a Series B financing round led by Lightspeed and Greenoaks Capital. Zetwerk co-founder and chief executive Amrit Acharya told TechCrunch in an interview that the startup has also raised about $14.2 million in debt from a consortium of banks, and others.

Existing investors Accel, Sequoia India and Kae Capital also participated in the round, which pushes the Bangalore-based startup’s total raise to date to about $41 million. Vaibhav Gupta, co-founder of business-to-business marketplace Udaan, and Maninder Gulati, one of the top executives at budget lodging startup Oyo also participated.

Zetwerk was founded by Acharya, Srinath Ramakkrushnan, Rahul Sharma and Vishal Chaudhary last year. The startup connects OEMs (original equipment manufacturers) and EPC (engineering procurement construction) customers with manufacturing small-businesses and enterprises.

Unlike the more common e-commerce firms we come across every day, Zetwerk sells goods such as parts of a crane, doors, chassis of different machines and ladders. The startup operates to serve customers in fabrication, machining, casting and forging businesses. Currently, Zetwerk works with more than 100 enterprises and 1,500 small and medium-sized businesses. It delivers more than 15,000 parts each month.

“These are all custom-made products,” explained Acharya. “Nobody has a stock of such inventories. You get the order, you find manufacturers and workshops that make them. Our customers are companies that are in the business of building infrastructure.”

“We index these small workshops and understand the kinds of products they have built before. These indexes help bigger companies discover and work with them,” he added.

Once a firm has placed an order, Zetwerk allows them to keep a tab on the progress of manufacturing and then the shipping. This “hand-holding” is crucial, as in this line of business, manufacturing and shipping typically take more than two to three months.

Zetwerk has also enabled manufacturers in India to discover and find clients overseas. Today, manufacturers on the platform export their goods to North America and Southeast Asia, Acharya said. “India has a lot of depth in manufacturing, but much of it has not been tapped well,” he said.

Helping these manufacturing workshops find clients online is still a new phenomenon in the nation. Acharya said Zetwerk largely competes with domain project consultants in the offline work. “They specialize in certain products and geographies. So let’s say someone wanted to buy a machine XYZ in Orissa, they reach out to consultants who help them find workshops and estimate how much time it would take to get the project done.”

According to industry reports, manufacturing today accounts for 14% of India’s GDP. But the nation lacks a supporting ecosystem to execute projects in an efficient manner.

Vaibhav Agarwal, a partner at Lightspeed, said it was unusual to come across a market that is as large as $40 billion to $60 billion in India and global trade-tailwinds that creates opportunity to serve international demand.

The startup plans to infuse portions of the fresh capital into expanding its international operations. Acharya did not share exactly how many clients it has outside of India but said exports currently account for less than 5% of the startup’s GMV, or gross merchandize value.

He said the startup will continue to focus on helping Indian manufacturers find clients outside, as it is better suited to address this, as opposed to helping Indian companies find manufacturers overseas.

The startup will also explore helping its manufacturing workshops access working capital, though Acharya cautioned that it is not something that would happen anytime soon.

In a statement, Prayank Swaroop, a partner at Accel, said, “the use of technology in project planning, procurement, audits, and supply chain transparency is the core offering of Zetwerk which is completely original. Accel is very fortunate to be part of Zetwerk journey since the startup’s inception.”

Powered by WPeMatico

Los Angeles-based ProducePay has inked a $190 million debt facility from CoVenture and TCM Capital to expand its lending business and marketplace for farmers.

ProducePay offers farmers cash advances throughout the growing season to smooth the sometimes lumpy revenues and give farmers a bit more predictability, the company said. It buys produce ahead of delivery and sets itself up as a middle-man between distributors, growers and grocers.

Since its launch in 2015, the company has seen $1.5 billion worth of produce flow across its marketplace; $750 million of those transactions were in the last year.

ProducePay’s pitch to farmers is the company’s centralized marketplace, which the company says offers growers higher pricing and certain payment from distributors, along with better pricing for supplies and services like seed, equipment and logistics services.

The marketplace service, which only launched in October, has already seen $100 million in purchases.

“In just four years, ProducePay has had a transformative effect on the financial health and success of scores of farmers and value-additive distributors in Latin America and the U.S.,” said ProducePay founder and CEO Pablo Borquez Schwarzbeck, in a statement. “This new debt facility will accelerate ProducePay’s impact, empowering more farmers and distributors to run their businesses more profitably, making high quality and affordable fresh produce available throughout the U.S.”

