Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Moda Operandi, an online marketplace that specialises in right-off-the-runway luxury fashion, accessories and home decor, is today announcing a high-priced event of its own: it’s raised $100 million, a mix of equity and debt that it will use to invest in its platform and technology as well as to continue growing business overall. Founded in 2010, it offers products from some 1,000 brands and designers and ships to 125 countries.

“For the past eight years, Moda has disrupted the way people shop for luxury fashion,” said Moda Operandi CEO Ganesh Srivats in a statement. “This investment will enable us to build on that innovation, investing further in the client and designer experience and connecting more of the world’s best fashion to more people.”

The financing is being co-led by NEA and Apax Partners, both previous investors in Moda Operandi, with participation also from the Santo Domingo family (connected to Lauren Santo Domingo, who co-founded Moda with Aslaug Magnusdottir), Comerica Bank, TriplePoint Capital and other unnamed investors.

The company’s valuation is not being disclosed, but in its last round, in 2017, Moda Operandi had a post-money valuation of $650 million, according to data from PitchBook. It has raised $345 million to date.

High-end fashion might not be the first thing that comes to mind when you think about online shopping, but it has actually been a ripe market for the e-commerce industry.

While those in the know (and in the money) might attend catwalk shows, and bijou boutiques in swish locales are likely to be around for many years to come, there is a massive population of people who have the income and inclination to shop for luxury fashion, but might not be in the right place, or have the time, to do so.

For these shoppers, websites, mobile apps and, most recently, new channels like Instagram and messaging services have become a key route to browsing and buying, leading to the rise of huge businesses like Farfetch, Net-a-Porter and more.

That trend has helped to buffer Moda Operandi up to now, but it’s also the one that will be interesting to watch down the line.

We’ve written about the rise of direct-to-consumer brands and how that has played out specifically in the world of fashion, which in turn becomes a new group of competitors to aggregating marketplaces like Moda Operandi.

Similarly, the growing trend of targeting consumers wherever they happen to be also represents a rival business model, with some fashion retailers now foregoing websites altogether in favor of using third-party messaging apps to reach their target customers. Will Moda Operandi change with the times to do more of this kind of selling, too? Like fashion, what’s in today might be out tomorrow, so even the best channels are moving targets.

In any case, Moda Operandi has most definitely shown that it’s prepared to evolve and upset the status quo. The company got its start in 2010 as part out of an aha-moment from Santo Domingo, a socialite, former model and former editor at Vogue.

As someone who had worked for years in the luxury fashion industry, fully immersed as a consumer to boot, she knew that only a small, rarefied group of people ever got full access to a designer’s runway collection.

Moda Operandi was her solution — a platform to broaden that out, giving access to a full trunkshows (as the runway collections are called) to a wider selection of possible buyers and improving revenues for designers and brands in the process, as they no longer had to rely just on more traditional channels, namely buyers for retailers. The site had some catches — for example, as we pointed out at the time, you could shop a runway look, but still had to wait months for the piece to actually arrive, as those items would have yet to be made; but it caught on with a loyal following.

Over the years, the site’s basic remit has expanded, covering not only runway collections but also extending into jewelry, accessories and home decor. (We asked what size the business is today, and whether Moda Operandi can share any details on how that has changed over time, but a spokesperson said the company would not be sharing these or other financial details today.)

In any case, it has remained a compelling enough business to have brought in a hefty round of growth funding from its previous backers.

“We continue to be impressed with the power of Moda’s brand and its positioning in the luxury market,” said Dan O’Keefe, managing partner of Apax Digital, in a statement. “Moda has been enhancing its technology capabilities as a world leading platform for fashion discovery and is led by a world-class team. We look forward to continuing to support their expansion.”

“Moda Operandi has really disrupted the traditional ecommerce model, using technology to give people unprecedented access to fashion,” added Tony Florence, general partner and head of technology investing at NEA, in a statement. “It was a really big idea when we led the Series A, and today Ganesh and the team are executing on that data-enabled retail model at scale. We are thrilled to continue supporting the company in this latest round.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

It was yet another jam-packed week full of big news, IPO happenings and venture activity. As always, we’ve done our best to deliver the gist on what’s been going on. We had Alex Wilhelm and Danny Crichton on hand to handle it all, which went medium-good. In other Equity news, we’re back with guests over the next few weeks, so if you miss us having a venture capitalist along for the ride, fear not, their return is just around the corner.

