Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Around 70% of the world’s population now has some form of bank account or — thanks to mobile phones — a facility to receive and send money virtually, according to the World Bank. But when it comes to people crossing borders and setting up lives in new countries, they essentially leave behind their financial histories, starting again from scratch in their new homes. But there are signs of that starting to change. A startup called Nova Credit has built a facility to import financial histories from one country to another, and today it’s announcing a $50 million round of funding to grow that business to cover more countries.

The funding is being led by Kleiner Perkins, with a list of other big names also participating. They include Canapi Ventures, a new fund focused on fintech startups, as well as previous backers Index Ventures, General Catalyst and Nyca Partners. Ashton Kutcher and Guy Oseary’s fund Sound Ventures is also in this round, along with baseball legend Alex Rodriguez and U2 guitarist the Edge.

Nova is not disclosing its valuation, but according to PitchBook, in the first-close of the round it was estimated at around $295 million. CEO and co-founder Misha Esipov would only say it was “much higher” than the company’s valuation in its previous round — supported by the facts that revenues grew four-fold in 2019, and that it now covers more than 1 billion consumer credit profiles, working out to over 50% of the most popular U.S. immigrant countries of origin.

Prior to this Series B, the company had raised just under $20 million, which also included funding from Y Combinator (where it was part of a 2016 cohort).

Esipov — who has worked as a banker at Goldman Sachs and at private equity firm Apollo, and himself is a first-generation Russian immigrant moving to the U.S. with his parents when he was three — said he and co-founders Loek Janssen and Nicky Goulimis first came up with the idea for Nova when they were still graduate students at Stanford, where they turned to their own classmates to look for gaps in the market of financial services.

“We made a discovery among the international students we surveyed, which was that many said they couldn’t get credit, cell phone plans, leases and anything else that required credit histories,” he said. “Many of them said the same thing to us: ‘I feel like a second-class citizen.’ And that was the light-bulb moment for us. We saw it was a systemic problem, and four years later I believe we’re solving a decent share of this problem.”

Nova’s solution is that it has built a digital framework that connects an individual’s credit history information from one country back into the country where the person is currently residing, creating a product that it refers to as a “Credit Passport.”

Nova partners with businesses that rely on this credit history in order to decide whether to do business with an individual. In cases where it comes up short in accessing an in-country history for a specific person — for example, American Express, in evaluating a person’s credit history to determine whether it should issue a card for a particular applicant — it can now use Nova to source a history from another market, using details provided by the user in question.

Nova’s business model is that it pays a fee to the credit bureau where the records are originating in order to source the data, and it then charges the business that is making the request for the data.

For now, the service is not global in a number of ways. The first is in terms of the geographies covered: Nova has so far only facilitated links between 11 countries, with the originating requests coming from the U.S. They include Australia, Canada, India, Kenya, Mexico and the U.K. Esipov said that the starting point came from close analysis of which countries send the most people to the U.S.

The other is that the service is largely geared toward people who have a credit history to speak of in their previous country. For many immigrants to the U.S., that is not actually the case for a number of financial, political and other reasons.

The strategy is to increasingly cover both of those bases better over time, Esipov said.

For example, while there are only 11 countries “live” at the moment, the company actually has deals with 19 countries currently, a list it hopes to grow more. The Dominican Republic and the Philippines will be the next two countries to launch. One reason for the relatively slow rollout is that this isn’t exactly a scalable problem with the same issues in each market, although it’s finally started to get some momentum.

“It’s an absolute nightmare,” Esipov said with a laugh when I asked him about the challenges of scaling the business. “Each country has its own complexities, whether it’s in terms of the partnership or technical complexity. Every market is different.” Some are surprising. He noted that France, for example, is the only G20 country without a centralised credit bureau, only a repository that logs “bad marks,” not good behaviour. “So we haven’t been able to develop a solution covering France so far.”

He notes that it has taken Nova a few years to build these relationships. “When we were still trying to find our footing, it was difficult, but now the five biggest credit agencies in the world work with us. We have established ourselves as the solution for cross-border credit reporting access.”

And on the side of making the product something that can be useful for more than just the percentage of immigrants who came from the credit-using class in their previous countries — the typical type of person who might end up at Stanford business school, if you will — Nova is working on that, too.

