Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

InsightFinder, a startup from North Carolina based on 15 years of academic research, wants to bring machine learning to system monitoring to automatically identify and fix common issues. Today, the company announced a $2 million seed round.

IDEA Fund Partners, a VC out of Durham, N.C., led the round, with participation from Eight Roads Ventures and Acadia Woods Partners. The company was founded by North Carolina State University professor Helen Gu, who spent 15 years researching this problem before launching the startup in 2015.

Gu also announced that she had brought on former Distil Networks co-founder and CEO Rami Essaid to be chief operating officer. Essaid, who sold his company earlier this year, says his new company focuses on taking a proactive approach to application and infrastructure monitoring.

“We found that these problems happen to be repeatable, and the signals are there. We use artificial intelligence to predict and get out ahead of these issues,” he said. He adds that it’s about using technology to be proactive, and he says that today the software can prevent about half of the issues before they even become problems.

If you’re thinking that this sounds a lot like what Splunk, New Relic and Datadog are doing, you wouldn’t be wrong, but Essaid says that these products take a siloed look at one part of the company technology stack, whereas InsightFinder can act as a layer on top of these solutions to help companies reduce alert noise, track a problem when there are multiple alerts flashing and completely automate issue resolution when possible.

“It’s the only company that can actually take a lot of signals and use them to predict when something’s going to go bad. It doesn’t just help you reduce the alerts and help you find the problem faster, it actually takes all of that data and can crunch it using artificial intelligence to predict and prevent [problems], which nobody else right now is able to do,” Essaid said.

For now, the software is installed on-prem at its current set of customers, but the startup plans to create a SaaS version of the product in 2020 to make it accessible to more customers.

The company launched in 2015, and has been building out the product using a couple of National Science Foundation grants before this investment. Essaid says the product is in use today in 10 large companies (which he can’t name yet), but it doesn’t have any true go-to-market motion. The startup intends to use this investment to begin to develop that in 2020.

