Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Energy demand has fallen globally. Oil prices are plummeting. Everywhere in the energy world things look fairly grim, but keeping the lights on and electrons moving remains critical to keeping even the hobbled economies of the world humming.

That’s why startups like Amperon, which use data analysis to provide predictive tools for energy retailers and grid operators, are still relevant — and still raising money.

The company raised $2 million in a round that closed in February before the pandemic hit U.S. shores. And the service, according to co-founder Abe Stanway, is still vital.

“We tell them how much electricity their customers are going to use on a short-term and long-term basis,” Stanway said of the company’s service. “When these exogenous shocks and black swan events occur we get much more valuable because you need this machine learning in order to understand how the grid is going to behave.”

The value proposition was clear to investors like Blackhorn Ventures, which led the round, and other backers, including Garuda Ventures, Intelis Capital, Powerhouse Ventures, SK Ventures and V1.VC.

“Amperon builds real-time operational grid intelligence tools via smart meters and AI for utilities, energy retailers, grid operators and institutional traders,” said Emily Kirsch, Powerhouse founder and chief executive. “Amperon’s iterative demand forecasting is able to account for never-before-seen grid volatility resulting from a global pandemic, climate disasters or an increasingly complex grid.”

Amperon is working with four major geographies, including Australia’s two major grid regions and the ERCOT regional transmission organization responsible for Texas, and PJM, which manages the mid-Atlantic’s electricity grid.

Stanway said the new money would be used to expand the company’s reach across more grid operators in the U.S.

While Amperon’s technology is incredibly useful for utilities and grid operators during times of crisis, it can help save money in normal times too. Long-term utility planners typically over-budget their energy needs by 1% every year, which adds up to billions of dollars spent on unnecessary additional generation capacity, according to Amperon.

Lower spending means reduced electricity prices for consumers. Another issue that Amperon says it can help energy providers address is the increasing complexity of grid management. Renewable energy generation adds variability to the grid that utilities and grid operators have yet to effectively manage, the company said.

Powered by WPeMatico

In today’s grim economic climate, companies are looking for ways to automate wherever they can. Bridgecrew, an early-stage startup that makes automated cloud security tooling aimed at engineers, announced a $14 million Series A today.

Battery Ventures led the round with participation from NFX, the company’s $4 million seed investor. Sorensen Ventures, DNX Ventures, Tectonic Ventures, and Homeward Ventures also participated. A number of individual investors also helped out. The company has raised a total of $18 million.

Bridgecrew CEO and co-founder Idan Tendler says that it is becoming easier to provision cloud resources, but that security tends to be more challenging. “We founded Bridgecrew because we saw that there was a huge bottleneck in security engineering, in DevSecOps, and how engineers were running cloud infrastructure security,” Tendler told TechCrunch.

They found that a lot issues involved misconfigurations, and while there were security solutions out there to help, they were expensive, and they weren’t geared towards the engineers who were typically being charged with fixing the security issues, he said.

The company decided to solve that problem by coming up with a solution geared specifically for the way engineers think and operate. “We do that by codifying the problem, by codifying what the engineers are doing. We took all the tasks that they needed to do to protect around remediation of their cloud environment and we built a playbook,” he explained.

The playbooks are bits of infrastructure as code that can resolve many common problems quickly. When they encounter a new problem, they build a playbook and then that becomes part of the product. He says that 90% of the issues are fairly generic like following AWS best practices or ensuring SOC-2 compliance, but the engineers are free to tweak the code if they need to.

Tendler says he is hiring and sees his product helping companies looking to reduce costs through automation. “We are planning to grow fast. The need is huge and the COVID-19 implications mean that more and more companies will be moving to cloud and trying to reduce costs, and we help them do that by reducing the barriers and bottlenecks for cloud security.”

The company was founded 14 months ago and has 100 playbooks available. It’s keeping the crew lean for now with 16 employees, but it has plans to double that by the end of the year.

Powered by WPeMatico

Airwallex, a Melbourne-based cross-border financial startup that achieved “unicorn” status last year, announced today that it has raised a $160 million Series D. The round included ANZi Ventures, the investment arm of ANZ Bank, and Salesforce Ventures, along with returning investors DST Global, Tencent, Sequoia Capital China, Hillhouse Capital and Horizons Ventures.

Founded in 2015, the company’s financial services include foreign currency accounts that let businesses receive money from around the world. Airwallex’s system uses inter-bank exchanges to trade foreign currencies at a mid-market rate and targets companies that do business in several different countries. The new funding will be used on potential acquisitions; expansion in American, European and Middle Eastern markets; and the launch of new products, including payment acceptance tools.

