Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

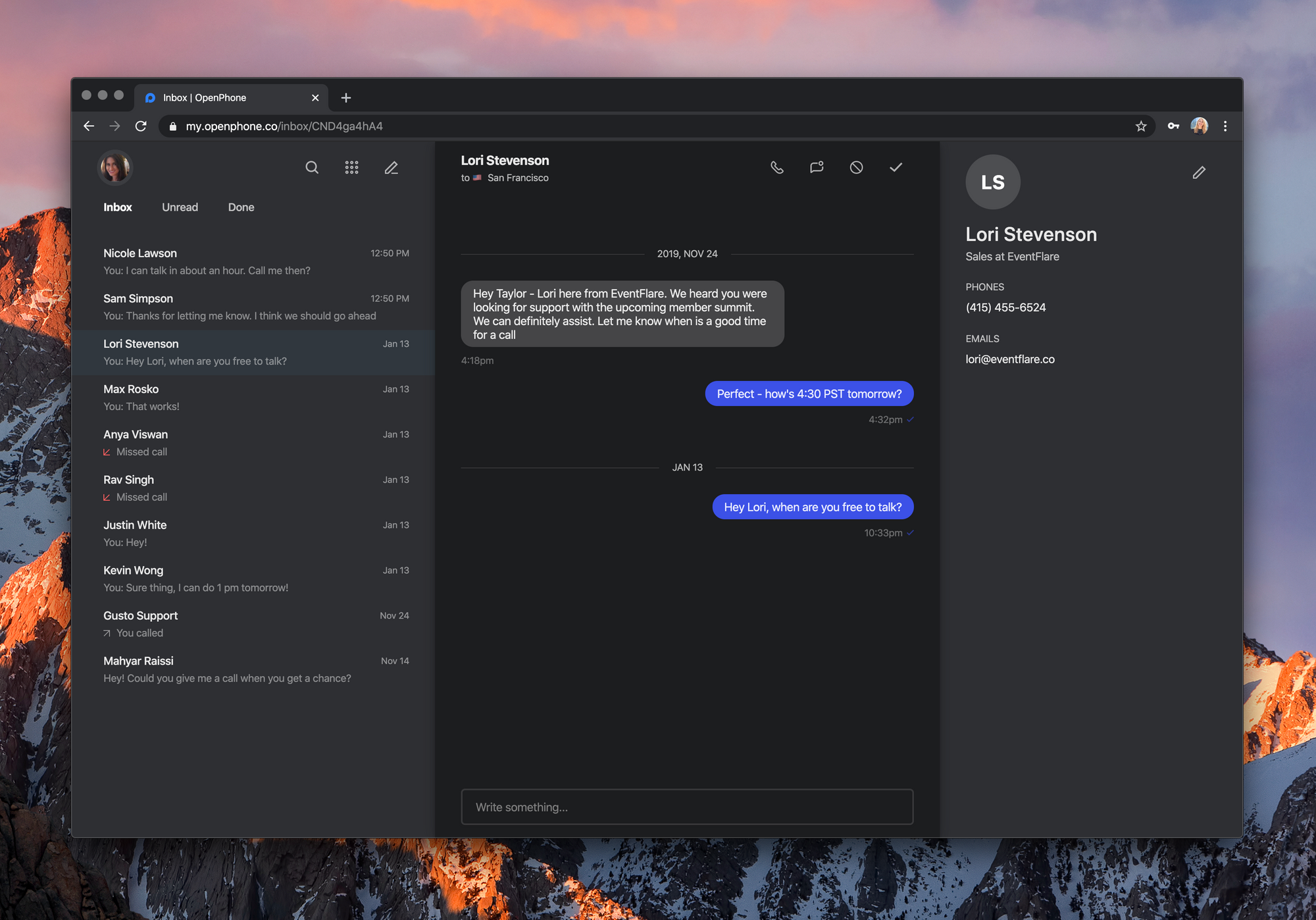

Y Combinator graduate OpenPhone is raising a $2 million funding round led by Slow Ventures. The company is working on an app that lets you seamlessly get a business phone number without a second phone or a second SIM card.

Y Combinator, Kindred Ventures, Garage Capital, 122WEST Ventures and others are also participating in today’s funding round.

Compared to Aircall and other enterprise solutions, OpenPhone targets small and medium companies that want a mobile-first, easy-to-use solution to take advantage of a second phone number.

For instance, if you’re a freelancer and you hate handing out your personal phone number, OpenPhone lets you separate your personal and professional life more easily.

OpenPhone works on iPhone, iPad and Android. You also can use a web interface to interact with the app from your computer. It currently costs $10 per month per user. For that price, you get a local number, a toll-free number or you can port an existing phone number. Five thousand people are using OpenPhone right now.

