Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

When Eliot Buchanan tried to use his credit card to pay his Harvard tuition bill, the payment was rejected because the university said it doesn’t accept credit. Realizing the same problem exists for thousands of different transactions like board, rent and vendor payments, he launched Plastiq. Plastiq helps people use credit cards to pay, or get paid, for anything.

Plastiq today announced that it has raised $75 million in venture capital in a Series D round led by B Capital Group. Kleiner Perkins, Khosla Ventures, Accomplice and Top Tier Capital Partners also participated in the round. The round brings the company’s total known venture capital raised to more than $140 million.

To use Plastiq, users enter their credit card information on Plastiq’s platform. In return, Plastiq will charge you a 2.5% fee and get your bills paid. While Plastiq was started with consumers in mind, SMBs have now accounted for 90% of the revenue, according to Buchanan. The new financing round will invest in building out features to give SMBs faster services around payments and processing.

Plastiq provides a way for SMBs and consumers to pay their bills and make sure they have reliable cash flow. For example, restaurants sometimes have a drop in revenue due to seasonality or, as we’re experiencing now with COVID-19, pandemic lockdowns. Or tourism companies for cities that are struggling to attract visitors. Those companies still need cash flow, and using Plastiq’s service, they can use credit cards to pay suppliers even in an off season.

There is no shortage of competition from other companies also trying to solve pain points in small-business cash flow. According to Buchanan, Plastiq’s biggest competitors are traditional lenders, as well as companies like Kabbage and Fundbox. Similar claims could be made about Brex, which offers a credit card for startups to access capital faster.

Kabbage provides funding to SMBs through automated business loans. The SoftBank-backed company landed $200 million in a revolving credit line back in July, fresh off of landing strong partnerships with banks and giants like Alibaba to access more customers. Kabbage loans out roughly $2-3 billion to SMBs every year.

Plastiq, according to its release, is also on track to make more than $2 billion in transactions. But unlike Kabagge, Plastiq doesn’t issue loans or credit, it just unlocks a payment opportunity.

“SMBs don’t need to be burdened with additional debt or additional loans,” Buchanan said. “So rather than trying to reinvent the wheel, let’s use a behavior they have already earned.”

Buchanan would not disclose Plastiq’s current valuation or revenue, but he did say that it’s not too far away from $100 million in revenue run rate. The company’s revenue has grown 150% from 2018 to 2019.

The company also noted that it has surpassed “well over 1 million users,” up 150% in unique new users from 2018 to 2019.

In terms of profitability, Buchanan said that “we could be profitable if we wanted to be,” noting that Plastiq’s revenue and margins could lead them toward profitability if they wanted to focus less on growth. But he added they don’t plan to “slow down” the growth engine any time soon — especially in the wake of the COVID-19 pandemic.

Because the Series D round closed at the end of 2019, Buchanan said the pandemic did not impact the deal. However, the company had planned to time the announcement with tax season. Now, as small businesses struggle to secure capital and stay afloat due to lockdowns across the country, Plastiq’s new raise feels more fitting.

“Our customers are more thankful for solutions like ours as traditional sources of lending are drying up and not as easy to access” Buchanan said. “Hopefully, we can measure how many businesses make it through this because of us.”

The 140-person company is currently hiring across product and engineering roles.

Powered by WPeMatico

Four years ago, mathematician Vlad Voroninski saw an opportunity to remove some of the bottlenecks in the development of autonomous vehicle technology thanks to breakthroughs in deep learning.

Now, Helm.ai, the startup he co-founded in 2016 with Tudor Achim, is coming out of stealth with an announcement that it has raised $13 million in a seed round that includes investment from A.Capital Ventures, Amplo, Binnacle Partners, Sound Ventures, Fontinalis Partners and SV Angel. More than a dozen angel investors also participated, including Berggruen Holdings founder Nicolas Berggruen, Quora co-founders Charlie Cheever and Adam D’Angelo, professional NBA player Kevin Durant, Gen. David Petraeus, Matician co-founder and CEO Navneet Dalal, Quiet Capital managing partner Lee Linden and Robinhood co-founder Vladimir Tenev, among others.

Helm.ai will put the $13 million in seed funding toward advanced engineering and R&D and hiring more employees, as well as locking in and fulfilling deals with customers.

Helm.ai is focused solely on the software. It isn’t building the compute platform or sensors that are also required in a self-driving vehicle. Instead, it is agnostic to those variables. In the most basic terms, Helm.ai is creating software that tries to understand sensor data as well as a human would, in order to be able to drive, Voroninski said.

That aim doesn’t sound different from other companies. It’s Helm.ai’s approach to software that is noteworthy. Autonomous vehicle developers often rely on a combination of simulation and on-road testing, along with reams of data sets that have been annotated by humans, to train and improve the so-called “brain” of the self-driving vehicle.

Helm.ai says it has developed software that can skip those steps, which expedites the timeline and reduces costs. The startup uses an unsupervised learning approach to develop software that can train neural networks without the need for large-scale fleet data, simulation or annotation.

“There’s this very long tail end and an endless sea of corner cases to go through when developing AI software for autonomous vehicles, Voroninski explained. “What really matters is the unit of efficiency of how much does it cost to solve any given corner case, and how quickly can you do it? And so that’s the part that we really innovated on.”