Airwallex reached a valuation of more than $1 billion last year when it closed its Series C funding, and has now raised a total of $360 million. Since that round, it has launched new operations in Tokyo, Bangalore and Dubai, and introduced products including Airwallex Borderless Cards in partnership with Visa and integration with accounting platform Xero. The company also now offers an API that enables companies to issue their own virtual cards.

In a press statement, Salesforce Ventures’ head of Australia Rob Keith said, “Being able to transact and do business with customers all over the world is a key criteria for companies who are going through a digital transformation. We’re excited to partner with Airwallex at this critical time in its growth, expanding both its footprint globally and its product capabilities.”

Other startups that have also raised funding to help small to medium-sized businesses deal with the challenges of doing trade in different currencies include Brex, another unicorn, and Hong Kong-based Neat.

Powered by WPeMatico

Israel-based Pileus, which is officially launching today, aims to help businesses keep their cloud spend under control. The company also today announced that it has raised a $1 million seed round from a private angel investor.

Using machine learning, the company’s platform continuously learns about how a user typically uses a given cloud and then provides forecasts and daily personalized recommendations to help them stay within a budget.

Pileus currently supports AWS, with support for Google Cloud and Microsoft Azure coming soon.

With all of the information it gathers about your cloud usage, the service can also monitor usage for any anomalies. Because, at its core, Pileus keeps a detailed log of all your cloud spend, it also can provide detailed reports and dashboards of what a user is spending on each project and resource.

If you’ve ever worked on a project like this, you know that these reports are only as good as the tags you use to identify each project and resource, so Pileus makes that a priority on its platform, with a tagging tool that helps enforce tagging policies.

“My team and I spent many sleepless nights working on this solution,” says Pileus CEO Roni Karp. “We’re thrilled to finally be able to unleash Pileus to the masses and help everyone gain more efficiency of their cloud experience while helping them understand their usage and costs better than ever before.”

Pileus currently offers a free 30-day trial. After that, the service shows you a $180/month or $800 per year price, but once you connect your accounts, it’ll charge 1% of your savings, not the default pricing you’ll see at first.

The company isn’t just focused on individual businesses, though. It’s also targeting managed service providers that can use the platform to create reports and manage their own customer billing. Karp believes this will become a significant source of revenue for Pileus because “there are not many good tools in the field today, especially for Azure.”

It’s no secret that Pileus is launching into a crowded market, where well-known incumbents like Cloudability already share mindshare with a growing number of startups. Karp, however, believes that Pileus can stand out, largely because of its machine learning platform and its ability to provide users with immediate value, whereas, he argues, it often takes several weeks for other platforms to deliver results.

