Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Ettitude, the Los Angeles-based, direct-to-consumer startup making sustainable bedding and sleepwear from bamboo fibers, has raised a sustainably sized round that should keep the company going even in the face of an economic recession.

Co-founded by the Melbourne, Australia native Phoebe Yu and serial entrepreneur Kat Dey, ettitude sells high-end bamboo bedding made using a process she first heard about in her old job working as an exporter helping chain stores source textiles in China.

Sourced from a factory in Zhejiang, China, near Shanghai, the bamboo textiles are made using non-toxic solvents and a closed-loop system that reuses water for the process, according to Yu.

Yu started selling the cleanBamboo-branded bedding under the ettitude label in Melbourne first, but when she saw the orders begin to pick up from the U.S. she relocated and took her company with her.

Upon arrival, Yu realized she’d need a strong co-founder with experience in branding to help her navigate the massive market in the U.S. So Yu turned to AngelList, which is where she found Dey.

A serial entrepreneur with a background in retail, whose first company TryTheWorld was acquired by EarthBox in 2017, Dey was looking for her next project.

“Phoebe sent me a sample and I had the best night of sleep in my life,” Dey said. From then on the two co-founders began the long, hard slog of marketing their business.

Sales are growing, according to the two women, and the company’s chances have certainly been improved by the capital infusion from Drumbeat Ventures and TA Ventures, a European female-founded fund focusing on technology innovation.

The $1.6 million financing will be used to boost sales and marketing as the company expands beyond bedding — with an average price of $178 for a queen-sized sheet set — and into sleepwear and other categories.

“Phoebe, Kat and their brand, ettitude, are as genuine a combination of passion, purpose, and proprietary product that I’ve seen in the marketplace in my 20 years,” said Drumbeat Ventures founder, Adam Burgoon, in a statement. “They are perfectly positioned to bring their mission of sustainability and comfort to a broader audience.”

Powered by WPeMatico

It seems that we are in the middle of a mini acquisition spree for Kubernetes startups, specifically those that can help with Kubernetes security. In the latest development, Venafi, a vendor of certificate and key management for machine-to-machine connections, is acquiring Jetstack, a U.K. startup that helps enterprises migrate and work within Kubernetes and cloud-based ecosystems, which has also been behind the development of cert-manager, a popular, open-source native Kubernetes certificate management controller.

Financial terms of the deal, which is expected to close in June of this year, have not been disclosed, but Jetstack has been working with Venafi to integrate its services and had a strategic investment from Venafi’s Machine Identity Protection Development Fund.

Venafi is part of the so-called “Silicon Slopes” cluster of startups in Utah. It has raised about $190 million from investors that include TCV, Silver Lake and Intel Capital and was last valued at $600 million. That was in 2018, when it raised $100 million, so now it’s likely Venafi is worth more, especially considering its customers include the top five U.S. health insurers, the top five U.S. airlines, the top four credit card issuers, three out of the top four accounting and consulting firms, four of the top five U.S., U.K., Australian and South African banks and four of the top five U.S. retailers.

For the time being, the two organizations will continue to operate separately, and cert-manager — which has hundreds of contributors and millions of downloads — will continue on as before, with a public release of version 1 expected in the June-July time frame.

The deal underscores not just how Kubernetes -based containers have quickly gained momentum and critical mass in the enterprise IT landscape, in particular around digital transformation, but specifically the need to provide better security services around that at speed and at scale. The deal comes just one day after VMware announced that it was acquiring Octarine, another Kubernetes security startup, to fold into Carbon Black (an acquisition it made last year).

“Nowadays, business success depends on how quickly you can respond to the market,” said Matt Barker, CEO and co-founder of Jetstack . “This reality led us to re-think how software is built and Kubernetes has given us the ideal platform to work from. However, putting speed before security is risky. By joining Venafi, Jetstack will give our customers a chance to build fast while acting securely.”

To be clear, Venafi had been offering Kubernetes integrations prior to this — and Venafi and Jetstack have worked together for two years. But acquiring Jetstack will give it direct, in-house expertise to speed up development and deployment of better tools to meet the challenges of a rapidly expanding landscape of machines and applications, all of which require unique certificates to connect securely.

“In the race to virtualize everything, businesses need faster application innovation and better security; both are mandatory,” said Jeff Hudson, CEO of Venafi, in a statement. “Most people see these requirements as opposing forces, but we don’t. We see a massive opportunity for innovation. This acquisition brings together two leaders who are already working together to accelerate the development process while simultaneously securing applications against attack, and there’s a lot more to do. Our mutual customers are urgently asking for more help to solve this problem because they know that speed wins, as long as you don’t crash.”

The crux of the issue is the sheer volume of machines that are being used in computing environments, thanks to the growth of Kubernetes clusters, cloud instances, microservices and more, with each machine requiring a unique identity to connect, communicate and execute securely, Venafi notes, with disruptions or misfires in the system leaving holes for security breaches.