Up top this week was Jon Shieber’s report that Kleiner Perkins has rapidly deployed its most recent fund, a $600 million vehicle. While the news felt surprising, digging back through our archives we were reminded that the firm had indicated it might put its capital to work quickly. Still, as Danny pointed out, it’s rare that venture capitalists have to go out raising from LPs on an annual basis.

After that, we turned to some funding rounds that held our attention, including the Free Agency round that is working to bring talent management to the technology industry similar to the sports and entertainment worlds.

The concept makes some sense, as compensation packages for top talent in the industry can extend into the seven-figures (Free Agency takes a 5-10% cut of an employee’s income using the increasingly popular income-share agreements). Also, this round felt a bit like a reminder that the labor market is tight at the moment.

We then moved on to Josh Constine’s story about “Ring for enterprise” startup Verkada, which raised a massive $80 million round at a $1.6 billion valuation. That’s eye-popping, since the extremely small dilution implied with those numbers (5%) is very rare in the venture world.

After that we turned to a few rounds that Alex has had his eye on, namely the somewhat-recent Insurify round, the pretty-recent Gabi round and the most-recent Policygenius. All told, they sum to $150 million, which made us ask the question, why are venture capitalists so into insurance marketplace startups?

Finally, we touched on the latest from the intra-SoftBank delivery war between DoorDash and Uber Eats, including who is impacted, and what it means for future consolidation in the on-demand world. Or more precisely, why hasn’t there been more?

Finally, don’t forget that IPO season is upon us. Are you caught up?

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

In 1998, the startup company Illumina launched a revolution in the life sciences industry by developing technology to slash the costs of identifying and mapping genetic material.

Now, a little over 20 years later, Mammoth Biosciences is hoping to do the same thing for gene editing tools.

The company, co-founded by Jennifer Doudna, who did some of the pioneering work to discover the gene editing enzyme known as CRISPR, has just raised $45 million as it looks to bring to market products that can be used not only for disease detection, but are more precise editing tools for genetic material.

Rather than get bogged down in the patent dispute that raged over the provenance and ownership of applications for the original CRISPR enzyme — the Cas9 discovered by Doudna and developed for clinical applications at the Broad Institute — Mammoth has joined a number of startups in identifying new enzymes with a broader array of properties.

“From the very beginning of the company we’ve only worked with novel new enzymes to create these diagnostic products and the new novel diagnostic and editing,” says Trevor Martin, Mammoth Biosciences co-founder and chief executive.

Chiefly, the company is touting its Cas14 enzyme, which the company says opens up new possibilities for programmable biology thanks to its small size, diverse targeting ability and high fidelity — meaning that there are no unforeseen side effects to edits made using the enzyme (something that has arisen with Cas9 applications).

“There’s not one protein that’s going to be the best at everything,” says Martin. “For any particular product that you’re building, at Mammoth, we have the broadest toolbox.”

The Cas14 enzyme can be used to make gene edits in-vivo, meaning in live organisms, instead of ex-vivo, or outside of an organism. The in-vivo use-case could accelerate the time it takes to conduct experiments or develop treatments.

“Twenty years from now, when the umpteenth drug gets approved using Crispr and some nuclease named Cas132013, people are going to look back on this patent battle and think, ‘what a godawful waste of money,’ ” Jacob Sherkow a patent law scholar at New York Law School told Wired back in 2018.

Already, Horizon Discovery, a Cambridge, U.K.-based gene editing technology developer, is using the new tools developed by Mammoth Bioscience to create new CRISPR tools for Chinese Hamster Ovary cell line editing.

That partnership is an example of how Mammoth is thinking about the commercialization of the new Cas14 enzyme line and its role in biological engineering.

“You will need a full toolbox of CRISPR proteins,” says Martin. “That will allow you to interact with biology in the same way that we interact with software and computers. “From first principles, companies will programmatically modify biology to cure a disease or decrease risk for a disease. That’s going to be really kind of a turning point.”

