Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

It’s no secret that it’s hard to make the economics work at rideshare companies. That may explain the success to date of HopSkipDrive, a six-year-old, L.A.-based company that pairs drivers with both families but also, crucially, school districts. Specifically, the now 100-plus person company has deals in place with school districts in 13 markets across eight states where it works with more than 7,000 contractors.

All contractors, says cofounder and CEO Joanna McFarland, must have at least five years of childcare experience before they are allowed to drive for the startup.

Interestingly, McFarland says the school systems’ most burning need is to ensure the safe arrival of both homeless and foster children, whose numbers in the U.S. have reached an astonishing 2.5 million and 440,000, respectively. On the heels of a brand-new funding round, we asked her what’s going on and why.

TC: You’re just announcing $22 million in new venture backing, congratulations. I wonder if your story was harder to tell investors than it might have been a year ago, when they were more bullish on car-share companies.

JM: We’ve never considered ourselves comparable to Uber or Lyft. We’re really caregivers on wheels, providing a very different service. We work with families, but we also contract with school districts and counties, and that has a strong path to profitability. We can predict supply and demand; we’re [enjoying] contracted revenue. It’s very different.

TC: How do you describe the market opportunity?

JM: U.S school districts spend $25 billion a year on transportation, yet only one-third of kids take a bus to school, so it’s expensive and inefficient and meanwhile districts are being asked to do more with less.

Particularly challenging for them are children with specialized needs or homeless children who are moving around a lot but have the same right to get to school. It’s hard to re-route school buses, so we help schools with alternative transportation. Once we’ve contracted with them, we’re available, including to pick up a student who might be in foster care and moved to a new place at 10:30 at night. We can still pick them up the next morning.

TC: There are thousands of homeless children attending San Francisco schools. Are you serving other markets where housing prices are forcing more families on to the streets?

JM: Unfortunately, there’s a large and growing population in a lot of places. Districts might not even know how many students are homeless or in foster care because their situations can change so significantly throughout the year. It might start with 500 students at the beginning of the year and end with 1,000. Because it fluctuates so much, it puts a ton of demand on these transportation directors to figure it out.

We’re partnered with L.A. County, for example, and it has the largest child welfare system in the country, with 88 districts and between 20,000 and 30,000 kids in foster care at any one time. It’s not a great statistic for L.A., but it’s the reality.

TC: And it’s one driver, one child?

JM: Sometimes there will be two or three kids. We can do carpools. If there are group homes, we’ll take them to their different schools.

TC: What do your contracts look like then with these school districts?

JM: We dictate the ride price, then it’s really on as as-needed basis. They pay for what they need. We talk with them about their needs last year and this year and that does help us tremendously with supply and demand.

TC: How much of your business is coming from school partnerships versus from families that hire your company to take their kids to soccer games?

JM: Our business for families is growing organically, there’s such a need for it, but 70 percent of our revenue comes from [school districts].

TC: Your drivers are 1099 workers, so presumably they are working for other ride-share or other gig-economy companies? How busy can you keep them?

JM: They are contractors. Because they must have five years of caregiving experience and because of the vetting we do, 90 percent of them are female, and they love what they do because they’re driving in communities where their kids grew up and they’re tied to the mission of what we’re doing.

We have some overlap with other gig companies, but with [HopSkipDrive] there’s safety on both sides of the platform, meaning they are driving kids, they aren’t driving late at night, they aren’t driving anyone who is drunk. They also have control over where they drive and when, based on personal preferences. They can choose some rides before school so they can take care of an elderly relative or grandchildren. They can see rides that are available up to a week in advance and select which ones they want depending on their schedule. Many are semi-retired and not looking for full-time income.

TC: How can parents be certain their kids are safe?

JM: We have a dual authentication process so drivers confirm a code word with the child and another piece of information that the child will know. Parents can track the rides in real time. We also have tech that monitors rides and can detect anomalies and provide support as needed. For example, they know via GPS and sensors if a driver is hitting traffic or has stopped owing to a flat tire and can react proactively, whether it is to send another car (in the case of a flat tire) or let the school and parents know that the child will be late. We designed the whole system for when a passenger may not have a phone.

TC: Why start this company?

JM: I started in finance then went into product management, working for tech companies. But as I was working, I was also growing my family, and I couldn’t get my son to karate at 3 o’clock. It was so frustrating. I didn’t need a nanny; I just needed to get him to karate.

All the moms I knew had their own version of this transportation story. [At a school function,] I suggested we put out money in a pot and hire a driver, and another mom said, ‘How do we do that?’ She’s one of my cofounders.

Pictured above from left to right: HopSkipDrive cofounders Carolyn Yashari Becher. Joanna McFarland, and Janelle McGlothlin

Powered by WPeMatico

As the national conversation pushes companies to reexamine the HR processes suppressing sexual harassment and bias reporting, tech startups are looking to find a way to smooth out the process and encourage communication.

