Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Two co-founders of Google Pay in India are building a neo-banking platform in the country — and they have already secured backing from three top VC funds.

Sujith Narayanan, a veteran payments executive who co-founded Google Pay in India (formerly known as Google Tez), said on Monday that his startup, epiFi, has raised $13.2 million in its Seed financial round led by Sequoia India and Ribbit Capital. The round valued epiFi at about $50 million.

David Velez, the founder of Brazil-based neo-banking giant Nubank, Kunal Shah, who is building his second payments startup CRED in India, and VC fund Hillhouse Capital also participated in the round.

The eight-month-old startup is working on a neo-banking platform that will focus on serving millennials in India, said Narayanan, in an interview with TechCrunch.

“When we were building Google Tez, we realized that a consumer’s financial journey extends beyond digital payments. They want insurance, lending, investment opportunities and multiple products,” he explained.

The idea, in part, is to also help users better understand how they are spending money, and guide them to make better investments and increase their savings, he said.

At this moment, it is unclear what the convergence of all of these features would look like. But Narayanan said epiFi will release an app in a few months.

Working with Narayanan on epiFi is Sumit Gwalani, who serves as the startup’s co-founder and chief product and technology officer. Gwalani previously worked as a director of product management at Google India and helped conceptualize Google Tez. In a joint interview, Gwalani said the startup currently has about two-dozen employees, some of whom have joined from Netflix, Flipkart, and PayPal.

Shailesh Lakhani, Managing Director of Sequoia Capital India, said some of the fundamental consumer banking products such as savings accounts haven’t seen true innovation in many years. “Their vision to reimagine consumer banking, by providing a modern banking product with epiFi, has the potential to bring a step function change in experience for digitally savvy consumers,” he said.

Cash dominates transactions in India today. But New Delhi’s move to invalidate most paper bills in circulation in late 2016 pushed tens of millions of Indians to explore payments app for the first time.

In recent years, scores of startups and Silicon Valley firms have stepped to help Indians pay digitally and secure a range of financial services. And all signs suggest that a significant number of people are now comfortable with mobile payments: More than 100 million users together made over 1 billion digital payments transaction in October last year — a milestone the nation has sustained in the months since.

A handful of startups are also attempting to address some of the challenges that small and medium sized businesses face. Bangalore-based Open, NiYo, and RazorPay provide a range of features such as corporate credit cards, a single dashboard to manage transactions and the ability to automate recurring payouts that traditional banks don’t currently offer. These platforms are also known as neo-bank or challenger banks or alternative banks. Interestingly, most neo-banking platforms in South Asia today serve startups and businesses — not individuals.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week we had TechCrunch’s Alex Wilhelm and Danny Crichton on hand to dig into the news, with Chris Gates on the dials and more news than we could possibly cram into 30 minutes. So we went a bit over; sorry about that.

We kicked off by running through a few short-forms to get things going, including:

Turning to longer cuts, the team dug into the latest from SoftBank, its Vision Fund and the successes and struggles of its enormous startup bets. Leading the news cycle this week were layoffs at Zume, a robotic pizza delivery venture that is no longer pursuing robotic pizza delivery. Now it’s working on sustainable packaging. Cool, but it’s going to be hard for the company to grow into its valuation while pivoting.

Other issues have come up — more here — that paint some cracks onto the Vision Fund’s sunny exterior. Don’t be too beguiled by the bad news, Danny says; venture funds run like J-Curves, and there are still winners in that particular portfolio.

After that, we turned to China, in particular its venture slowdown. The bubble, in Danny’s view, has burst. The story discussed is here, if you want to read it. The short version for the lazy is that not only has China’s venture scene slowed down dramatically, but startups — even those with ample capital raised — are dying by the hundred. But one highly caffeinated Chinese startup continues to find growth in the world’s greatest tea market.

Finally we hit on the Sam Altman wager and the latest from Sisense, which is now a unicorn. All that and we had some fun.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Just Spices, the German-founded spice mix brand, is disclosing €13 million in Series B funding. The round is led by Five Seasons Ventures and Coefficient Capital, with Bitburger Ventures also joining.