To achieve its vision, Mammoth has managed to nab top talent from the life sciences industry, including Peter Nell, a co-founder of Casebia (a joint venture between Bayer and CRISPR Therapeutics), who came on board as chief business officer, and Ted Tisch, a former executive at Synthego and Bio-Rad, who joined the company as chief operating officer.

The company also nabbed $45 million of funding, including investment firms Mayfield, NFX, Verily (the Alphabet subsidiary) and Brook Byers, which was led by Decheng Capital — bringing the company to more than $70 million in funding.

“There are a dozen or so products that are in clinical development with CRISPR,” says Ursheet Parikh, a partner with Mayfield. “Maybe that number would go up by five or 10 without Mammoth, but it will go up by one or two orders of magnitude with Mammoth.”

To Parikh, Mammoth is the best positioned of the CRISPR development tools, because the company is building a whole platform that customers can license and use to develop products using gene editing.

The thinking, according to Parikh, is as follows, “if this technology can power lots of applications, let’s basically ensure that lots of these applications can come to market and as that happens I get my app store cut.”

“It’s an Illumina-like business,” Parikh says. “Just as anybody who is innovating with genomics needs an Illumina sequencer because they want to be able to do the sequencing… if someone wants to do editing… This gives them the access to do the right sequencing.”

Powered by WPeMatico

The Bouqs plans to take a slice of Japan’s $6 billion flower market this year with a $30 million strategic growth round from Japanese enterprise business investor Yamasa. While The Bouqs still must compete with bigger contenders like 1-800-Flowers and FTD in the U.S., it will now have to take on incumbents like Ayoma Flower Market and FloraJapan, both of which also offer same-day delivery throughout the land of the rising sun.

So why Japan? According to The Bouqs founder and CEO John Tabis, his company had been looking to expand internationally for awhile and Japan seemed to fit well within that plan.

The Bouqs CEO and founder John Tabis

But as far as bigger competition in any country, Tabis is undeterred, telling TechCrunch there’s plenty of opportunities in the flower delivery business if you know where to look. “There’ve been four or five other startups that tried something similar — some of them no longer exist,” Tabis said. “But the thing that’s worked for us, the first is the way that we’ve sourced is unique and it’s really the foundation of our brand.”

The Bouqs sprung up in a wave of Silicon Valley funded flower delivery startups like BloomThat, Farm Girl and Urban Stems, all promising Pinterest -worthy bouquets at the click of a button. But what set it apart was its farm-direct supply chain, cutting out costs from middlemen and delivering flowers that last longer.

This particular round now puts The Bouqs up top as far as total funding raised among its flower delivery startup peers, bringing in $74 million in total funding to date, with competitor Urban Stems in second place with $27 million in funding, according to Crunchbase.

Tabis also tells TechCrunch the new funds will further the company’s development into brick-and-mortar stores and that it’s jumping into the wedding biz. As anyone who’s ever planned a wedding will tell you, it’s an industry ripe for disruption — with brides and grooms spending about 8% of the budget on the flowers alone.

One other renewed focus for the company will be its subscription business, keeping customers set up with a fresh bunch of flowers once the old bouquet is ready for tossing. “It’s sort of the linchpin of our business that’s grown very nicely…expanding both our revenue and profitability,” Tabis told TechCrunch.

The SVP of Yamasa, Norikazu Sano, also mentioned further expansion into Asia for the company in a company press release, so we could see The Bouqs in more international areas over time, if all goes right in Japan.

“This financing will enable us to fully realize our vision to create a global network of top-quality farms paired with a category-defining local floral brand enabled by proprietary supply chain technology and vertically integrated sourcing capabilities. We’re so excited for this next phase of the business, and all of the opportunities that lie ahead,” Tabis said.

Powered by WPeMatico

After selling autonomous driving startup Scotty Labs to DoorDash just five months ago, entrepreneur Tobenna Arodiogbu is back with a new startup. This time, he’s focused solely on truck drivers and their businesses. CloudTrucks, which aims to help truck drivers earn more money, has closed a $6.1 million round led by Craft Ventures with participation from Khosla Ventures, Kindred Ventures and Abstract Ventures.

Described as a “business in a box,” CloudTrucks is designed to make it easier for truck owners and operators to run their businesses. Through software and data science, CloudTrucks aims to reduce operating costs for truck drivers and improve revenue, cash-flow and costs.