Voroninski first became interested in autonomous driving at UCLA, where he learned about the technology from his undergrad adviser who had participated in the DARPA Grand Challenge, a driverless car competition in the U.S. funded by the Defense Advanced Research Projects Agency. And while Voroninski turned his attention to applied mathematics for the next decade — earning a PhD in math at UC Berkeley and then joining the faculty in the MIT mathematics department — he knew he’d eventually come back to autonomous vehicles.

By 2016, Voroninski said breakthroughs in deep learning created opportunities to jump in. Voroninski left MIT and Sift Security, a cybersecurity startup later acquired by Netskope, to start Helm.ai with Achim in November 2016.

“We identified some key challenges that we felt like weren’t being addressed with the traditional approaches,” Voroninski said. “We built some prototypes early on that made us believe that we can actually take this all the way.”

Helm.ai is still a small team of about 15 people. Its business aim is to license its software for two use cases — Level 2 (and a newer term called Level 2+) advanced driver assistance systems found in passenger vehicles and Level 4 autonomous vehicle fleets.

Helm.ai does have customers, some of which have gone beyond the pilot phase, Voroninski said, adding that he couldn’t name them.

Powered by WPeMatico

OfferUp, a top online and mobile marketplace app, announced this morning it’s raising $120 million in a new round of funding led by competing marketplace letgo’s majority investor, OLX Group, and others. As a part of the deal, OfferUp will also be acquiring letgo’s classified business, with OLX Group gaining a 40% stake in the newly combined entity.

Other investors in the new round include existing OfferUp backers Andreessen Horowitz and Warburg Pincus. The funds will be put toward continued growth, product innovation and monetization efforts, OfferUp says.

The round will close with the closing of the acquisition, which is expected to take place sometime in May. To date, OfferUp has raised $380 million.

The acquisition will see two of the largest third-party buying and selling marketplaces — outside of Craigslist, eBay and Facebook Marketplace, of course — become a more significant threat to the incumbents. Together, the new entity will have more than 20 million monthly active users across the U.S. For consumers, the deal means they’ll no longer have to list in as many apps when looking to unload some household items, electronics, furniture or whatever else they want to sell.

“My vision for OfferUp has always been to build a company that helps people connect and prosper,” said Nick Huzar, OfferUp CEO, in a statement about the acquisition. “We’re combining the complementary strengths of OfferUp and letgo in order to deliver an even better buying and selling experience for our communities. OLX Group has unparalleled expertise and clear success with growing online marketplace businesses, so they’ll be a great partner as we continue to build the widest, simplest, and most trustworthy experience for our customers.”

OfferUp also acknowledged that mid-pandemic is an odd time to announce such a deal — especially at a time when the COVID-19 outbreak is affecting its own employees, its partners, and the buying and selling community itself. And this will continue for some time.

However, Huzar positions the deal as one that will allow the business to grow, despite the current state of affairs.

“This news helps us to continue to innovate and grow, in spite of these challenging times, and continue to deliver on that promise,” Huzar noted, in a company blog post.

For now, the OfferUp and letgo apps will remain separate experiences and no disruptions to any sales will be made. Consumers will also be able to download both apps to iOS and Android devices for the time being, too.

But soon, both sets of users will gain access to a larger network of buyers and sellers, along with nationwide shipping options, and trust and safety problems. We understand this will involve allowing users of both sets of apps to see more posts and interact with more buyers and sellers — so some sort of merging of the two networks is at play here. There will be additional changes to improve the user experience for all users in the future, as well, but the company isn’t sharing details on that today.

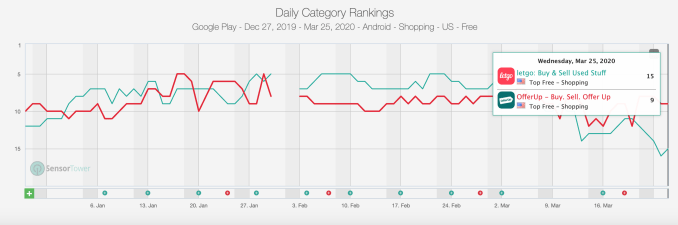

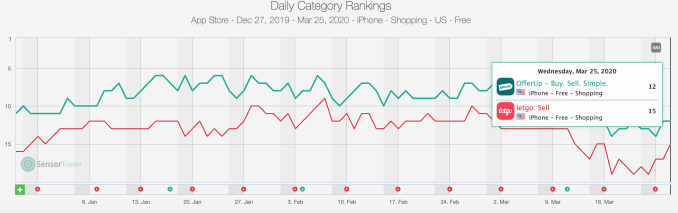

Letgo is bringing to the table an app with more than 100 million worldwide downloads, so there is a potential to reactivate some of the lapsed users who aren’t currently shopping or selling on its marketplace today. The two apps were often neck-and-neck in terms of their app store category rankings, though on iPhone OfferUp has maintained a slight lead. (See App Store and Google Play charts below.)

However, letgo’s business outside of North America will be separately owned and operated as part of the OLX Group, the companies said.

