Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

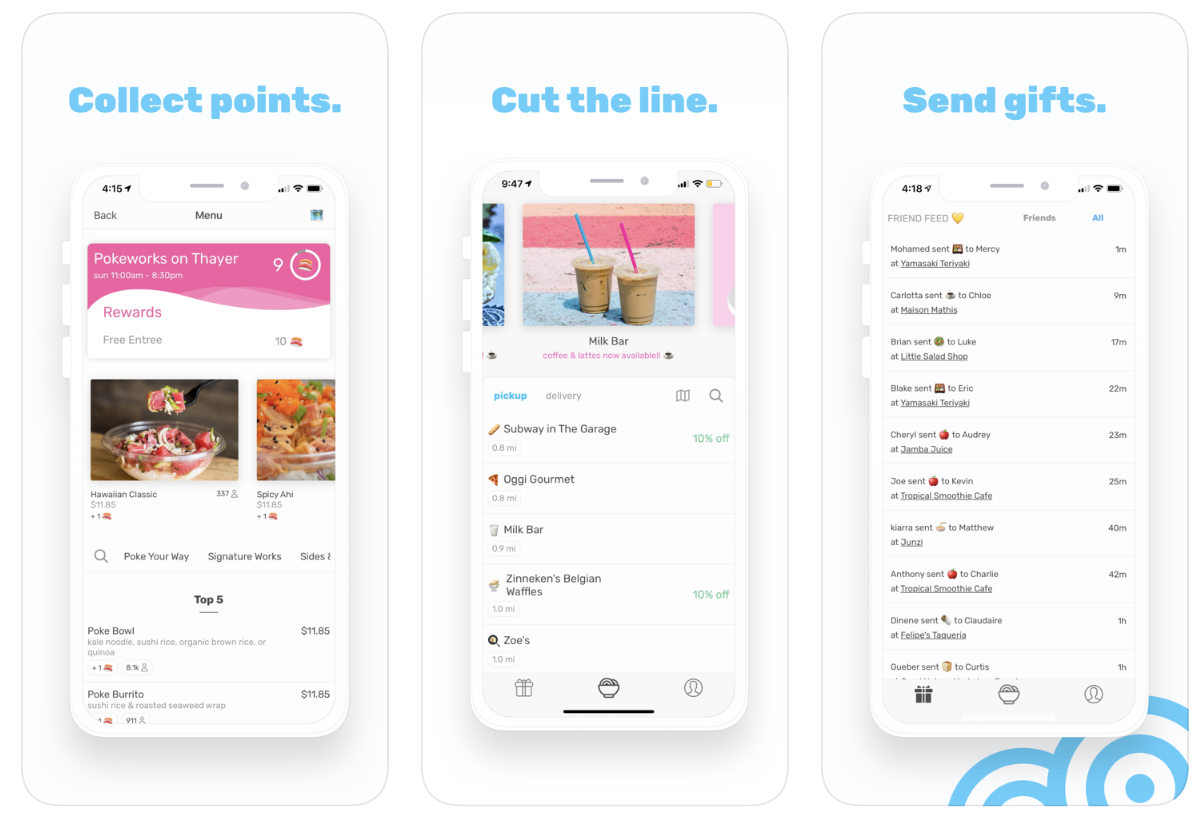

“We were in the back washing blenders so they could keep taking Snackpass orders,” recalls co-founder and CEO Kevin Tan. The team from order-ahead food startup Snackpass was willing to get their hands dirty to keep up with demand at one of their first restaurant partners, Tropical Smoothie Cafe on the Yale University campus.

Why were people so eager to pay for takeout through Snackpass? Because it lets them earn loyalty points to redeem for free food — both for themselves and as gifts for their friends. Sending people Snackpass rewards became a new way to flirt or show gratitude at Yale. And through the Venmo-esque Snackpass social feed, users could keep up with a fresh form of gossip while discovering restaurants.

“Anywhere someone is standing in line to order something, we can solve that with Snackpass,” says Tan. “Consumer spending will be social in the future.”

That future is already taking hold. Two years after launch, Snackpass is on 11 college campuses across the U.S., often boasting a 75% penetration rate amongst students within six months. It takes a cut of every order and keeps margins high because users pick up the food themselves rather than waiting for delivery. While other food ordering startups battle to offer discounts as marauding users deal-hop between apps, Snackpass keeps users coming back through its loyalty program.

Its momentum, retention and opportunity to expand from colleges to dense cities has now won Snackpass a $21 million Series A led by Andreessen Horowitz partner Andrew Chen. The round was joined by other heavy hitters, like Y Combinator, General Catalyst, Inspired Capital and First Round, plus angels, including musician Nas, NFL star Larry Fitzgerald and legendary talent agent Michael Ovitz. Building on Snackpass’ $2.7 million seed, the cash will go toward hiring up with the goal of reaching 100 campuses in two years.

Its momentum, retention and opportunity to expand from colleges to dense cities has now won Snackpass a $21 million Series A led by Andreessen Horowitz partner Andrew Chen. The round was joined by other heavy hitters, like Y Combinator, General Catalyst, Inspired Capital and First Round, plus angels, including musician Nas, NFL star Larry Fitzgerald and legendary talent agent Michael Ovitz. Building on Snackpass’ $2.7 million seed, the cash will go toward hiring up with the goal of reaching 100 campuses in two years.

“Takeout is an important market because it’s huge — also in the hundreds of billions — and fragmented,” writes Chen. “The opportunity complements the food delivery market in a big way: For the average restaurant, there are 6 takeout orders for every delivery order!”

