Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Checkly, a Berlin-based startup that is developing a monitoring and testing platform for DevOps teams, today announced that it has raised a $2.25 million seed round led by Accel. A number of angel investors, including Instana CEO Mirko Novakovic, Zeit CEO Guillermo Rauch and former Twilio CTO Ott Kaukver, also participated in this round.

The company’s SaaS platform allows developers to monitor their API endpoints and web apps — and it obviously alerts you when something goes awry. The transaction monitoring tool makes it easy to regularly test interactions with front-end websites without having to actually write any code. The test software is based on Google’s open-source Puppeteer framework and to build its commercial platform, Checkly also developed Puppeteer Recorder for creating these end-to-end testing scripts in a low-code tool that developers access through a Chrome extension.

The team believes that it’s the combination of end-to-end testing and active monitoring, as well as its focus on modern DevOps teams, that makes Checkly stand out in what is already a pretty crowded market for monitoring tools.

“As a customer in the monitoring market, I thought it had long been stuck in the 90s and I needed a tool that could support teams in JavaScript and work for all the different roles within a DevOps team. I set out to build it, quickly realizing that testing was equally important to address,” said Tim Nolet, who founded the company in 2018. “At Checkly, we’ve created a market-defining tool that our customers have been demanding, and we’ve already seen strong traction through word of mouth. We’re delighted to partner with Accel on building out our vision to become the active reliability platform for DevOps teams.”

“As a customer in the monitoring market, I thought it had long been stuck in the 90s and I needed a tool that could support teams in JavaScript and work for all the different roles within a DevOps team. I set out to build it, quickly realizing that testing was equally important to address,” said Tim Nolet, who founded the company in 2018. “At Checkly, we’ve created a market-defining tool that our customers have been demanding, and we’ve already seen strong traction through word of mouth. We’re delighted to partner with Accel on building out our vision to become the active reliability platform for DevOps teams.”

Nolet’s co-founders are Hannes Lenke, who founded TestObject (which was later acquired by Sauce Labs), and Timo Euteneuer, who was previously Director Sales EMEA at Sauce Labs.

Tthe company says that it currently has about 125 paying customers who run about 1 million checks per day on its platform. Pricing for its services starts at $7 per month for individual developers, with plans for small teams starting at $29 per month.

Powered by WPeMatico

While human travel has become severely restricted in recent months, the movement of goods has remained a constant priority — and in some cases, has become even more urgent. Today, a startup out of Switzerland that builds hardware and operates a logistics network designed to transport one item in particular — pharmaceuticals — is announcing a significant round to fuel its growth.

SkyCell — a designer of “smart containers” powered by software to maintain constant conditions for drugs that need to be kept at strict temperatures, humidity levels, and levels of vibration, which are in turn used to transport pharmaceuticals around the globe on behalf of drug companies — is today announcing. that it has raised $62 million in growth funding.

This latest round is being led by healthcare investor MVM Partners, with participation also from family offices, a Swiss insurance company that declined to be named, as well as previous investors the Swiss Entrepreneurs Fund (managed by Credit Suisse and UBS), and the BCGE Bank’s growth fund.

The company was founded in 2012 Switzerland when Richard Ettl and Nico Ros were tasked to design a storage facility for one of the big Swiss pharma giants. The exec charged with overseeing the project brainstormed that the work they were putting in could potentially be applied to transportation containers, and thus SkyCell was born.

Today, Ettl (who is the CEO, while Ros is the CTO), said in an interview that the company now works with eight of the world’s biggest pharmaceutical companies and has been in validation trials with a further seven. These use SkyCell’s network of some 22,000 air freight pallets to move their products around the world.

The new capital will be used to expand that reach further, specifically in the U.S. and Asia, and to double its fleet to become the biggest pharmaceutical transportation company globally. With 30 of the 50 biggest-selling drugs in the world being temperature sensitive (and some generics for one of the biggest-selling, the arthritis medication Humira, now also coming out), this makes for a huge opportunity.

And unsurprisingly, several of SkyCell’s customers are working on COVID-19 medications, Ettl said, either to help ease symptoms or potentially to vaccinate or eradicate the virus, and so it’s standing at the ready to play a role in getting drugs to where they need to be.

“We are well positioned in case there is a vaccine developed. Out of the six pharma companies developing these right now, four of them are our customers, so there is a high likelihood we would transport something,” Ettl said.

For now, he said SkyCell has been involved in helping to transport “supportive” medications related to the outbreak, such as flu shots to make sure people are not falling ill with other viral infections at the same time.