LA-based AllVoices is building an encrypted communications platform for offices that allows employees to anonymously send complaints to their human resources department that can then follow-up and track the cases in an easy-to-use dashboard. CEO Claire Schmidt tells TechCrunch that her company has just closed a $3 million seed round with funding from Crosscut, Greycroft, Halogen Ventures, Vitalize VC and others.

CEO Claire Schmidt

Schmidt, most recently a VP at 20th Century Fox, started AllVoices after finding inspiration in Susan Fowler’s Uber blog post to create a platform that allowed employees at companies to anonymously offer feedback and file reports about internal toxicity. Schmidt says existing processes used for reporting can leave victims of harassment hesitant to come forward and fearful of the risk of damaging their career paths.

“We’re using this really outdated process, we’re basically telling people, ‘Okay, just come in and tell someone in HR, and hope for the best,’ ” Schmidt told TechCrunch in an interview. “And to me that seemed especially unfair to the most vulnerable people in any given work environment because they’re junior, they don’t have as much job security — they’re viewed as more expendable.”

Employees at companies that use AllVoices can log into a mobile app and anonymously submit reports and receive text notifications when they’ve gotten a response from the company, a streamlined process that Schmidt hopes can encourage people to “report in real time.” HR people don’t see names or any other identifying information and AllVoices doesn’t know the name of the employee either, with all communications being encrypted.

“We do encrypt all of our data in storage, in backup, in transit, at rest — at every level,” Schmidt says.

Sixty days after a complaint is made, AllVoices sends a notification to the employee asking whether they were aware of any action being taken by the company and how satisfied they were with it. The startup then aggregates that data and provides it back to the company so they can get a clearer sense of their own responsiveness.

AllVoices isn’t the only startup tackling this issue; in 2018 we profiled Spot, which is also building an anonymous reporting platform. AllVoices’ platform goes beyond streamlining processes for sexual harassment; the startup has modules for general feedback, ethics and compliance issues, culture problems, diversity and inclusion concerns and harassment and bias complaints.

The startup has also aimed to make a free version of its product so that employees at companies that haven’t integrated AllVoices can still make anonymous complaints by entering in an email for someone in their HR department. Schmidt hopes that the free service will serve their broader mission and help them onboard new customers.

AllVoices says they now have nearly 50 companies using the platform, including Instacart, GoPro, Wieden+Kennedy, The Wing and FabFitFun.

Powered by WPeMatico

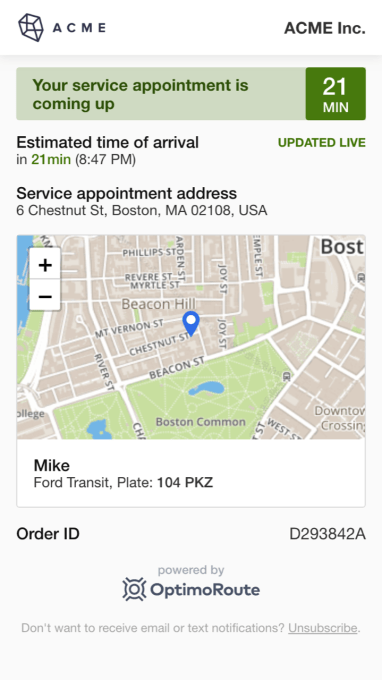

Route planning sounds like it’s a problem for big logistics companies like Amazon, FedEx and UPS, but in reality, it’s something every small business with more than a few mobile employees deals with. OptimoRoute, which today announced that it has raised a $6.5 million Series A round led by Prelude Ventures, is tackling exactly this problem. Built by a team of former Google and Yelp engineers, the service allows businesses to set their specific constraints and then automatically creates daily routes for their drivers, no matter whether they are doing deliveries or cleaning pools.

What makes OptimiRoute stand out from some of its competitors in this space isn’t just its often significantly lower prices but also that it offers drivers and customers a mobile experience that includes live tracking and ETAs and the ability to change routes in real time as necessary. With OptimoRoute, companies can plan for specific days of the week or up to five weeks in advance. The company is also currently testing a pickup and delivery system for both passengers and goods, as well as support for multi-day long-haul routes.

As the company’s co-founder and CEO Marin Šarić told me, route optimization is obviously a popular academic problem. “On the one side, you do have these academic problems that are very proof of concept and minimalistic,” he said. “And then, in the commercial space, you have software that is running — in our estimation — algorithms that have been well known in the previous century, literally, you know there’s even things from the 80s. […] We at OptimoRoute really worry about the real-world constraints of what it means to build an effective schedule.”

OptimoRoute takes into account a number of variables (how much material can fit into a van, hourly wages, skills needed to perform a certain repair, etc.) and lets companies choose different priorities for optimizing their routes.