Like many of the best startup ideas, Snackpass was born out of the founders’ own needs at Yale. Slow and expensive food delivery services didn’t make sense for smaller orders like a coffee, ice cream or a pepperoni slice on campuses small enough for customers to walk or bike to the restaurant. Tan says, “I was dabbling in several side projects, including helping a friend who managed a local pizza shop build a website to help better reach the local student community.” He realized how tough it was for restaurants around colleges to retain and reward customers, especially as regulars graduated.

Tan joined up with neuroscience student and Thiel Fellow Jamie Marshall, who became Snackpass’ COO. “I had grown up calling in every order,” Marshall tells me. “Waiting in line didn’t make sense for me. I used every order-ahead platform and thought this was the future.” Jonathan Cameron, a serial entrepreneur who’d built his own order-ahead app called Happy Hour, rounded out the founding team.

Snackpass founders (from left): Jamie Marshall and Kevin Tan

Snackpass offers users a list of nearby restaurants from which they can order ahead, with special tags for ones offering deals. Menu items include counts of how many people have ordered them and how many rewards points you’ll earn buying them. You pay in the app, skip the line at the restaurant and grab your order from the counter. Each restaurant can configure their own rewards system with how much items earn and cost, such as giving you a free coffee for every 10 you buy.

Users can then spend their points to get themselves free menu items, or send a virtual Snackpass gift card to any of their phone contacts or people they find via search. This gives Snackpass a way to grow virally that most food apps lack. Thankfully, you can block people on Snackpass if they get creepy showering you with gifts.

Each purchase and gift on Snackpass shows up in its social feed unless you make it private. “That’s become its own language. People use it to flirt with each other, or bond and connect with someone new,” Tan tells me. “There’s some drama or intrigue there seeing who’s sending gifts to who. People even look at the feed in the way they look at someone’s Instagram to see what’s going on with them.”

Snackpass has also done some integration work specifically for the college market that sets it apart from other order-ahead and delivery services. It can sync with students’ campus meal plans so they can spend them through the app. And student groups from clubs to fraternities can pre-load and replenish accounts for their members. Snackpass works with the same organizations to launch on new campuses. “We host parties, sponsor tailgates and make it feel like a student-led effort so it grows organically across campus communities,” Tan explains. “These efforts, combined with the social feed which would give anyone FOMO if they’re not in the app.”

With all the competition in the space, restaurants can be inundated with apps to manage, some of which just exacerbate spikes in demand that overwhelm kitchens. “There is certainly a risk that local restaurants will start to get platform fatigue, finding that using some apps will take too big of a bite out of their margins,” says Tan. That’s why Snackpass built features that let restaurants batch orders and control how many come in at a certain time so dine-in patients and non-app users aren’t stuck with unreasonable delays.

With all the competition in the space, restaurants can be inundated with apps to manage, some of which just exacerbate spikes in demand that overwhelm kitchens. “There is certainly a risk that local restaurants will start to get platform fatigue, finding that using some apps will take too big of a bite out of their margins,” says Tan. That’s why Snackpass built features that let restaurants batch orders and control how many come in at a certain time so dine-in patients and non-app users aren’t stuck with unreasonable delays.

Snackpass has recruited talent from Uber Eats and an advisor from Yelp’s executive team to help it navigate the tricky SMB sales process. One ace up its sleeve is that it can offer to send push notifications to announce recently signed partners or specials they’re launching, driving the new customers restaurants are desperate for. Tan says his startup is considering if it could charge for this kind of promotion down the line. Most customers who walk into restaurants are effectively in incognito mode, but Snackpass provides its partners with analytics to help them improve their own businesses.

“At the surface level there is a lot of competition in this space,” Tan admits. “The social aspect of the app has been the key differentiator for us. Other companies have been focused on creating the fastest, cheapest, most efficient delivery service, but it’s really hard to make those margins work and consumers are trained to shop around on different apps to get the best deal or fastest delivery time . . . Eating food is supposed to be fun and social, and our generation grew up online and in social networks. We’re combining the social aspect of eating with the utility of order ahead, which has helped us build loyalty and enable retention amongst our users.”

It will still be a battle to overtake long-running competitors like Allset, Level Up and Ritual, plus incumbents that offer takeout pickup like Uber and Grubhub. Logistics is a cut-throat business, and plenty of startups have already failed in the restaurant loyalty space.

Having Andreessen Horowitz’s support could give Snackpass some extra firepower. “A16z has better support and services for their portfolio companies than any other VC we’ve come across and they’ve delivered,” Tan tells me. “We knew that Andrew Chen understands growth and marketplaces from his blog and his Twitter.” That’s critical in a crowded space where such a precise balance of customer acquisition and lifetime value is necessary.

Snapchat, TikTok and Fortnite have all tapped into the youth market with a lighthearted nature that keeps users coming back until they develop network effect. Snackpass is managing to do the same, not with a messaging app or game, but a commerce platform. “We play up creativity, silliness and delight in areas where most companies focus on utility and convenience,” Tan concludes. “We built Snackpass for ourselves and our friends. We’ve carried on this philosophy: if something makes us laugh, we put it in the app.”

Powered by WPeMatico

One of the more notable startups using artificial intelligence to understand and fight cancer has raised $45 million more in funding to continue building out its operations and inch closer to commercialising its work.

Paige — which applies AI-based methods such as machine learning to better map the pathology of cancer, an essential component of understanding the origins and progress of a disease with seemingly infinite mutations (its name is an acronym of Pathology AI Guidance Engine) — says it will be use the funding to inch closer to FDA approvals for products it is developing in areas such as biomarkers and prognostic capabilities.

It also plans to use the funding to continue developing better ways of diagnosing and ultimately fighting the disease, as well as exploring further commercial opportunities for its work, specifically within the bio-pharmaceutical industry.