Powered by WPeMatico

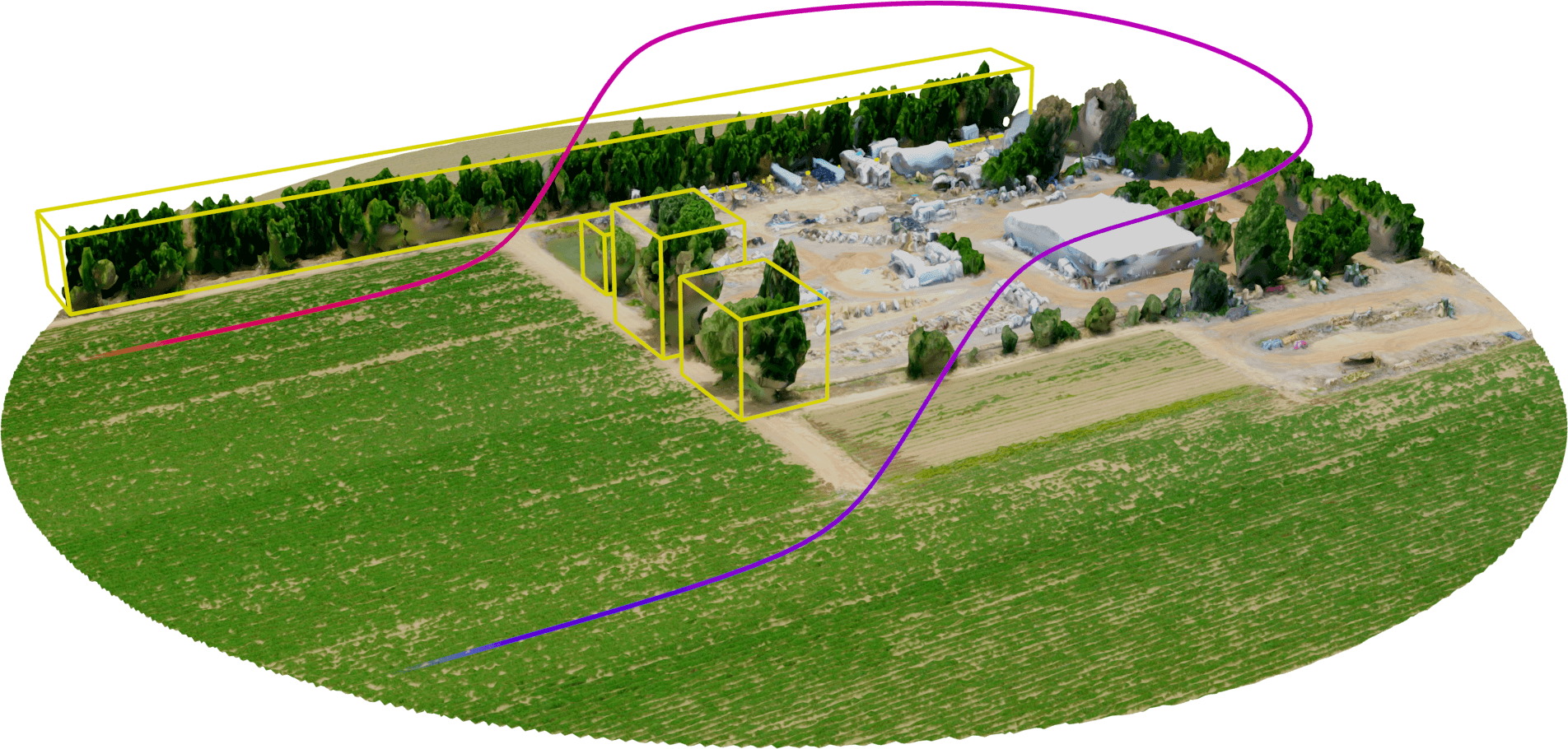

Modern agriculture involves fields of mind-boggling size, and spraying them efficiently is a serious operational challenge. Pyka is taking on the largely human-powered spray business with an autonomous winged craft and, crucially, regulatory approval.

Just as we’ve seen with DroneSeed, this type of flying is risky for pilots, who must fly very close to the ground and other obstacles, yet also highly susceptible to automation; That’s because it involves lots of repetitive flight patterns that must be executed perfectly, over and over.

Pyka’s approach is unlike that of many in the drone industry, which has tended to use multirotor craft for their maneuverability and easy take-off and landing. But those drones can’t carry the weight and volume of pesticides and other chemicals that (unfortunately) need to be deployed at large scales.

The craft Pyka has built is more traditional, resembling a traditional one-seater crop dusting plane but lacking the cockpit. It’s driven by a trio of propellers, and most of the interior is given over to payload (it can carry about 450 pounds) and batteries. Of course, there is also a sensing suite and onboard computer to handle the immediate demands of automated flight.

Pyka can take off or land on a 150-foot stretch of flat land, so you don’t have to worry about setting up a runway and wasting energy getting to the target area. Of course, it’ll eventually need to swap out batteries, which is part of the ground crew’s responsibilities. They’ll also be designing the overall course for the craft, though the actual flight path and moment-to-moment decisions are handled by the flight computer.

Example of a flight path accounting for obstacles without human input

All this means the plane, apparently called the Egret, can spray about a hundred acres per hour, about the same as a helicopter. But the autonomous craft provides improved precision (it flies lower) and safety (no human pulling difficult maneuvers every minute or two).

Perhaps more importantly, the feds don’t mind it. Pyka claims to be the only company in the world with a commercially approved large autonomous electric aircraft. Small ones like drones have been approved left and right, but the Egret is approaching the size of a traditional “small aircraft,” like a Piper Cub.

Of course, that’s just the craft — other regulatory hurdles hinder wide deployment, like communicating with air traffic management and other craft; certification of the craft in other ways; a more robust long-range sense and avoid system and so on. But Pyka’s Egret has already flown thousands of miles at test farms that pay for the privilege. (Pyka declined to comment on its business model, customers or revenues.)

The company’s founding team — Michael Norcia, Chuma Ogunwole, Kyle Moore and Nathan White — comes from a variety of well-known companies working in adjacent spaces: Cora, Kittyhawk, Joby Aviation, Google X, Waymo and Morgan Stanley (that’s the COO).

The $11 million seed round was led by Prime Movers Lab, with participation from Y Combinator, Greycroft, Data Collective and Bold Capital Partners.