You can then use that number for unlimited calls and texts in the U.S. and Canada. Behind the scene, OpenPhone uses your internet connection to establish voice-over-IP calls.

The startup has been working on collaborative features so you can use OpenPhone with multiple users. For instance, you can share a phone number with other users so your team can answer text messages faster and pick up the phone more often. The company has also launched a Slack integration that lets you receive a notification when somebody calls or texts your phone number.

Powered by WPeMatico

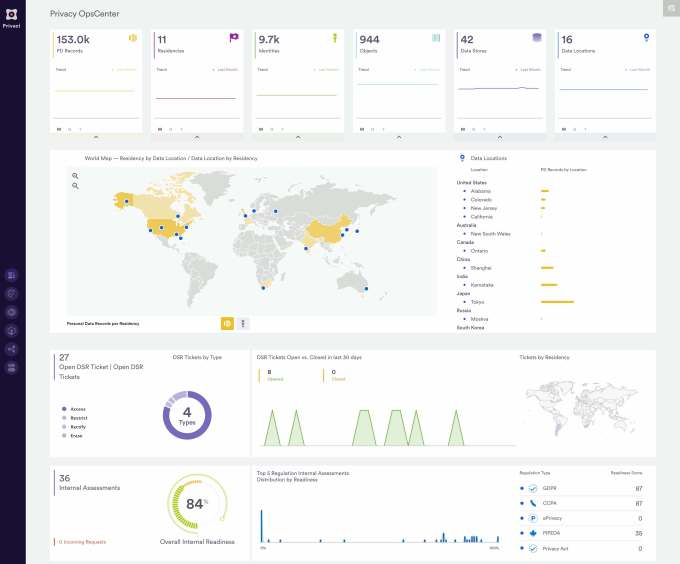

Securiti.ai, a San Jose startup, is working to bring a modern twist to data governance and security. Today the company announced a $50 million Series B led by General Catalyst, with participation from Mayfield.

The company, which only launched in 2019, reports it has already raised $81 million. What is attracting all of this investment in such a short period of time is that the company is going after a problem that is an increasing pain point for companies all over the world because of a growing body of data privacy regulation like GDPR and CCPA.

These laws are forcing companies to understand the data they have, and find ways to be able to pull that data into a single view, and, if needed, respond to customer wishes to remove or redact some of it. It’s a hard problem to solve with customer data spread across multiple applications, and often shared with third parties and partners.

Company CEO and founder Rehan Jalil says the goal of his startup is to provide an operations platform for customer data, an area he has coined PrivacyOps, with the goal of helping companies give customers more control over their data, as laws increasingly require.

“In the end it’s all about giving individuals the rights on the data: the right to privacy, the right to deletion, the right to redaction, the right to stop the processing. That’s the charter and the mission of the company,” he told TechCrunch.

You begin by defining your data sources, then a bot goes out and gathers customer data across all of the data sources you have defined. The company has links to more than 250 common modern and legacy data sources out of the box. Once the bot grabs the data and creates a central record, humans come in to review the results and make any adjustments and final decisions on how to handle a data request.

It has a number of security templates for different kinds of privacy regulations, such as GDPR and CCPA, and the bot finds data that must meet these requirements and lets the governance team see how many records could be in violation or meet a set of criteria you define.

Securiti.ai data view. Screenshot: Securiti.ai (cropped)

There are a number of tools in the package, including ways to look at your privacy readiness, vendor assessments, data maps and data breaches to look at data privacy in broad way.

The company launched in 2019, and in just five months has already grown to 185 employees, a number that is expected to increase in the next year with the new funding.

Powered by WPeMatico

Cooks Venture, the agtech company looking to revolutionize the chicken industry, has today announced the close of a $4 million funding round led by Golden West Food Group.

Cooks Venture has been working in stealth for many years, but launched onto the scene in 2018 with a plan to reshape agriculture from the ground up. And the key to that strategy? Chickens.

Cooks Venture geneticists and scientists have spent years isolating genetic lines of chickens to create a new, proprietary breed, called the Pioneer, a type of heirloom chicken. Most folks don’t know that, no matter what brand of chicken you buy at the store, chances are it’s one of two breeds, the Cobb 500 or the Ross 308, which are produced by Cobb and Aviagen, respectively.

Both of these breeds of broilers are fast-growing (they’re ready to be processed in just over five weeks) and use a three-phase feed system for growth. This system, and these breeds, are a big reason why animal activist groups express so much concern over the well-being of chicken livestock, often explaining that the birds are too young to carry around all the weight they put on so quickly.

Cooks Venture looked to science to solve the problem. The company’s Pioneer chicken can eat a highly diverse diet, and can be raised in 60 to 65 days. This means that the Pioneer chickens are truly free range, wandering around the farm. It also means that these chickens, with a digestive tract that can handle a diverse diet and the ability to exercise, live a healthier life, are higher in Omega-3 and taste better than your average Cobb 500 or Ross 308, according to the company.