“We’re really focused on trying to make this technology available for everyone and this is appreciated even by very senior experienced logistics managers because they can focus on problems they’re trying to solve as opposed to working around hiccups with the software,” explained Šarić.

Currently, OptimoRoute has about 800 customers that range from small businesses to large energy companies like Southern Star Central Gas Pipeline, which manages the routes of more than 300 maintenance technicians with the help of the service. By reducing the mileage employees have to drive, users not only see increased productivity from their employees but, as Šarić noted, also reduce their overall carbon footprint.

Currently, OptimoRoute has about 800 customers that range from small businesses to large energy companies like Southern Star Central Gas Pipeline, which manages the routes of more than 300 maintenance technicians with the help of the service. By reducing the mileage employees have to drive, users not only see increased productivity from their employees but, as Šarić noted, also reduce their overall carbon footprint.

The team spent a lot of time on developing the basic algorithms that power the service. The team, though, expected that a lot of its users would be very sophisticated logistics managers, but it turned out that there was a lot of demand from small and medium businesses, too.

“Prelude is excited to help OptimoRoute expand its reach and further develop its offerings for a multitude of mobile workforces,” said Victoria Beasley, partner, Prelude Ventures . “We strongly believe that OptimoRoute is set to have a huge impact on the route optimization market, saving time, money and resources, while also reducing carbon footprint, for their many diverse clients.”

Powered by WPeMatico

Netskope has always focused its particular flavor of security on the cloud, and as more workloads have moved there, it has certainly worked in its favor. Today the company announced a $340 million investment on a valuation of nearly $3 billion.

Sequoia Capital Global Equities led the round, but in a round this large, there were a bunch of other participating firms, including new investors Canada Pension Plan Investment Board and PSP Investments, along with existing investors Lightspeed Venture Partners, Accel, Base Partners, ICONIQ Capital, Sapphire Ventures, Geodesic Capital and Social Capital. Today’s investment brings the total raised to more than $740 million, according to Crunchbase data.

As with so many large rounds recently, CEO Sanjay Beri said the company wasn’t necessarily looking for more capital, but when brand name investors came knocking, they decided to act. “We did not necessarily need this level of capital but having a large balance sheet and a legendary set of investors like Sequoia, Lightspeed and Accel putting all their chips behind Netskope for the long term to dominate the largest market in security is a very strong signal to the industry,” Beri said.

From the start, Netskope has taken aim at cloud and mobile security, eschewing the traditional perimeter security that was still popular when the company launched in 2012. “Legacy products based on traditional notions of perimeter security have gone obsolete and inhibit the needs of digital businesses. Today’s urgent requirement is security that is fast, delivered from the cloud, and provides real-time protection against network and data threats when cloud services, websites, and private apps are being accessed from anywhere, anytime, on any device,” he explained.

When Netskope announced its $168.7 million round at the end of 2018, the company had a valuation over $1 billion at that time. Today, it announced it has almost tripled that number, with a valuation close to $3 billion. That’s a big leap in just two years, but it reports 80% year-over-year growth, and claims to be “the fastest-growing company at scale in the fastest-growing areas of cybersecurity: secure access server edge (SASE) and cloud security,” according to Beri.

The next natural step for a company at this stage of maturity would be to look to become a public company, but Beri wasn’t ready to commit to that just yet. “An IPO is definitely a possible milestone in the journey, but it’s certainly not limited to that and we’re not in a rush and have no capital needs, so we’re not commenting on timing.”

Powered by WPeMatico

Antler is a “company builder” that emerged a couple of years ago, running startup generator programs and investing from an early stage, bringing a heady mix of technologists, product builders and operators together with its own technology stack.

Now, plenty of “company builders” have come and gone. It’s a bit like Apocalypse Now: everyone goes in thinking they will come up with the major formula to spit out startups at a prodigious rate and they come out screaming “The Horror! The Horror!”

But Antler appears to have been on an interesting run. It has so far made more than 120 investments across a wide range of companies, with several going on to raise later-stage funding from the likes of Sequoia, Golden Gate Ventures, East Ventures, Venturra Capital and the Hustle Fund.

Since its launch in Singapore two years ago, Antler now has a presence across New York, London, Singapore, Sydney, Amsterdam, Stockholm, Nairobi and Oslo.

Today, it’s announcing that it has attracted investment from British investment management company Schroders, investment house FinTech Collective and Ferd, the vehicle used by Johan H. Andresen, the Norwegian industrialist and investor.

This latest investment takes the capital raised by Antler over the past six months to more than $75 million.

These investors join an existing group that includes Facebook co-founder Eduardo Saverin, Canica International and Credit Saison, the third-largest credit card issuer in Japan. The idea here is that these investors get exposure to early-stage companies as they are built.