A direct to consumer play, Just Spices offers two main product lines: Spice Mixes and “IN MINUTES”.

The first consists of various spice blends, with new blends being developed based on the sales and customer feedback data the startup is amassing.

The second, launched in 2018, is recipe-driven, offering 27 “fix” meal preparations that sees Just Spices provide the recipe and spice mix needed to prepare a quick meal, with only a few additional fresh ingredients required to complete the dish. It appears to share some similarities with SimplyCook in the U.K.

“The need for innovative, fast and still balanced solutions in the food sector is greater than ever,” says Just Spices co-founder and CEO Florian Falk. “On the one hand, people have less time available so food has to be as uncomplicated as possible, but on the other, we still have wants and needs… With Just Spices, and especially with IN MINUTES, we offer a carefree alternative, which consumers can be confident is fast and tasty whilst still fitting into a conscious, healthy diet.”

“The need for innovative, fast and still balanced solutions in the food sector is greater than ever,” says Just Spices co-founder and CEO Florian Falk. “On the one hand, people have less time available so food has to be as uncomplicated as possible, but on the other, we still have wants and needs… With Just Spices, and especially with IN MINUTES, we offer a carefree alternative, which consumers can be confident is fast and tasty whilst still fitting into a conscious, healthy diet.”

As part of its customer acquisition strategy and to power a product development feedback loop, Just Spices says it has built a vibrant, active digital community of home cooks. More than 60% of its sales are generated online, and the company claims to be one of the most followed spices brands in Europe (on social media). And certainly the startup is investing in content, including operating its own in-house studio and producing podcasts.

“We want to become the world’s largest lifestyle spice brand,” adds Falk. “To achieve this, we have not only built a fantastic partnership network, we have brought together an amazing team. We want to bring the joy and fun of cooking to many more people.”

Powered by WPeMatico

Two years ago, we created the Matrix FinTech Index to highlight what we saw as the beginnings of a 10+ year mega innovation wave in financial services.

The trillion-dollar financial services industry was going to be turned on its head over the next decade, and we were just getting started. At the time, the top 10 publicly traded U.S. fintech companies had just surpassed the $100 billion mark in terms of total market capitalization, 12 unicorns had emerged in the category, and the U.S. VC industry had just poured in $6.7B — a record at the time.

As we predicted last year, the innovation cycle continues, and we are transitioning into its mid-phase. So what happened in U.S. fintech in 2019? In short, monster growth.

On the public side, fintechs delivered resoundingly. PayPal alone gained $26B in market capitalization. On a return basis, the public Matrix FinTech Index continued to crush every major equity index as well as the financial services incumbents. Nicely matching our forecasts, our Index delivered 213% returns over the last three years. The Index outperformed the financial services incumbents by 151 percentage points and the S&P 500 by 170 percentage points.

Powered by WPeMatico

Sisense, an enterprise startup that has built a business analytics business out of the premise of making big data as accessible as possible to users — whether it be through graphics on mobile or desktop apps, or spoken through Alexa — is announcing a big round of funding today and a large jump in valuation to underscore its traction. The company has picked up $100 million in a growth round of funding that catapults Sisense’s valuation to over $1 billion, funding that it plans to use to continue building out its tech, as well as for sales, marketing and development efforts.

For context, this is a huge jump: The company was valued at only around $325 million in 2016 when it raised a Series E, according to PitchBook. (It did not disclose valuation in 2018, when it raised a venture round of $80 million.) It now has some 2,000 customers, including Tinder, Philips, Nasdaq and the Salvation Army.

This latest round is being led by the high-profile enterprise investor Insight Venture Partners, with Access Industries, Bessemer Venture Partners, Battery Ventures, DFJ Growth and others also participating. The Access investment was made via Claltech in Israel, and it seems that this led to some details of this getting leaked out as rumors in recent days. Insight is in the news today for another big deal: Wearing its private equity hat, the firm acquired Veeam for $5 billion. (And that speaks to a particular kind of trajectory for enterprise companies that the firm backs: Veeam had already been a part of Insight’s venture portfolio.)