But the chickens themselves are only part of the solution. A byproduct of the proliferation of these fast-growing chickens produced by Cobb and Aviagen is that they have to eat, and their diet is very specific. That means that farmers must produce a great deal of one or two crops to feed the millions of chickens out there. The result is that our agricultural land is not being used in an efficient or eco-friendly way.

In fact, Cooks Venture founder Matt Wadiak says that the vast majority of our crop production in the United States is used for ethanol or animal feed, which indexes toward corn and soy. The USDA says, of feed grains, that corn accounts for more than 95% of total production and use in the country.

Many farmers would love to implement regenerative agricultural practices, a big part of which includes creating a biodiverse ecosystem with many different crops, but who would they sell the extra, low-demand crops to?

The answer now can be Cooks Venture. With strong digestive systems, Cooks Venture chickens can eat a diet that comes from a more biodiverse farm. Moreover, when Cooks Venture is ready to expand globally, the chickens are able to eat crops local to the ecosystems of emerging nations, such as yucca and quinoa.

Cooks Venture has its own farm, and works with farm partners to set up regenerative agricultural practices around producing Pioneer chicken feed. Cooks also does its own processing at its own plant.

Golden West Food Group is a manufacturer of meat products and value-add food products like marinated chicken, such as Jack Daniel’s pulled pork. It’s worth noting that GWFG is not a competitor to Cooks Venture, as it produces no meat products whatsoever, but rather an important distribution partner for the brand.

Through the partnership with GWFG, Cooks can start to ramp up commercialization of its chickens, which are currently sold through some retailers, on the Cooks website and on FreshDirect.

As part of the announcement, Cooks Venture is also bringing on Ankur Agrawal as chief financial officer. Wadiak, a co-founder at Blue Apron, worked with Agrawal back in the Blue Apron, days and says that his understanding of agricultural finance is top of the line.

Editor’s Note: An earlier version of this article misidentified the Pioneer chicken and mistook HelloFresh for FreshDirect. It has been updated for accuracy.

Powered by WPeMatico

Marketing and sales automation — tools that leverage the advances and data of our digital age to better identify and then interact with customers — is big business, with the whole market expected to generate some $6.6 billion in revenues for related companies by 2025.

But “companies” is the operative word here: it’s a very fragmented space, with dozens of hopefuls covering different aspects of marketing and sales, each with its own unique approach. There is an alternative trend, though, and today a customer experience automation company called ActiveCampaign, catering not just to large enterprises but small and medium businesses too, has raised a large round of funding to build out its own one-stop-shop model. It includes the tools to run email and messaging-based marketing campaigns; marketing automation across sites and events; and sales and CRM.

The Chicago-based company is today announcing that it has closed a Series B of $100 million, money that it will use to invest in building out new technology and to expand internationally. The funding is being led by Susquehanna Growth Equity, with PE firm Silversmith Capital Partners also participating.

ActiveCampaign is not your typical startup. It has been around since 2003, and this is only the second time it has raised money — the first time was in 2016, a modest $20 million round from Silversmith. Fundraising is not the only thing that sets it apart: it’s also profitable and has been for years (one reason it hasn’t raised money), and it’s actually already quite large, with 90,000 customers in 161 countries.

Yet it’s something of a theme in the world of “startups” — meaning tech companies that are still privately owned and raising from VCs and related backers — particularly those that are B2B focused, that some of the more interesting and successfully bootstrapped of them at some point turn to VC and private equity when it comes to needing an extra boost to move beyond what has become its natural growth rate.

In the case of ActiveCampaign, it had a taste of what a little outside investment could do in the last few years: Jason VandeBoom, founder and CEO of ActiveCampaign, said the company has seen its annual recurring revenues grow 6x since 2016 to $90 million, with employees booming from 65 to more than 550.

The company’s core proposition is that it provides a less fragmented approach to businesses interested in building in some digital marketing or sales tools into their outreach and then considering what to do next.

“What we are up against are a number of companies focused on a single slice of customer experience, either CRM or a customer success platform,” VandeBoom said. “We’re still at this point in the industry where the category is taking shape,” which spells a ripe opportunity for ActiveCampaign.

The need for what ActiveCampaign provides is a basic one: Whether you are an online retailer or any business that wants to expand its audience or make sure to stay connected to the one you already have, you need tools to reach users, figure out what they want to see from you and connect in a relevant way.

VandeBoom added while there are no specific plans for acquisitions that can be discussed now, the funding also gives the company “optionality” in terms of what it might do next.

Part of the company’s approach is to build technology in-house, but in the spirit of all-in-one platforms, its value also lies in how many other things its users can plug into using ActiveCampaign.