As with most company builders and accelerators, Antler only takes 1-1.5% of the applicants

Its portfolio includes Sampingan, an on-demand workforce in Indonesia; Xailient, a computer vision technology; Airalo, a global e-sims marketplace; and FusedBone, which enables medical centers to produce bespoke, non-metal implants on-site.

Magnus Grimeland, Antler co-founder and CEO said: “With our support, our founders start refining their ideas and building new and innovative businesses. What is equally important is the deep relationship our founders build with their peers, our advisors and backers. Having accomplished investors like Schroders, Ferd and FinTech Collective on board means we can provide a more valuable network for our startups as they grow their businesses.”

Peter Harrison, Group CEO of Schroders, who will also be joining Antler’s advisory board, said: “We are in a period of unprecedented change. The visibility on venture capital activity and innovation that Antler provides is therefore leading-edge.”

Antler says more than 40% of its portfolio companies have a female co-founder and 78% of these have a female CEO.

Powered by WPeMatico

The growing ubiquity of open-source software has been a big theme in the evolution of enterprise IT. But behind that facade of popularity lies another kind of truth: Companies may be interested in using more open-source technology, but because there is a learning curve with taking on an open-source project, not all of them have the time, money and expertise to adopt it. Today, a startup out of Finland that has built a platform specifically to target that group of users is announcing a big round of funding, underscoring not just demand for its products, but its growth to date.

Aiven — which provides managed, cloud-based services designed to make it easier for businesses to build services on top of open-source projects — is today announcing that it has raised $40 million in funding, a Series B being led by IVP (itself a major player in enterprise software, backing an illustrious list that includes Slack, Dropbox, Datadog, GitHub and HashiCorp).

Previous investors Earlybird VC, Lifeline Ventures and the family offices of Risto Siilasmaa (chairman of Nokia), and Olivier Pomel (founder of Datadog), also participated. The deal brings the total raised by Aiven to $50 million.

Oskari Saarenmaa, the CEO of Aiven who co-founded the company with Hannu Valtonen, Heikki Nousiainen and Mika Eloranta, said in an interview that the company is not disclosing its valuation at this time, but it comes in the wake of some big growth for the company.

It now has 500 companies as customers, including Atlassian, Comcast, OVO Energy and Toyota, and over the previous two years it doubled headcount and tripled its revenues.

“We are on track to do better than that this year,” Saarenmaa added.

It’s a surprising list, given the size of some of those companies. Indeed, Saarenmaa even said that originally he and the co-founders — who got the idea for the startup by first building such implementations for previous employers, which included Nokia and F-Secure — envisioned much smaller organisations using Aiven.

But in truth, the actual uptake speaks not just to the learning curve of open-source projects, but to the fact that even if you do have the talent to work with these, it makes more sense to apply that talent elsewhere and use implementations that have been tried and tested.

The company today provides services on top of eight different open-source projects — Apache Kafka, PostgreSQL, MySQL, Elasticsearch, Cassandra, Redis, InfluxDB and Grafana — which cover a variety of basic functions, from data streams to search and the handling of a variety of functions that involve ordering and managing vast quantities of data. It works across big public clouds, including Google, Azure, AWS, Digital Ocean and more.

The company is running two other open-source technologies in beta — M3 and Flink — which will also soon be added on general release, and the plan will be to add a few more over time, but only a few.

“We may want to have something to help with analytics and data visualisation,” Saarenmaa said, “but we’re not looking to become a collection of different open-source databases. We want to provide the most interesting and best to our customers. The idea is that we are future-proofing. If there is an interesting technology that comes up and starts to be adopted, our users can trust it will be available on Aiven.”

He says that today the company does not — and has no plans to — position itself as a system integrator or consultancy around open-source technologies. The work that it does do with customers, he said, is free and tends to be part of its pre- and after-sales care.

One primary use of the funding will be to expand its on-the-ground offices in different geographies — Aiven has offices in Helsinki, Berlin and Sydney today — with a specific focus on the U.S., in order to be closer to customers to continue to do precisely that.

But sometimes the mountain comes to Mohamed, so to speak. Saarenmaa said that he was first introduced to IVP at Slush, an annual tech conference in Helsinki held in November, and the deal came about quickly after that introduction.

“The increasing adoption of open-source infrastructure software and public cloud usage are among the incredibly powerful trends in enterprise technology and Aiven is making it possible for customers of all sizes to benefit from the advantages of open source infrastructure,” Eric Liaw, a general partner at IVP, said in a statement.

“In addition to their market potential and explosive yet capital-efficient growth, we were most impressed to hear from customer after customer that ‘Aiven just works.’ The overwhelmingly positive feedback from customers is a testament to their hiring practices and the strong engineering team they have built. We’re thrilled to partner with Aiven’s team and help them build their vision of a single open-source data cloud that serves the needs of customers of all sizes.”

Liaw is joining the board with this round.

