Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

DeHaat, an online platform that offers full-stack agricultural services to farmers, has raised $12 million as it looks to scale its network across India.

The Series A financial round for the eight-year-old Patna and Gurgaon-based startup was led by Sequoia Capital India. Dutch entrepreneurial development bank FMO, and existing investors Omnivore and AgFunder, also participated in the round. The startup, which began to seek funding from external investors last year, has raised $16 million to date and $3 million in venture debt.

DeHaat (which means village in Hindi) eases the burden on farmers by bringing together brands, institutional financers and buyers on one platform, explained Shashank Kumar, co-founder and chief executive of the startup, in an interview with TechCrunch.

The platform helps farmers secure thousands of agri-input products, including seeds and fertilizers, and receive tailored advisory on the crop they should sow in a season. “We have built a comprehensive database of crop tests to offer advice to farmers,” he said.

DeHaat, which employs 242 people, also helps them connect with 200 institutional partners to provide farmers with working capital, and when the season is over, helps them sell their yields to bulk buyers such as Reliance Fresh, food delivery startup Zomato and business-to-business e-commerce giant Udaan.

DeHaat today operates in 20 regional hubs in the eastern part of India — states such as Bihar, Uttar Pradesh, and Jharkhand — and serves more than 210,000 farmers, said Kumar.

Shashank Kumar, Amrendra Singh, Adarsh Srivastav and Shyam Sundar Singh co-founded DeHaat in 2012

The startup has developed a network of hundreds of micro-entrepreneurs in rural areas that distribute agri-input goods to farmers from their regional hubs and then bring back the output to the same hub.

“We have an app in local languages and a helpline desk that farmers, many of whom don’t own a smartphone, use to reach out to us and explain their pain points and needs,” he said.

DeHaat does not charge any fee for its advisory, but takes a cut whenever farmers use its platform to buy agri-inputs or sell their crop yields.

The startup will use the fresh capital to extend its network to 2,000 rural retail centres, on-board more micro-entrepreneurs for last-mile delivery and reach 1 million farmers by June of next year, said Kumar. DeHaat is also working on automating its supply chain and developing more sophisticated data analytics, he said.

At stake is India’s agriculture market that is worth $350 billion and serves nearly 100 million small and independent farmers, said Abhishek Mohan, VP at Sequoia Capital India, the VC fund that writes more checks than anyone else in the country.

“This industry is on the brink of a massive transformation thanks to ease of regulation, farmers getting organized and increasing penetration of smartphones. DeHaat is leveraging these trends to build the next-gen product in agricultural supply chain,” said Mohan in a statement.

“The tipping point that led to Sequoia India’s decision to partner with them was the field visit, where the farmers expressed how proud they were to be associated with a platform they felt truly worked in their favour. This impact and deep brand loyalty stems from the leadership team’s razor-sharp focus, deep empathy and fine execution,” he added.

Powered by WPeMatico

“Our real focus is on democratizing mental healthcare,” says SonderMind co-founder chief executive, Mark Frank.

His company, founded back in 2017, is having a moment. With the restrictions and economic stresses caused by the government’s efforts to mitigate the spread of the COVID-19 epidemic in the U.S., demand for mental health services is soaring. And it’s compounding what was already a mental health crisis in the U.S.

A 2019 article from Bloomberg Businessweek laid out the scope of the problem in stark terms. In 2017, 47,000 people died by suicide in the U.S. and there were 1.4 million suicide attempts — a suicide rate that’s the country’s highest since World War II, according to the Centers for Disease Control and Prevention. Drug overdoses, another measure of the nation’s anguish, killed 70,000 people in 2017. Another 7% of U.S. adults reported suffering at least one major depressive episode in 2018.

Taken together, the data points to a tremendous health problem. One that the current healthcare system is only now grappling with.

SonderMind’s chief executive sees his company as part of the solution.

Most mental health practitioners don’t operate within a healthcare network or take insurance, which means that the only folks with access to care are the ones that can afford the high price of therapy. SonderMind changes that equation by offering practitioners a toolkit and back office services so they can bill insurance providers and take care of the operational side of running a healthcare practice. It also acts as a funnel, gauging the needs of potential patients and connecting them to the therapists that are best suited to provide them the care they need. That lets practitioners focus on seeing patients, the company said.