“Letgo and OfferUp have always shared the same core vision for how large America’s secondhand economy can become — harnessing tech innovation to bring about an extraordinarily positive impact on consumers’ wallets and also on the environment,” said letgo co-founder Alec Oxenford. “Bringing our apps together moves us much closer to that vision,” he added.

Prior to this deal, OfferUp had seen a number of executive departures, including the exit of Engineering lead and VP Peter Wilson in 2017, VP of Product Chloe Harford in 2018, VP of Employee Experience Deb Nielsen in 2018, subsequent VP of Employee Experience Sarah Bilton in 2019, and Chief Experience Officer Jerry Howe in January 2020. CFO Rodrigo Brumana has also left, which was previously unreported. The company’s interim CFO is Chief Growth Officer Ian Fliflet, and OfferUp is actively hiring for a new CFO, we’re told.

Huzar characterizes these changes as part of the challenges with growing a startup and getting the right people into place.

“As the company grows up, so must leaders and so must the culture. I think a lot of times when you’re scaling businesses…you go through evolutions where leaders really need to evolve and change,” he says. “If you look to Bill Carr, for example, our COO, you know he helped build out Amazon Video from nothing to over 2,000 employees. We had nobody in the halls of OfferUp that had seen that scale before,” Huzar added.

There’s some admiration for Amazon’s culture, as well.

“There are clearly things that Amazon has done very well — like their ability to innovate at scale is unbelievable,” Huzar says. “We do think people [who] come out of Amazon have great startup DNA. They’re very scrappy. They dive deep into the business and understand things. They can think big. There’s a lot of value I think from that business that I really appreciate,” he added.

OfferUp also just hired former ChannelAdvisor VP Mark Vandegrift as head of e-commerce this month, as the company focuses on growth and scale.

But not all employees have been on board with these exec shakeups. More than a handful of employee reviews on Glassdoor and chatter on networking app Blind speak to various company culture issues, women being treated inequitably, negative office politics, and attrition — including among senior management.

In addition to the COVID-19 crisis, OfferUp may have needed to merge to scale and compete with the marketplace giants. User growth was slowing, for instance — the userbase was 42 million annual users in 2018 that only grew to 44 million in 2019. Presumably, slower revenue growth had followed. (Huzar declined to speak to current revenue and valuation.)

A combination of OfferUp and letgo could help to strengthen numbers outside of coastal cities, like Seattle, L.A., and Miami, where OfferUp was historically strong. Letgo was stronger in other parts of the country, like the Midwest, Huzar says. OfferUp will also bring its shipping business to letgo, which could be particularly helpful now as people are looking to sell household items for extra cash.

The deal is still subject to regulatory approval. If given, the combined businesses will be operated by OfferUp, headquartered in Bellevue, Wash. Huzar will continue to be CEO of OfferUp and chairman of the board. Oxenford, meanwhile, will join the board and serve as a senior advisor to OLX Group and Prosus.

Because the deal is still in the process of closing, the companies can’t speak to any team changes, including potential layoffs as a result of overlapping positions or other redundancies, we’re told.

Updated 3/25/20, 4:00 PM ET with additional quotes and background, following Huzar interview.

Powered by WPeMatico

SouSmile is a direct to consumer dental company based in São Paulo. SouSmile has raised $10 million in Series A funding from Global Founders Capital, Kaszek Ventures and Canary, bringing the company’s total funding to $11.4 million. The two-year-old startup sells an invisible aligner and whitening gels through five retail stores in shopping malls across São Paulo and Rio.

SouSmile is a new option for Brazilians hoping to get started on orthodontic work. The process consists of an evaluation by a licensed dentist that includes a panoramic X-ray, 3D scan and a clinical exam. Then, the company approves customers for treatment. SouSmile’s follow-up process includes bimonthly appointments, and costs approximately $1,000, which co-founder Michael Ruah says is 60% cheaper than comparable treatments, and can be paid in installments. Treatment is fast, taking between three to nine months.

SouSmile has a six-person co-founding team. The 100-person startup is made up of 50% licensed dentists.

Ruah anticipates that the coronavirus pandemic will have a negative short-term revenue impact for the company, as they anticipate less foot traffic in retail stores over the coming weeks, possibly months. He hopes that because the business is still young, macro indicators won’t have a huge impact on the bottom line in the medium-to-long term. Ruah says that the most important thing is that SouSmile employees and customers are safe and healthy at this point.

With 2 million orthodontic cases per year, highly populous Brazil is one of the largest dental markets globally, yet the penetration of invisible aligners is less than 2% due to prohibitive prices. Ruah compares this to the 40% penetration in the U.S. for adults, citing Invisalign’s numbers. There’s still a dent to be made, as SouSmile says it saw more than 10,000 bookings last year.

Ruah also cites a cultural reason as to why Brazil is a smart market for a product like this: Brazilians care a lot about both beauty and their oral health. “Brazilians brush their teeth three times a day. They’ll go out for lunch, they’ll come back to the office and brush their teeth. Everybody has their toothbrush and toothpaste with them all the time,” he explains.

SouSmile’s invisible aligner costs around $1,200. Treatment lasts between 3-9 months.