“There are a lot of potential strategies for those countries where central credit bureaus don’t exist,” Esipov said. “We have to be creative in using potential data sources that we can find to say this is a new and good segment. There are alternative data sources, and we are exploring how to bring those into the U.S. market. But, if they are not as well-established, no matter how creative we are, it’s a matter of working with risk officers and trying to teach them, too.” Indeed, we are starting to see a rise of other services aiming at immigrants — for example, new bank accounts launched by Remitly last week — speaking to how multiple startups are tuning into demographics that have been traditionally overlooked, but now represent growth opportunities in what is otherwise a tight and competitive market with slowing growth.

“In a competitive financial services industry with shifting demographics, developing a strategy to attract the growing newcomer segment has become a strategic necessity for banks to defend and grow market share,” said Gene Ludwig, managing partner of Canapi Ventures, in a statement. “Nova Credit stands out as the only enduring solution to financial access for the millions of newcomers who come to the US each year. They’ve assembled an exceptional, mission-driven team that has what it takes to bring systemic change to life.”

It can’t come a moment too soon. Nova, citing research from Pew, notes that immigrants account for 55% of U.S. population growth, which will grow to 80% by 2050. Helping them get better integrated into the economy is a critical step for integrating into society.

“Credit is fundamental to economic success, but today’s systems and infrastructure have not kept up with an increasingly mobile world,” said Ilya Fushman, a partner at Kleiner Perkins, in a statement. “Nova Credit is democratizing access to credit globally and we’re delighted to lead the Series B.

Powered by WPeMatico

Model9, an Israeli startup launched by mainframe vets, has come up with a way to transfer data between mainframe computers and the cloud, and today the company announced a $9 million Series A.

Intel Capital led the round with help from existing investors, including StageOne, North First Ventures and Glenrock Israel. The company reports it has now raised almost $13 million.

You may not realize it, but the largest companies in the world, like big banks, insurance companies, airlines and retailers, still use mainframes. These companies require the massive transaction processing capabilities of these stalwart machines, but find it’s difficult to get the valuable data out for more modern analytics capabilities. This is the hard problem that Model9 is attempting to solve.

Gil Peleg, CEO and co-founder at Model9, says that his company’s technology is focused on helping mainframe users get their data to the cloud or other on-prem storage. “Mainframe data is locked behind proprietary storage that is inaccessible to anything that’s happening in the evolving, fast-moving technology world in the cloud. And this is where we come in with patented technology that enables mainframes to read and write data directly to the cloud or any non-mainframe distributed storage system,” Peleg explained.

This has several important use cases. For starters, it can act as a disaster recovery system, eliminating the need to maintain expensive tape backups. It also can move this data to the cloud where customers can apply modern analytics to data that was previously inaccessible.

The company’s solution works with AWS, Google Cloud Platform, Microsoft Azure and IBM’s cloud solution. It also works with other on-prem storage solutions like EMC, Nutanix, NetApp and Hitatchi. He says the idea is to give customers true hybrid cloud options, whether a private cloud or a public cloud provider.

“Ideally our customers will deploy a hybrid cloud topology and benefit from both worlds. The mainframe keeps doing what it should do as a reliable, secure, trusted [machine], and the cloud can manage the scale and the rapidly growing amount of data and provide the new modern technologies for disaster recovery, data management and analytics,” he said.

The company was founded in 2016 and took a couple of years to develop the solution. Today, the company is working with a number of large organizations using mainframes. Peleg says he wants to use the money to expand the sales and marketing operation to grow the market for this solution.

Powered by WPeMatico

Alpha Foods, the vegetarian prepared food manufacturer, has raised $28 million in financing for its portfolio of vegetarian burritos, tamales, nuggets, pizzas, burgers, patties and sausages.

The Glendale, Calif.-based company was launched by Loren Wallis, the founder of the dairy substitute, Good Karma Foods, and Cole Orobetz, a former director with the agricultural debt lending firm Avrio Capital.

First launched in 2015, Alpha Foods previously raised $12 million in financing from investment firms like New Crop Capital and AccelFoods, whose other brands include Kite Hill, Good Catch, BRAMi and Evoke Healthy Foods.