Powered by WPeMatico

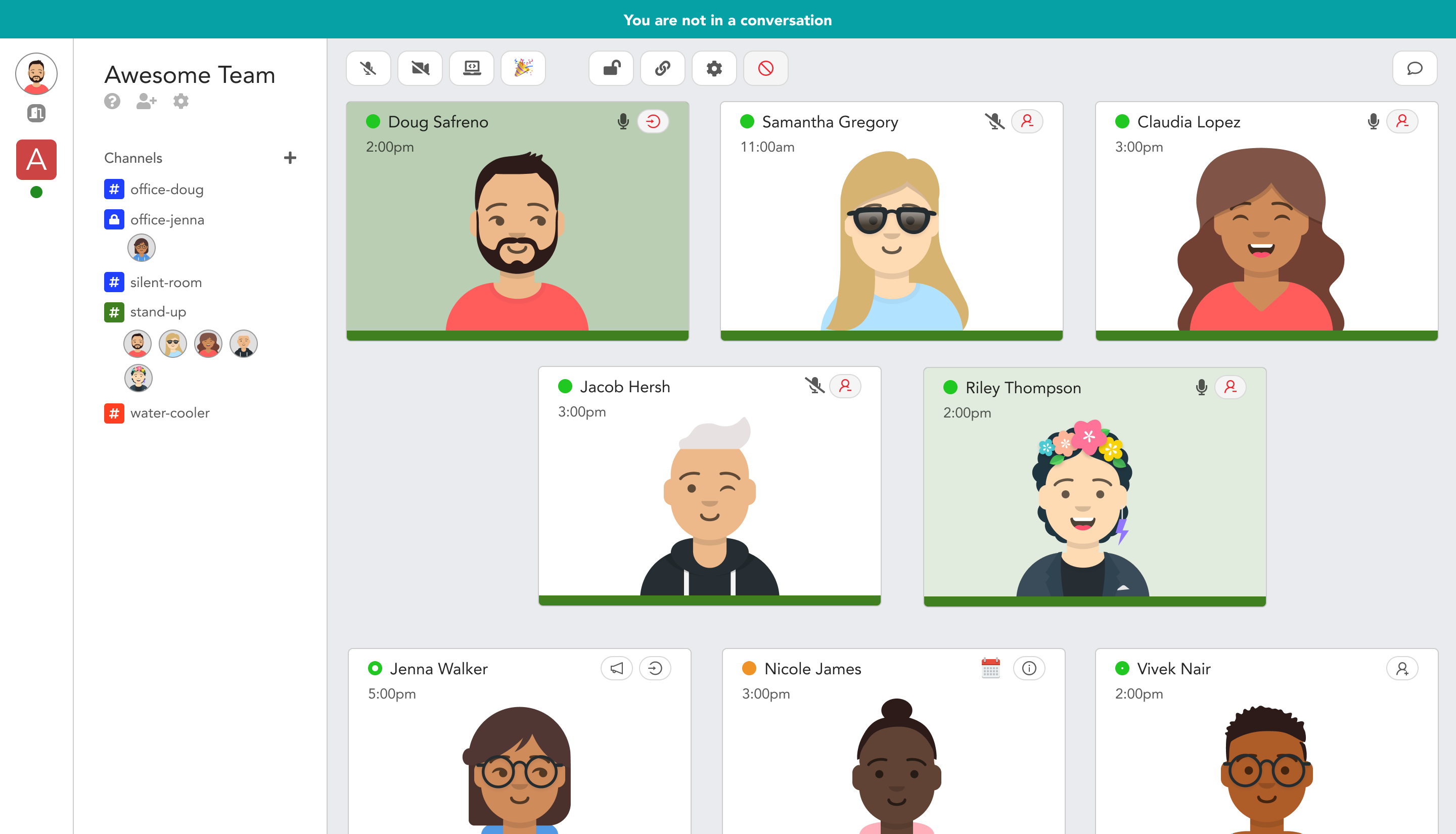

Could avatars that show what co-workers are up to save work-from-home teams from constant distraction and loneliness? That’s the idea behind Pragli, the Bitmoji for the enterprise. It’s a virtual office app that makes you actually feel like you’re in the same building.