Jetstack’s approach to information security came by way of its expertise in Kubernetes, developing cert-mananger specifically so that its developer customers could easily create and maintain certificates for their networks.

“At Jetstack we help customers realize the benefits of Kubernetes and cloud native infrastructure, and we see transformative results to businesses firsthand,” said Matt Bates, CTO and co-founder of Jetstack, in a statement. “We developed cert-manager to make it easy for developers to scale Kubernetes with consistent, secure, and declared-as-code machine identity protection. The project has been a huge hit with the community and has been adopted far beyond our expectations. Our team is thrilled to join Venafi so we can accelerate our plans to bring machine identity protection to the cloud native stack, grow the community and contribute to a wider range of projects across the ecosystem.” Both Bates and Barker will report to Venafi’s Hudson and join the bigger company’s executive team.

Powered by WPeMatico

Small and medium businesses and sole-traders account for the vast majority of businesses globally, 99.9% of all enterprises in the U.K. alone. And while the existence of millions of separate companies, with their individual demands, speaks of a fragmented market, together they still represent a lot of opportunity. Today, a U.K. fintech startup looking to capitalise on that is announcing a round of growth funding to enter Europe after onboarding 20,000 customers in its home country.

ANNA, a mobile-first banking, tax accounting and financial service assistant aimed at small and medium businesses and freelancers, has closed a $21 million round of investment from a single investor, the ABHH Group, the sometimes controversial owner of Alfa Bank in Russia, the Amsterdam Trade Bank in the Netherlands and other businesses.

The investment is a strategic one: ANNA will be using the funding to expand for the first time outside of the U.K. into Europe, and CEO Eduard Panteleev said that effort will be built on Amsterdam Trade Bank’s rails. He confirmed that the investment values ANNA at $110 million, and the founders keep control of 40% of the company in the deal.

The fundraising started before COVID-19 really picked up speed, but its chilling effect on the economy has also had a direct impact on the very businesses that ANNA targets as customers: some have seen drastic reductions in commercial activity, and some have shuttered their businesses altogether.

Despite this, the situation hasn’t changed measurably for ANNA, Panteleev said.

“COVID-19 hasn’t impacted us so far. We are designed as a digital business, and so working from home was a completely normal shift for us to make,” he said, but added that when it comes to the customers, “Yes, we have seen that our customers’ incoming payments are quite affected, with 15-30% decrease in the volume of customer payments.” The firm belief that ANNA and investors have, however, is that business will bounce back, and ANNA wants to make sure it’s in a strong position when it does.

ANNA is an acronym for “Absolutely No Nonsense Admin,” and that explains the gist of what it aims to do: it provides an all-in-one service for smaller enterprises that lets them run a business account to make and receive payments, along with software for invoicing, accounting and managing taxes that is run through a chat interface to assist you and automate some of the functions (like invoice tracking). ANNA also offers additional services, such as connecting you to a live accountant during tax season.

ANNA is part of a wave of fintech startups that have cropped up in the last several years specifically targeting SMEs .

It used to be the case that SMEs and freelancers were drastically underserved in the world of financial services: their business, even collectively, is not as lucrative as accounts from larger enterprises, and therefore there was little innovation or attention paid to how to improve their experience or offerings, and so whatever traditional banks had to offer was what they got.

All that changed with the rise of “fintech” as a salient category: ever-smarter smartphones and app usage are now ubiquitous, broadband is inexpensive and also widespread, cloud and other technology has turbo charged what people can do on their devices and people are just more digitally savvy. And many startups have taken advantage of all that to develop fintech services catering to SMEs, which also has meant competition from the likes of Monzo, Revolut, Tide and now even offerings from high-street banks like NatWest.

Panteleev believes ANNA’s product stands separate from these. “We offer more of a financial assistant to users, rather than just moving their money, and it’s also a different business case, because we look at what a user needs more holistically,” he said. Pricing is also a little different: businesses with monthly income of less than $500 can use ANNA for free. It then goes up on a sliding scale to a maximum of £19.90 per month, for those with monthly income between £20,000 and £500,000.

Panteleev — who co-founded the company with Andrey Pachay, Boris Dyakonov, Daljit Singh, Nikita Filippov and Slava Akulov — is a repeat entrepreneur, having founded two other banking startups in Russia with Dyakonov that are still going: Knopka (Russian for button) and Totchka (Russian for dot). These are older and more established: Totchka for example has some 500,000 users, but Panteleev has said there are no plans to try to bring ANNA into the Russian market, nor take these other companies international.

For ABHH, the attraction of investing in this particular startup was probably two-fold. The businesses have Russian DNA in common, making for potentially a better cultural fit, but also it is yet another example of a legacy, large bank tapping into a smaller and more fleet-of-foot startup to address a market sector that the bigger company might be more challenged to do alone.