The company has some 260 technology partners and a “recipe library” with more than 250 automations already built, or users can build and customise themselves from more than 300 possible apps that can be integrated, including Shopify, Square, Facebook, Eventbrite and Salesforce.

With this round, Martin Angert, director at Susquehanna, is joining ActiveCampaign’s board of directors. His existing roles on the boards of Workfront, WhiteSource, XebiaLabs and Allocadia speaks to interesting potential strategic partnerships for ActiveCampaign.

“ActiveCampaign and the CXA category have grown significantly and our investment in the series B reconfirms Silversmith’s commitment to ActiveCampaign’s future,” said Todd Maclean, co-founder and managing partner of Silversmith Capital Partners, in a statement.

Powered by WPeMatico

Moons, a Mexico City-based startup that’s angling to be the Invisalign for the Latin American market, has joined the ranks of Y Combinator as part of the accelerator’s latest cohort.

The company already has $5 million in financing in the bank from an international group of investors, including Jaguar Ventures, Foundation Capital and Tuesday Capital, along with a whole host of strategic individual investors from Latin America’s dental community.

“We provide dental services throughout Mexico, Colombia and soon throughout Latin America,” says Moon co-founder and chief executive officer, Tommaso Tomba.

Like Invisalign, Moons conducts free initial conversations with potential patients and does a free scan of their teeth. “We have a team of orthodontists that take a look at the patient and determines whether the patient is a good candidate,” says Tomba.

If there’s a good fit, then the company creates a treatment plan and consultation schedule with a patient and fits them out with a pair of 3D-printed aligners — all for around $1,200.

That’s far lower than the treatment costs using established vendors, says Tomba. Already the company has 18 locations in Mexico and another two in Colombia — where Tomba expects operations to expand at a rapid clip. “We’re turning more cases than Invisalign in Mexico because we’ve brought the price right down,” says Tomba.

A graduate of Cambridge and Oxford Universities, Tomba and his founding team chose Latin America to launch their dental business after months of market analysis. Latin America is host to three of the most active destinations for cosmetic surgeries in the world.

Tomba market-tested by creating a website advertising the launch of his new business and taking pre-orders for the service in Europe, Latin America and the U.S. He settled on Mexico in part because of the demand he saw and in part because he’d had experience in the market previously as an early employee of Linio — a Rocket Internet-backed competitor to Amazon on the continent.

During his time at Linio, Tomba met his co-founder Leonardo Miron, a serial entrepreneur whose previous business was a mobile phone repair service called Rescata. Alex Clapp, a university friend of Tomba’s with experience in investment banking and healthcare-focused private equity in London and New York, rounded out the founding team.

The team chose to apply to Y Combinator because of the firm’s access to capital and ability to open doors in the U.S., Tomba said. “In LatAm, access to capital to build long-lasting companies is still relatively limited compared to the U.S., so we think it makes sense to YC so that they help us with investors and attracting talent going forward,” he said.

And Moons has bigger dreams than just the dental market. “We plan to go into other healthcare verticals,” says Tomba. “Always with the core tenet of providing high-quality healthcare and making it accessible.”

Powered by WPeMatico

What if it was easier to eat salad than junk food? Most diet routines take a ton of time, whether you’re cooking from scratch, making a meal kit or seeking a nutritious restaurant. But on-demand prepared food delivery companies like Sprig that tried to eliminate that work have gone bankrupt from poor unit economics.

Thistle is a different type of food startup. It delivers thrice-weekly cooler bags customized with meat-optional, plant-based breakfasts, lunches, dinners, snacks, sides and juices. By batching deliveries in the less-congested early morning hours and optimizing routes to its subscribers, or by mailing weekly boxes beyond its own geographies, Thistle makes sure you already have your food the moment you’re hungry. Whether you heat them up or eat them straight out of the fridge, you’re actually dining faster than you could even place an Uber Eats order.

The food on Thistle’s constantly rotating menu is downright tasty. You might get a sunrise chia parfait for breakfast, a chicken tropical mango salad for lunch, a microwaveable bulgogi noodle bowl for dinner, with beet hummus and kale-cucumber juice for snacks. Thistle’s not cheap, with meals averaging about $14 each. But compared to competitors’ on-demand delivery markups and service fees, wasting ingredients from the grocer and the hours of cooking for yourself, it can be a good deal for busy people.

“We see Thistle as part of a movement to make health convenient rather than a high willpower chore,” CEO Ashwin Cheriyan tells me. What Peloton did to shave time off getting a great workout, Thistle does for eating a nourishing meal. It makes the right choice the easiest choice.