Mature enterprise startups have proven their business cases are going to be an ongoing theme in this year’s fundraising stories, and Sisense is part of that theme, with annual recurring revenues of over $100 million speaking to its stability and current strength. The company has also made some key acquisitions to boost its business, such as the acquisition of Periscope Data last year (coincidentally, also for $100 million, I understand).

Its rise also speaks to a different kind of trend in the market: In the wider world of business intelligence, there is an increasing demand for more digestible data in order to better tap advances in data analytics to use it across organizations. This was also one of the big reasons why Salesforce gobbled up Tableau last year for a slightly higher price: $15.7 billion.

Sisense, bringing in both sleek end user products but also a strong theme of harnessing the latest developments in areas like machine learning and AI to crunch the data and order it in the first place, represents a smaller and more fleet of foot alternative for its customers. “We found a way to make accessing data extremely simple, mashing it together in a logical way and embedding it in every logical place,” explained CEO Amir Orad to us in 2018.

“We have enjoyed watching the Sisense momentum in the past 12 months, the traction from its customers as well as from industry leading analysts for the company’s cloud native platform and new AI capabilities. That coupled with seeing more traction and success with leading companies in our portfolio and outside, led us to want to continue and grow our relationship with the company and lead this funding round,” said Jeff Horing, managing director at Insight Venture Partners, in a statement.

To note, Access Industries is an interesting backer which might also potentially shape up to be strategic, given its ownership of Warner Music Group, Alibaba, Facebook, Square, Spotify, Deezer, Snap and Zalando.

“Given our investments in market leading companies across diverse industries, we realize the value in analytics and machine learning and we could not be more excited about Sisense’s trajectory and traction in the market,” added Claltech’s Daniel Shinar in a statement.

Powered by WPeMatico

Perch, the vertically integrated platform for buying and selling homes, has today announced the close of a $36 million equity round led by Navitas, with participation from existing investor FirstMark Capital, Juxtapose and Accomplice. The company is also announcing that it is rebranding from Perch to Orchard.

Orchard launched in September of 2017 with a plan to bring the full home selling and buying experience under one roof. Most home buyers are what the industry calls “dual trackers,” which means they are in the process of selling their house and buying a new one at the same time.

This usually forces those buyers to either take on a huge financial risk by buying a new home before they’ve sold their last home, or to place an offer on their new home contingent on the sale of their old home, which is unattractive to most sellers.

Orchard solves this by making an offer on buyers’ old houses that is guaranteed for 90 days. Orchard co-founder Court Cunningham says that more than 85% of those homes sell at a market price before the 90-day period.

Cunningham believes that Orchard’s advantage comes not only in the fact that it has products to serve each part of the process — search, title and mortgage — but that it’s iterated on each of those pieces of the puzzle.

For example, Orchard has improved its search functionality to allow users to choose which photo they’re searching for. Let’s say the master bathroom or the kitchen is the most important room in the home to you. Orchard lets you search by pictures of that room as you browse homes. Orchard is also working on a new machine learning-powered search system that would allow users to select five homes they love to help the search algorithm find homes similar to them.

With a team of data scientists, Orchard works to price homes as “close to the pin as possible,” according to Cunningham. It’s also worth noting that Orchard compensates its realtors via salary and benefits as opposed to the usual commission framework most real estate agents live off.

Cunningham believes this is what makes Orchard a more human tech real estate platform, fully aligning the interests of the real estate agent with the buyer/seller.

When a home doesn’t sell before the 90-day period, Orchard buys the home a few points below market value through that guaranteed offer, and then makes small improvements to the home to help it sell. Orchard underwrites the home again and puts it back on the market in a process Cunningham describes as “much more capital efficient than you think.”

This is thanks in large part to the $200 million+ debt financing Orchard secured alongside its Series A funding round, and the fact that Orchard’s data scientists can help recycle those homes (and with it, the capital) relatively quickly on the market. Cunningham says the company is only using a fraction of its debt financing.

Orchard also offers a title business, letting buyers close the transaction via their phone from the comfort of their home. And Orchard shows no signs of slowing. The company currently has a mortgage product in beta.