This round is being led by Healthcare Venture Partners, with previous investor Breyer Capital, Kenan Turnacioglu and other funds participating. The company is not disclosing its valuation, but PitchBook noted that a first close of this round (when it raised $33 million) put the valuation at $208 million. That would value Paige now at about $220 million with the $45 million close, more than three times its valuation in its previous round.

Paige first emerged from stealth back in 2018 — with a bang.

Paige.AI — as it was known at the time — was hatched inside the Memorial Sloan Kettering Cancer Center, one of the world’s foremost institutions both for working on cancer therapies and treating cancer patients, and along with a $25 million investment led by Jim Breyer, Paige had secured exclusive access to MSK’s 25 million pathology slides as well as its intellectual property related to the AI-based computational pathology that underpinned its work. These slides make up one of the biggest repositories of its kind in the world, and as all solutions and services built on machine learning are only as good as the data that’s fed into them, they were critical to the startup’s beginnings.

The startup also launched with some serious talent behind it.

Much of the computational pathology being used by Paige had been developed by Dr Thomas Fuchs, who is known as the “father of computational pathology” and is the director of Computational Pathology in The Warren Alpert Center for Digital and Computational Pathology at Memorial Sloan Kettering, as well as a professor of machine learning at the Weill Cornell Graduate School of Medical Sciences.

Fuchs co-founded Paige with Dr David Klimstra, chairman of the department of pathology at MSK, and Fuchs had originally started out as the CEO of Paige, but was replaced earlier this year by Leo Grady, who joined from another bio-startup, Heartflow (another company backed by Healthcare Venture Partners). Fuchs is still supporting the company, but no longer in an executive role.

In the nearly two years since it launched, there have been some milestones reached. The company, which has around 30 employees today, has been the first to get an FDA breakthrough designation (which helps expedite the long process of drug approvals in urgent areas where there are few or no other options for patients) for using AI in oncology pathology. It’s also the first to get a CE mark in the same category, which opens the door to working in Europe, too. Paige has so far ingested 1.2 million images into its slide database and is using them — in algorithms that also take in genomic data, drug response data and outcome data — to work on developing diagnostic solutions.

But as with all new medical products, progress is not measured in quarters as it might be with a more typical tech startup. Moving fast and breaking things is something to be avoided. So even with all of the above advances, there has yet to be any commercial products launched, nor is Grady giving any specific time frames for when they will. And when the company came out of stealth in 2018, it said it would be focusing on breast, prostate and other major cancers, although today it’s not as quick to specify what its targets will be when it does launch commercial products.

Similarly, it’s also expanding its remit from primarily clinical environments to pharmaceutical ones.

“The clinical side is still our focus, but this is an expansion and realisation that this has a broader impact, and that includes pharmaceutical customers,” Grady said.

And the dropping of the .AI in its name was also intentional, in part a reaction it seems to how much AI gets thrown around today.

“There is a fundamental misconception, which is thinking of AI as a product and not a technology,” said Grady. “It’s a technology set that can allow you to do many things that could not have been done in the past, but you need to apply it in a meaningful way. Developing a good AI and putting that on the market will not cut it in terms of clinical adoption.”

The funding round, Grady said, saw a lot of interest from strategic investors, although the company intentionally has stayed away from these.

“We were approached by all of the scanner vendors and some of the biopharmaceutical companies,” he said. “But we made the decision to not take a strategic investment with this round because we wanted to be neutral with hardware vendors and not be too tied with any one.”

He also pointed to the challenges of talking to investors when you are working in a cutting-edge area (a challenge that has foxed many an investor also into backing the wrong horses, too, such as Theranos).

“We’re at the intersection of three areas: tech, medical devices and clinical medicine, and life sciences and biotech,” he said. “Many investors sit squarely in one and don’t feel comfortable in others. That makes the conversations challenging and short. But there has been an increasing blend between those three sectors.”

That’s where Healthcare Venture Partners fits into the mix. “Paige exemplifies the benefits of digital pathology and represents the bright future of AI-driven medical diagnosis,” said Jeff Lightcap of Healthcare Venture Partners, in a statement. “As hospitals embark on digital transformations, they will face challenges associated with these transitions. We believe Paige addresses many of these issues by enhancing the ability of clinical teams and pathologists to collaborate. We’re confident in Paige’s future and believe they will continue to develop cutting-edge technologies that enable pathology departments to transform their practices, which have changed little in the last century.”

“We applaud Paige’s commitment to building clinical AI products that will improve the diagnostic process and patient care,” added Jim Breyer of Breyer Capital, in a statement. “This is a critical time for Pathology, as pathologists are carrying a heavier workload than ever before. Paige understands their needs and the team has built cutting-edge technologies to address them. Paige represents the future of computational pathology and we look forward to their continued growth and success.”

Powered by WPeMatico

The insurance industry, sleepy and ancient, is ripe for disruption. We’ve seen companies like Lemonade, Hippo and Rhino get in on that opportunity. Today, an insurtech company focused on small business insurance has raised $18 million to keep growing.

Meet Huckleberry, whose Series A was led by Tribe Capital, with participation from Amaranthine, Crosslink Capital and Uncork Capital.

Huckleberry launched in 2017 to offer business insurance, including workers’ compensation and general liability, all through an online portal.

Small business insurance coverage is not like car insurance or renters insurance. It’s not as simple as filling out a few forms and getting a quote. Even if a few platforms do have algorithms for providing quotes, you can’t really close the deal unless you get on the phone.