In the U.S., about 91% of fleets are small businesses, operating six or fewer trucks, according to the American Trucking Associations. Last year, almost 800 trucking businesses went bankrupt in the U.S. Analysts attribute that to a rise in insurance costs and excess supply, which drove shipping rates down. Additionally, operators are tasked with managing safety programs, invoicing and other paperwork. This is where CloudTrucks comes in.

“CloudTrucks focuses on the owner-operator and small trucking companies because they are the lifeblood of the industry and facing the largest pressures with fast-rising insurance rates, predatory factoring options and a quickly changing landscape,” Arodiogbu told TechCrunch.

Already, CloudTrucks has a small number of early customers to fine-tune the platform. The startup is accepting new customers on a case-by-case basis.

Prior to CloudTrucks, Arodiogbu co-founded Scotty Labs to enable humans to virtually control cars and trucks. The idea was to assist drivers in long-haul trips. Before DoorDash’s acquisition of the startup, Scotty Labs had raised $6 million in funding. Now, Arodiogbu serves as an advisor to DoorDash.

“Tobenna is a proven entrepreneur and product thinker with a clear vision of the problem CloudTrucks intends to solve,” Craft co-founder and general partner David Sacks said in a statement to TechCrunch. “Trucking is at the heart of the American economy and yet technology still plays a very small role. We are excited to support the entire CloudTrucks team as they build the platform that will increase revenue and efficiency for thousands of owner-operator truck drivers.”

Powered by WPeMatico

Medloop, which allows patients to manage healthcare needs and providers, has secured €6 million from Kamet Ventures and AXA.

The cash will be used to enhance its product offering and continue expansion across Germany and the U.K. Medloop is also developing an evidence-based medical rule engine embedded on the Electronic Medical Record (EMR) of patients.

Medloop offers patients what it calls “intuitive” self-service features in an app that enables them to navigate their own healthcare, including online appointment bookings, electronic medical results and prescription refills, as well as chatting in-app with healthcare providers.

Founded in 2018 by Berlin-based entrepreneur Shishir Singhee, some medical practices in Germany use the Medloop doctor system to run their entire practice, using it to give an overview of their patient population.

Singhee, said: “Healthcare today has become increasingly impersonalized as ever-growing patient registers have made it challenging for doctors to treat patients in a bespoke way. Medloop strives to bridge this critical gap, by employing technology to empower patients and help doctors deliver proactive and holistic care.“

Stephane Guinet, CEO of Kamet Ventures, said: “It is no secret how overstretched doctors are in terms of the time and care they can offer each patient. Medloop’s offering is a novel solution to this challenge and we are very excited to be part of Medloop’s growth story given how critical its offering is to the U.K. market and beyond.”

Medloop achieved compatibility with EMIS last summer, enabling its entry into the U.K. market.

In Germany, its main competitors are the incumbents that were built in the early 1990s, such as Medatix and Medistar. In the U.K. it is up against patient management tools such as QMasters.

Powered by WPeMatico

Millennials are tired of being drunk, but are locked into a culture that puts alcohol at the center of professional events and outside-of-work gatherings. Twenty-somethings in New York and San Francisco don’t want to spend $17 on a gin and tonic at a compulsory happy hour. That’s why Haus, a new direct-to-consumer aperitif startup, is debuting its membership program.

Co-founders Helena Price Hambrecht and Woody Hambrecht, who are married, have also secured $4.5 million in seed funding to fuel their bid for a more laid back and less alcohol-centric way to party, starting with a 15% ABV (alcohol by volume) citrus and flower-flavored aperitif. For comparison, most hard liquors are between 35 and 45% alcohol. Wine averages at 11.6%.

Members across the U.S. can now sign up for a monthly shipment of either six bottles per month for $144, two bottles per month for $63 or one bottle per month for $35. Unlike most wine clubs, it’s free to join. Haus will also begin a wholesale initiative with bars and restaurants in New York, San Francisco, Portland, Seattle and Denver.

The genesis for Haus was the founders’ idea to create a transparent alcohol brand, or a “Glossier for alcohol,” notes Helena, a Silicon Valley branding veteran. Woody, an experienced winemaker, identified a loophole that allows distributors to ship alcohol direct-to-consumer if the product is made mostly from grapes and is under 24% alcohol. Not only could a beverage be distributed straight to buyers, but it can be done with transparency, including ingredients and nutrition facts. This will allow Haus to collect user data that big alcohol companies just don’t have.