Powered by WPeMatico

American automotive technology startup Rivian has raised $1.3 billion in new funding, the company announced today. The new investment is the fourth round of capital announced by the company in 2019 alone, following prior announcements of $700 million led by Amazon, $500 million from Ford (which includes a collaboration on electric vehicle technology) and $350 million from Cox Automotive.

That’s a lot of money, but Rivian’s not your typical startup, as it’s aiming to bring fully electric vehicles to market, including the R1T pickup truck and the R1S sport utility vehicle. Both of those are consumer cars, which the company aims to bring to market starting at the end of next year — and Rivian is also working with Amazon on all-electric delivery vans, of which the commerce giant has ordered 100,000, with a target of starting deliveries of the first of those in 2021.

Rivian’s new monster round includes participation from Amazon and Ford Motor Company, along with funds advised by T. Rowe Price Associates and BlackRock, the company said in a release. It’s not adding any new board seats attached to this funding, and it’s not sharing any further details on the specific funds involved in the investment at this time.

The company, founded in 2009, has R&D facilities in a number of cities globally, and also has a 2.6-million-square-foot manufacturing facility in Normal, Ill. It debuted its pickup and SUV at the LA Auto Show last November, and the vehicles will launch with higher-end trim levels first, including up to 410 miles of range on a single charge. Base prices for the R1T pickup start at $69,000 before any tax credits are applied, while the R1S SUV starts at $72,500; Rivian has been taking pre-order reservations, available with a $1,000 deposit.

For a company that in many ways has seemed to appear out of nowhere, Rivian’s capitalization and partnerships make it one of the better existing contenders to take on Tesla, especially in the truck and SUV categories, where Tesla has less presence, with only the high-end Model X actually available to purchase so far.

Powered by WPeMatico

Eddy Travels, an AI-powered travel assistant bot which can understand text and voice messages, has closed a pre-seed round of around $500,000 led by Techstars Toronto, Practica Capital and Open Circle Capital VC funds from Lithuania, with angel investors from the U.S., Canada, U.K.

Launched in November 2018, Eddy Travels claims to have more than 100,000 users worldwide.

Travelers can send voice and text messages to the Eddy Travels bot and get personalized suggestions for the best flights. Because of this ease of use, it now gets 40,000 flight searches per month — tiny compared to the major travels portals, but not bad for a bot that is available on Facebook Messenger, WhatsApp, Telegram, Rakuten Viber, Line and Slack chat apps.

The team is now looking to expand into accommodation, car rentals and other travel services. Eddy Travels search is powered by partnerships with Skyscanner and Emirates Airline.

The founders are from Lithuania: Edmundas Balcikonis, CEO, (previously founded and led as CEO TrackDuck startup, acquired by Invision), Pranas Kiziela and Adomas Baltagalvis. The company HQ is in Toronto, Canada.

Powered by WPeMatico

HomeLane, a Bangalore-based startup that helps people manage home renovations and interior design, today announced it has raised $30 million in a new financing round as it looks to expand its proprietary technology.

The financing round, dubbed Series D, was led by Evolvence India Fund (EIF), Pidilite Group and FJ Labs. Existing investors Accel Partners, Sequoia Capital and JSW Ventures also participated in the round, which pushes the five-year-old startup’s all-time raise to $46 million.

HomeLane helps property owners furnish and install fixtures in their new apartments and houses. Interior designers need to be local to customers and supply chain partners need to have the capacity to ship to a location. So HomeLane has established 16 experience centers in seven Indian cities so consumers can touch and see materials and furniture.

The startup plans to use the fresh capital to broaden its technology infrastructure and expand to eight to 10 additional cities.

HomeLane competes with other online furniture sellers such as Livspace and Urban Ladder, as well as brick-and-mortar stores. Founders Rama Harinath and Srikanth Iyer say their startup differentiates by offering a one-stop shop — it sells everything from fitted kitchens and wardrobes to entertainment units and shoe racks — and by providing guaranteed on-time delivery and after-sale services to help homeowners finish projects.

The site allows property owners to upload floor plans, which are reviewed by interior designers who provide product suggestions, price quotes and 3D pictures of how furnishings and fixtures will look after they are installed. The startup, which has worked with more than 900 design experts to deliver over 6,000 projects, pays to the designers a fraction of the money it charges customers.