On the heels of this new funding round, Orchard wants to double the size of its team from 150 people to 300 by the end of 2020. Cunningham also expects to see more than 100% revenue growth over the next year.

“The greatest challenge is to grow rapidly and build the tech around this that allows us to deliver in a repeatable way,” said Cunningham. “Buying a home is the biggest financial transaction of someone’s life and the human element is really important. So we need to grow quickly but in a way that is highly human and highly consistent.”

Powered by WPeMatico

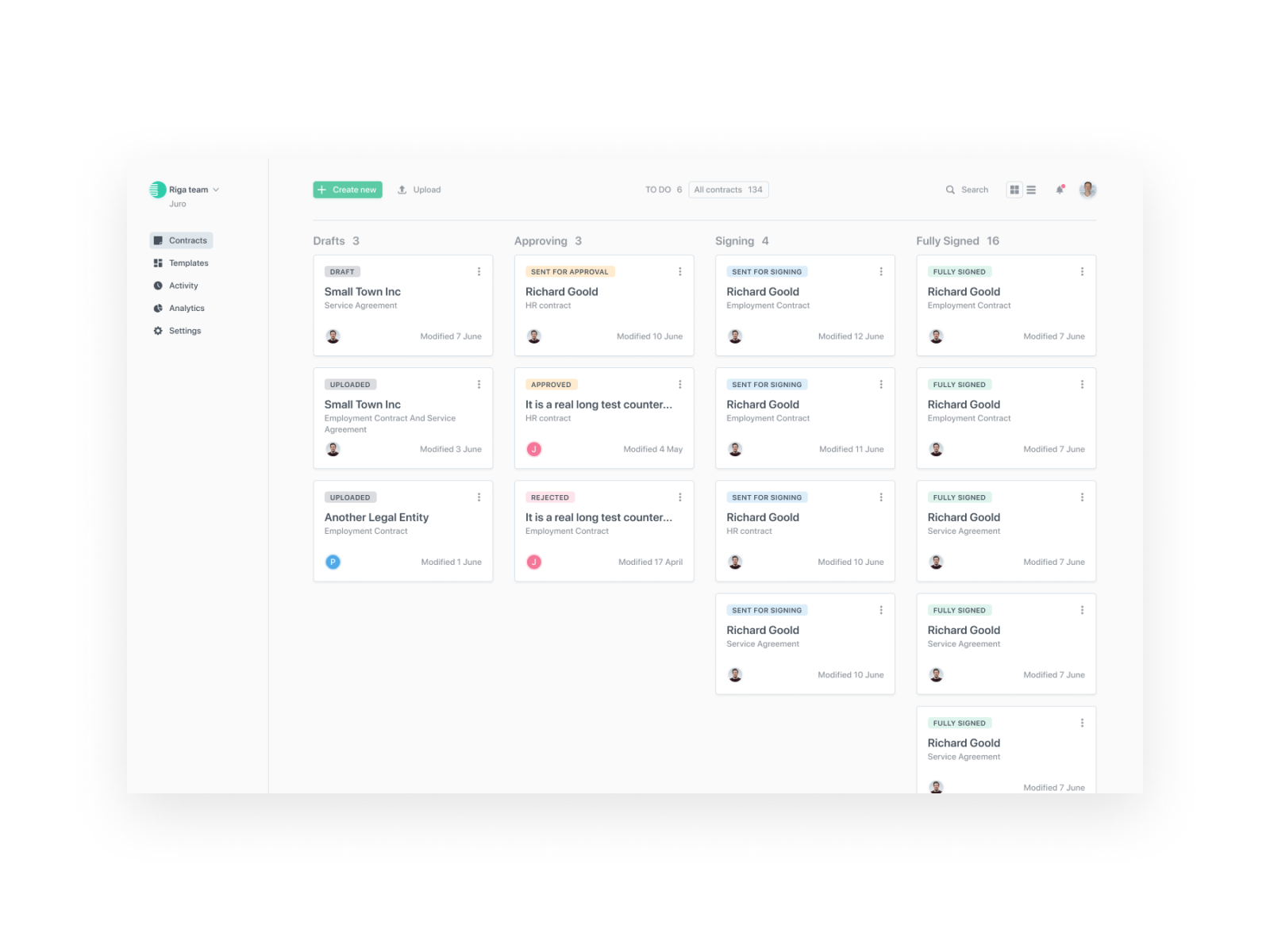

Juro, a UK startup that’s using machine learning tech and user-centric design to do for contracts what Typeform does for online forms, has caught the eye of Union Square Ventures. The New York-based fund leads a $5 million Series A investment that’s being announced this morning.

Also participating in the Series A are existing investors Point Nine Capital, Taavet Hinrikus (co-founder of TransferWise) and Paul Forster (co-founder of Indeed). The round takes Juro’s total raised to-date to $8M, including a $2M seed which we covered back in 2018.

London is turning into a bit of a hub for legal tech, per Juro CEO and co-founder Richard Mabey — who cites “strong legal services industry” and “strong engineering talent” as explainers for that.

It was also, he reckons, “a bit of a draw” for Union Square Ventures — making what Juro couches as a “rare” US-to-Europe investment in legal tech in the city via the startup.

“Having brand name customers in the US certainly helped. But ultimately, they look for product-led companies with strong cross-functional teams wherever they find them,” he adds.

Juro’s business is focused on taking the tedium out of negotiating and drawing up contracts by making contract-building more interactive and trackable. It also handles e-signing, and follows on with contract management services, using machine learning tech to power features such as automatic contract tagging and for flagging up unusual language.

All of that sums to being a “contract collaboration platform”, as Juro’s marketing puts it. Think of it like Google Docs but with baked in legal smarts. There’s also support for visual garnish like animated GIFs to spice up offer letters and engage new hires.

“We have a data model underlying our editor that transforms every contract into actionable data,” says Mabey. “Juro contracts look like contracts, smell like contracts but ultimately they are written in code. And that code structures the data within them. This makes a contract manager’s life 10x easier than using an unstructured format like Word/pdf.”