“I’m looking forward to embarking on this exciting journey together,” said Alan Vaksman, member of the supervisory board at Amsterdam Trade Bank and future chairman of ANNA, in a statement. “At this moment most SMEs find themselves in a challenging situation; however, once the pandemic comes to an end, there will be a very clear realisation that neither corporates nor family businesses can afford to run most operational processes manually. Tech services and platforms, like ANNA, are in for some dynamic times ahead.”

Powered by WPeMatico

FeaturePeek’s founders graduated from Y Combinator in Summer 2019, which for an early-stage startup must seem like a million years ago right now. Despite the current conditions though, the company announced a $1.8 million seed investment today.

The round was led by Matrix Partners with some unnamed angel investors also participating.

The startup has built a solution to allow teams to review front-end designs throughout the development process instead of waiting until the end when the project has been moved to staging, co-founder Eric Silverman explained.

“FeaturePeek is designed to give front-end capabilities that enable developers to get feedback from all their different stakeholders at every stage in the development process and really fill in the missing gaps of the review cycle,” he said.

He added, “Right now, there’s no dedicated place to give feedback on that new work until it hits their staging environment, and so we’ll spin up ad hoc deployment previews, either on commit or on pull requests and those fully running environments can be shared with the team. On top of that, we have our overlay where you can file bugs, you can annotate screenshots, record video or leave comments.”

Since last summer, the company has remained lean with three full-time employees, but it has continued to build out the product. In addition to the funding, the company also announced a free command line version of the product for single developers in addition to the teams product it has been building since the Y Combinator days.

Ilya Sukhar, partner at Matrix Partners, says as a former engineer, he had experienced this kind of problem firsthand, and he knew that there was a lack of tooling to help. That’s what attracted him to FeaturePeek.

“I think FeaturePeek is kind of a company that’s trying to change that and try to bring all of these folks together in an environment where they can review running code in a way that really wasn’t possible before, and I certainly have been frustrated on both ends of this where as an engineer, you’re kind of like, ‘okay, I wrote it, are you ever going to look at it?’ ” he said.

Sukhar recognizes these are trying times to launch a startup, and nobody really knows how things are going to play out, but he encourages these companies not to get too caught up in the macro view at this stage.

Silverman knows that he needs to adapt his go to market strategy for the times, and he says the founders are making a concerted effort to listen to users and find ways to improve the product while finding ways to communicate with the target audience.

Powered by WPeMatico

Even in these trying economic times, there are some services that companies can’t do without. Having good security tools is one of them. Expel, a four-year-old startup that offers security operations as a service, announced a $50 million Series D financing today.

CapitalG led the round with participation from existing investors Battery Ventures, Greycroft, Index Ventures, Paladin Capital Group and Scale Venture Partners. The company has now raised almost $117 million, according to PitchBook data.

It’s never easy finding quality security talent to help protect a large organization. The idea behind Expel is to give customers a set of tools to help use automation to reduce the number of people required to keep an organization safe.

Most companies struggle to find experienced security employees, so it’s using automation to solve a real pain point for them. While co-founder and CEO Dave Merkel says you still need to staff the security operations center, you can do it with fewer people with his platform.

“You may have a 24×7 Security Operations Center, but you don’t need the number of people everybody else does to protect your customers because Workbench does all of the heavy lifting for you. So instead of a SOC with 100 people, maybe you’ve got one with 15 people, and that gives tremendous leverage through this platform, and the platform ensures that you can provide high quality security without having to continually grow headcount,” Merkel explained.

Merkel sees the same economy everyone else does, but he believes that companies will continue to invest in security because they have to.

“Security tends to be a need as opposed to a want in many organizations, and so we still do see business happening. We will be using some of the money to continue to invest smartly in sales and marketing, but we’ll just need to be deliberate to make sure that we’re picking the right things that are still effective right now,” he said.

One thing that’s remarkable about this round is that Expel didn’t go looking for this new money. In fact, CapitalG came knocking, according to CapitalG general partner Gene Frantz.

“We sought out Expel, first and foremost. It wasn’t that Expel sought out to raise money and they called a bunch of people. We called them, and that was in response to a bunch of thematic work that we continually do in the security space,” Frantz told TechCrunch.

That work involved three main areas, where Expel happened to check all the boxes. The first was the threat landscape becoming ever more treacherous. The second was information overload from a variety of security products, and finally the dearth of experienced security personnel to deal with the first two problems.

“And so our bet is that this is the company in the space that actually will take on and address these challenges,” Frantz said.

Merkel describes having a company like CapitalG come to him as a humbling experience for him and his co-founders, especially under the current circumstances.

“It’s tremendous validation, but it is also humbling. We’re pretty thankful to be in that position, and we want to make sure that we do the right things to continue to honor the opportunity that we see in front of us.”

Powered by WPeMatico

Sleeper is widening its ambitions to esports as the arena sports world goes into hibernation amid the COVID-19 pandemic.

While CEO Nan Wang has high hopes that the upcoming NFL season can proceed amid the pandemic, he’s hoping to expand his fantasy sports app’s appeal to gamers by launching support for the intensely popular title League of Legends. Wang says that esports support was always in the cards, but that its rollout was never supposed to come this early.