SkyCell is not disclosing its valuation but we understand that it’s in the many hundreds of millions of dollars. The company had raised some $36 million in equity and debt before this, bringing the total outside funding now to $98 million.

In a market that’s estimated to be worth some $2.8 billion annually and growing at a rate of between 15% and 20% each year, there are a number of freight businesses that focus on the transportation of pharmaceuticals. They include not only freight companies but airlines themselves, which often buy in containers from third parties. (And for some more context, one of its competitors, Envirotainer, was acquired for over $1 billion in 2918; while another, CSafe, has raised significantly more funding.)

But there was virtually no innovation in the market, and most pharmaceutical companies factored in failure rates of between 4% and 12% depending on where the drugs were headed.

One key differentiator with SkyCell has been its containers, which are able to withstand temperatures as high as 60 degrees Celsius or as low as negative 10 degrees Celsius, and have tracking on them to better monitor their movements from A to B.

These came to the market at a time when incumbents were only able to (and some still are only able to) guarantee insulation for temperatures as high as 40 degrees, which was not as pressing an issue in the past as it is today, in part because of rising temperatures around the globe, and in part because of the growing sophistication of pharmaceuticals.

“We’ve found that the number of days where [one has to consider] temperature extremes has been going up,” Ettl said. “Last year, we had 30 days where it was warmer than 40 degrees Celsius across our network of countries.”

On top of the containers themselves, SkyCell has built a software platform that taps into the kind of big data analytics that are now part and parcel of how modern companies in the logistics industry work today, in order to optimise movement and best routing for packages.

The conditions it considers include not only the obvious ones around temperature, humidity and vibration, but distance and time of travel, as well as overall carbon emissions. SkyCell claims that its failure rate comes out at less than 0.1%, with CO2 emissions reduced by almost half on a typical shipment.

Together, the hardware and software are covered by some 100 patents, the company says.

Powered by WPeMatico

Online lending firms might be beginning to feel the heat of the coronavirus pandemic in Southeast Asia, but investors’ faith in digital insurance startups remains unflinching in the region.

Jakarta-based Qoala has raised $13.5 million in its Series A financing round, the one-year-old startup said Tuesday. Centauri Fund, a joint venture between funds from South Korea’s Kookmin Bank and Telkom Indonesia, led the round.

Sequoia India, Flourish Ventures, Kookmin Bank Investments, Mirae Asset Venture Investment, Mirae Asset Sekuritas and existing investors MassMutual Ventures Southeast Asia, MDI Ventures, SeedPlus and Bank Central Asia’s Central Capital Ventura participated in the round, which pushes the startup’s to-date raise to $15 million.

Qoala works with leading insurers including AXA Mandiri, Tokio Marine, Great Eastern to offer customers cover against phone display damage, e-commerce logistics and hotel-quality checks. The startup says it offers personalized products to customers and eases the burden while making claims by allowing them to upload pictures.

The startup maintains partnership with several e-commerce firms including Grabkios, JD.ID, Shopee and Tokopedia and hotel and travel booking firms PegiPegi and RedBus.

It uses machine learning to detect fraud claims. It’s a win-win scenario for customers, who can make claims easily and have more affordable and sachet insurance products to buy, and for insurers, who can reach more customers.

Qoala processes more than 2 million policies each month, up from 7,000 in March last year. The startup said it is working on insurance products to cover health and peer-to-peer categories. The startup, which employs about 150 people currently, plans to double its headcount in a year.

“As a relatively new entrant in the space we are delighted to partner with leading global investors whose tremendous thought leadership as well as operational experience will allow us to maintain our innovative edge. This truly demonstrates the ecosystem’s belief in what Qoala is trying to achieve — humanizing insurance and making it accessible and affordable to all,” said Harshet Lunani, founder and chief executive of Qoala, in a statement.

Kenneth Li, managing partner at Centauri Fund, said Qoala’s multi-channel approach has the potential to unlock Indonesia’s untapped insurance industry.

“Our thesis identified that Indonesia has a considerably low gross written premium (GWP) to GDP ratio in comparison to other emerging countries, coupled with the large growing middle class in need of more security in their financial planning which allows immense potential for the insurance sector to take off in Indonesia through innovative propositions,” he added.

According to one estimate (PDF), Southeast Asia’s digital insurance market is currently valued at $2 billion and is expected to grow to $8 billion by 2025. Last week, Singapore-based Igloo extended its Series A financing round to add $8.2 million to it.