“Antiquated liquor laws have stunted innovation in the spirits space since prohibition, despite the fact that today’s drinkers are desperate for something different,” says Price Hambrecht. “Selling directly to the drinker means we can build relationships with our customers, iterate quickly based on their feedback and ultimately create the products they want.” So, Haus was born.

Co-founders and co-CEOs Helena Price Hambrecht and Woody Hambrecht.

Haus saw fundraising as a chance to grow not only an early community of stakeholders, but customers. Helena equates their fundraising process to more of a crowdfunding approach than a traditional VC round, with over 10 funds and 100 individual investors contributing. Raising capital meant crowdsourcing a community of people who believed in what they were building and were willing to seed it into their own networks. Some angels included Casey Neistat, former CEO and chairman of Campari Gerry Ruvo, Away co-founder Jen Rubio, Superhuman founder Rahul Vohra and Yelp co-founder Russell Simmons.

Contributing funds include Combine, Haystack Ventures, Homebrew, Shrug Capital, Resolute Venture Partners, Coatue, Dream Machine and Work Life Ventures, among others.

Subscriptions work when customers form habits. Haus plans to retain its community around its trendy party beverage with discounts and events, bolstered by editorial content in the future. What the founders are really pitching, however, is a lifestyle change.

In “The Art of the Gathering,” Priya Parker argues that in our modern society, we’ve lost our ability to finesse purposeful events. We end up gathering in ways that don’t actually serve us, and we aren’t connecting in the ways we ought to. Whether it’s a boring dinner party that isn’t focused on the guests, or a dreaded happy hour after a long work day.

It has yet to be determined if aperitifs could win over wine and liquor lovers at a macro scale. But Haus thinks that with a trendy product and hyper-engaged community, they can leverage this loophole to change the way we gather. Starting with how we drink.