It’s an incredibly tedious and stressful process. In fact, Huckleberry co-founders Bryan O’Connell and Steve Au first came up with the idea for Huckleberry when they were seeking out their own small business coverage for a previous startup idea.

The industry itself is incredibly fragmented, which is caused in part by the fact that small business coverage underwriting varies wildly from business to business. For example, the policy for three or four restaurants might look relatively similar. However, a fast food restaurant might be identified as a higher risk with regards to workers’ compensation than a Michelin-star restaurant, where workers might be more eager to get back to work and take home their tip money. These differences come in the form of location, operations and many other factors, as well as business vertical.

Huckleberry has worked to build out myriad coverage verticals, including food and beverage, fitness, retail, legal, healthcare, hair and beauty and more.

The firm offers worker’s comp, as well as a package policy that includes general liability, property and business interruption insurance. Customers also can purchase add-ons like hired and non-owned auto insurance, employment practices liability insurance (EPLI), liquor liability insurance, employee dishonesty coverage, professional liability insurance, equipment breakdown coverage and spoilage coverage.

Huckleberry isn’t itself an insurance carrier, but does have the authority to underwrite and sell policies on behalf of the carrier. That said, Huckleberry’s expansion both by vertical and geography is more difficult than your average software startup. The regulatory landscape of insurance in the U.S. goes state by state.

“Our biggest challenge is navigating 50 states’ worth of extremely complicated regulations on something that is much more complicated than a software product,” said O’Connell. “We’re trying to protect individual workers and businesses all while staying fully compliant in every market.”

Powered by WPeMatico

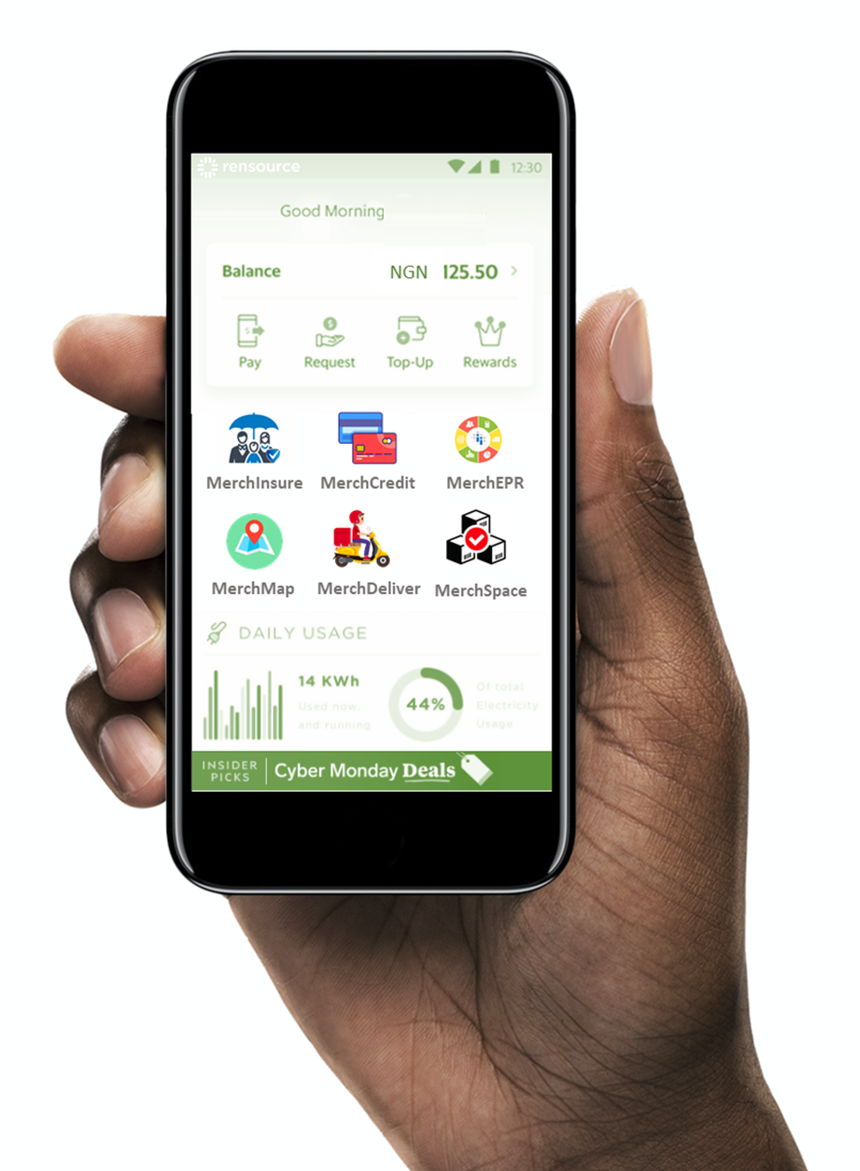

Nigerian startup Rensource Energy has raised a $20 million Series A round co-led by CRE Venture Capital and the Omidyar network.

The renewable energy company builds and operates solar-powered micro-utilities that provide electricity to commercial community structures, such as open-air trading bazaars.

Launched in 2016, the startup has shifted its operating strategy. “We’ve pivoted away from a residential focus…and we’re building much larger systems to become essentially the utility for these large urban markets we have a lot of in Nigeria,” Rensource co-founder Ademola Adesina told TechCrunch.

The company has a partnership with German manufacturer BOS AG, with whom it designs specialized panels for it use case. Rensource also has developer teams in Nigeria and Europe for its software-related programs.

In addition to becoming a micro-energy provider to Nigeria’s robust SME classes, the startup aims to offer them B2B services. With the $20 million round, Rensource is launching its Spaces Offline to Online platform for supply-chain services, including business-analytics and working capital options.