Powered by WPeMatico

Oriente, a Hong Kong-based startup that develops tech infrastructure for digital credit and other online financial services, has raised $50 million for its ongoing Series B round. The funding was led by Peter Lee, co-chairman of Henderson Land, one of Hong Kong’s largest property developers, with participation from investors including website development platform Wix.com.

Launched in 2017 by Geoff Prentice (one of Skype’s co-founders), Hubert Tai and Lawrence Chu, Oriente focuses on markets that are underserved by traditional financial institutions. The new funding will be used for growth in Oriente’s existing markets, the Philippines and Indonesia, and expansion into new countries, including Vietnam.

It will also be used to continue building Oriente’s technology, which uses big data analytics to help merchants increase sales conversions and lower risk. Oriente has now raised more than $160 million in equity and debt, including a $105 million round in November 2018.

While many large tech companies, including Grab, Google, Facebook, Amazon, Uber, Apple and Samsung, are looking at digital payments and other online financial services, they need the tech infrastructure to do so, and partners that can also help them handle regulations in different markets.

Oriente doesn’t compete with payment providers. Instead, it is “innovating credit as a service,” Prentice told TechCrunch, by building technology that allows offline and online merchants to launch digital credit solutions quickly.

Oriente “is the only company that is focusing on building an end-to-end digital financial services infrastructure,” he added, with services created for consumers, online and offline merchants, and enterprise clients.

For consumers, the startup currently offers two apps, Cashalo in the Philippines and Finmas in Indonesia, which it says has a combined 5 million users and more than 1,000 merchants. Services include cash loans, online credit and working capital for small to medium-sized enterprises.

Oriente says that in 2019, it saw a 700% year-over-year growth in transactions and served more than 4 million new users, while merchant partners had a more than 20% increase in sales volume.

Over the next few months, Oriente plans to expand its Pay Later digital credit feature and launch new growth capital solutions for small businesses that need financing. Oriente also has several partnerships in the works to expand its enterprise solutions for larger businesses and corporations.

In Vietnam, Oriente is currently beta testing a consumer platform similar to Cashalo and Finmas. It will offer online credit and financing, as well as other services in partnership with local companies.

Oriente has also started focusing on how to serve businesses during the COVID-19 pandemic, since many merchants are coping with revenue declines, loss of users and cash flow issues.

“Over the past few weeks, we’ve reprioritized our corporate strategy to focus on the top opportunities within each market. We have also taken various steps to rebuild our organizations for optimized operational and financial efficiency in line with current and forecasted market conditions and our more focused strategy,” Prentice said.

“Our aim is not only to mitigate anticipated headwinds on liquidity but to demonstrate that our business has the potential to overcome and outperform the market in a recession—unlocking value for all stakeholders for years to come.”

Powered by WPeMatico

Earlier this month, edtech unicorn Duolingo raised $10 million in new venture capital from General Atlantic, per an SEC filing. With the raise, the online language learning platform accepted its first outside investor in almost three years. General Atlantic will take a board observer seat at the company, per Duolingo.

The company, which was last valued at $1.5 billion, says the round has increased its valuation, but it declined to share by how much.

General Atlantic has invested in a number of edtech companies around the world, like OpenClassrooms, Ruangguru and Unacademy. Duolingo said that General Atlantic’s global platform and experience with online education in Asia would help guide its own growth, specifically pointing to its plans to scale up the Duolingo English test.

The e-learning company last raised $30 million in December at that $1.5 billion valuation. To raise a smaller sum a few months later is uncommon. Historically, that type of raise could happen for a number of reasons: a company is accepting a later investment as part of the same funding round, it needs more cash and this is an easy way to raise it or the company tried to raise a new large round and failed to secure past $10 million.

So where does the language learning unicorn fit?

In Duolingo’s case, it said the $10 million was raised because it wanted to bring a new investor on, but didn’t need a massive amount of primary capital. Duolingo says it is cash-flow positive.

In the past few weeks, Duolingo launched a new app to help children read and write, passed one million paying subscribers for Duolingo Plus and disclosed that its annual bookings run rate is $140 million. The company also recently hired its first CFO and general counsel.

“Because our business has been growing very fast and we have more than enough capital, there was limited need for us to raise more primary capital. However, over the last year, we developed a relationship with General Atlantic,” the company said in a statement to TechCrunch.

Tanzeen Syed, a managing director for General Atlantic, said that Duolingo is a “market leader in the language learning space. Syed also said Duolingo has a “profitable, efficient business model while maintaining hyper-growth characteristics.”