Powered by WPeMatico

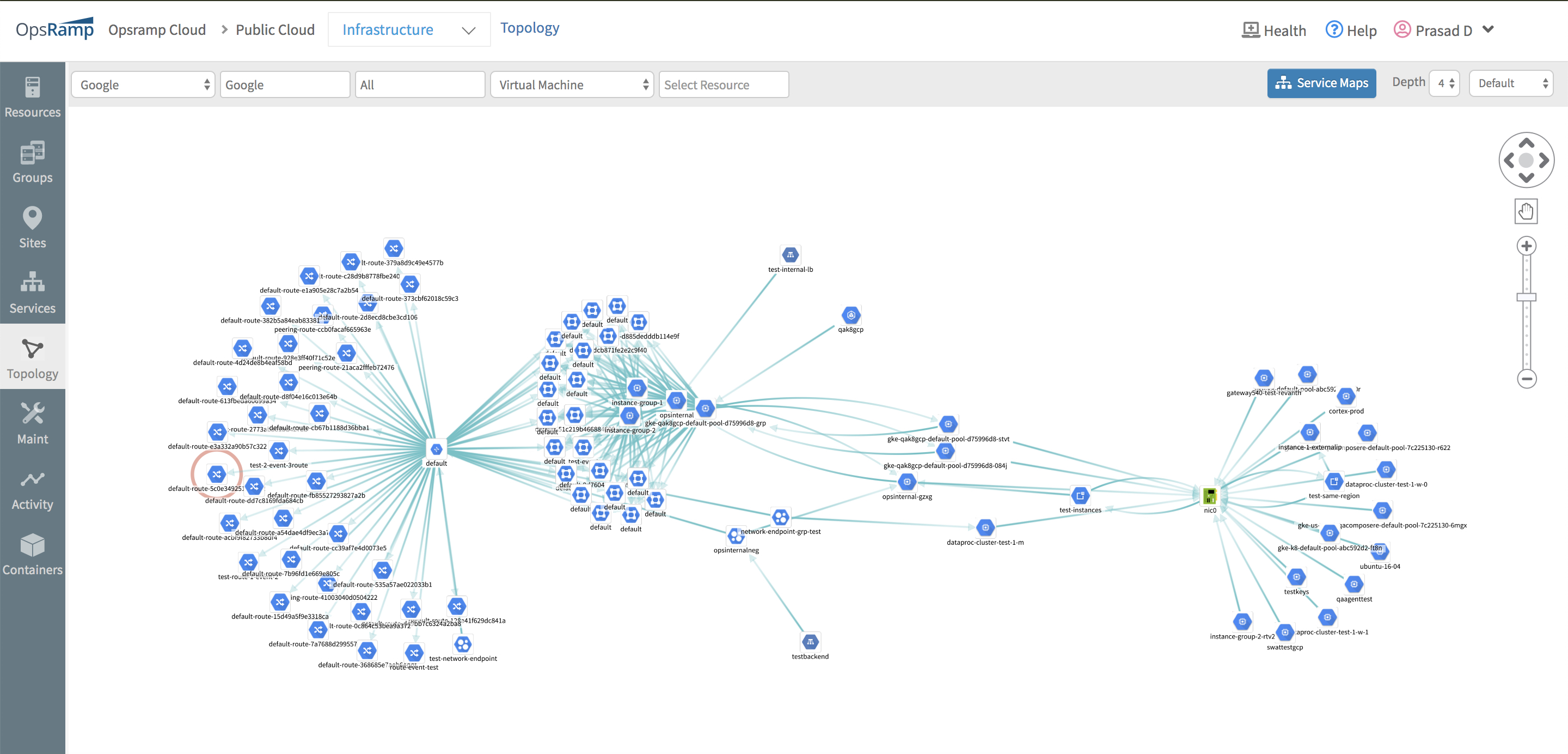

OpsRamp, a service that helps IT teams discover, monitor, manage and — maybe most importantly — automate their hybrid environments, today announced that it has closed a $37.5 million funding round led by Morgan Stanley Expansion Capital, with participation from existing investor Sapphire Ventures and new investor Hewlett Packard Enterprise.

OpsRamp last raised funding in 2017, when Sapphire led its $20 million Series A round.

At the core of OpsRamp’s services is its AIOps platform. Using machine learning and other techniques, this service aims to help IT teams manage increasingly complex infrastructure deployments, provide intelligent alerting and eventually automate more of their tasks. The company’s overall product portfolio also includes tools for cloud monitoring and incident management.

The company says its annual recurrent revenue increased by 300% in 2019 (though we obviously don’t know what number it started 2019 with). In total, OpsRamp says it now has 1,400 customers on its platform and alliances with AWS, ServiceNow, Google Cloud Platform and Microsoft Azure.

The company says its annual recurrent revenue increased by 300% in 2019 (though we obviously don’t know what number it started 2019 with). In total, OpsRamp says it now has 1,400 customers on its platform and alliances with AWS, ServiceNow, Google Cloud Platform and Microsoft Azure.

According to OpsRamp co-founder and CEO Varma Kunaparaju, most of the company’s customers are mid to large enterprises. “These IT teams have large, complex, hybrid IT environments and need help to simplify and consolidate an incredibly fragmented, distributed and overwhelming technology and infrastructure stack,” he said. “The company is also seeing success in the ability of our partners to help us reach global enterprises and Fortune 5000 customers.”

Kunaparaju told me that the company plans to use the new funding to expand its go-to-market efforts and product offerings. “The company will be using the money in a few different areas, including expanding our go-to-market motion and new pursuits in EMEA and APAC, in addition to expanding our North American presence,” he said. “We’ll also be doubling-down on product development on a variety of fronts.”

Given that hybrid clouds only increase the workload for IT organizations and introduce additional tools, it’s maybe no surprise that investors are now interested in companies that offer services that rein in this complexity. If anything, we’ll likely see more deals like this one in the coming months.

“As more of our customers transition to hybrid infrastructure, we find the OpsRamp platform to be a differentiated IT operations management offering that aligns well with the core strategies of HPE,” said Paul Glaser, vice president and head of Hewlett Packard Pathfinder. “With OpsRamp’s product vision and customer traction, we felt it was the right time to invest in the growth and scale of their business.”

Powered by WPeMatico

Drone delivery may not make a lot of sense for food or parcel delivery yet, but for hospitals it could be a lifesaver. A new test program is being inaugurated at UC San Diego’s Jacobs Medical Center, where Matternet drones operated by UPS will fly blood samples and other items to and from other nearby facilities.