“It’s a mini-ERP tool. We’re trying to bring a universe of people who are banked, but…still offline — their products are offline, they don’t track anything, and there’s no data behind their business — online,” said Adesina.

The benefit Rensource seeks to deliver to Nigeria’s SMEs — at a profit for itself — is to lower overhead costs through better business practices and free them from the bane of generators.

Across marketplaces in West Africa, noisy, fuel-guzzling and pollution-producing generators are like an unwelcome, yet necessary business partner.

Lack of affordable and reliable electricity in Nigeria creates a massive real and opportunity cost to Africa’s largest economy.

For perspective, the West African country is roughly the size of Texas, with a 200 million population larger than Russia, and generates less gigawatt hours of electricity annually than the U.S. state of Connecticut.

Nigerian businesses (and citizens) adjust for these power deficiencies by spending on diesel fuel and generators.

The IMF’s 2019 Nigeria report quoted economic losses of $29 billion in Nigeria due to unreliable electricity supply. On global Doing Business rankings, Nigeria ranked 169 out of 190 countries in the category of “Getting Electricity.”

This difficulty and cost weighs particularly heavy on Nigeria (and the continent’s) SMEs, which often operate in Africa’s informal economy — projected to be one of the largest off-the grid commercial spaces in the world.

Rensource’s micro-utility model deploys power clusters — made up of solar-panels, batteries and a power management system — adjacent to markets and commercial hubs. The energy application isn’t totally clean, as the startup still uses its own diesel backup system.

Rensource’s micro-utility model deploys power clusters — made up of solar-panels, batteries and a power management system — adjacent to markets and commercial hubs. The energy application isn’t totally clean, as the startup still uses its own diesel backup system.

Rensourse has used this model to become an off-grid energy provider in six states in Nigeria, and powers the Sabon Gari market — one of the country’s largest, located in northern Kano State.

The company plans to expand to 100 markets within Nigeria and to additional African countries within 24 months, according to Adesina.

Rensource generates revenue from charging merchants daily, weekly or monthly fees. “In 2017, we did a few hundred thousand dollars in revenue. Last year we did about $7 million in revenue, and this year we’ll do better than that,” Adesina said.

The company doesn’t release official financials, but generated a small profit last year, according to Adesina. He named deploying more of its micro-utilities to new markets and diversifying services as the path to long-term profitability.

Rensource differentiates itself from many home-kit solar energy startups in Africa, such as M-Kopa, by becoming a renewable energy utility at scale.

The startup’s CEO sees the model as a classic leapfrog tech business, effectively bypassing Nigeria’s deficient electricity grid and providing a less capital intensive alternative to large (and often complicated) energy infrastructure projects.

The startup’s CEO sees the model as a classic leapfrog tech business, effectively bypassing Nigeria’s deficient electricity grid and providing a less capital intensive alternative to large (and often complicated) energy infrastructure projects.

Rensource is also following a trend by some Nigeria-based startups, such as trucking-logistics company Kobo360 and motorcycle ride-hail company Gokada, to shape a suite of additional services around the needs of core clients.

In Rensource’s case, those clients are SMEs and traders in the informal economy. “This informality of theirs is what we see as an opportunity in building this new business line and bringing these [merchants] into the online world,” said Adesina.

Powered by WPeMatico

Airbnb has well and truly disrupted the world of travel accommodation, changing the conversation not just around how people discover and book places to stay, but what they expect when they get there, and what they expect to pay. Today, one of the startups riding that wave is announcing a significant round of funding to fuel its own contribution to the marketplace.

Domio, a startup that designs and then rents out apart-hotels with kitchens and other full-home experiences, has raised $100 million ($50 million in equity and $50 million in debt) to expand its business in the U.S. and globally to 25 markets by next year, up from 12 today. Its target customers are millennials traveling in groups or families swayed by the size and scope of the accommodation — typically five times bigger than the average hotel room — as well as the price, which is on average 25% cheaper than a hotel room.

The Series B, which actually closed in August of this year, was led by GGV Capital, with participation from Eldridge Industries, 3L Capital, Tribeca Venture Partners, SoftBank NY, Tenaya Capital and Upper90. Upper90 also led the debt round, which will be used to lease and set up new properties.

Domio is not disclosing its valuation, but Jay Roberts, the founder and CEO, said in an interview that it’s a “huge upround” and around 50x the valuation it had in its seed round and that the company has tripled its revenues in the last year. Prior to this, Domio had only raised around $17 million, according to data from PitchBook.

For some comparisons, Sonder — another company that rents out serviced apartments to the kind of travelers who have a taste for boutique hotels — earlier this year raised $225 million at a valuation north of $1 billion. Others like Guesty, which are building platforms for others to list and manage their apartments on platforms like Airbnb, recently raised $35 million with a valuation likely in the range of $180 million to $200 million. Airbnb is estimated to be valued around $31 billion.

Domio plays in an interesting corner of the market. For starters, it focuses its accommodations at many of the same demographics as Airbnb. But where Airbnb offers a veritable hodgepodge of rooms and homes — some are people’s homes, some are vacation places, some never had and never will have a private occupant, and across all those the range of quality varies wildly — Domio offers predictability and consistency with its (possibly more anodyne) inventory.

“We are competing with amateur hosts on Airbnb,” said Roberts, who previously worked in real estate investment banking. “This is the next step, a modern brand, the next Marriott but with a more tech-powered brain and operating model.” These are not to be confused with something like Hilton’s Homewood Suites, Roberts stressed to me. He referred to Homewood as “a soulless hotel chain.”

“Domio is the anti-hotel chain,” he added.