As more Americans move to supplement their diets with plant-based products, companies like Alpha Foods have found willing investors for new food brands. The company’s new round was led by AccelFoods, with existing investors, including New Crop Capital, Green Monday Ventures and Blue Horizon, also participating.

Companies like Alpha compete with huge consumer packaged goods companies like Kellogg’s (through its Morningstar Farms line of vegetarian products) and Nestlé (through Sweet Earth Foods).

While the Morningstar Farms brand might seem a bit stale, the market has been reinvigorated through the marketing muscle and venture dollars supplied by companies like Beyond Meat and Impossible Foods, whose products have captured contracts from some of the world’s biggest fast food chains — including McDonald’s, KFC and Burger King.

Alpha Foods said it will use the latest money to launch new products, make new hires and expand its distribution channels nationally and internationally.

The company is already sold in well over 9,000 stores at chains including Wegmans, Walmart, Kroger and Publix.

“As more and more people actively seek out plant-based options, whether for their health or the environment, we are looking to expand our innovations within the category and bring easy to prepare products to a wider audience,” said Cole Orobetz, co-founder and president of Alpha Foods, in a statement.

The sale of pre-prepared plant-based meals reached $387 million in 2019, up 6% over the past year, according to data from the Good Food Institute.

“We are in the early days of plant-based consumption. As a portable, functional food business geared towards the newly emergent flexitarian consumer, the Alpha platform meets all of its customers’ snack and mealtime needs,” said AccelFoods Managing Partner Jordan Gaspar. “We couldn’t be prouder to lead this strong nexus of collaborative investors, who had the opportunity to organically build trust this past year allowing for an incredibly successful outcome in this financing.”

Powered by WPeMatico

Sixgill, an Israeli cyberthreat intelligence company that specializes in monitoring the deep and dark web, today announced that it has raised a $15 million funding round led by Sonae IM, a fund based in Portugal, and London-based REV Venture Partners. Crowdfunding platform OurCrowd also participated in the round, as did previous investors Elron and Terra Venture Partners.

According to Crunchbase, this brings the company’s total funding to $21 million to date.

Sixgill, which was founded in 2014, plans to use the new funding to expand its efforts in North America, EMEA and APAC. In addition to expanding its geographic focus, Sixgill plans to expand its product’s capabilities, including its Dynamic CVE Rating.

Its current customer base mostly includes large enterprises, law enforcement and other government agencies, as well as other security providers.

Given its focus, that client list doesn’t come as a surprise. The company uses its technology to automatically monitor dark web forums and marketplaces for potential threats and then find those that could affect its clients. Users can either access Sixgill through its SaaS platform or install it on-premises. For enterprises and agencies that don’t have their own staff to run the service, Sixgills also offers access to its internal analysts.

“Sixgill uses advanced automation and artificial intelligence technologies to provide accurate, contextual intelligence to customers. The solution integrates seamlessly into the platforms that security teams use to orchestrate, automate, and manage security events,” said Sharon Wagner, CEO of Sixgill. “The market has made it clear that Sixgill has built a powerful real-time engine for more effective handling of the rapidly expanding threat landscape; this investment will position us for significant growth and expansion in 2020.”