Powered by WPeMatico

In these waning days of the second decade of the twenty-first century, technologists and investors are beginning to lay the foundations for new, truly transformational technologies that have the potential to reshape entire industries and rewrite the rules of human understanding.

It may sound lofty, but new achievements from businesses and research institutions in areas like machine learning, quantum computing and genetic engineering mean that the futures imagined in science fiction are simply becoming science.

And among the technologies that could potentially have the biggest effect on the way we live, nothing looms larger than genetic engineering.

Investors and entrepreneurs are deploying hundreds of millions of dollars to create the tools that researchers, scientists and industry will use to re-engineer the building blocks of life to perform different functions in agriculture, manufacturing and medicine.

One of these companies, 10X Genomics, which gives users hardware and software to determine the functionality of different genetic code, has already proven how lucrative this early market can be. The company, which had its initial public offering earlier this year, is now worth $6 billion.

Another, the still-private company Inscripta, is helmed by a former 10X Genomics executive. The Boulder, Colo.-based startup is commercializing a machine that can let researchers design and manufacture small quantities of new organisms. If 10X Genomics is giving scientists and businesses a better way to read and understand the genome, then Inscripta is giving those same users a new way to write their own genetic code and make their own organisms.

It’s a technology that investors are falling over themselves to finance. The company, which closed on $105 million in financing earlier in the year (through several tranches, which began in late 2018), has just raised another $125 million on the heels of launching its first commercial product. Investors in the round include new and previous investors like Paladin Capital Group, JS Capital Management, Oak HC/FT and Venrock.

“Biology has unlimited potential to positively change this world,” says Kevin Ness, the chief executive of Inscripta . “It’s one of the most important new technology forces that will be a major player in the global economy.”

Ness sees Inscripta as breaking down one of the biggest barriers to the commercialization of genetic engineering, which is access to the technology.

While genome centers and biology foundries can manufacture massive quantities of new biological material for industrial uses, it’s too costly and centralized for most researchers. “We can put the biofoundry capabilities into a box that can be pushed to a global researcher,” says Ness.

Earlier this year, the company announced that it was taking orders for its first bio-manufacturing product; the new capital is designed to pay for expanding its manufacturing capabilities.

That wasn’t the only barrier that Inscripta felt that it needed to break down. The company also developed a proprietary biochemistry for gene editing, hoping to avoid having to pay fees to one of the two laboratories that were engaged in a pitched legal battle over who owned the CRISPR technology (the Broad Institute and the University of California both had claims to the technology).

Powered by WPeMatico

Babies have options these days when it comes to what goes in their mouths. No more is it just the standard mush in a jar. Now they’ve got everything from pouches to organic purees delivered right to their parents’ door — and Yumi is one of several startups cashing in.

The company has just announced that it raised another $8 million from several of Silicon Valley’s household names, including Allbirds, Warby Parker, Harry’s, Sweetgreen, SoulCycle, Uber, Casper and the CEO of Blue Bottle Coffee, James Freeman. That puts the total raised now to $12.1 million.

But it’s a tough and saturated market full of products all vying for mom and dad’s attention, and that’s not a lot of cash to go on, compared to the billion-dollar industry Yumi is up against. According to Zion Market Research, the global baby food market could reach as much as $76 billion by 2021. However, you wouldn’t know Yumi was up against such odds if you ask them and their financial supporters.

The advantage, according to the company, is in providing fresh food alternatives, and that “shelf-stable” competitors like Gerber lack key nutrients parents want for their little ones.

“Our goal is to change the standards for childhood nutrition, and completely upend what it means to be a food brand in America,” Yumi co-founder and CEO Angela Sutherland said. “This group of visionary leaders have all redefined their categories and now we have the opportunity to work together to reimagine early-age nutrition for the next generation.”

Will that bet pay off and help this startup stand out? Sales continue to rise and have risen by 10 times in the last year, according to the company — we’ve asked but don’t know what those sales numbers are, unfortunately. However, Yumi’s bet on fresh and delivered could prove to be just what parents want as the company continues to grow.

“As a parent, Yumi’s mission immediately resonated,” said co-founder and co-CEO of Warby Parker Neil Blumenthal . “As we’ve seen at Warby Parker, and now at Yumi, there is a massive shift happening in the world of retail. There’s now a new generation of consumers who are actively seeking brands that reflect their values and lifestyle — the moat that big, legacy brands once enjoyed has evaporated.”

Powered by WPeMatico