SmileDirectClub raised nearly $440 million at a $3.2 billion valuation before going public in 2019. The teeth-straightening company built its brand by leveraging the celebrity beauty angle with Instagram influencer campaigns that marketed the visual results of its product. While SouSmile hopes to see big numbers like its U.S.-based predecessor, it wants to take more of a healthcare-first approach to its branding, rather than cosmetic.

SouSmile is up against some big challenges. Physical retail costs are expensive. Manufacturing is hard, and the company doesn’t appear to be particularly tech-enabled, relying mainly on physical retail presence for customer acquisition.

SouSmile isn’t the only Latin American startup working on an anti-braces dental solution, either. Moons, a Mexican invisible aligner startup that just launched out of Y Combinator, may have a head start. Moons delivers a similar product as SouSmile for around the same cost, and is also using 3D printing to manufacture its aligners. Moons is targeting the Latin America market with $5 million in funding and the Y Combinator stamp of approval. Moons has already opened 18 locations across Mexico and Colombia.

But Brazilian tech can operate like a separate ecosystem apart from adjacent Spanish-speaking Latin America due to country regulations, language barriers and shipping complications. Consumer startups that can deliver products that improve the daily lives of Brazil’s massive middle class are the ones that succeed, and SouSmile now has the capital to shoot its shot.

Powered by WPeMatico

Long and short distance travel have all but stopped for many people at the moment. But looking forward to a time when that may no longer be the case, a company designing flying taxis is today announcing a large round of funding to help continue developing its product.

Lilium, a Munich-based startup that is designing and building vertical take-off and landing (VTOL) aircraft with speeds of up to 100 km/h that it plans eventually to run in its own taxi fleet, has closed a funding round of “over” $240 million — money that it plans to use to keep developing its aircraft, and to start building manufacturing facilities to produce more of them, for an expected launch date of 2025.

“We’re working to deliver a brand new form of emissions-free transport,” said a spokesperson. “Doing something like that takes significant time and investment, but the outcome is a valuable business and a chance to have a genuinely positive impact on the way we travel.”

This latest investment was an inside round (involving existing, not new, investors) and it closed last month. It was led by Tencent, with participation from other previous backers that included Atomico, Freigeist and LGT. The valuation is not being disclosed, but the company confirms that it is significantly higher than it was in its Series B in 2017. (For some more context, PitchBook estimates that last year the company was valued at around $470 million.)

The news today caps off some challenging recent months for the company, even before the Coronavirus took hold of the world and cast a dark shadow on any kind of travel.

Last October, we reported that several sources said that Lilium, which employs 400 people, was looking to raise between $400 million and $500 million, a round that it had been working on for some months. In the end, the lower amount the company is putting out today is $160 million less than the lower end of that range, but from what we’ve been told, this is not far from what the company was actually aiming to raise. Still, that combined with the fact that there are no new investors in the raise might imply some challenges there.

(It is, nevertheless, one of the biggest fundraises to date for a startup in the “flying vehicle” space. (Volocopter, which is also designing a new kind of flying taxi-style vehicle and service, closed a $94 million round in February.) Lilium has now raised more than $340 million to date.)

“This additional funding underscores the deep confidence our investors have in both our physical product and our business case. We’re very pleased to be able to complete an internal round with them, having benefited greatly from their support and guidance over the past few years,” said Christopher Delbrück, Lilium’s CFO, in a statement. “The new funds will enable us to take big strides towards our shared goal of delivering regional air mobility as early as 2025.”

But raising money has not been the only challenge. At the beginning of this month, the older of Lilium’s two prototypes burst into flames while some maintenance was being carried out. The model was close to being retired, but testing on the second, newer model has nonetheless been paused until the company can determine the cause of the accident with the first aircraft.

“Our second demonstrator aircraft was fortunately undamaged in the fire and will begin flight testing once we’ve understood the cause of the fire in the first aircraft,” a spokesperson said.

The market for aircraft-based taxi services — be they electric, autonomous, or both — is still very nascent. There are no approved aircraft yet on the market (indeed, the regulations for what these would even look like haven’t even been created), and, as a result, there are no services yet in place, either.

But the opportunity of building fast services that could mitigate current traffic congestion, while also reducing carbon emissions, is potentially massive, and so we are seeing a lot of activity and investment from many corners as companies hope their takes on solving that challenge are the ones to hit the mark.

Lilium’s would-be rivals include not just fellow German startup Volocopter, but also Kitty Hawk, eHang, Joby and Uber, in addition to Blade and Skyryse, air taxi services of sorts that offer more conventional helicopters and other vessels in limited launches for those willing to spend the money.

It’s not clear how much of this will fare in the months and years ahead, in particular at a tricky time for travel and the wider economy. But for now, Lilium’s work so far — it was founded in 2015 by Daniel Wiegand (CEO), Sebastian Born, Matthias Meiner and Patrick Nathen — has been promising enough for its investors to continue backing it for the long haul.

“At Tencent we’re committed to supporting technologies that we believe have the potential to tackle the greatest challenges facing our world,” said David Wallerstein, Chief eXploration Officer at Tencent, in a statement. “Over the last few years we’ve had the opportunity to see the professionalism and dynamism with which Lilium are approaching their mission and we’re honored to be supporting them as they take the next steps on their journey.”