Another key factoid here is that along with the $10 million, there was a larger secondary transaction, which occurs when an existing stockholder sells their stock for cash or to a third party, or to the company itself while the company is still private.

In this case, an existing investor in Duolingo sold a small portion of their existing stake to allow General Atlantic to have a bigger stake in the company.

The company declined to share the size of the secondary market transaction.

In light of this new information, Duolingo’s expansion to Asia, which has a robust market of English learners, welcomed one investor and lessened the stake of another.

Based on what we know, the transaction signals that a preexisting investor in Duolingo was looking for liquidity at a time where the public markets are tightening and private markets are pausing. And at a time when companies are staying private longer than ever before, secondary transactions are hardly rare.

Sometimes, however, secondary transactions signal a lack of faith from a preexisting investor in the company’s current trajectory.

Duolingo is full steam ahead on its goal to expand across the world — and now has new cash in the bank, and a new observer seat on the board, to prove it.

Powered by WPeMatico

The co-founders of Walrus.ai, a new software company that raised $4 million in a new round of financing from Homebrew, Felicis Ventures and Leadout Capital, started their business with one problem.

Jake Marsh, Ogden Nathan and Scott White had a problem. They left Wealthfront to launch a new service that would solve what they saw as a key problem with new business workflows. Their idea was to integrate the disparate software silos that different parts of their former business used to complete assignments.

The company was going to be called Monolist and it was going to aggregate tasks across every tool into a single actionable list. Unfortunately it wasn’t working.

They had founded the business back in 2018 and had gone on to raise seed capital from Homebrew and Leadout Capital, but they were hitting walls in their product development.

“Reliability was a huge problem for us,” said company co-founder, Scott White. “There were various frameworks that would let you test your automation so that before you launch your software, you catch bugs… There were some code languages that exist that can help you do this, but they didn’t work for us at all.”

The browser testing frameworks that White and his co-founders were using hadn’t kept up with the evolution of the software development industry and couldn’t adequately recreate the ways that actual users would interact with the software. “The stuff is super brittle,” said White.

Typically, according to White, these assurance tests break and then force engineers and developers to then investigate why the tests broke, to see if they can figure out what went wrong with the test even before they move on to any quality assurance of the actual changes made to a product.

“They weren’t designed to handle that much complexity,” White said of the existing testing tools.

So White and his co-founders thought about how they’d solve what they see as one of the critical problems that engineers face.

“The problem for engineers right now is that writing tests for your applications is hard because you have to write code and the frameworks are very inflexible and flaky,” White said. “Engineers spend tons of time running tests and if those tests fail then your code would not get shipped so you have to debut all those tests.”

Enter the new venture from White and his co-founders.

That would be Walrus.ai . “We’re outsourced engineering through an API,” said White. “We understand how to do testing and we can do it way better and more quickly.”

Using simple text descriptions of a planned user interface, Walrus.ai’s co-founder said his company can run diagnostics on just how effectively the code manages to execute its planned commands.

Given its status as a relatively new kind on the testing block, Walrus.ai only has tens of paying customers right now as it spins out from Monolist.

The company sees its competition coming primarily from outsourced quality assurance companies like Rainforest QA; test recorders like Mabel and Testim; and testing frameworks like Selenium and Cypress, but believes that its ability to take natural language prompts and run QA tests will be enough of a differentiator to capture a significant share of the market.

Powered by WPeMatico

A startup that’s hoping to be a contender in the very large and fragmented market of human resources software has captured the eye of a big investor out of the US and become its first investment in Spain.

Barcelona-based Factorial, which is building an all-in-one HR automation platform aimed at small and medium businesses that manages payroll, employee onboarding, time off and other human resource functions, has raised €15 ($16 million) in a Series A round of funding led by CRV, with participation also from existing investors Creandum, Point Nine and K Fund.

The money comes on the heels of Factorial — which has customers in 40 countries — seeing eightfold growth in revenues in 2019, with more than 60,000 customers now using its tools.

Jordi Romero, the CEO who co-founded the company with Pau Ramon (CTO) and Bernat Farrero (head of corporate), said in an interview that the investment will be used both to expand to new markets and add more customers, as well as to double down on tech development to bring on more features. These will include RPA integrations to further automate services, and to move into more back-office product areas such as handling expenses,

Factorial has now raised $18 million and is not disclosing its valuation, he added.

The funding is notable on a couple of levels that speak not just to the wider investing climate but also to the specific area of human resources.