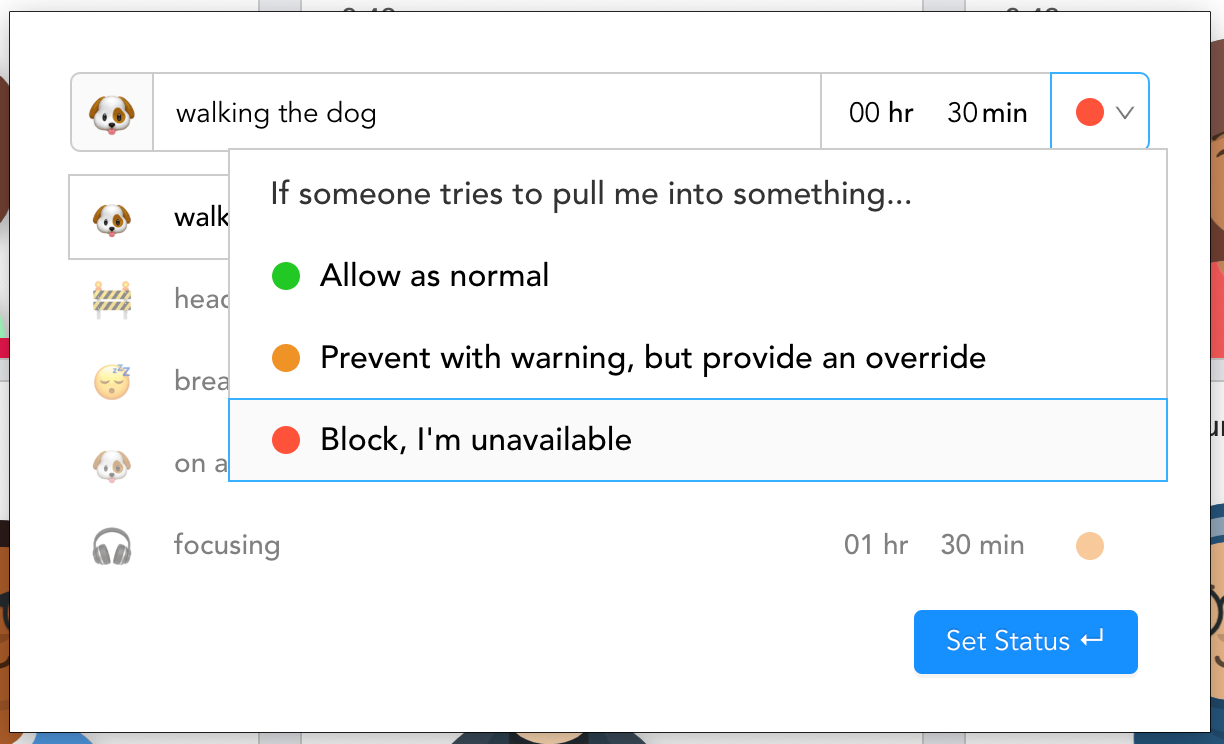

Pragli uses avatars to signal whether co-workers are at their desk, away, in a meeting, in the zone while listening to Spotify, taking a break at a digital virtual water coooler or done for the day. From there, you’ll know whether to do a quick ad hoc audio call, cooperate via screenshare, schedule a deeper video meeting or a send a chat message they can respond to later. Essentially, it translates the real-word presence cues we use to coordinate collaboration into an online workplace for distributed teams.

“What Slack did for email, we want to do for video conferencing,” Pragli co-founder Doug Safreno tells me. “Traditional video conferencing is exclusive by design, whereas Pragli is inclusive. Just like in an office, you can see who is talking to who.” That means less time wasted planning meetings, interrupting colleagues who are in flow or waiting for critical responses. Pragli offers the focus that makes remote work productive with the togetherness that keeps everyone sane and in sync.

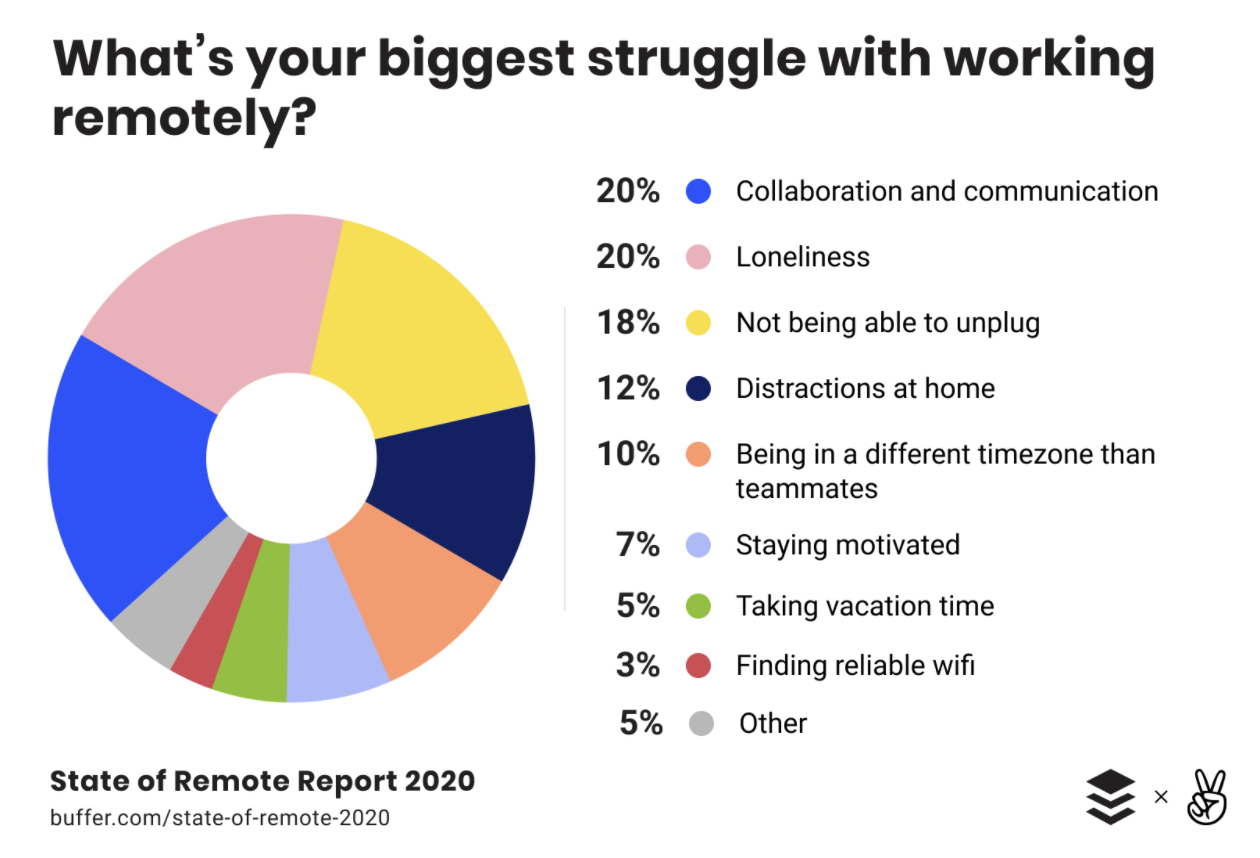

The idea is to solve the top three problems that Pragli’s extensive interviews and a Buffer/AngelList study discovered workers hate:

You never have to worry about whether you’re intruding on someone’s meeting, or if it’d be quicker to hash something out on a call instead of vague text. Avatars give remote workers a sense of identity, while the Pragli water cooler provides a temporary place to socialize rather than an endless Slack flood of GIFs. And because you clock in and out of the Pragli office just like a real one, co-workers understand when you’ll reply quickly versus when you’ll respond tomorrow unless there’s an emergency.