Powered by WPeMatico

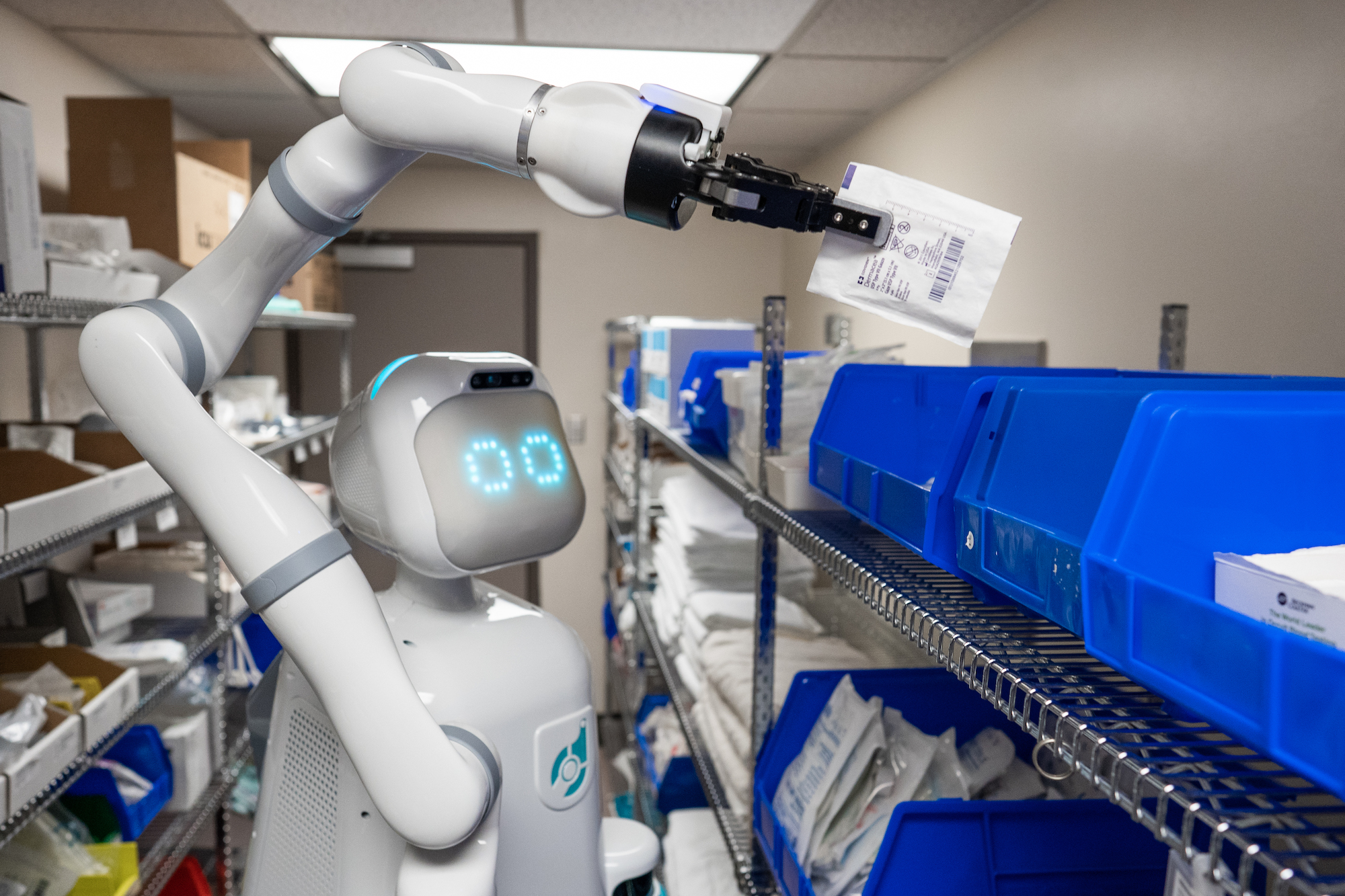

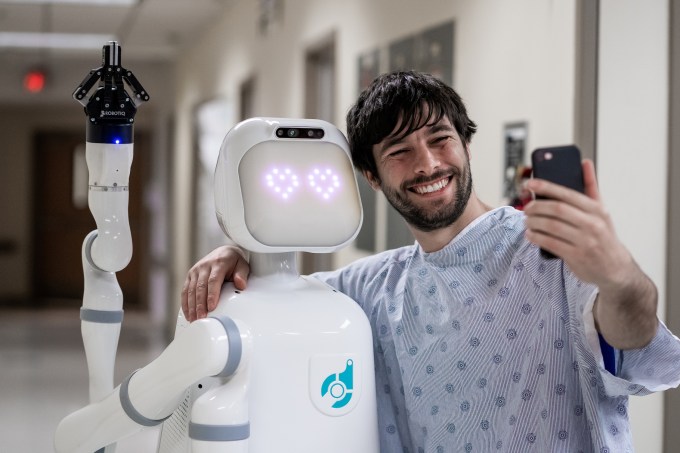

Twenty-eight percent of a nurse’s time is wasted on low-skilled tasks like fetching medical tools. We need them focused on the complex and compassionate work of treating patients, especially amid the coronavirus outbreak. Diligent Robotics wants to give them a helper droid that can run errands for them around the hospital. The startup’s bot Moxi is equipped with a flexible arm, gripper hand and full mobility so it can hunt down lightweight medical resources, navigate a clinic’s hallways and drop them off for the nurse.