Powered by WPeMatico

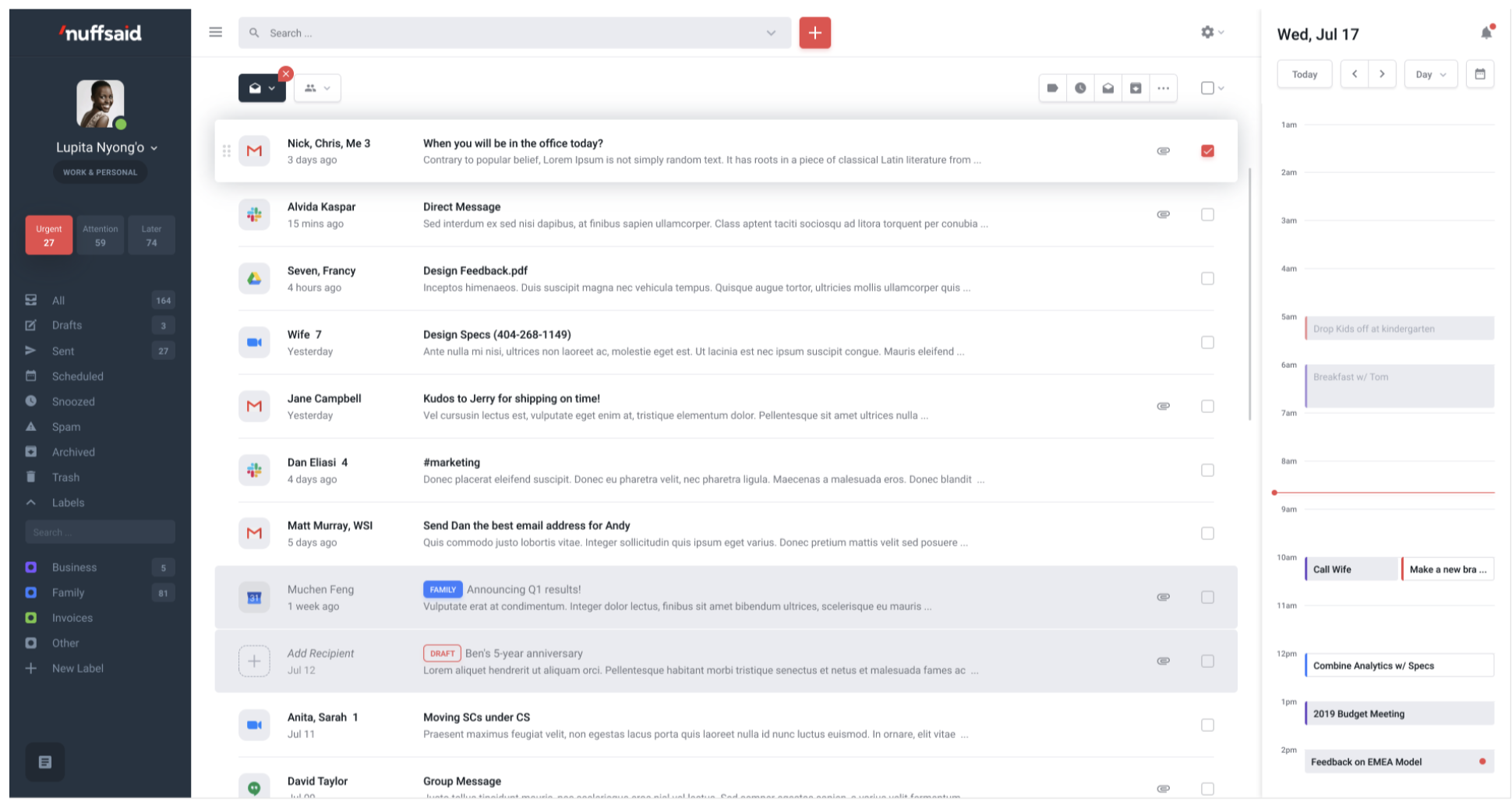

There have been plenty of stories written about the so-called “Slack-lash” and the growing unrest among workers dealing with DM interruptions that take their attention away from the task at hand. Slack is a poster child for the problem, but VCs have invested heavily in a number of collaboration tools over the past several years that have compartmentalized chat and commenting systems and have left workers reeling.

It seems fairly likely that we’ve reached peak VC interest in collaboration, but VCs are dealing with any slowdown by betting more heavily on tools that help workers make sense of the panoply of slick interfaced messaging tools. The latest bet, ’nuffsaid, is, yes, yet another productivity startup, though one that seems devoted to making the messaging realities of 2020 employment a bit more tolerable.

The Utah startup is emerging from stealth, launching the first element of their productivity platform in early access, and disclosing that they’ve raised $4.3 million in seed funding from General Catalyst, Google’s Gradient Ventures, Global Founders Capital, Work Life Ventures, SV Angel and Wasabi Ventures.

The oddly named company is releasing its first oddly named product, ‘nflow, into early access, bringing multiple collaboration platforms and a calendar into a single inbox. Just as the algorithmic timeline shaped how we digest the firehose of social media content, algorithmic inboxes might be the solution to a Slack-lash. And ’nuffsaid is taking this algorithmic approach for prioritizing Slack messages, as well as emails, texts and Zoom messages, with ‘nflow. The searchable unified inbox brings all of your messages into a single app, letting you know what’s urgent and what can probably wait until you’re finished taking care of the task at hand.