“Still our main competitor is MS Word,” he adds. “Our challenge is to bring lawyers (and other users of contracts) out of Word, which is a significant task. Fortunately, Word was never designed for legal workflows, so we can add lots of value through our custom-built editor.”

Part of Juro’s Series A funds will be put towards beefing up its machine learning/data science capabilities, per Mabey — who says the overall plan at this point is to “double down on product”, including by tripling the size of the product team.

“That means hiring more designers, data scientists and engineers — building our engineering team in the Baltics,” he tells us. “There’s so much more we are excited to do, especially on the ML/data side and the funding unlocks our ability to do this. We will also be building our commercial team (marketing, sales, cs) in London to serve the EU market and expand further into the US, where we already have some customers on the ground.”

The 2016-founded startup still isn’t breaking out customer numbers but says it’s processed more than 50,000 contracts for its clients so far, noting too that those contracts have been agreed in 50+ countries. (“Everywhere from Estonia to Japan to Kazakhstan,” as Mabey puts it.)

In terms of who Juro users are, it’s still mostly “mid-market tech companies” — with Mabey citing the likes of marketplaces (Deliveroo), SaaS (Envoy) and fintechs (Luno), saying it’s especially companies processing “high volumes of contracts”.

Another vertical it’s recently expanded into is media, he notes.

“E-signature giants have grown massively in the last few years, and some are gradually encroaching into the contract lifecycle — but again, they deal with files (pdfs mostly) rather than dynamic, browser-based documentation,” he argues, adding: “In terms of new legal tech entrants — I’m excited by Kira Systems especially, who are working on unpicking pdf contracts post-signature.”

As part of the Series A, Union Square Ventures parter, John Buttrick, is joining Juro’s board.

Commenting in a supporting statement, Buttrick said: “We look for founders with products equipped to change an industry. While contract management might not be new, Juro’s transformative vision for it certainly is. There’s no greater proof of the product’s ease of use than the fact that we negotiated and closed the funding round in it. We’re delighted to support Juro’s team in making their vision a reality.”