With the world facing a critical shortage of medical care professionals, Moxi could help healthcare centers use their staffs as efficiently as possible. And because robots can’t be infected by COVID-19, they’re one less potential carrier interacting with vulnerable populations.

Today, Diligent Robotics announces its $10 million Series A that will help it scale up to deliver “more robots to more hospitals,” CEO Andrea Thomaz tells me. “We’ve been designing our product, Moxi, side by side with hospital customers because we don’t just want to give them an automation solution for their materials management problems. We want to give them a robot that frontline staff are delighted to work with and feels like a part of the team.”

The round, led by DNX Ventures, brings Diligent Robotics to $15.75 million in total funding that’s propelled it to the fifth generation of its Moxi robot. It currently has two deployed in Dallas, Texas, but is already working with two of the three top hospital networks in the U.S. “As the current pandemic and circumstance has shown, the real heroes are our healthcare providers,” says Q Motiwala, partner at DNX Ventures. The new cash from DNX, True Ventures, Ubiquity Ventures, Next Coast Ventures, Grit Ventures, E14 Fund and Promus Ventures will help Diligent Robotics expand Moxi’s use cases and seamlessly complement nurses’ workflows to help alleviate the talent crunch.

The round, led by DNX Ventures, brings Diligent Robotics to $15.75 million in total funding that’s propelled it to the fifth generation of its Moxi robot. It currently has two deployed in Dallas, Texas, but is already working with two of the three top hospital networks in the U.S. “As the current pandemic and circumstance has shown, the real heroes are our healthcare providers,” says Q Motiwala, partner at DNX Ventures. The new cash from DNX, True Ventures, Ubiquity Ventures, Next Coast Ventures, Grit Ventures, E14 Fund and Promus Ventures will help Diligent Robotics expand Moxi’s use cases and seamlessly complement nurses’ workflows to help alleviate the talent crunch.

Thomaz came up with the idea for a hospital droid after doing her PhD in social robotics at the MIT Media lab. Her co-founder and CTO Vivian Chu had done a master’s at UPenn on how to give robots a sense of touch, and then came to work with Thomaz at Georgia Tech. They were inspired by a study revealing how nurses spent so much time acting as hospital gofers, so in 2016 they applied for and won a National Science Foundation grant of $750,000 that funded a six-month sprint to build a prototype of Moxi.

Since then, 18-person Diligent Robotics has worked with hundreds of nurses to learn about exactly what they need from an autonomous assistant. “Today you will go about your day, and you probably won’t interact with any robots….we want to change that,” Thomaz tells me. “The only way you can really bring robots out of the warehouses, off of the factory floors, is to build a robot that can work in our dynamic and messy everyday human environments.” The startup’s intention isn’t to fully replace humans, which it doesn’t think is possible, but to let them focus on the most human elements of their jobs.

Moxi is about the size of a human, but designed to look like an ’80s movie robot so as not to engender an uncanny valley cyborg weirdness. Its head and eyes can move to signal intent, like which direction it’s about to move, while sounds let it communicate with nurses and acknowledge their commands. A moving pillar lets it adjust its height, while its gripper hand and arm can pick and put down smaller pieces of hospital equipment. Its round shape and courteous navigation makes sure it can politely share crowded hallways and travel via elevator.

Diligent Robotics’ solution engineers work with hospitals to teach Moxi how to get around and what they need. The company hopes to eventually build the ability to learn and adapt right into the bot so nurses can teach it new tasks on the fly. “The team continues to demonstrate unmatched robotics-specific innovation by combining social intelligence and human-guided learning capabilities,” says True Ventures partner and Diligent board member Rohit Sharma.

Hospitals pay an upfront fee to buy Moxi robots, and then there’s a monthly fee for the software, services and maintenance. Thomaz admits that “Hospitals are naturally risk-averse, and can be wary to take up new technology,” so the startup is taking a slow and steady approach to deployment so it can convince buyers that Moxi is worth the learning curve.

Diligent Robotics will be competing with companies like Aethon’s TUG bot for pulling laundry and pharmacy carts. Other players in the hospital tech space include Xenex’s machine that disinfects rooms with light, and surgical bots like those from Johnson & Johnson’s Auris and Intuitive Surgical.

Diligent Robotics hopes to differentiate itself by building social intelligence into Moxi so it feels more like an intern than a gadget. “Time and again, we hear from our hospital partners that Moxi not only returns time back to their day but also brings a smile to their face,” says Thomaz. The company wants to evolve Moxi for other dull, dirty or dangerous service jobs.

Eventually, Diligent Robotics hopes to bring Moxi into people’s homes. “While we don’t see robots replacing the companionship and the human connection, we do dream of a time that robots could make nursing homes more pleasant by offsetting the often staggering numbers of caretakers to bed ratios (as bad as 30:1),” Thomaz concludes. That way, Moxi could “help people age with dignity and hold onto their independence for as long as possible.”