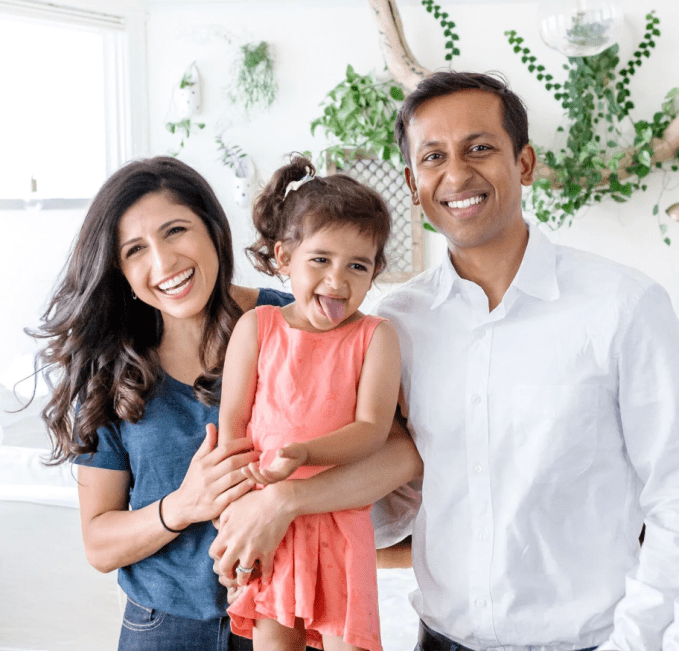

Thistle COO Shiri Avnery and CEO Ashwin Cheriyan with their daughter

The idea of a button you can push to make you healthier has attracted a new $5.65 million Series A round for Thistle led by its first institutional investor, PowerPlant Ventures . Bringing the startup to $15 million in funding, the cash will expand Thistle’s delivery domain. Dan Gluck of PowerPlant, which has also funded food break-outs like Beyond Meat, Thrive Market and Rebbl, will join the board.

Currently Thistle delivers in-person to the Bay Area, LA metro, San Diego and Sacramento while shipping to most of Washington, Oregon, Utah, Idaho, Nevada and Arizona. Thistle actually held off on raising more since launching in 2013 to make sure it hammered out unit economics to prevent an implosion. It’s also planning broader meal options, additional product lines and fresh distribution strategies like getting stocked in office smart kitchens or subsidized by wellness plans.

“The reasons that so many food delivery companies have failed likely fall into two buckets: one, a lack of focus on margins and unit economics, and two, premature geographic expansion before proving out the business model,” says Cheriyan. “Thistle makes money similar to how a well-run restaurant would make money — by having strong gross margins, efficient customer acquisition costs and solid customer retention / lifetime metrics. We currently deliver tens of thousands of meals on a weekly basis to customers on the West Coast and our annual average growth rate since launch has been 100%+.”

It’s nice that Thistle hasn’t gone out of business, because I’ve been eating its salads 6X a week for three years. It’s been the most efficient way for me to get healthier and lose weight after a half-decade of ordering takeout sandwiches and then feeling sluggish all day. I legitimately look forward to each one since they often have 20+ ingredients and only repeat every few months, so they’re never boring.

It has helped me keep my work-from-home lunches to about 20 minutes so I have more time for writing. Thistle is one of the few startups I consistently recommend to people. When asked how I lost 25lbs before my wedding, I point to Peloton cycling, Future remote personal training and Thistle salads — none of which require me to leave the house.

Cheriyan tells me, “We wanted the better-for-you and better-for-planet choice to be the default choice.”

Thistle has already pivoted past the business model burning tons of cash across the startup world. The company started as an on-demand cold-pressed juice delivery service, sending hipster glass bottles of watermelon and charcoal extract to doors around San Francisco. It was 2013, yoga was booming and people were paying crazily high prices for liquified lemongrass. Health made simple seemed like a sure bet to the founding team of Alap Shah, Naman Shah, Sheel Mohnot and Johnny Hwin, some of whom run Studio Management, a family office and startup incubator. [Disclosure: Hwin and Alap Shah are friends of mine, but didn’t pitch or discuss this article with me.]

Thistle eventually straightened things out with a shift to subscriptions and batched delivery under the leadership of the newly added co-founders, Cheriyan and his wife and COO Shiri Avnery. “I came from a family of physicians — both my parents, brother, and enough aunts, uncles, and cousins are doctors that they could start a small hospital,” Cheriyan, a former corporate attorney in M&A tells me. “A common point of frustration was about patients suffering from diet-related illnesses who were unable to make a lifestyle change because it was too hard.”

Avnery, a PhD in air pollution and climate change’s impact on agriculture, had become exasperated with the slow pace of policy change and the inaction of governments and corporations. The two quit their jobs, moved to San Francisco, and searched for a point of leverage for positively influencing people’s diets and interaction with the environment. They teamed up with the founders and launched Thistle v1.

A lack of experience in logistics led to the initial detour into on-demand. But rather than trying to fix the problem with VC money, Thistle stayed lean and discovered the opportunity nestled between Uber Eats and Blue Apron: sending people food they don’t have to eat now, but that takes low or no time to prepare when they’re peckish. Through its app, users can customize their meal plans, ban their allergens, pause deliveries and see what they’ll eat next.