“Originally, the goal was to do arena sports and then strategically select esports that we thought would be big market opportunities,” Wang says. “In the absence of sports, it becomes easier for us to push something that was further out on the roadmap.”

As Sleeper looks to push beyond its 1 million active users, the company is bulking up on funding reserves. The fantasy sports app has closed a $20 million Series B funding round led by Andreessen Horowitz. Kevin Durant, Baron Davis, JuJu Smith-Schuster and Twitch CEO Kevin Lin are also recent investors. In August, the company shared it had raised a $5.3 million Series A led by General Catalyst.

For now, all of Sleeper’s services are free and there aren’t immediate plans to change that. Wang says that delayed and canceled seasons of arena sports is likely going to push out the company’s timelines for beginning to generate revenues.

Sleeper’s investors have hailed the startup as leading the way among a new class of vertical-focused social networks.

“The next social platforms are going to be vertical and look a lot more like games, offering deeper engagement than broad social networking platforms. Sleeper’s leagues provide shared activities between friends, and has some of the best stickiness metrics we’ve seen,” Andreessen Horowitz GP Andrew Chen said in a statement.

With its League of Legends launch, Sleeper is in the position of helping define a fantasy league experience for a popular franchise. The league’s organization isn’t fundamentally different from other fantasy sports. Users recruit a fantasy crew and draft professional esports athletes to their teams. From there, users in a league participate in weekly head-to-head matches with each other, making predictions and leveraging gameplay-specific mechanics.

League of Legends support is a big deal to Sleeper because it also represents the company’s first international foray. Users in the U.S., Europe, Vietnam, Korea and Brazil can participate in this upcoming fantasy season.

On the product side, the startup recently launched voice chat to capitalize on users stuck at home amid the pandemic. Wang tells TechCrunch the team is also hoping to add video chat to the app soon. Wang also notes that Sleeper is on track to launch three new sports this year.

As Sleeper aims to grow around the roadblocks of pandemic lockdowns, Wang and his team hope that their continued focus on social features can ensure the startup’s shared success in the worlds of online gaming and arena gaming.

“The roadmap for us has always been to win both sports and esports because they both have the same underlying motivation,” Wang says. “The most important thing for any sports fan is being able to enjoy it with their friends and family members.”