The company currently counts 500 providers on its marketplace, which operates in Colorado, Arizona and Texas, and has raised $27 million in its latest round of financing to extend its services to other parts of the U.S.

The San Francisco-based investment firm General Catalyst led the financing, which also included additional new investors F-Prime Capital and participation from previous investors like the Kickstart Seed Fund, Diōko Ventures (managed by FCA Venture Partners) and Jonathan Bush.

“This financing provides the fuel to support our growth objectives and advance our mission to make behavioral health more accessible, approachable and utilized by building a modern marketplace that holds great appeal to both clinician and patient,” said Frank in a statement.

The investment extends General Catalyst’s funding into healthcare services in recent years and represents a continued emphasis on healthcare services for the firm. “Healthcare is obviously a really important thesis for GC as a whole,” says Holly Maloney, a managing director at General Catalyst. “This is going to be one of the largest value drivers for VC this decade.”

General Catalyst already had a robust portfolio of healthcare-focused companies — including Livongo, OM1 and Oscar Health.

For Maloney, the investment in SonderMind grew out of the firm’s exposure to mental health investment through another portfolio company, Mindstrong Health. “Mindstrong forced us to explore… access to care and finding care,” says Maloney.

The General Catalyst investor sees the investment in SonderMind as also helping to open doors for more people to join the profession.

“It helps people to start their business for sure. It helps more people pursue it as a career path,” she said. And that’s good for a country where more mental health professionals and better access to care are desperately needed.

Powered by WPeMatico

Airbnb said Monday that it has raised $1 billion in debt and equity from private equity firms Silver Lake and Sixth Street Partners, even as the online rental marketplace has seen its business plummet due to the COVID-19 pandemic.

Terms of the deal were not disclosed. It’s unclear how this funding might alter Airbnb’s previously shared plans to go public.

COVID-19, the disease caused by coronavirus, prompted governments throughout the world to issue stay-at-home orders, triggering a wave of cancellations in the travel and hospitality industries. Airbnb emphasized that the funds would support its ongoing work to invest over the long term, a statement aimed at couching this raise as strategic and not a bailout in troubled times.

“While the current environment is clearly a difficult one for the hospitality industry, the desire to travel and have authentic experiences is fundamental and enduring,” Silver Lake co-CEO and managing partner Egon Durban said in a statement. “Airbnb’s diverse, global, and resilient business model is particularly well suited to prosper as the world inevitably recovers and we all get back out to experience it.”

Airbnb CEO Brian Chesky acknowledged Monday that while the desire to connect and travel has been reinforced during this time, the “way it manifests will evolve as the world changes.”

Airbnb is betting how and where people work will evolve. As a result, the company said it will direct its attention and new funds toward three core products: hosts, long-term stays and Airbnb experiences.

Last month, Airbnb said it would direct $250 million to help hosts who have been impacted by COVID-19. The funds will be used to pay a host 25% of what they would normally receive through their cancellation policy if a guest cancels a reservation due to COVID-19 between March 14 and May 31. Airbnb said this policy applies retroactively to all cancellations during that period.

The move was an attempt by Airbnb to make amends to its hosts who complained that the company’s policy would allow guests to cancel reservations and receive a full refund. That policy, which is still active, lets guests who booked reservations on or before March 14 that begin anytime on or before May 31 to cancel and receive a standard refund or travel credit.

Powered by WPeMatico

Flagship Pioneering, the Boston-based biotech incubator and holding company, said it has raised $1.1 billion for its Flagship Labs unit.

Flagship, which raised $1 billion back in 2019 for growth-stage investment vehicles, develops and operates startups that leverage biotechnology innovation to provide goods and services that improve human health and promote sustainable industries.

“We’re honored to have the strong support of our existing Limited Partners, as well as the interest from a select group of new Limited Partners, to support Flagship’s unique form of company origination during this time of unprecedented economic uncertainty,” said Noubar Afeyan, the founder and chief executive of Flagship Pioneering, in a statement.

In addition to its previous focus on health and sustainability, Flagship will use the new funds to focus on new medicines, artificial intelligence and “health security,” which the company says is “designed to create a range of products and therapies to improve societal health defenses by treating pre-disease states before they escalate,” according to Afeyan.