Juro’s contract management platform — dashboard view

Powered by WPeMatico

The Guild, a nearly four-year-old, Austin, Texas-based startup that turns apartments into comfortable short-term accommodations for business and other travelers, has landed $25 million in Series B funding from some of its earlier investors, including Maveron and Convivialite, along with real estate companies like the Nicol Investment Company, which owns some of the buildings in which The Guild has units.

The 171-person company — started by two University of Texas grads who met in 2015 through their overlapping interests (one worked in boutique hotel development and the other is a co-founder of the apartment marketplace Apartment List) — has plenty of competition. Lyric, Domio and Sonder are but three of the many other well-funded companies now in the business of gussying up apartments and renting them out like hotel rooms.

The competition is so stiff, in fact, that all are fast adding other services to their offerings. All promise around-the-clock support, for example, so if the Wi-Fi goes down, there’s someone to scream at, no matter the hour. Lyric also offers its customers “curated in-suite art, music and coffee programs.” The Guild touts its personal approach, like adding a Christmas tree to a room for a family that is temporarily displaced during the holidays. Meanwhile, among its offerings, Sonder offers “pre-stay cleaning.”

The last seems less like a perk than a necessity, but in the race to capture mindshare, no detail is too small to promote, apparently.

As for its part, The Guild is now operating 565 units, with another 235 units in the “final stages of development,” the company tells us. It’s also operating in six cities currently — Austin, Cincinnati, Dallas, Denver, Miami and Nashville — but it plans to land in six more in the next 12 to 24 months. (If you’re curious about how long it takes for a unit to become profitable, the company says the investment payback is traditionally within 12 months.)

As for how it’s breaking through the noise of its competitors, the company has a corporate sales team that works with companies like McKinsey, Google and Whole Foods, and it partners with travel companies, including Concur, Airbnb and Expedia.

Certainly, investors see promise in its strategy — and its momentum.

The Guild, which says it generated $10 million in revenue in 2018, tells us it generated more than $20 million in 2019 and that it expects to maintain 100% growth in 2020, thanks in part to its new round of funding.

Powered by WPeMatico

Loft may have better product market fit in Brazil than Opendoor does in the U.S. And now the São Paulo-based property tech company has growth funding to prove it.

Andreessen Horowitz is doubling down on its first Brazil investment with Loft, a two-year-old real estate marketplace. The $175 million Series C was co-led by Vulcan Capital.

In the U.S., sites like Opendoor give us visibility into how much your house or properties you’re interested in are worth. That transparency doesn’t exist in Latin America.

Loft founder and co-CEO Mate Pencz describes the residential real estate market in Latin America as a $6 trillion opportunity. As it exists now, lack of data transparency around property listings results in low-quality listings, disproportionately high asking prices and prolonged selling times. This creates a painful experience for buyers, sellers and brokers. The market is locked up, but Loft thinks it can create transparency and liquidity with open data sets for property value.

Loft has been supported by some pretty big Silicon Valley names since its genesis in 2018. Loft raised equity capital from angel investors such as Max Levchin of PayPal, Joe Lonsdale of Palantir, Opendoor founder Eric Wu, Mike Krieger of Instagram, David Vélez of Nubank and Josh Kushner of Thrive Capital, whom Pencz met during undergrad studies at Harvard. It helped that Loft was not Pencz’s first entrepreneurial rodeo — the founder started web-printing company Printi, which exited to Vistaprint in 2014 for a $25 million stake.

Pencz says they’ve transacted on 1,000 properties in their key market of São Paulo, and plans to tackle new cities with the “Uber growth model” of replicating the same service in new cities, like Mexico City. Loft is currently operative in Brazil, and has big plans for Mexico in 2020. Penzc has poached the Latin American head of Uber Eats, Juan Pablo Ramos, to launch Loft’s services in Mexico City within the next two to four months. As Loft mobilizes in Mexico, this could mean trouble for Flat, an existing Opendoor clone in Mexico, which will now fight for market share against a heavily funded competitor.