Powered by WPeMatico

Scopely, the mobile gaming publisher behind titles including Marvel Strike Force, Scrabble Go, Yahtzee with Buddies and Star Trek Fleet Command, has added another $200 million to its hoard of cash for mergers and acquisitions.

While some startups are fearing a cash crunch, other businesses seem to be preparing to go on a shopping spree. The economic slowdown has many businesses reconsidering their prospects, and it’s a good time for startups and established businesses with lots of cash to consider going on a shopping trip.

With $650 million in venture dollars raised so far, Scopely can certainly consider making some bids. The latest $200 million doubles the amount of money the company closed on for its Series D round. Investors included Advance (the privately held media and publishing company behind Conde Naste and a slew of local news [online and print] publications), and the consumer-focused investment firm, The Chernin Group.

“The FoxNext Games acquisition reinforced our commitment to M&A, and the opportunity to partner with Advance and TCG was a welcome addition to further support our strategy,” said Javier Ferreira, the co-chief executive officer of Scopely, in a statement.

Advance’s investment comes as the company experiments with various new media, entertainment and publishing formats of its own and looks to invest in more digital media companies, according to a statement.

Chernin, a longtime investor in Scopely (since the company’s earliest rounds), said that its investment in Scopely on the heels of closing a $700 million new investment fund was a no-brainer.

“As the traditional media industry continues to go through unprecedented change, we believe that Scopely has all the ingredients for tremendous success — exposure to games (the fastest-growing sector in media), a scalable and durable technology platform, a diversified set of well-known IP, an attractive economic profile, and a team hyper-focused on execution and long-term success,” said Jesse Jacobs, a co-founder and partner at The Chernin Group .

Powered by WPeMatico

With most new social media startups seeming to dial in on specific communities to thrive in a still Facebook-dominated sphere, some of the more broadly focused social investments from top VCs are going into online gaming.

The latest is Mainframe Industries, a Nordic game studio building a massively multiplayer online title. The team doesn’t have much to share of what their title will actually look like gameplay-wise, they’re just saying it’s a sandbox MMO designed for cloud streaming built on Epic Games’ Unreal Engine.

The startup, which has offices in Helsinki and Reykjavik, isn’t building cloud gaming tech but is instead building an MMO title that’s designed from the get-go for streaming platforms like Google Stadia or Microsoft xCloud that beam a title to a user’s device from a cloud-hosted GPU. What does being a cloud-native game entail? Mainly, it seems to mean that they’re creating a social title that is as fully playable on mobile as it is on PC/console.

Building a robust mobile game that meets console/PC gamers expectations has been one of the more tenuous pursuits of the past decade, and one that has more often than not led to watered-down experiences. Mainframe CEO Thor Gunnarsson acknowledges that titles have sometimes catered to the “lowest common denominator,” but he believes that as game-streaming advances lower technical barriers, his team can focus wholly on solving the user experience challenges.

A big focus seems to be leveraging cross-play with more consistent experiences on differently powered devices thanks to cloud streaming. Gunnarsson believes his company’s approach to what occurs on the “social layer” of the title will be what differentiates them the most, though he is mum on details regarding what that will look like in the eventual release.

The startup has some big names supporting them in their quest. The startup announced today that they’ve closed an $8.1 million (€7.6 million) Series A round led by Andreessen Horowitz. Riot Games, Maki.vc, Play Ventures, Sisu Game Ventures and Crowberry Capital also participated in the round.

Andreessen Horowitz, already having bet big on Roblox’s $150 million Series G last month, has been quite active in placing bets on smaller gaming startups in the past year or so, most of which have been made by GP Andrew Chen.

Early last year, Chen directed a16z’s investment in Sandbox VR’s $68 million Series A, a startup aiming to make shared virtual reality experiences more common by building out physical retail locations in malls and shopping areas across the globe. This past August, Chen was also behind the firm’s investment in Singularity 6, another MMO gaming startup that’s looking to build a “virtual society.” Chen was also behind the investment in Mainframe Industries .

“We believe that cloud-native games are poised to revolutionize the entertainment industry in the coming years, yielding entirely new gameplay experiences and business models,” said Chen in a press release announcing the startup’s raise.

In some part, these investments highlight the belief of venture capitalists that online games like Fortnite may represent the future of social networks. They are also, however, platform bets that are rooted in early content plays, which can be notoriously difficult to pick winners in.

While Gunnarsson was quick to discuss how important he believed their title’s social platform would become, he was also just as quick to admit that building a great game was the most critical. “All of the platform stuff is ancillary to the prospect of creating a fun game, but we have really strong game design team.”

Games these days, particularly MMOs, are far from “finished” by launch. Gunnarsson plans to use this round of funding to reach a closed alpha of their title. He didn’t offer any timelines for launch, as they’re only in pre-production now, but did say it certainly won’t be coming out this year.

Powered by WPeMatico

Quantum Machines, a Tel Aviv-based startup that is building both hardware and software to operate quantum computers, today announced that it has raised a $17.5 million Series A funding round. The round was led by Israeli tech entrepreneur Avigdor Willenz (who, among other companies, co-founded Habana Labs and Anapurna Labs and sold them to Intel and Amazon, respectively) and Harel Insurance Investments.