Flagship companies are already on the forefront of the healthcare industry’s efforts to stop the COVID-19 pandemic. Portfolio company Moderna is one of the companies leading efforts to develop a vaccine for the novel coronavirus which causes COVID-19.

In the 20 years since its launch, Flagship has 15 wholly owned companies and another 26 growth-stage companies among its portfolio of investments.

New companies include: Senda Biosciences, Generate Biomedicines, Tessera Therapeutics, Cellarity, Cygnal Therapeutics, Ring Therapeutics and Integral Health. Growth companies developed or backed by Flagship include Ohana Biosciences, Kintai Therapeutics and Repertoire Immune Medicines.

Two of the companies in the Flagship Labs portfolio have already had initial public offerings in the past two years, the company said. Kaleido Biosciences and Axcella Health raised public capital in 2019, and Moderna Therapeutics conducted a $575 million secondary offering earlier this year.

Powered by WPeMatico

GDPR and other data protection and privacy regulations — as well as a significant (and growing) number of data breaches and exposées of companies’ privacy policies — have put a spotlight on not just the vast troves of data that businesses and other organizations hold on us, but also how they handle it. Today, one of the companies helping them cope with that data in a better and legal way is announcing a huge round of funding to continue that work. Collibra, which provides tools to manage, warehouse, store and analyse data troves, is today announcing that it has raised $112.5 million in funding, at a post-money valuation of $2.3 billion.

The funding — a Series F, from the looks of it — represents a big bump for the startup, which last year raised $100 million at a valuation of just over $1 billion. This latest round was co-led by ICONIQ Capital, Index Ventures, and Durable Capital Partners LP, with previous investors CapitalG (Google’s growth fund), Battery Ventures, and Dawn Capital also participating.

Collibra was originally a spin-out from Vrije Universiteit in Brussels, Belgium and today it works with some 450 enterprises and other large organizations. Customers include Adobe, Verizon (which owns TechCrunch), insurers AXA and a number of healthcare providers. Its products cover a range of services focused around company data, including tools to help customers comply with local data protection policies and store it securely, and tools (and plug-ins) to run analytics and more.

These are all features and products that have long had a place in enterprise big data IT, but they have become increasingly more used and in-demand both as data policies have expanded, as security has become more of an issue, and as the prospects of what can be discovered through big data analytics have become more advanced.

With that growth, many companies have realised that they are not in a position to use and store their data in the best possible way, and that is where companies like Collibra step in.

“Most large organizations are in data chaos,” Felix Van de Maele, co-founder and CEO, previously told us. “We help them understand what data they have, where they store it and [understand] whether they are allowed to use it.”

As you would expect with a big IT trend, Collibra is not the only company chasing this opportunity. Competitors include Informatica, IBM, Talend, and Egnyte, among a number of others, but the market position of Collibra, and its advanced technology, is what has continued to impress investors.

“Durable Capital Partners invests in innovative companies that have significant potential to shape growing industries and build larger companies,” said Henry Ellenbogen, founder and chief investment officer for Durable Capital Partners LP, in a statement (Ellenbogen is formerly an investment manager a T. Rowe Price, and this is his first investment in Collibra under Durable). “We believe Collibra is a leader in the Data Intelligence category, a space that could have a tremendous impact on global business operations and a space that we expect will continue to grow as data becomes an increasingly critical asset.”

“We have a high degree of conviction in Collibra and the importance of the company’s mission to help organizations benefit from their data,” added Matt Jacobson, general partner at ICONIQ Capital and Collibra board member, in his own statement. “There is an increasing urgency for enterprises to harness their data for strategic business decisions. Collibra empowers organizations to use their data to make critical business decisions, especially in uncertain business environments.”

Powered by WPeMatico

Notion, a startup that operates a workplace productivity platform, has raised $50 million from Index Ventures and other investors at a $2 billion valuation, the company told The New York Times.

A Notion spokesperson confirmed the raise and valuation to TechCrunch.

As startups across the board begin looking at layoffs or raising at less than favorable terms, Notion had been in the unusual position of turning away interested investors for years. With this raise, the firm has amassed $67 million in total funding, the company says. Their last raise of $10M valued them at $800 million.

The company’s highly customizable note-taking app allows enterprise customers to create linked networks of databases and documents.