“In Pragli, you log into the office in the morning and there’s a clear sense of when I’m working and when I’m not working. Slack doesn’t give you a strong sense if they’re online or offline,” Safreno explains. “Everyone stays online and feels pressured to respond at any time of day.”

Pragli co-founder Doug Safreno

Safreno and his co-founder Vivek Nair know the feeling first-hand. After both graduating in computer science from Stanford, they built StacksWare to help enterprise software customers avoid overpaying by accurately measuring their usage. But when they sold StacksWare to Avi Networks, they spent two years working remotely for the acquirer. The friction and loneliness quickly crept in.

They’d message someone, not hear back for a while, then go back and forth trying to discuss the problem before eventually scheduling a call. Jumping into synchronous communicating would have been much more efficient. “The loneliness was more subtle, but it built up after the first few weeks,” Safreno recalls. “We simply didn’t socially bond while working remotely as well as in the office. Being lonely was de-motivating, and it negatively affected our productivity.”

The founders interviewed 100 remote engineers, and discovered that outside of scheduled meetings, they only had one audio or video call with co-workers per week. That convinced them to start Pragli a year ago to give work-from-home teams a visual, virtual facsimile of a real office. With no other full-time employees, the founders built and released a beta of Pragli last year. Usage grew 6X in March and is up 20X since January 1.

Today Pragli officially launches, and it’s free until June 1. Then it plans to become freemium, with the full experience reserved for companies that pay per user per month. Pragli is also announcing a small pre-seed round today led by K9 Ventures, inspired by the firm’s delight using the product itself.

To get started with Pragi, teammates download the Pragli desktop app and sign in with Google, Microsoft or GitHub. Users then customize their avatar with a wide range of face, hair, skin and clothing options. It can use your mouse and keyboard interaction to show if you’re at your desk or not, or use your webcam to translate occasional snapshots of your facial expressions to your avatar. You can also connect your Spotify and calendar to show you’re listening to music (and might be concentrating), reveal or hide details of your meeting and decide whether people can ask to interrupt you or that you’re totally unavailable.

![]()

From there, you can by audio, video or text communicate with any of your available co-workers. Guests can join conversations via the web and mobile too, though the team is working on a full-fledged app for phones and tablets. Tap on someone and you can instantly talk to them, though their mic stays muted until they respond. Alternatively, you can jump into Slack-esque channels for discussing specific topics or holding recurring meetings. And if you need some down time, you can hang out in the water cooler or trivia game channel, or set a manual “away” message.

Pragli has put a remarkable amount of consideration into how the little office social cues about when to interrupt someone translate online, like if someone’s wearing headphones, in a deep convo already or if they’re chilling in the microkitchen. It’s leagues better than having no idea what someone’s doing on the other side of Slack or what’s going on in a Zoom call. It’s a true virtual office without the clunky VR headset.

“Nothing we’ve tried has delivered the natural, water-cooler-style conversations that we get from Pragli,” says Storj Labs VP of engineering JT Olio. “The ability to switch between ‘rooms’ with screen sharing, video and voice in one app is great. It has really helped us improve transparency across teams. Plus, the avatars are quite charming as well.”

With Microsoft’s lack of social experience, Zoom consumed with its scaling challenges and Slack doubling down on text as it prioritizes Zoom integration over its own visual communication features, there’s plenty of room for Pragli to flourish. Meanwhile, COVID-19 quarantines are turning the whole world toward remote work, and it’s likely to stick afterwards as companies de-emphasize office space and hire more abroad.

The biggest challenge will be making comprehensible enough to onboard whole teams such a broad product encompassing every communication medium and tons of new behaviors. “How do you build a product that doesn’t feel distracting like Slack but where people can still have the spontaneous conversations that are so important to companies innovating?,” Safreno asks. The Pragli founders are also debating how to encompass mobile without making people feel like the office stalks them after hours.

“Long-term, [Pragli] should be better than being in the office because you don’t actually have to walk around looking for [co-workers], and you get to decide how you’re presented,” Safreno concludes. “We won’t quit, because we want to work remotely for the rest of our lives.”