“We think there’s going to be an entire category of products that are all about adding AI into existing workflows. With ‘nflow, we think we’re taking our first baby step to our vision of that future,” CEO and co-founder Chris Hicken tells TechCrunch. Hicken was previously COO of UserTesting.

One of the more exciting elements of ‘nflow is the way it brings the calendar inside the communications hub. Google Calendar is still among the more estranged elements of productivity workflows. Using messages and emails as the basis for calendar events has always been a wishlist item, but the integration is rarely tight enough. Although ’nuffsaid’s drag-and-drop interface for creating calendar events while tagging team members and adding additional info showcases seems to be a pretty attractive solution, I’ll wait until I can poke around the app myself before making any full-throated endorsements.

The ’nuffsaid team says ‘nflow will launch commercially at (a rather pricey) $25 per month, but that people who sign up for their early access waitlist will unlock a lifetime rate of $10 per month.

The team of 18 has bigger near-term ambitions than the product they’re launching in early access today. If ‘nflow represents a more mass-market approach to delivering a productivity tool to workers frustrated by a messaging overload, their future launches signify a desire to dig deeper into specific enterprise workflows and bring specific types of teams on board.

Over the summer, the company plans to roll out a separate AI-driven customer success module that integrates with a variety of apps to give workers more actionable insights on what tasks are the most critical to maintaining and building customer relationships. The startup plans to build and roll out dedicated versions of the module for engineering, product and marketing, as well.

“There are so many collaboration tools, what I like about ’nuffsaid is that it’s where the work is actually happening and they’re not asking users to change their procedures,” General Catalyst Managing Director Niko Bonatsos tells TechCrunch. “Users still have the same email address, they’re still contacting their customers the same ways, they don’t have to start doing unnatural things that disrupt their workflows.”

Powered by WPeMatico

Negotiatus, a SaaS business meant to optimize and streamline the purchasing and procurement process for businesses, has today announced the close of a $10 million Series A round.

The funding was led by Rally Ventures, with participation from ERA, 645 Ventures, Green Visor Capital and Stage 2 Capital. This brings the company’s total funding to nearly $20 million.

Negotiatus was founded by Zach Garippa and Tom Jaklitsch with an idea to detangle the process of purchasing supplies for a business. Garippa told TechCrunch that most solutions to this problem focus on one piece of the puzzle, serving finance or operations or the purchasers themselves, but ultimately making the process more difficult for the other functions in the business.

Negotiatus pulls all of those stakeholders into a single platform where they can shop, place orders, track delivery information and manage spend all from one place.

For example, finance departments often have to manually review and remit payment for thousands of invoices a month, normally across at least several vendors and various formats. Negotiatus allows the finance department to view all of that in a weekly or monthly invoice.

Before Negotiatus, purchasers had to cross-reference approved brands, vendors and products each time they needed a new set of pens or toilet paper, jumping from one website to another and tracking shipments across multiple websites. Negotiatus scrapes your past purchase history to show purchasers what they want in a single place. And, of course, users can track those products directly from the Negotiatus dashboard.

Operations can centralize order requests and approvals within the Negotiatus platform, and leverage analytics provided by the company to make better purchasing decisions. Negotiatus scrapes the SKUs themselves, across vendors, to make sure that businesses are making the smartest possible decision with their budget.

The company says that it takes less than a day to get going on the platform.

Negotiatus generates revenue in two ways. The first is a regular subscription model that charges on a monthly basis for each location on the platform. The second is based on spend volume on the platform (which comes from the vendor side).

Thus far, Negotiatus has 300 customers, with a particular popularity among health and wellness businesses (SoulCycle, Orangetheory, CorePower Yoga) and co-working businesses (WeWork, Zeus, Domio). The company hopes to soon expand beyond physical products into software services.

Powered by WPeMatico

Impala has raised another round of funding just a few months after raising an $11 million Series A round. This time, the startup is raising a $20 million Series B round led by Lakestar. Latitude Ventures is also participating in the round.

The company is building a service that works pretty much like Plaid, but for hotel rooms. The hotel industry relies on old-school “property management systems” to manage rooms, room types, pricing, extras, taxes, etc.