Roberts is also quick to describe how Domio is not a real estate company as much as it is a tech-powered business. For starters, it uses quant-style algorithms that it’s built in-house to identify regions where it wants to build out its business, basing it not just on what consumers are searching for, but also weather patterns, economic indicators and other factors. After identifying a city or other location, it works on securing properties.

It typically sets up its accommodations in newer or completely new buildings, where developers — at least up to now — are not usually constructing with short-term rentals in mind. Instead, they are considering an option like Domio as an alternative to selling as condominiums or apartments, something that might come up if they are sensing that there is a softening in the market. “We typically have 75%-78% occupancy,” Roberts said. He added that hotels on average have occupancy rates in the high 60% nationally.

As Domio lengthens its track record — its 12 U.S. markets include Miami, Los Angeles, Philadelphia and Phoenix — Roberts says that they’re getting a more select seat at the table in conversations.

“Investors are starting to go out to buy properties on our behalf and lease them to us,” he said. This gives the startup a much more favorable rate and terms on those deals. “The next step is that Domio will manage these directly.” The most recent property it signed, he noted, includes a Whole Foods at the ground level, and a gym.

Using technology to identify where to grow is not the only area where tech plays a role. Roberts said that the company is now working on an app — yet to be released — that will be the epicenter of how guests interact to book places and manage their experience once there.

“Everything you can do by speaking to a human in a traditional hotel you will be able to do with the Domio app,” he said. That will include ordering room service, getting more towels, booking experiences and getting restaurant recommendations. “You can book your Uber through the Domio app, or sync your Spotify account to play music in the apartment.

Ans there are plans to extend the retail experience using the app. Roberts says it will be a “shoppable” experience where, if you like a sofa or piece of art in the place where you’re staying, you can order it for your own home. You can even order the same wallpaper that’s been designed to decorate Domio apartments.

Although Airbnb has grown to be nearly as ubiquitous as hotels (and perhaps even more prominent, depending on who you are talking to), the wider travel and accommodation market is still ripe for the taking, estimated to reach $171 billion by 2023 and the highest growth sector in the travel industry.

“Airbnb has taught us that hotels are not the only place to stay,” said Hans Tung, GGV’s managing partner. “Domio is capitalizing on the global shift in short-term travel and the consumer demand for branded experiences. From my travels around the world, there is a large, underserved audience — millennials, families, business teams — who prefer the combined benefits of an apartment and hotel in a single branded experience.”

I mentioned to Roberts that the leasing model reminded me a little of WeWork, which itself does not own the property it curates and turns into office space for its tenants. (The SoftBank investor connection is interesting in that regard.) Roberts was very quick to say that it’s not the same kind of business, even if both are based around leased property re-rented out to tenants.

“One of the things we liked about Domio is that is very capital-efficient,” said Tung, “focusing on the model and payback period. The short-term nature of customer stays and the combination of experience/price required to maintain loyal customers are natural enforcers of efficient unit economics.”

“For GGV, Domio stands out in two ways,” he continued. “First, CEO Jay Roberts and the Domio team’s emphasis on execution is impressive, with expansion into 12 cities in just three years. They have the right combination of vision, speed and agility. Domio’s model can readily tap into the global opportunity as they have ambition to scale to new markets. The global travel and tourism spend is $2.8 trillion with 5 billion annual tourists. Global travelers like having the flexibility and convenience of both an apartment and hotel — with Domio they can have both.”

Powered by WPeMatico

In a world where ad rates are declining for traditional broadcast media, the corporations responsible for making the fictions that millions devour daily need to find a new business model.

Subscription services are on the rise — with every major broadcaster launching an on-demand service — and so are ad-supported video streaming services to replace the traditional networks.

But there’s another Holy Grail of the advertising industry, long thought to be too technologically difficult to achieve, that may finally be within reach. It’s the on-demand product placement of branded goods in a video, and it’s the technology that Ryff has been developing since it was founded in early 2018.

Product placement is an increasingly big business in the U.S., raking in some $11.44 billion in 2019, according to data collected by Statista. That figure is up from $4.75 billion in 2012. The same report indicated that roughly 49% of Americans took action after seeing product placement in media.

The effectiveness of product placement has even been proven by researchers from Indiana University and Emory University. They found that “prominent product placement embedded in television programming does have a net positive impact on online conversations and web traffic for the brand.”

And while streaming services enjoy the dollars their subscribers are throwing at them, they’re also looking at ways to diversify their revenue streams. Netflix and Hulu are both expanding their product marketing divisions and analysts like those from Forrester Research predict that product placement will be a huge moneymaker for the company as traditional ad rates decline.

There are companies that handle product placement already. Startups like Branded Entertainment Network, which works with brands and producers to place real brands into contextually relevant scenes in movies and television, and Mirriad, which adds branded billboards to scenes, are working to bring more money to platforms and producers.

Ryff takes the technology to the next level, using computer vision, machine learning and rendering technologies to identify objects in a scene and replace them with branded products that can be tailored based on customer data.

“The infusion of SVOD/streaming platforms into the market, combined with platforms like Netflix that are unsuccessfully trying to grow their subscriber base will force those same platforms to explore and embrace alternative revenue streams,” said Marlon Nichols, managing general partner at MaC Venture Capital, and a new director on the Ryff board. “In addition, consumers on paid platforms do not want their content consumption interrupted by ads. As such, product placement will be an important growth channel and Ryff’s new marketplace and unique technology set it up to be the unequivocal growth market leader.”

To continue its technology development and ramp up sales and marketing, the company has raised $5 million in financing. According to Crunchbase, Ryff had previously raised $3.6 million from investors, including a subsidiary of the Mahindra Group and undisclosed investors. The new financing came from Valor Siren Ventures, MaC Venture Capital, Moneta Ventures and Vulcan Capital.