Iyer, who serves as the chief executive of HomeLane, claimed that the startup is inching closer to being EBIDTA profitable (which does not include taxes and a range of other expenses). That would be a notable turnaround for HomeLane, which reported a net loss of $4.1 million on revenue of $5.6 million in the financial year that ended in March 2018.

Prashanth Prakash, a partner at Accel India, said, “We are very happy with HomeLane’s current growth trajectory and are believers in the long-term growth prospects of the home improvement consumer segment in India.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week Kate was in SF, Alex was in Providence and there was a mountain of news to shovel through. If you’re here because we mentioned linking to a certain story in the show notes, that’s here. For everyone else, let’s get into the agenda.

We kicked off with a look at three new venture funds. In order:

From there we turned to the gender imbalance in the world of venture capital. This year, companies founded by women raised only 2.8% of capital. These not-so-stellar statistics are always worth digging into.

We then took a quick look at two different venture rounds, including ProdPerfect’s $13 million Series A and Pepper’s smaller $5.6 million round. ProdPerfect’s round was led by Anthos Capital (known for investing in Honey, which sold for $4 billion). The company has $2 million in ARR and is growing quickly. Pepper, formed by former Snap denizens, is working to help other startups lower their CAC costs in-channel. Smart.

And finally, Alex wanted to bring up his series on startups that reach the $100 million ARR threshold (Extra Crunch membership required). A first piece looking into the idea led to a few more submissions. There seem to be enough companies to name the grouping with something nice. Centurion? Centipede? Centaur? We’re working on it.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

A company building a very high-tech glove has just gotten its hands on some new money.

HaptX is building a sensor-packed glove for VR and robotics applications that simulates haptic and resistance feedback for enterprise users.

The Seattle startup has raised $12 million in new funding from Mason Avenue Investments, Taylor Frigon Capital Partners, Upheaval Investments, Votiv Capital, Keiretsu Forum, Keiretsu Capital, NetEase and Amit Kapur of Dawn Patrol Ventures. HaptX has now raised $19 million to date.

The company says this funding will go toward the company’s next generation of glove hardware.

I got a chance to demo the company’s glove last year and there are certainly some bizarre experiences that are enabled by the product, which uses an external pneumatic box to expand and contract air pockets inside a glove form factor to make it feel like the virtual object you’re holding onto in VR is actually in your hand.

Needless to say at this point, the virtual reality industry’s consumer ambitions haven’t quite panned out as expected. The enterprise space has found slightly more enduring success, though much of the enterprise use hasn’t expanded too far beyond “internal innovation hubs” and pilot programs. HaptX seems to have zeroed in on the same enterprise customer base as other VR startups, with a lot of its customers using the gloves in design and visualization processes. HaptX has moved away from marketing itself as a VR-only company and has expanded into robotics, reshaping its offering into a solution framed by real-world input and real-world output.

Alongside the funding announcement, HaptX is sharing that it has partnered with Advanced Input Systems to collaborate on “product development, manufacturing, and go-to-market.”

The company is focused on enterprise and unfortunately doesn’t seem to be building a mech suit for Jeff Bezos, although they sent me a great gif of him demoing the technology earlier this year at a conference.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the grey space in between.

Today, we’re digging into a host of data concerning the East Coast venture capital scene, specifically looking into the performance of its two key startup markets.

It’s 12 degrees Fahrenheit as I write this in my office situated between Boston and New York City — a perfect vantage point for studying these vibrant tech ecosystems. Let’s see what the data tells us.

The information we’re examining today comes from White Star Capital (often via CBInsights), a venture capital firm that describes itself as “transatlantic” and takes part in seed, Series A and Series B rounds around the globe. The group last raised a $180 million fund that TechCrunch covered here, noting at the time that capital pool was “oversubscribed from an initial target of $140 million” and would be invested into “around 20 new companies from the new fund, writing opening cheques of between $1 million and $6 million.”

With boots on the ground in New York, White Star cares about the East Coast, so the fund’s put dossier on the region isn’t unexpected. What it includes, however, is.

We’ll start with NYC and its surprising 2019 before turning to Boston, digging into its super-giant venture totals and hearing from Founder Collective’s Eric Paley on the state of things in urban Massachusetts.