Powered by WPeMatico

Trucking is currently the most popular mode of transporting freight in the U.S., accounting for around $12.5 billion of the $17 billion freight market, according to the Bureau of Transportation Statistics. But with thousands of small and single-vehicle operators and legacy (often paper-based) systems underpinning communications, it’s also one of the most inefficient.

Now there are signs that this is changing. A startup out of Phoenix, Ariz. called Emerge, which has built a platform for shippers and brokers to find and allocate truck freight more effectively across the long tail of available truck-based carriers (a little like a Flexport but for trucks), is announcing a round of $20 million, funding it will use to continue building out its technology, as well as to keep expanding business.

The Series A — led by NewRoad Capital Partners, with previous investors Greycroft and 9Yards Capital also participating — comes on the heels of some already strong traction for Emerge. Since being founded in 2018 by brothers Andrew and Michael Leto, the company has processed more than $1 billion in freight with 1,500% year-over-year growth between 2018 and 2019. Emerge has now raised just over $40 million and we understand that its valuation is currently at more than $100 million.

Some of its traction so far is down to the founders. Both are vets of the trucking industry whose previous company, a multimodal shipment visibility/supply chain solutions platform called 10-4, sold to Trimble in a $400 million deal. And some of that is down to the gap in the market that Emerge is filling.

“Gap” is actually the operative word here. How shipments are booked on trucks today is quite inefficient, with orders often leaving empty spaces on truck beds that could be filled with goods going in the same direction; and in about 20% of all journeys carrying no load at all.

Part of the reason for this is the antiquated way that shippers book space on trucks, and part of the reason is because there is just simply too much fragmentation in the system, with 80% of all shipments today contract-based and the remaining 20% operating as a “spot market” and booked on the fly, and neither of them particularly efficient when it comes to truck occupancy. (Most of the latter spot market is booked through spreadsheets and email, Michael Leto, the CEO, said in an interview.)

Emerge’s solution is something of a stick-and-carrot approach that reminds me a little also of how advertising exchanges work.

A shipper that wants to use the Emerge platform essentially activates/lists its entire inventory of truck providers on the platform to get started. That list and inventory, in turn, become part of a bigger database of other providers: and again, this is a long-tail approach, with typically the trucking companies on the platform having no more than 200 trucks (and often fewer) in their fleets.

Then, when a shipper goes to Emerge to book a shipment, options are provided that might include previous truckers, but might also include others. The idea is that this provides a more efficient picture, and that in turn gets passed on as cost savings to the customers, who can typically reduce shipping costs by as much as 20% using the platform.

If the cost savings and expanded choice are the carrots, the stick comes in the form of the requirement to upload truck data and share it with other shippers: you can’t use the system without doing it.

“But it’s a network effect,” Leto explained when I asked if Emerge ever saw resistance to the model. “We allow these companies to share capacity to drive efficiencies, and to drive and lower costs with less deadhead miles. There are a lot of benefits to capacity sharing.” It doesn’t seem to have deterred too many in any case. There are currently some 30,000 carrier profiles on the platform, and 12,000 transportation entities — including carriers, brokers or other shippers — transacted in Q4 alone, speaking to activity on the platform being strong.

Emerge is not the only company that has identified the opportunity in providing a better and more updated platform to communicate and book space in the fragmented truck market. Sennder out of Berlin — which last year raised a sizeable round of funding — has also built a platform to centralise communications around booking shipments. It, however, seems to have less of an emphasis on encouraging shippers to take the lead in expanding that network effect that Leto describes.

Others that are tackling the wider shipping and logistics market and trying to improve how it runs include Sendy out of Kenya, which recently also announced a $20 million raise; Flexport, which now has a $3.2 billion valuation; Zencargo, which has also raised $20 million; and FreightHub ($30 million), Bringg ($25 million) and NEXT ($97 million).

But within that, Emerge’s performance so far, coupled with the Leto brothers’ history as founders, is giving the startup some extra mileage as we enter the next phase of what trucking might hold, which could include a critical mass of autonomous and electric vehicles on pre-defined routes.

“Uniquely, Emerge combines an exciting new technology designed to serve existing, unmet market need with experienced industry operators and entrepreneurs,” said Tracy Black of NewRoad in a statement. “Andrew and Michael are building the most innovative marketplace we’ve seen in the freight and digital marketplace industry — bringing contracts and carriers together to create new capacity. We are excited to be leading their Series A and I am thrilled to join the board to support their growth.”