Powered by WPeMatico

Frank, a New York-based student-facing startup, has raised $5 million in what the company described as an “interim strategic round” that Chegg, a public edtech company, took part in. According to Frank founder and CEO Charlie Javice, previous investors Aleph and Marc Rowan took part in the round alongside new investor GingerBread Capital.

The education funding-focused startup last raised known capital in December of 2017, when it closed a $10 million Series A. Frank raised a seed round earlier that same year worth $5.5 million.

According to Javice, her firm closed its round in early March, before the recent market carnage. Bearing in mind that there is always lag between when a funding round is closed and when it is announced, the new Frank round is on the fresher side of things. Most rounds are a bit more like Shippo’s recent investment (closed in December, announced in April) than Podium’s recent deal, which it started raising in mid-February of this year.

Timing aside, what Frank is doing is interesting, so let’s talk about its business, how it approached 2019 and how it’s faring in today’s changed market.

To help keep student debt low, Frank is a bit akin to TurboTax for college money, as TechCrunch wrote when covering its Series A, helping students get through a thicket of forms and aid to collect as much aid as possible while avoiding borrowing.

American higher education is too expensive, and applying for financial help is irksome and byzantine. I can safely report that sans quoting an expert, as I had to go through it as a student and only finished paying my student loans last July.

Frank wants to help make college more affordable, with the company noting in a call with TechCrunch that there’s been a good number of companies working to help students service debt in a less expensive way after they’ve hired the money; it wants to help students avoid taking on so much red ink in the first place.

According to Javice, lots of students fail to finish signing up for federal aid programs, and some students wind up dropping out of programs before finishing them, leaving them saddled with debt but no degree. That’s a hell of a trap to wind up in, as student loans are the barnacles of the financial world — incredibly hard to get rid of.

According to Javice, Frank was a little early to rethinking its own growth/profit trade-off than the rest of the startup world, which woke up when WeWork filed to go public and was quickly booed off Wall Street. In mid-2019, Frank slowed growth to get closer to the margins it wanted. (Thinking out loud, this is probably how the startup managed to survive so long off its December 2017 Series A.)

Indeed, according to Frank’s CEO, it was in a comfortable cash position before this round, which she described as more a vote of confidence than a round of necessity.

Which brings us to today, and the new, COVID-19 world. In an email to TechCrunch, Javice said that “like everyone else,” her company is “adjusting to the new realities.” She added that college and university attendance “has typically been countercyclical” and that her company is “seeing a large demand for higher education and specifically financial aid.”

If the new economy winds up creating a little tailwind for Frank, it won’t be the only startup to accrue help; Slack and Zoom and other remote work-friendly companies have also seen their fortunes turn for the better in recent weeks. And now with $5 million more on hand, it can certainly meet new demand.

Update: An earlier version of this article listed Chegg as the round’s lead investor; it did receive a board seat in the transaction but Frank does not consider it a lead investor. The post has been amended.

Powered by WPeMatico

Tyto Care, the provider of a home health diagnostic device and telemedicine consultation app, said it has raised $50 million in a new round of funding.

The round was led by Insight Partners, Olive Tree Ventures, and Qualcomm Ventures, according to a statement, and brings the startup’s total capital raised to more than $105 million.

The funding comes just as Tyto has seen a dramatic surge in demand brought on by the global response to the COVID-19 pandemic. Tyto Care’s toolkit is being used as a telehealth diagnostic solution that was already seeing three times sales growth in 2019 alone.

Last year, the company inked a deal with Best Buy and works with most of the major telemedicine providers, including American Well, Teladoc and others.

Previous investors Orbimed, Echo Health, Qure, Teuza and others also participated in the new financing, the company said in a statement.

With the financing, Tyto Care is well-positioned to both buy and build new tools based on its existing diagnostics platform, as well as expand its home health testing kit into new areas.

Companies like Scanwell Health are providing at-home diagnostic tests for things like urinary tract infections, and Tyto Care chief executive Dedi Gilad definitely sees options for new products around different kinds of at-home tests, the Tyto Care founder said in an interview.

All of this new capital comes with surging demand where Tyto Care’s telehealth technology is being used by every hospital in Israel to provide remote examinations of quarantined and isolated patients infected with COVID-19. Other hospital networks are also turning to the company’s diagnostics tools for similar applications, the company said.

The remote medical exams can protect health providers from exposure to SARS-Cov-2, the virus that causes COVID-19, and enables uninfected patients to get an examination of their basic health remotely, without needing to go to a medical facility.