Instead of asking hotels to switch to an entirely different property management system, the company is upgrading those systems with a modern API. This way, you can build applications that query hotel data directly with a few lines of code. You get a standardized JSON response from the API.

Impala is currently compatible with a handful of property management systems. The company is still adding more systems in order to cover a wider range of hotels.

Three hundred hotels are currently working with Impala, such as Accor hotels (Mercure) and Hyatt-branded hotels. The company currently has a backlog of 3,500 hotels. It really shows that the industry has been waiting for a product like this.

While Impala is still focused on surfacing data in an easy-to-code manner, the company is already thinking beyond read-only data. The startup wants to let developers book rooms directly using the Impala API.

It could open up hotel bookings to many other services. For instance, you could imagine being able to book rooms on Lonely Planet’s website. Services selling train tickets and flights could upsell you with hotel rooms.

In order to offer rooms on the usual hotel booking services from Booking Holdings websites (Booking.com, Priceline, Agoda, Kayak…) and Expedia Group websites (Expedia, Hotels.com, HomeAway, Trivago…), many hotels currently work with channel managers to send out information to multiple services at once. In the future, Impala could replace those channel managers with its API.

Powered by WPeMatico

“It’s an open secret that every company is on fire,” says Kintaba co-founder John Egan. “At any given moment something is going horribly wrong in a way that it has never gone wrong before.” Code failure downtimes, server outages and hack attacks plague engineering teams. Yet the tools for waking up the right employees, assembling a team to fix the problem and doing a post-mortem to assess how to prevent it from happening again can be as chaotic as the crisis itself.

Text messages, Slack channels, task managers and Google Docs aren’t sufficient for actually learning from mistakes. Alerting systems like PagerDuty focus on the rapid response, but not the educational process in the aftermath. Finally, there’s a more holistic solution to incident response with today’s launch of Kintaba.

The Kintaba team experienced these pains firsthand while working at Facebook after Egan and Zac Morris’ Y Combinator-backed data transfer startup Caffeinated Mind was acqui-hired in 2012. Years later, when they tried to build a blockchain startup and the whole stack was constantly in flames, they longed for a better incident alert tool. So they built one themselves and named it after the Japanese art of Kintsugi, where gold is used to fill in cracked pottery, “which teaches us to embrace the imperfect and to value the repaired,” Egan says.

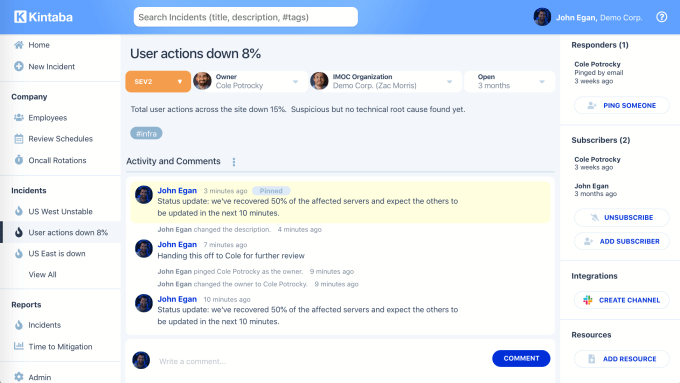

With today’s launch, Kintaba offers a clear dashboard where everyone in the company can see what major problems have cropped up, plus who’s responding and how. Kintaba’s live activity log and collaboration space for responders let them debate and analyze their mitigation moves. It integrates with Slack, and lets team members subscribe to different levels of alerts or search through issues with categorized hashtags.

“The ability to turn catastrophes into opportunities is one of the biggest differentiating factors between successful and unsuccessful teams and companies,” says Egan. That’s why Kintaba doesn’t stop when your outage does.

Kintaba Founders (from left): John Egan, Zac Morris and Cole Potrocky

As the fire gets contained, Kintaba provides a rich text editor connected to its dashboard for quickly constructing a post-mortem of what went wrong, why, what fixes were tried, what worked and how to safeguard systems for the future. Its automated scheduling assistant helps teams plan meetings to internalize the post-mortem.

Kintaba’s well-pedigreed team and their approach to an unsexy but critical software-as-a-service attracted $2.25 million in funding led by New York’s FirstMark Capital.