In November, COO Akshay Kothari told TechCrunch that the company was hoping not to raise outside funding again, “So far one of the things we’ve found is that we haven’t really been constrained by money. We’ve had opportunities to raise a lot more, but we’ve never felt like if we had more money we could grow faster.”

What’s changed? Just the global economy. The firm told the Times that this new raise should put them in a more stable position and leave them with enough funding for “at least” 10 years. That said, the startup’s team has expanded rapidly in recent months, growing 40% since November. Their user numbers appear to also be growing rapidly, with Kothari telling the Times that total users have “nearly quadrupled” from one million, a figure the company released in early 2019.

Notion offers free and paid accounts, ranging from $5 to $25 billed monthly.

Powered by WPeMatico

Time is money, as the old adage goes, and this is doubly true in healthcare systems operating with thin margins now made even thinner thanks to the loss of revenue caused by a freeze on elective procedures.

Stepping in with a technology that automates much of the time-consuming back-end processes hospitals and healthcare providers need to keep up with is Olive, a startup out of Columbus, Ohio.

The company, which counts among its customers more than 500 hospitals representing some of the largest healthcare providers in the U.S., has raised a new round of $51 million as it sees significant growth for its business.

The round, raised from investors including Drive Capital, Oak HC/FT and Ascension Ventures, was led by General Catalyst, which recently closed on $2.3 billion in new capital to invest in early-stage companies.

As a result of the investment, Ron Paulus, the former president and chief executive of Mission Health, will join the board of directors, the company said in a statement.

Olive’s software toolkit automates administrative tasks like revenue cycle, supply chain management, clinical administration and human resources, the company said in a statement. And demand for the company’s technology is surging.

According to data provided by the company, roughly half of hospital administrators intend to invest in robotic process automation by 2021.

“There’s a growing, multi-billion dollar problem: healthcare doesn’t have the internet. Instead, healthcare uses humans as routers, forcing workers to toggle between disparate systems — they copy, they paste, they manipulate data – they become robots. They click and type and extract and import, all day long — and it’s one of the leading reasons that one out of every three dollars spent in the industry today is spent on administrative costs,” said Olive chief executive Sean Lane in a September statement.

Olive doesn’t just automate processes, but makes those processes better for hospitals by identifying problem areas that could lead to lost revenues for hospitals. The software has access to pre-existing health claim status data, which allows it to identify where mistakes in previous claims were made. By using accurate coding, hospitals can add additional revenue.

“As a recent health system CEO, I appreciate the duress our hospitals are under as they focus on delivering the best patient care possible under challenging circumstances all while needing to keep the lights on,” said Dr. Ronald A. Paulus. “Olive’s reliable automation of essential back-office processes saves time, reduces errors and allows staff to focus on higher-order work. I am excited to be working closely with Olive’s management team to maximize the outsized positive impact we can have in healthcare on both the administrative and clinical fronts.”

Powered by WPeMatico

Vericool, a Livermore, Calif.-based startup that’s replacing plastic coolers and packaging with plant-based products, has raised $19.1 million in a new round of financing.

The company’s stated goal is to replace traditional packaging materials like polystyrene with plant-based insulating packaging materials.

Its technology uses 100% recycled paper fibers and other plant-based materials, according to the company, and are curbside recyclable and compostable.

Investors in the round include Radicle Impact Partners, The Ecosystem Integrity Fund, ID8 Investments and AiiM Partners, according to a statement.

“We’re pleased to support Vericool because of the company’s track record of innovation, high-performance products, well-established patent portfolio and focus on environmental resilience. We are inspired by the company’s social justice commitment to address recidivism and provide workplace opportunity to formerly incarcerated individuals,” said Dan Skaff, managing partner of Radicle Impact Partners and Vericool’s new lead director.

Powered by WPeMatico

As companies get to grips with a wider (and, lately, more enforced) model of remote working, a startup that provides a platform to help track and manage all the devices that are accessing networked services — an essential component of cybersecurity policy — has raised a large round of growth funding. Axonius, a New York-based company that lets organizations manage and track the range of computing-based assets that are connecting to their networks — and then plug that data into some 100 different cybersecurity tools to analyse it — has picked up a Series C of $58 million, money it will use to continue investing in its technology (its R&D offices are in Tel Aviv, Israel) and expanding its business overall.