Powered by WPeMatico

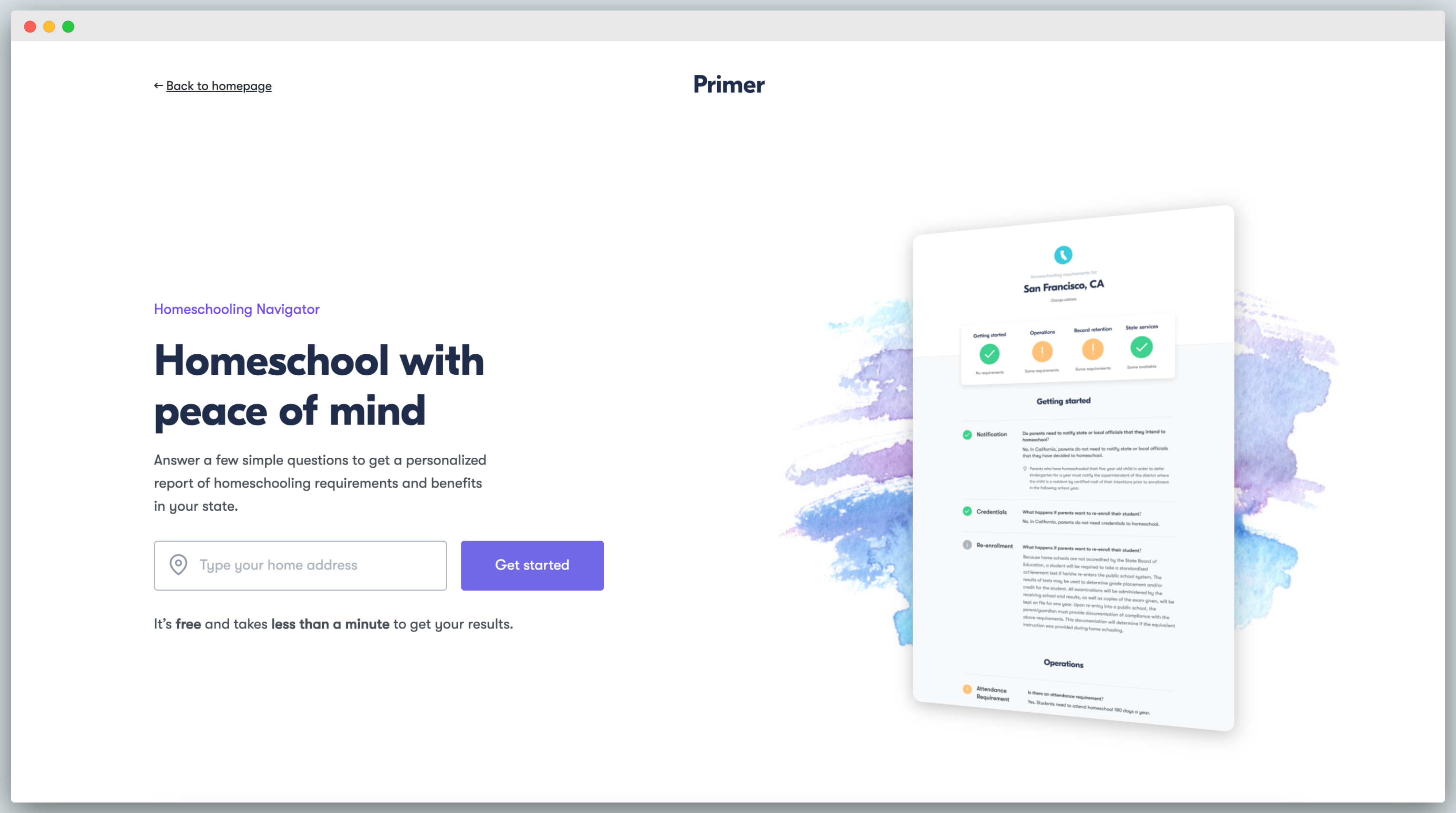

As parents across the country are tasked with managing their children’s schooling amid a pandemic, investors are betting on a homeschooling startup that’s aiming to provide parents with services that can simplify the process of giving their kids a tailored education at home.

Founder Ryan Delk says his startup Primer is building the “full-stack infrastructure” that parents need to homeschool their kids, an interactive suite of products that he hopes can “make homeschooling a mainstream option for families.”

His company shared funding details with TechCrunch, disclosing that his startup had closed a $3.7 million seed round led by Founders Fund . Other investors in the round include Naval Ravikant, Cyan Banister and Village Global.

As of 2016, about 2.4 million kids in the United States are homeschooled. Delk says that he’s been “stunned by the lack of infrastructure” available today for parents interested in homeschooling their kids. Delk was homeschooled by his parents from kindergarten through eighth grade, an experience he looks back on fondly, he says.

Primer isn’t offering a dedicated curriculum. So far, they’ve been building tools to help parents acquaint themselves with what’s out there. Primer has already rolled out a pair of free homeschooling resources for parents, including Navigator, a tool to help parents stay compliant with state regulations for homeschooling their kids, as well as Primer Library, a collection of free digital instruction materials.

Since launching its compliance and library tools late last year, the team has been prepping for their next launch, a series of interest-based communities that homeschoolers can join and participate in online. The communities will begin rolling out this August in time for a new school year. Delk says the team is hoping to launch about 5-7 different classes, spanning topics like “rockets, chess and baking,” with instruction from experts and interactions with other students. Primer hasn’t finalized pricing, but the team plans to charge a monthly subscription fee for membership to the communities.

Today, the startup is launching a waitlist for this feature. In a blog post, Delk notes that next year he hopes to launch “several more products that deliver everything parents need to give their children an exceptional homeschooling experience.”

Delk believes that there’s going to be a “huge influx” of new homeschoolers as shelter-in-place winds down and some parents find that homeschooling is something they’d like to pursue long-term. He notes that the products his team is creating are still pretty high-touch for parents and that it isn’t the right fit for everyone, much like homeschooling.

“It’s going to be very hands-on and we’re going to be upfront about that,” Delk says. “We are not building a plant-your-kid-in-front-of-an-iPad-for-six-hours product.”

Powered by WPeMatico

When it comes to corporate venture capital, semiconductor giant Intel has shaped up to be one of the most prolific and prescient investors in the tech world, with investments in 1,582 companies worldwide, and a tally of some 692 portfolio companies going public or otherwise exiting in the wake of Intel’s backing.

Today, the company announced its latest tranche of deals: $132 million invested in 11 startups. The deals speak to some of the company’s most strategic priorities currently and in the future, covering artificial intelligence, autonomous computing and chip design.

Many corporate VCs have been clear in drawing a separation between their activities and that of their parents, and the same has held for Intel. But at the same time, the company has made a number of key moves that point to how it uses its VC muscle to expand its strategic relationships and also ultimately expand through M&A. Just earlier this month, it acquired Moovit, an Intel Capital portfolio company, for $900 million (a deal that was knocked down to $840 million when accounting for its previous investment).

“Intel Capital identifies and invests in disruptive startups that are working to improve the way we work and live. Each of our recent investments is pushing the boundaries in areas such as AI, data analytics, autonomous systems and semiconductor innovation. Intel Capital is excited to work with these companies as we jointly navigate the current world challenges and as we together drive sustainable, long-term growth,” said Wendell Brooks, Intel senior vice president and president of Intel Capital, in a statement.