Loft’s São Paulo HQ

When it comes to marketing, Loft isn’t thinking about Facebook or SEO performance advertising. Pencz sees more value in physically integrating the Loft brand into the fabric of new neighborhoods through festival sponsorships and community events, while leveraging broker channels. “Partnering with brokers and being perceived as a positive brand with a high NPS are the two key pillars of Loft’s expansion strategy,” says Pencz.

The founders began by physically measuring buildings and making estimates about how much houses and apartments were worth. The founders didn’t stop there — they envision the future of Loft as a one-stop shop with services like renovations, property financing for mortgages and insurance through banks. The company wants to completely upend real estate in Latin America, and those big ambitions have piqued investor interest.

Andreessen Horowitz and Vulcan Capital co-led the Series C, with participation from QED Investors, Fifth Wall Ventures, Thrive Capital, Valor Capital and Monashees.

Andreessen Horowitz general partner Alex Rampell notes that while Loft marked the firm’s entry into Brazil, the fund has been active in Latin America for a few years: a16z invested in Colombia’s delivery unicorn Rappi, Uruguayan restaurant management platform Meitre and Colombian point of sale lender ADDI. And, a16z joined in Loft’s $70 million Series B that closed in March 2019.

Rampell, who previously invested in Opendoor and sits on the board of TransferWise, says that a16z doesn’t really have an investment strategy when it comes to Latin America. Instead, the idea with Loft was that while the iBuyer Opendoor for transactional multiple listing services isn’t by any means a proprietary business model, it may work better in a country like Brazil — where buyers and sellers are slowed down by bureaucratic policies and lack of fair market value data — than in the U.S. To put it simply, Loft has better product market fit in Brazil than Opendoor does in the U.S.

Loft hopes its customer-friendly Nubank-esque branding will win over new users

Rampell references the U.S.’s Groupon and Korea’s Coupang for comparison. The Groupon model blew up in Asia as Coupang’s valuation reached $9 billion. Groupon rose fast and fell hard, and now its founders are on to their next entrepreneurial ventures.

“There’s a lot of value in multiple listings services, and the opportunity might be better for a market like Brazil, especially if you back the right entrepreneurs — because that’s all that really matters in the end,” says Rampell.

Loft monetizes through the sale of properties and ancillary products. Cuts from referral and partnership fees from banks or insurance companies will continue to help Loft monetize, in addition to the $275 million in capital it has raised during its two short years in existence.

Pencz declined to comment on Loft’s valuation.

Powered by WPeMatico

Just over two years ago, PerceptIn announced an $8 million Series A. The funding followed a $2 million seed round, and found the startup essentially coming out of stealth to showcase the sensors it was building for a wide range of form factors, from cars to robot vacuums.

The company’s been quite busy in the meantime. In fact, it even went so far as changing its name. PerceptIn is now “Trifo” — a punchier name, if not quite as memorable. The company’s currently on its third robotic vacuum, announced today and set to be officially unveiled at CES in a few days.

Along with the arrival of “Lucy” comes some more big funding from the Samsung Ventures-supported startup. Trifo has just raised a $15 million Series B, bringing its total funding up to $26 million. The round includes backing from Yidu Cloud, Tsinghua AI Fund and Matrix Partners, with a focus on producing more hardware and software solutions in the home robotics space, additional hiring and pushing into the U.S. and European markets.

For now, robot vacuums appear to be the company’s primary public-facing output. It’s a tough market — one that’s traditionally been dominated by one player (iRobot). Still, there’s no shortage of alternatives from players big and small looking to crack it.

As for what sets Lucy apart, there are a pair of cameras on board — that could either be a plus or minus, depending on where you land on matters of privacy. The pair combine 1080p color images with depth sensing to provide home surveillance and mapping in light and dark settings. The robot can also be designed to “patrol” the home in predefined routes.

Lucy also features built-in obstacle avoidance for objects as short as one inch, room-by-room cleaning and and a 5,200 mAh battery for up to two hours of cleaning on a charge. Pricing is $799, putting it in line with iRobot’s offerings. It’s set to arrive at some point in Q1.

Powered by WPeMatico