“Over the past two years, Tyto Care has increased momentum faster than ever before and is playing a leading role in changing how people receive healthcare. Telehealth is heeding the call of the COVID-19 pandemic and we are proud that our unique solution is aiding health systems and consumers around the world in the fight against the virus,” said Gilad, in a statement. “This new funding comes at a pivotal moment in the evolution of telehealth and will enable us to continue to transform the global healthcare industry with the best virtual care solutions.”

Powered by WPeMatico

A startup that has framed itself as an Instagram for websites is now squaring up against Shopify as it nabs new funding from Google’s venture capital arm.

Brooklyn-based Universe has just closed a $10 million Series A from GV. The funding round was well in the works before the COVID-19 pandemic took hold stateside; nevertheless, CEO Joseph Cohen definitely sounded relieved to have everything signed.

“Hopefully, it’ll take some weight off their shoulders that may have been there otherwise,” said GV general partner M.G. Siegler, who led the deal and is taking a seat on their board.

When the team launched out of YC two years ago, the initial aim was to be the go-to short link for young people and creatives to stick in their Instagram bios. The mobile app allowed users to create very basic landing pages, allowing them to type up some text, toss up photos and arrange their creation across a couple of web pages.

As the startup matures and looks to home in on a more robust business model, they’re now looking to build an incredibly low-friction commerce platform. Users can add a shopping “block” to their site, add a photo, description and price and then start accepting orders.

“We’ve gone from a landing page builder to a full-fledged website builder,” Cohen told TechCrunch in an interview.

Universe is going after what Cohen calls “very small businesses.” This could be an artist selling prints, a yoga instructor charging for Zoom classes or one of their latest customers, a farmer selling live bait. “These are people who don’t work at desks,” Cohen says.

Shopify has been one of the biggest tech success stories of the past several years, but Cohen sees weaknesses for Universe to capitalize on. Shopify is “complex and not mobile-first,” he says. Universe not only doesn’t require a developer to implement, it doesn’t seem to require someone that’s particularly tech-savvy.

The price of simplicity for the end user is a hefty cut for Universe. At launch, the company isn’t taking a percentage for the first $1,000 of a customer’s revenue, but will take a 10% slice thereafter, a number that’s notably multiples higher than the rates of competitors.

Cohen acknowledges that if a business succeeds, this can be a significant expense for them, one that might push them to another platform. He say that he wants to figure out a model that can help his startup “grow and scale” with their customers, but he didn’t offer up any details on what that might look like.

The team is still working with free and paid “pro” tiers that offer advanced features like analytics. Commerce features will be available for both tiers.

Universe has raised $17 million to date. Other investors include Javelin Venture Partners, General Catalyst and Greylock Partners.

We chatted with GV’s M.G. Siegler about closing this deal and how his role as an investor has shifted since the current crisis took hold. You can read that interview on Extra Crunch.

Powered by WPeMatico

Early this afternoon Shippo, a shipping software and services company, announced that it has closed a $30 million Series C. The funding round roughly doubles the capital that the firm has raised to-date, from a little over $29 million to just under $60 million.

The round, however, wasn’t put together recently. As is often the case with funding events, Shippo raised its capital a while back and is only announcing it now. According to its CEO, Laura Behrens Wu, her startup started raising its Series C in late Q4 2019, with the capital hitting its accounts the day after Christmas. So, Shippo started 2020 well capitalized, and should have a comfortable capital base heading into this year’s economic uncertainty.

The funding round was led by a new investor, D1 Capital Partners, and participated in by a number of prior investors including Uncork Capital (which led a 2014 Seed investment into the company), Union Square Ventures (which led the company’s Series A in 2016) and Bessemer (which led its 2017 Series B).

Shippo sits between retailers and consumers, helping sellers ship goods to buyers quickly and, it promises, inexpensively. The startup works with nearly five dozen shipping partners around the world, and plugs into the merchant worlds of Amazon, Shopify, Wix and others.

Like a number of successful startups, Shippo is trying to take something that is complex, and make it simple while generating revenue along the way. There are a number of loose examples we can lean on. For example, Plaid took all the complexity of talking to different financial institutions and shoved it into an accessible API. Twilio did something similar for telephony. Stripe made payments simple for others to integrate. You get the idea. Shippo wants to the same for shipping.

So far its model has good momentum. Heading into its funding round the firm had doubled (“100% growth,” Behrens Wu) in the preceding year, the sort of expansion that investors covet. It’s never bad to raise on the back of aggressive growth, as Shippo’s Series C shows; the company’s new valuation is “slightly higher” than TechCrunch’s estimate of $150 million, according to its CEO.

And even more, Shippo’s hybrid software and sales model (it charges for access to its shipping software and generates revenue from select shipping spend) creates attractive economics. Shippo’s gross margins are right around 80%, according to the startup, putting the company in the middle-upper tier of SaaS firms. Its growth isn’t based on the upselling shipping by a few points at volume; Shippo does have venture-ready economics.