The tranche of deals come at a critical time in the worlds of startups and venture investing. Many are worried that the slowdown in the economy, precipitated by the COVID-19 pandemic, will mean a subsequent slowdown in tech finance. Intel says that it plans to invest between $300 million and $500 million in total this year, so this would go some way to refuting that idea, along with some of the other monster deals and big funds that we’ve written out in the last couple of months.

The list announced today doesn’t include specific investment numbers, but in some cases the startups have also announced the fundings themselves and given more detail on round sizes. These still, however, do not reveal Intel’s specific financial stakes.

Here’s the full list:

Powered by WPeMatico

UpKeep, a mobile-first platform for maintenance and operations collaboration, has today announced the close of a $36 million Series B financing round. The round was led by Insight Partners, with participation from existing investors Emergence Capital, Battery Ventures, Y Combinator, Mucker Capital and Fundersclub.

UpKeep was founded by Ryan Chan. Chan worked at Trisep Corporation, a chemical manufacturing company, before founding UpKeep and saw first-hand how plant maintenance was handled. Despite the fact that the plant had purchased software for facilities maintenance and operations, most of the data was written down on pen and paper before being input into the system because that software was desktop only.

The idea for UpKeep was born.

UpKeep meets maintenance workers where they are, which could be just about anywhere.

With any maintenance job, from changing a lightbulb in an office building to repairing a complicated piece of machinery on the floor of a manufacturing plant, there are usually three parties involved: the requester, the facilities manager, and the technician.

Before UpKeep, the requester would either send an email to the facilities manager or perhaps use some other software to let them know of the problem. The facilities manager would prioritize the various requests of the day and send out technicians to resolve them.

Technicians have to log plenty of information when they’re out on the job, but this usually involved writing this info down on paper and then returning to a desk to input the data into the system.

With UpKeep, the requester can use the app itself to notify the facilities manager of problems, or send an email that flows directly into the UpKeep system. Facilities managers use UpKeep to prioritize and assign issues to their team of technicians, who then receive the work orders right on UpKeep.

Instead of logging information on paper, these technicians can take pictures of the problem and note the parts they need or other details of the job right in the app. No duplication of effort.

UpKeep operates on a freemium model, allowing technicians to manage their own work for free. Collaborative use of the product across an organization costs on a per user on both an annual or monthly basis. The company offers various tiers, from a Starter Plan ($35/month/user) to an Enterprise Plan ($180/month/user).

Higher tier plans offer more in-depth reporting and analysis around the work that gets done. Chan explained that these reports are not necessarily about tracking people, though.

“Yes, we track technicians and it’s a tool to manage work done by people,” said Chan. “But a manufacturing facility really cares much more about the equipment. They can use UpKeep to manage things like how many hours of downtime a piece of equipment has, etc. It’s more targeted toward the actual asset and the equipment versus the person completing their work.”

Chan said that around 80 percent of the company’s 400,000 users are on the free version of the app. Some brands on the app include Unilever, Siemens, DHL, McDonald’s, and Jet.com. Chan said UpKeep saw a 206 percent increase in revenue in 2019.

Important to the company’s future, UpKeep is working with OSHA and a group called SQF (Safe Quality Food) to offer templates around best practices during the pandemic. Now, maintenance workers and facilities staffs have a whole new checklist around sanitation and safety that many businesses are just getting up to speed on. UpKeep is working to make these new practices easier to adopt by providing those checklists directly to facilities managers.

This latest funding round brings UpKeep’s total funding to $48.8 million.

Powered by WPeMatico

Four years ago, Brandon Gell was an architecture student who spent most of his time working on 3D printing modular housing. Now, he’s the founder of Clyde, an extended warranty startup that wants to help small e-commerce businesses offer product protection.

Today, the company announced it has raised a $14 million Series A led by Spark Capital with participation from Crosslink, RRE, Rea Sea Ventures and others.

How do you go from being a product person to the founder of an insurance startup? According to Gell: a stint at a four-person 3D scanner startup in Columbus, Ohio.

Because the team and resources were small, Gell was put in charge of finding an insurance company to work with to protect their expensive end product of scanners.

“I spent six months trying to find a company,” he said. After seeing how seamless it was to work with fintech customer support tools from companies like Stripe, Shopify, Affirm and others, he said it was clear that insurance, and especially the extended warranty space, wasn’t as mature. So he set up an office in his grandma’s New York apartment.