The round is being led by prolific enterprise investor Lightspeed Venture Partners, with previous backers OpenView, Bessemer Venture Partners, YL Ventures, Vertex, and WTI also participating in the round.

Dean Sysman, CEO and Co-Founder at Axonius, said in an interview that the company is not disclosing its valuation, but for some context, the company has now raised $95 million, and PitchBook noted that in its last round, a $20 million Series B in August 2019, it had a post-money valuation of $110 million.

The company has had a huge boost in business in the last year, however — especially right now, not a surprise for a company that helps enable secure remote working, at a time when many businesses have gone remote in an effort to follow government policies encouraging social distancing to slow the spread of the coronavirus pandemic. As of this month, Axonius has seen customer growth increase 910% compared to a year ago.

Sysman said that this round had been in progress for some time ahead of the announcement being made, but the final stages of closing it were all done remotely last week, which has become something of a new normal in venture deals at the moment.

“We’ve all been staying at home for the last few weeks,” he said in an interview. “The crisis is not helping with deals. It’s making everything more complex for sure. But specifically for us there wasn’t a major difference in the process.”

Sysman said that he first thought of the idea for Axonius when at a previous organization — his experience includes several years with the Israeli Defense Forces, as well as time at a startup called Integrity Project, acquired by Mellanox — where he realised the organization itself, and all of its customers, never actually knew how many devices accessed their network, which is a crucial first step in being able to secure any network.

“Every CIO I met I would ask, do you know how many devices you have on your network? And the answer was either ‘I don’t know,’ or big range, which is just another way of saying, ‘I don’t know,’” Sysman said. “It’s not because they’re not doing their jobs but because it’s just a tough problem.”

Part of the reason, he added, is because IP addresses are not precise enough, and de-duplicating and correlating numbers is a gargantuan task, especially in the current climate of people using not just a multitude of work-provided devices, but a number of their own.

That was what prompted Sysman and his cofounders Ofri Shur and Avidor Bartov to build the algorithms that formed the basis of what Axonius is today. It’s not based on behavioural data as some cybersecurity systems are, but something that Sysman describes as “a deterministic algorithm that knows and builds a unique set of identifiers that can be based on anything, including timestamp, or cloud information. We try to use every piece of data we can.”

The resulting information becomes a very valuable asset in itself that can then be used across a number of other pieces of security software to search for inconsistencies in use (bringing in the behavioural aspect of cybersecurity) or other indicators of malicious activity — specifically following the company’s motto, “Know Your Assets, Identify Gaps, and Automate Security Policy Enforcement” — even as data itself may seem a little pedestrian on its own.

“We like to call ourselves the Toyota Camry of cybersecurity,” Sysman said. “It’s nothing exotic in a world of cutting-edge AI and advanced tech. However it’s a fundamental thing that people are struggling with, and it is what everyone needs. Just like the Camry.”

For now, Axonius is following the route of providing a platform that can interconnect with a number of other security products — currently numbering around 100 — rather than building those tools itself, or acquiring them to bring them in house. That could be one option for how potentially it might evolve over time, however.

For now, the idea of being agnostic to those specific tools and providing a platform just to identify and manage assets is a formula that has already seen a lot of traction with customers — which include companies like Schneider Electric, the New York Times, and Landmark Medical, among others — as well as investors.

“Any enterprise CISO’s top priority, with unwavering consistency, is asset discovery and management. You can’t protect a device if you don’t know it exists.” said Arsham Menarzadeh, general partner at Lightspeed Venture Partners, in a statement. “Axonius integrates into any security and management product to show customers their full asset landscape and automate policy enforcement. Their integrated approach and remediation capabilities position them to become the operating system and single source of truth for security and IT teams. We’re excited to play a part in helping them scale.”

Powered by WPeMatico

CRM has for years been primarily a story of software to manage customer contacts, data to help agents do their jobs, and tools to manage incoming requests and outreach strategies. Now to add to that we’re starting to see a new theme: apps to help agents track how they work and to work better.