“Ryff’s offering is well-timed with the rapidly increasing demand for solutions that extend the reach of a brand’s content and drive business results,” said Uday Ghare, vice president for media and entertainment at Tech Mahindra, in a statement at the time of the company’s investment. “We believe the market will continue to see a shift of brand dollars to both content marketing and programmatic advertising as brands increase their reliance on content-centric programs and look to scale those efforts.”

Ryff’s ads can be tailored to the viewer’s taste, the platform on which video is being distributed, the geography of the broadcast, the date and time of the broadcast and a broader demographic profile, according to the company. Basically it’s like AdWords for videos.

In a blog post writing about the rationale behind his investment firm’s capital commitment to the company, Marlon Nichols of MaC Ventures wrote:

Imagine a future where an IP owner can maximize the value of its content by putting it on the Ryff marketplace, where that content will be mapped for dozens if not hundreds of product placement opportunities and be layered with restrictions that comply with creative needs. Those opportunities will be ranked and priced by their effectiveness to drive marketing goals for brands. Brands can bid on in-video placement opportunities that fit their marketing strategies and budgets. 3D brand assets can be uploaded and inserted dynamically into content right before the moment of video delivery.

Ryff’s first disclosed partnership is with the “reality” television producer Endemol Shine.

“Ryff successfully takes the concept of product placement, the only advertising format that can’t be skipped by the viewer, and delivers a scalable and adaptable advertising solution that can be applied to any content, at any time and in any market,” said Roy Taylor, founder and CEO of Ryff, in a statement. “The result benefits all — content free from annoying distractions, audience-specific brand placement and delivering a new means towards monetizing video assets.”

Powered by WPeMatico

Trialjectory, which is developing a new technology service to match cancer patients with clinical trials, has raised $2.7 million to finance its continued growth.

Led by Contour Venture Partners, the new financing will be used to accelerate Trialjectory’s operations by adding more clinical trials for different cancer types and expanding the company’s outreach to caregivers, pharmaceutical companies and patients, the company said.

“As cancer is the second leading cause of death for Americans — with thousands of new cases diagnosed each year — having access to advanced treatment options is a necessity, not a privilege, as new trials provide better outcomes to patients,” said Tzvia Bader, Trialjectory chief executive and co-founder. “What’s more, one of the top obstacles that oncologists face today is the lack of clinical trial access for patients, which is due to the availability of more treatment options overall. Additionally, it is a very complex process to match the right patient with the right treatment, especially with the rise of personalized medicine.”

The company currently supports trials for breast cancer, colon cancer, bladder cancer, melanoma and myelodysplastic syndromes.

Trialjectory’s software was trained to seek out keywords in unstructured treatment descriptions and extracting relevant data. Its software then groups that information into clusters and standardizes the information to create a database that highlights patient attributes that would be appropriate for clinical trials.

Patients are then matched to the clinical trials after filling out a questionnaire.

“Trialjectory’s work — driven by a highly experienced management team, comprised of both oncology and technology experts — is disrupting and reshaping how we think about traditional cancer care today,” concluded Bob Greene, from Contour Venture Partners . “Even more important, it is empowering patients to take back control of their treatment, and we look forward to watching Trialjectory’s platform continue to grow quickly. We believe that the company has the potential to become a go-to resource for the global medical community to help doctors provide personalized, matched treatment options to patients in need everywhere.”

Powered by WPeMatico

Hugging Face has raised a $15 million funding round led by Lux Capital. The company first built a mobile app that let you chat with an artificial BFF, a sort of chatbot for bored teenagers. More recently, the startup released an open-source library for natural language processing applications. And that library has been massively successful.

A.Capital, Betaworks, Richard Socher, Greg Brockman, Kevin Durant and others are also participating in today’s funding round.

Hugging Face launched its original chatbot app back in early 2017. After months of work, the startup wanted to prove that chatbots don’t have to be a glorified command line interface for customer support.

With the app, you could generate a digital friend and text back and forth with your companion. And it wasn’t just about understanding what you meant — the app tried to detect your emotions to adapt answers based on your feelings.

It turns out that the technology behind that chatbot app is solid. As Brandon Reeves from Lux Capital wrote, there’s been a ton of progress when it comes to computer vision and image processing, but natural language processing has been lagging behind.

Hugging Face’s open-source framework Transformers has been downloaded over a million times. The GitHub project has amassed 19,000 stars, proving that the open-source community thinks this is a useful brick to build upon. Researchers at Google, Microsoft and Facebook have been playing around with it.

Some companies even use it in production, such as challenger bank Monzo for its customer support chatbot and Microsoft Bing. You can leverage Transformers for text classification, information extraction, summarization, text generation and conversational artificial intelligence.

With today’s funding round, the company plans to triple its headcount in New York and Paris.

Powered by WPeMatico

Oto, a startup spun off from research at SRI International to help customer service operations understand voice intonation, announced a $5.3 million seed round today.

Participants in the round included Firstminute Capital, Fusion Fund, Interlace Ventures, SAP.iO and SRI International . The total includes a previous $1 million seed round, according to the company.

Teo Borschberg, co-founder and CEO at Oto, says the company launched out of SRI International, the same company where Apple’s Siri technology was originally developed. It has been developing intonation data, based originally on SRI research, to help customer service operations respond better to caller’s emotions. The goal is to use this area of artificial intelligence to improve interactions between customer service reps (CSRs) and customers in real time.

As part of the research phase, the company compiled a database of 100,000 utterances from 3,000 speakers, culled from two million sales conversations. From this data, it has built a couple of tools to help customer service operations automate intonation understanding.