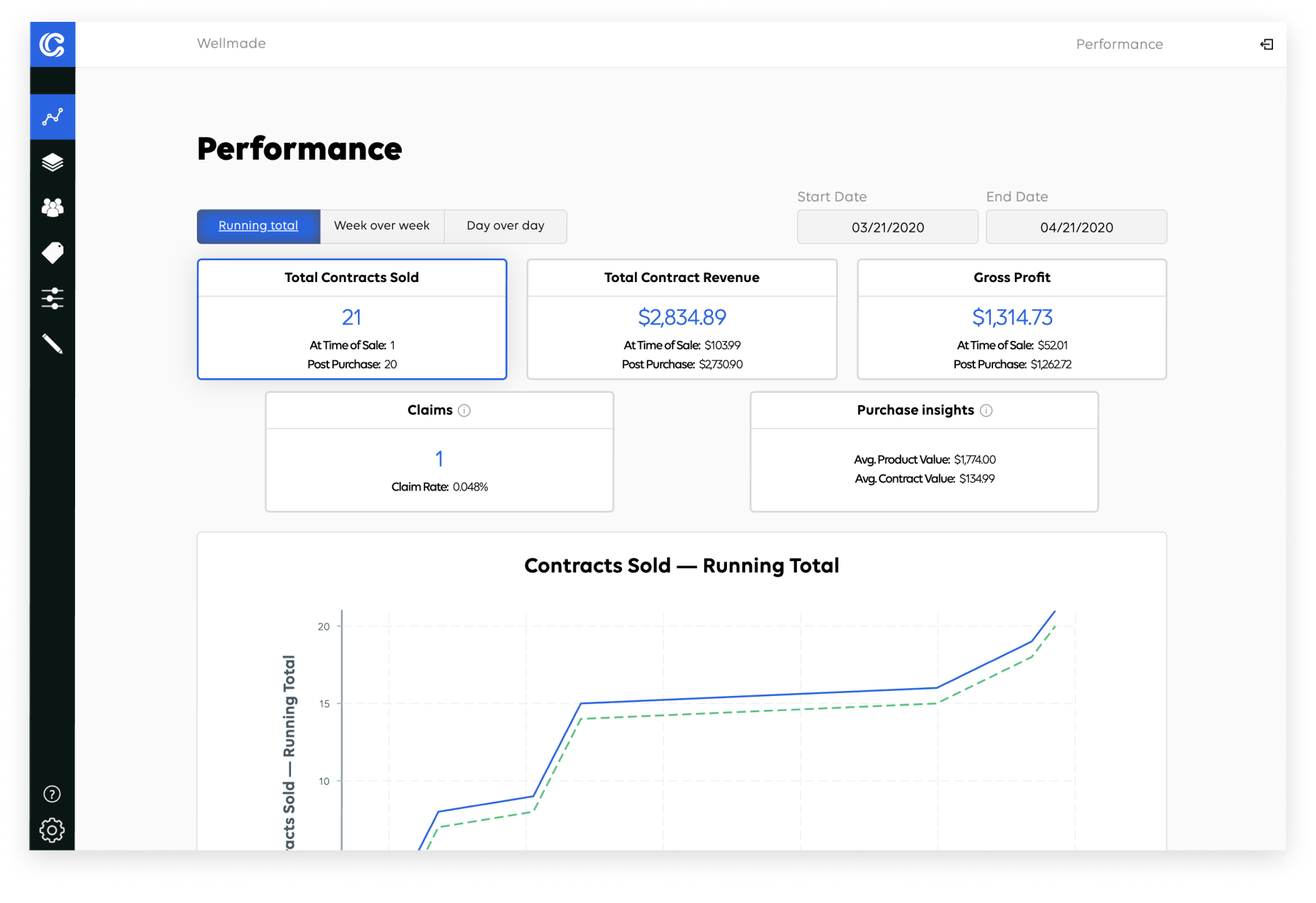

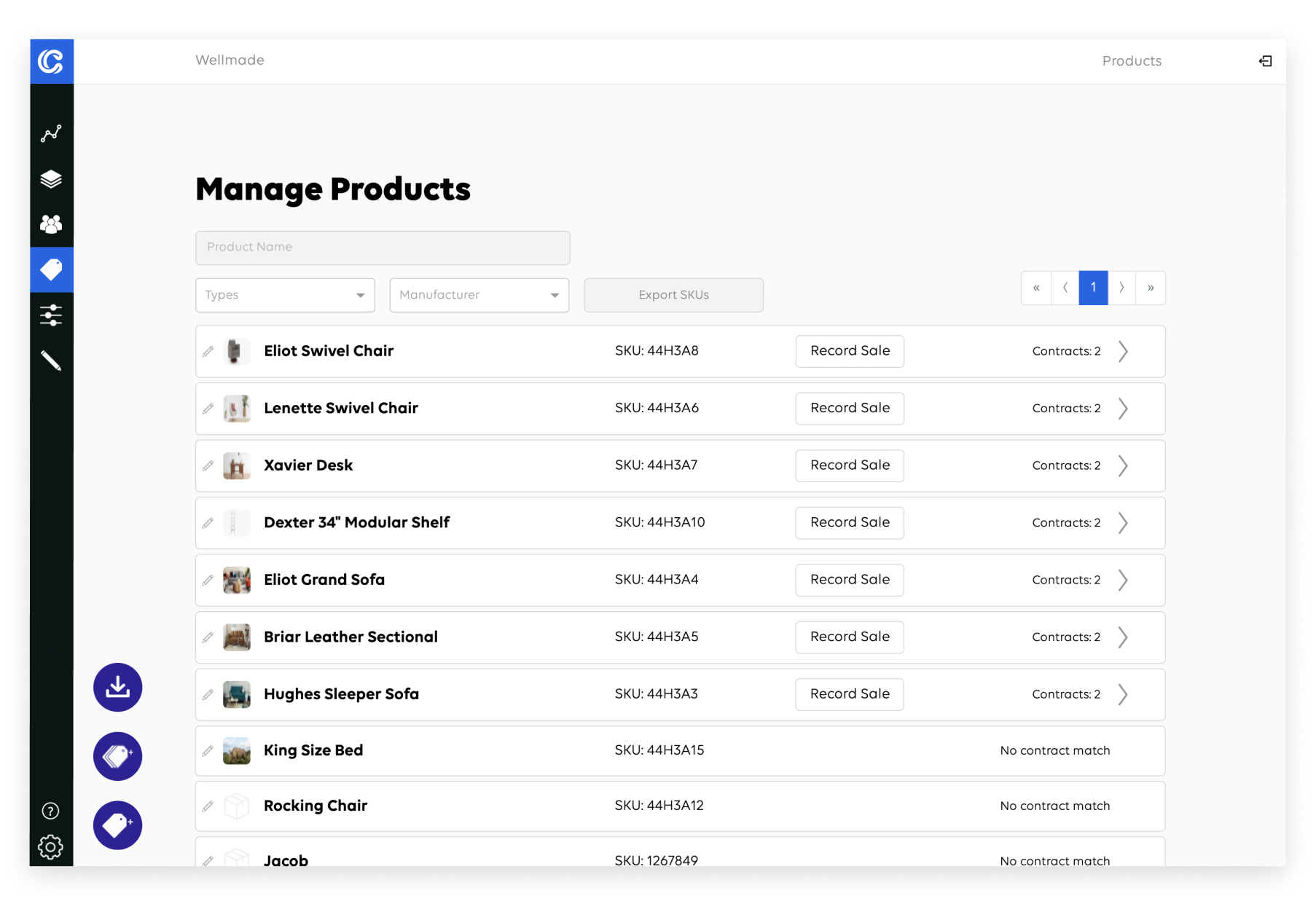

Clyde is a platform that connects small retailers to insurance companies to launch and manage product protection programs.

Using Clyde, customers can access a dashboard and e-commerce apps to manage their protection programs. For example, a user can see how many contracts were sold, how much revenue total those bring and gross profit in real time. It also can see which products are most often purchased with an extended warranty contract.

“It’s a similar type of offering as Affirm or Stripe,” he said. “We give you access to large insurance companies and we enable you to launch the program live on your website or physical point of sale and store wherever you sell.” It has plugins with Shopify, BigCommerce, Salesforce, Magento, Woocommerce, and more so store owners on the site can add Clyde to their small businesses.

Clyde’s most critical metric is that it has an 18% attachment rate on average, which means that 18% of people that go through a Clyde-powered purchasing path end up purchasing extended warranties or protection plans.

The reason businesses care about extended warranty is two-fold. First, insurance benefits the customer experience. Second, insurance purchases are often the highest-margin product that companies sell to their customers. Product protection alone is a $50 billion market. Gell said that Best Buy drives about 2% of its annual revenue from the sale of extended warranties, but that generates more than half of its profit.

Clyde helps small businesses, like a four-person startup in Columbus Ohio, get a bite of this profitable pie. Most e-commerce businesses have to work with Amazon, thus giving a lot of that cash to the big company versus putting it in their own pocket, per Gell. He says that when Amazon sells an extended warranty on a seller’s product, it doesn’t share any revenue with the seller on how the product performs, which prevents a seller from both a stream of revenue and data analytics.