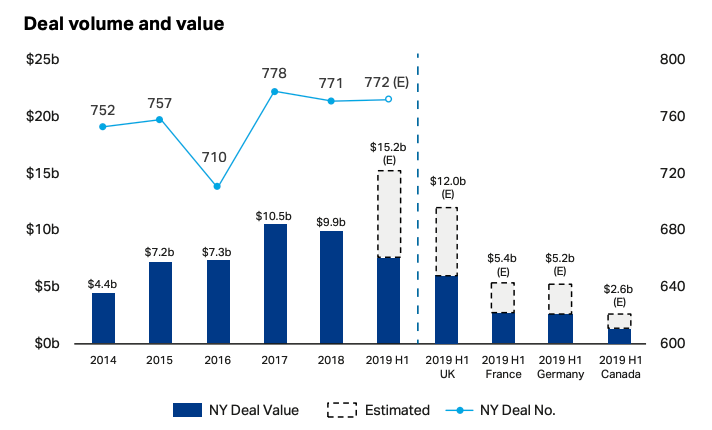

White Star’s report details record-breaking figures for NYC’s current year. Off of effectively flat deal volume (New York City sees around 775 venture deals per year at the moment, or a little more than two per day), the overgrown town should set record venture dollar volume in 2019.

Observe the following, astounding chart detailing the abnormality of 2019 from a comparative venture dollar perspective:

By smashing 2017’s local maximum, 2019 appears set to crush the city’s record — and rich — venture investment totals. The graphic also manages to point out (somewhat embarrassingly) that Gotham will manage to best a number of European countries’ aggregate venture dollar investments by itself this year.

That’s is a useful bit of context as in the United States, New York City is always Number Two to Silicon Valley. But, this chart argues, being number two in the number-one market is still a hell of a lot of capital.

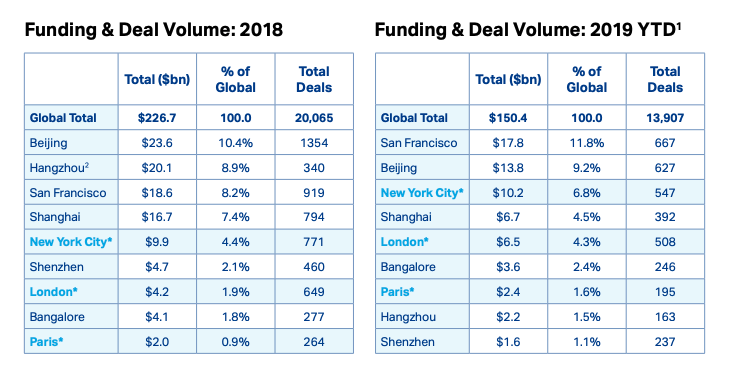

Putting New York City’s venture into even sharper comparative perspective, observe the following table:

Powered by WPeMatico

Scott Wolfe, chief executive officer of Levelset, the New Orleans-based money management and payment startup for contractors in the construction industry, always thought he’d be in the grocery business.

His family owned a number of grocery stores around New Orleans and he was readying himself to go into the family business when Hurricane Katrina hit.

As the family business faced significant losses in their stores, the construction and contracting service they’d built to develop the land the stores were on had a tremendous opportunity. Within the span of a year, Wolfe had pivoted the family’s operations to focus on renovations and restorations and launched fully into construction.

It was during that time that Wolfe saw the need for some sort of software service that could manage cash flow and payment for the tens to hundreds of small business contractors involved in getting a project done.

So he built Levelset to be that service.

Now the company has closed on $30 million in financing from Horizons Ventures, the investment firm backed by Li Ka-shing, who is one of the world’s wealthiest billionaire property developers.

When Bart Swanson, an advisor to Horizons, met Levelset through a mutual friend who did some investing around the New Orleans-based Tulane University ecosystem, he immediately felt it was an opportunity that the Horizons investment committee would understand.

“This is a global issue,” says Swanson. “Sixty-four percent of construction businesses fail in their first five years because they have nowhere to turn for help,” when it comes to ensuring payment.

For now, Levelset is focused on digitizing billing and payments and providing insights into who is actually on a job site and the responsibilities that those workers have on site, according to Wolfe.

“There’s a ton of investment that has gone into the field,” says Wolfe. “What has seen a lack of as prolific an investment are things behind the scenes outside of the field that happen in the office. This is the accountants and administrative workers who have to take the information that’s in the field and turn it into money.”