A sample of Thistle 8 meal plans

“The unit economics problem most heavily plagued the early on-demand food companies. Food / labor waste and inefficient deliveries were likely the biggest reasons why the economics were unsustainable without venture life support. We know this personally as Thistle started our delivery service as an on-demand company before quickly realizing that the unit economics couldn’t sustain a healthy business,” Cheriyan explains, regarding companies like Sprig, DoorDash and Grubhub. Beyond unsold food, “the margins very likely did not support ordering a $12-$15 single meal for immediate delivery when average hourly driver wages reached $18-20.”

Meal kits were supposed to make dining healthier and cheaper, but they proved too much of a chore and led customers to boxes of ingredients piling up unused. Munchery and Nomiku went out of business while giants like Blue Apron have incinerated hundreds of millions of dollars and seen their share prices sink.

“The meal kit companies fared a little better from a gross margin perspective (due to pre-orders and more efficient deliveries), but suffer most from an easy-to-copy business model. This led to a rise in copycats, and, as a result, heavily rising customer acquisition costs, low switching costs and poor retention,” Cheriyan tells me. “Fundamentally the meal kit companies face another challenge, which is that people have less and less time to cook and are increasingly looking for ready-to-eat options.”

A slower, steadier approach with less overhead, more convenience and fewer direct competitors has helped Thistle grow to 400 employees, from culinary to engineering to logistics.

Still, it’s vulnerable. It may still be too expensive for some markets and demographics. Logistics experts like Amazon and Whole Foods could try to barge into the market. Cloud kitchens without dining rooms are making restaurant food more affordable for delivery. And another startup could always take the gamble on raising a ton of cash and subsidizing prices to steal market share, especially where Thistle doesn’t operate yet.

Thistle could counter these threats by further eliminating delivery costs by selling through partners like office smart fridges where employees pay on the spot, or equipping gym lobbies with more than just Muscle Milk.

“One opportunity we’re excited to test is attended and unattended retail — it would be great to be able to pick up Thistle products at your local grocery store, gym or coffee shop,” Cheriyan says. As for offices, “Today’s corporate lunchtime solutions often require a trade-off between health and convenience: either wait in line for 30+ minutes at your favorite salad spot for a healthy option, or opt into catered restaurant meals that leave you feeling sluggish and unproductive.” Thistle could help employers prevent the 3pm energy lull.

The startup’s focus on plant-forward meals also centers it in the path of another megatrend: the shift to environmentally conscious diets. Almost 60% of Americans are trying to eat less meat and 50% are eating meat-alternatives like Impossible Burgers. That stems both from interest in the humane treatment of animals and how 15% of green house emissions come from livestock. But 45% of Americans say they hate to cook. That’s why Thistle makes pre-made meals where meat and egg are optional, but the food is healthy and delicious without them.

In the age of Uber, we’ve acclimated to an effortless life. The new wave of “push-button health” startups like Thistle could finally take the hassle out of aligning your actions in the gym or kitchen with your intentions.

Powered by WPeMatico

If a thousand companies make their own smart light bulb, do a thousand companies also have to design a light switch app to control them?

Kraftful, a company out of Y Combinator’s Summer 2019 class, doesn’t think so. Kraftful builds the myriad components that an IoT/smart home company might need, puzzle piecing them together into apps for each company without requiring them to reinvent the light switch (or the padlock button, or the smart thermostat dial) for the nth time.

Because no company wants an app that looks identical to a competitor’s, much of what Kraftful produces is built to be tailored to each company’s branding — all the surface-level stuff, like iconography, fonts, colors, etc. are all customizable. Under the hood, though, everything is built to be reusable.

This focus on finding the parts that can be built once makes sense, especially given the team’s background. CEO Yana Welinder and CTO Nicky Leach were previously head of Product and a senior engineer, respectively, at IFTTT — the web service made up of a zillion reusable, interlinking “recipe” applets that let you hook just about anything (Gmail, Instagram, your cat’s litter box, whatever) into anything else to let one trigger actions on the other.

Kraftful founders Nicky Leach and Yana Welinder

So why now? More smart devices are coming onto the market every day, many of them from legacy appliance companies that don’t have much (or any) history in building smartphone apps. Good apps are the exception — the Philips Hue app is one of the better ones out there, and even it’s a little wonky sometimes. Many of them are… really bad.

Bad apps get bad App Store reviews, and bad reviews dent sales. And even for those who dive in and buy it without checking the reviews first, bad apps means returned devices. According to this iQor survey from 2018, 22% of smart home customers give up and return the products before getting them to work.

“We kind of looked around and realized that 80% of all smart home apps have zero, one or two stars on the App Store,” Welinder tells me.