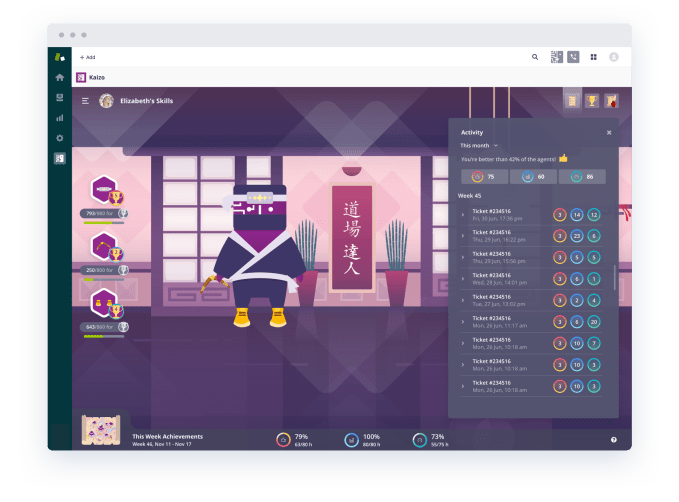

Today comes the latest startup in that category, a Dutch company called Kaizo, which uses AI and gamification to provide feedback on agents’ work, tips on what to do differently, and tools to set and work to goals — all of which can be used remotely, in the cloud. Today, it is announcing $3 million in a seed round of funding co-led by Gradient — Google’s AI venture fund — and French VC Partech.

And along with the seed round, Kaizo (which rebranded last week from its former name, Ticketless) is announcing that Christoph Auer-Welsbach, a former partner at IBM Ventures, is joining the company as a co-founder, alongside founder Dominik Blattner.

Although this is just a seed round, it’s coming after a period of strong growth for the company. Kaizo has already 500 companies including Truecaller, SimpleSurance, Miro, CreditRepairCloud, Justpark, Festicket and Nmbrs are using its software, covering “thousands” of customer support agents, which use a mixture of free and paid tools that integrate with established CRM software from the likes of Salesforce, Zendesk and more.

Customer service, and the idea of gamifying it to motivate employees, might feel like the last thing on people’s minds at the moment, but it is actually timely and relevant to our current state in responding to and living with the coronavirus.

People are spending much more time at home, and are turning to the internet and remote services to get what they need, and in many cases are finding that their best-laid plans are now in freefall. Both of these are driving a lot of traffic to sites and primarily customer support centers, which are getting overwhelmed with people reaching out for help.

And that’s before you consider how customer support teams might be impacted by coronavirus and the many mandates we’ve had to stay away from work, and the stresses they may be under.

“In our current social climate, customer support is an integral part of a company’s stability and growth that has embraced remote work to meet the demands of a globalized customer-base,” said Dominik Blattner, founder of Kaizo, in a statement. “With the rise of support teams utilizing a digital workplace, providing standards to measure an agent’s performance has never been more important. KPIs provide these standards, quantifying the success, achievement and contribution of each team member.”

On a more general level, Kaizo is also changing the conversation around how to improve one’s productivity. There has been a larger push for “quantified self” platforms, which has very much played out both in workplaces and in our personal lives, but a lot of services to track performance have focused on both managers and employees leaning in with a lot of input. That means if they don’t set aside the time to do that, the platforms never quite work the way they should.

This is where the AI element of Kaizo plays a key role, by taking on the need to proactively report into a system.

“This is how we’re distinct,” Auer-Welsbach said in an interview. “Normally KPIs are top-down. They are about people setting goals and then reporting they’ve done something. This is a bottom-up approach. We’re not trying to change employees’ behaviour. We plug into whatever environment they are using, and then our tool monitors. The employee doesn’t have to report or measure anything. We track clicks on the CRM, ticketing, and more, and we analyse all that.” He notes that Kaizo is looking at up to 50 datapoints in its analysis.

“We’re excited about Kaizo’s novel approach to applying AI to existing ticket data from platforms like Zendesk and Salesforce to optimize the customer support workflow,” said Darian Shirazi, General Partner at Gradient Ventures, in a statement. “Using machine learning, Kaizo understands which behaviors in customer service tickets lead to better outcomes for customers and then guides agents to replicate that using ongoing game mechanics. Customer support and service platforms today are failing to leverage data in the right way to make the life of agents easier and more effective. The demand Kaizo has seen since they launched on the Zendesk Marketplace shows agents have been waiting for such a solution for some time.”

Kaizo is not the only startup to have identified the area of building new services to improve the performance of customer support teams. Assembled earlier this month also raised $3.1 million led by Stripe for what it describes as the “operating system” for customer support.

Powered by WPeMatico