For developers like Cheung Kong Holdings, Li’s development business, the promise of Levelset’s software is a huge boon. The construction industry runs on small businesses that lack software and services to process payments quickly. The time it takes to deal with paperwork can delay a project and ultimately cost developers money.

Horizons was joined in the new round by S3 Ventures, Operating Venture Capital, Altos Ventures and Darren Bechtel of Brick & Mortar Ventures. As a result of the investment, Swanson will take a seat on the company’s board.

In a recent survey of contractors by Levelset and T-Sheets by Quickbooks, more than half of contractors stated they were not paid on time and had significant cash flow challenges, and more than 75% craved more transparency in the payment process. This is no surprise, given PWC’s working capital studies in the past decade demonstrating that construction industry payment speeds are the slowest of all (83+ days).

“The effort required to get paid, and the cash stress put on contractors is unbelievable,” said Wolfe, in a statement. “The world’s biggest industry is full of small and medium businesses who are the fabric of our economy. It’s crucial that they can do their work without worrying about cash.”

Powered by WPeMatico

Leapfin, a startup selling corporate finance tooling, announced a $4.5 million round this morning. The funding event was led by Bowery Capital, and included dollars from a number of former technology executives.

Before its newly announced investment, the company had raised just a small seed round. The small capital amounts may seem inconsequential, but they’re more strategic than anything. According to Leapfin CEO Raymond Lau, the company is running lean and keeping an eye on profitability.

After being founded in 2015 and starting commercialization of its product in 2018, the company is stepping a bit further out of the shadows this morning. Let’s talk about what it does, and why both its product and business philosophy are neat.

Leapfin helps companies track their revenue and cost of revenue expenses.

In more human terms, Leapfin helps companies track sales, and how much it costs to create and distribute its goods and services to customers. “Cost of revenue,” also known (roughly) as “cost of goods sold,” may sound like a jargony accounting term, but in reality it’s a bedrock business concept that anyone involved with startups needs to understand.

Let’s explain why. Once you deduct costs of revenue from revenue itself, you’re left with gross profit. That’s what businesses use to cover their operating costs. And, crucially, the larger a company’s gross profit is in relation to its revenue, the higher margin its revenue is; investors love high gross margin revenue.

In part, their high gross margins are why software startups are worth so much.

Back to Leapfin, its product is a shot at making business a more limpid process. In a call with TechCrunch, Leapfin’s Lau explained that many companies only have “one-in-thirty” visibility into their operations; that business owners only manage to fully collate their revenue and cost of revenue results monthly, meaning that the rest of the time they are flying at least partially blind.

The goal of Leapfin, according to Lau, is to provide a “single source of truth” for ongoing business results, using “robotic process automation” to help companies cut down on repetitive work. So Lepafin does two things: helps companies know where they stand financially, and saves them time on rote tasks that tend to come with accounting.

The company is pretty happy with its ability to sell its product so far. Lau told TechCrunch that it has found “very, very strong product market fit,” for example. Asked to describe when he felt that Leapfin had gelled with the market, Lau explained that in his view, product market fit is more “process” than a “tipping point,” but that he was confident in Leapfin’s product-market harmony when its customers began referring other companies (to a product that costs six-figures annually), and its sales cycle tightened.

Leapfin is run a bit differently from most SaaS companies that we cover. Instead of raising lots to invest in blow-out sales and marketing expenses, Leapfin is running pretty lean.

TechCrunch asked Lau why he only raised $4.5 million in the new round, which, given the product progress his company has made, felt modest. He said that the Leapfin staff “are outsiders in a way,” and that while his “peers are raising tens of millions,” his company could be profitable by the third quarter of next year. So Leapfin doesn’t need more money, and selling shares ahead of growth is an expensive way to raise capital.

Lau also said, however, that his company’s small raise “doesn’t mean that [it] won’t raise more down the road.” Another check in 2020 to ward off any downturn fears would make some sense. But Leapfin probably won’t sweat a crash too much, as the company keeps profitability and cash flow positivity “in sight,” according to its CEO.

Despite that, the company expects to hire quickly, expanding from around 20 people today to 50 by the end of next year. What we need next from Leapfin is an ARR number so we can vet just how much product market fit it really has.

Powered by WPeMatico