Knowing what’s working and what’s not with buyers is a strength of Kraftful’s approach; behind the scenes, they can run all sorts of analytics on how users are actually interacting with components in the apps they’re powering and adjust all of them accordingly. If they make a tweak to the setup process in one app, do more users actually get all the way through it? Great. Now roll that out everywhere.

“If you look at some of the leading smart lock apps, they all have very… very similar interfaces. They’ve basically gotten to a standardized user experience, but they’ve all be developed individually,” says Welinder. “So all of these companies are spending the resources designing and developing these apps, but they’re not getting the benefit of being standardized across the board and being able to leverage data from all of these apps to be able to improve them all at once”

Kraftful builds the app for both iOS and Android, tailors it to the brand’s needs, offers cloud functionality like push notifications and activity history, provides analytics for insights on how users are actually using an app and keeps everything working as OS updates roll out and as device display sizes grow ever larger.

Of course, the entire concept of a dedicated app for a smart home device has some pretty fierce competition — between Apple’s HomeKit and Google Home, the platform makers themselves seem pretty set on gobbling up much of the functionality. But most buyers still expect their shiny devices to have their own apps — something branded and purpose-built, something for the manual to point them to. Power users, meanwhile, will always want to do things beyond what the all-encompassing solutions like HomeKit/Home are built for.

Folks at Google seem to agree with Kraftful’s approach — the team counts the Google Assistant Investments Program as one of the investors in the $1 million they’ve raised. Other investors include YC, F7 Ventures, Cleo Capital, Julia Collins (co-founder of Zume Pizza and Planet Forward), Lukas Biewald (co-founder of CrowdFlower), Nicolas Pinto (co-founder of Perceptio) and a number of other angel investors.

Welinder tells me they’re already working with multiple companies to start powering their apps; NDAs prevent her from saying who, at this point, but she notes that they’re “some of the largest brands that provide smart lights, plugs/switches, thermostats and other smart home products.”

Powered by WPeMatico

Los Angeles is one of the most desirable locations for commercial real estate in the United States, so it’s little wonder that there’s something of a boom in investments in technology companies servicing the market coming from the region.

It’s one of the reasons that CREXi, the commercial real estate marketplace, was able to establish a strong presence for its digital marketplace and toolkit for buyers, sellers and investors.

Since the company raised its last institutional round in 2018, it has added more than 300,000 properties for sale or lease across the U.S. and increased its user base to 6 million customers, according to a statement.

It has now raised $30 million in new financing from new investors, including Mitsubishi Estate Company (“MEC”), Industry Ventures and Prudence Holdings . Previous investors Lerer Hippeau Ventures and Jackson Square Ventures also participated in the financing.

CREXi makes money three ways. There’s a subscription service for brokers looking to sell or lease property; an auction service where CREXi will earn a fee upon the close of a transaction; and a data and analytics service that allows users to get a view into the latest trends in commercial real estate based on the vast collection of properties on offer through the company’s services.

The company touts its service as the only technology offering that can take a property from marketing to the close of a sale or lease without having to leave the platform.

According to chief executive Mike DeGiorgio, the company is also recession-proof thanks to its auction services. “As more distressed properties hit the market, the best way to sell them is through an online auction,” DeGiorgio says.

So far, the company has seen $700 billion of transactions flow through the platform, and roughly 40% of those deals were exclusive to the company.

“The CRE industry is evolving, and market players, especially younger, digitally native generations are seeking out platforms that provide free and open access to information,” said Gavin Myers, general partner at Prudence Holdings, in a statement. “CREXi directly addresses this market need, providing fair access to a range of CRE information. As CREXi continues to build out its stable of services, features, and functionality, we’re thrilled to partner with them and support the company’s continued momentum.”

CREXi joins the ranks of startups based in Los Angeles that have raised money to reshape the real estate industry. Estimates from Built in LA count roughly 127 companies, which have raised in excess of $2.4 billion, active in the real estate industry in Los Angeles. These companies range from providers of short-term commercial office space, like Knotel, or co-working companies like WeWork, to companies focused on servicing the real estate industry like Luxury Presence, which raised a $5 million round earlier in the year.

Due to inaccurate information provided by the company, an initial version of this story indicated that CREXi had raised $29 million in its Series B round. The correct number is $30 million.

Powered by WPeMatico

As the number of drones proliferates in cities and towns across America, government agencies are scrambling to find ways to manage the oncoming traffic that’s expected to clog up their airspace.

Companies like Airmap and KittyHawk have raised tens of millions to develop technologies that can help cities manage congestion in the friendly skies, and now they have a new competitor in the Detroit-based startup, Airspace Link, which just raised $4 million from a swarm of investors to bring its services to the broader market.