In addition to being CRV’s first deal in Spain, the investment is being made at a time when the whole VC model is under a lot of pressure because of the global coronavirus pandemic — not least in Spain, which has a decent, fledgling technology scene but has been one of the hardest-hit countries in the world when it comes to COVID-19.

“It made the closing of the funding very, very stressful,” Romero said from Barcelona last week (via video conference). “We had a gentleman’s agreement [so to speak] before the virus broke out, but the money was still to be wired. Seeing the world collapse around you, with some accounts closing, and with the bigger business world in a very fragile state, was very nerve wracking.”

Ironically, it’s that fragile state that proved to be a saviour of sorts for Factorial.

“We target HR leaders and they are currently very distracted with furloughs and layoffs right now, so we turned around and focused on how we could provide the best value to them,” Romero said.

The company made its product free to use until lockdowns are eased up, and Factorial has found a new interest from businesses that had never used cloud-based services before but needed to get something quickly up and running to use while working from home. He noted that among new companies signing up to Factorial, most either previously kept all their records in local files or at best a “Dropbox folder, but nothing else.”

The company also put in place more materials and other tools specifically to address the most pressing needs those HR people might have right now, such as guidance on how to implement furloughs and layoffs, best practices for communication policies and more. “We had to get creative,” Romero said.

At $16 million, this is at the larger end of Series A rounds as of January 2020, and while it’s definitely not as big as some of the outsized deals we’ve seen out of the US, it happens to be the biggest funding round so far this year in Spain.

Its rise feels unlikely for another reason, too: it comes at a time when we already have dozens (maybe even hundreds) of human resources software businesses, with many an established name — they include PeopleHR, Workday, Infor, ADP, Zenefits, Gusto, IBM, Oracle, SAP, Rippling, and many others — in a market that analysts project will be worth $38.17 billion by 2027 growing at a CAGR of over 11%.

But as is often the case in tech, status quo breeds disruption, and that’s the case here. Factorial’s approach has been to build HR tools specifically for people who are not HR professionals per se: companies that are small enough not to have specialists, or if they do, they share a lot of the tasks and work with other managers who are not in HR first and foremost.

It’s a formula that Romero said could potentially see the company taking on bigger customers, but for now, investors like it for having built a platform approach for the huge but often under-served SME market.

“Factorial was built for the users, designed for the modern web and workplace,” said Reid Christian, General Partner at CRV, in a statement. “Historically the HR software market has been one of the most lucrative categories for enterprise tech companies, and today, the HR stack looks much different. As we enter the third generation of cloud HR products, with countless point solutions, there’s a strong need for an underlying platform to integrate work across these.”

Powered by WPeMatico

In a small suburb of Melbourne, two entrepreneurs are developing a technology that could mean big changes for the packaging industry.

Stuart Gordon and Mark Appleford are the co-founders of Varden, a company that has developed a process to take the waste material from sugarcane and convert it into a paper-like packaging product with the functional attributes of plastic.

Their technology managed to grab the attention of — and $2.2 million in funding from — Horizons Ventures, the venture capital fund managing the money of Li Ka-shing, one of the world’s wealthiest men.

It’s an opportune time to launch a novel packaging technology, as the European Union has already instituted a ban on single-use plastic items, which will go into effect in 2021. Taking their lead, companies like Nestlé and Walmart have pledged to use only sustainable packaging for products beginning in 2025.

The environmental toll that packaging takes on the earth’s habitats is already a concern for many, and the urgency to find a solution is only mounting with consumers and businesses actually producing more waste in the rush to change consumer behavior and socially distance as a result of the COVID-19 global pandemic.

“I like technologies that focus on carbon reductions,” said Chris Liu, Horizons Ventures’ representative in Australia.

A longtime tech and product executive who had stints at Intel and Fjord, a digital design studio, Liu relocated to Australia recently and has actually taken himself off the grid.

Living in Western Australia, the climate emergency was brought directly to the top of Liu’s mind when the wildfires, which raged through the country, came within two kilometers of his new home.

For Mark Appleford, it wasn’t so much the fires as it was the garbage that kept washing up on the shores of his beloved beaches.

Over beers at a barbecue he began talking to his eventual co-founder, Stuart Gordon, about the environmental problem they’d solve if they had the ability to change things. They settled on plastics.

Working in Appleford’s laundry room they started developing the technology that would become Varden. That early laundry room-work in 2015 led to a small seed round and the company’s long slog to get an initial product in the hands of test customers.

Finagling some time with the New Zealand manufacturer Fisher and Paykel, the two co-founders put together an early prototype of their coffee pods made from sugarcane bagasse, a waste byproduct of the sugar feedstock.

“We worked backwards through customers to supply chain, which led us to material selection, which was something that would allow us to create a product that people understood,” said Gordon.

The production process has evolved to fit inside a 40-foot container that holds the firm’s machine, which takes agricultural waste and converts that waste into packaging.

Instead of using rollers like a paper mill, Varden’s technology uses a thermoform to mold the plant waste into a product that has the same properties as plastic.

It removes a complicated step that’s been essential to the current crop of bioplastics, which use bacteria to convert plant waste into plastic substitutes that are then sold to the industry.

“It looks like paper… you can tear it in half and it sounds like paper when you rip it, and you can throw it in the bin,” said Appleford.

Gordon said that the company’s containers are outperforming commodity based plastics. And the first target for replacement, the founders said, is coffee capsules.

“We went for coffee because it’s the hardest,” said Appleford.

It’s also a huge market, according to the company. Varden estimates there are more than 20 billion coffee pods consumed every year.

With the new money, Varden will begin manufacturing at scale to meet initial demand from pilot customers and is hoping to expand its product line to include medical blister packs in addition to the coffee pods.

“A pilot plant on the products we’re looking at is a pilot plant that can generate 20 million units a year,” said Gordon.

Both men are hoping that their product — and others like it — can usher in a generation of new sustainable packaging materials that are better for the environment at every stage of their life cycle.

“The next generation of packaging will be better… there are plant-based flexibles for your salads, for your potato chips… [But] the next generation of molded packaging is us… bioplastic will ultimately go.”

Powered by WPeMatico

U.S. companies rely on Mexican manufacturers for goods ranging from automotive and aerospace parts, to avocados and other produce, to electronics and furniture. But the trucking system that transports these things across the border relies on an inefficient mix of paper, phone calls, faxes and too many stakeholders who drive up costs.

These snarls congesting border traffic are precisely why Nuvocargo founder and CEO Deepak Chhugani has raised a $5.3 million seed round for a managed marketplace for door to door freight transportation, serving trade routes between the United States and Mexico.

Investment came from both sides of the border. The round was co-led by Silicon Valley-based NFX and Mexico City-based ALLVP. And Nuvocargo marks the first deal for Antonia Rojas-Eing, the youngest female VC in Latin America, under ALLVP, which she joined earlier this year as a partner.

The seed round also saw participation from One Way Ventures, Maya Capital, Magma Partners, the co-founders of Rappi, the former CMO of Cabify and other angels. The total includes earlier backing from Y Combinator, when Nuvocargo existed under a different name.

Chhugani joined Y Combinator’s W18 class with a startup called The Lobby, which sought to connect job seekers to personalized coaches. He raised $1.2 million for the startup, but decided to pivot into logistics and work on Nuvocargo. The change in direction was fairly natural for the Ecuador-raised entrepreneur, who cited his family’s previous work in the Latin American logistics industry.

When the time came to pivot, Chhugani offered investors their money back. Some chose to leave, but Y Combinator elected to stay under the new promise of digitizing trucking between Mexico and the U.S. Nuvocargo says that the $5.3 million seed is its first round, and what they’ve raised to date. Investors who stayed in from The Lobby are part of this round for Nuvocargo.

Nuvocargo, which calls itself a modern managed marketplace for door to door freight transportation, has set up shop with fully bilingual teams in both New York and Mexico.

Mexico is already one of the United States’ largest trade partners, and Chhugani predicts that relationship will only strengthen in the next decade. The U.S.-China trade war shows no signs of easing and tariffs have increased buying friction. With the 2018 United States-Mexico-Canada Agreement that aims to renegotiate NAFTA and uncertainty around coronavirus, Chhugani believes Mexico will become an even more attractive trade opportunity to capitalize on with Nuvocargo.

To the company’s knowledge, U.S.-Mexico trucking is within the top five biggest trade lanes in the world, with 6.5 million trucking shipments going between Mexico and the U.S. every year. Notably, 80% of all the goods transported between the U.S. and Mexico move by truck.

VCs have jumped on the freight and logistics opportunity as startups like NEXT Trucking, Convoy and Flexport secure hundreds of millions dollars from investors like Sequoia and SoftBank.

Now, smaller startups like Nuvocargo that specialize on specific routes and countries are focusing in regionally to bring online these systems that rely on paper, phone calls, faxes and spreadsheets to do business.

Nuvocargo’s free software digitizes the different steps with timestamps, geo tracking and document housing in a centralized cloud-based dashboard, providing a snapshot understanding of every step of a cross border shipment. Customers can request new shipments using Nuvocargo using a WhatsApp integration, email or SMS.

The 15-person startup wants to house the entire shipping process within its tracking software, simplifying the customer experience. The customer, Chhugani says, is any company that needs to move goods between Mexico and the U.S., and he notes that Nuvocargo is working with dozens of customers ranging from beverage companies to multi-billion-dollar corporations — though he declined to specify who.

Chhugani says that in a typical U.S.-Mexico cross-border trucking transaction, up to 12 stakeholders are involved in a single shipment, and that is too many. Multiple people on the U.S. side are procuring the trucks and managing customs, FDA inspection and warehouse storage. On the Mexico side there are even more entities handling scheduling and pick up for the trucking companies and drivers.

With the new seed funding, Nuvocargo will prioritize early hires in product, operations, finance and engineering in its New York and Mexico offices on its fully bilingual team.

Chhugani says he’s especially appreciative of the truck drivers that put themselves in harms way to ensure critical items are getting to the right destination, ensuring shelves are stocked. He says that in this uncertain time, Nuvocargo is working to give drivers predictable business near their homes, and pay them faster. “All of us as a society should be more appreciative of truck drivers and the trucking industry, because this is something that really fuels the economy in both the United States and in Mexico.”

In the current age of the coronavirus pandemic, Nuvocargo says it is focusing significant efforts on working with companies that are transporting essential goods to aid in the supply crisis.

Powered by WPeMatico

Digits, a fintech startup hailing from the same team that built and sold Crashlytics to Twitter, is officially launching today after two years of development. It’s also announcing a $22 million Series B round of funding led by GV, as it makes its public debut.

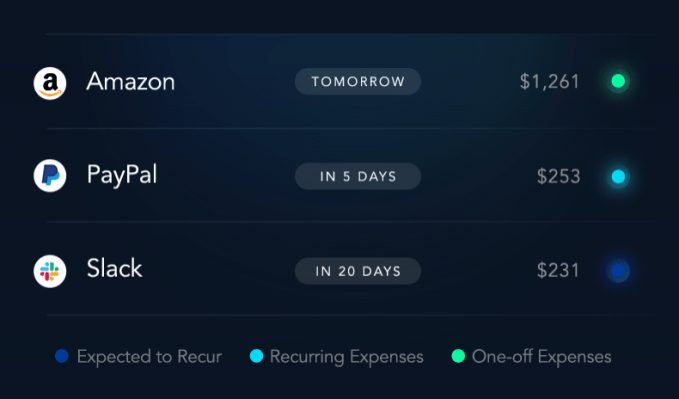

While the company had been fairly quiet about product details while in stealth mode, it’s today unveiling its first product: a visual, machine learning-powered expense monitoring dashboard aimed at startups and small businesses.

The dashboard, called Digits for Expenses, helps business owners track how their company is spending money, by showing things like spend by category, by identifying vendors and recurring expenses and by offering real-time alerts, among other features.

Instead of requiring business owners to make a switch from their existing financial solutions, Digits connects with the accounting software, banks, payroll providers, financial packages, sources of revenue and credit cards the business already uses — like Xero, QuickBooks, NetSuite, Citi, Bank of America or Chase, for example.

Instead of requiring business owners to make a switch from their existing financial solutions, Digits connects with the accounting software, banks, payroll providers, financial packages, sources of revenue and credit cards the business already uses — like Xero, QuickBooks, NetSuite, Citi, Bank of America or Chase, for example.

At launch, the list includes more than 9,000 banks, with support for Xero and NetSuite coming soon.

After setup, Digits will then automatically analyze the company’s spend and visualize it, in real time.

While visualizations of data may be reminiscent of personal finance startup Mint, Digits’ web-based solution is more technical in nature and offers an expanded analysis of the data on hand. Plus, as a business solution, it has to offer features like security, permissioning and collaborative workflows, which results in a more sophisticated product.

Digits also uses machine learning technology to predictively categorize transactions as they happen and the software can alert users to anomalies — like suspicious activity or unexpectedly large transactions — in real time. Business owners can use the dashboard to find out things like how quickly expenses are growing, what the cash flow looks like, where costs can be trimmed, what services are being paid for on a recurring basis and more, and can search for transactions.

Digits also uses machine learning technology to predictively categorize transactions as they happen and the software can alert users to anomalies — like suspicious activity or unexpectedly large transactions — in real time. Business owners can use the dashboard to find out things like how quickly expenses are growing, what the cash flow looks like, where costs can be trimmed, what services are being paid for on a recurring basis and more, and can search for transactions.

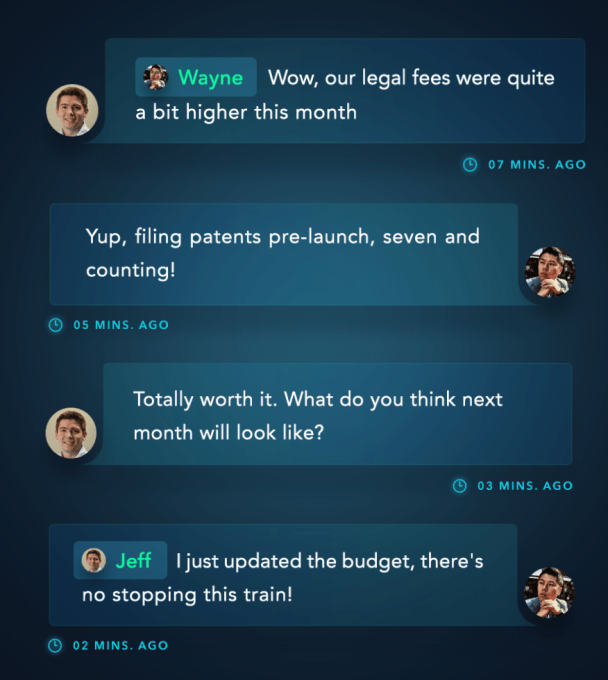

The software also supports the ability to comment on transactions, loop in a colleague to ask for clarification about a charge and upload missing receipts. Everything uses HTTPS along with TLS and certificates so data is encrypted between Digit’s services and at rest.

The original idea for Digits came from a problem that co-founders Wayne Chang and Jeff Seibert faced themselves when building Crashlytics. As they explained previously, their focus as entrepreneurs was on solving technical challenges, not on the operational side of running a business.

Many entrepreneurs also find themselves in this same space. They’re trying to solve a problem or crack a tough engineering puzzle, but instead have to redirect their time and resources to spreadsheets, financial reports, transaction records and other paperwork required to actually run the business.

“Startups and small businesses today simply don’t have the resources to manage their finances internally. Most of them still settle for spreadsheets, and the lucky ones work on an hourly basis with external accountants,” explains Seibert. “As a result, their accounting itself is seen as a cost-center, and they pay for little beyond the basic monthly financial statements — Profit & Loss, Balance Sheet, etc. By the time those statements are delivered — weeks after the end of each month — they’re already out of date,” he said.

That means things businesses need — like updates, one-off reports and new budgets — can require additional costs and longer wait times, so they get skipped.

The COVID-19 pandemic has put even more pressure on small businesses, many of which are now struggling to even survive. As a result, Digits has decided to launch the product for free to those who sign up — not a free trial, but actually free. It plans to later charge for additional products and paid upgrades to support its own business.

Digits is able to make this offer because of its now-expanded venture funding.

Already, the company had raised $10.5 million in Series A funding in a round led by Benchmark. That round had included a sizable 72 angel investors as well, including founders and CEOs from companies like Box, GitHub, Tinder, Twitch, StitchFix, SoFi and several others — entrepreneurs with an understanding of the problems Digits is aiming to solve.

Today, Digits is announcing an additional $22 million led by Jessica Verrilli at GV, who also now joins Digits’ board alongside Benchmark’s Peter Fenton. (Benchmark also participated in the new round).

“Jeff and Wayne are masterful at creating intuitive, high-utility products from complicated data,” said Verrilli about the GV investment. “I saw this up close with Crashlytics and Twitter, and I’m thrilled to partner with them on Digits as they reimagine financial software for startups,” she added.

The startup, now a team of 18 and hiring, was already offering its software solution to a group of customers ahead of today’s public launch, who effectively operated as beta testers allowing Digits to refine its product. Digits isn’t able to share its customer names, for the most part. However, it noted that Coda was one of early adopters and provided valuable feedback.

It also has over 10,000 companies who joined its waitlist over the past two years who are now being let in.

At the time of its Series A, Digits saw more than $1.5 billion in transaction value flowing across its production systems. That number has since grown to $8 billion.

The software is free starting today for U.S.-based small businesses. The company plans to add support for international markets later this year.

Powered by WPeMatico