Powered by WPeMatico

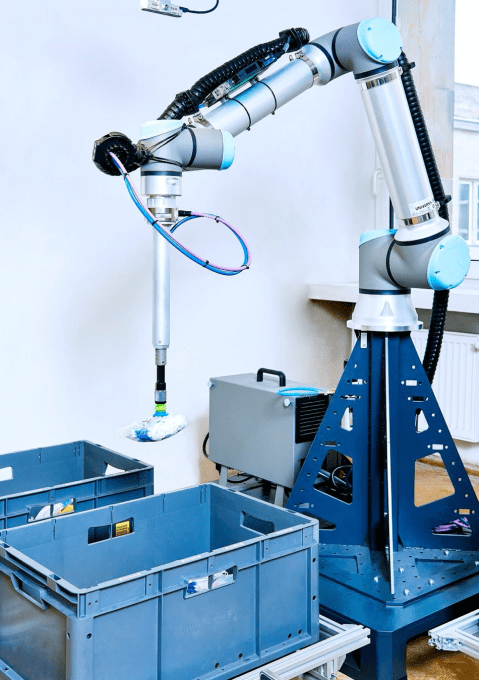

Factories and warehouses have been two of the biggest markets for robots in the last several years, with machines taking on mundane, if limited, processes to speed up work and free up humans to do other, more complex tasks. Now, a startup out of Poland that is widening the scope of what those robots can do is announcing funding, a sign not just of how robotic technology has been evolving, but of the growing demand for more automation, specifically in the world of logistics and fulfilment.

Nomagic, which has developed way for a robotic arm to identify an item from an unordered selection, pick it up and then pack it into a box, is today announcing that it has raised $8.6 million in funding, one of the largest-ever seed rounds for a Polish startup. Co-led by Khosla Ventures and Hoxton Ventures, the round also included participation from DN Capital, Capnamic Ventures and Manta Ray, all previous backers of Nomagic.

There are a number of robotic arms on the market today that can be programmed to pick up and deposit items from Point A to Point B. But we are only starting to see a new wave of companies focus on bringing these to fulfilment environments because of the limitations of those arms: they can only work when the items are already “ordered” in a predictable way, such as on an assembly line, which has mean that fulfilment of, for example, online orders is usually carried out by humans.

There are a number of robotic arms on the market today that can be programmed to pick up and deposit items from Point A to Point B. But we are only starting to see a new wave of companies focus on bringing these to fulfilment environments because of the limitations of those arms: they can only work when the items are already “ordered” in a predictable way, such as on an assembly line, which has mean that fulfilment of, for example, online orders is usually carried out by humans.

Nomagic has incorporated a new degree of computer vision, machine learning and other AI-based technologies to elevate the capabilities of those robotic arm. Robots powered by its tech can successfully select items from an “unstructured” group of objects — that is, not an assembly line, but potentially another box — before picking it up and placing it elsewhere.

Kacper Nowicki, the ex-Googler CEO of Nomagic who co-founded the company with Marek Cygan (an academic) and Tristan d’Orgeval (formerly of Climate Corporation), noted that while there has been some work on the problem of unstructured objects and industrial robots — in the US, there are some live implementations taking shape, with one, Covariant, recently exiting stealth mode — it has been mostly a “missing piece” in terms of the innovation that has been done to make logistics and fulfilment more efficient.

That is to say, there has been little in the way of bigger commercial roll outs of the technology, creating an opportunity in what is a huge market: fulfilment services are projected to be a $56 billion market by 2021 (currently the US is the biggest single region, estimated at between $13.5 billion and $15.5 billion).

“If every product were a tablet or phone, you could automate a regular robotic arm to pick and pack,” Nowicki said. “But if you have something else, say something in plastic, or a really huge diversity of products, then that is where the problems come in.”

Nowicki was a longtime Googler who moved from Silicon Valley back to Poland to build the company’s first engineering team in the country. In his years at Google, Nowicki worked in areas including Google Cloud and search, but also saw the AI developments underway at Google’s DeepMind subsidiary, and decided he wanted to tackle a new problem for his next challenge.

His interest underscores what has been something of a fork in artificial intelligence in recent years. While some of the earliest implementations of the principles of AI were indeed on robots, these days a lot of robotic hardware seems clunky and even outmoded, while much more of the focus of AI has shifted to software and “non-physical” systems aimed at replicating and improving upon human thought. Even the word “robot” is now just as likely to be seen in the phrase “robotic process automation”, which in fact has nothing to do with physical robots, but software.

“A lot of AI applications are not that appealing,” Nowicki simply noted (indeed, while Nowicki didn’t spell it out, DeepMind in particular has faced a lot of controversy over its own work in areas like healthcare). “But improvements in existing robotics systems by applying machine learning and computer vision so that they can operate in unstructured environments caught my attention. There has been so little automation actually in physical systems, and I believe it’s a place where we still will see a lot of change.”

Interestingly, while the company is focusing on hardware, it’s not actually building hardware per se, but is working on software that can run on the most popular robotic arms in the market today to make them “smarter”.

“We believe that most of the intellectual property in in AI is in the software stack, not the hardware,” said Orgeval. “We look at it as a mechatronics problem, but even there, we believe that this is mainly a software problem.”