The new program will be the third under Matternet’s belt; an earlier partnership with UPS has made some 1,900 flights at WakeMed hospital in North Carolina, and flights with SwissPost in Zurich resume this month after crashes put them on ice over the summer.

Biological samples and other items that need to be moved quickly generally travel by courier service, which is of course fine sometimes, but not during rush hour. No one wants to have a second spinal tap because the first one got stuck in traffic.

The flights these drones will be undertaking will be autonomous, but with remote monitoring and line of sight from Jacobs to the Moores Cancer Center and Center for Advanced Laboratory Medicine, both of which are less than a mile away.

It’s a big month for Matternet, which in addition to these two concurrent flight test programs recently pulled in a strategic round from the healthcare-focused McKesson Ventures.

Powered by WPeMatico

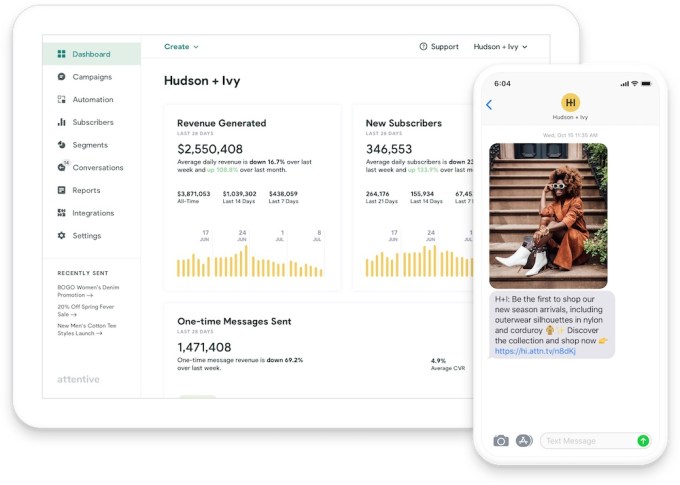

Less than six months after it announced $40 million in funding, Attentive has raised another $70 million — this time in Series C funding.

The new round was led by Sequoia and IVP, two firms that were part of the Series B. Previous investors Eniac Ventures and NextView Ventures also participated.

CEO Brian Long (who, along with his Attentive co-founder Andrew Jones, sold his previous startup TapCommerce to Twitter) told me that he wasn’t planning to raise money again so soon, but things were going even better than expected, with a client list that has grown to more than 750 businesses, including Coach, Urban Outfitters, CB2, PacSun, Party City and Jack in the Box.

Long noted that it’s always smarter to raise money when things are going swimmingly, rather than dealing with the “not-so-fun process” of trying to raise “when you really need it.”

He added, “When you see that you’re doing that well, you think, ‘Hey, we should hire a lot more people to support this growth.’ And then the other piece is just being able to move faster into new areas.”

Long attributed the success Attentive has had thus far to the growing importance of text messages as a channel for businesses to reach consumers, particularly as those consumers are less inclined to open marketing emails or download retailers’ mobile apps. And in contrast to broader messaging platforms, Long said Attentive is “focused on just doing this channel right.”

He said the platform is designed to solve the main problems faced by retailers trying to build a mobile messaging strategy — first, by helping them create a text subscriber list in a way that complies with regulations, then by offering “the ability to send messages that frankly aren’t going to piss people off.”

“We want the messages to be relevant for the consumer, we want to send them things that they care about,” Long said. “The package is on the way, real-time customer service, a product that you were looking at recently is on-sale … there’s a lot of data that you can put to work in order to do it at scale.”

Looking ahead, he hopes to expand beyond the United States and Canada, and to move into industries beyond e-commerce — for example, into more traditional retail, and also to start working with colleges that are looking to attract more applicants.

“Attentive’s growth is a clear indication that people want to interact with brands in new ways, and brands are embracing messaging as an effective way to reach consumers,” said Sequoia partner Pat Grady in a statement. “We are thrilled to double down on our partnership with Attentive so they can continue to deliver fantastic results for their customers and valuable experiences for consumers.”

Attentive has now raised a total of $124 million.

Powered by WPeMatico