“All these features add up to Kintaba taking away all the annoying administrative overhead and organization that comes with running a successful modern incident management practice,” says Egan, “so you can focus on fixing the big issues and learning from the experience.”

Egan, Morris and Cole Potrocky met while working at Facebook, which is known for spawning other enterprise productivity startups based on its top-notch internal tools. Facebook co-founder Dustin Moskovitz built a task management system to reduce how many meetings he had to hold, then left to turn that into Asana, which filed to go public this week.

The trio had been working on internal communication and engineering tools as well as the procedures for employing them. “We saw firsthand working at companies like Facebook how powerful those practices can be and wanted to make them easier for anyone to implement without having to stitch a bunch of tools together,” Egan tells me. He stuck around to co-found Facebook’s enterprise collaboration suite Workplace while Potrocky built engineering architecture there and Morris became a mobile security lead at Uber.

Like many blockchain projects, Kintaba’s predecessor, crypto collectibles wallet Vault, proved an engineering nightmare without clear product market fit. So the team ditched it and pivoted to build out the internal alerting tool they’d been tinkering with. That origin story sounds a lot like Slack’s, which began as a gaming company that pivoted to turn its internal chat tool into a business.

So what’s the difference between Kintaba and just using Slack and email or a monitoring tool like PagerDuty, Splunk’s VictorOps or Atlassian’s OpsGenie? Here’s how Egan breaks a site downtime situation handled with Kintaba:

You’re on call and your pager is blowing up because all your servers have stopped serving data. You’re overwhelmed and the root cause could be any of the multitude of systems sending you alerts. With Kintaba, you aren’t left to fend for yourself. You declare an incident with high severity and the system creates a collaborative space that automatically adds an experienced IMOC (incident manager on call) along with other relevant on calls. Kintaba also posts in a company-wide incident Slack channel. Now you can work together to solve the problem right inside the incident’s collaborative space or in Slack while simultaneously keeping stakeholders updated by directing them to the Kintaba incident page instead of sending out update emails. Interested parties can get quick info from the stickied comments and #tags. Once the incident is resolved, Kintaba helps you write a postmortem of what went wrong, how it was fixed, and what will be done to prevent it from happening. Kintaba then automatically distributes the postmortem and sets up an incident review on your calendar.

Essentially, instead of having one employee panicking about what to do until the team struggles to coordinate across a bunch of fragmented messaging threads, a smoother incident reporting process and all the discussion happens in Kintaba. And if there’s a security breach that a non-engineer notices, they can launch a Kintaba alert and assemble the legal and PR team to help, too.

Alternatively, Egan describes the downtime fiascoes he’d experience without Kintaba like this:

The on call has to start waking up their management chain to try and figure out who needs to be involved. The team maybe throws a Slack channel together but since there’s no common high severity incident management system and so many teams are affected by the downtime, other teams are also throwing slack channels together, email threads are happening all over the place, and multiple groups of people are trying to solve the problem at once. Engineers begin stepping all over each other and sales teams start emailing managers demanding to know what’s happening. Once the problem is solved, no one thinks to write up a postmortem and even if they do it only gets distributed to a few people and isn’t saved outside that email chain. Managers blame each other and point fingers at people instead of taking a level headed approach to reviewing the process that led to the failure. In short: panic, thrash, and poor communication.

While monitoring-apps like PagerDuty can do a good job of indicating there’s a problem, they’re weaker at the collaborative resolution and post-mortem process, and designed just for engineers rather than everyone, like Kintaba. Egan says, “It’s kind of like comparing the difference between the warning lights on a piece of machinery and the big red emergency button on a factory floor. We’re the big red button . . . That also means you don’t have to rip out PagerDuty to use Kintaba,” since it can be the trigger that starts the Kintaba flow.

Still, Kintaba will have to prove that it’s so much better than a shared Google Doc, an adequate replacement for monitoring solutions or a necessary add-on that companies should pay $12 per user per month. PagerDuty’s deeper technical focus helped it go public a year ago, though it has fallen about 60% since to a market cap of $1.75 billion. Still, customers like Dropbox, Zoom and Vodafone rely on its SMS incident alerts, while Kintaba’s integration with Slack might not be enough to rouse coders from their slumber when something catches fire.