TLV Partners and Battery Ventures also participated in this round. TLV Partners also led the company’s $5.5 million seed round in 2018, in which Battery Partners also participated.

“The race to commercial quantum computers is one of the most exciting technological challenges of our generation,” said Willenz. “Our goal at [Quantum Machines] is to make this happen faster than anticipated and establish ourselves as a key player in this emerging industry.”

The company says it will use the new funding to accelerate the adoption of its Quantum Orchestration Platform. This platform went live earlier this year. What makes it unique is that it’s a combination of custom hardware, which the company designed itself, and software tools that can be used to control virtually any quantum processor. To control a quantum processor, you also need a powerful classical computer, but traditional computers are ill-suited for this task, Quantum Machines argues, and it’ll take specialized hardware for classical computing to harness the power of quantum computing and run complex algorithms on these machines.

“The classical layers of the quantum computer are the real unmet need. They are the bottleneck,” Quantum Machines co-founder Itamar Sivan told me when the platform launched. “We were really looking into what is holding the industry back. What are the things that we can do today to drive this industry forward, but that will also enable faster progress in the future. Since most of the focus in the last years has been devoted to quantum processors, it was only natural that you know we take on this challenge.”

Powered by WPeMatico

As a former Jam City executive, Jill Wilson led teams behind some of the top-grossing gaming franchises, like Cookie Jam and Panda Pop. Now she’s running her own startup, Robin Games, where a team of mostly women is working to create a new niche in mobile entertainment they’re calling “lifestyle gaming.” As the name implies, the idea is to create a mobile gaming experience — in this case, fantasy gaming — that’s more like the sophisticated and stylish lifestyle content that’s popular today.

Robin Games is backed by $7 million in seed funding, the company announced on Thursday, as it made its public debut. The round was led by early-stage fund LVP, which has invested in other to game companies including Supercell, Playfish, and NaturalMotion . Additional investors in the oversubscribed round include 1Up Ventures, Alpha Edison, Everblue Management, firstminute Capital, Greycroft Tracker Fund, Hearst Ventures, and Third Kind Venture Capital.

“Traditionally in gaming, when you say ‘fantasy,’ you mean dragons and other mythical creatures, disproportionately built women, armies and battles and explosions and glory,” explained Wilson, Robin Games’ sole founder and CEO. “As a lifelong gamer, I love (most) of these themes, but traditional gamers are no longer in the majority. Thanks to the smartphone, everyone now has access to a gaming console in their pockets. We are expanding the definition of “fantasy” for this modern wave of gamers, whose fantasies are just as diverse as they are,” she added.

Wilson clarified that she’s not meaning to stereotype women as not enjoying fantasy games about things like warriors and dragons. Instead, Robin Games aims to expand the types of fantasies being explored through gaming — including those mobile gaming has yet to include.

While the company isn’t yet announcing its first titles or specific details, like launch dates, the games are said to cover content you’d typically find in a lifestyle magazine, on an Instagram influencer’s profile or on a lifestyle blog for example.

“We are focused on developing games that are deeply sophisticated under the hood, with an elevated, real-world, approachable style that reflects more of the lifestyle content you’d previously see outside of gaming,” Wilson told TechCrunch .

All this will be wrapped up in the free-to-play business model that powers most top-grossing games. In addition, Robin Games’ strategy will allow it to expand to include a partnership strategy, which will diversify its revenue streams further down the road.

Wilson said the idea for Robin Games was something she had in mind for some time, as she was personally looking for games to like this to play herself — only to find they didn’t exist.

“I’ve always designed products for myself first and foremost, which allows me to deeply connect with what the end-user really wants — since the end-user is me,” said Wilson. “Recently, I realized that not only did we have a unique answer to a pretty major gap in the market, but also that the timing was right and, most importantly, that we could pull together the exact right team to execute this vision.”

The startup is currently a team of nine based in Venice Beach. Management is 80% women and everyone had worked together to make hit games in years prior. In terms of hiring, the company is focused on building out a diverse team in order to better realize its vision, Wilson said, and, more broadly, change the face of the gaming industry as it stands today.

“Our mission goes beyond filling a gap in the market. We’re really looking to shake up the games industry, not only redefining what a modern game team looks like, but also changing the definition itself of what it means to be a gamer,” noted Wilson.

In previous studies, female players have been shown to prefer match-3 and social farming games, among others, with fantasy and MMOs further down the list, and sports and shooting games last. But the types of games Robin Games is proposing don’t really fit into any one category that exists today, so it’s still unknown how female gamers will respond.

However, it makes sense to target this underserved market, given that women account for 46% of all U.S. game enthusiasts.

“Jill Wilson and her incredible team are already further along than most developers starting out,” added Are Mack Growen, partner at LVP and member of Robin Games’ Board of Directors, about the firm’s investment. “This team has developed and operated some of the world’s most successful games for a decade, and now they have assembled to bring premium experiences to the massively underserved audience of women. In addition to their industry expertise, they fundamentally understand their audience and the ingredients for powerful entertainment. We are proud to have led their seed round and look forward to helping them redefine what it means to be a gamer.”

Powered by WPeMatico