It might seem odd to stress that point, but after WeWork’s implosion, it’s worth checking to make sure that startups raising as if they have strong revenue quality actually do.

Shippo has big aspirations, as you’d expect. “When you think about shipping software,” Behrens Wu told TechCrunch during an interview, “most people, even in tech, can’t name a single shipping software company, but everyone can name one or two payment companies. Everyone knows PayPal, Stripe, maybe Adyen or Braintree.” She wants to make Shippo as well known for shipping as Stripe is for payments.

There was secular movement towards her vision even before the pandemic. Today, online shopping — the grist for Shippo’s mill — is even more important. And it’s likely to become even more so over time, if growth shown by Amazon and Shopify in recent quarters is any indication of what’s to come, which means that the market for Shippo’s services will grow in time, and it’s always easier to grow in an expanding market than to claw for share in a stagnant pool.

Finally, in addition to its new capital and raised valuation, Shippo also announced that it has hired Catherine Stewart, former chief business officer at WordPress juggernaut Automattic, to be its COO. If Shippo is hiring a COO now, then we expect to see a CFO added around the time of its Series D. And then we get to start annoying the company about its IPO timeline.

Shippo is one of the lucky startups that raised right before the world changed. Now it’s up to the startup to conserve cash while continuing to grow while the global economy struggles. Let’s see how it performs.

Powered by WPeMatico

Securitization is a critical function of the modern financial system. Banks “package” individual loans, say a mortgage or an auto loan, into a group with similar characteristics and sell them to other investors. That gets the debt off the originator’s balance sheet so that they can offer more loans, while also offering private investors alternative investment opportunities to buy up.

Despite the scale of the market — the trade association SIFMA’s research shows that the volume for asset-backed securities reached more than $300 billion in 2019 (excluding mortgages) — much of that structuring remains relatively ad hoc, with structuring agents and buyers constantly seeking each other out.

Much in the way that real estate and startup crowdsourcing platforms democratized access to those alternative investments, Cadence wants to expand access to securitized products while increasing the velocity of transactions for originators and lowering prices. Founder and CEO Nelson Chu said that “our job is to bring transparency and efficiency to this market and through all the various things that we do.” The company operates on top of the Ethereum blockchain network.

Founded in 2018 and launched publicly in 2019, the New York City-based capital markets startup has now structured $88 million in notes across 76 offerings and 12 originators according to the company. The firm’s public leaderboard shows that the largest originators were Sellers Funding with more than $23 million and Wall Street Funding with almost $26 million in transaction volume. Chu said that “I think we are the 21st largest structuring agent the United States in 2020 so far,” which is not a bad place to be for a young startup in a massive multi-trillion dollar market.

In addition to that $88 million volume processed on the company’s retail platform, Cadence also structured a $40 million whole business securitization with FAT Brands, the owner of restaurant chains like Fatburger and Yalla Mediterranean. The company notes that the structuring reduced the company’s interest costs by $2 million.

The company has hit a number of milestones over the past two years. It closed a seed round of $4 million in December led by Revel VC, with Revel’s Thomas Falk, Navtej S. Nandra, former President of E*Trade, and portfolio manager Oliver Wriedt joining the company’s board.

In addition, back in 2019, the company said that it also became the first digital asset company to launch a digital asset ticker on Bloomberg Terminal and also the first to join the Bloomberg App Portal. It also secured the first financial debt rating for a digital asset.

The company has a variety of revenue streams from different areas of its platform. It takes transaction fees on each deal, but also derives revenues from hosting data related to the performance of the underlying loans. Given the company’s technology stack, it has better and more verified data about how the underlying assets that back each security are performing, giving all investment holders a much more robust look at the health of their portfolio.

Longer term, Cadence’s goal is to move to a mostly SaaS model for originators and buyers. “We can be very, very beneficial to every single counterparty involved when we become that,” Chu said, adding “we essentially are Switzerland … because our incentives are all aligned.”

I asked about how the company is responding to the COVID-19 situation, and Chu said that as the world saw in the 2008 global financial crisis, “there are pockets of opportunity here that we continue to find, and we allow retail, accredited investors to get access to that.” Chu gave the example of game developers waiting on payments from Apple and Google who need short-term loans to cover costs.

In addition to Revel, other investors in the seed round included Morgan Creek Digital, Nimble Ventures, Argo, Tuesday Capital, Manatt, and Recharge Capital. R&R Venture Partners, a joint VC firm of former Citi chairman Richard D. Parsons and Clinique chairman Ronald S. Lauder, also participated.

Powered by WPeMatico