“Our sort of mantra is that the retailers that we work with are basically everybody that’s not Amazon and Walmart,” he said.

Clyde’s goal is different from Upsie, another venture-backed startup focusing on warranties. Upsie is looking to be a direct-to-consumer warranty replacement, while Clyde works on behalf of the retailer and insurance company to connect the two parties.

Closer competitors to the startup include Mulberry and Extend, which were both founded after Clyde and have raised less in venture capital funding. Gell thinks his competitive advantage is partnerships with top insurance companies, and a strong product-focused platform. Clyde’s entire founding team is made up of product people.

Startups right now need to prove that they are viable in both a pre-coronavirus and post-coronavirus world. And Clyde might be exactly in that sweet spot, as it focuses on e-commerce businesses.

The Series A round closed a few weeks ago, before the COVID-19 craziness began, but he said that the pandemic has led to more inbounds and interest than ever before. Gell says it’s a mix of e-commerce being more important than ever, and customer behavior.

“It’s a shift of customers that want to buy online more, but also protect their purchases more than ever,” he said. “Companies are realizing how important it is.”

New cash in hand, Clyde’s growing while its customer-base is looking for new ways to bring in revenue and take care of customers. If the startup can handle the influx of attention and importance right, sticky harmony will follow.

Powered by WPeMatico