The first is a live coaching tool. It’s difficult to have management monitor every call, so only a small percentage gets monitored. With Oto, CSRs can get real-time coaching on every call to raise their energy or to calm a frustrated customer before a problem escalates. “In real time, we’re able to guide the agents on how they sound, how energetic they are, and we can nudge and push them to be more energetic,” Borschberg explained.

He says this has three main advantages: more engaged agents, higher sales conversion rates and better satisfaction scores and cost reduction.

The other product measures the quality of a customer experience and gives a score at the end of each call to help the CSR (and their managers) understand how well they did, simply based on intonation. It displays the score in a dashboard. “We’re building a universal understanding of satisfaction from intonation, where we can learn acoustic signatures that are positive, neutral, negative,” Borschberg said.

He sees a huge market opportunity here, pointing to Qualtrics, which sold to SAP last year for $8 billion. He believes that surveying people is just a part of the story. You can build a better customer experience when you understand intonation of just how well that experience is going, and you put it on a scale so that it makes it easy to understand just how well or how poorly you are doing.

The company has 20 employees today, with offices in New York, Zurich and Lisbon. It has seven customers working with the product so far, but it is still early days.

Powered by WPeMatico

Skyryse is a three-year-old transportation startup that is approaching the future of aviation from a different angle when compared to most. You often see startups building new kinds of aircraft, with electric powertrains, multiple rotors for vertical take-off and landing, and more: Skyryse thinks the smarter approach is to start at a more fundamental — and comprehensive — level, building an autonomous technology “stack” that can work with existing flight and safety-certified aircraft.

The Skyryse model, as explained to me by CEO and founder Mark Groden, is all about broad applicability, reliability, redundancy and safety. The startup’s main product, which it is unveiling today, along with the demonstration below of the tech in action on a Robinson R-44 helicopter, is the “Skyryse Flight Stack,” which includes simplified flight controls to either fully automate flight, or provide assistance to human pilots; flight control automation that can still operate safely even in case of failure; safe operational limit monitoring and intervention; connected, intelligent helipads that provide monitoring and alerts; and an air traffic control component designed to work with existing FAA systems.

Skyryse and its approach comes from Groden’s belief that city infrastructure has developed to the point where solutions about managing movement within and around them isn’t addressable simply by adjusting the grid or changing the flow of people and things along the paths of the network; instead, he thinks what’s needed is a much more basic perception shift about the potential solutions available.

“At a fundamental level, I realized at a very young age that the transportation system that’s built on the infrastructure that cars follow was no longer serving us,” explained Groden. “Rather the other way around, we are now serving our transportation systems — for example, where I live in Los Angeles, and many of the people that work at Skyryse, we choose where we live based upon the way the transportation system may or may not be able to get us to the places that we need to go.”

“The reality is that it just hasn’t evolved in roughly 100 years,” he added. “We’re trying to push more and more throughput through existing transportation infrastructure. And the only way to solve this problem is to get away from infrastructure — any infrastructure-dependent approach is going to have some fixed throughput.”

Groden’s reasoning isn’t that far off from that of others pursuing autonomous aerial transportation technology. Kitty Hawk and Google self-driving car project founder Sebastian Thrun, for instance, has often talked about how it’s actually likely more easily achievable to tackle autonomy in the air than on the ground, for similar reasons. But Skyryse’s approach differs from others tackling this problem because they’s intent on building the full system, not just the flying car.

“We want to deliver the fastest and safest transportation system to the people and communities that we serve,” Groden says. “We think automation is really critical to making it affordable and ultimately accessible to everyone — but more than automation is necessary. This is like a metaphorical train system, and so you need the tracks, you need the switches, you need the communications architecture, you need all these other things going on, in order to allow the ‘locomotives,’ to roll down the ‘track’ and be automated to whatever level that it is. That full-stack technology system to support this transportation system is what we’re focused on.”

To that end, Skyryse has a team made up of talented transportation experts and engineers with history at companies including Airbus, Boeing, Ford, JetBlue, Moog, SpaceX and more. The startup’s CTO is Dr. Gonzalo Rey, who previously was CTO at Moog, where he oversaw the development of flight control actuation systems for the Boeing 787 and Airbus 350. Skyryse COO Brian Coulter previously co-founded both JetSuite Air and JetBlue, which adds into the mix experience operating in the airline industry.

To that end, Skyryse has a team made up of talented transportation experts and engineers with history at companies including Airbus, Boeing, Ford, JetBlue, Moog, SpaceX and more. The startup’s CTO is Dr. Gonzalo Rey, who previously was CTO at Moog, where he oversaw the development of flight control actuation systems for the Boeing 787 and Airbus 350. Skyryse COO Brian Coulter previously co-founded both JetSuite Air and JetBlue, which adds into the mix experience operating in the airline industry.

Today, the company is demonstrating that its technology can already work with existing aircraft and air traffic management systems — that’s a promising achievement that shows more in terms of real-world feasibility than many of the new vehicle technology demonstrations you see in this industry. Skyryse is also revealing that it now has $38 million in total funding, including an additional $13 million on top of the Series A it announced last August. This round includes participation by Ford Motor Company Chairman Bill Ford, a sign that Groden says shows confidence the startup’s approach has the potential to upend traditional transportation models.

Car sharing, ride hailing and now on-demand electric bike and scooter services have all made claims around being able to alleviate congestion and traffic within cities, but so far none has really helped reverse the problem. Autonomous air transportation might be the solution that actually makes a difference, and Skyryse might be the startup that helps make that possible with its full-stack approach.

Powered by WPeMatico