Still, Kintaba will have to prove that it’s so much better than a shared Google Doc, an adequate replacement for monitoring solutions or a necessary add-on that companies should pay $12 per user per month. PagerDuty’s deeper technical focus helped it go public a year ago, though it has fallen about 60% since to a market cap of $1.75 billion. Still, customers like Dropbox, Zoom and Vodafone rely on its SMS incident alerts, while Kintaba’s integration with Slack might not be enough to rouse coders from their slumber when something catches fire.

If Kintaba can succeed in incident resolution with today’s launch, the four-person team sees adjacent markets in task prioritization, knowledge sharing, observability and team collaboration, though those would pit it against some massive rivals. If it can’t, perhaps Slack or Microsoft Teams could be suitable soft landings for Kintaba, bringing more structured systems for dealing with major screw-ups to their communication platforms.

When asked why he wanted to build a legacy atop software that might seem a bit boring on the surface, Egan concluded that, “Companies using Kintaba should be learning faster than their competitors . . . Everyone deserves to work within a culture that grows stronger through failure.”

Powered by WPeMatico

Meet AssoConnect, a French startup that is building a software-as-a-service application to give you all the tools you need to manage your nonprofit organization (association in French).

The company just raised a $7.7 million (€7 million) funding round with XAnge and ISAI leading the round. Various business angels, such as Nicolas Macquin, Rodolphe Carle, Michaël Benabou, Thibaud Elzière and Phil Tesler are also participating in today’s funding round.

Many nonprofit organizations use tools and services that aren’t really designed for this type of organization. Some manage members in an Excel spreadsheet, waste a ton of time with accounting tasks and leave money on the table by making it hard to accept donations and memberships.

AssoConnect combines multiple services in its web interface. First, it lets you centralize information about your members in a single database. It acts as a light CRM, and you can create multiple groups of members depending on what they do in the organization.

Second, AssoConnect handles memberships and donations directly. You can create a form that interacts directly with your database to help new users join your organization. You also can create a donation module that can automatically generate tax forms. And you can create an online store if you’re selling goods.

If you don’t have a website already, you can use AssoConnect’s template-based website builder. You also can create events and email your members from AssoConnect using Mailgun.

Finally, the startup tries to generate accurate accounting reports based on donations, membership fees, ticket sales, etc. That’s why it makes sense to centralize everything through AssoConnect.

The service offers a free tier for organizations with 30 members or fewer. But you’ll have to pay a monthly subscription fee if you have higher needs. It’s a tough sell, given that nonprofit organizations usually don’t have a ton of money to spend on tools and services.

But the company has managed to convince 10,000 French organizations to switch to AssoConnect so far. Up next, AssoConnect wants to hire 80 people in 2020 and launch its service in the U.S.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week was something fun. First, we were back as a group in the San Francisco studio, which is always fun. Even better, we had NEA’s Rick Yang on hand to chat with Danny and Alex about the week. Yang, as old-school Equity listeners will recall, was on the show back in 2017. (Equity turns three soon, which is somewhat amazing.)

All that aside, let’s talk about what we talked about. As always, we kicked off with three rounds:

After that we chugged through a mountain of news. First up, the confirmation of a story that we mentioned on the show before, namely the existence of a new venture fund (angel pool, perhaps) from the CEO of email startup Superhuman Rahul Vora and Eventjoy founder Todd Goldberg. The $7 million vehicle is going to cut pre-seed sized checks ($75,000 to $200,000), which should make it a popular pit stop for pre-revenue companies.

What next? Well, Casper of course. The company’s IPO pricing and debut was this week, something that we’ve had something to say about. That, and the latest from One Medical’s strong post-IPO performance, and the news that Asana has filed privately to go public in a direct listing.

That last item was of particular interest, as the company hasn’t raised as much cash as other companies that we’ve seen direct list, the Spotifys and Slacks of the world. So has it raised capital that we haven’t heard about, or has it simply not spent the capital it has raised? If it had spent the money, then wouldn’t it want to raise some like with a traditional IPO? Mysteries! Riddles that will be solved when we get to see the damn filing.

Oh, and Spotify continues to pour money into podcasting. Which everyone ’round the table thought was pretty smart.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico