Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

As a number of startups get back into fundraising in earnest, one that is on a growth tear has closed a substantial debt round to hold on to more equity in the company as it inches to being cash-flow positive. MemSQL — the relational, real-time database used by organisations to query and analyse large pools of fast-moving data across cloud, hybrid and on-premise environments (customers include major banks, telecoms carriers, ridesharing giants and even those building COVID-19 tracing apps) — has secured $50 million in debt, money that CEO Raj Verma says should keep it “well-capitalised for the next several years” and puts it on the road to an IPO or potential private equity exit.

The funding is coming from Hercules Capital, which has some $4.3 billion under management and has an interesting history. On the one hand, it has invested in companies that include Facebook (this was back in 2012, when Facebook was still a startup), but it has also been in the news because its CEO was one of the high fliers accused in the college cheating scandal of 2019.

MemSQL does not disclose its valuation, but Verma confirmed it is now significantly higher than it was at its last equity raise of $30 million in 2018, when it was valued at about $270 million, per data from PitchBook.

Why raise debt rather than equity? The company is already backed by a long list of impressive investors, starting with Y Combinator and including Accel, Data Collective, DST, GV (one of Google-owner Alphabet’s venture capital vehicles), Khosla, IA Ventures, In-Q-Tel (the CIA-linked VC) and many more. Verma said in an interview with TechCrunch that the startup had started to look at this fundraise before the pandemic hit.

It had “multiple options to raise an equity round” from existing and new investors, which quickly produced some eight term sheets. Ultimately, it took the debt route mainly because it didn’t need the capital badly enough to give up equity, and terms “are favourable right now,” making a debt facility the best option. “Our cash burn is in the single digits,” he said, and “we still have independence.”

The company has been on a roll in recent times. It grew 75% last year (note it was 200% in 2018) with cash burn of $8-9 million in that period, and now has annual recurring revenues of $40 million. Customers include three of the world’s biggest banks, which use MemSQL to power all of its algorithmic trading, major telecoms carriers, mapping providers (Verma declined to comment on whether investor Google is a customer), and more. While Verma today declines to talk about specific names, previous named customers have included Uber, Akamai, Pinterest, Dell EMC and Comcast.

And if the current health pandemic has put a lot of pressure on some companies in the tech world, MemSQL is one of the group that’s been seeing a strong upswing in business.

Verma noted that this is down to multiple reasons. First, its customer base has not had a strong crossover with sectors like travel that have been hit hard by the economic slowdown and push to keep people indoors. Second, its platform has actually proven to be useful precisely in the present moment, with companies now being forced to reckon with legacy architecture and move to hybrid or all-cloud environments just to do business. And others like True Digital are specifically building contact-tracing applications on MemSQL to help address the spread of the novel coronavirus.

The company plays in a well-crowded area that includes big players like Oracle and SAP. Verma said that its tech stands apart from these because of its hybrid architecture and because it can provide speed improvements of some 30x with technology that — as we have noted before — allows users to push millions of events per day into the service while its users can query the records in real time.

It also helps to have competitive pricing. “We are a favourable alternative,” Verma said.

“This structured investment represents a significant commitment from Hercules and provides an example of the breadth of our platform and our ability to finance growth-orientated, institutionally-backed technology companies at various stages. We are impressed with the work that the MemSQL management team has accomplished operationally and excited to begin our partnership with one of the promising companies in the database market,” said Steve Kuo, senior managing director technology group head for Hercules, in a statement.

Powered by WPeMatico

“Is Greta Thunberg a hypocrite?” Google that phrase and you will get thousands of results. It just goes to show that, to a large extent, the “Q&A” model is broken on the internet. Where once Yahoo Answers and Quora were considered the bright young things of Web 2.0’s “Read/Write Web,” today there is only the chaos of myriad search results. Let’s face it, many have tried to really crack Q&A (remember “Mahalo”?), but few ever got very far — and most became zombie sites.

But look again and you will notice something. A site called Parlia sits at No. 3 on that search result for “Is Greta Thunberg a hypocrite.” But Parlia only launched (in stealth mode) in October last year.

So how can this be?

Well, this upstart in the Q&A space has now closed a pre-seed round of funding from Bloomberg Beta, Tiny VC and others (amount undisclosed).

And as founder, and former journalist, Turi Munthe tells me, the idea here is Parlia will become an “encyclopedia of opinion.”

“We’re a wiki: mapping out all the perspectives on both the breaking stories and controversies of the day, as well as the big evergreen questions: does God exist? Is Messi really better than Ronaldo? The way we’re building is to also help fix today’s polarisation, outrage and information silo-ing,” he tells me.

While most Q&A sites are geared around X versus Y, and focused on rational debate, Parlia is trying to map ALL the opinions out there: flat earthers’ included. It’s aiming to be descriptive not prescriptive, and is closer to a wiki, unlike Quora, where the authors are often selling “something” as well as themselves as experts.

The site is already on a tear. And also highly appropriate for this era.

Right now top subjects include “How to stay healthy during quarantine at home?” or “What are the effects of spending long periods in coronavirus isolation?” or “Will the coronavirus crisis bring society together?” The list goes on. Users see the arguments calmly, dispassionately laid out, alongside counter-arguments and all the other arguments and positions.

Says Munthe: “In 2016, I realized the age of political consensus was over. I watched as Britain spilt maybe a trillion words of argument in the build-up to the Brexit Referendum and thought: there are no more than a half-dozen reasons why people will vote either way.”

He realized that if there’s a finite number of arguments around something as huge and divisive as Brexit, then this would be true for everything. Thus, you could theoretically map the arguments around gun control, abortion, responses to the coronavirus, the threat of AI and pretty much everything.

So why would anyone want to do that? It’s, of course, a good thing in itself and would help people understand what they think as well as help them understand how the rest of the world thinks.

Luckily, there is also a business model. It will potentially carry ads, sponsorships, membership and user donations. Another is data. If they get it right, they will have surfaced foundational information about the very ways we think.

Munthe thinks all the users will come through Search. “The media opportunity, we think, is 100 million-plus pageviews/month,” he says.

Munthe’s co-founder is J. Paul Neeley, former professor of the Royal College of Art, and a service designer who’s worked with Unilever and the U.K.’s Cabinet Office. Munthe himself has been exploring the systemic issues of the media ecosystem for some time. From founding a small magazine in Lebanon, reporting in Iraq in 2003, then starting and exiting Demotix, to launching North Base Media (a media-focused VC).

The temptation, of course, is to allow bias to creep in return for commercial deals. But, says Menthe: “We will never work with political parties, and we will set up our own ethics advisory board. But that understanding should be of value to market researchers and institutions everywhere.”

So now you can find out how coronavirus will change the world.

Powered by WPeMatico

Imagine a model of collaborative research and development among hospitals, pharmaceutical companies, universities and other research institutions where no one shared any actual data.

That’s the dream of the new New York-based startup Owkin, which has raised $25 million in fresh financing from investors, including Bpifrance Large Venture, Cathay Innovation and MACSF (the French Pension Fund for Clinicians), alongside previous investors GV, F-Prime Capital and Eight Roads.

The company’s pitch is that data scientists, clinical doctors, academics and pharmaceutical companies can all log in to the virtual lab that Owkin calls the Owkin Studio.

In that virtual environment, all parties can access anonymized data sets and models exclusively to refine their own research and development and studies to ensure that the most cutting-edge insights into novel biomarkers, mechanisms of action and predictive models inform the work that all of the relevant parties are doing.

The ultimate goal, the company said, is to improve patient outcomes.

In its quest to get more companies and institutions to open up and share information — with the promise that the information can’t be extracted or used in a way that isn’t allowed by the owners of the data — Owkin is replicating work that other companies are pursuing in fields ranging from healthcare to financial services and beyond.

The Israeli company Qedit has developed similar technologies for the financial services industry, and Sympatic, a recent graduate from one of the recent batches of Techstars companies, is working on a similar technology for the healthcare industry.

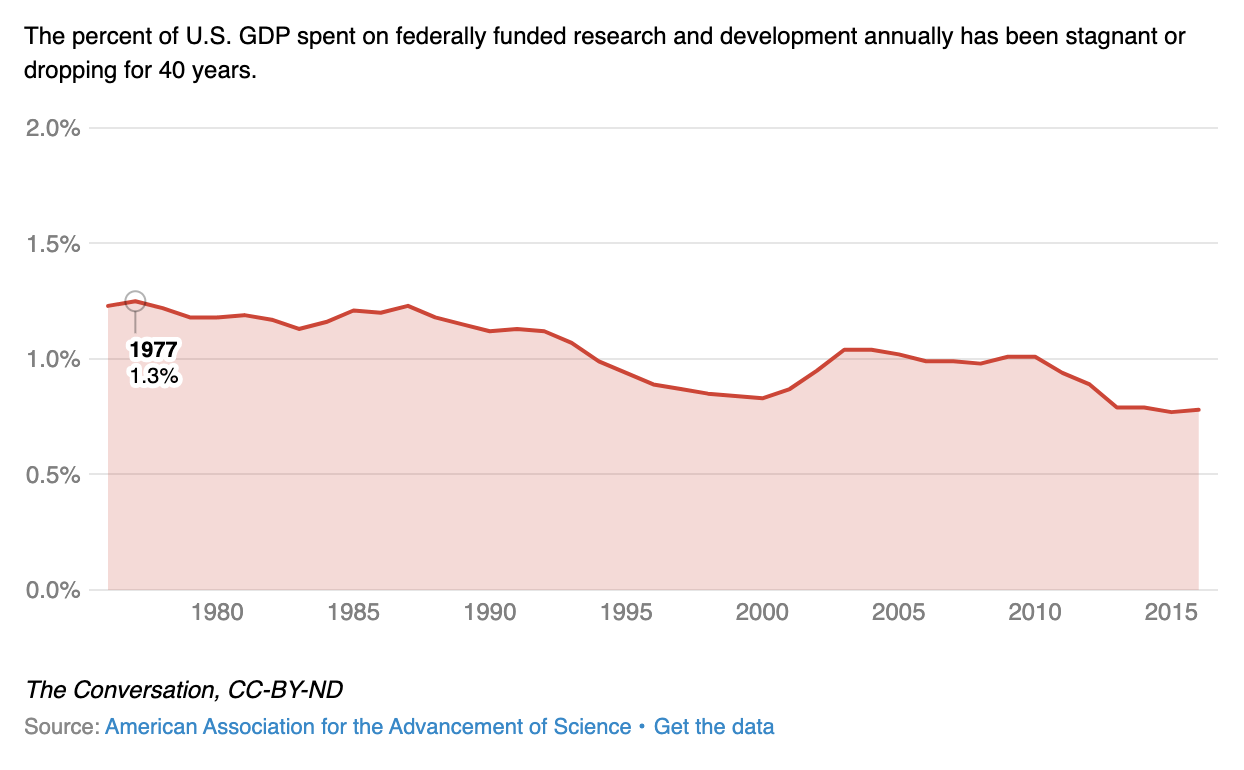

Owkin makes money by enabling remote access to the data sets for pharmaceutical companies and licensing the models developed by universities to those companies. It’s a way for the company to entice researchers to join the platform and provide another revenue stream for research institutions who have seen their funding decline over the last 40 years.

“We have a huge loop of academic universities that have access to the data and are developing algorithms and we share data,” said the company’s chief executive Dr. Thomas Clozel. “At the end what it helps is developing better drugs.”

Declines in federal funding for scientific research since the 1980s (Image courtesy of The Conversation)

The investment from Owkin’s new and existing investors takes the company to $55 million in total capital raised through the extension of its Series A round. In all, the round totaled $52 million, Clozet said.

“We are exactly where we need to be because it’s about privacy and privacy is more important than ever before,” said Clozet.

The COVID-19 epidemic has emphasized the need for closer collaboration among different corporations and research institutions, and that has also increased demand for the company’s technology. “It touches everything… We have access to the right data sets and centers to build the best models for COVID,” said Clozet. “We’re lucky to have the right traction before the COVID happens and we have the right research that has been done.”

In fact, the company has launched the Covid-19 Open AI Consortium (COAI), and is using its platform to advance collaborative research and accelerate clinical development of effective treatments for patients infected with the coronavirus, the company said. All of its findings will be shared with the global medical and scientific communities.

The initial focus on the research is on cardiovascular complications in COVID-19 patients in collaboration with CAPACITY, an international registry working with over 50 centers worldwide, the company said. Other areas of research will include patient outcomes and triage, and the prediction and characterization of immune response, according to Owkin.

“Since we first backed Owkin in 2017, we have been sharing its vision to apply AI to fighting one of the most dreadful diseases on earth: cancer,” said Jacky Abitbol, a partner at Cathay Innovation. “Owkin has risen to become a leader in digital health, we are proud to grow our investment in the company to fuel its ambition to pioneer AI for medical research, while preserving patient-privacy and data security.”

Powered by WPeMatico

ReadySet, a diversity, equity and inclusion startup led by Project Include founding member Y-Vonne Hutchinson, has raised its first, and perhaps last, round of funding from Indie.vc.

“We were lucky enough to close our round right as the coronavirus was hitting and then shifted our business to doing remote stuff that offered connection,” Hutchinson told TechCrunch.

For the last five years, ReadySet has been sustaining itself off of revenue, and in the last year saw about $1 million in annual revenue. ReadySet makes money by offering consulting services to companies looking to create more inclusive workplaces and cultures. ReadySet has worked with companies like Salesforce, Airbnb, Amazon, GitHub, UCSF Health, Mailchimp, Medium and many others.

“We’ve been profitable the entire time we’ve been in business,” Hutchinson said. “But we wanted to be able to maximize our impact beyond in-person training services and doing stuff that felt a little more like product development that didn’t necessitate immediate revenue.”

ReadySet decided to take funding from Indie.vc because of the firm’s focus on startups that are profit-driven, she said. She also “didn’t want to give up a huge chunk of ownership in a firm I built from scratch.”

Indie.vc doesn’t take any equity upfront. If a startup in its portfolio raises additional money or sells, Indie.vc converts its investment to equity at a percentage decided on by the company. If the company never sells or never raises another round, Indie.vc gets a share of the company’s revenue until the firm makes 5x its investment.

“They weren’t interested in taking a big chunk of the business but were instead interested in helping us get more profitable,” she said. “For me, as a founder that has not been in the VC space, it’s been hard to be seen as a real entrepreneur.”

Indie.vc aims to be the last outside financing founders ever need to take. For Hutchinson, she said that could be the case.

“I don’t want to be the kind of founder that chases the next round,” she said. “I want to smartly leverage the funding and continue our profitability and do it at scale. I think some founders get stuck doing that and then don’t focus on the product.”

In light of these trying times amid the COVID-19 pandemic, ReadySet is investing more heavily in remote training offerings.

“We’re really sort of looking for ways we can resource companies trying to rethink digital interaction,” she said. “I also think a lot of people or some people think this is a blip on the radar and we’ll go back to normal. We don’t think that is necessarily going to happen.”

Despite these rocky times where many tech companies are laying off staff members and putting some on furlough, Hutchinson said some companies have doubled down on what they’re doing in terms of workplace culture.

In past recessions, where diversity, equity and inclusion has been seen as a ” ‘nice to have,’ there is an existential threat that has changed the way we live and the way we have to show up at work,” Hutchinson said.

People are now isolated or needing to take care of family, she says. Perhaps they’re drinking more and/or working through grief, loss and death — all of which are traumatic, she said.

“All of those issues actually implicate DE&I,” Hutchinson said. “We’re used to siloing it, but in reality, DE&I speaks to how people show up, how they feel included, how we support people and now, more than ever, that’s really important.”

Hutchinson says her clients are asking her more about mental health, belonging, childcare and bringing compassion into these trying times.

“A lot of tech companies don’t necessarily have strong management cultures,” she said. “Those gaps are now becoming really obvious to people. I think we’re all in a place where we’re trying to figure out how we adjust to what’s going on now. It’s about so much more than work right now. I would encourage companies, even if they don’t consider that to be DE&I, to think about how they’re treating their employees.”

Powered by WPeMatico

“Assembly” may sound like one of the simpler tests in the manufacturing process, but as anyone who’s ever put together a piece of flat-pack furniture knows, it can be surprisingly (and frustratingly) complex. Invisible AI is a startup that aims to monitor people doing assembly tasks using computer vision, helping maintain safety and efficiency — without succumbing to the obvious all-seeing-eye pitfalls. A $3.6 million seed round ought to help get them going.

The company makes self-contained camera-computer units that run highly optimized computer vision algorithms to track the movements of the people they see. By comparing those movements with a set of canonical ones (someone performing the task correctly), the system can watch for mistakes or identify other problems in the workflow — missing parts, injuries and so on.

Obviously, right at the outset, this sounds like the kind of thing that results in a pitiless computer overseer that punishes workers every time they fall below an artificial and constantly rising standard — and Amazon has probably already patented that. But co-founder and CEO Eric Danziger was eager to explain that this isn’t the idea at all.

“The most important parts of this product are for the operators themselves. This is skilled labor, and they have a lot of pride in their work,” he said. “They’re the ones in the trenches doing the work, and catching and correcting mistakes is a big part of it.”

“These assembly jobs are pretty athletic and fast-paced. You have to remember the 15 steps you have to do, then move on to the next one, and that might be a totally different variation. The challenge is keeping all that in your head,” he continued. “The goal is to be a part of that loop in real time. When they’re about to move on to the next piece we can provide a double check and say, ‘Hey, we think you missed step 8.’ That can save a huge amount of pain. It might be as simple as plugging in a cable, but catching it there is huge — if it’s after the vehicle has been assembled, you’d have to tear it down again.”

This kind of body tracking exists in various forms and for various reasons; Veo Robotics, for instance, uses depth sensors to track an operator and robot’s exact positions to dynamically prevent collisions.

But the challenge at the industrial scale is less “how do we track a person’s movements in the first place” than “how can we easily deploy and apply the results of tracking a person’s movements.” After all, it does no good if the system takes a month to install and days to reprogram. So Invisible AI focused on simplicity of installation and administration, with no code needed and entirely edge-based computer vision.

“The goal was to make it as easy to deploy as possible. You buy a camera from us, with compute and everything built in. You install it in your facility, you show it a few examples of the assembly process, then you annotate them. And that’s less complicated than it sounds,” Danziger explained. “Within something like an hour they can be up and running.”

Once the camera and machine learning system is set up, it’s really not such a difficult problem for it to be working on. Tracking human movements is a fairly straightforward task for a smart camera these days, and comparing those movements to an example set is comparatively easy, as well. There’s no “creativity” involved, like trying to guess what a person is doing or match it to some huge library of gestures, as you might find in an AI dedicated to captioning video or interpreting sign language (both still very much works in progress elsewhere in the research community).

As for privacy and the possibility of being unnerved by being on camera constantly, that’s something that has to be addressed by the companies using this technology. There’s a distinct possibility for good, but also for evil, like pretty much any new tech.

One of Invisible’s early partners is Toyota, which has been both an early adopter and skeptic when it comes to AI and automation. Their philosophy, one that has been arrived at after some experimentation, is one of empowering expert workers. A tool like this is an opportunity to provide systematic improvement that’s based on what those workers already do.

It’s easy to imagine a version of this system where, like in Amazon’s warehouses, workers are pushed to meet nearly inhuman quotas through ruthless optimization. But Danziger said that a more likely outcome, based on anecdotes from companies he’s worked with already, is more about sourcing improvements from the workers themselves.

Having built a product day in and day out year after year, these are employees with deep and highly specific knowledge on how to do it right, and that knowledge can be difficult to pass on formally. “Hold the piece like this when you bolt it or your elbow will get in the way” is easy to say in training but not so easy to make standard practice. Invisible AI’s posture and position detection could help with that.

“We see less of a focus on cycle time for an individual, and more like, streamlining steps, avoiding repetitive stress, etc.,” Danziger said.

Importantly, this kind of capability can be offered with a code-free, compact device that requires no connection except to an intranet of some kind to send its results to. There’s no need to stream the video to the cloud for analysis; footage and metadata are both kept totally on-premise if desired.

Like any compelling new tech, the possibilities for abuse are there, but they are not — unlike an endeavor like Clearview AI — built for abuse.

“It’s a fine line. It definitely reflects the companies it’s deployed in,” Danziger said. “The companies we interact with really value their employees and want them to be as respected and engaged in the process as possible. This helps them with that.”

The $3.6 million seed round was led by 8VC, with participating investors including iRobot Corporation, K9 Ventures, Sierra Ventures and Slow Ventures.

Powered by WPeMatico

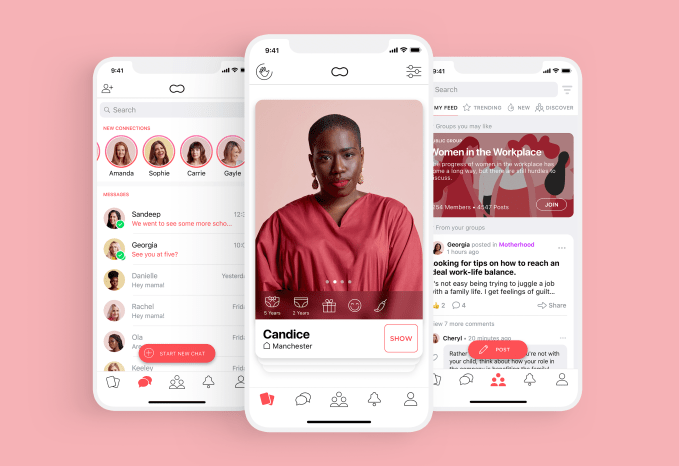

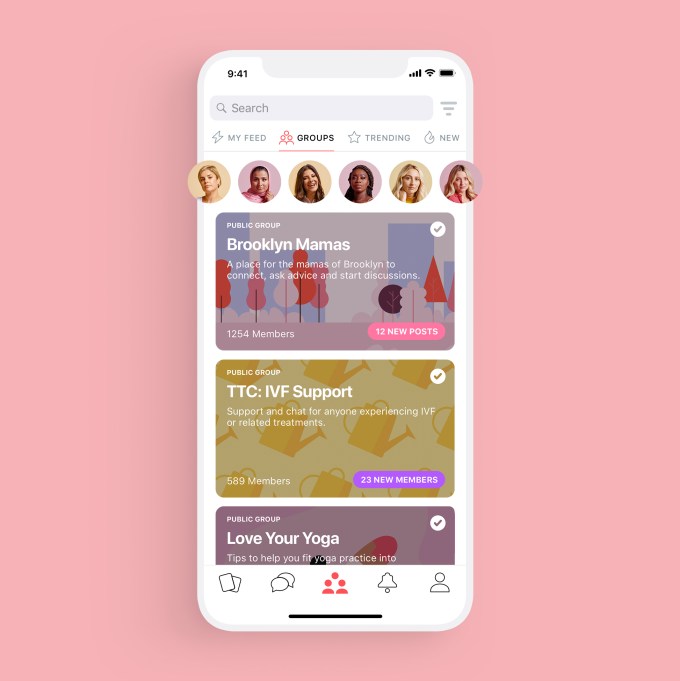

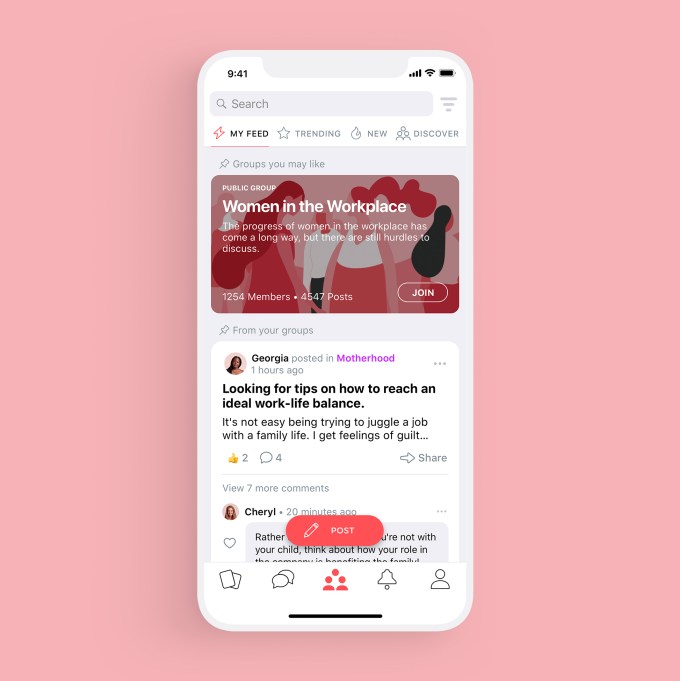

Peanut, an app that began as a tool for finding new mom friends, has evolved into a social network now used by 1.6 million women to discuss a range of topics, from pregnancy and parenthood to marriage and menopause, and everything in between. On the heels of significant growth in online networking fueled by the COVID-19 pandemic, the company is today announcing the close of a $12 million Series A round of funding, led by EQT Ventures, a multi-stage VC firm that invests in companies across Europe and the U.S.

Index Ventures and Female Founders Fund also participated, bringing Peanut’s total raise to date to $21.8 million.

The round itself closed just weeks ago — arriving at a time when the coronavirus pandemic is impacting the startup world, often drying up venture capital for emerging companies. Some startups, as a result, have laid off employees to self-sustain, while others have sought exits or even folded.

Peanut, on the other hand, has seen rapid growth for its platform as women looked for a supportive online environment to discuss their own concerns over how COVID-19 was impacting their lives.

Many women participating in Peanut’s newer “Trying to Conceive” group, for example, worried about their canceled IVF rounds and how to plan for the future. Current moms-to-be wanted to hear from others about how COVID-19 would impact their hospital delivery plans. And others stuck working at home with kids looked for advice and coping strategies.

Since the outbreak, Peanut has seen engagement across its app increase by 30% and content consumption increase by 40%. Its total community also grew from 1 million users in December 2019 to now 1.6 million, as of April.

“We’re really lucky in that we’re growing and that we are, for the most part, untouched by what’s happening,” says Peanut founder and CEO Michelle Kennedy. “And actually, if anyone needed community more, it’s now,” she added.

Though the pandemic has sent the app’s usage skyrocketing, it has also readjusted Peanut’s priorities with regard to its roadmap.

Most notably, its friend-finding feature needs a rethink.

Peanut originally worked as a sort of “Tinder for mom friends” — an idea that arose from Kennedy’s personal experience with how difficult it was to forge female friendships after motherhood. As the former deputy CEO at dating app Badoo and an inaugural board member at Bumble, she brought her extensive experience in matchmaking apps to Peanut, which uses a similar swipe-based mechanism.

But COVID-19 has up-ended this side of Peanut’s business. Today, Peanut users are meeting in Zoom chat rooms to hangout or play games, but not in person.

Kennedy says the company will try to meet these users where they are with the development of more video networking features, potentially with technology built in-house. Other plans for the new capital include improvements to the social discovery aspects of its app, the development of a web version of Peanut, and the creation of more groups beyond those focused on fertility and motherhood, which have so far been core to the Peanut experience.

Specifically, the company soon plans to launch a new community focused on women living with menopause, an experience that will reach more than a billion women by 2025. Despite the fact that all women with ovaries will go through menopause, there are relatively few online communities dedicated to it — which Peanut sees as an untapped market.

Peanut’s real strength, however, is not in the types of communities it grows on its platform, but how they’re created.

There has not yet been a social network that focused on “building a platform for women, thinking about women’s needs and built by a women,” explains Kennedy. “So what we end up doing is using things that already exist — trying to twist them and mold them into what we need, and never getting it exactly right,” she says. “We can do better than that.”

One small example of this is the recent launch of Peanut’s “Mute Keywords” feature that allows women to remove certain types of discussions from their feeds and notifications. Some women used this to create a coronavirus-free news feed that focused on other aspects of motherhood. Others who were trying to conceive muted conversations around “pregnancy,” which they found emotionally triggering.

With the Series A’s close, Peanut says Naza Metghalchi from EQT Ventures joins the company’s majority-female board, alongside Hannah Seal from existing investor Index Ventures.

“Peanut’s user engagement metrics are a testament to the app’s ability to act as a true emotional companion throughout women’s journeys,” said Naza Metghalchi, venture lead and investment advisor at EQT Ventures, in a statement. “The EQT Ventures team is excited to partner with Michelle and continue to grow Peanut into a platform that serves all women at different life milestones, exploring topics beyond fertility and motherhood which have already seen such huge traction.”

The additional funding allows London-based Peanut to expand its business and hire more engineers to join its current team of just 16.

“I think having closed a round in this climate is great for the team,” says Kennedy. “It’s also great for the community because it means that we can grow the team, build quicker, build faster and develop the product more quickly,” she adds.

Powered by WPeMatico

Orca Security, an Israeli cloud security firm that focuses on giving enterprises better visibility into their multi-cloud deployments on AWS, Azure and GCP, today announced that it has raised a $20 million Series A round led by GGV Capital. YL Ventures and Silicon Valley CISO Investments also participated in this round. Together with its seed investment led by YL Ventures, this brings Orca’s total funding to $27 million.

One feature that makes Orca stand out is its ability to quickly provide workload-level visibility without the need for an agent or network scanner. Instead, Orca uses low-level APIs that allow it to gain visibility into what exactly is running in your cloud.

The founders of Orca all have a background as architects and CTOs at other companies, including the likes of Check Point Technologies, as well as the Israeli army’s Unit 8200. As Orca CPO and co-founder Gil Geron told me in a meeting in Tel Aviv earlier this year, the founders were looking for a big enough problem to solve and it quickly became clear that at the core of most security breaches were misconfigurations or the lack of security tools in the right places. “What we deduced is that in too many cases, we have the security tools that can protect us, but we don’t have them in the right place at the right time,” Geron, who previously led a security team at Check Point, said. “And this is because there is this friction between the business’ need to grow and the need to have it secure.”

Orca delivers its solution as a SaaS platform and on top of providing work level visibility into these public clouds, it also offers security tools that can scan for vulnerabilities, malware, misconfigurations, password issues, secret keys in personally identifiable information.

“In a software-driven world that is moving faster than ever before, it’s extremely difficult for security teams to properly discover and protect every cloud asset,” said GGV managing partner Glenn Solomon . “Orca Security’s novel approach provides unparalleled visibility into these assets and brings this power back to the CISO without slowing down engineering.”

Orca Security is barely a year and a half old, but it also counts companies like Flexport, Fiverr, Sisene and Qubole among its customers.

Powered by WPeMatico

API-powered startups are having a good year, with Plaid’s mega-exit to Visa still fresh in mind. And digital video-powered startups are also having a good year, as the world stays home more than before and work shifts to a more remote-friendly landscape. What about a company that does both?

Well, they’d probably raise money and see their usage spike, right? That’s precisely the case with Daily.co, a startup that has both raised new capital this year and has seen usage of its product rapidly rise.

In simple terms, Daily.co is a startup that provides an API that lets users and customers quickly integrate video chat into their product or website.

Today’s news is that Daily.co put together a $4.6 million round that was led by Jenny Lefcourt from Freestyle. The round was closed in January, but announced this week. (It’s common for venture rounds to close and then ripen in a dark cellar before they are uncorked and shared with the world, though increased Form D vigilance is changing the game.)

Freestyle was not alone in the new round. The investment was funded by a bevy of investors, including three new institutional investors (Moxxie, Slack Fund, SV Angel), and a host of angels (April Underwood, Sarah Imbach, Ellen Levy and Elizabeth Weil, among others). Three prior investors also took part: Haystack, TenOneTen and Root.

If the round didn’t have a lead investor the deal would feel like a unicorn-era party round. Daily.co previously raised $2.5 million in 2016, co-founder Kwindla Hultman Kramer told TechCrunch in an interview. TechCrunch’s first question was how the startup lasted so long on just a few million dollars. The answer was a surprise.

Daily.co’s path to an API-powered service was not as simple as you’d imagine. In fact, it’s the first startup I’ve ever spoken to that used a hardware product as a temporary method of funding itself.

According to Kramer, his company built and sold a video-conferencing hardware box that it sold for a few hundred dollars and a regular stream of SaaS payments (you can read more about it here, and here, if you want to go spelunking). The income its boxes generated helped the startup keep at its longer-term plan of building a WebRTC-powered API.

According to the firm, handling a “non-trivial” number of minutes via that first product was also an important learning mechanism.

Daily.co’s thesis that the live video tooling that large companies built into expensive conference rooms would come to everyone’s pocket now feels somewhat obvious. But back in 2015 when the company got started (it went through Y Combinator in 2016) the future wasn’t as clear.

A few market trends came together to make the company’s original vision bear out, including growing device power (your new iPhone has more oomph than your old iPhone), better, faster internet penetration, and the uptake of the WebRTC protocol. As each trend matured, Daily.co’s product wager has gone from possible to likely to existing in the market.

After moving away from the hardware world, Daily.co launched its video chat API in 2019, a year in which the company did not grow its staffing. However, 2020 has seen the startup’s headcount quickly expand (recall that this round was closed in January) and its usage skyrocket — according to Kramer, Daily.co has seen 12x usage growth in the last six weeks.

Daily.co charges a hybrid price for its service, including a small SaaS fee and usage costs. Given that it is a SaaS company, effectively, TechCrunch was curious about its margins. According to Kramer, the firm’s margins are attractive, and there are ways for the startup to actively manage its bandwidth costs (thus lowering revenue costs, and bolstering its gross margin profile). So, the startup should be valued at a SaaS multiple during its life.

Looking ahead, Daily.co is seeing increased attention from larger companies, it told TechCrunch, something that could power future growth. But those clients will require hand-holding, we presume, which means an ever-larger staff. It will be interesting to see how much Daily.co can grow in people and revenue terms in 2020 while the rest of the global economy slips into negative territory. More when we have it.

Powered by WPeMatico

There are some startups that behave like sprinters, and others that run a marathon. I came across Instabug when I was in Cairo in 2013. Born during the chaotic era of the Arab Spring, this plucky startup managed to make it to TechCrunch Disrupt, then Y Combinator in 2016, then a $1.7 million in seed round led by Accel Partners. Originally part of the Egyptian accelerator Flat6Labs Cairo, they raised $300,000 from angel investors in 2013.

Today they announced a $5 million Series A round, once again led by Accel . Other angel investors joining include Amr Awadallah, co-founder of Cloudera, and Jim Payne, founder and CEO of MoPub, both of whom have invested previously.

Instabug provides mobile developers with real-time insights throughout the app life cycle, with its bug and feedback reporting, secure crash reporting and in-app surveys. All the more important these days, given so many people are relying on apps during their pandemic lockdowns.

Omar Gabr, co-founder and CEO of Instabug, said in a statement: “We’ve been working with Accel since 2016 and we’re very excited to continue our partnership. We grew 120% in revenues in the last 12 months, adding dozens of Enterprise customers. We’ve always been running a disciplined business, we’re almost profitable for some time now. This is what made our fundraising fast in the middle of all the current events. Our fundraising conversations with Accel started after the pandemic outbreak.”

Instabug says that since the COVID-19 outbreak, it has seen a “massive surge” in usage, which has grown 45% since January. It’s also designed to streamline the communication between QA and developers, which is very relevant now, as many are working remotely.

Some 28 of the top 100 apps on the App Store use Instabug. Several competitors have been acquired, including Crashlytics (by Google) and HockeyApp (by Microsoft).

Given that the startup still has most of its team in Egypt, this is once again a great win for the MENA region.

Powered by WPeMatico

Oxwash, a UK-based laundry startup that’s aiming to disrupt traditional but environmentally costly washing and dry-cleaning processes by using ozone to sterilize fabrics at lower temperatures, along with electric cargo bikes for hyper local pick ups and deliveries, has bagged a £1.4 million (~$1.7M) seed.

Backers in the funding round include TrueSight Ventures, Biz Stone (co-founder of Twitter), Paul Forster (founder of Indeed.com), Founders Factory and other unnamed angel investors.

Prior to this, Oxwash was working with a £300k pre-seed round — which it used to fund building its first washing hubs (which it calls “Lagoons”) and to test its reengineered washing process.

The startup’s pitch is that its applying “space age” technology to clean dirty laundry, burnished by the claim that its co-founder and CEO, Kyle Grant, is a former NASA engineer — having spent two years as a systems engineer where he researched the use and effect of microorganisms for extended space travel.

That said, it’s packing its reengineered cleaning system into standard (but “massively” modified) industrial washing machines. Just add coronavirus-safe ‘space suits’ (er, PPE)….

“Washing still has crazy carbon emissions, pollution and collection/delivery services cause large amounts of congestion. We saw a way to re-engineer the laundry process from the ground up and to be the first truly sustainable, space-age laundry company in the world,” says Grant, discussing the opportunity he and his co-founder spied to rethink laundry.

“We’re developing processes to have zero net carbon emissions for the whole laundry process — from collection to washing and back to delivery.”

The team is developing “chemistry that works at 20˚C better than at 40˚C or higher, integrating ozone disinfection to remove microorganisms by oxidation rather than using heat and developing water recycling and filtration systems to reduce water consumption and remove microfibre pollution at the same time”, per Grant.

It’s also structuring business operations to locate washing hubs in city centres, where its customers are based, so it can make use of electric bikes for moving the laundry around — allowing for a next day service with 30 minute collection and delivery windows.

“Traditional washing processes use huge amounts of water, energy to heat said water, harsh chemicals and normal petrol/diesel vans for the collections and deliveries. These process warehouses are usually located outside of cities and there are large lags in when items are returned to the customers (up to two weeks),” he further claims.

While ozone itself is a pollutant that degrades air quality, and can even be dangerous if released, Grant says the ozone used in its cleaning machines — which is produced from oxygen in the atmosphere — degrades back to oxygen “within minutes and is therefore inert and safe”.

“After extensive analysis ozone is far safer to use in commercial laundry processes than heat and harsh chemicals such as peroxides (bleach),” he suggests.

On safety, he also says their washing machines are modified to be sealed whilst “washing and disinfecting”, and can only be opened after the ozone has degraded. “Our lagoons are also fitted with ozone sensors that will cut off our generators if the ozone concentration in the air ever goes over the safe limit,” he adds. “Thankfully this has never occurred. The risks to our staff are far lower than when working with boiling water tanks, harsh chemicals and manual handling, the usual work flow in commercial laundries.”

Oxwash launched in the UK in early 2018 and now has more than 4,000 individual customers, per Grant, along with “several hundred” business customers — including the Marriott Hotel Chain, NHS GP practices, London Marathon and Universities of Oxford and Cambridge.

It’s executed a slight pivot of focus over the past two months — spying an opportunity to target risks related to the coronavirus. “We’ve developed a service in the last 2 months that is available to provide coronavirus disinfection,” he says in a statement. “We are working closely with [the UK’s National Health Service] NHS and vulnerable groups to provide support when needed.”

“We have adopted laboratory-grade PPE [personal protective equipment] processes, heavily inspired and adapted from my time working at NASA but also from guidelines from the NHS and HSE England,” Grant adds. “For example, we now perform contactless collections and deliveries whereby the customers pre-bag their items in supplied dissolvable bags. Our rider then has gloves, goggles and a respirator to perform the transfer back to the lagoon where a member of our team in full hazmat gear will load and unload the machines where disinfection is performed.”

Before the COVID-19 pandemic, he says the startup was getting traction from customers wanting to remove allergens that caused them allergic reactions.

“We were confident of moving into the healthcare market in the years to come but usually the tender process for such contracts is not conducive to a startup,” says Grant. “However since the advent of COVID-19 and our ongoing healthcare certification, we have seen a huge increase in the value of proper hygiene to both the individuals and businesses we serve. The Marriott Hotel chain and Airbnb have both expressed serious intent to work on a non-healthcare hygiene rating much like that of the Food Standards Authority. We are working with CINET (the international textile committee) to bring this to market with our technology and processes.”

The seed funding will be used to expand to more cities within the UK and Europe — with London and other European hubs, such as Paris and Amsterdam, in its sights. Its initial two locations are Oxford and Cambridge.

It’s also going to spin up on the hiring front, planning to add a head of growth and head of tech, as well as new operational roles in London.

Ploughing more resource into software dev is another focus, with funding going to expand the tech stack and the software systems which run its logistics and integrate with its digitised washing process. More work on its app is also planned.

Asked what makes Oxwash a scalable business, Grant points to the development of this proprietary software alongside the reengineered washing service. “This iteration of technology and service allows us to develop our washing technology rapidly and get real-time feedback on the end-product and service from our customers,” he says. “The scalable technology element is the proprietary washing process driven by our bespoke software stack and process algorithms.”

On the labor side, Grant says Oxwash is “working towards a B Corp accreditation”.

“[We] have long held that our team should be properly reimbursed for their work but also as ambassadors for our brand out on our bikes. To that end all of our riders (couriers) are fully employed and like the rest of the team they are paid in excess of the national living wage,” he adds.

Powered by WPeMatico