Having Khosla as a backer is notable given that a very large part of the VC’s prolific investing has been in North America up to now. Nowicki said he had a connection to the firm by way of his time in the Bay Area, where before Google, Vinod Khosla backed a startup of his (which went bust in one of the dot-com downturns).

While there is an opportunity for Nomagic to take its idea global, for now Khosla’s interested because of the a closer opportunity at home, where Nomagic is already working with third-party logistics and fulfilment providers, as well as retailers like Cdiscount, a French Amazon-style, soup-to-nuts online marketplace.

“The Nomagic team has made significant strides since its founding in 2017,” says Sven Strohband, Managing Director of Khosla Ventures, in a statement. “There’s a massive opportunity within the European market for warehouse robotics and automation, and NoMagic is well-positioned to capture some of that market share.”

Powered by WPeMatico

As Silicon Valley’s entrepreneurs cluster around the worldview that artificial intelligence is poised to change how we work, investors are deciding which use cases make the most sense to pump money into right now. One focus has been the relentless communication between companies and customers that takes place at call centers.

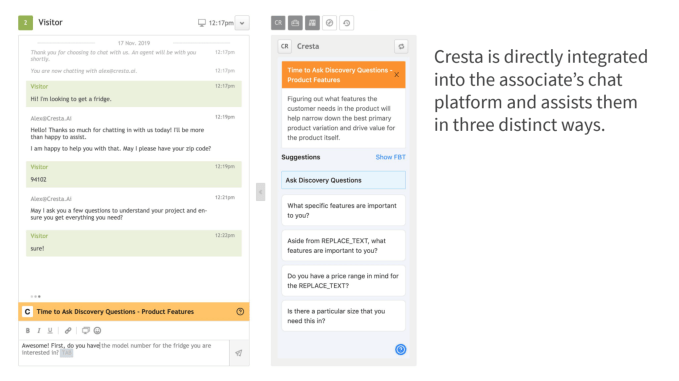

Call center tech has spawned dozens if not hundreds of AI startups, many of which have focused on automating services and using robotic voices to point customers somewhere they can spend money. There has been a lot of progress, but not all of those products have delivered. Cresta is more focused on using AI suggestions to help human contact center workers make the most of an individual call or chat session and lean on what’s worked well for past interactions that were deemed successful.

“I think that there will always be very basic boring stuff that can be automated like frequently asked questions and ‘Oh, what’s the status of my order?,’ ” CEO Zayd Enam says. “But there’s always the role of the person that’s building the relationship between the company and the customer, and that’s a really strategic role for companies in the modern age.”

Udacity co-founder Sebastian Thrun is the startup’s board chairman and is listed as a co-founder. Enam met Thrun during his PhD research at Stanford focused on workplace productivity. Cresta is launching from stealth and announcing that they’ve raised $21 million in funding from investors including Greylock Partners and Andreessen Horowitz. The company recently closed a $15 million Series A round.

Cresta wants to use AI to school customer service workers and salespeople on how to close the deal.

There’s quite a lot of turnover in contact center jobs and that can leave companies reticent to spend a ton of time investing in each employee’s training. Naturally, there are some inherent issues where the workers interacting with an individual customer might not have the experience necessary to suggest a solution that they might if they had more experience. In terms of live feedback, for many, fumbling through paper scripts at their desk can be about as good as it gets. Cresta is hoping that by tapping improvements in natural language processing, their software can help alleviate some stress for contact center workers and help them move conversations in the direction of selling something else for their company.

Cresta is entering a field where there’s already quite a bit of interest from established software giants. Salesforce, Google and Twilio all operate AI-driven products for contact centers. Even with substantial competition, Enam believes Cresta’s team of 30 can offer its customers a lot more individual attention.

“We’re one of the few technical teams where we’re just obsessed with the customer, to the point where it’s normal for people on our team to fly to the customer and live by a call center in an Airbnb for a week,” Enam said. “When Greylock led the Series A, they had heard that and said that’s what gave them so much conviction that we were the team to solve the problem.”

Sun Microsystems co-founder Andy Bechtolsheim, Mark Leslie and Vivi Nevo are also investors in Cresta.

Powered by WPeMatico

Legacy, a male fertility startup, has just raised a fresh, $3.5 million in funding from Bill Maris’s San Diego-based venture firm, Section 32, along with Y Combinator and Bain Capital Ventures, which led a $1.5 million seed round for the Boston startup last year.

We talked earlier today with Legacy’s founder and CEO Khaled Kteily about his now two-year-old, five-person startup and its big ambitions to become the world’s preeminent male fertility center. Our biggest question was how Legacy and similar startups convince men — who are generally less concerned with their fertility than women — that they need the company’s at-home testing kits and services in the first place.