The financing for Airspace Link follows the company’s reception of a stamp of approval from the Federal Aviation Administration for low-altitude authorization and notification capabilities, according to chief executive Michael Healander.

According to Healander, what distinguishes Airspace Link from the other competitors in the market is its integration with mapping tools used by municipal governments to provide information on ground-based risk.

“We’re creating the roads based on ground-based risk and we push that out into the drone community to let them know where it’s okay to fly,” says Healander.

That knowledge of terrestrial critical assets in cities and towns comes from deep integrations between Airspace Link and the mapping company ESRI, which has long provided federal, state and local governments with mapping capabilities and services.

“We’ve just spent the past month understanding what regulation is going to be around to support it. In two years from now every drone will be live tracked in our platform,” says Healnder. “Today we’re just authorizing flight plans.”

As drone operators increase in number, the autonomous vehicles pose more potential risks to civilian populations in the wrong hands.

Parking lots, sporting events, concerts — really any public area — could be targets for potential attacks using drones.

“Drones are becoming more and more powerful and smarter,” EU Security Commissioner Julian King warned in a statement last summer, “which makes them more and more attractive for legitimate use, but also for hostile acts.”

Already roughly half of the population of the U.S. lives in controlled airspace where drones flying with more than a half a pound of weight require flight plan authorization, according to Healander.

“We build out population data and give state and local governments a tool to create advisories for emergency events or any areas where high densities of people will be,” says Healander. “That creates an advisory that goes through our platform to the drone industry.”

Airspace Link closed a $1 million pre-seed round in September 2019 with a $6 million post-money valuation. The current valuation of the company is undisclosed, but the company’s progress was enough to draw the attention of investors led by Indicator Ventures with participation from 2048 Ventures, Ludlow Ventures, Matchstick Ventures, Detroit Venture Partners and Invest Detroit.

For Healander, Airspace Link is only the latest entrepreneurial venture. He previously founded GeoMetri, an indoor GPS tracking company, which was acquired by Acuity Brands.

I’ve been a partner of ESRI my entire life,” says Healander. “I’ve been in the geospatial industry for four or five companies with them.”

The company has four main components of its service. There’s AirRegistry, where people can opt-in or out of receiving drone deliveries; AirInspect, which is a service that handles city and state permitting for drone operators; AirNetm, which works with the FAA to create approved air routes for drones; and AirLink, an API that connects drone operators with local governments and collects fees for registering drones.

Powered by WPeMatico

If you’ve ever entered a company’s office as a visitor or contractor, you probably know the routine: check in with a receptionist, figure out who invited you, print out a badge and get on your merry way. Brussels, Belgium and New York-based Proxyclick aims to streamline this process, while also helping businesses keep their people and assets secure. As the company announced today, it has raised a $15 million Series B round led by Five Elms Capital, together with previous investor Join Capital.

In total, Proxyclick says its systems have now been used to register more than 30 million visitors in 7,000 locations around the world. In the U.K. alone, more than 1,000 locations use the company’s tools. Current customers include L’Oréal, Vodafone, Revolut, PepsiCo and Airbnb, as well as a number of other Fortune 500 firms.

Gregory Blondeau, founder and CEO of Proxyclick, stresses that the company believes that paper logbooks, which are still in use in many companies, are simply not an acceptable solution anymore, not in the least because that record is often permanent and visible to other visitors.

“We all agree it is not acceptable to have those paper logbooks at the entrance where everyone can see previous visitors,” he said. “It is also not normal for companies to store visitors’ digital data indefinitely. We already propose automatic data deletion in order to respect visitor privacy. In a few weeks, we’ll enable companies to delete sensitive data such as visitor photos sooner than other data. Security should not be an excuse to exploit or hold visitor data longer than required.”

What also makes Proxyclick stand out from similar solutions is that it integrates with a lot of existing systems for access control (including C-Cure and Lenel systems). With that, users can ensure that a visitor only has access to specific parts of a building, too.

In addition, though, it also supports existing meeting rooms, calendaring and parking systems, and integrates with Wi-Fi credentialing tools so your visitors don’t have to keep asking for the password to get online.

Like similar systems, Proxyclick provides businesses with a tablet-based sign-in service that also allows them to get consent and NDA signatures right during the sign-in process. If necessary, the system also can compare the photos it takes to print out badges with those on a government-issued ID to ensure your visitors are who they say they are.

Blondeau noted that the whole industry is changing, too. “Visitor management is becoming mainstream, it is transitioning from a local, office-related subject handled by facility managers to a global, security and privacy-driven priority handled by chief information security officers. Scope, decision drivers and key people involved are not the same as in the early days,” he said.

It’s no surprise then that the company plans to use the new funding to accelerate its roadmap. Specifically, it’s looking to integrate its solution with more third-party systems with a focus on physical security features and facial recognition, as well as additional new enterprise features.

Powered by WPeMatico