“They should be worried about [their fertility],” said Kteily, a former healthcare and life sciences consultant with a master’s degree in public policy from the Harvard Kennedy School. “Sperm counts have gone down 50 to 60% over the last 40 years.” More from our chat with Legacy, a former TechCrunch Battlefield winner, follows; it has been edited lightly for length.

TC: Why start this company?

KK: I didn’t grow up wanting to be the king of sperm [laughs]. But I had a pretty bad accident — a second-degree burn on my legs after having four hot Starbucks teas spill on my lap in a car — and between that and a colleague at the Kennedy School who’d been diagnosed with cancer and whose doctor suggested he freeze his sperm ahead of his radiation treatments, it just clicked for me that maybe I should also save my sperm. When I went into Cambridge to do this, the place was right next to the restaurant Dumpling House and it was just very awkward and expensive and I thought, there must be a better way of doing this.

TC: How do you get started on something like this?

KK: This was before Ro and Hims began taking off, but people were increasingly comfortable doing things from their own homes, so I started doing research around the idea. I joined the American Society of Reproductive Medicine. I started taking continuing education classes about sperm…

TC: Women are under so much pressure from the time they turn 30 to monitor their fertility. Aside from extreme circumstances, as with your friend, do men really think about testing their sperm?

KK: Men should be worried about it, and they should be taking responsibility for it. What a lot of folks don’t know is for every one in seven couples that are actively trying to get pregnant, the man is equally responsible [for their fertility struggles]. Women are taught about their fertility but men aren’t, yet the quality of their sperm is degrading over the years. Sperm counts have gone down by 50 to 60% over the last 40 years, too.

TC: Wait, what? Why?

KK: [Likely culprits are] chemicals in plastics, chemicals in what we eat eat and drink, changes in lifestyle; we move less and eat more, and sperm health relates to overall health. I also think mobile phones are causing it. I will caveat this by saying there’s been mixed research, but I’m convinced that cell phones are the new smoking in that it wasn’t clear that smoking was as dangerous as it is when the research was being conducted by companies that benefited by [perpetuating cigarette use]. There’s also a generational decline in sperm quality [to consider]; it poses increased risk to the mother but also the child, as the risk of gestational diabetes goes up, as well as the rate of autism and other congenital conditions.

TC: You’re selling directly to consumers. Are you also working with companies to incorporate your tests in their overall wellness offerings?

KK: We’re investing heavily in business-to-business and expect that to be a huge acquisition channel for us. We can’t share any names yet, but we just signed a big company last week and have a few more in the works. These are mostly Bay Area companies right now; it’s an area where our experience as a YC alum was valuable because of the founders who’ve gone through and now run large companies of their own.

TC: When you’re talking with investors, how do you describe the market size?

KK: There are four million couples that are facing fertility challenges and in all cases, we believe the man should be tested. So do [their significant others]. Almost half of purchases [of our kits] are by a female partner. We also see men in the military freezing their sperm before being deployed, same-sex couples who plan to use a surrogate at some point and transgender patients who are looking at a life-changing [moment] and want to preserve their fertility before they start the process. But we see this as something that every man might do as they go off to college, and investors see that bigger picture.

TC: How much do the kits and storage cost?

KK: The kit costs $195 up front, and if they choose to store their sperm, $145 a year. We offer different packages. You can also spend $1,995 for two deposits and 10 years of storage.

TC: Is one or two samples effective? According to the Mayo Clinic, sperm counts fluctuate meaningfully from one sample to the next, so they suggest semen analysis tests over a period of time to ensure accurate results.

KK: We encourage our clients to make multiple deposits. The scores will be variable, but they’ll gather around an average.

TC: But they are charged for these deposits separately?

KK: Yes.

TC: And what are you looking for?

KK: Volume, count, concentration, motility and morphology [meaning the shape of the sperm].

TC: Who, exactly, is doing the analysis and handling the storage?

KK: We partner with Andrology Labs in Chicago on analysis; it’s one of the top fertility labs in the country. For storage, we partner with a couple of cryo-storage providers in different geographies. We divide the samples into four, then store them in two different tanks within each of two locations. We want to make sure we’re never in a position where [the samples are accidentally destroyed, as has happened at clinics elsewhere].

TC: I can imagine fears about these samples being mishandled. How can you assure customers this won’t happen?

KK: Trust and legitimacy are core factors and a huge area of focus for us. We’re CPPA and HIPAA compliant. All [related data] is encrypted and anonymized and every customer receives a unique ID [which is a series of digits so that even the storage facilities don’t know whose sperm they are handling]. We have extreme redundancies and processes in place to ensure that we’re handling [samples] in the most scientifically rigorous way possible, as well as ensuring the safety and privacy of each [specimen].

TC: How long can sperm be frozen?

KK: Indefinitely.

TC: How will you use all the data you’ll be collecting?

KK: I could see us entering into partnerships with research institutions. What we won’t do is sell it like 23andMe.

Powered by WPeMatico